Etching Chemicals Market Outlook:

Etching Chemicals Market size was valued at USD 2.9 billion in 2025 and is projected to reach USD 6.7 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, from 2026 to 2035. In 2026, the industry size of etching chemicals is estimated at USD 3.6 billion.

The global etching chemicals market is expected to grow significantly over the forecast years, primarily due to the increase in semiconductor production capacity, specifically supported by government policy and investment (e.g., the U.S. CHIPS & Science Act). This expansion is supported by the chemical industry of the U.S. through exports and through intensive R&D investment. For example, as SelectUSA reports, the export of chemicals in the U.S. in 2022 amounted to USD 494 billion, and the research and development expenditure was USD 28.2 billion, indicating supplier capability of high-purity and specialty chemical process feeds (etchants) and innovation required to support demanding needs of semiconductor fabs. In addition, according to the NSF, in 2019, 18% of U.S. business R&D was in computer and electronic products manufacturing, adding up to USD 86.7 billion, indicating the intensity of R&D in the sector, closely related to advanced materials as well as the chemicals used in the etching processes.

The supply chain, production capacity, trade flows, and price trends are crucial in the global etching chemicals market. Etching chemicals commonly include inorganic acids, specialty gases, catalysts, as well as high-purity reagents, and can be imported or localized. The U.S. export trends in industrial organic chemicals, which contain most of the inputs used in the production of semiconductors, including etching chemicals, showed continued growth. The U.S. Census Bureau showed that exports in this category increased to USD 2,823.63 million in February 2024 compared to USD 2,615.29 million in January 2024. Traditionally, the average exports have been USD 1,925.12 million in the years 1989 to 2024, with a high of USD 3,633.10 million recorded in December 2010. This positive trend indicates growing demand for developed chemical materials in precision processes such as semiconductor etching globally. Meanwhile, imports of chemicals and allied products have fluctuated; the index of the import price of chemicals (excluding medicinals and food additives) in the U.S. was 189.8 (2000=100) in June 2025, indicating the effect on the cost of most chemical products caused by world supply pressures. U.S. Producer Price Index (PPI) for Chemicals and Related Products Industrial Chemicals was 309.215 (2002=100) in March 2025. Likewise, the U.S. Bureau of Labor Statistics estimates that in calendar year 2024, import price indexes of chemical manufacturing rose by 1.1 % after declining every year since 2021. During the same year, producer (domestic) chemical manufacturing prices increased by a more modest amount; however, this still adds to a 3.7‛% increase calculated over the same period of December 2021 to December 2024.

Key Etching Chemicals Market Insights Summary:

Regional Insights:

