Error Monitoring Software Market Outlook:

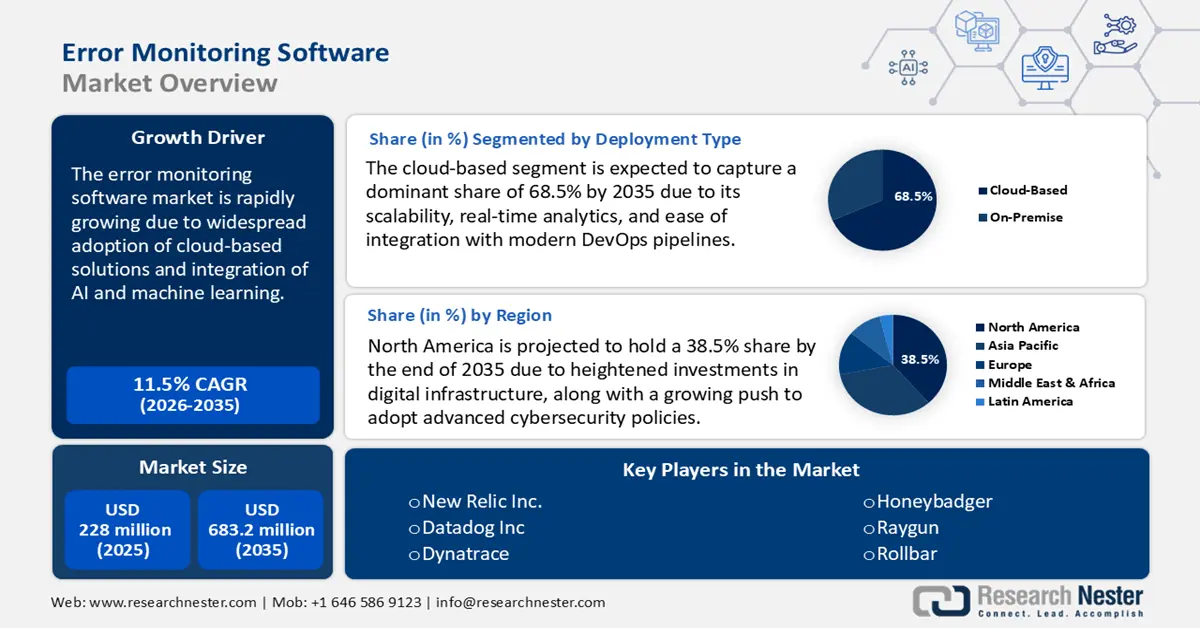

Error Monitoring Software Market size was valued at USD 228 million in 2025 and is projected to reach USD 683.2 million by the end of 2035, rising at a CAGR of 11.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of error monitoring software is assessed at USD 254.4 billion.

The combination of IoT, 5G, and edge computing is changing digital systems and increasing the need for advanced error monitoring tools. These technologies create huge amounts of real-time data, driving demand for error monitoring solutions in industries like manufacturing, healthcare, and transportation. The expansion of smart factories across the world is also amplifying the trade of error monitoring software technologies.

According to a December 2023 report from the Ministry of Industry and Information Technology, China has created over 10,000 digital workshops and smart factories. This makes China the world’s largest market for smart manufacturing applications. The developing regions are expected to be prime markets for error management software companies. The rapid expansion of 5G and other wireless communication networks is boosting Internet penetration in these regions. The Ministry of Electronics & IT disclosed that India’s digital economy is set to make up one-fifth of the country’s total income by 2029-30. In 2022-23, it contributed 11.74% to India’s GDP, equal to around USD 402 billion. Thus, the digitization of industries is creating a lucrative environment for error monitoring software companies.

Key Error Monitoring Software Market Insights Summary:

Regional Highlights:

