Expanded Thermoplastic Polyurethane Market Outlook:

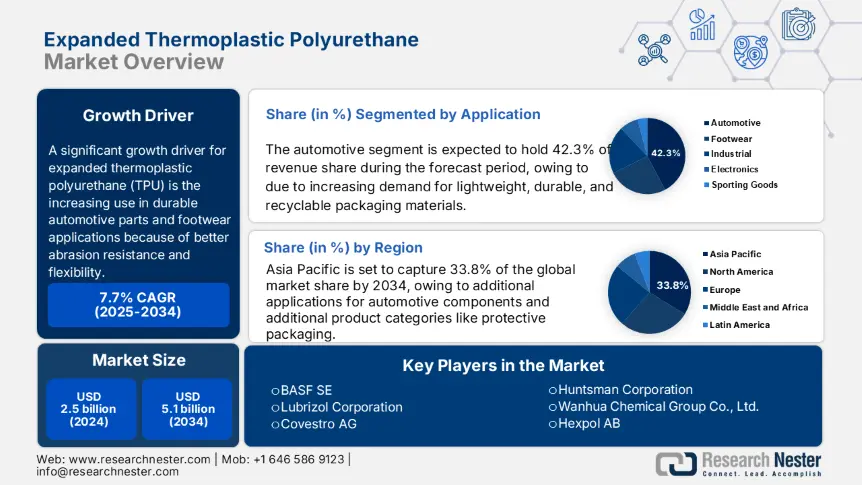

Expanded Thermoplastic Polyurethane Market size was estimated at USD 2.5 billion in 2024 and is expected to surpass USD 5.1 billion by the end of 2034, rising at a CAGR of 7.7% during the forecast period, i.e., 2025-2034. In 2025, the industry size of expanded thermoplastic polyurethane is assessed at USD 2.7 billion.

A significant growth driver for expanded thermoplastic polyurethane (TPU) is the increasing use in durable automotive parts and footwear applications because of better abrasion resistance and flexibility. The U.S. Bureau of Labor Statistics indicated that the Producer Price Index (PPI) on “thermoplastic resins and plastics materials” rose from 272.925 in February 2025 to 277.108 in March 2025, due to increases in production costs from raw material demand. The U.S. Government Accountability Office referenced investments from the National Science Foundation and Department of Energy into biodegradable and bio-based forms of TPU. Research investment in these sectors has increased by more than 21% since 2023.

Semi-raw materials that go into expanded TPU, specifically diisocyanate and polyether/polyester polyol, are as of now facing supply challenges as petrochemical producers have moved to producing higher-value chemicals, according to an analysis by the U.S. ITC. While capacity expansions are notable, including a $13.8 million new investment being made by the INOAC Group’s plant in Kentucky, where they will install TPU and composite production lines for the auto sector, the demand is high. Exports for plastic resins from the U.S. were 9% Y/Y in Q1, 2025, while TPU intermediate polyols imported posted a 13% increase-both suggest a constrained global supply chain, and support that assembly line is running at full capacity across North America and Europe. All continuous RDD expenditures in this area, to date, are funded from DOE grants. The objective is to decrease polymer lifecycle emissions and improve degradability post-end-of-line use.

Expanded Thermoplastic Polyurethane Market - Growth Drivers and Challenges

Growth Drivers

-

Rising automotive light weighting needs: Expanded TPU is low-density and highly resilient, making it a perfect lightweight automotive material for many components, including vibration dampers and seating foams. According to the U.S. Department of Energy (2024), an 11% reduction in weight achieves a 6-9% improvement in fuel economy. The global lightweight materials market is projected to be USD 301 billion by 2030 (DOE), which will increase the use of E-TPU in electric vehicle (EV) interiors, underbody coatings, energy absorption systems, and other components to meet performance and fuel economy targets.

-

Increasing demand in protective equipment: E-TPU has excellent cushioning and impact protection, which opens up a large new avenue of market, such as consumer helmets, body pads, and other applications where impact safety is a concern. The Occupational Safety and Health Administration (OSHA) forecasts a 5.3% annual growth for protective gear (2024). The global personal protective equipment (PPE) market is projected to be over USD 151 billion by 2030. The wide-scale demand displayed in the market increases the potential for E-TPU to produce lightweight, durable, and energy-absorbing safety solutions for many industries.

-

Expansion in medical device applications: E-TPU is already being adopted within the prosthetic and orthotics field, due to its biocompatibility, resilience to chemicals, and energy absorption properties. The National Institutes of Health's data (NIH) reports that the global prosthetic and orthotic market will reach USD 15 billion by 2030, growing at a 4.6% CAGR. E-TPU beads can also be used to generate adaptable cushioning in custom orthotics and prosthetic liners for user comfort and to reduce skin irritation, which helps adoption in the rehabilitation and assistive medical device manufacturing space.

