Polyurethane Elastomers Market Outlook:

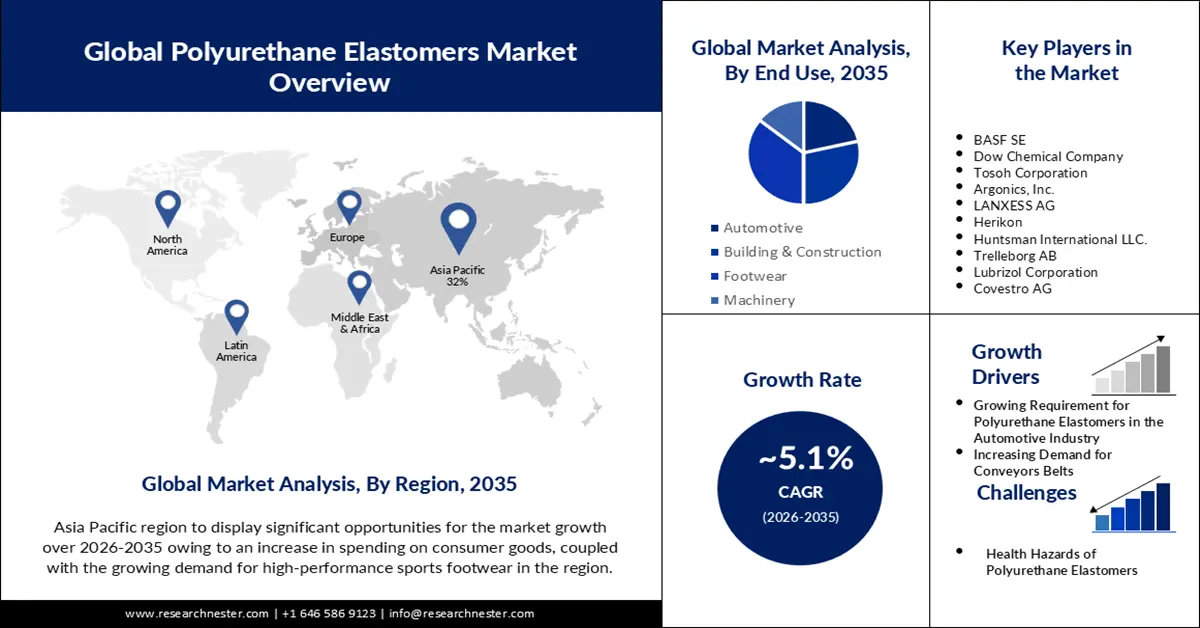

Polyurethane Elastomers Market size was over USD 6.24 billion in 2025 and is projected to reach USD 10.26 billion by 2035, growing at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyurethane elastomers is assessed at USD 6.53 billion.

The market growth is impelled by growing requirement for polyurethane elastomers in the automotive industry. Polyurethane elastomers are highly used in the automotive industry to manufacture doors, window surrounds, acoustic insulation, headrests, seats, trimming, and exterior & interior of automobiles. Furthermore, these elastomers are also used in the tires and wheels of automobiles.

Additionally, rising demand for polyurethane elastomers in mining is believed to fuel the market expansion. For instance, polyurethane elastomers are highly used in the mining sector such as pump impellers, mining screens, conveyors’ belts, and others. It is a highly required product in mining since it can decrease wear and tear, abrasion, and shock.