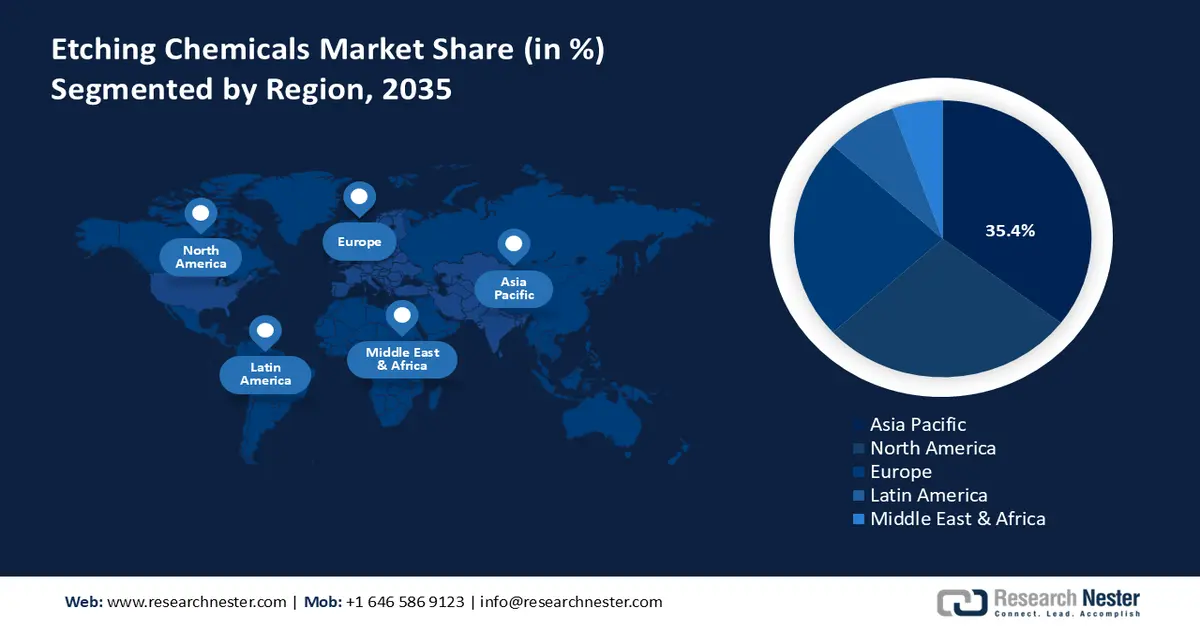

- By 2035, the Asia Pacific region is projected to secure a 35.4% share of the etching chemicals market during 2026–2035, supported by rapid industrialization and escalating demand for advanced semiconductor and display manufacturing.

- North America is anticipated to account for a 27.8% share by 2035, bolstered by expanding semiconductor fabrication and tightening environmental and safety frameworks.

Segment Insights:

- The dry etching segment is expected to capture a 64.8% share by 2035 in the etching chemicals market, underpinned by its precision capabilities that enable next-generation semiconductor architectures.

- The silicon segment is forecast to hold a 60.3% revenue share over 2026–2035, reinforced by its cost efficiency and well-established processing ecosystem.

Key Growth Trends:

- EU regulation CLP regulation & packaging compliance costs

- Effluent water discharge standards in semiconductor sector

Major Challenges:

- Price volatility of raw materials & energy

- Absence of harmonization among jurisdictions

Key Players: Soulbrain (South Korea), KMG Chemicals (U.S.), Formosa Daikin Advanced Chemicals (Taiwan), Honeywell International (U.S.), Solvay SA (Belgium), Avantor (U.S.), OCI Company Ltd (South Korea), Zhejiang Morita New Materials (China), Israel Chemicals Ltd (ICL) (Israel), Do-Fluoride Chemicals Co., Ltd (China), Shin-Etsu Chemical (Japan), Daikin Industries (Japan), Mitsubishi Chemical (Japan), Stella Chemifa (Japan).

Global Etching Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.9 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 6.7 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: Vietnam, India, Taiwan, Singapore, Mexico

Last updated on : 8 December, 2025

Etching Chemicals Market - Growth Drivers and Challenges

Growth Drivers

- EU regulation CLP regulation & packaging compliance costs: The updated EU Classification, Labelling and Packaging (CLP) Regulation, which has been in effect since 1 July 2026, requires more stringent labeling and classification of chemical hazards. It brings about virtual labels, necessitates more detailed statements of hazard, and establishes single standards of packaging of hazardous material throughout the EU. This immediately affects the suppliers of etching chemicals, especially those relying on hydrofluoric acid (HF), nitric acid, and other corrosives or toxicants. The change to less hazardous etching alternatives poses a more commercially prudent move to smaller manufacturers who bear disproportionately higher financial costs across the transition period. These are modifications that conform to the EU Chemicals Strategy of Sustainability, which pushes the etching chemicals market back on course.

- Effluent water discharge standards in semiconductor sector: The U.S. Environmental Protection Agency (EPA) has revised Effluent Guidelines on Electrical and Electronic Components (EEG) in 40 CFR Part 469, which has strengthened the discharge limit of acidic, fluorinated, and metal-containing wastewater of semiconductor and PCB manufacturing. The etching chemicals include hydrofluoric acid, nitric acid, ammonium bifluoride, and so on, and they play a great role in wastewater loads. Etching chemical manufacturers have a way to achieve long-term compliance and sustainable operations through investing in advanced wastewater treatment. A techno-economic analysis of chromic wastewater treatment has estimated a cost of USD 2.8 million in capital (capital cost) and USD 345,000/annum in operating costs (operating cost). These are significant but validate regulatory preparedness, brand value, and future-proofing in the context of an increasingly constrained environmental sustainability. Failure to comply is subject to civil penalties and closure of operations. This regulation increases the pressure on low-toxicity, low-discharge etching chemistries and recycling technologies in modular, in-process to alleviate treatment pressure.

