Thermoplastic Elastomer Market Outlook:

Thermoplastic Elastomer Market size was valued at USD 28.31 Billion in 2025 and is set to exceed USD 48.82 Billion by 2035, expanding at over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thermoplastic elastomer is estimated at USD 29.74 Billion.

The growth of the market can be attributed to the increasing demand from consumer-based industries such as automotive, construction, and consumer electronics and the growing demand for sustainable and eco-friendly materials. It has been estimated that in the past five years, the popularity of internet searches for sustainable goods and materials has increased by 70% around the world. Thermoplastic elastomers are a type of material that are biodegradable and have a lower environmental impact than other materials such as PVC, rubber, and polyethylene. This makes them attractive to manufacturers who are looking to reduce their environmental footprint and make their products more sustainable.

In addition to these, factors that are believed to fuel the market growth of thermoplastic elastomers include growing demand for lightweight yet resilient materials for automotive applications and increasing demand for thermoplastic elastomer from the footwear industry are two of the key factors expected to drive the market growth of thermoplastic elastomer. Footwear is a major consumer of thermoplastic elastomer, as it is used for shoe soles to provide cushioning, flexibility and durability. It is also used in the production of shoe uppers and insoles. TPE offers a unique combination of properties that makes it ideal for many shoe applications. Thus, the increasing production of footwear is projected to drive market growth. For instance, global production and exports increased by 8.6% and 7.4%, respectively in 2021. The world exported 13 billion pairs of footwear in 2021, along with 22 billion pairs produced worldwide.

Key Thermoplastic Elastomer Market Insights Summary:

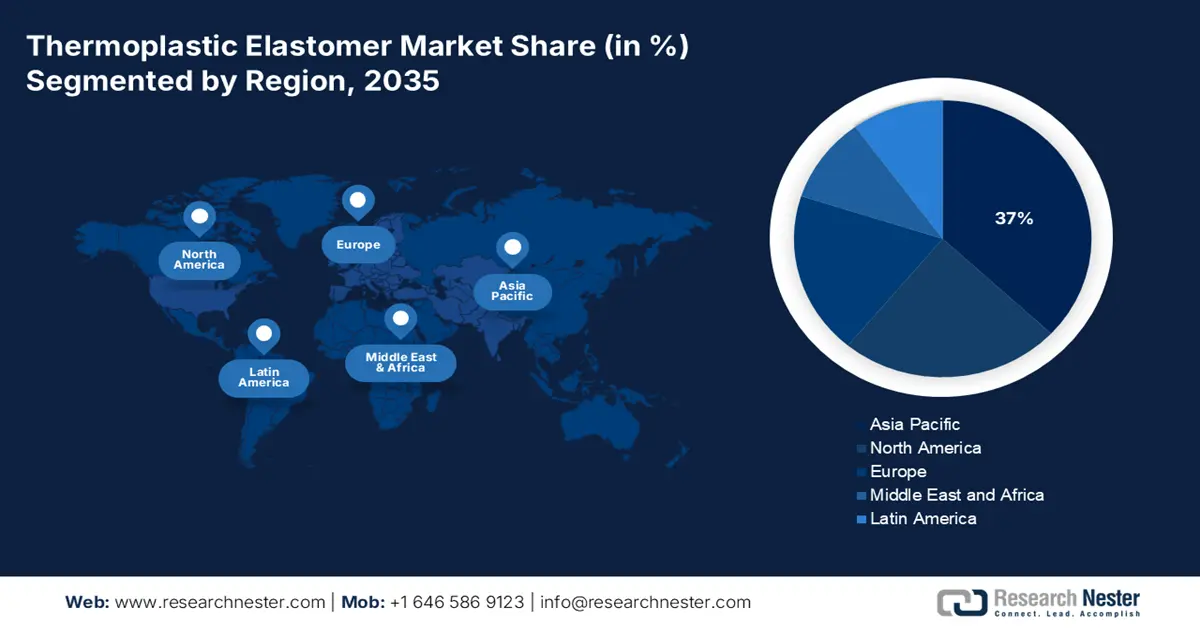

Regional Highlights:

- Asia Pacific thermoplastic elastomer market is predicted to capture 37% share by 2035, driven by strong manufacturing base and demand from automotive and packaging sectors.

- North America market will account for 27% share by 2035, driven by rising demand for lightweight automotive components and increased healthcare investments.

