Adhesive Tapes Market Outlook:

Adhesive Tapes Market size was over USD 85.35 billion in 2025 and is projected to reach USD 140.36 billion by 2035, growing at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of adhesive tapes is evaluated at USD 89.27 billion.

The growth of the adhesive tapes market can be attributed to the increasing demand of adhesive tapes from various industries. Adhesive tapes are used in a wide range of industries, including automotive, electronics, healthcare, packaging, construction, and others. Additionally, the packaging industry is expanding rapidly. For instance, amidst the e-commerce boom, the Indian packaging industry is experiencing rapid growth and is one of the fastest growing sectors. According to the Indian Institute of Packaging (IIP), packaging consumption in India has increased by 200% over the last decade, from 4.3 kg per person per year (pppa) to 8.6 kg pppa.

In addition to this, the growth of the e-commerce industry has led to an increase in the demand for adhesive tapes for packaging and shipping purposes. Global e-commerce sales are projected to reach USD 6 trillion by the year 2024, up from USD 3.53 trillion in the year 2019. Mobile e-commerce sales are growing at a faster rate than desktop sales. In the year 2020, mobile e-commerce sales accounted for nearly 45% of total e-commerce sales worldwide, up from 40% in the year 2018. First coined by Kevin Duffey at the inception of the Global Mobile Commerce Forum in 1997, the term mobile commerce means "bringing electronic commerce capabilities directly into the hands of consumers, wherever they are, via wireless technology." These are the factors that are predicted to present the potential for adhesive tapes market expansion over the projected period.

Key Adhesive Tapes Market Insights Summary:

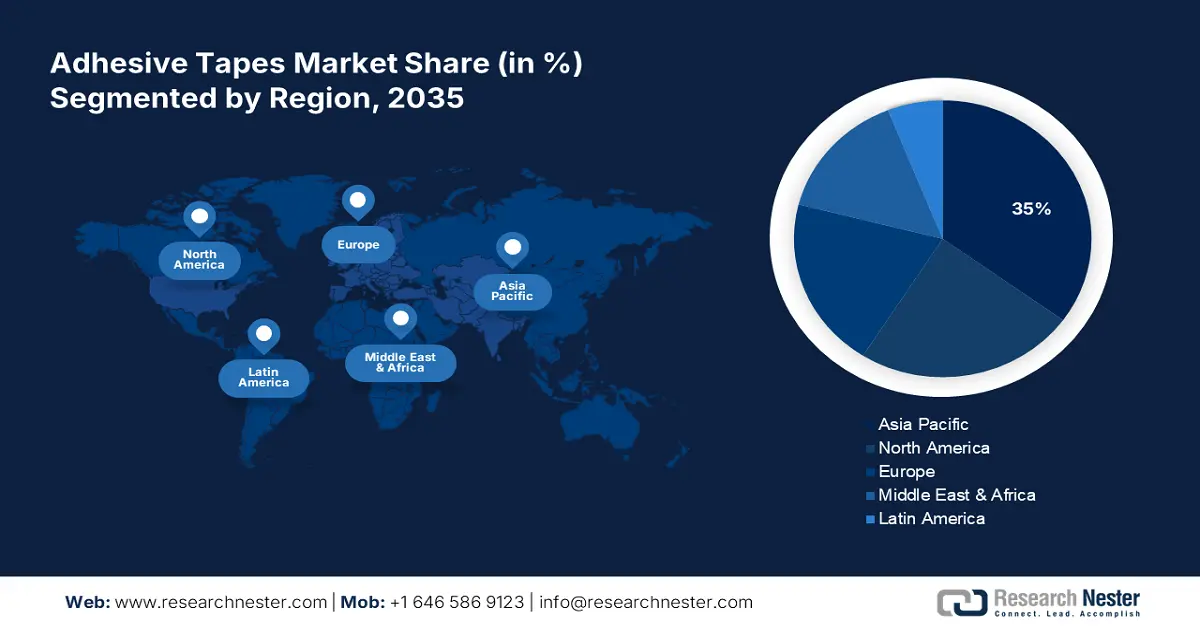

Regional Highlights:

- Asia Pacific adhesive tapes market is predicted to capture 35% share by 2035, driven by increasing vehicle demand and rising production of electric vehicles.

- North America market will account for 24% share by 2035, driven by rapid expansion of the automotive industry and rising per capita income.

Segment Insights:

- The automotive segment segment in the adhesive tapes market is expected to achieve a 35% share by 2035, driven by increasing production rate of electric vehicles and growing awareness about traffic emissions.