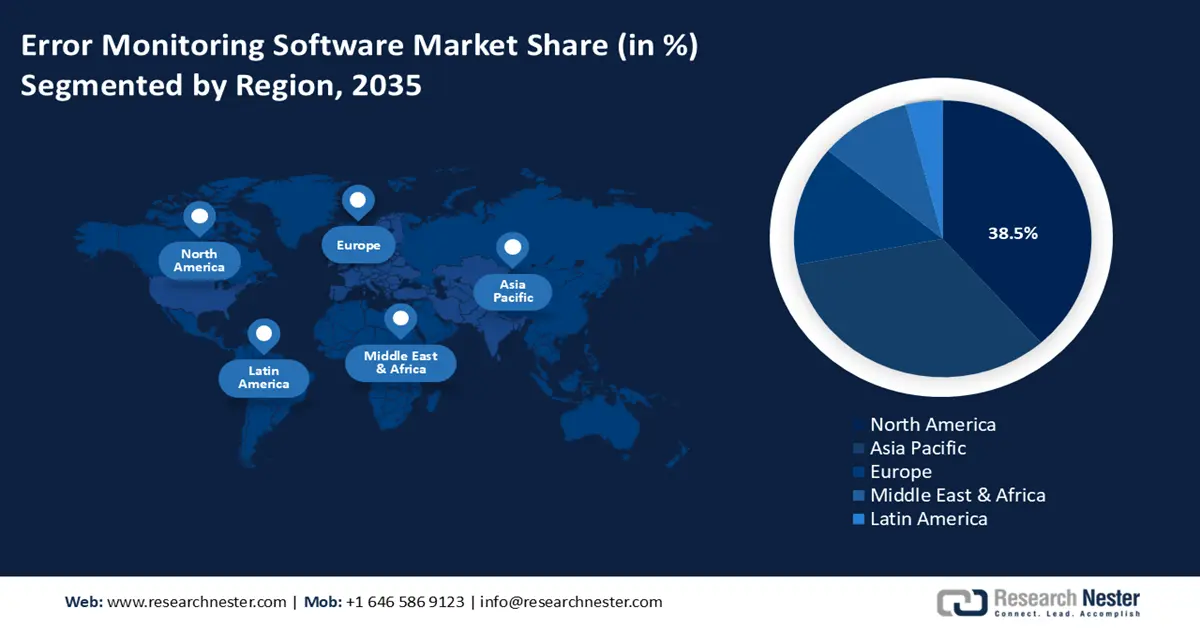

- North America error monitoring software market is predicted to hold a 38.5% share by 2035 owing to heightened investments in digital infrastructure and advanced cybersecurity policies.

- APAC market is projected to expand rapidly during the forecast period 2026–2035 due to the increasing adoption of cloud-based applications and AI-driven error resolution.

Segment Insights:

- The cloud-based deployment segment in the Error Monitoring Software Market is projected to account for a 68.5% share throughout the forecast period 2026–2035, impelled by cost-effectiveness and scalable operational efficiency.

- The web applications segment is anticipated to hold a 60.2% share by 2035, bolstered by the growing reliance on web-based platforms to optimize business operations.

Key Growth Trends:

- Widespread adoption of cloud-based solutions

- Integration of AI and ML

Major Challenges:

- Complex integration process

- High implementation costs

Key Players: Datadog, Inc., Sentry (Contrast Security), Dynatrace, AppDynamics (Cisco), Honeybadger, Raygun, Rollbar, Bugsnag, LogRocket, Airbrake, Fujitsu, Samsung SDS, Zoho Corporation, Fusionex.

Global Error Monitoring Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 30 September, 2025

Error Monitoring Software Market - Growth Drivers and Challenges

Growth Drivers

- Widespread adoption of cloud-based solutions: The move from on-premises systems to cloud-based solutions has boosted the demand for error monitoring software optimized for cloud environments. These cloud-native solutions offer scalable, flexible, and real-time visibility into application performance. The European Commission reports that in 2023, 42.5% of businesses in the EU purchased cloud computing services. With more organizations embracing cloud technologies, having error monitoring tools that seamlessly integrate with these platforms is essential to sustain system reliability and performance.

- Integration of AI and ML: The integration of AI and ML into error tracking software improves predictive analytics and automated issue detection. This integration allows for more precise identification of anomalies and proactive resolution of potential issues, thereby improving software reliability and reducing downtime. For instance, in June 2025, Datadog, Inc. launched three new AI tools that help development, security, and operations teams by investigating issues interactively and fixing code automatically in the background. This indicates that key players are focused on R&D to introduce advanced error monitoring software and attract a wider consumer base, leading to a robust revenue hike.

- Emphasis on enhanced user experience and operational resilience: Businesses are gradually shifting to delivering exceptional consumer experiences and ensuring operational resilience, wherein error monitoring software plays a critical role by proactively identifying and resolving issues that potentially influence application performance. The incorporation of error monitoring tools into DevOps and CI/CD pipelines supports faster development cycles and more trustworthy software releases. The focus on improving user experience and making operations more efficient is encouraging more industries to use advanced error monitoring tools.

