Pressure Sensitive Adhesives Market Outlook:

Pressure Sensitive Adhesives Market size was over USD 13.58 Billion in 2025 and is projected to reach USD 19.34 Billion by 2035, growing at around 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pressure sensitive adhesives is evaluated at USD 14.02 Billion.

The growth of the market can be attributed to the growing demand for adhesives worldwide for the packaging of food, pharmaceuticals, beverages, and other products which need extended shelf life. People nowadays are purchasing packaged food in escalated quantities that require advanced packaging. For instance, in 2020, the demand for adhesives across the globe was estimated at 15 million tonnes. Furthermore, pressure-sensitive adhesives are experiencing rapid market expansion backed by the rising consumer demand for lightweight, low-emission vehicles. In the automotive industry, polymer-based hot adhesives are mostly utilized for panel laminating. The demand for such adhesives in the automobile industry is expected to grow as individuals become more cognizant of the improved fuel economy and reduced pollution of lightweight vehicles. The global market for pressure-sensitive adhesives is therefore anticipated to increase as a result of the rising demand for fuel-efficient vehicles.

Global pressure-sensitive adhesives market trends such as higher utilization of pressure-sensitive adhesives in plastic production and significant need for pressure-sensitive adhesives in the paper & coating industry are projected to influence the growth of the market positively over the forecast period. It is observed that around 250 million tons of paper are produced annually across the globe. Pressure-sensitive adhesives are made of cloth, plastic, metal, paper, and others. These adhesives are generally used to manufacture labels and tapes. Multiple industries such as food, packaging, automotive, electronics, and others have a higher demand for these adhesives. Hence, such as higher demand for pressure-sensitive adhesives in multiple industries is anticipated to hike the growth of the market over the forecast period.

Key Pressure Sensitive Adhesives Market Insights Summary:

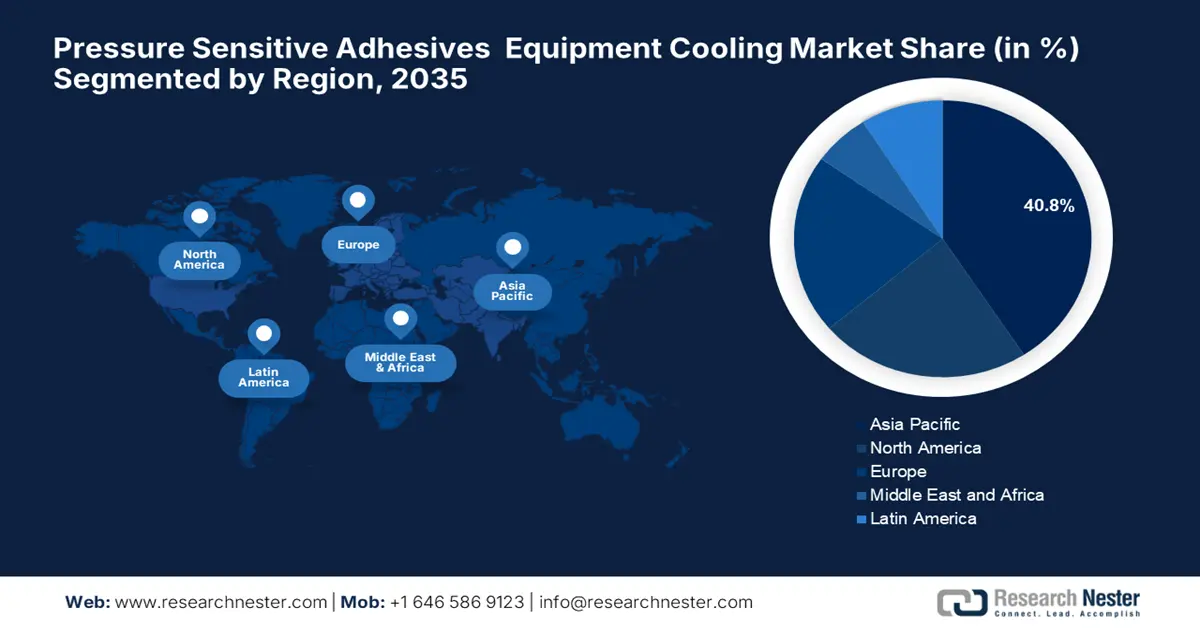

Regional Highlights:

- Asia Pacific’s pressure sensitive adhesives market is predicted to capture 40.8% share by 2035, driven by increased demand for adhesives in oil & gas, textiles, and packaging industries.

- North America market will grow rapidly through 2035, attributed to higher production and distribution of cosmetic products.

Segment Insights:

- The tapes segment in the pressure sensitive adhesives market is expected to capture the largest share by 2035, driven by increasing demand in the packaging industry and other sectors like construction and electronics.

- The packaging segment in the pressure sensitive adhesives market is forecasted to capture a significant share by 2035, driven by rising demand for flexible and medical packaging using pressure-sensitive adhesives.

Key Growth Trends:

- Increasing Production of Pigment Globally to Boost Market Growth

- Escalating Utilization of Pressure Sensitive Adhesives in Manufacturing of Cosmetics

Major Challenges:

- Increasing Production of Pigment Globally to Boost Market Growth

- Escalating Utilization of Pressure Sensitive Adhesives in Manufacturing of Cosmetics

Key Players: Henkel AG & Co. KGaA, The Dow Chemical Company, Avery Dennison Corporation, Ashland Inc., H.B. FULLER COMPANY, Sika India Private Limited, Arkema Group, Wacker Chemie AG, ExxonMobil Corporation, 3M Company.

