Global Ethylene Market

- An Outline of the Global Ethylene Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Ethylene

- Recent News

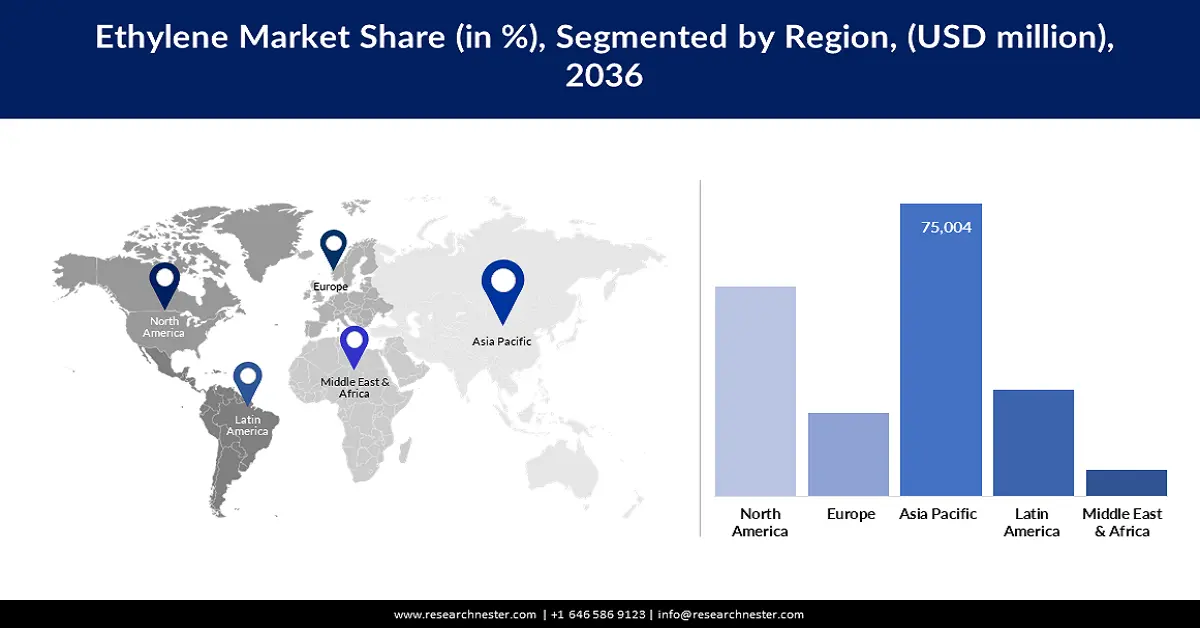

- Regional Demand

- Ethylene Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Ethylene Demand Landscape

- Ethylene Demand Trends Driven by Electrification, Downsizing, and Lightweighting (2026-2038)

- Root Cause Analysis (RCA) for discovering problems of the Ethylene Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Ethylene Market – Key Player Analysis (2024)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2024 (%)

- Business Profile of Key Enterprise

- ExxonMobil Chemical Company

- Dow Inc.

- LyondellBasell Industries N.V.

- INEOS Group

- Chevron Phillips Chemical Company LLC

- Reliance Industries Limited – Petrochemicals

- LG Chem, Ltd.

- Lotte Chemical Corporation

- TotalEnergies SE (Chemicals)

- Borealis AG

- PETRONAS Chemicals Group Berhad (PCG)

- Business Profile of Key Enterprise

- Global Ethylene Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Ethylene Market Segmentation Analysis (2026-2038)

- By Feedstock

- Naphtha-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Butane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Propane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Derivative/Application

- Polyethylene (PE), Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Oxide, Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Dichloride, Market Value (USD Million), and CAGR, 2026-2038F

- Styrene, Market Value (USD Million), and CAGR, 2026-2038F

- Alpha Olefins, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- End Use

- Packaging, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive, Market Value (USD Million), and CAGR, 2026-2038F

- Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Textile, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Regional Synopsis, Value (USD Million), 2026-2038

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Feedstock

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Segmentation (USD million), 2026-2038, By

- By Feedstock

- Naphtha-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Butane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Propane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Derivative/Application

- Polyethylene (PE) , Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Oxide, Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Dichloride, Market Value (USD Million), and CAGR, 2026-2038F

- Styrene, Market Value (USD Million), and CAGR, 2026-2038F

- Alpha Olefins, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- End Use

- Packaging, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive, Market Value (USD Million), and CAGR, 2026-2038F

- Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Textile, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Feedstock

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Segmentation (USD million), 2026-2038, By

- By Feedstock

- Naphtha-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Butane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Propane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Derivative/Application

- Polyethylene (PE), Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Oxide, Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Dichloride, Market Value (USD Million), and CAGR, 2026-2038F

- Styrene, Market Value (USD Million), and CAGR, 2026-2038F

- Alpha Olefins, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- End Use

- Packaging, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive, Market Value (USD Million), and CAGR, 2026-2038F

- Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Textile, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Feedstock

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Segmentation (USD million), 2026-2038, By

- By Feedstock

- Naphtha-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Butane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Propane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Derivative/Application

- Polyethylene (PE) , Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Oxide, Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Dichloride, Market Value (USD Million), and CAGR, 2026-2038F

- Styrene, Market Value (USD Million), and CAGR, 2026-2038F

- Alpha Olefins, Market Value (USD Million), and CAGR, 2026-2038F

- Others , Market Value (USD Million), and CAGR, 2026-2038F

- End Use

- Packaging, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive, Market Value (USD Million), and CAGR, 2026-2038F

- Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Textile, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Feedstock

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2038, By

- By Feedstock

- Naphtha-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Butane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Propane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Derivative/Application

- Polyethylene (PE), Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Oxide, Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Dichloride, Market Value (USD Million), and CAGR, 2026-2038F

- Styrene, Market Value (USD Million), and CAGR, 2026-2038F

- Alpha Olefins, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- End Use

- Packaging, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive, Market Value (USD Million), and CAGR, 2026-2038F

- Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Textile, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Feedstock

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2038, By

- By Feedstock

- Naphtha-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Butane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Propane-based Ethylene, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Derivative/Application

- Polyethylene (PE) , Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Oxide, Market Value (USD Million), and CAGR, 2026-2038F

- Ethylene Dichloride, Market Value (USD Million), and CAGR, 2026-2038F

- Styrene, Market Value (USD Million), and CAGR, 2026-2038F

- Alpha Olefins, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- End Use

- Packaging, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive, Market Value (USD Million), and CAGR, 2026-2038F

- Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Textile, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Feedstock

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Ethylene Market Outlook:

Ethylene Market size was USD 205.2 billion in 2025 and is estimated to reach USD 374.05 billion by the end of 2036, expanding at a CAGR of 5.8% during the forecast timeline, i.e., 2026-2036. In 2026, the industry size of ethylene is evaluated at 212.5 billion.

The global market is experiencing rapid expansion due to increasing demand for sustainable materials among consumers and corporate targets related to decarbonization. Due to this, companies in the market are focused on bio-based production. In April 2024, BlackRock and Temasek finalized a funding of USD 1.4 billion to fuel investments in technology companies involved in driving decarbonization outcomes, including bio-based production. This shift to bio-based production provides companies with the opportunity to produce bio-based ethylene using feedstocks such as sugarcane and corn, which can make the market more sustainable and foster its growth.

Technological advancements, such as the development of catalytic cracking and steam cracking technologies, also drive the growth of the global market. For instance, in March 2023, Linde collaborated with Coolbrook for the electrification and decarbonization of steam crackers with the use of RotoDynamic Reactor technology. The use of the RotoDynamic Reaction technology can replace the cracker furnaces that are fuel-based in the production of ethylene. The electrification and decarbonization of steam crackers provide the opportunity to make the process of ethylene production more efficient and reduce carbon emissions in the enhancement of the same.

