Email Security Market Outlook:

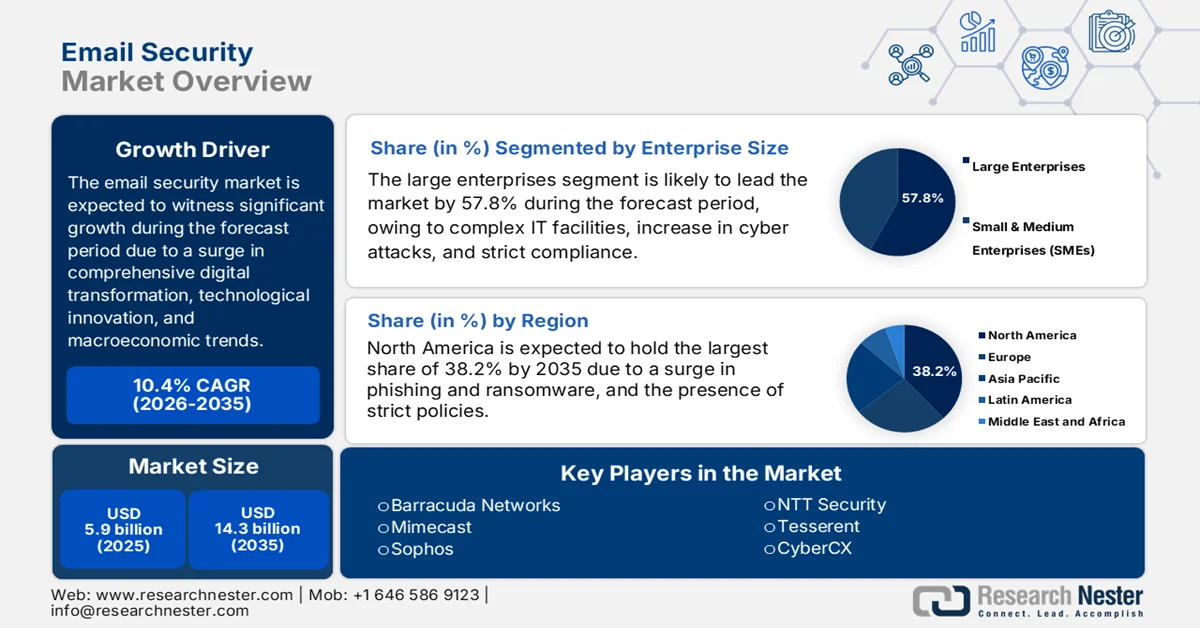

Email Security Market size was over USD 5.9 billion in 2025 and is estimated to reach USD 14.3 billion by the end of 2035, expanding at a CAGR of 10.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of email security is estimated at USD 6.5 billion.

The international email security market is continuously evolving within a wide digital transformation landscape that is shaped by technological advancement, organizational, geopolitical, and macroeconomic trends. According to official statistics published by the IDA in June 2025, the internet utilization has been 33% across different countries, in comparison to 91% across high-income nations, leading to an increase in the market’s demand globally. Besides, the Digital Economy for Africa (DE4A), which is an IDA-financed program, readily supports the objective to ensure that every individual, government, and business in Africa is expected to be digitally enabled by the end of 2030. Therefore, through this strategy, the World Bank assisted in increasing accessibility to broadband internet in Africa from 26% to 36% as of 2022, thereby bolstering the market’s exposure internationally.

Furthermore, the integration with collaborative programs, a rise in API-based security models, and an increase in behavioral analytics adoption are certain trends that are uplifting the email security market’s growth globally. As stated in an article published by NLM in March 2022, the separate assessment of nearly 32 million emails is considered secure by traditional safety protocols and is readily sent to business mailboxes, accounting for nearly 467,000 phishing websites. Besides, 93% of cyberattacks tend to capture confidential material, including authorized login details, which are subsequently utilized to develop a hostile influence inside organizations or retransmit confidential material. Moreover, the Australia Competition and Consumer Commission reported obtaining almost 200,000 fraud cases with alleged risks exceeding AUD 340 million, thus denoting a positive impact on the market’s upliftment.

