Polyethylene Terephthalate Market Outlook:

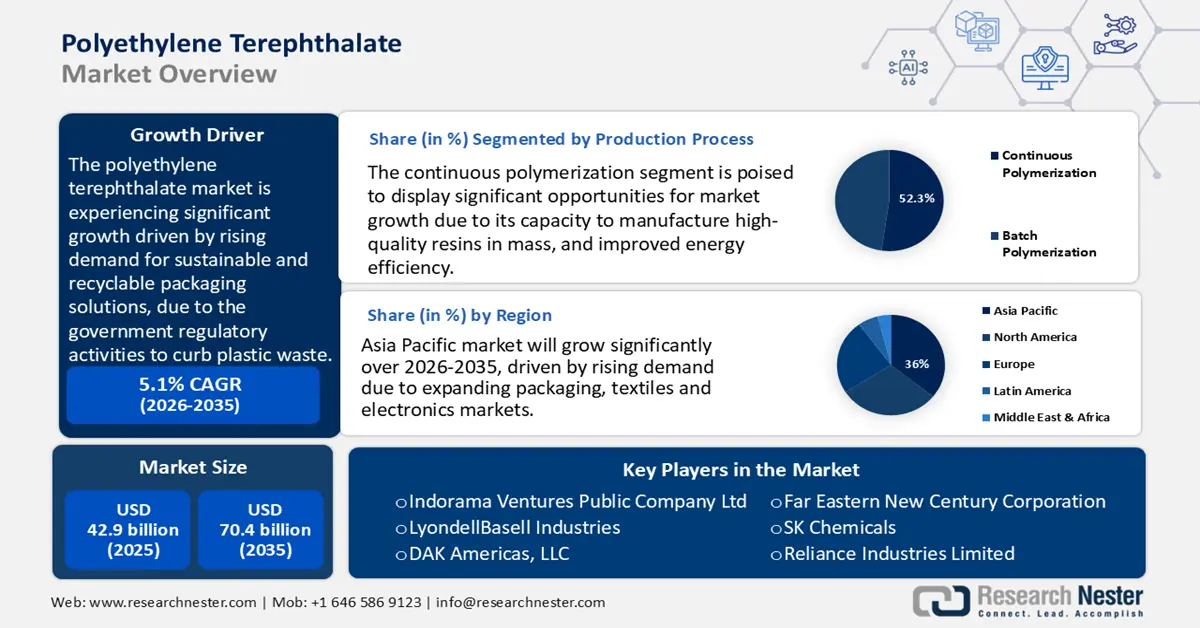

Polyethylene Terephthalate Market size was valued at USD 42.9 billion in 2025 and is projected to reach USD 70.4 billion by the end of 2035, rising at a CAGR of 5.1% during the forecast period, from 2026-2035. In 2026, the industry size of polyethylene terephthalate is estimated at USD 45.3 billion.

The global polyethylene terephthalate market is anticipated to grow significantly over the forecast years, primarily driven by the rising demand for sustainable and recyclable packaging solutions due to the growing government regulatory activities to curb plastic waste. According to the U.S. EPA’s 2024 “Financial Assessment of the U.S. Recycling System Infrastructure” report, the country generates 96 million tons of packaging waste annually, with only 39% recycled; improving infrastructure could recover an additional 38–45 million tons by 2030, requiring USD 36–43 billion in investment. Regulatory regulations globally, such as extended producer responsibility (EPR) policies and other initiatives related to the circular economy, such as Ellen MacArthur Foundation Global Commitments, also encourage manufacturers to use PET in the packaging and textile markets. Such interventions, in conjunction with increased consumer awareness towards environmentally friendly product consumption, drive the polyethylene terephthalate market to keep rising.

The supply chain of PET depends on the petrochemical derivatives like monoethylene glycol (MEG) and purified terephthalic acid (PTA), whose supply and price have strong effects on the economy of production. According to the International Trade Administration under the U.S. Department of Commerce, in 2023, PET products had a robust foothold in global trade as the U.S. exported USD 44.7 billion of plastic materials and products to its partners through Free Trade Agreements. With anti-dumping investigations of Malaysia against PET imports from China and Indonesia are an example of measures that might influence the stability of the supply chains, indicating a complicated trade dynamic. The U.S. Environmental Protection Agency has established a national recycling objective that calls for a significant improvement in PET recycling skills, to raise the overall recycling rate to 50% by 2030. Additionally, the U.S. Department of Energy's Strategy for Plastics Innovation implements new technologies for upcycling plastic waste into useful products, which is expected to increase the resilience and sustainability of the PET supply chain. In 2021, more than £1.9 billion of PET bottles were collected for recycling in the United States, with £1.2 billion of recycled PET produced domestically, demonstrating a robust circular supply chain.

