API Security Market Outlook:

API Security Market size was over USD 10.8 billion in 2025 and is estimated to reach USD 46.1 billion by the end of 2035, expanding at a CAGR of 17.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of API security is assessed at USD 12.6 billion.

The international API security market is rapidly evolving since enterprises are expanding digitalized ecosystems and regulators are tightening compliance frameworks. According to official statistics published by the World Bank Organization in September 2025, artificial intelligence advancement is extremely concentrated across high-income nations, significantly accounting for 85% of start-ups, 91% of venture capital funding, and 54% of international publications. Besides, a suitable rise in corporate power, with 80% of standard artificial intelligence-based models readily emerging from private laboratories, is also responsible for boosting the market’s exposure. Moreover, China significantly accounts for 66% of gen-specific artificial intelligence patent filings, and meanwhile, India demonstrates the highest growth, catering to 56% every year, thereby making it suitable for boosting the application programming interface (API) security market growth and development globally.

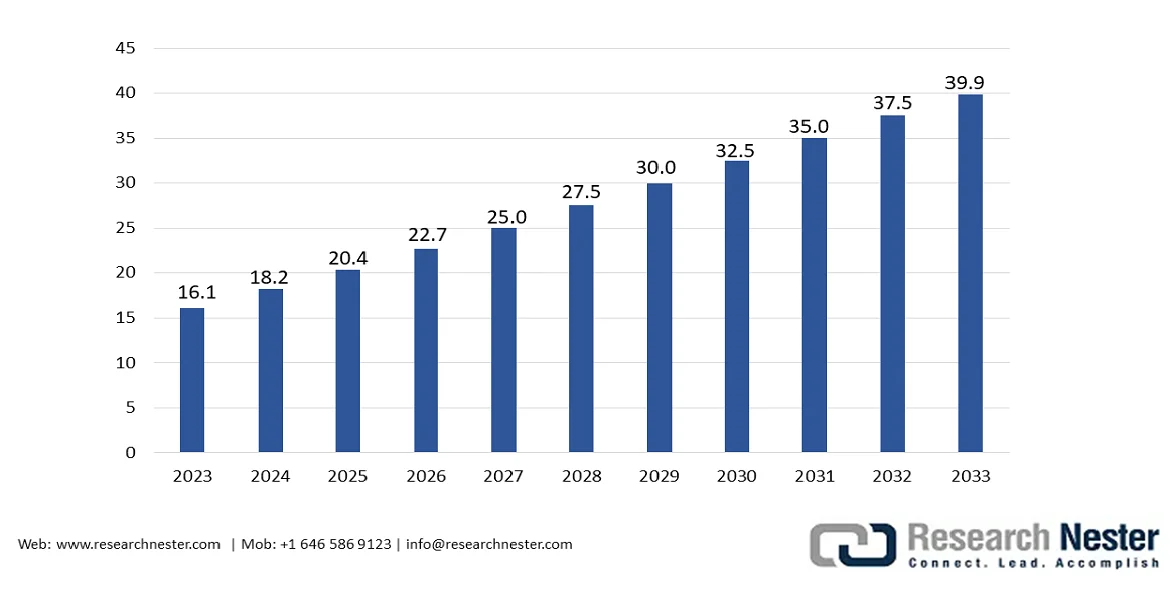

Furthermore, the sudden transition toward runtime protection, integration with DevSecOps pipelines, expansion of API security in edge computing and Internet of Things (IoT), and a rise of open-source security frameworks are a few trends that are also uplifting the market. As per an article published by the IMC in May 2024, international IoT-based connections are projected to reach 40 billion by the end of 2033. In addition, there have been 16.1 billion proactive IoT devices as of 2023, which is further predicted to increase to 39.9 billion by the end of the same year, along with a 10% growth rate. Additionally, the yearly device sales are expected to surge from 4.1 billion as of 2023 to 8.7 billion through an 8% growth rate. Besides, short-range technologies are anticipated to dominate connections, significantly accounting for 73% by 2033, thus denoting an optimistic outlook for the application programming interface security market’s growth internationally.