Key Email Security Market Insights Summary:

Regional Highlights:

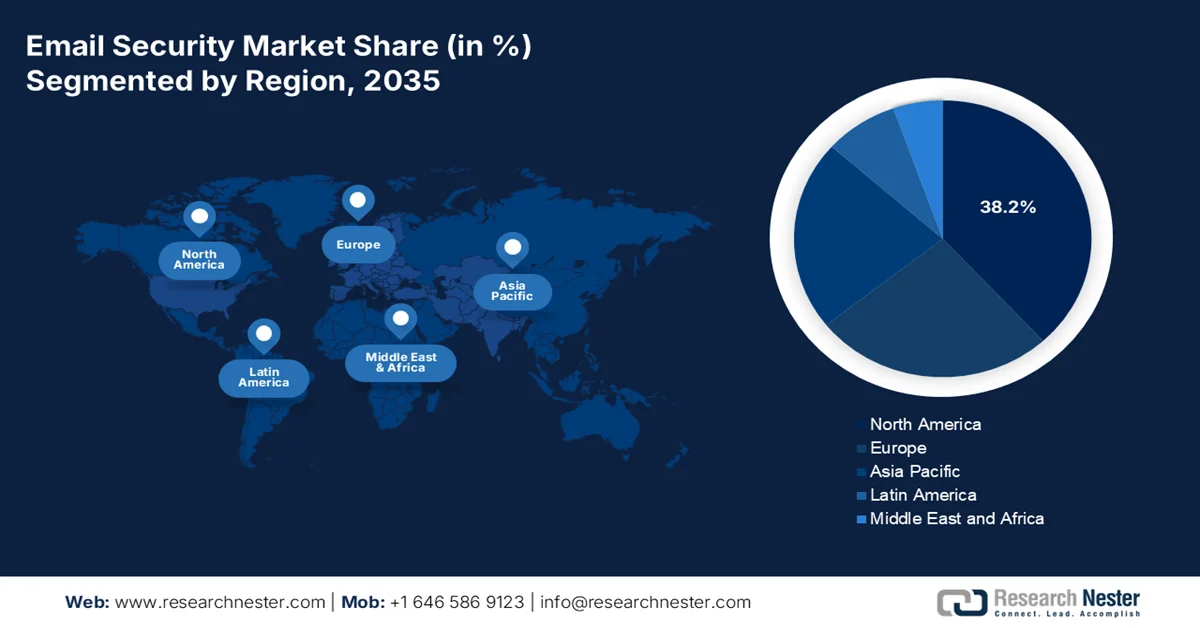

- North America is anticipated to capture a 38.2% share by 2035 in the email security market, attributed to escalating ransomware and phishing incidents alongside stringent regulatory frameworks such as GDPR, SOX, and HIPAA.

- Asia Pacific is poised to be the fastest-growing region during 2026–2035, fueled by rising phishing attacks, accelerating cloud adoption, and supportive government digital transformation initiatives.

Segment Insights:

- The large enterprises sub-segment is projected to command a 57.8% share by 2035 in the email security market, propelled by complex IT infrastructures, elevated exposure to cyber threats, and stringent regulatory compliance mandates.

- The cloud segment is expected to secure the second-largest share during 2026–2035, stimulated by the rising need for real-time defense against sophisticated threats including zero-day attacks, ransomware, and phishing.

Key Growth Trends:

- Expansion of remote workforces

- Increase of SME digitalization

Major Challenges:

- Evolving sophistication of cyber threats

- Regulatory compliance and data privacy

Key Players: Microsoft, Cisco Systems, Proofpoint, Fortinet, Palo Alto Networks, Broadcom, Barracuda Networks, Mimecast, Sophos, Trend Micro, NEC Corporation, NTT Security, Tesserent, CyberCX, AhnLab, SK Infosec, Tata Consultancy Services, Wipro Limited, Telekom Malaysia, IRONSCALES

Global Email Security Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.9 billion

- 2026 Market Size: USD 6.5 billion

- Projected Market Size: USD 14.3 billion by 2035

- Growth Forecasts: 10.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: - United States, China, Germany, United Kingdom, Japan

- Emerging Countries: - India, Singapore, South Korea, Australia, Canada

Last updated on : 18 February, 2026

Email Security Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of remote workforces: The increase in hybrid and remote work models has extended the attack surface, driving enterprises to invest in secure email gateways and encryption tools to protect distributed teams, which is positively impacting the email security market globally. According to official statistics published by the U.S. Bureau of Labor Statistics in October 2024, 4 major industries witnessed a phenomenal increase in remote work by more than 30% points. Additionally, management of companies and enterprises, finance and insurance, information, professional, scientific, and technical services comprised more than 39% of their workforce remotely working in comparison to less than 17% in previous years, thereby denoting a huge demand for the market’s growth and expansion.

