Polyurethane Adhesives Market Outlook:

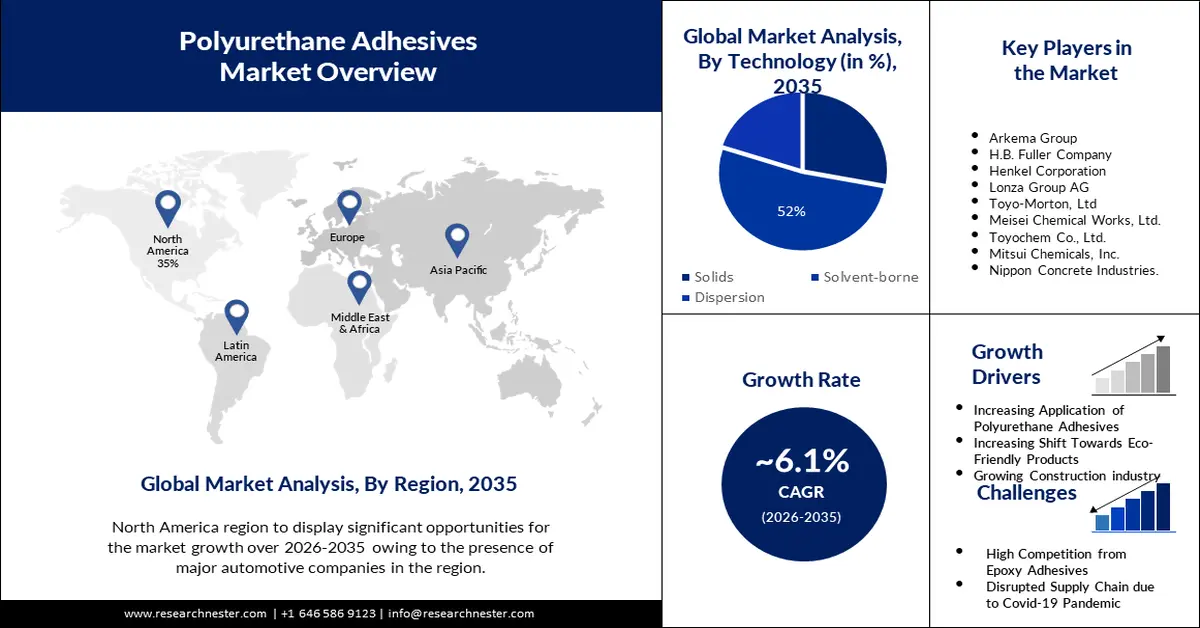

Polyurethane Adhesives Market size was valued at USD 10.49 billion in 2025 and is set to exceed USD 18.96 billion by 2035, expanding at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyurethane adhesives is estimated at USD 11.07 billion.

The market is expanding as a result of the characteristics of polyurethane adhesives, such as their strength and lightweight, which are widely utilized in the automotive industry to reduce the overall weight of cars and improve performance in terms of fuel efficiency and environmental sustainability. By 2030, emissions from autos can be cut by 40% thanks to lighter materials.

Polyurethane can be used as a substitute for plastic and other materials because of its benefits and characteristics. The polyurethane adhesives market is anticipated to expand over the forecast period as a result of the growing popularity of polyurethane adhesive. Additionally, polyurethane has a variety of end-use applications in the automotive, building, packaging, electrical and electronics, and other industries.

Key Polyurethane Adhesives Market Insights Summary:

Regional Highlights:

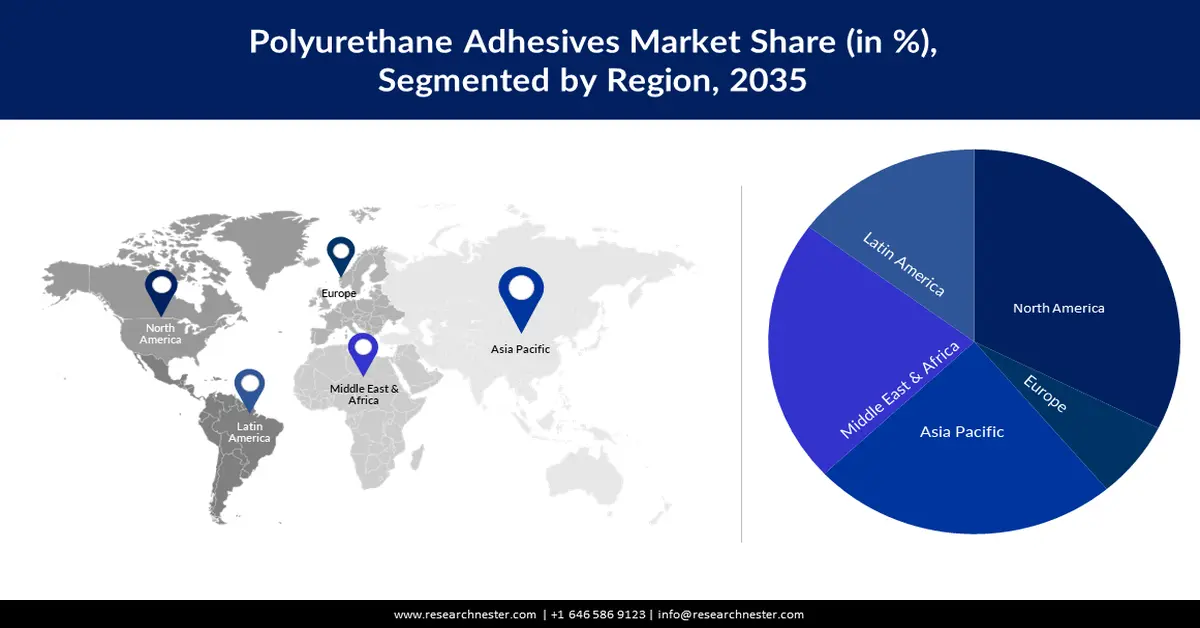

- North America polyurethane adhesives market achieves a 35% share by 2035, fueled by the presence of major automotive companies and increased construction activity.