Key Polyethylene Terephthalate Market Insights Summary:

Regional Insights:

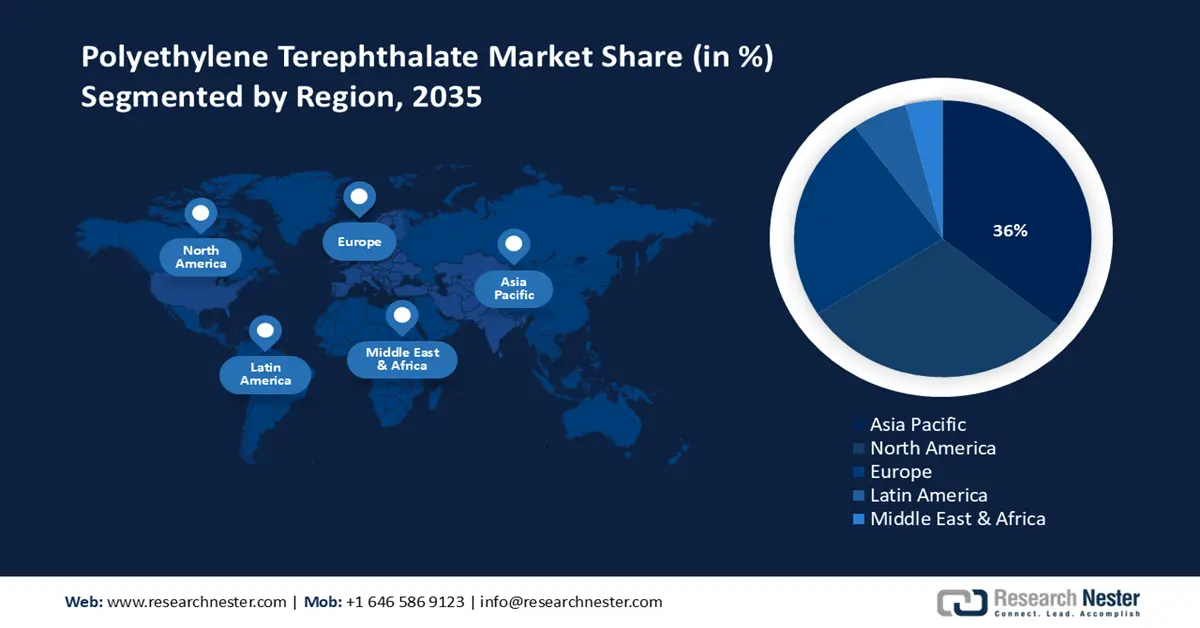

- Across 2026–2035, the Asia Pacific region is projected to command a 36% share in the polyethylene terephthalate market, propelled by expanding packaging, textile, and electronics demand.

- North America is expected to secure a 30% share by 2035, supported by advancing recycling infrastructure and rising adoption of PET-based packaging.

Segment Insights:

- By 2035, the continuous polymerization segment is set to capture a 52.3% share, reinforced by its ability to deliver high-quality resins at scale with improved energy efficiency.

- The virgin PET segment is anticipated to hold a 47.2% share from 2026–2035, aided by its consistent physical properties and suitability for tightly regulated food and pharmaceutical applications.