- The polyvinyl chloride (pvc) segment in the adhesive tapes market is expected to achieve a 30% share by 2035, driven by growing demand in construction, automotive, and packaging industries.

Key Growth Trends:

- Increasing Revenues of the Automotive Industry

- Increasing Incorporation of Advanced Driver Assistance Systems (ADAS) Technology

Major Challenges:

- Price volatility of raw materials:

- Increasing competition in the global adhesive tapes market.

Key Players: BASF SE, Nitto Denko Corporation, Tesa SE, Avery Dennison Corporation, Henkel AG & Co. KGaA, Lohmann GmbH & Co. KG, Scapa Group plc, Intertape Polymer Group Inc., Shurtape Technologies LLC, Lintec Corporation.

Global Adhesive Tapes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 85.35 billion

- 2026 Market Size: USD 89.27 billion

- Projected Market Size: USD 140.36 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Indonesia, Thailand, Vietnam

Last updated on : 10 September, 2025

Adhesive Tapes Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Revenues of the Automotive Industry – The expansion of the adhesive tapes market can be attributed to the increasing revenues of the automotive industry worldwide. This is the result of increased vehicle production worldwide. The global automotive industry is expected to reach approximately USD 9 trillion by 2030. Additionally, increasing demand for premium vehicles with premium materials, safety and technical features, and aesthetically enhanced environments is expected to drive the adhesive tapes market growth. Adhesive tapes for the automotive industry are a combination of materials with an adhesive-coated backing and optionally a release liner.

- Increasing Incorporation of Advanced Driver Assistance Systems (ADAS) Technology – Adhesive tapes are used as bonding solutions and connecting solutions in the ADAS systems. ADAS is the latest safety technology to help drivers navigate and park by coordinating the actions of cameras, sensors and radar to scan an area and relay this information to the driver. With the increase in road accidents and fatalities, road safety has become very important. About 1.3 million people die each year in road accidents. This can be mitigated with safety technology such as its ADAS, which has hitherto been limited to luxury vehicles.

- Rise in Research Spending – Growth in the global market during the forecast period can be further attributed to increased investment in research and development activities to continuously find more viable solutions for adhesive tapes. Research reports show that global R&D spending on adhesive tapes has more than tripled in real terms since 2000, rising from about USD 680 billion to more than USD 2.5 trillion in the year 2019.

- Growing Demand for Environmentally Friendly Products: The increasing awareness about the environmental impact of products is driving the demand for eco-friendly adhesive tapes market that are made from renewable and biodegradable materials. In a survey conducted in the year 2020, nearly 68% of US consumers stated that they had switched to a more environmentally friendly product in the past year.

- Increase in Construction Activities: With the increase in construction activities worldwide, the demand for adhesive tapes for bonding, sealing, and masking applications is increasing. In the United States, construction spending in the residential sector reached nearly USD 614 billion in 2020, up 14% from the previous year.

Challenges

-

Price volatility of raw materials: The prices of raw materials used in adhesive tapes, such as petroleum-based adhesives, can be volatile, making it challenging for manufacturers to maintain stable prices for their products.

- Increasing competition in the global adhesive tapes market.

- Supply chain disruptions: Disruptions in the global supply chain, such as those caused by the COVID-19 pandemic, can impact the availability of raw materials and finished products, leading to challenges for manufacturers in meeting customer demand.

Adhesive Tapes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 85.35 billion |

|

Forecast Year Market Size (2035) |

USD 140.36 billion |

|

Regional Scope |

|

Adhesive Tapes Market Segmentation:

Application Segment Analysis

The global adhesive tapes market is segmented and analyzed for demand and supply by application into automotive, healthcare, packaging, electronics, and others. Out of the five types of end users, the automotive segment is estimated to gain the largest market share of about 35% in the year 2035. The growth of the segment can be accredited to the increasing production rate of electric vehicles worldwide and the growing awareness of the global population about the negative impact of traffic emissions on human health and the environment. This is backed by the expected high demand. The International Energy Agency reported that in 2021, electric vehicle sales surpassed its 2020 sales, nearly doubling to 6.6 million. Tapes designed for vehicles are primarily used for specific purposes and therefore require a different type of adhesive. Masking tape, for instance, is used as an adhesive tapes market for painting automobiles. It protects vehicle's windows, exterior and interior when painting.