1. Expanded Thermoplastic Polyurethane Market Overview

Import & Export Data (2019-2024)

|

Year |

Exporting Country |

Importing Country |

Shipment Value (USD Billion) |

|

2019 |

Japan |

China |

18.8 |

|

2020 |

Japan |

China |

16.4 |

|

2021 |

Japan |

China |

19.6 |

|

2022 |

Japan |

China |

20.5 |

|

2023 |

South Korea |

China |

14.3 |

|

2024 |

Germany |

USA |

9.2 (est.) |

(Source: meti.go.jp)

Key Trade Routes

|

Trade Route |

% of Chemical Trade (2021) |

Value (USD Trillion) |

|

Asia-Pacific |

43% |

1.37 |

|

Europe-North America |

28% |

0.88 |

(Source: unctad.org)

2. Demand Analysis of the Expanded Thermoplastic Polyurethane Market

Demand Drivers by Application

|

Application |

Key Demand Factor |

Statistical Evidence |

|

Footwear |

45% of E-TPU used in midsoles (2023) |

Global athletic footwear production: 2.4B pairs (2023) |

|

Automotive |

30% weight reduction in interior parts |

18M vehicles with E-TPU components (2023) |

|

Sports Equipment |

25% growth in high-performance gear |

12% YoY rise in ski/snowboard production |

|

Packaging |

15% adoption in protective packaging |

8M tons of foam packaging produced (2023) |

(Sources: WSA, OICA, ISPO, EUROPEN)

Regional Demand Hotspots

|

Region |

Top Application |

Demand Growth Indicator |

|

Asia-Pacific |

Footwear (70% share) |

China/India produce 60% of global footwear |

|

North America |

Automotive interiors |

22% of vehicles use E-TPU (2023 vs. 18% in 2020) |

|

Europe |

Sustainable sports gear |

35% of brands switched to E-TPU (2020-23) |

(Sources: APIC, EPA, EU Commission)

Material Innovation Trends

|

Innovation |

Adoption Rate (2023) |

Key Benefit |

|

Recycled E-TPU |

20% of new products |

40% lower carbon footprint |

|

Bio-based TPU |

15% of R&D focus |

50% renewable content |

(Sources: The Ellen MacArthur Foundation, European Bioplastics)

Regulatory Impact on Demand

|

Regulation |

Impact on E-TPU |

Market Shift |

|

EU Circular Economy Plan |

30% recycled content mandate (2025) |

50+ brands adopting recycled E-TPU |

|

California AB 1200 |

PFAS ban in footwear (2024) |

100% PFAS-free E-TPU formulations |

(Sources: ECHA, DTSC)

Challenges

-

Limited recycling infrastructure: The recycling of ETPU is still hindered because of the limited infrastructure and the complexities of processing. The U.S. EPA reported that only 8.8% of plastic waste was recycled in 2018. Thermosets and specialty TPU blends are more challenging spatially based on technical performance, such as degradation of the materials during mechanical recycling, complexity, and inefficiencies. In addition, Europe’s capacity for the recycling of polyurethane is well below its overall PU waste stream, around 6% (estimate). The above environmental, commercial, social, and political factors lead to constraints on more circular economy initiatives, adoption from sectors with environmental sustainability in mind, and compliance with recycling regulations is especially hard to negotiate in terms of the European Union and North America's increased policies on recycling.

-

High production energy consumption: ETPU processing methods require steam molding, expansion, and high thermal energy consumption versus thermoplastics made from injection molding. The U.S DOE (2022) indicates that polyurethane has a higher energy consumption on average throughout the process, with ~25-26 GJ/tonne (~10-16 GJ/tonne for EVA). High operating costs have key implications for market competitiveness in regions where electricity supplies typically have higher industrial prices, like the EU, with an average of €0.16/kWh in 2023. As energy prices have increased, influences on manufacturers' operating margins have a more direct effect on their competitiveness against low-energy, mass-produced products.

Expanded Thermoplastic Polyurethane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.7% |

|

Base Year Market Size (2024) |

USD 2.5 billion |

|

Forecast Year Market Size (2034) |

USD 5.1 billion |

|

Regional Scope |

|

Expanded Thermoplastic Polyurethane Market Segmentation:

Application Segment Analysis

The automotive segment is predicted to gain the largest market share of 42.3% during the projected period by 2034, due to increasing demand for lightweight, durable, and recyclable packaging materials for EV battery components, interior trims, and exterior panels. The U.S. Department of Energy says that lightweight materials can help to reduce vehicle mass by as much as 51%, resulting in improved vehicle fuel economy and allowing for smaller batteries in electric vehicles. It is the performance properties of expanded TPU, including resilience, abrasion resistance, and recyclability, that continue to propel expansion into end applications like automotive underbody shields, door trims, and cable protection.