Key Ethylene Market Insights Summary:

Regional Insights:

- Asia Pacific is projected to command a 54.5% share by 2036 in the ethylene market, supported by escalating demand from packaging, automotive, and construction industries amid rapid industrialisation and urbanisation.

- North America is anticipated to be the fastest-growing region at a 6% CAGR during 2026–2036, underpinned by rising investments in ethylene production capacity and export-oriented infrastructure.

Segment Insights:

- The ethane-based segment is forecast to secure a 42.5% share by 2036 in the ethylene market, attributed to abundant ethane availability and its cost-efficient use as a petrochemical feedstock.

- The polyethylene (PE) segment is expected to represent a 41.6% share during 2026–2036, strengthened by extensive packaging applications and comparatively low manufacturing costs.

Key Growth Trends:

- Surging demand for polyethylene in packaging

- Growing construction and infrastructure activities

Major Challenges:

- Volatility in feedstock prices

- High capital investments

Key Players: ExxonMobil Chemical Company, Dow Inc., LyondellBasell Industries N.V., INEOS Group, Chevron Phillips Chemical Company LLC, Reliance Industries Limited – Petrochemicals, LG Chem, Ltd., Lotte Chemical Corporation, TotalEnergies SE (Chemicals), Borealis AG, PETRONAS Chemicals Group Berhad (PCG), Mitsubishi Chemical Group Corporation, Sumitomo Chemical Co., Ltd., Mitsui Chemicals, Inc., Qenos Pty Ltd (in administration/closure).

Global Ethylene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 63.12 billion

- 2026 Market Size: USD 212.5 billion

- Projected Market Size: USD 374.05 billion by 2036

- Growth Forecasts: 5.8% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (54.5% share by 2036)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Saudi Arabia, Germany

- Emerging Countries: Vietnam, Indonesia, Thailand, Mexico, Brazil

Last updated on : 19 August, 2025

Ethylene Market - Growth Drivers and Challenges

Growth Drivers

- Surging demand for polyethylene in packaging: Ethylene is a widely used feedstock in the production of polyethylene, and the surging demand for polyethylene in packaging is significantly fuelling the market growth. The key characteristics of polyethylene, including versatility, durability, resistance to chemicals, impact, and bacteria, and low capacity for moisture absorption, also fuel polyethylene’s demand in packaging. As a result, companies have started to invest in the production of polyethylene. For instance, in March 2025, Borealis announced the launch of Borcycle M CWT120CL, a recycled linear polyethylene with low density and designed for flexible packaging applications for non-food items.

- Growing construction and infrastructure activities: The demand for ethylene-derived products is rapidly increasing due to the rise of urbanization, the initiation of smart city programs, the construction of large-scale housing in the emerging economies, and the expansion of infrastructural development. Particularly, the demand for products, such as polyethylene and PVC, is increasing for insulation, pipeline, and structural purposes. In October 2024, a panel discussion was hosted by the Public-Private Infrastructure Advisory Facility (PPIAF) at the World Bank Headquarters Main Complex 4-800 with the motive of scaling up sustainable infrastructure. The focus of the discussion at the event was on the role that the pooled infrastructure investment vehicles play in attracting private financing for projects related to climate and infrastructure.

- Automotive light-weighting initiatives: The demand for ethylene-derived polymers such as polyethylene and ethylene‑propylene diene monomer (EPDM) is significantly driven by automotive light-weighting initiatives that are aimed at reducing the mass of vehicles. In July 2024. Dow announced the launch of NORDEL REN EPDM at DKT 2024. It is a bio-based and high-performance elastomer, which has been designed for weather seals and hoses in the automotive industry. In addition, the need for increasing fuel efficiency, which is met by automotive light-weighting initiatives, also accelerates the consumption of ethylene.