Key Polyurethane Elastomers Market Insights Summary:

Regional Highlights:

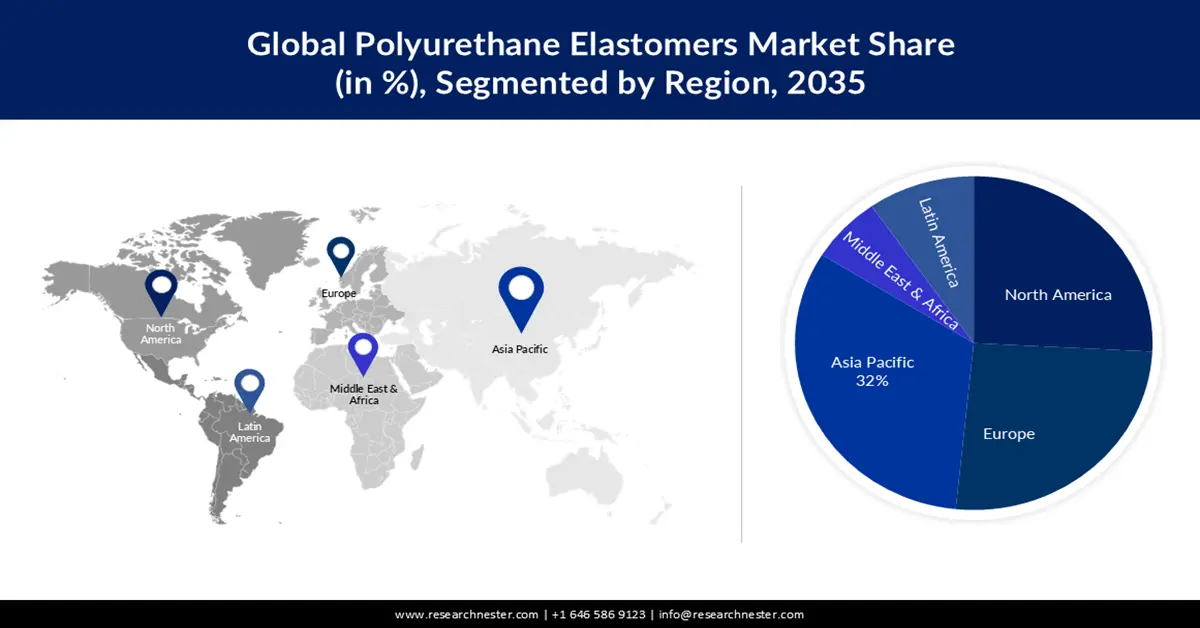

- Asia Pacific polyurethane elastomers market will hold around 32% share by 2035, driven by increased consumer spending on goods requiring polyurethane elastomers.

- North America market projects lucrative growth during the forecast timeline, driven by growth in the construction sector.

Segment Insights:

- The footwear segment in the polyurethane elastomers market is forecasted to capture a 24% share by 2035, driven by the favorable properties of polyurethane elastomers in footwear manufacturing.

- The thermoset pu elastomers segment in the polyurethane elastomers market is expected to achieve a notable revenue share by 2035, supported by its high elasticity and low-temperature performance.

Key Growth Trends:

- Increasing Demand for Conveyors Belts

- Growing Demand in Medical Devices

Major Challenges:

- Health Hazards of Polyurethane Elastomers

- Poor Weatherability and Thermal Capability

Key Players: BASF SE, Dow Chemical Company, Tosoh Corporation, Argonics, Inc., LANXESS AG, Herikon, Huntsman International LLC., Trelleborg AB, Lubrizol Corporation, Covestro AG.

Global Polyurethane Elastomers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.24 billion

- 2026 Market Size: USD 6.53 billion

- Projected Market Size: USD 10.26 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Polyurethane Elastomers Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Demand for Conveyors Belts - Polyurethane elastomers are the most suitable material to make conveyor belts. Moreover, polyurethane adhesives are usually used to seal the ends of conveyor belts and can be utilized in even the most delicate food applications without any problems. Therefore, higher demand for conveyor belts in bottling manufacturing, mining, agriculture, food, and industries is estimated to propel the market growth over the forecast period.

-

Growing Demand in Medical Devices- The high strength and simplicity of processing polyurethane elastomers make them the material of choice for innumerable medical devices. Polyurethanes elastomers are used in medicine since they are compatible with the human body and are also employed in medical devices such as surgical instruments.