Material Segment Analysis

The global adhesive tapes market is also segmented and analyzed for demand and supply by material into polypropylene (PP), paper, and polyvinyl chloride (PVC). Amongst these three segments, the polyvinyl chloride (PVC) segment is expected to garner a significant share of around 30% in the year 2035. The growth of the segment can be accredited to the growing demand of PVC in the construction industry. PVC is widely used in the construction industry for applications such as pipes, window profiles, and roofing membranes. As the construction industry continues to grow, particularly in emerging economies, the demand for PVC is expected to increase. PVC is used in various automotive applications, such as seat covers, dashboard skins, and insulation. As the automotive industry continues to grow, particularly in Asia Pacific, the demand for PVC is expected to increase. PVC is used in various packaging applications, such as blister packaging, shrink wrapping, and food packaging. As the packaging industry continues to expand, particularly in e-commerce and food and beverage sectors, the demand for PVC is expected to increase. PVC can be made with eco-friendly additives that reduce its environmental impact, such as phthalate-free plasticizers and bio-based additives. The demand for eco-friendly PVC is expected to increase as consumers become more environmentally conscious. As urbanization continues to increase globally, the demand for PVC products in construction and infrastructure applications is expected to rise, leading to growth in the PVC segment over the forecast period.

Our in-depth analysis of the global adhesive tapes market includes the following segments:

|

By End User |

|

|

By Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Adhesive Tapes Market Regional Analysis:

APAC Market Insights

The adhesive tapes market in the Asia Pacific region, amongst the market in all the other regions, is projected to hold the largest market share of about 35% by the end of 2035. The regional growth can majorly be attributed to the increasing demand for vehicles, resulting in increasing vehicle production and sales in the region. Statistics from the International Automobile Manufacturers (OICA) show that in the year 2021, total vehicle production in the region increased from 44 million in 2020 to 46 million in the year 2020. Moreover, the production of electric vehicles is increasing in the Asia Pacific region, and their growing preference is another growth factor for market expansion. For instance, the International Energy Agency announced that China was largest producer of electric vehicles in 2020, with about 1.3 million electric vehicles registered in the same year. Furthermore, the presence of several major EV manufacturers in the region and the increasing development of better battery designs that require adhesive tape on EVs to provide maximum benefit to the battery cells used, is expected to drive the growth of the regional adhesive tapes market.

North American Market Insights

The North America adhesive tapes market,amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market in this region can primarily be attributed to the rapid expansion of the automotive industry in the region. Approximately 923,000 Americans are engaged in manufacturing automobiles and their parts, and 1,251,600 work in dealerships. As of the year 2021, the U.S. auto and parts industry generated approximately USD 1.5 trillion in revenue. The automobile industry contributes 3% of its GDP to America. In addition, increased per capita income for local residents is estimated to enable them to switch to individual, environmentally friendly vehicles. Nearly 75% of Americans said they owned a car by the year 2022, and another 20% say they would own a business or family car by 2024. Hence, this is expected to drive the adhesive tapes market growth in the North America region.

Europe Market Forecast

Europe region is anticipated to register substantial growth through 2035. The growth of the market can be attributed majorly to the increasing demand for lightweight and fuel-efficient vehicles. Adhesive tapes are widely used in the automotive industry for bonding and joining applications, particularly in lightweight and fuel-efficient vehicles. As the demand for such vehicles increases in Europe, the demand for adhesive tapes in the automotive industry is expected to grow. With the increasing trend of online shopping in Europe, the demand for packaging tapes used for e-commerce applications is also increasing. The use of adhesive tapes in packaging offers improved security, convenience, and protection to the products during transportation, which is expected to drive the growth of the adhesive tapes market in Europe. Adhesive tapes are widely used in the construction industry for bonding and sealing applications. As the construction industry continues to grow in Europe, particularly in emerging economies, the demand for adhesive tapes in the industry is expected to increase. Adhesive tapes are widely used in the medical industry for wound care, surgical applications, and other medical procedures. As the demand for medical tapes in Europe increases, the demand for adhesive tapes market in the medical industry is also expected to grow.

Adhesive Tapes Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nitto Denko Corporation

- Tesa SE

- Avery Dennison Corporation

- Henkel AG & Co. KGaA

- Lohmann GmbH & Co. KG

- Scapa Group plc

- Intertape Polymer Group Inc.

- Shurtape Technologies LLC

- Lintec Corporation

Recent Developments

-

BASF SE and Toray Advanced Composites have signed an agreement focused on manufacturing continuous fiber reinforced thermoplastic (CFRT) strips for the automotive and industrial markets.

-

Tesa SE plans to build a new factory in Vietnam to produce adhesive tapes for the Asian market from 2023.

- Report ID: 4804

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Adhesive Tapes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.