Key Growth Trends:

- Increase in manufacturing capacity and supply chain matters

- Recent technological advancements in catalysts and polymerization processes

Major Challenges:

- Market access barriers and trade restrictions

- Delays in the launch of products due to changing safety and quality standards

Key Players: Indorama Ventures Public Company Ltd, LyondellBasell Industries, DAK Americas, LLC, Far Eastern New Century Corporation, SK Chemicals, Reliance Industries Limited, Nan Ya Plastics Corporation, Asia Pacific Resources International Holdings (APRIL), Invista (a Koch Industries company), Sateri Holdings Limited, Jindal Poly Films Limited

Global Polyethylene Terephthalate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.50 billion

- 2026 Market Size: USD 1.60 billion

- Projected Market Size: USD 2.79 billion by 2035

- Growth Forecasts: 6.4 % CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Vietnam, Indonesia, Mexico, Brazil, Turkey

Last updated on : 14 August, 2025

Polyethylene Terephthalate Market - Growth Drivers and Challenges

Growth Drivers

- Increase in manufacturing capacity and supply chain matters: Approximately 82 million metric tons of polyethylene terephthalate are manufactured annually at a global level, for usage in clothes, single-use beverage bottles, carpets, and packaging. As per the WWF (World Wide Fund for Nature) globally, around 35.4 million metric tons of PET were produced in 2024. Through improved supply chain integration, such as a U.S. government report indicates that in North America, four multinational companies operate 12 chemical plants producing PET resin and fibers, with two-thirds (8 plants) located in the Southeast U.S., strategically positioned close to polyester textile manufacturers, helps reduce transportation time and improve supply responsiveness, which has allowed for responding to the market demand in a shorter time. Also, localized production contributes to cutting the cost of transportation and related carbon emissions, which is in line with the sustainability objectives of the world.

- Recent technological advancements in catalysts and polymerization processes: Innovations in the catalysts and polymerization processes have led to enhanced performance of PET resin. Catalyst chemistry in the synthesis of PET plays a direct role in determining the quality of resin, mainly by impacting polymer morphology and the crystallization behaviour. Germanium, Antimony, and titanium, as residual catalysts, can act as heterogeneous nucleating agents, modifying polymer structure, quickening crystal formation in the polycondensation process. These variations impact the mechanical, thermal, and optical performance of PET and enhance its suitability for implementation in varied high-performance operations. It is also improving the control of polymerization, which is contributing to the production of specialty PET grades with increases in barrier grades, helping drive increasing emerging applications and more sustainable packaging.

- Circular economy and Extended Producer Responsibility (EPR) policies: Extended Producer Responsibility (EPR) policies are gaining focus on polyethylene terephthalate market dynamics, particularly in the European Union, with a government policy mandating a minimum of 30% recycled PET content in packaging by 2030. In addition, according to the OECD, without concerted regulatory action, global plastic waste mismanagement could soar to 119 million tons per year by 2040. Policymakers can counter this through robust interventions, such as eco-design standards, Extended Producer Responsibility (EPR) schemes, and improved recycling infrastructure, that can nearly eliminate plastic leakage while limiting economic impact to just a 0.5% reduction in global GDP by 2040. The resulting switch not only reduces the amount of plastic waste that is generated by the company, but it also decreases greenhouse gas emissions during virgin resin production.