Global IoT Connections Forecast Analysis (2023-2033)

Source: IMC

Key API Security Market Insights Summary:

Regional Highlights:

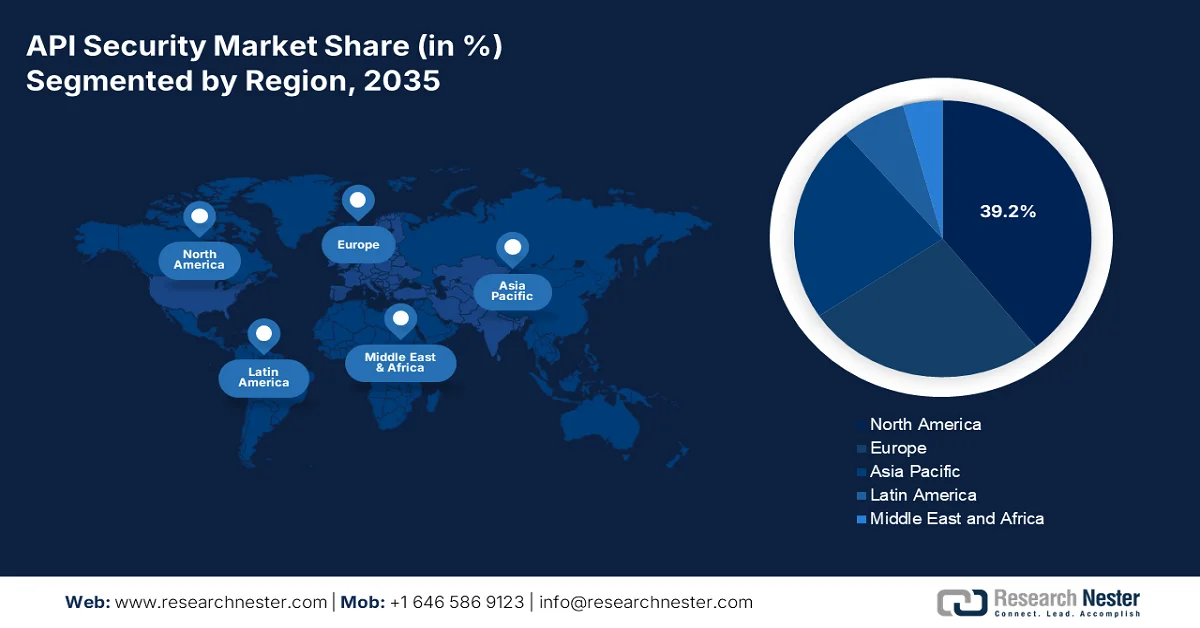

- The API security market in North America is projected to hold a leading 39.2% share by 2035, driven by substantial federal investments in broadband expansion and secure API integration under national infrastructure programs

- Asia Pacific is anticipated to register the fastest growth through 2026–2035, propelled by expanding government-backed ICT initiatives and rapid digital economy acceleration

Segment Insights:

- The platform and solutions sub-segment of the API security market is projected to account for a dominant 68.7% share by 2035, propelled by the growing deployment of structured tools, protocols, and protective mechanisms to mitigate unauthorized access, cyberattacks, and data breaches

- The REST segment is anticipated to secure the second-largest share during 2026–2035, driven by its widespread enterprise adoption, scalability advantages, and increasing need for advanced authentication and zero-trust security frameworks

Key Growth Trends:

- Explosion of API traffic

- Increase in security breaches

Major Challenges:

- Complexity of API ecosystems

- Regulatory compliance and data privacy

Key Players: Google LLC (U.S.), Microsoft Corporation (U.S.), IBM Corporation (U.S.), Oracle Corporation (U.S.), Akamai Technologies Inc. (U.S.), Salt Security Inc. (U.S.), Noname Security Inc. (U.S.), Amazon Web Services (U.S.), Broadcom Inc. (U.S.), Cisco Systems Inc. (U.S.), SAP SE (Germany), Software AG (Germany), WSO2 Inc. (UK), Axway Software (France), TIBCO Software Inc. (U.S.), Fujitsu Limited (Japan), NEC Corporation (Japan), Samsung SDS (South Korea), Infosys Limited (India), Telstra Corporation Limited (Australia).