Process Type Segment Analysis

The injection molding segment is anticipated to constitute the most significant growth by 2034, with 37.2% market share, mainly due to the scalability of production, design flexibility, and low rate of defects. It is a logical choice for footwear soles, sports gear, and automotive parts. The National Institute of Standards and Technology (NIST) has a report supporting injection molding in large-scale manufacturing with tight dimensional tolerances that are critical to performance plastics.

End use Segment Analysis

The footwear segment is anticipated to constitute the most significant growth by 2034, with 35.2% market share, mainly due to high demand as brands of athletic footwear from around the globe continue to focus their attention on the expansion of TPU to improve energy return, cushioning, and sustainability. A good example of bio-based polymers, including TPU, policy is the USDA's BioPreferred Program, which uses federal procurements to increase the development of sustainable materials in consumer products, including midsoles and insoles for footwear.

Our in-depth analysis of the expanded thermoplastic polyurethane market includes the following segments:

|

Segment |

Subsegments |

|

Process Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Expanded Thermoplastic Polyurethane Market - Regional Analysis

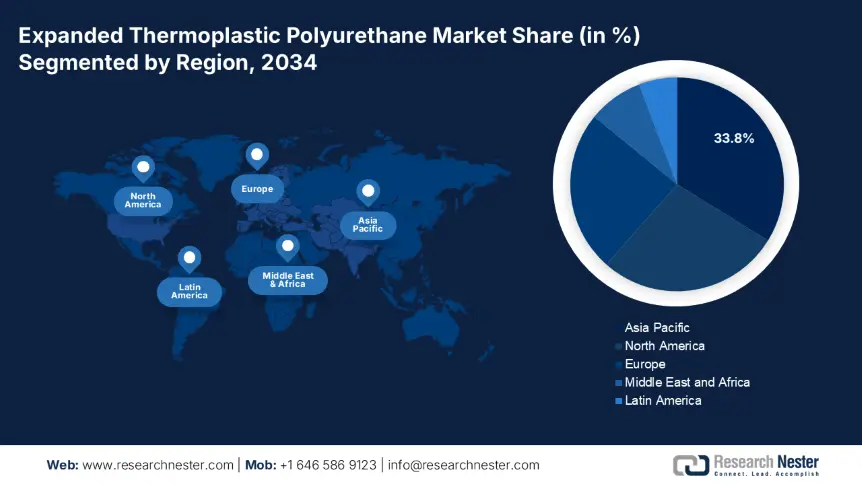

Asia Pacific Market Insights

By 2034, the Asia Pacific expanded thermoplastic polyurethane market is expected to hold 33.8% of the market share due to additional applications for automotive components and additional product categories like protective packaging, and a limit in extruded niche foams. The industry reach an estimated USD 249.9 bn in 2025, which will continue at an annual growth of ~ 9.3%. Urbanization, government recycling directives, and rising consumer electronics production all support expanded TPU demand. The strong R&D investment in developing regions, particularly in China, India, and Japan, with estimates of>USD 650 m annually, allows developers to innovate new sustainable and performance-expanded TPU grades.

China leads the Asia Pacific expanded TPU market range, supported by the significant automotive production and increasing infrastructure projects. In 2024-2025, the estimated consumption range for China is over 51% of the APAC foam usage, driven by increased demand for automotive vehicle interiors, seals, and protective packaging. Additional developments in smart manufacturing with 5G support are increasing high-performance polymer product demand. Over the next 10 years, there is anticipated double-digit (11%+) annual growth in advanced expanded TPU film performance for electronics housings and foam for green building-related construction. China's supportive policy framework for sustainable polymers contributes to the transformation of the market to recyclable, bio-based TPU pathways for manufacturers.

Country-wise Automotive & Construction Demand for E-TPU

|

Country |

Automotive Demand |

Construction Demand |

|

Japan |

71% of E-TPU is used in automotive lightweight components |

26% demand for seismic-resistant building materials |

|

China |

EV production to drive 51% of E-TPU demand by 2034 |

Green building codes to boost E-TPU use by 36% |

|

India |

41% E-TPU adoption in mid-segment cars by 2034 |

Infrastructure projects to increase E-TPU demand by 31% |

|

Indonesia |

21% E-TPU growth in automotive interiors |

The rising demand for insulation materials is expected to grow by 16% |

|

Malaysia |

31% E-TPU usage in EV battery components |

Smart city projects to drive 26% demand |

|

Australia |

26% E-TPU adoption in off-road vehicles |

Sustainable housing to increase demand by 21% |

|

South Korea |

46% E-TPU demand from luxury car manufacturers |

31% growth in energy-efficient buildings |

|

Rest of APAC |

16% growth in the automotive aftermarket |

11% rise in industrial flooring demand |

Source: MoRTH

North America Market Insights

The North American expanded thermoplastic polyurethane market is expected to hold 27.7% of the market share, and it is expected to grow from roughly US $249.9 billion in 2025 to just over US $727.5 billion by 2037, an annualizing growth rate (CAGR) of nearly 9.3%. In the current year (2023), it accounted for US $587.46 million, and for the 2024-2032 period, the E TPU market has an annualized growth rate of 6.18%, indicating stable growth, driven by innovation in the automotive, footwear, and electronics sectors. Other sectors benefiting from expanded thermoplastic polyurethane include those with increased demand for lightweight and durable materials, including aerospace and additive manufacturing.