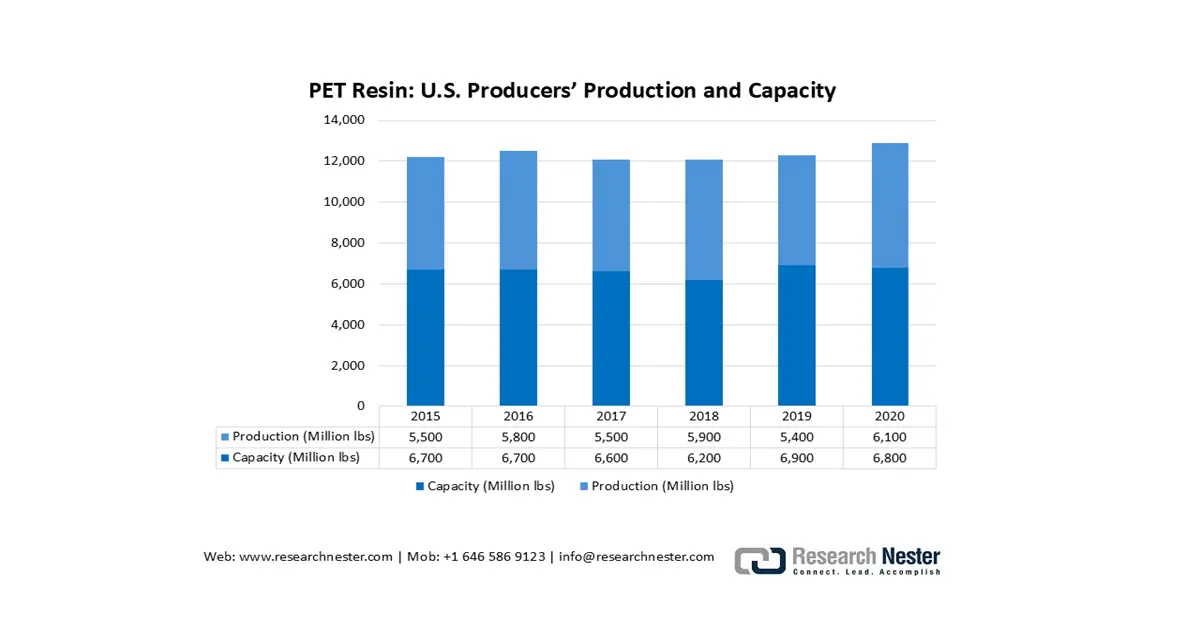

- Polyethylene Terephthalate (PET Resin) Market: Production Capacity

PET resin producers in the United States are nearly at full capacity due to high demand from packaging and textiles, with investments expanding production to satisfy sustainability-driven shifts toward recycled PET (rPET). Major industry participants are expanding their facilities in line with circular economy goals.

(Source: U.S. International Trade Commission)

2. Polyethylene Terephthalate Market: Pricing Analysis

Polyethylene Terephthalate (PET) Price Trends Comparison, China & Europe (Q3 & Q4) 2024

|

Product |

Category |

Region |

Q3 2024 Time period |

Price (USD/MT) |

Q4 2024 Time-Period |

Price (USD/MT) |

|

Polyethylene Terephthalate (PET) |

Packaging |

China |

July

|

986 |

October

|

914 |

|

Europe |

1295 |

1306 |

||||

|

China

|

September

|

900 |

December

|

846 |

||

|

Europe |

1266 |

1258 |

Challenges

- Market access barriers and trade restrictions: Global PET suppliers face major challenges due to market barriers and trade restrictions in terms of tariffs and anti-dumping quotas, which make global polyethylene terephthalate market access difficult and disrupt the entire supply chain. In 2024, Malaysia started an anti-dumping inquiry on the import of PETs into Malaysia, China, and Indonesia, which led to a delay in supplying shipments and the presence of rising prices of exports to the country. According to UNCTAD, quantity and price control measures affect around 15% of world trade, indicating how trade protection can disrupt markets, destabilize prices, and restrict growth possibilities for manufacturers dependent on cross-border sales. Such barriers force businesses to adjust their supply chain strategies, adding to the production costs and logistical challenges.

- Delays in the launch of products due to changing safety and quality standards: Regulatory variations can disrupt the continuity of supply in major markets. For example, China issued an inclusive Action Plan on Controlling New Pollutants in 2022, enhancing environmental governance to contain full life-cycle risk evaluations for evolving pollutants, including industrial chemicals. These reinforced regulations present additional regulatory steps, such as targeted testing, certification, and synchronized control procedures, that are expected to extend pre-market timelines for specialty chemical products such as new PET resin grades. Regulatory unpredictability deters timely entry in the market and increases the burden of compliance in companies that may not have enough room to increase compliance costs. Such regulatory harmony is essential in the efforts to trim such delays and promote stable market growth.

Polyethylene Terephthalate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 42.9 billion |

|

Forecast Year Market Size (2035) |

USD 70.4 billion |

|

Regional Scope |

|

Polyethylene Terephthalate Market Segmentation:

Production Process Segment Analysis

The continuous polymerization segment is projected to grow substantially over the forecast years at a revenue polyethylene terephthalate market share of 52.3%, due to its capacity to manufacture high-quality resins in mass and improved energy efficiency. This technology is likely to be capable of serving the packaging and beverage industries that have large manufacturing needs, due in part to their extensive production requirements, and it helps to reduce waste and emissions that reflect the world's sustainability and cost aims. The continuous polymerization technologies, particularly systems capable of automatically monitoring and controlling molecular weight, enable real-time feedback control during resin synthesis, as per the U.S. DOE. This polymerization method expands product consistency, reduces waste, and enhances energy efficiency, thereby advancing more sustainable chemical production.