- Increase of SME digitalization: The aspect of government-based SME digitalization strategies across regions, such as Europe and the Asia Pacific, is escalating the adoption of cost-effective and cloud-native email security solutions. Besides, SMEs are emerging as a major growth driver for the email security market, owing to affordability and compliance demands. As per an article published by NLM in March 2024, SMEs usually make up 90% of overall global enterprises and firms, and nearly 50% of the international workforce is readily engaged in SMEs. Therefore, the digital adoption across SMEs is also gradually increasing, leading to an increase in cybersecurity risks, which is reducing the workflow and posing privacy challenges. Hence, ensuring standard security policies is essential, particularly to safeguarding emails, thus proliferating the market’s demand.

- Presence of vertical-based compliance mandates: Industries, such as defense, BFSI, and healthcare, experience sector-specific mandates, thereby pushing enterprises to adopt innovative encryption and archiving solutions that are tailored to regulatory environments. As stated in an article published by NLM in February 2022, cybersecurity is estimated to cost the international economy just under USD 1 trillion, thus indicating a surge of over 50%. Besides, the average cyber insurance claim rose from USD 145,000 to USD 359,000, denoting a growing necessity for standard cyber information sources and databases. Therefore, to combat these cyber risks, compliance mandates are rapidly being unveiled, thereby enhancing the market’s exposure internationally.

Challenges

- Evolving sophistication of cyber threats: The most pressing challenge in the email security market is the rapid evolution of cyberattacks, particularly phishing, ransomware, and business email compromise (BEC). Attackers increasingly leverage artificial intelligence and machine learning to craft highly personalized and convincing emails that bypass traditional filters. This sophistication makes detection harder, requiring continuous innovation in threat intelligence. Enterprises often struggle to keep pace with the speed of these evolving threats, leading to vulnerabilities in legacy systems. Moreover, attackers exploit cloud-based collaboration tools, expanding the attack surface beyond traditional email gateways. Besides, as attackers adopt polymorphic malware and advanced social engineering, organizations must invest heavily in adaptive, AI-driven solutions.

- Regulatory compliance and data privacy: Compliance with diverse regulatory frameworks such as GDPR in Europe, HIPAA in the U.S., and Canada’s Digital Charter presents a significant challenge. Therefore, organizations must ensure secure email communication while adhering to strict data protection mandates. Non-compliance can result in severe penalties, reputational damage, and loss of customer trust. The complexity arises from varying regional laws, requiring multinational companies to implement multi-layered compliance strategies. For instance, GDPR mandates encryption and secure handling of personal data, while HIPAA enforces stringent controls over healthcare communications. Moreover, enterprises often face difficulties integrating compliance-driven encryption tools with existing IT infrastructure, thus negatively impacting the email security market.

Email Security Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.4% |

|

Base Year Market Size (2025) |

USD 5.9 billion |

|

Forecast Year Market Size (2035) |

USD 14.3 billion |

|

Regional Scope |

|

Email Security Market Segmentation:

Enterprise Size Segment Analysis

The large enterprises sub-segment, which is part of the enterprise size segment, is anticipated to garner the largest share of 57.8% in the email security market by the end of 2035. The sub-segment’s upliftment is highly fueled by complex IT infrastructures, high exposure to cyber threats, and stringent compliance requirements across industries such as BFSI, healthcare, and government. Large organizations face frequent business email compromise (BEC) and phishing attacks, often targeting executives and financial departments. To mitigate risks, they invest heavily in AI-driven secure email gateways, encryption tools, and advanced threat intelligence platforms. Compliance mandates like HIPAA, SOX, and GDPR-equivalent frameworks further drive adoption of enterprise-grade solutions. Additionally, large enterprises are early adopters of Zero Trust architectures and cloud-native email security platforms, ensuring scalability across global operations.