- Etching chemical worker safety rules: Occupational Safety and Health Administration (OSHA) regulations on semiconductor etching equipment impose strict rules on the use of toxic and corrosive chemicals, in particular, hydrofluoric, hydrochloric, and nitric acid. Under 29 CFR 1910.1000 and related standards, etching operations are required to meet ventilation, PPE use, spill control, and medical monitoring requirements. OSHA semiconductor-specific guidance provides etchant exposure limits and procedural controls of wet processing lines. HF-facilities, such as those, are required to stock HF emergency kits in calcium gluconate gel and have eyewash stations available--increasing compliance costs significantly per production bay. Regulatory oversight and injury liability drive the seeking of less-hazardous etching formulations, automated handling, and closed-loop chemical dosing.

Challenges

- Price volatility of raw materials & energy: Etching chemicals depend on volatile raw materials, e.g., hydrofluoric acid, nitric acid, and ammonium bifluoride, which are energy-intensive to manufacture. After the 2022-2024 energy crisis, electricity and gas prices in the industries of Europe increased to 2 to 4 times higher than those of major trading partners. These high energy prices added a lot of cost to production among etching chemical manufacturers. Consequently, the industry is experiencing increased financial stress that affects the competitiveness and sustainability of its operations. Such volatility complicates the predictability of pricing and value of contracts to etching chemical manufacturers, particularly those that depend on imports. As a result, most of the mid-sized suppliers either transfer their expenses to consumers or cut down production, which may cause a bottleneck in supply and disrupt downstream production in the electronic and semiconductor fabrication industries.

- Absence of harmonization among jurisdictions: The chemical sector of the world is becoming more and more fragmented as a result of conflicting regulations. For example, the TSCA Chemical Substance Inventory, managed by the U.S. EPA, is an inventory of more than 86,000 chemical substances that are manufactured or processed in the United States and used commercially there. It contains organics, inorganics, polymers, and complex substances and is a key to regulating industrial chemicals under TSCA, and has disparate data, hazard, and labeling specifications. In addition, a recent study by the ECHA Enforcement Forum through a EU-wide project found that 35% of Safety Data Sheets (SDS) used in the chemical industry were not compliant. Even though compliance has been enhanced, a lot still needs to be done to have good and comprehensive SDS documentation. This is a risk to the etching chemicals market, whose quality safety information should be conserved in order to safeguard workers, users, and the environment. The absence of harmonized chemical regulation eventually retards innovation, discourages market development, and leads to increased time-to-market of etching formulations worldwide.

Etching Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 2.9 billion |

|

Forecast Year Market Size (2035) |

USD 6.7 billion |

|

Regional Scope |

|

Etching Chemicals Market Segmentation:

Etching Type Segment Analysis

The dry etching segment is projected to grow with the largest etching chemicals market share of 64.8% by 2035, as it is essential for high-tech semiconductor fabrication. It is capable of accurate anisotropic etching needed to support a sub-10nm node, which makes it possible to implement next-generation chip architectures. U.S. Department of Energy states that as the complexity of chips rises, semiconductor manufacturing is projected to increase exponentially as more refinement is required in the etching process, including plasma and reactive ion etching (RIE). More complex dry etching methods, including atomic layer etching (ALE) and neutral beam etching (NBE), are essential to satisfy future technology node requirements with the ability to remove materials with minimal damage and enhance efficiency in semiconductor manufacturing applications. Additionally, Argonne National Laboratory has also invented a dry etching method, known as Molecular Layer Etching (MLE), which allows one to remove materials in a layer-by-layer fashion via gas-phase reactions. This technique guarantees that the damage caused to underlying structures is low and also provides atomic-level control. MLE has shown that dry etching can be used to achieve the future scaling and performance requirements of semiconductors. This ever-increasing dependence on etching chemicals in dry form is the main force in the market, and manufacturers are investing in cleaner and more efficient plasma etching chemistries to improve yield and performance.

Substrate Segment Analysis

The silicon segment in the etching chemicals market is projected to grow significantly, with a revenue share of 60.3%, over the forecast period, attributed to its cost-effectiveness and established processing infrastructure. The National Institute of Standards and Technology (NIST) estimates that the production of silicon wafers continues to be scaled with the development of semiconductor technology, which sustains billions of devices around the world. The wide use of silicon in logic and memory devices keeps up the demand for etching chemicals that are optimized for silicon materials. There is also government-funded research into silicon processing, which should improve the purity of the materials and etching accuracy, which directly benefits chemical suppliers that serve this market.

Application Segment Analysis

The semiconductor segment in the etching chemicals market is expected to grow at share of 53.6% over the forecast period, owing to the rising need for microchips in numerous sectors such as automotive, communications, and medical industries. According to the U.S. International Trade Administration, the semiconductor industry in various countries, such as India, is growing at a very high rate due to the technological improvements in 5G, artificial intelligence, and Internet of Things. Such expansion drives the demand for etching chemicals in the wafer processing steps, which is imperative in the transfer of patterns and device construction. In addition, the government efforts like the CHIPS Act in the U.S. are expected to increase the domestic semiconductor manufacturing capacity, increasing the demand for chemicals in semiconductor fabrication facilities. All these trends support the fact that semiconductors are the leaders in the market of etching chemicals.

Our in-depth analysis of the etching chemicals market includes the following segments:

|

Segment |

Subsegments |

|

Etching Type |

|

|

Application |

|

|

Substrate |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Etching Chemicals Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific etching chemicals market is expected to dominate with the largest revenue share of 35.4% from 2026 to 2035, mainly due to the intense industrialization and the rising electronic manufacturing industries. Demand in this region is also becoming stronger in terms of high-end semiconductor products and displays that are driving the consumption of specialized etching chemicals. Asia-Pacific leads the world in manufacturing semiconductors, with approximately 75% of the world's capacity, and is predicted to take two-thirds of the world's revenues by 2025. In this, Vietnam is becoming a strategic investment destination because of its increasing supply chain and favorable government policies. The policies of the government that encourage digital transformation and clean manufacturing technologies further encourage market growth. Additionally, the region enjoys the advantage of heavy investment in research and development that is supported by regional organizations of sustainable chemical practices. There is also a rising trend of stricter environmental laws, positioning the need to use more green etching chemicals and processes. The high export volume of electronics in the Asia Pacific, and the rising infrastructure and production resources, make the Asia Pacific the most rapidly expanding market.

By 2035, China’s etching chemicals market is projected to lead the Asia Pacific region with a substantial share, driven by its leadership in the electronics manufacturing industry and semiconductor assembly across the globe. China's semiconductor product sales grew at an annual rate of around 10.4% in July 2025, with still strong industry engagement, even though it was lower than the worldwide average of 20.6%. This constant expansion keeps on influencing the high demand for high-precision etching chemicals, a key constituent in high-tech chip production, thus enhancing the role of China within the international semiconductor supply chain. The initiatives of the government, like the Made in China 2025 program, focus on the self-reliance of the semiconductor materials, which has led to the investment of more than 150 billion dollars in semiconductor-related industries. Moreover, according to the report by the U.S. Congressional Research Service, China had established the China Integrated Circuit Industry Investment Fund (CICIIF) to direct what it estimated to be USD 150 billion in state funds to support its domestic semiconductor sector, including foreign acquisitions as well as foreign purchases of semiconductor equipment. Together with increasing export of electronics and electric vehicles, these developments make China an important growth engine in the market across the globe.

The etching chemicals market in India is likely to grow with the fastest CAGR over the projected years by 2035, owing to on the move with the booming growth in electronics production and industrial policies initiated by the government. According to the Ministry of Electronics & IT, in FY 2024-25, the electronics production in India has increased 5-fold in the past 10 years, with its exports increasing over 6-fold, and CAGR over 20%. Meanwhile, the country’s electronics production CAGR is above 17%. The programs like the Make in India initiative and Production Linked Incentive (PLI) schemes have brought in major investments committed to expansion in semiconductor and electronics fabrication capacity. For example, the India Brand Equity Foundation (IBEF) announced that the Indian government had given a ₹76,000 crore (around USD 9.95 billion) Production Linked Incentive (PLI) programme to promote the manufacturing of semiconductors and displays. This falls under wider initiatives under Make in India to lure huge investments into semiconductor and electronics fabricating capacities. Moreover, the Central Pollution Control Board (CPCB) instituted environmental regulations that are used to guarantee sustainable manufacturing of chemicals. The growing domestic demand for consumer electronics and electric vehicles only further increases the need for specialized etching chemicals, which are driving a high growth potential in the market.

North America Market Insights

North America etching chemicals market is set to experience stable growth with a revenue share of 27.8% over the forecast years, owing to the growth in semiconductor fabrication and the rising need for accuracy in the etching procedure within industries. Environmental and safety standards are also very strict, and the regulatory authorities like the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) impose regulations on the practices and development of products in the chemical industry. There has also been more government spending on clean and sustainable chemical production. The Department of Energy (DOE) 2024 declared more than USD 5.4 billion in investments as a way of modernizing the energy grid in the country, improving clean energy infrastructure, and supporting domestic manufacturing. The purpose of these efforts is to hasten the implementation of renewable energy sources and enhance supply chains that are of great importance to the clean energy industry. These investments have been central in the development of the etching chemicals sector in North America since they provide a stable and secure supply of important materials such as hydrofluoric acid and specialty gases, which are crucial to the semiconductor production processes. In addition, chemical safety and waste minimization initiatives have led to increased sustainable operations in manufacturing sites. All these, coupled with the current research efforts that are being made with the help of bodies like the National Institute of Standards and Technology (NIST), are speeding up the change of technology, making demands on high-performance etching chemicals, and maintaining the actions in accordance with the emerging regulatory frameworks.

The etching chemicals market in the U.S. is expected to dominate North America, driven by a highly crucial market of the country that leads in the production of semiconductors and high-tech electronics. According to the 2023 report of the Semiconductor Industry Association (SIA), the companies in the U.S. semiconductor ecosystem have, since the enactment of the CHIPS and Science Act, mobilized to announce investment amounts in the U.S. ecosystem above USD 200 billion, driving its rapid development. Such a huge investment facilitates the increase of production capacity and high-technology manufacturing processes, including essential high-precision chemicals that are utilized in the etching of wafers. Production is also influenced by environmental laws put in place by the Environmental Protection Agency (EPA), whereby the Clean Air Act under the EPA guarantees that there are tight emission controls on chemical production plants. Moreover, the CHIPS Act by the U.S. government has estimated an investment of about USD 50 billion into domestic semiconductor manufacturing and research and development, increasing the demand for specialty chemicals, such as etchants. OSHA provides strict working conditions and safety measures that also influence the practice of chemical handling and use even more. All these factors make the U.S. a strong market in terms of etching chemicals with long growth opportunities.

By 2035, Canada’s etching chemicals market is likely to grow steadily due to the strong governmental support of clean technology and sustainable manufacturing. The Clean Growth Program (CGP), by Natural Resources Canada, had a four-year budget of USD 155 million that ended in March 2022. It has financed 43 clean technology R&D and demonstration projects in the energy, mining, and forestry industries with emphasis on lowering emissions, lessening environmental impact, and clean material and technology advancement. The program also created partnerships between the federal laboratories and innovators to speed up commercialization and enhance the climate goals and economic opportunities in Canada. There is an upsurge in investment in semiconductor manufacturing centres, especially in Ontario and Quebec, as a result of partnerships facilitated by the Canada Semiconductor Innovation Network. For example, in April 2024, IBM, the Government of Canada, and the Government of Quebec announced that they would jointly invest some CAD 187 million to expand semiconductor assembly, testing, and packaging facilities by IBM Canada in its Bromont plant. The purpose of this initiative is to strengthen the semiconductor industry in Canada by building high-tech manufacturing processes of semiconductor modules, which have found application in a wide range of fields such as telecommunications, high-performance computing, and Artificial Intelligence. Such efforts, combined with growing demand in both automotive electronics and renewable energy industries, are all bringing about a stable growth to the market in Canada.

Europe Market Insights

Europe etching chemicals market is predicted to witness an upward trend during the projected years from 2026 to 2035, mainly driven by its high level of semiconductor manufacturing, automotive electronics, and renewable energy, among others. According to the ESPAS report, the European Chips Act will focus on mobilizing volumes of policy-driven investments of up to 43 billion euros by 2030 to reinforce semiconductor manufacturing, innovation, and security of supply in Europe. This will push the demand for specialized etching chemicals needed in the processing of wafers and manufacturing display fabrication as Europe upgrades its manufacturing capacity and technological advantage in the global business arena. The European Chemicals Agency (ECHA) implements strict rules and regulations in the framework of REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), which compels producers to use more sustainable and safer etching chemical solutions. Government initiatives, including Horizon Europe, are providing significant grants for research and innovation of advanced materials and green chemistry. Moreover, the growing investments in electric vehicle manufacturing and clean energy technologies cause a rise in the consumption of etching chemicals.

The UK government is investing in its semiconductor sector up to £200 million between 2023-25 and up to £1 billion between 2025-35, with a bias towards research and development (R&D), domestic infrastructure, design/IP, and compound semiconductors, according to the National Semiconductor Strategy of the UK. The country’s push toward reshoring critical manufacturing capabilities and strengthening supply-chain resilience supports investment in advanced materials processing. Rising innovation in printed circuit boards, microfabrication, and renewable-energy technologies further enhances etching chemicals market prospects, positioning the UK as a niche but significant player in next-generation etching and precision-engineering applications.

Moreover, the Federal Ministry for Economic Affairs and Climate Action (BMWK) revealed that Germany is spending around 4 billion euros on funding 31 microelectronics projects in 11 federal states. It is also an initiative of the Important Project of Common European Interest (IPCEI) on Microelectronics and Communication Technologies, which aims at enhancing the semiconductor and chemical industries. The funding will harness more than 10 billion investments of the private industry, to include semiconductor production, materials, and production equipment.

Key Etching Chemicals Market Players

- BASF (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Soulbrain (South Korea)

- KMG Chemicals (U.S.)

- Formosa Daikin Advanced Chemicals (Taiwan)

- Honeywell International (U.S.)

- Solvay SA (Belgium)

- Avantor (U.S.)

- OCI Company Ltd (South Korea)

- Zhejiang Morita New Materials (China)

- Israel Chemicals Ltd (ICL) (Israel)

- Do-Fluoride Chemicals Co., Ltd (China)

- Shin-Etsu Chemical (Japan)

- Daikin Industries (Japan)

- Mitsubishi Chemical (Japan)

- Stella Chemifa (Japan)

Below is the list of some prominent players operating in the global etching chemicals market:

The global etching chemicals market landscape is marked by an intense competition environment where key market players continue to implement strategic plans to boost their presence in the market. The market is dominated by companies such as Stella Chemifa and BASF with considerable shares due to the large number of products and relations they have with their customers. BASF has an almost 9% market share, and it relies on its diversified chemical products and long-term investments in microelectronics-grade etching agents to sustain its competitiveness. Furthermore, Soulbrain and KMG Chemicals, with substantial shares in terms of innovation and product diversification, satisfy the increasing demand in semiconductor and electronics production. These companies often undertake strategic efforts, including mergers and acquisitions, investments in research and development, and the expansion in geo-location, in order to boost their market share and offer the products and services that are emerging to meet the demands of the market.

Recent Developments

- In April 2025, BASF declared an investment to grow its large-scale semiconductor-grade sulfuric acid manufacturing at its Ludwigshafen location, Germany, to meet the increasing demand of new chip production facilities in Europe aimed at automotive, mobile communications, and artificial intelligence (AI) applications. The hi-tech plant covers the state-of-the-art standards of purity and localises supply chains to the customers in Europe, thereby providing consistency and minimised lead times. The expansion with a large price tag of millions of euros will be fully functional in 2027. The strategic action reinforces the strategic position of BASF in the high-end semiconductor value chain in Europe, with the rise in semiconductor business in Europe.

- In November 2024, Hitachi High-Tech introduced the DCR Etch System 9060 Series, which is configured to execute isotropic etching of the latest 3D semiconductor devices at the atomic scale. This system uses plasma etching technology to enhance horizontal etching control, which is key to the production of complex and miniaturized semiconductor chips. The 9060 Series has a small footprint, which is capable of high-throughput-processing through the incorporation of advanced wafer-cooling and infrared lamps to perform a rapid temperature cycling. The shortened development cycles and decreased expenses make it more productive, which helps to increase the influence of Hitachi on the semiconductor etching market.

- In October 2024, Fujifilm launched negative-tone EUV resist and EUV developer materials, which can be used in further EUV lithography in semiconductor fabrication. The new resist contains a photo-decomposable quencher-linked photoacid generator (PCP), which minimizes circuit pattern variation by about 17%. The developer formulation reduces resist swelling, increasing the resolution and process stability. This introduction helps in next-generation semiconductor nodes that need extreme accuracy. Fujifilm announced the expansion of production and inspection in Shizuoka (Japan) and Pyeongtaek (South Korea) facilities, and the new equipment will be online by October 2025.

- Report ID: 8279

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Etching Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.