Electronic Chemicals and Materials Market Outlook:

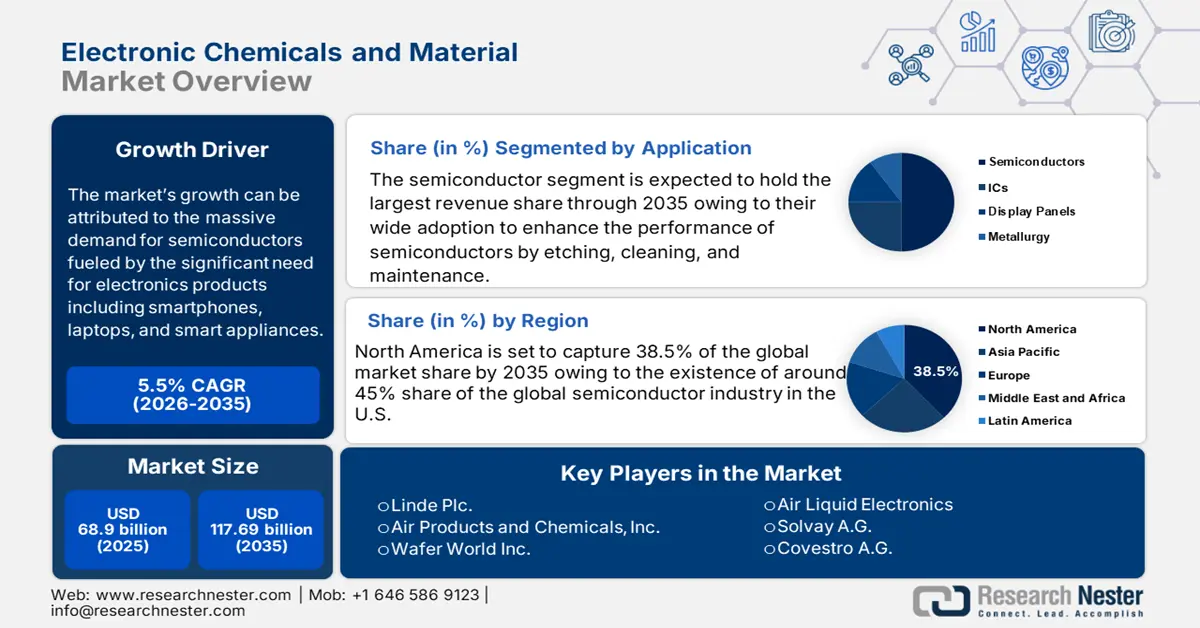

Electronic Chemicals and Materials Market size was valued at USD 68.9 billion in 2025 and is likely to cross USD 117.69 billion by 2035, registering more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electronic chemicals and materials is assessed at USD 72.31 billion.

The market is growing on the back of increasing demand for semiconductors, which in turn is expanding with the rising demand for electronic products, such as smartphones, laptops, and smart home gadgets, as well as the expanding use of technologies such as the Internet of Things (IoT) and autonomous cars. For instance, the global sales revenue for the semiconductor industry increased by 7% to $48.6 billion in July 2022 from $44.9 billion in July 2021.

The worldwide electronic industry's expanding demand for chemicals and materials is propelling the market's expansion. To improve semiconductors' performance, these electronic chemicals and materials are used for their etching, cleaning, and maintenance. Additionally, the electronics industry's technological development is anticipated to accelerate market expansion. Global demand for microelectromechanical systems and nanoelectromechanical systems incorporating nanotechnology has greatly expanded market prospects. The demand for IoT-driven devices and AI for enhanced and secure performance has also increased with the trend towards connected devices and smart technologies. With more than 10 billion IoT devices connected globally in 2020, the demand for electronic chemicals and materials is bound to grow.