- Asia Pacific market will secure 26% share by 2035, attributed to increased demand for adhesives in the furniture sector and rising vehicle production.

Segment Insights:

- The solvent-borne segment in the polyurethane adhesives market is expected to capture a 52% share by 2035, influenced by the formulation advantages of solvent-borne polyurethane adhesives.

- The building & construction segment in the polyurethane adhesives market is expected to capture a 31% share by 2035, driven by rising demand for housing and government infrastructure spending.

Key Growth Trends:

- Increasing Application of Polyurethane Adhesives

- Increasing Shift Towards Eco-Friendly Products

Major Challenges:

- Environmental Regulations in Some Regions

- High Competition from Epoxy Adhesives

Key Players: Bostik, Arkema Group, H.B. Fuller Company, Henkel Corporation, Lonza Group AG, Toyo-Morton, Ltd, Meisei Chemical Works, Ltd., Toyochem Co., Ltd., Mitsui Chemicals, Inc., Nippon Concrete Industries.

Global Polyurethane Adhesives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.49 billion

- 2026 Market Size: USD 11.07 billion

- Projected Market Size: USD 18.96 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, Thailand, Indonesia

Last updated on : 9 September, 2025

Polyurethane Adhesives Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Application of Polyurethane Adhesives – Due to its applications in dairy goods as well as in packaging and the industrial sector, polyurethane adhesives are a product that can be utilized in a variety of products. In her packaging industry, the use of polyurethane adhesive increased from 2.2% in 2018 to 5% in 2019.

- Increasing Shift Towards Eco-Friendly Products – The need for environmentally friendly adhesives rises as people become more conscious of how chemicals affect the environment and human health. Due to their low emissions of volatile organic compounds (VOCs), polyurethane adhesives are a popular choice among consumers seeking an environmentally acceptable substitute for conventional adhesives.

- Growing Construction Industry – In the forecast period, Polyurethane Adhesives represent one of the largest applications in the vehicle and building sectors which will also have a positive impact on market growth. With regard to the construction industry, polyurethane adhesive has a wide range of characteristics that are important in terms of its performance as regards good cohesion, adhesion, flexibility, durability, and Interco ciliation; which is also beneficial for the sector.

Challenges

- Environmental Regulations in Some Regions – Due to some environmental concerns, polyurethane adhesive is subject to regulation by various bodies in Europe and North America. The growth of the market could be hampered by this factor.

- High Competition from Epoxy Adhesives

- Disrupted Supply Chain due to Covid-19 Pandemic

Polyurethane Adhesives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 10.49 billion |

|

Forecast Year Market Size (2035) |

USD 18.96 billion |

|

Regional Scope |

|

Polyurethane Adhesives Market Segmentation:

Application Segment Analysis

The building & construction segment in the polyurethane adhesives market is expected to hold a share of 31% during the forecast period. There are reasons for this growth, namely rising demand for residential properties and the increased infrastructure spending by governments of different regions in the coming years which is consequently giving rise to such a market. In addition, the construction industry benefits from various properties of polyurethane adhesion. According to a report, half of the world's population will call for housing at roughly 97,000 dwellings per day.

Technology Segment Analysis

Polyurethane adhesives market from the solvent-borne segment is anticipated to hold a significant share of 52% during the forecast period. A high molecular weight hydroxyl-terminated polyurethane is dissolved in a solvent to form solvent-borne PU adhesives. The most common aromatic polyurethanes, such as toluene diisocyanates and diphenylmethane isocyanates, reduce both the properties of the adhesive and its appearance in a way similar to that of regular urethane adhesives.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyurethane Adhesives Market Regional Analysis:

North American Market Insights

North America polyurethane adhesives market is expected to hold a share of 35% during the forecast period. The growth can be attributed to the presence of major automotive companies in advanced countries, which is also supported by increased construction activity. According to the data, 3,033,216 cars and 8,156,769 commercial vehicles were manufactured in the US in 2019. Because people in this area have increased their disposable income, they're demanding ownership of homes.

APAC Market Insights

The polyurethane (PU) adhesives market in Asia Pacific is expected to hold a share of 26% during the forecast period. Due to increased demand for adhesives in the furniture sector, this market growth can be attributed. It is also expected that the consumption of polyurethane adhesives in these areas will rise over the forecast period due to an increased number of vehicle production and sales.

Polyurethane Adhesives Market Players:

- Bostik

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Arkema Group

- H.B. Fuller Company

- Henkel Corporation

- Lonza Group AG

Recent Developments

- H.B. Fuller Company (NYSE: FUL) announced that it has acquired the Belgium-based company Fourny nv, a well-respected provider of construction adhesives with more than 70 years of experience in technologies focused on commercial roofing, construction, and other private label industrial specialties.

- Henkel has introduced the new solvent-free and elastic adhesive Loctite UK 2073-2173, which is based on two-component polyurethane (2K-PU) technology, designed for superior performance on various substrates. With the launch of Loctite UK 2073-2173, Henkel is expanding its broad portfolio of 2-component polyurethane adhesives. As a longstanding partner to the automotive industry, Henkel enables the manufacturers to meet recent automotive performance requirements through reliable adhesion performance and a simplified manufacturing process.

- Report ID: 3610

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyurethane Adhesives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.