Challenges

- Complex integration process: An important challenge in the error monitoring software market is handling the complexity of integrating these tools across diverse and rapidly evolving IT environments. With organizations adopting a mix of cloud, on-premises, and hybrid systems, ensuring seamless compatibility and consistent error tracking becomes difficult. This complexity leads to gaps in monitoring, delayed issue detection, and increased costs, making it harder for businesses to maintain high software reliability and performance.

- High implementation costs: The high cost of error monitoring software makes it challenging for small and medium-sized businesses with tight budgets to use it. The incorporation of advanced technologies such as artificial intelligence and machine learning also increases the price, which limits its use in markets where cost is a big concern. Further, the need for advanced infrastructure for the deployment of next-gen error monitoring software solutions hinders the overall market growth.

Error Monitoring Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 228 million |

|

Forecast Year Market Size (2035) |

USD 683.2 million |

|

Regional Scope |

|

Error Monitoring Software Market Segmentation:

Deployment Type Segment Analysis

The cloud-based deployment segment is poised to account for a dominant revenue error monitoring software market share of 68.5% throughout the forecast timeline. The cloud-based deployment is lucrative due to the cost-effectiveness it offers. Additionally, cloud-based deployments offer greater scalability, allowing enterprises to adjust resources on demand, boosting operational efficiency. In workflow, the debugging process has been optimized due to the integration of cloud-based error monitoring, exhibiting the segment's high potential.

Application Segment Analysis

The web applications segment is poised to account for a leading revenue error monitoring software market share of 60.2% by the end of 2035. A key factor contributing to the segment's growth is the increasing reliance on web-based platforms to optimize business operations. Due to the proliferation of e-commerce, the requirement for error monitoring in web applications has heightened. The International Trade Administration (ITA) reports that global online sales for B2B businesses have been growing every year for the past ten years, reaching a value of USD 36 trillion by 2026-end. Most of these sales come from industries including advanced manufacturing, energy, healthcare, and professional business services. Thus, the dependency on web apps as their primary interface is bolstering the segmental growth.

Enterprise Size Segment Analysis

The large enterprises segment is projected to hold a dominant error monitoring software market share throughout the study period. The scalability and criticality of their IT operations, big companies heavily invest in error monitoring software solutions. Also, any downtime, error, or system failure leads to significant financial loss and regulatory penalties. Thus, to avoid these issues, large companies are employing advanced error monitoring software technologies. The strict regulatory compliance needs are also contributing to the segmental growth.

Our in-depth analysis of the error monitoring software market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Application |

|

|

Enterprise Size |

|

|

Platform |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Error Monitoring Software Market - Regional Analysis

North America Market Insights

The North America error monitoring software market is poised to register a dominant revenue share of 38.5% by the end of 2035. A major factor that has contributed to the growth is the heightened investments in digital infrastructure, along with a growing push to adopt advanced cybersecurity policies. The tech ecosystem in the country is mature for the greater adoption of error monitoring software solutions. Additionally, the U.S. government's allocation of USD 65 billion via the Infrastructure Investment and Jobs Act is a highlight of the commitment to improving internet accessibility. From that investment, USD 42.45 billion was dedicated to the BEAD program. Additionally, in Canada, the Affordable Connectivity Program seeks to provide discounted internet services to households with low incomes. The convergence of supportive investments from government bodies has ensured that North America to remain lucrative by the end of 2035.

The U.S. error monitoring software market is expected to maintain a leading share in North America throughout the forecast period. The growth is supported by federal initiatives that seek to expand the country's digital infrastructure. In terms of supportive investments, the NTIA launched the Digital Equity Competitive Grant Program, which allocates more than USD 1.0 billion to support projects for digital inclusion. The robust technological ecosystem in the country is slated to ensure sustained opportunities for the adoption of error monitoring software throughout the forecast timeline.

The Canada error monitoring software market is estimated to be driven by the increasing digitalization across various enterprises. The cloud shift in the public sector is also a prime accelerator for the application of error monitoring software solutions. Furthermore, according to Statistics Canada, in 2023, around 7% of Canadian businesses with five or more employees utilized AI software or hardware, indicating a 3% increase from 2021. The information and cultural industries sector also had the highest AI adoption at 26%, with the largest increase of 13% since 2021. The country’s high internet penetration and digitalization of operations are thus set to accelerate the trade of error monitoring software solutions in the years ahead.