Challenges

-

Health Hazards of Polyurethane Elastomers - To give shape to end-use products manufactured from polyurethane elastomers, the hot wire cutting method is used. During this process, vapors from the hot wire cutting can be irritating and hence in acute conditions, result in coughing. The emitted vapor is also known to contain trace amounts of toluene diisocyanate (TDI) or diphenylmethane diisocyanate (MDI), which is harmful to human health. In chronic conditions, studies showed that inhalation or overexposure to clouds of dust may cause inflammation of the lungs, fibrosis, and airway obstruction. Such factors are anticipated to hamper the growth of the global polyurethane elastomers market.

-

Poor Weatherability and Thermal Capability

-

Flammable and Utilizes Toxic Isocyanates

Polyurethane Elastomers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 6.24 billion |

|

Forecast Year Market Size (2035) |

USD 10.26 billion |

|

Regional Scope |

|

Polyurethane Elastomers Market Segmentation:

End Use Industry Segment Analysis

The footwear segment is estimated to hold 24% share of the global polyurethane elastomers market by 2035, owing to its numerous favorable properties of polyurethane elastomers when used as a raw material for manufacturing footwear. The composition of polyurethane elastomer is mostly utilized to create flexible high-tensile soles, suppers, and accessories. PU elastomers maintain the aesthetics of the footwear. Also, it prevents the formation of wrinkles and has excellent hydrolysis and abrasion resistance. Utilization of PU elastomers for manufacturing footwear also provides good compression. In addition, numerous forms of footwear, including boots and shoes for sports and hiking, are made of polyurethane elastomer foams owing to their low weight and excellent dampening properties.

Type Segment Analysis

The thermoset PU elastomers segment is set to garner a notable share in the near future, driven by the fact that it has high elasticity compared to other polymer elastomers and it can function quite well in low-temperature with robust flexibility. Elastomers are polymers with weak crosslinks, which exhibit great elasticity at room temperature and can be widely stretched. Moreover, it is a versatile material that can take multiple forms. Thermoset PU elastomers are highly used in the mining processes such as storage, transportation, and extraction mainly in rollers, mining screens, pump impeller wheels, and others. Furthermore, thermoset PU elastomers are also used as adhesives, mold compounds, insulation, and coatings.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyurethane Elastomers Market Regional Analysis:

APAC Market Insights

Polyurethane Elastomers market in Asia Pacific is predicted to account 32% share by the end of 2035, impelled by increase in spending on consumer goods. For instance, more and more consumers in the region are investing in home furniture and bedding products to upgrade their living spaces which require the usage of polyurethane elastomers since they are Rubber-like materials and can be molded into practically any shape. Furthermore, these materials are also used to create hard foams that offer support and cushioning.

North American Market Insights

The polyurethane elastomers market in North America is estimated to register lucrative CAGR during the forecast timeframe, led by increasing construction sector. For instance, Canada is one of the wealthiest nations with one of the largest economies in the world, and the foundation of its economy is construction. As a result, the demand for polyurethane elastomers is expected to rise in the region.

Moreover, polyurethane-elastomers are suitable as forms for cement-bound materials including concrete, which is primarily utilized for sealing joints and openings in constructions. Owing to their superior bonding qualities and endurance, they are also frequently employed as sealants and adhesives in construction. According to the estimates, in 2022, the construction market in the United States was estimated to be around USD 1 trillion.

Polyurethane Elastomers Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Chemical Company

- Tosoh Corporation

- Argonics, Inc.

- LANXESS AG

- Herikon

- Huntsman International LLC.

- Trelleborg AB

- Lubrizol Corporation

- Covestro AG

Recent Developments

- BASF SE announced that it has expanded the application range of Ultrasim, which is a computer-aided engineering (CAE) simulation tool, aimed to support the manufacturing process of thermoplastic elastomers.

- Dow Inc. announced that it has partnered with Univar Inc. for the distribution of its broad portfolio range of polyurethane products in North America.

- Report ID: 2842

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyurethane Elastomers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.