Segment Insights:

- The automotive segment in the thermoplastic elastomer market is forecasted to attain a 36% share by 2035, attributed to the increasing demand for lightweight materials and development of electric vehicles in the automotive sector.

- The tpv (thermoplastic elastomer market) segment is anticipated to secure a 26% share by 2035, driven by TPV's unique combination of flexibility, strength, and resistance, making it ideal for various applications.

Key Growth Trends:

- Elevating Preference for Lightweight Vehicles

- Increasing Production of Electric Vehicles

Major Challenges:

- Price Volatility of Raw Materials

- High Cost of Thermoplastic Elastomers

Key Players: Arkema, Huntsman International LLC, Covestro AG, KRAIBURG TPE GmbH & Co. KG, Kent Elastomer Products, ALTANA AG, Tosoh America, Inc., The Lubrizol Corporation, Teknor Apex Company, Inc., JSR Corporation, DuPont.

Global Thermoplastic Elastomer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.31 Billion

- 2026 Market Size: USD 29.74 Billion

- Projected Market Size: USD 48.82 Billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Thermoplastic Elastomer Market Growth Drivers and Challenges:

Growth Drivers

-

Elevating Preference for Lightweight Vehicles -With the increasing preference for lightweight vehicles to reduce overall fuel consumption, the demand for thermoplastic elastomers is increasing. These materials are lightweight yet strong and have the properties of both rubber and plastic, making them the ideal choice for the automotive industry. Also, it is estimated that by reducing vehicle weight by 10%, fuel economy could be increased by as much as 6-8 %.

-

Increasing Production of Electric Vehicles - Electrified cars in the US accounted for 4.6 percent of total car sales in 2021, up from 0.2 percent in 2011. In 2030, electric vehicle sales are expected to reach 40% of total passenger car sales in the United States, and more optimistic projections anticipate reaching 50% of sales. Electric vehicles require a high amount of TPEs owing to their lightweight properties and resistance to wear and tear, making them ideal for automotive parts and components. Additionally, the increasing use of TPEs in the interiors of electric vehicles to reduce noise and vibration is driving the market growth.

-

Growing Concern About Reducing Carbon Emissions - The global emissions of CO2 increased by 240 million tons per year between 2011-2015 compared to 2016-2019. As governments around the world are increasingly enacting laws and regulations to reduce carbon emissions, the demand for materials that are sustainable and recyclable has grown. Thermoplastic elastomers are a type of polymer that can be recycled and reused, making them an attractive option for reducing carbon emissions.

-

Increasing Plastic Production- Plastic production in the world is expected to grow from 9 billion tons in 2017 to 35 billion tons by 2050. Plastic is a cost-effective and versatile material that can be used in a wide range of applications. As such, the demand for plastic has been increasing, leading to a corresponding increase in the demand for thermoplastic elastomers, which are used to make plastics such as polypropylene and polyethylene.

-

Rising Consumer Electronics Sales - Globally, consumer electronics sales grew much faster for computers 35% and TV sets 15% globally in the past three years, owing to COVID-19 restrictions and more time spent at home working and learning. Thermoplastic Elastomer (TPE) is used in a wide range of consumer electronics, such as smartphones, tablets, laptops, and other gadgets. With the increasing demand for consumer electronics, manufacturers are turning to TPE as a preferred material for their products, leading to an increase in sales of TPE.

Challenges

- Price Volatility of Raw Materials – The exhaustion of raw materials such as fossil fuels resources along with indefinite crude oil prices performs as the biggest challenge for the market growth. This would restrict the production of raw materials for TPEs, therefore affecting the market growth. Additionally, strict regulations by governments and usage of non-renewable resources will pose a risk to the supply chain which will again hinder market growth.

- High Cost of Thermoplastic Elastomers

- Lack of Technical Expertise

Thermoplastic Elastomer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 28.31 Billion |

|

Forecast Year Market Size (2035) |

USD 48.82 Billion |

|

Regional Scope |

|

Thermoplastic Elastomer Market Segmentation:

Type Segment Analysis

The global thermoplastic elastomer market is segmented and analyzed for demand and supply by type into SBC, TPU, TPO, TPV, COPE, and PEBA. Out of these, the TPV segment is estimated to gain the largest market share of about 26% in the year 2035. TPV's unique combination of properties, such as its flexibility, strength, and resistance to abrasion, temperature, and chemicals, make it ideal for use in a wide variety of applications, including automotive, electrical/electronics, construction, and consumer products. These benefits are expected to drive the demand for TPV in the coming years. Moreover, TPV is a thermoplastic elastomer made from a blend of polypropylene, ethylene propylene diene monomer rubber, and other materials. The blend of materials makes it both strong and flexible, and its recyclability makes it an environmentally friendly choice. A report found that about 60% of consumers worldwide are making eco-friendly and sustainable purchases.