Challenges

- Volatility in feedstock prices: Ethane, naphtha, butane, and propane are some feedstocks used in the production of ethylene, and the volatility in the prices of such feedstocks significantly hampers the market growth, thereby exerting upward pressure on the prices of ethylene. Due to unprecedented volatility in the prices of crude oil, the prices of feedstocks required for ethylene production have been fluctuating. The upward pressure on the prices of ethylene can hamper the adoption of ethylene for price-sensitive consumers.

- High capital investments: High capital investment is required for the production of ethylene, since facilities for ethylene-based petrochemicals are supposed to be large and complex, and must encompass sophisticated operational units and processing conditions. This can be a key restraint for small-scale ethylene producers.

Ethylene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 205.2 billion |

|

Forecast Year Market Size (2036) |

USD 374.05 billion |

|

Regional Scope |

|

Ethylene Market Segmentation:

Feedstock Segment Analysis

The ethane-based segment is expected to account for a share of 42.5% by the end of 2036, owing to the abundant availability of ethane, its cost-effectiveness compared to naphtha or propane, and high usage as a feedstock in the petrochemical industry. Ethane is widely produced in the U.S, followed by India, China, and the UK. Since July 2025, Reliance Industries Limited has started to strengthen its strategic position in the global energy trade by boosting ethane imports in the U.S. In addition, the development of technologies like modified ZSM-5 zeolites for cracking influences the dominance of ethane in the global ethylene market.

Derivative/Application Segment Analysis

The polyethylene (PE) segment is expected to account for a significant market share of 41.6% during the forecast period from 2026 to 2036. A large number of businesses operating globally are involved in the production of polyethylene. A widespread use of polyethylene is noticed for packaging purposes across the consumer goods and packaging industries. Polyethylene is a versatile material, and the manufacturing of the same costs less. Considering this, Unilever initiated the development of new sustainable technologies and materials in the plastic packaging production through investment in materials science and technology in October 2024.

Our in-depth analysis of the ethylene market includes the following segments:

|

Segment |

Subsegments |

|

Feedstock |

|

|

Derivative/Application |

|

|

End use industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethylene Market - Regional Analysis

APAC Market Insights

The Asia Pacific market is expected to account for a 54.5% share during the forecast period, owing to rising demand for ethylene across the packaging, automotive, and construction sectors, especially in India and China. In addition, rapid industrial growth and urbanisation in the region are increasing the demand for packaging and construction materials, which ultimately influences the growth of the ethylene market. One of the latest developments in the region is the agreement between Enilive and LG Chem in August 2025 to establish the very first HVO/SAF Plant in South Korea and cater to rising ethylene demand.

China is anticipated to expand at a CAGR of 7.2% during the forecast period due to rising demand for petrochemicals. The demand and prices for ethylene in China are the highest in the world as the country continues to import raw materials required for the production of the crucial chemicals. CNOOC Petrochemicals Investment Ltd and Shell Nanhai B.V. formed a joint venture in January 2025 to meet the rising demand for petrochemicals. Through this, investment decisions have been finalised for the expansion of the petrochemical complex in Daya Bay, Huizhou, south China.

India market is expected to evolve rapidly with a CAGR of 6.7% during the forecast period due to relevant government initiatives to enhance the sales of ethylene and its derivatives. One such example is the partnership of GAIL with Scientech Inc., a U.S.-based producer of biofuel, in August 2024 for the establishment of a 500 kilo-tonne bio-ethylene plant in India every year. The rising need for plastic packaging is another factor fuelling the growth of the market in India.

North America Market Insights

North America is expected to emerge as one of the fastest-growing ethylene markets, expanding at a CAGR of 6% due to the presence of organisations investing in ethylene production and export. The availability of oxidative dehydrogenation in North America is another factor that fosters the growth of the ethylene market, providing the opportunity to enhance the production of ethylene. As reported by the American Chemical Society (ACS) in July 2022, 50% stakes of the U.S and China ethylene complex were bought by LyondellBasell. The company also has plans to build a high-density plant for polyethylene in Corpus Christi, Texas.