Key Electronic Chemicals and Materials Market Insights Summary:

Regional Highlights:

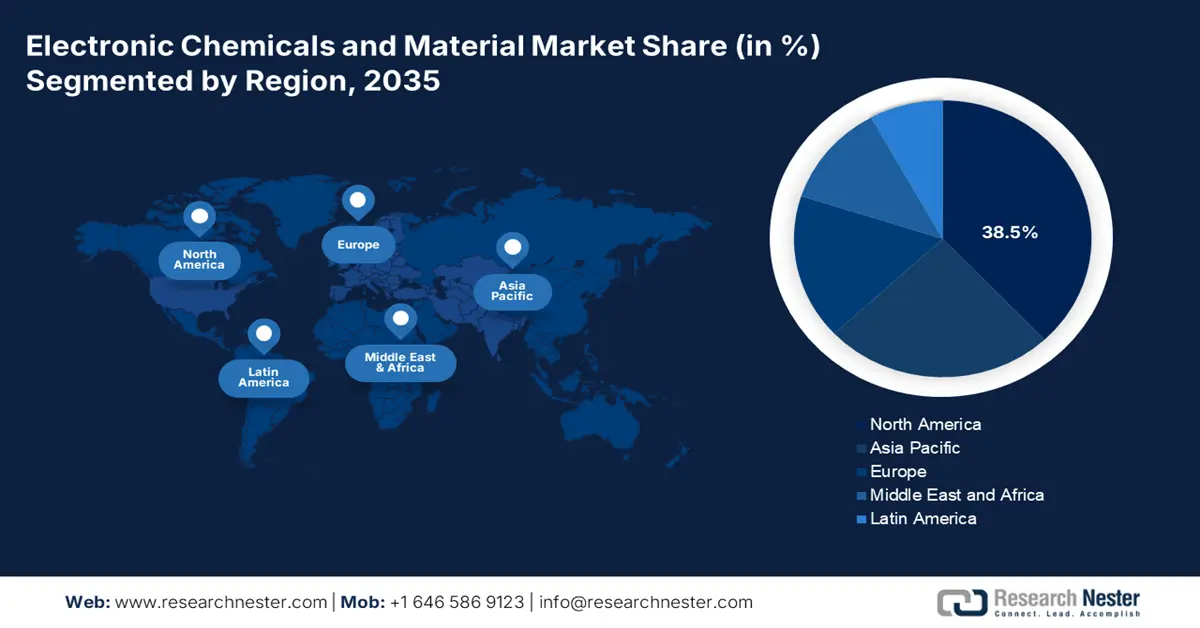

- North America electronic chemicals and materials market will hold over 38.50% share by 2035, driven by U.S. semiconductor industry leadership and R&D investments.

Segment Insights:

- The semiconductors segment in the electronic chemicals and materials market is projected to hold the largest share by 2035, attributed to the extensive use of chemicals and materials to improve semiconductor performance.

- The silicon wafers segment in the electronic chemicals and materials market will hold the largest share, driven by increasing global usage across devices and industries over the forecast period 2026-2035.

Key Growth Trends:

- The Use of Electronic Chemicals and Materials in the Semiconductor Industry

- Technology is the Fastest Growing Industry

Major Challenges:

- Disruptions in supply chains that can cause imbalances

- Strict regulations regarding the use of hazardous chemicals

Key Players: Linde plc, Air Products and Chemicals, Inc., Wafer World Inc., Air Liquide Electronics, Solvay A.G., Covestro AG, CMC Materials Corporation, BASF SE, Showa Denko Materials Co., Ltd., SONGWON.

Global Electronic Chemicals and Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 68.9 billion

- 2026 Market Size: USD 72.31 billion

- Projected Market Size: USD 117.69 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 10 September, 2025

Electronic Chemicals and Materials Market Growth Drivers and Challenges:

Growth Drivers

- The Use of Electronic Chemicals and Materials in the Semiconductor Industry – During the production of semiconductors, the semiconductor industry significantly relies on electronic chemicals and materials. Electronic gadgets such as computers, cell phones, and televisions all depend on semiconductors. Electronic chemicals and materials are employed throughout the manufacture of semiconductors, including wafer cleaning, lithography, etching, and deposition, and it is anticipated to boost the growth of the global electronic chemicals and materials market. The semiconductor industry globally generated USD 415 billion in sales in 2019 and climbed up to USD 439.4 Billion in 2020, a 6.8% increase, partly as a result of increased demand brought on by the COVID-19 pandemic.

- Technology is the Fastest Growing Industry – With constant developments in various sectors ranging from AI and ML to cloud computing and 5G, technology has become the most valuable and fastest-growing sector in the world. In 2020, over 40% of the top 50 biggest global corporations belonged to the technology sector.