End-user Segment Analysis

The global thermoplastic elastomer market is segmented and analyzed for demand and supply by end user into automotive, building & construction, footwear, wire & cable, medical, and engineering. Out of these, the automotive segment is estimated to gain the significant market share of about 36% in the year 2035. The growth of the segment can be attributed to the increasing demand for lightweight materials in the automotive sector as it helps to reduce the overall weight of the vehicle while providing better performance, along with the development of electric vehicles and other advanced technologies. Additionally, the stringent regulations imposed by governments on the automotive industry to reduce emissions and improve the fuel economy of vehicles are also expected to drive the demand for thermoplastic elastomers in the automotive sector. Additionally, they are durable and can withstand the harsh conditions of the road, making them perfect for use in automotive parts.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By End User |

|

|

By Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thermoplastic Elastomer Market Regional Analysis:

APAC Market Insights

The market share of thermoplastic elastomer in Asia Pacific, amongst the market in all the other regions, is projected to be the largest with a share of about 37% by the end of 2035. The growth of the market can be attributed majorly to the region's strong manufacturing base and increasing demand for thermoplastic elastomer from various end-use industries such as automotive, construction, and packaging. A number of advantages over thermoset rubber, such as superior physical and chemical properties, easy processing and manufacture, and cost-effectiveness, cause thermoplastic elastomers to be increasingly replaced by thermoset rubber in the region. For instance, as a result of COVID-19, a decrease in the rubber industry in India has been observed, resulting in a reduction of 25 million metric tons every year. In addition, demand for thermoplastic elastomers widely originated from the construction and automotive industry in the Asia Pacific region. China holds the largest market share of the thermoplastic elastomer market followed by Japan and South Korea in 2021.

North American Market Insights

The North America thermoplastic elastomer market is estimated to be the second largest, registering a share of about 27% by the end of 2035. The growth of the market can be attributed majorly to the demand for thermoplastic elastomer in the North America region is expected to be driven by the rising demand for light-weight automotive components, growing demand for consumer goods, and increasing investments in the healthcare sector. Additionally, the increasing demand for thermoplastic elastomer-based products in the automotive and construction industries is expected to fuel the growth of the North American thermoplastic elastomer market. Owing to thermoplastic elastomer properties such as versatility, easy molding, and customizable shape formation they are crucial for each and every industry. Many automobile companies look for plastic-made products as they are low in cost and they increase the bottom line as well.

Europe Market Insights

Europe region is set to witness significant growth till 2035. Increasing demand for thermoplastic elastomers in the automotive sector, primarily in the production of engine mounts and other automotive components, is driving the growth of the market in Europe. The medical industry in this region also has a high demand for Thermoplastic Elastomer (TPE). Market growth in this region is driven by its growing use of TPE in medical devices, equipments, surgical instruments, and other medical products. Thermoplastic elastomers are used in medical devices owing to their combination of properties, such as flexibility, strength, and tear resistance, which make them well-suited for use in medical applications. They are also biocompatible, making them a safe choice for medical devices.

Thermoplastic Elastomer Market Players:

- Arkema

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huntsman International LLC

- Covestro AG

- KRAIBURG TPE GmbH & Co. KG

- Kent Elastomer Products

- ALTANA AG

- Tosoh America, Inc.

- The Lubrizol Corporation

- Teknor Apex Company, Inc.

- JSR Corporation

- DuPont

Recent Developments

-

Covestro AG decided to expand the portfolio of circular TPU products based on alternative resources. Covestro is moving forward with the expansion of its product line based on alternative resources as part of its programme to realize the circular economy.

-

New DuPontTM LiveoTM Pharma TPE Tubing was unveiled at three industry events: CBioPC in Nanjing, China, INTERPHEX in New York, and CPhI in Milan, Italy. The new DuPontTM LiveoTM Pharma TPE Tubing is specifically designed for use in the pharmaceutical industry and is engineered to meet the exacting standards of the industry.

- Report ID: 4529

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thermoplastic Elastomer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.