APAC Market Insights

The APAC error monitoring software market is projected to register a rapid CAGR of 10.5% during the forecast period due to the rapid digital shift across industries such as finance, e-commerce, and healthcare. As more businesses adopt cloud-based applications, the demand for real-time error monitoring and resolution tools has increased. Further, the integration of AI and machine learning boosts the predictive capabilities of these error tracking tools, allowing for faster and more optimized issue resolving power. A surging startup environment and a rising number of SMEs further increase the need for flexible, cost-effective monitoring pathways. Additionally, businesses are placing greater emphasis on user experience, making error detection critical to maintaining service quality. Government initiatives promoting digital infrastructure and data compliance also contribute to market expansion.

In China, the error monitoring software market is expected to account for a significant share during the forecast period. This growth is fueled by the country's strong push for digital transformation, bolstered by significant government investment and a rapidly growing tech sector. The government reported that the software and IT services industry earned about USD 1.73 trillion in 2023. This is a 13.4% increase compared to the previous year. Additionally, the government's emphasis on strengthening cybersecurity and ensuring system reliability reinforces the critical role of error monitoring tools in China's digital ecosystem.

The India error monitoring software market is estimated to increase at the fastest CAGR from 2026 to 2035. The rapid digital transformation and strong presence of BFSI, IT services, and e-commerce sectors are propelling the adoption of error monitoring software solutions. The government-backed digitalization programs are also key factors boosting the overall market growth. The India Brand Equity Foundation (IBEF) reported that the country’s information technology (IT) industry was calculated at USD 253.9 billion in FY24, expanding at a rate of 3.8% year-on-year. Thus, the booming developer ecosystem, coupled with widespread adoption of cloud infrastructure, is set to push the overall trade of error monitoring software solutions in the years ahead.

Europe Market Insights

The Europe error monitoring software market is estimated to account for the second-largest revenue share through 2035. The region’s heavy focus on data protection under the General Data Protection Regulation (GDPR) emphasizes a high need for error monitoring software solutions. The sectors such as financial services, healthcare, manufacturing, and e-commerce are prime end users of error monitoring software solutions. The public sector’s strong push toward cloud adoption is set to act as a major driver for the overall market growth.

Germany is expected to lead sales of error monitoring software solutions throughout the forecast period. The advanced manufacturing sector and strong financial services industry are the key promoters of error monitoring software technologies. The International Trade Administration (ITA) states that Germany has one of the biggest information and communication technology (ICT) markets globally and is Europe’s largest software market, with about 100,000 IT companies employing around 1.189 million people. In 2024, the German ICT market earned USD 240.9 billion, and this grew to USD 252 billion in 2025. This indicates that investing in Germany is poised to double the revenues of key players in the years ahead.

The U.K. error monitoring software market is projected to be driven by its strong financial services sector and dynamic technology ecosystem. The early shift toward cloud-native operations in both the public and private sectors is accelerating the demand for error monitoring software solutions. The TechUK report reveals that the country’s tech industry employs more than 1.7 million people and contributes over USD 187.5 billion to the economy each year. Thus, heavy reliance on digital platforms is estimated to accelerate the trade of error monitoring software technologies.

Key Error Monitoring Software Market Players:

- New Relic, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Datadog, Inc.

- Sentry (Contrast Security)

- Dynatrace

- AppDynamics (Cisco)

- Honeybadger

- Raygun

- Rollbar

- Bugsnag

- LogRocket

- Airbrake

- Fujitsu

- Samsung SDS

- Zoho Corporation

- Fusionex

The error monitoring software market is intensely competitive, with U.S.-based companies leading the adoption of advanced AI and cloud-native technologies to improve real-time error detection and resolution. European firms such as Dynatrace prioritize enterprise-level offerings with a strong focus on scalability and regulatory compliance. Meanwhile, several companies in Asia, such as Fujitsu, Samsung SDS, Zoho, and Fusionex, are expanding their presence by combining AI-powered analytics and tailoring solutions to specific regional demands to enter into emerging markets. The key growth strategies in the industry include strategic acquisitions to enhance capabilities, partnerships with cloud solution providers for smooth integration, and consistent innovation in predictive analysis to reduce downtime and strengthen customer loyalty. Given below is a table of the top players in the market with their respective shares.

Recent Developments

- In September 2025, Sentry launched a new tool for monitoring errors and crashes in gaming consoles, a big step in supporting game developers. It works with Xbox, PlayStation, and Nintendo Switch, helping developers quickly find and fix problems that affect gameplay.

- In May 2023, Harness launched its Continuous Error Tracking (CET) tool for public testing, designed to help developers spot and fix errors in modern apps. As part of the Harness Platform, CET supports developers by finding and solving problems throughout the entire software creation and delivery process.

- Report ID: 3275

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Error Monitoring Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.