Deployment Mode Segment Analysis

The cloud segment in the email security market is projected to account for the second-largest share during the forecast period. The segment’s growth is highly driven by its critical importance for providing real-time protection against evolving and advanced threats, such as zero-day attacks, ransomware, and phishing, which native fibers usually tend to overlook. According to the 2024 Cloud Security Report, 96% of companies are readily concerned about public cloud security, denoting a suitable indicator of the pervasive concern regarding cloud vulnerabilities. Besides, achieving multi-cloud environments is recognized as a primary risk by 55%, thereby emphasizing the critical demand for skills in seamless cloud integration and data protection. Moreover, notable obstacles in cloud security integration comprises 48% of budget constraints, 45% of skilled staff absence, and 40% of data privacy concerns, thus boosting the market’s demand globally.

Component Segment Analysis

By the end of the stipulated timeline, the solutions sub-segment, part of the component segment, is expected to account for the third-largest share in the email security market. The sub-segment’s development is highly propelled by the aspects of email filtering, encryption, archiving, anti-phishing, and advanced threat protection. Enterprises increasingly prefer integrated solutions that combine multiple functionalities into a single platform, reducing complexity and improving efficiency. Rising phishing and ransomware attacks drive demand for AI-powered filtering and sandboxing technologies, while compliance requirements push adoption of encryption and archiving tools. Besides, cloud-native solutions are particularly attractive, offering scalability and cost efficiency for SMEs and large enterprises alike.

Our in-depth analysis of the email security market includes the following segments:

|

Segment |

Subsegments |

|

Enterprise Size |

|

|

Deployment Mode |

|

|

Component |

|

|

Security Type |

|

|

Service Type |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Email Security Market - Regional Analysis

North America Market Insights

North America in the email security market is anticipated to garner the highest share of 38.2% by the end of 2035. The market’s upliftment in the region is highly driven by a rise in ransomware and phishing attacks, the presence of stringent compliance, such as GDPR, SOX, and HIPAA, which are extremely relevant in Canada. Based on government estimates published by the FBI in April 2025, the Federal Bureau of Investigation’s Internet Crime Complaint Center (IC3) has put forth 859,532 complaints of suspected internet crime, as well as details reporting loss that has surpassed USD 16 billion, denoting a 33% surge in losses since 2023. In addition, the top three cybercrimes, in terms of complaints reported by victims as of 2024, included personal data breaches, extortion, and phishing or spoofing. Besides, victims of investment-based fraud, particularly those comprising cryptocurrency, reported the majority of losses, amounting to more than USD 6.5 billion, thereby bolstering the market’s growth in the overall region.

The presence of compliance mandates, federal ICT investments, along with the FCC's Affordable Connectivity Program subsidizing secure broadband access, and ensuring email security adoption across enterprises and households, are certain factors that are boosting the email security market in the U.S. According to official statistics published by the U.S. Department of Education in January 2026, over 600 districts and schools, including small and large-scale, rural and urban schools, have been selected to jointly receive almost USD 200 million in cybersecurity tools, which is part of the Federal Communications Commission’s Cybersecurity Pilot Program. Besides, Connecticut’s Connecticut Education Network offers equitable and accessible pricing for broadband to 100% of the state’s school districts and various cybersecurity services at zero-expense, thereby positively impacting the market’s growth.

The email security market in Canada is growing significantly, owing to compliance policies, government-backed ICT modernization, enabling secure communication accessibility globally, and a rise in the demand for cloud-native secure email gateways. As per an article published by the National Cybersecurity Consortium (NCC) in October 2025, the organization declared a slate of 31 Canada-based projects that are expected to receive funding as part of its standard commitment to the Government of Canada’s Cyber Security Innovation Network (CSIN). The NCC has generously contributed USD 20.9 million toward privacy and cybersecurity projects, generating USD 40.6 million in ecosystem activity. This particular funding strategy is readily led by companies within industry, academia, and not-for-profit industry, thereby denoting an optimistic outlook for the email security market’s growth in the country.