- Growing Adoption of Nanotechnology – By manipulating substances at the nanoscale, nanotechnology enables the development of novel materials with special qualities, including boosted strength, better electrical conductivity, and improved optical capabilities. Nanotechnology is being applied to the semiconductor industry to develop new semiconductor types with enhanced functionality and reduced power consumption. For instance, it is anticipated that in the next 3 years, the Nanotechnology industry is set to generate over 300 billion USD in revenue globally.

- Recovering Semiconductor Industry Post Global Shortage – The productivity of semiconductor manufacturers has grown around the world, which helped in driving up the predicted revenue growth to over 8.5% in 2021 from roughly 5% in 2019, the last year before the pandemic. To minimize supply chain interruptions, governments are also increasing their investments in semiconductor technology.

- Global Advent and Adoption of 5G – Over 1/3rd of all semiconductors produced are used in the communications industry. It is anticipated that in 2025, one-third of the world's population will be covered by 5G networks 2025. The growth of 5G technology will further propel the global electronic chemicals and materials market.

Challenges

- High associated cost of operations, investment, and manufacture of electronic chemicals and materials. - The production and use of electronic chemicals and materials can be costly owing to several factors, such as the fluctuating prices of raw materials, costs incurred during the manufacturing process, and the ongoing research and development process. These factors contribute to the high associated cost of operations, investment, and manufacture in electronic chemicals and materials market. However, the industry is continuously evolving, and new methods and technologies are being developed to reduce the cost of production and make the materials more accessible to manufacturers.

- Strict regulations regarding the use of hazardous chemicals

- Disruptions in supply chains that can cause imbalances.

Electronic Chemicals and Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 68.9 billion |

|

Forecast Year Market Size (2035) |

USD 117.69 billion |

|

Regional Scope |

|

Electronic Chemicals and Materials Market Segmentation:

Application Segment Analysis

The global electronic chemicals and materials market is segmented and analyzed for demand and supply by application into semiconductors, ICs, display panels, and metallurgy. Out of these segments, the semiconductors segment is expected to keep holding the largest market share by 2035. This is based on the fact that electronic chemicals and materials are most extensively used to improve the performance of semiconductors by etching, cleaning, and maintenance. Semiconductors are projected to be one of the most demanded products in the coming future, as an anticipated 7 trillion USD are projected to be invested in digital transformation by 2023 around the globe.

Type Segment Analysis

The global electronic chemicals and materials market is also segmented and analyzed for demand and supply by type into specialty gases, CMP slurries, photoresist chemicals, conductive polymers, low K dielectrics, wet chemicals, silicon wafers, and PCB laminates. Out of these segments, the silicon wafers segment is expected to keep holding the largest market share by 2035. This can be owed to the ever-growing use of silicon wafers across various devices and industries globally. For instance, it is estimated that over 17.2 billion square inches of silicon wafers will be sold globally in the coming two years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electronic Chemicals and Materials Market Regional Analysis:

North American Market Insights

The North American electronic chemicals and materials market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. This can be accredited to the fact that the United States alone holds more than 45% share of the world’s semiconductor industry. The semiconductor industry in the USA is a significant contributor to the country's economy and technology sector. The industry is one of the most advanced and competitive in the world, and it plays a crucial role in the development and production of semiconductors and electronic devices. The US government has also played a significant role in supporting the semiconductor industry, with initiatives such as the National Semiconductor Technology Center (NSTC) and the Semiconductor Research Corporation (SRC) providing funding for research and development. Apart from that, the U.S. is the global leader in semiconductor R&D and design that is further anticipated to boost the market’s growth in the region.

Electronic Chemicals and Materials Market Players:

- Linde plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Products and Chemicals, Inc.

- Wafer World Inc.

- Air Liquide Electronics

- Solvay A.G.

- Covestro AG

- CMC Materials Corporation

- BASF SE

- Showa Denko Materials Co., Ltd.

- SONGWON

Recent Developments

-

Air Liquide Electronics – To invest over 200 million Euros to increase manufacturing capabilities in Tainan and Hsinchu, Taiwan. The Group will be able to supply three high-volume semiconductor fabrication plants currently under construction in Tainan Science Park.

-

BASF SE - A contract between BASF and Entegris for the acquisition of the Precision Microchemicals division by Entegris for US$90 million was signed. The technology, intellectual property, and trademark transactions were completed by the end of 2021.

- Report ID: 4610

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electronic Chemicals and Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.