Global Pressure Sensitive Adhesives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.58 Billion

- 2026 Market Size: USD 14.02 Billion

- Projected Market Size: USD 19.34 Billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Pressure Sensitive Adhesives Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Production of Pigment Globally to Boost Market Growth - As of 2021, pigment production was estimated to be around 14 thousand metric tons in India while it was projected to be about 100 thousand metric tons in South Korea. Pressure-sensitive adhesives are used to make pigment owing to their specific properties such as waterproofing, sealing agents, and corrosion & oxidation prevention. Significant demand for pigment has emerged in the market as a result of increasing urbanization and a growing interest in interior design. Pigments are colored material and are considered to be inorganic compound and it is insoluble in water. A wide range of applications requires pigments such as cosmetics, coloring paint, fabric, ink, plastic, and others.

-

Escalating Utilization of Pressure Sensitive Adhesives in Manufacturing of Cosmetics- The cosmetics industry was estimated to generate a revenue of about USD 5 billion in 2022 globally. Pressure-sensitive adhesives are used to pack cosmetics products as it is pressure-sensitive which can prevent moisture to penetrate and damage the product quality.

-

Significant Requirement Pressure Sensitive Adhesives in Making Medicine- The total spending on medicine in the United States was estimated to reach around USD 500 billion in 2021.

Challenges

-

Unpredictability in Raw Material Prices - Manufacturing pressure-sensitive adhesives require petrochemicals that are derived from crude oil. A constant fluctuation in the prices of petrochemicals and crude is estimated to hamper the market growth over the forecast period. Various Geopolitical and weather-related factors are a major reason to cause this fluctuation in price

-

Presence of Alternative Products Such as Mechanical Fasteners

- Requirement for Higher Initial Funding

Pressure Sensitive Adhesives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 13.58 Billion |

|

Forecast Year Market Size (2035) |

USD 19.34 Billion |

|

Regional Scope |

|

Pressure Sensitive Adhesives Market Segmentation:

Application

The tapes segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the rising sales of tapes in the packaging industry for keeping the packaging in place until it reaches its required location. Adhesive tapes are used to bond objects together by eliminating the use of welding, fasteners, screws, and others. Tapes come in multiple forms such as electrical, masking, packing, flooring, painting, and duct tape. Adhesive tapes are required in a wide array of industries such as paper & printing, building & construction, retail, consumer & office, electrical & electronics, automotive, white goods, and others. The growth of these industries is projected to be interlinked with the growth of the tapes segment owing to its higher demand.

End-user

The packaging segment is expected to garner a significant share among these segments over the forecast period. higher utilization of pressure-sensitive adhesives in medical packaging, flexible packaging, and others is expected to propel the market growth over the forecast period. The proper packaging of the medical product is necessary since it is responsible to preserve the medicine throughout its lifecycle. Pressure-sensitive adhesives are used in medical packaging to prevent moisture and oxidation of the packaged medical product.

Our in-depth analysis of the global market includes the following segments:

|

By Composition |

|

|

By Technology |

|

|

By Application |

|

|

By End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pressure Sensitive Adhesives Market Regional Analysis:

APAC Market Insights

Asia Pacific region is poised to dominate around 40.8% market share by 2035. The growth of the market can be attributed majorly to an up-surged demand for pressure-sensitive adhesives in the oil & gas industry for varied processes in procuring oil and gas products. For instance, the countries in Southern Asia are anticipated to launch nearly 50 oil and gas projects by the year 2025. Furthermore, the total oil production in the region was estimated to be about 7000 thousand barrels a day in 2021. Moreover, increasing utilization of these adhesives in textiles, and pharmaceuticals along with a higher adoption rate in the packaging industry including medical, personal care, food & beverage, and other types of packaging is also expected to hike the market growth over the forecast period.

North American Market Insights

Additionally, the market in the North American region is also projected to grow rapidly over the forecast period on the back of higher production and distribution of cosmetic products. In North America, a robust inclination toward the utilization of cosmetic products has been observed which is set to grow exponentially. Hence, for better distribution of products and to preserve their chemical and compounds, advanced packaging is necessary. For instance, it is observed that every year, approximately USD 50 billion are obtained from cosmetic product sales solely in the USA. Additionally, the average amount of money spent on cosmetics every month by Americans is estimated to be around 200 U.S. dollars to 300 U.S. dollars per month. Hence, such a higher utilization of pressure-sensitive adessives in the packaging of a wide range of products across several industries is estimated to hike the market growth over the forecast period.

Pressure Sensitive Adhesives Market Players:

- Henkel AG & Co. KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Dow Chemical Company

- Avery Dennison Corporation

- Ashland Inc.

- H.B. FULLER COMPANY

- Sika India Private Limited

- Arkema Group

- Wacker Chemie AG

- ExxonMobil Corporation

- 3M Company

Recent Developments

-

Henkel AG & Co. KGaA is going to merge Laundry & Home Care and Beauty Care in its portfolio. The company is determined to create a multi-category platform by continuing the optimization of consumer portfolios.

-

The Dow Chemical Company assists automotive OEMs to understand the utilization of silicon. The company has also prepared a skillset to identify innovation opportunities.

- Report ID: 4337

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pressure Sensitive Adhesives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.