APAC Market Insights

The Asia Pacific email security market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by an increase in phishing attacks, a surge in cloud adoption, the presence of compliance mandates, and the provision of generous government expenditure. According to official statistics published by the ADB Organization in January 2024, the economic contribution of cloud computing to economies such as Vietnam, Thailand, the Republic of Korea, Singapore, the Philippines, New Zealand, Malaysia, Japan, Indonesia, India, and Australia ranged from 0.2% to 2.2% of the overall GDP. Besides, middle-income economies in the region tend to upgrade their cloud policy strategies to the most innovative level, which has the ability to boost their GDP growth by 0.5% to 0.7% between 2024 and 2028, thus proliferating the market’s development.

The aspects of government spending, an increase in enterprise adoption, regulatory compliance, the presence of digital transformation programs, along with an upsurge in cloud and AI adoption are factors that are bolstering the email security market in China. As per a data report published by the World Economic Forum in January 2025, the country’s AI industry is massive and rapidly growing, exceeding USD 70 billion, and has significantly cultivated more than 4,300 organizations that have successfully contributed to an ongoing stream of breakthroughs. Besides, the share of companies’ revenue is AI-powered and has doubled as of 2024. Overall, 90% of domestic organizations tend to view generative AI as extremely crucial for growth, thus reflecting increased optimism in its potential, thereby making it suitable for boosting the market’s growth in the country.

The email security market in India is gaining increased traction, owing to government-based ICT strategies, an increase in small and medium-sized enterprises (SME) adoption, and rapid digitalized transformation. Based on government estimates published by the PIB Government in August 2025, the digital economy in the country significantly contributed 11.7% to national income between 2022 and 2023, which further rose to 13.4% between 2024 and 2025. This is highly fueled by innovations in digital infrastructure, cloud computing, and AI, with the country ranking third internationally, and by the end of 2030, the digital economy is projected to account for almost 1/5th of the total GDP. Therefore, with this continuous advancement in the digital economy, there is a huge growth opportunity for the market’s expansion and upliftment in the overall country.

Europe Market Insights

Europe in the email security market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by GDPR compliance, regional digital innovation hubs funding, enterprise cloud adoption, AI-based phishing detection, encryption for cross-border data transfer, and zero trust adoption. According to official statistics published by the Europe Commission in January 2026, 52.7% of regional enterprises utilized paid cloud computing services as of 2025, mainly for the storage of files, office software, and e-mail. Additionally, in comparison with 2023, the share of enterprises utilizing these particular services has increased by 7.4% points as of the same year. Besides, cloud computing services are applied to nearly 99% of regional enterprises with more than 10 employees and self-employed, thus creating an optimistic outlook for the market’s growth in the region.

Country-Wise Enterprises Utilizing Paid Cloud Computing Services in Europe (2023 and 2025)

|

Countries |

2023 |

2025 |

|

Finland |

78.2% |

79.2% |

|

Italy |

61.3% |

75.6% |

|

Malta |

66.7% |

74.8% |

|

Ireland |

63.1% |

73.0% |

|

Sweden |

71.6% |

72.0% |

|

Denmark |

69.4% |

68.8% |

|

Netherlands |

64.1% |

68.4% |

|

Belgium |

51.6% |

61.6% |

Source: Europe Commission

The aspects of government ICT expenditure, regulatory compliance, enterprise demand, digital transformation programs, telecom regulation, and industrial associations are certain factors that are proliferating the email security market in the UK. As per a data report published by Ofcom Organization in November 2025, 78% of residential premises in the country have accessibility to full fiber broadband, denoting an increase of 9% points from 2024. In addition, 87% of domestic residential premises have access to gigabit-based networks, and meanwhile, more than 56% of premises that have access to a particular gigabit-specific network have implemented this particular service. Besides, 42% of premises that have access to a complete fiber network have also taken it up, thereby making it suitable for effectively bolstering the market’s growth in the overall country.

The email security market in Germany is gaining increased exposure, owing to the provision of generous budgets, and administrative bodies emphasizing secure communications as essential for digitalized infrastructure. According to official statistics published by the GovTech Intelligence Hub in July 2025, Estonia’s X-Road data-sharing facility readily connects more than 99% of its public services and different private ones, thus ensuring that data is deliberately shared securely and seamlessly. Besides, gaining Denmark’s level of administrative digitization tends to increase the country’s actual gross domestic product (GDP) per capita by 2.7%. Moreover, as per the 2026 Germany Trade and Invest article, the domestic ICT revenue accounted for a 4.7% growth rate, amounting to EUR 235.4 billion between 2024 and 2025, thereby positively impacting the market’s expansion in the country.

Key Email Security Market Players:

- Microsoft (U.S.)

- Cisco Systems (U.S.)

- Proofpoint (U.S.)

- Fortinet (U.S.)

- Palo Alto Networks (U.S.)

- Broadcom (U.S.)

- Barracuda Networks (U.S.)

- Mimecast (UK)

- Sophos (UK)

- Trend Micro (Japan)

- NEC Corporation (Japan)

- NTT Security (Japan)

- Tesserent (Australia)

- CyberCX (Australia)

- AhnLab (South Korea)

- SK Infosec (South Korea)

- Tata Consultancy Services (India)

- Wipro Limited (India)

- Telekom Malaysia (Malaysia)

- IRONSCALES (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Microsoft dominates the email security market through its Microsoft Defender for Office 365, offering advanced phishing protection, malware detection, and AI-driven threat intelligence. Its integration with Microsoft 365 ensures seamless adoption across enterprises. Strategic investments in Zero Trust frameworks and compliance-driven encryption tools strengthen its leadership position.

- Cisco Systems provides robust email security solutions via its Secure Email Gateway and Cisco Secure Email Threat Defense. Leveraging Talos threat intelligence, Cisco delivers real-time protection against phishing and ransomware. Its focus on cloud-native deployments and partnerships with MSSPs enhances scalability and enterprise adoption.

- Proofpoint is a specialist in email security, widely recognized for its Targeted Attack Protection (TAP) platform. It leads in business email compromise (BEC) prevention and advanced threat detection. Proofpoint’s strength lies in its data loss prevention (DLP) capabilities and compliance-focused solutions for regulated industries like BFSI and healthcare.

- Fortinet integrates email security into its FortiMail Secure Email Gateway, backed by the FortiGuard Labs threat intelligence network. Its solutions emphasize AI-driven filtering, encryption, and sandboxing. Fortinet’s competitive edge comes from offering end-to-end cybersecurity ecosystems, combining email security with firewalls and endpoint protection.

- Palo Alto Networks enhances email security through its Prisma Cloud and Cortex XDR platforms, focusing on advanced phishing detection and cloud-native protection. Its strategy emphasizes AI-powered analytics and integration with broader cybersecurity frameworks. Palo Alto’s investments in Zero Trust architectures and acquisitions of niche security firms bolster its market share.

Here is a list of key players operating in the global email security market:

The global email security market is highly competitive, dominated by U.S. players such as Microsoft, Cisco, and Proofpoint, alongside strong Europe-based firms, including Mimecast and Sophos. Asia-specific companies, including Trend Micro, NEC, and AhnLab, are expanding rapidly, leveraging regional demand for cloud-native solutions. Strategic initiatives include AI-driven phishing detection, Zero Trust architectures, and compliance-focused encryption tools. Partnerships with managed security service providers (MSSPs) and investments in R&D for advanced threat intelligence are common. Besides, in September 2025, Varonis expanded its data security platform to include AI-based email security by acquiring SlashNext. This tactical approach provides consumers with an overall threat detection and response solution from the first point of attack to the last, thereby proliferating the email security market worldwide.

Corporate Landscape of the Email Security Market:

Recent Developments

- In October 2025, Kaseya declared the successful acquisition of INKY, which is one of the pioneers in generative and modern AI-based email security for small to midsize businesses (SMBs) and managed service providers (MSPs), to emerge as the indispensable partner to assist MSPs in leading the upcoming evolution of security and IT.

- In July 2025, Bitdefender significantly completed acquiring Mesh Security Limited to strengthen the unified security and risk analytics platform with native email protection and boost its Managed Detection and Response (MDR) service offerings.

- In April 2025, Hornetsecurity deliberately partnered with Amazon to offer Amazon Simple Email Service (SES) Mail Manager consumers with its Vade Advanced Email Security Add-On, thus permitting customers to protect and scan both outbound and inbound email traffic.

- Report ID: 8397

- Published Date: Feb 18, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Email Security Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.