Continuous polymerization plays a crucial role as it creates a high-quality PET resin that is extensively utilised in the packaging and beverage industry. This process has enabled large and efficient production of lightweight, robust bottles and containers that meet the strict requirements of safety, clarity, and performance needed to package water, soft drinks, juice, etc. In addition, the beverage industry that uses a lot of PET resin and maintains demand in continuous polymerization due to its capacity to ensure uniformity of products, and the costs involved. Furthermore, constant polymerization helps with sustainability efforts to decrease the amount of energy required and use recycled material without sacrificing quality.

Resin Type Segment Analysis

Virgin PET segment is anticipated to grow with a notable polyethylene terephthalate market share of 47.2% from 2026 to 2035, attributed to the consistency of the physical characteristics of PET, its safety, and clarity, which make it the most preferred resin to be used to package foods and pharmaceuticals. The U.S. Food and Drug Administration sets stringent purity and safety standards listed under secondary direct additives mentioned in 21 CFR 173 and indirect food additives listed under 21 CFR Parts 175-178, 179.45, and 180.22, that PET resins must meet for food-contact use. Additionally, the FDA’s guidance on the use of recycled plastics in food packaging needs wide-ranging testing, including source control and contaminant migration, highlighting the strict regulatory environment that supports constant demand for suitable virgin PET in sensitive applications.

Food-grade packaging marks the highest usage of Virgin PET since it is highly clear and strong, yet meets the global food standards. The Federal Food, Drug, and Cosmetic Act, administered and controlled by the U.S. FDA, has regulated food contact materials so that food contact materials such as PET do not expose foods to harmful or injurious materials. Code 21, Part 177 of the FDA title code states that the polymers, like PET, have to fulfill the purity and safety standards in order to gain a perspective to use in food packaging. Further, textile fibers are one of the main elements of polyester fiber, commonly used in clothing, upholstery, and other industrial textiles that require robustness and moisture-wicking.

Application Segment Analysis

The packaging segment held a polyethylene terephthalate market share of 42.5% in 2025 and is projected to grow at a steady pace over the forecast years, owing to regulatory mandates on recyclable packaging material and consumers who want sustainable products. The Packaging and Packaging Waste Directive implemented by the European Union implies reporting recycled content levels and promoting the principles of the circular economy, which has promoted the use of PET in the packaging market on a worldwide scale. Moreover, new e-commerce businesses and convenience market packaging innovations are growing this segmentation.

Our in-depth analysis of the polyethylene terephthalate market includes the following segments:

|

Production Process |

|

|

Resin Type

|

|

|

Application |

|

|

End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyethylene Terephthalate Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific market is expected to dominate the global market with the largest revenue share of 36% over the forecast years from 2026 to 2035, driven by rising demand due to expanding packaging, textiles, and electronics markets. PET-based products are experiencing the demands created by the growing middle class and urbanization in the region, and sustainable and recyclable packaging solutions. The regions provide ways through government initiatives, which promote green chemistry and a circular economy-based model where manufacturers are influenced to make environmentally friendly production processes and enhance recycling facilities. For instance, the 12th Regional 3R and Circular Economy Forum, held in March 2025 in India, underscores these efforts by encouraging countries to adopt circular economy principles like reduce, reuse, and recycle (3R) to achieve sustainable resource management, waste reduction, and carbon neutrality.

The forum's new Declaration (2025-2034) seeks to catalyze policy changes, institutional frameworks, financing models, and technologies that support zero-waste societies. This approach integrates circular economy strategies into national and regional policies, fostering collaborations among governments, businesses, and civil society to transition from linear to resource-efficient economies. Advanced manufacturing technologies and increasing regulatory concerns of environmental factors are also fuelling the growth of the markets. Also, increased awareness of consumers on the concept of environmental sustainability is driving the use of recycled PET, which is enhancing the market expansion. All of these contribute to the Asia-Pacific region being the trendsetter in the development of the global PET industry in the future.

By 2035, China is expected to grow at the largest revenue share in the APAC market, owing to the large manufacturing capacity of China, the growing packaging industry, and a government that is keen on sustainable chemical manufacture. The Chinese government led investment approach towards the green chemical industry, demonstrated by top-level corporations such as Wanhua Chemical Group in 2022, hiked its R&D investment to 3.42 billion yuan (appx. USD 472 million), which is a 55% year-on-year increase. The investment lies behind the production of specialty and green chemicals, a part of the targeted policy and subsidies of China to encourage green innovation of chemicals and green chemical production.