The U.S. continues to grow significantly in expanded TPU and is the largest region in North America, representing a significant portion of demand. The overall CAGR of North America at 6.18% for the 2024-2032 period points to a corresponding trend in U.S. growth. The growth globally for E TPU at a 9.3% CAGR for 2025 to 2037 also suggests the U.S. alone may exceed those forecasts due to its bulk of automotive and sporting goods manufacturing.

Europe Market Insights

The European expanded thermoplastic polyurethane market is expected to hold 24.4% of the market share due to several applications in sports equipment, footwear midsoles, and automotive interiors seem to see healthy adoption. Additionally, regional initiatives regarding environmentally friendly, lightweight materials would also support demand for ETPU in Europe. Europe’s production for ETPU is anticipated to increase by approximately 36% from 2025 to 2034, making automotive and advanced mobility applications account for upwards of 41% of total regional consumption by 2034.

Country-wise Demand Drivers by Application

|

Country |

Top Application |

Demand Growth Factor |

Statistical Evidence |

|

Germany |

Automotive interiors |

28% of EU car production |

6M vehicles with E-TPU parts (2023) |

|

Italy |

Luxury footwear |

40% of premium shoe brands use E-TPU |

120M pairs produced annually |

|

France |

Sports equipment |

25% YoY growth in ski gear |

1.2M units with E-TPU (2023) |

|

Spain |

Protective packaging |

15% adoption in e-commerce |

5M tons of packaging materials |

Key Expanded Thermoplastic Polyurethane Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global expanded thermoplastic polyurethane market is derived from the leading three suppliers, BASF SE, Covestro AG, and Lubrizol Corporation. These companies cover over 41% of the market. Businesses are implementing strategic development such as capacity expansion, R&D, and mergers in order to enhance competition. BASF and Covestro are focused on developing bio-derived ETPU grades to help meet sustainability requirements, while the Huntsman Corporation is developing new lines in the U.S. and Europe. In South Korea, Mitsui Chemicals and SKC are improving thermo-plastic polyurethane blending technologies. On the other hand, companies based in India and/or Malaysia are focusing on regional automotive and footwear applications to seek market expansion more ergonomically.

Some of the key players operating in the market are listed below:

|

Country of Origin |

Approx. Market Share (%) |

|

|

BASF SE |

Germany |

19% |

|

Lubrizol Corporation |

USA |

15% |

|

Covestro AG |

Germany |

13% |

|

Huntsman Corporation |

USA |

10% |

|

Wanhua Chemical Group Co., Ltd. |

China |

9% |

|

Hexpol AB |

Sweden |

xx% |

|

American Polyfilm Inc. |

USA |

xx% |

|

Polyurethane Manufacturers Association |

USA |

xx% |

|

Coim Group |

Italy |

xx% |

|

Mitsui Chemicals & SKC Polyurethanes Inc. |

South Korea |

xx% |

|

Tosoh Corporation (Malaysia Operations) |

Malaysia |

xx% |

|

Arlanxeo |

Netherlands |

xx% |

|

Miracll Chemicals Co. Ltd. |

China |

xx% |

|

Era Polymers Pty Ltd |

Australia |

xx% |

|

Sheela Foam Limited |

India |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In April 2024, Covestro AG introduced its Desmopan EC ETPU series, which has better mechanical properties and a lower carbon footprint. This series is aimed at automotive interior components and high-end sports protective equipment. As a result, Covestro’s TPU business segment achieved a 13% increase in year-on-year sales for the first half of 2024, driven by strong demand in Europe and the Asia-Pacific region from industries looking for long-lasting and sustainable thermoplastic polyurethane options.

- In March 2024, BASF SE developed a new grade of expanded Ultramid Balance, which is an ETPU for use in footwear and sports equipment. This product is bio-based, consisting of up to 61% of renewable materials from castor oil. With this launch, BASF increased its share of high-performance ETPU foam in the EU sportswear market by 15% mid-2024, after major brands like Adidas started using the material in their new lightweight, durable, and sustainable performance shoes.

- Report ID: 3131

- Published Date: Jul 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Expanded Thermoplastic Polyurethane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert