Performance Fluorine Chemicals & Polymers Market Outlook:

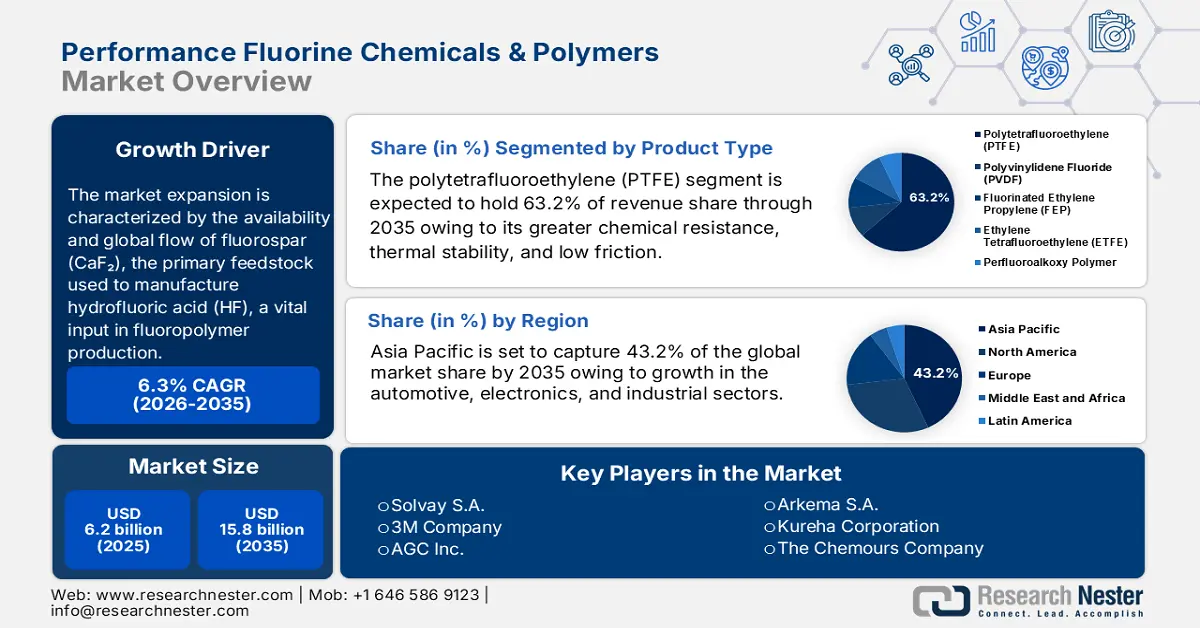

Performance Fluorine Chemicals & Polymers Market size was estimated at USD 6.2 billion in 2025 and is expected to surpass USD 15.8 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period 2026-2035. In 2026, the industry size of performance fluorine chemicals & polymers is evaluated at USD 7.8 billion.

The global performance fluorine chemicals & polymers market is expected to experience significant growth over the forecast years, primarily driven by the availability and global flow of fluorospar (CaF2), the primary feedstock used to manufacture hydrofluoric acid (HF), a vital input in fluoropolymer production. According to the U.S. Geological Survey (USGS), China produced the highest volume of fluorspar at 5,900 thousand metric tons in 2024, accounting for the largest portion of global production, which totaled 9,500 thousand metric tons. Mexico and Mongolia had a production of 1.2 million metric tons each, whereas South Africa had a production of 0.38 million metric tons. The US has a total reliance on imports to supply its fluorspar consumption, with 62% of imports being sourced in Mexico and 14% in Vietnam in the period between 2020 and 2023.

This dependence on imports and the preeminent production of China contribute to the development of the international fluorspar market, facilitating such primary sectors as steel production, refining of aluminium, and production of fluorochemicals. These trends boost investment in extraction, processing, and logistics, performance fluorine chemicals & polymers market growth, and industry development as nations look to steady, high-quality supply and long-term supply security, as evidenced by active mine projects in North America, Asia, and Africa. In the US, a report on the national minerals by the USGS revealed that the U.S. was still 100% reliant on imports to supply fluorspar in 2024, which highlights strategic susceptibility in this upstream area. Further, it is also noted that the cumulative worth of the U.S. nonfuel mineral commodity production rose to USD 106 billion in 2024, which demonstrates the continued industrial need for important minerals and feedstocks like fluorospar.

In addition, a worldwide increase in production capacity for downstream fluoropolymers, such as polytetrafluoroethylene (PTFE) and polyvinylidene fluoride (PVDF), is growing globally from the Asia Pacific to some parts of the European Union (EU). A factor laid out by the U.S. Department of Energy is that sustainable energy storage and semiconductor fabrication have spurred worldwide investment in Southeast Asia. Meanwhile, the Producer Price Index (PPI) of Basic Inorganic Chemicals increased by 3.7% month-to-month in May 2025 due to more expensive feedstocks of fluorine.

Moreover, the Consumer Price Index (CPI) of all items in the Northeast region, which gives an overall picture of the trend of pricing of the chemical products, increased by 2.8% in the same period. These indices indicate that price measures are exerted on the performance fluorine chemicals & polymers market. It is important that these official metrics are monitored to analyze the supply chains and markets. In line with this expansion, the world capacity of semiconductor manufacturing is expected to rise by 6% in 2024 and 7% in 2025, with some of the growth due to demand for high-end fluoropolymers to be employed in etching and insulating processes. Southeast Asia alone is projected to have a growth in 200 mm semiconductor fabs by 32% between 2023 and 2026, which will further increase the consumption of fluoropolymer in the region.

Key Performance Fluorine Chemicals & Polymers Market Insights Summary:

Regional Highlights:

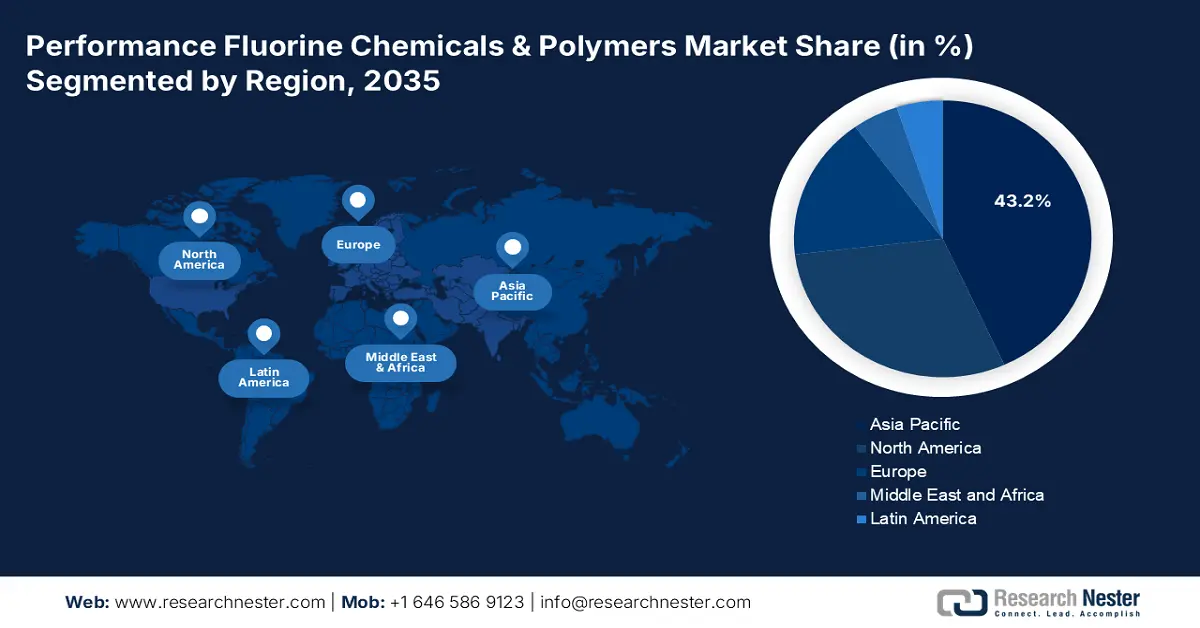

- Asia Pacific is anticipated to secure a 43.2% share from 2026 to 2035 in the performance fluorine chemicals & polymers market, supported by expanding automotive, electronics, and industrial activities.

- North America is expected to account for a 31.5% share over the forecast years, bolstered by rising demand across automotive, electronics, semiconductor, and hvac applications.

Segment Insights:

- The polytetrafluoroethylene (PTFE) segment is projected to hold a 63.2% share by 2035 in the performance fluorine chemicals & polymers market, sustained by its greater chemical resistance, thermal stability, and low friction.

- The industrial equipment segment is anticipated to witness notable growth by 2035, underpinned by the increasing need for fluoropolymers’ durability in corrosive environments.

Key Growth Trends:

- Surge in EV & battery applications

- Growth in semiconductor fabrication

Major Challenges:

- Stringent environmental regulations on PFAS

- High compliance costs for environmental safety

Key Players: Solvay S.A., Daikin Industries, Ltd., AGC Inc., 3M Company, Dongyue Group Ltd., Gujarat Fluorochemicals Limited, Arkema S.A., Hubei Everflon Polymer Co., Ltd., Halopolymer Kirovo-Chepetsk, LLC, Chemfab Alkalis Limited, Lotte Chemical Corporation, Dyno Nobel (Incitec Pivot Limited), Petronas Chemicals Group Berhad, Kureha Corporation.

Global Performance Fluorine Chemicals & Polymers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 30 September, 2025

Performance Fluorine Chemicals & Polymers Market - Growth Drivers and Challenges

Growth Drivers

- Surge in EV & battery applications: The increase in electric vehicles is significantly driving the demand for PVDF, which is a critical binder and separator coating in lithium-ion batteries. The electric vehicle battery industry is expected to be over $215 billion by 2030, and the demand for performance-grade fluoropolymers is surging. Performance-grade fluoropolymers are considered for their thermal stability, chemical resistance, and electrochemical performance needed for higher capacity energy storage. As original equipment manufacturers (OEMs) increase electric vehicle production, polymer suppliers are looking to increase PVDF capacity, particularly in Asia and North America. According to the report by the International Energy Agency (IEA) Global EV Outlook 2025, the EV battery requirement is forecasted to be over 3 TWh in the year 2030 under its STEPS scenario, compared to around 1 TWh in the year 2024. This threefold rise in demand suggests much greater demands on battery materials, coating, binders, and performance fluoropolymers, which is causing capacity expansions and investments in supply chains, especially fluorine feedstocks and PVDF.

- Growth in semiconductor fabrication: Semiconductor fabrication requires ultrapure etching gases and fluoropolymers. Given that global chip production is projected to grow at a CAGR of 6.5% through 2030, and the large investments being made under the U.S. CHIPS Act and EU Digital Strategy, the demand for fluoropolymer materials and high-purity forms of PTFE is expected to increase in the future. Fluoropolymers are critical and essential for some very precise applications, such as wafer processing materials or cleanroom systems. The European Commission predicts that the EU will start increasing its share of the global semiconductor value chain by 9.8% in 2022 to 11.7% in 2030, with substantial support of policy and private investments in line with the EU Chips Act. In addition, the EU Chips Industry factsheet stated that the global semiconductor sales expanded by a better year-over-year growth rate from USD 526.8 billion to reach USD 627.6 billion in 2023 and 2024 accordingly. These signs point to the continuing positive trend in growth and the demand for the performance-grade fluoropolymers.

- Expansion in sustainable energy applications: The increased attention to renewable energy systems in the world, including solar panels and wind turbines, is driving the need for fluoropolymers such as PVDF as a protective surface coating and encapsulating material due to their chemical inertness and stability. Renewable Capacity Statistics 2025 of IRENA represent the total power growth in the world in 2024, which was 585 GW of renewable power, with more than 90% of it in the world, representing a 15.1% growth record each year. Further, the 1.5 °C Scenario prepared by IRENA indicates that in 2030, the installed renewable power generation capacity in the world would require an increase of over three times that of 2030. This has increased the level of renewable infrastructure that needs materials that can survive the extreme conditions of the environment, and thus, the demand for fluoropolymers is on the increase. In addition, fluoropolymers are also used to enhance the performance and durability of energy storage systems that are necessary in stabilizing renewable power grids, and hence, sustainable energy is a significant developmental force behind the growth of fluorine chemicals and polymers in the global market.

Impact of Fluorspar Mine Production on the Market

Fluorspar mine production plays a crucial role in driving the fluorine chemicals and polymers market because it is the primary raw material for hydrofluoric acid (HF), which forms the backbone of fluorine-based derivatives. A steady and reliable supply of fluorspar ensures cost stability and production continuity for high-performance products such as refrigerants, fluoropolymers (PTFE, PVDF, FEP), aluminum fluoride, and specialty chemicals. When mine output rises, downstream industries benefit from improved availability and reduced supply risks, enabling expansion into applications like electronics, automotive, aerospace, and renewable energy. Conversely, supply shortages or uneven production can lead to price volatility, pressuring manufacturers and potentially slowing innovation. Thus, fluorspar mining directly influences the growth, competitiveness, and sustainability of fluorine chemicals and polymers markets worldwide.

Fluorspar Mine Production, in thousand MT by Country (2023-2024)

|

Country |

2023 Production |

2024 Production |

|

China |

6,000 |

5,900 |

|

Germany |

100 |

100 |

|

Iran |

121 |

120 |

|

Mexico |

1,160 |

1,200 |

|

Mongolia |

1,210 |

1,200 |

|

South Africa |

345 |

380 |

|

Spain |

165 |

160 |

|

Thailand |

48 |

76 |

|

Vietnam |

146 |

110 |

Source: usgs.gov

Challenges

- Stringent environmental regulations on PFAS: The EPA and ECHA have placed limitations on PFAS, including fluoropolymers, because of their environmental persistence. Expensive reformulations affect smaller manufacturers by delaying market access. The EU market share increased by 10% in 2024 as a result of Arkema's USD 50 million investment in non-fluorinated surfactants in 2023. Since regulations are becoming tighter, particularly in an ECHA proposal to ban over 10,000 PFAS substances in 2023, manufacturers are hastening with reformulation plans. Arkema has completely moved to non-fluorinated surfactants in products of PVDF production in all its locations, and this is an indication of the industry changing to move to regulatory pressure. The shift increases the costs of R&D and the lead times, particularly to the SMEs venturing into the highly controlled EU and US markets.

- High compliance costs for environmental safety: EPA's Toxic Release Inventory expansion drives up reporting expenses. Small and medium-sized enterprises struggle, limiting market involvement. Fluorotech lowered its compliance costs by 16% in 2023 after entering Canada. The chemical industry is expected to grow by 3.6% in 2024 despite regulatory constraints. As of 2024, the EPA required reporting of 196 PFAS compounds under the Toxics Release Inventory (TRI) after including seven new chemicals in 2023. These would add to the administrative complexity and reporting expenses, including the reporting exemptions, which add to the administrative complexities and reporting expenses, particularly when the SMEs do not have their own compliance infrastructure.

Performance Fluorine Chemicals & Polymers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 6.2 billion |

|

Forecast Year Market Size (2035) |

USD 15.8 billion |

|

Regional Scope |

|

Performance Fluorine Chemicals & Polymers Market Segmentation:

Product Type Segment Analysis

The polytetrafluoroethylene (PTFE) segment is predicted to gain the largest performance fluorine chemicals & polymers market share of 63.2% during the projected period by 2035, due to its greater chemical resistance, thermal stability, and low friction. The U.S. Department of Energy (DOE) put up USD 44 million as an investment to increase the reliability of the grid through supporting the projects that are more effective in integrating wind and solar energy. Furthermore, DOE has funded research in renewable sources such as wind and solar to generate sustainable fuels and chemicals at a cost of USD 41 million to move towards industrial decarbonization. These significant investments are driving growth in PTFE applications for improving efficiency and durability in wind and solar energy systems. PTFE is highlighted by the National Institute of Standards and Technology (NIST) as a critical material for semiconductor fabrication driven by 5G and IoT developments.

The Polytetrafluoroethylene (PTFE) segment is expanding due to the rise of granular PTFE and Fine Powder PTFE in the market. The U.S. International Trade Commission has determined that granular PTFE has a high superiority due to its superior molding property, mechanical strength, and chemical resistance, making it very suitable in automotive, aerospace, and chemical processing industries. It finds wide application in the manufacture of high-strength sheets, rods, and tubes. Additionally, fine powder PTFE is known to be used in the fields of coating and membrane, the property of lubricating and anti-friction that is required in electronics and automobiles. The combination of these sub-segments is facilitating the growing application of PTFE based on industrial requirements for chemical resistance, thermal stability, and longevity.

Application Segment Analysis

The industrial equipment segment is anticipated to constitute the most significant growth by 2035, due to fluoropolymers’ durability in corrosive environments. According to the Quality Improvement Program (QIP) developed by the U.S. EPA, the excellence of the emission technology used to replace the leaking pumps and seals is required to change them to 20% each year. This leads to the demand for industrial equipment based on PTFE because of its chemical resistance and hardness. The adherence to these laws is one of the drivers in the development of the industrial equipment sector. As the emission criteria continue to tighten, industries are becoming more dependent on the use of fluoropolymers such as seals, gaskets, and valves. This control boost has a direct effect on performance fluorine chemicals & polymers market growth and development in high-performance equipment.

Fluorine-lined pumps and valves are essential elements of the chemical industry, especially with regard to resisting corrosion and their capability to work with highly corrosive chemicals without a problem. These pumps lower the costs of maintenance and enhance sustainability in adverse conditions to help the stable functioning of fluid handling systems. Fluoropolymers such as PTFE are excellent in offering leak-resistant and durable sealing solutions as seals and gaskets with good chemical resistance and integrity at high temperatures and high pressures, and are thus required where the industrial needs of leak-proof and durable sealing are necessary. The fluorine-lined resin products, such as resin products used in pumps, valves, seals, and gaskets, are important to U.S. importation and exportation as per the U.S. International Trade Commission. These applications also ensure dependability in operations that lead to the expansion of industrial equipment in the market.

End Use Segment Analysis

Electrical & electronics segment is expected to grow substantially with the performance fluorine chemicals & polymers market share by 2035, owing to its outstanding dielectric characteristics, high temperature tolerance, and chemical insensitivity. PTFE has numerous applications in cable insulation and connectors, and printed circuit boards (PCBs) connecting to safer and more efficient electronic devices. According to the U.S. Department of Energy (DOE), advanced polymers such as PTFE play a key role in enhancing the reliability and performance of electrical insulation systems, which help in energy efficiency and safety. Furthermore, the National Institute of Standards and Technology (NIST) emphasizes the use of PTFE in electronic components as well as in semiconductor manufacturing. Consumer electronics, electric vehicles, and renewable energy technologies continue to increase the demand for PTFE in this segment.

Our in-depth analysis of the global performance fluorine chemicals & polymers market includes the following segments:

|

Segment |

Sub-segment |

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Performance Fluorine Chemicals & Polymers Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to dominate the market with the largest revenue share of 43.2% over the projected years from 2026 to 2035, due to growth in the automotive, electronics, and industrial sectors. In 2022, Japan sold 58,813 battery electric vehicles (BEVs), which is 2.7 times more than in 2021, contributing to the BEV market, with BEVs constituting 1.7% of passenger car sales. In fiscal year 2022, the government subsidized the adoption of EVs to the tune of about 70 billion Yen (USD 501 million).

Additionally, the growth of the market is very strong due to increasing industrial needs and environmental laws. In 2022, the output of the fluorine chemical products in China was about 3.984 million tons, and it is expected to be 4.028 million tons by 2023, and increase to 4.105 million tons in 2024. The market worth of the region is high, and China alone has a market worth of 58.556 billion yuan in 2022. In India, the government agencies, such as the Department of Chemicals and Petrochemicals, are actively involved in overseeing and assisting the industry in the form of statistics and policy programs. The developments have formed the basis of increasing use of high-performance fluorine polymers in the chemical industry, electronics industry, automobile industry, and renewable energy industry in the Asia Pacific.

By 2035, the market in China is expected to lead the Asia Pacific region with a significant share, driven by its semiconductor and automotive sectors. The Ministry of Ecology and Environment's increasing restrictions on perfluoroalkyl and polyfluoroalkyl substances (PFAS) have pushed low-global warming potential (GWP) alternatives like hydrofluoroolefins (HFOs). Additionally, the 14th Five-Year Plan of China (2021- 2025) requires that the chemical and petrochemical industries that should cut emissions of volatile organic compounds by more than 10% compared to 2016 and 2020, increase 70 green, smart, competitive chemical industrial parks producing more than 70% of the chemical products, and encourage clean technologies in synthesis.

Moreover, the Chinese filled fluoropolymer market, which is a very crucial sub-industry of the performance fluorine chemicals & polymers market, is estimated to be USD 6.3 billion in 2030. The demand by the automotive and electronic industries, as well as the chemical industries, to have better mechanical performance, chemical resistance, and lightweight materials, drives this growth. The growth is in line with the overall strategic orientation of China in the development of high-performance fluoropolymers in sustainable manufacturing, which is in line with the overall expansion drivers in the performance fluorine chemicals & polymers market internationally.

The Indian performance fluorine chemicals & polymers market is likely to grow steadily over the forecast period, attributed to the increasing demand in the automotive, electrical, electronics, and healthcare industries, where fluoropolymers are employed due to their chemical and thermal stability and durability. The domestic production and research in the field of fluoropolymer manufacture are being spurred by government programs such as the National Chemical and Petrochemical Policy and the Make in India campaign. For example, Gujarat Fluorochemicals Limited (GFL), which has now expanded its fluoropolymer line to include PFA, FEP, PVDF, as well as FKM, with its own research and development facility in Ranjit Nagar. This facility is based on sustainable technologies in its manufacturing and development of products that do not contain PFOA and non-fluorinated surfactants, which reduce the impact on the environment. Similarly, the emergence of the fluoropolymers in industrial coatings, seals, and electrical insulation is partly due to the environmental regulations of using environmentally friendly materials. The biggest revenue share goes to industrial processing, with the construction expected to exhibit the highest growth rate, driven by the development of infrastructure and smart cities.

North America Market Insights

The North American performance fluorine chemicals & polymers market is expected to grow with a notable revenue share of 31.5% over the forecast years, propelled by the growing demand in automotive, electronics, semiconductors, and HVAC markets. As of 2023, the U.S. Environmental Protection Agency (EPA) estimates that the greenhouse gas emissions of the U.S. chemical manufacturing industry reached 184.8 million metric tons of CO 2 equivalent (CO 2e), including the following gases: petrochemicals, fertilizers, and fluorochemicals. In this, 3.5 million metric tons of CO2e were assigned directly to the production of fluorinated gases, such as hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and other high-performance fluorinated substances. Moreover, the HFCs are being phased out by regulatory measures under the American Innovation and Manufacturing (AIM) Act, which has led to the industry developing low-global-warming fluoropolymers and refrigerants. The HFC Data Hub of the EPA allows monitoring this shift in detail, highlighting how policy affects the dynamics of the market.

The U.S. performance fluorine chemicals & polymers market is predicted to lead the North America region with the largest share by 2035, owing to the increasing semiconductor and EV demand. The EPA Green Chemistry Challenge Awards have honoured more than 133 technologies in the U.S that produce no 830 million pounds of hazardous chemicals and solvents, and save more than 20 billion gallons of water and 7.8 billion pounds of CO2e per year. These breakthroughs directly aid in the development of the performance fluorine chemicals & polymers market, where new technological innovation in low-emission fluoropolymers, non-PFOA surfactant, and more eco-friendly synthesis processes continue to accelerate, especially in the high-performance markets such as electronics, automotive, and aerospace, where sustainability is necessary along with thermal and chemical resistance. Semiconductor production is critical for 5G and is growing at 11% annually, and the NIST has a USD 52 million grant for research and development of GaAs wafers that will increase fluoropolymer applications. Furthermore, the DOE takes clean energy innovation seriously as the initiative is reflected in wider funding programs (i.e., the $150 million dedicated to mitigating the climate effects of energy technologies and manufacturing, and the $590 million dedicated to the expansion of bioenergy research). Such activities help in the creation of green materials and processes that are favorable to the performance fluorine chemicals & polymers market.

The performance fluorine chemicals & polymers market in Canada is projected to grow at the fastest CAGR within the North America region, mainly due to high demand in the medical, electronics, and automobile industries. Natural Resources Canada recorded a 13.5% growth in manufacturing shipments in the chemical manufacturing industry in 2022, which indicates the growing demand and investment in high-performance materials, such as high-performance fluoropolymers, in industrial applications. The sector employs around 90,800 people, highlighting the economic importance and ability of the industry to facilitate the specialized production of polymers. The increasing rate of manufacturing production and manpower growth is expanding the performance fluorine chemicals & polymers market growth in Canada based on the increasing rate of adoption in transport, airplane, electronic, and sustainable manufacturing industries. The federal focus on the use of green technology helps in the development of environmentally friendly fluoropolymers, which are essential in lightweight, durable parts in electric vehicles and electronic gadgets. Moreover, Environment and Climate Change Canada states a slow decline in industrial emissions, which implies the implementation of more sustainable chemical processes, which are beneficial to the market of fluorine chemicals.

Europe Market Insights

The European performance fluorine chemicals & polymers market is anticipated to expand notably, with a revenue share of 23.4% from 2026 to 2035, driven by high requirements in the automotive, aerospace, electronics, and medical industries. The European Chemicals Agency (ECHA) claims that fluoropolymers are essential in industries that demand chemical resistance and durability, and are finding more and more applications in environmentally controlled applications. In addition, according to the European Environment Agency (EEA), there has been a slow reduction of industrial emissions as a result of tougher regulations that have been adopted to promote the adoption of greener fluoropolymer production processes. The Green Deal will improve the growth potential of the market by funding and policy through sustainable chemistry, established by the EU. Government projects in the UK to promote sustainable manufacturing are promoting fluoropolymer innovation and net-zero emissions are with the goal of 2050. Germany focuses on the National Hydrogen Strategy for the modernization of the advanced chemical industry in favor of low-emission fluoropolymer technologies. These government initiatives and environmental regulations together are expected to drive the growth of the performance fluorine chemicals & polymers market in the region.

Key Performance Fluorine Chemicals & Polymers Market Players:

- The Chemours Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solvay S.A.

- Daikin Industries, Ltd.

- AGC Inc.

- 3M Company

- Dongyue Group Ltd.

- Gujarat Fluorochemicals Limited

- Arkema S.A.

- Hubei Everflon Polymer Co., Ltd.

- Halopolymer Kirovo-Chepetsk, LLC

- Chemfab Alkalis Limited

- Lotte Chemical Corporation

- Dyno Nobel (Incitec Pivot Limited)

- Petronas Chemicals Group Berhad

- Kureha Corporation

The performance fluorine chemicals & polymers market is highly competitive, dominated by Daikin, The Chemours Company, and Solvay, collectively holding over 40% market share. Key players are making strategic moves such as expanding their capacity, as shown by Solvay's doubling of PVDF production in China in 2020. They are also making R&D investments like Daikin with PFA for powder bed fusion (2022). The impetus of sustainability is driving innovation, one example is Arkema's acquisition of Polimeros Especiales for eco-friendly resins (2022), and emerging contenders such as Gujarat Fluorochemicals and Dongyue are paving the way with their production additions at a cost-competitive level. Each region's strength drives competition in the U.S. on advanced manufacturing, Japan on innovative technology, and India's vastly growing automotive segment, prompting players to focus on green chemistry and strategic collaborations.

Top Global Performance Fluorine Chemicals & Polymers Manufacturers:

Recent Developments

- In June 2025, Clariant introduced its AddWorks PPA line, consisting of AddWorks PPA 101 FG and AddWorks PPA 122 G, and shifted towards PFAS-free polymer processing aids significantly. These innovative additives are specific polyolefin extrusion additives, which assist manufacturers in eradicating shark-skin flaws and enhancing the surface of the film. Most significantly, the products comply with strict food packaging regulations entirely, thus showing that Clariant is aligned with global regulatory and sustainability requirements. This commercial launch helps the industry to move on to non-traditional fluoropolymer-based aids, as it responds to mounting regulatory pressure, but where converters and packaging manufacturers remain highly competitive in major international markets.

- In March 2025, Chemours and Navin Fluorine Industries created a strategic alliance where they would produce a new liquid cooling product to be used in advanced thermal management applications. It has made use of the distinctive characteristics of the fluorinated chemicals and polymers, like high thermal stability, resistive qualities towards chemical and electrical insulation, which is why it is perfectly suited when it comes to cooling systems in electric vehicles, electronics, and industrial machinery. The joint venture will increase its capacity and quicken the production of high-performance and environmentally friendly cooling fluids to fit the rising market need. This partnership enhances the market standings of the two companies in the performance fluorine chemicals and polymers business.

- In November 2024, Syensqo introduced a next-generation fluoropolymer Aquivion N+ 125D based upon Non-Fluorinated Surfactant (NFS) technology. It is a product that is used in applications related to hydrogen, such as fuel cells and electrolysis systems, and would correspond with the company's effort to stop using fluorosurfactants in its production processes. Aquivion N+ 125D is also part of a wider Syensqo strategy to make the company virtually 100 percent fluorosurfactant-free by 2026. The introduction is one of the milestones of sustainable fluoropolymer development, which provides a better safety of the environment without a decrease in chemical performance. It is also an indicator of the increasing European, Asian, and North American demand for clean hydrogen technologies and sustainable materials.

- Report ID: 3165

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Performance Fluorine Chemicals & Polymers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.