As of 2022, China contributes the largest portion of capital investment in the global chemical industry with approximately 46%, indicating the dominant position that China holds in growing the green chemical technology. The advanced polymer recycling and energy-saving production technology is subject to the investment provided through the National Development and Reform Commission (NDRC). ChemChina and CPCIF have also promoted R&D in biodegradable polymers, chemical recycling, associated with government actions. All these elements create a conservative but progressive market base, keeping China in the top position in the APAC PET market.

India’s polyethylene terephthalate market is projected to grow with the highest CAGR estimated at around 8.2% from 2026 to 2035 due to high rates of industrialization, the increase in disposable income, and government support for green chemical technology. The chemical sector of India has been estimated to have an approximate 2 million workforce by the Ministry of Chemicals and Fertilizers, and is fast embracing greener chemistry by using renewable raw materials and adopting the principles of the circular economy. With the efforts of the government, various regulations in the industry, and other innovations, the chemical market is expected to grow to USD 304 billion in 2025. The growth in finances and policies that encourage the use of environmentally friendly industrial processes has motivated the investment in sustainable chemical production, with constantly growing rates. Research in the advanced polymerization and recycling technique specific to PET is funded actively by the Department of Science & Technology (DST). Furthermore, there are industry associations such as the Federation of Indian Chambers of Commerce & Industry (FICCI) and the Indian Chemical Council (ICC) working on sustainability policies and programs, as well as policy advocacy. The increasing packaging, textile, and consumer goods market, a very supportive regulatory environment, and a rising environmental alert make India the fastest-growing PET market in APAC.

North America Market Insights

The North American polyethylene terephthalate market is expected to grow significantly with a market share of 30% over the forecast period by 2035, attributed to the rising use in packaging, mostly beverage bottles, technical textiles, and the developing electronic industries. In the U.S., the recycling infrastructure is mature, and consumer awareness of sustainable packaging has aided the growth in the use of recycled PET (PET). The U.S. Environmental Protection Agency (EPA) estimates that an investment of USD 36.5 to USD 43.4 billion is needed by 2030 to modernize recycling infrastructure, including facilities for PET plastics. This would boost the recycling rate in the country and raise it to 61% as opposed to the current 32%, thus boosting the recovery of packaging materials such as PET. Contemporarily, widely accepted recycling contents in the general recycling programs entail plastics of polyethylene terephthalate (PET) (plastic type 1), which means an established recycling program with a developed community recycling through drop-off and curbside recycling.

In the U.S., the Department of Energy (DOE) is committed to grant specific subsidies to investment in the chemical manufacturing to advance the industry in the process of decarbonization and technological enhancement. For example, in 2023, the DOE reported USD 78 million of its funding, which will be specifically targeted at decarbonizing chemicals manufacturing and the development of cross-sectoral industrial technologies. Such initiative involves new technologies such as advanced catalysts and energy-efficient chemical reactions that are essential in reducing chemical manufacturing emissions.

The U.S. polyethylene terephthalate market is expected to dominate the region with the highest revenue share in 2025, driven by the rising demand for PET in the packaging industry, with its major traction on beverage containers, food packaging, and growth in its sustainable consumption. The expanding investment in clean energy and state-of-the-art technologies of chemical manufacturing by the government has also increased the production capacity in this country. Also, environmental strategies adopted by the regulating agencies (such as the Green Chemistry program proposed by the EPA) help establish sustainable production processes, which translates to less harmful waste and increased process efficiencies during the production of the PET. OSHA regulates chemical safety through standards like the Hazard Communication Standard (29 CFR 1910.1200), Permissible Exposure Limits in Subpart Z (29 CFR 1910), and the Respiratory Protection Standard (29 CFR 1910.134). These rules require proper labelling, worker training, exposure limits, and the use of protective equipment to ensure safe chemical manufacturing environments. The U.S. market is expected to continue growing steadily, following the national trends in the policies' concentration on the circular economy and sustainability.