The ethylene market in Canada is expected to expand at a CAGR of 6.7% throughout the forecast period due to investments in low-emission technologies. Several funding, incentive programs, and grants are managed by the Federal Government of Canada with the motive of encouraging research & development, and demonstration across the nation. One such example is the announcement to invest around USD 9.5 million by the local government in February 2025 for six innovative projects focused on carbon capture, storage, and technologies related to transportation.

The U.S is likely to register a CAGR of 5.9% during the forecast period due to rising production of ethane across the nation. In July 2022, TotalEnergies announced the establishment of a new ethane cracker in a joint venture with Borealis. The rising adoption of ethylene across multiple industries, including packaging, automobile, consumer goods, and others in the U.S, also fuels the growth of the ethylene market.

Europe Market Insights

Europe is expected to register rapid growth during the forecast period due to a focus on sustainability, resilience, and efficiency. Rising production of ethylene and growing demand for the same in the automotive sector is a key factor fueling market growth in the region. The increased production of ethylene fosters the market growth by meeting the rising demand for polyethylene. For instance, the announcement of Regulation (EU) 2022/1616 in September 2022 has fostered the safety of food packaging by obligating the use of recycled plastics in packaging.

Germany is expected to emerge as a steadily growing ethylene market, expanding at a CAGR of 7% during the forecast period due to the rising demand for sustainable packaging. Increasing investment in ethylene production is another factor that fuels the growth of the ethylene market. For example, an investment of USD 582.47 million was initiated by BASF in 2022 for increasing the production capacity of ethylene by 400000 metric tons per year. The plan also includes the increase of production capacity of ethylene in Germany as well, fostering the ethylene market growth across the nation.

The UK is anticipated to register a CAGR of 6.5% throughout the forecast period, due to the rising use of polyethylene in the production of sustainable packaging. For instance, in January 2023, Tesco revealed its plans to use discarded plastics for fish packaging. Controlled recycling of discarded plastics through processes such as pyrolysis can break them down into valuable hydrocarbons, including ethylene, which can then be reused in packaging production, thereby reducing reliance on fossil fuel–derived ethylene. The rising demand for lithium-ion batteries due to the rising adoption of EVs also fuels the growth of the ethylene market in the UK.

Key Ethylene Market Players:

- ExxonMobil Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Inc.

- LyondellBasell Industries N.V.

- INEOS Group

- Chevron Phillips Chemical Company LLC

- Reliance Industries Limited – Petrochemicals

- LG Chem, Ltd.

- Lotte Chemical Corporation

- TotalEnergies SE (Chemicals)

- Borealis AG

- PETRONAS Chemicals Group Berhad (PCG)

- Mitsubishi Chemical Group Corporation

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- Qenos Pty Ltd (in administration/closure)

The global ethylene market is highly competitive, consisting of key players operating at a global and regional level. These players are focused on feedstock diversification, capacity expansion, and sustainable production initiatives to strengthen their market position. Companies are investing in new crackers and feedstock diversification to reduce production costs and strengthen supply security in regions with abundant ethane resources. Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, the Westlake Corporation announced the formation of the Westlake Chemical Partners with the motive of operating, acquiring, and developing production facilities for ethylene.

- In June 2025, the shareholders of Chevron Phillips Chemical Company LLC agreed to share 100% of their shares they have for the business and polyethylene manufacturing facilities in Singapore to Aster Chemicals and Energy.

- In February 2025, BASF India initiated the establishment of a new plant with the motive of increasing the production capacity of Cellasto microcellular polyurethane (MCU). The newly established production plant is located in Dahej, India.

- Report ID: 4540

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethylene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.