The polyethylene terephthalate market is Canada is anticipated to grow at a steady pace as a result of growing demand in the textile and packaging markets due to national consumption or export opportunities. Canadian government investment in sustainable chemical production has grown, and the level of clean energy investment has grown significantly since 2020. For instance, USD 1.5 billion in Budget 2021 to the Clean Fuels Fund (CFF) to boost domestic clean fuel production, including hydrogen, was committed by the Canadian government. In addition, by October 2023, about 10 hydrogen production projects had been selected for over USD 300 million in support. The Clean Hydrogen Investment Tax Credit (CHITC) is projected to provide USD 17.7 billion in tax incentives to the sector by 2035. There are also government-supported programs to promote collaborations in R&D to advance PET recycling rates and diminish carbon imprints, crucial to achieving Canadian targets on climate. This is a synergy of factors that makes Canada a rising and sustainable market of the PET industry in North America.

Europe Market Insights

The European polyethylene terephthalate market is projected to witness a substantial rise during the projected years from 2026 to 2035, driven by an increasing demand for eco-sensitive packaging, strong environmental laws and guidelines, and higher investments in green chemical technologies in the region. The dedication of the region to the circular economy concept and improved recycling service helps expand the usage of PET in various sectors like automotive, textiles, and consumer products.

Germany is the industrial powerhouse in the European Union, with high levels of government investment. For example, in July 2024, Germany Trade & Invest informs that the Leuna Chemical Complex in Saosony-Anhalt already received more than EUR 2 billion in investment, in the form of a hub of sustainable chemical production leadership in the world. Also, UPM Biochemicals started a EUR 1.2 billion investment at the location in 2020 to produce bio-based ethylene glycol made out of wood. In 2024, modernization measures used by InfraLeuna at the complex assumed approximately EUR 300 million.

Similarly, the investment in new recycling technologies that the UK government promises to undertake involves PET polymer recycling as well. The government announced incentives and funding through the Environmental Improvement Plan 2023, including novel recycling centres and new plastic reprocessing infrastructure as part of the shift towards a circular economy and a reduction in plastic pollution. Collectively, these nations are major influencers of the PET industry of Europe under the conditions of the transforming regulatory and sustainability environments.

Key Polyethylene Terephthalate Market Players:

- Indorama Ventures Public Company Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LyondellBasell Industries

- DAK Americas, LLC

- Far Eastern New Century Corporation

- SK Chemicals

- Reliance Industries Limited

- Nan Ya Plastics Corporation

- Asia Pacific Resources International Holdings (APRIL)

- Invista (a Koch Industries company)

- Sateri Holdings Limited

- Jindal Poly Films Limited

The global polyethylene terephthalate market is highly concentrated, with major competitors dominating the market due to their wide production capacities, highly developed R&D, and acquisitions. The industries that focus on green production and innovative recycling technologies are the Japanese producers such as Teijin Limited, Mitsubishi Chemical Corporation, Toray Industries, and SK Chemicals (South Korea). The USA and European companies are at growth in capacity and creating variants of bio-based PET to comply with growing environmental regulations. Indian and Malaysian companies are also growing fast to meet the emerging demand in the market. One important strategic advantage in this dynamic market is maintaining a competitive advantage through capacity expansions, joint ventures, and investing in green chemistry.

Top Global Polyethylene Terephthalate Manufacturers

Recent Developments

- In January 2025, Eastman was awarded RecyClass Recyclability Approvals for eight specialty PET copolyester resins and their Renew grades, which have equivalent recycled content. These special plastics included six of them as fully compatible with the European cutting-edge recycling of PET bottles. These resins were independently tested to ensure that they do not interact with recycling already established bottle recycling processes and are therefore suitable in non-beverage packaging applications like skincare jars, bottles, caps, and color cosmetics. These resins provide product durability and high transparency with luster because of low crystallization rates as compared to standard PET.

- In October 2024, Indorama Ventures partnered with Suntory and other industry leaders to introduce the world's first commercially scaled PET bottles made using a bio-paraxylene manufacturing process using used cooking oil. This new initiative can make a substantial difference in the amount of CO2 emissions that are involved in the standard PET production. Bio-PET bottles will be introduced to concentrate on Suntory beverages produced in Japan, and anecdotally, competitors have done so as well. This project is a demonstration of how collaboration between industries can be used to promote sustainable packaging options.

- Report ID: 8003

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyethylene Terephthalate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.