Global API Security Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.8 billion

- 2026 Market Size: USD 12.6 billion

- Projected Market Size: USD 46.1 billion by 2035

- Growth Forecasts: 17.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Canada, Singapore, Australia

Last updated on : 18 February, 2026

API Security Market - Growth Drivers and Challenges

Growth Drivers

- Explosion of API traffic: The international API traffic is exponentially growing, with enterprises depending on APIs for microservices, omnichannel experiences, and SaaS integration, which is positively impacting the market demand. According to official statistics published by the Risk Management Association of India in March 2025, API usually account for almost 90% of international web traffic, with a 460% surge in public APIs. This rapid growth has resulted in an upsurge in security threats, including server-side request forgery, injection attacks, and broken authentication. In addition, there has been an increase in API attacks in India by 62% as of 2024, compromising not only sensitive data but also threatening customer trust and business stability, thus enhancing the market’s demand.

- Increase in security breaches: The aspect of high-profile breaches comprising unsecured APIs has raised awareness among regulators and enterprises, thus accelerating investments across advanced security platforms. Based on government estimates published by the UK Government in June 2025, the prevalence of cyber security breaches has been high among secondary schools by 60%, 85% of education colleges, and 91% for higher education institutions. Besides, primary schools have been close to businesses overall in terms of identified attacks or breaches, accounting for 44% in primary schools and 43% of businesses. Therefore, the continuous increase in such attacks is responsible for boosting the market’s exposure across different nations.

- Shift to cloud migration: Businesses are transitioning to hybrid and multi-cloud environments, based on which secure APIs are emerging, critical to enabling compliant and seamless data exchange. As per an article published by DP Insights in January 2023, the worldwide public cloud expenditure increased by 21% and reached 591.7 billion in 203 from 490.3 billion as of 2022. Besides, SaaS is regarded as the most popular cloud service model, comprising 33% of overall public cloud end-user spending in 2023. In addition, the international SaaS model spending amounted to USD 195 billion in the same year, denoting a rise from USD 167 billion as of 2022 and a 16.8% surge. Therefore, based on this continuous increase in cloud computing, there is a huge growth opportunity for the API security market globally.

International Public Cloud Services Expenditure Forecast Analysis (2021-2023)

|

Components |

2021 (USD Million) |

2022 (USD Million) |

2023 (USD Million) |

|

Desktop-as-a-Service (DaaS) |

2,059 |

2,539 |

3,104 |

|

Cloud Management and Security Services |

28,489 |

34,143 |

41,675 |

|

Cloud Business Process Services (BPaaS) |

54,952 |

60,127 |

65,145 |

|

Cloud Application Infrastructure Services (PaaS) |

8,991 |

110,677 |

136,408 |

|

Cloud System Infrastructure Services (IaaS) |

90,894 |

115,740 |

150,254 |

|

Cloud Application Services (SaaS) |

146,326 |

167,107 |

195,208 |

Source: DP Insights

Challenges

- Complexity of API ecosystems: The rapid proliferation of the API security market across industries creates highly complex ecosystems that are difficult to secure. Enterprises often deploy thousands of APIs spanning legacy systems, cloud-native applications, and third-party integrations. This fragmentation leads to inconsistent security policies, weak authentication, and gaps in monitoring. As APIs evolve dynamically, traditional perimeter-based security models fail to provide adequate protection. Organizations struggle to maintain visibility into shadow APIs that are undocumented or unmanaged, which significantly increases vulnerability to attacks. The challenge lies in balancing innovation with security, as developers prioritize speed-to- application programming interface (API) security market over robust governance.

- Regulatory compliance and data privacy: The market is tightly linked to compliance with global data protection regulations such as GDPR in Europe, HIPAA in the U.S., and CCPA in California. These frameworks mandate strict controls over data access, encryption, and user consent. APIs, by design, facilitate data exchange across platforms, making them a focal point for compliance risks. Enterprises face challenges in ensuring that APIs adhere to jurisdiction-specific requirements, especially when operating globally. For instance, GDPR requires explicit consent and data minimization, while HIPAA enforces stringent safeguards for healthcare APIs. Meanwhile, non-compliance can result in severe financial penalties and reputational damage, thus causing hindrance in the application programming interface (API) security market expansion.

API Security Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.5% |

|

Base Year Market Size (2025) |

USD 10.8 billion |

|

Forecast Year Market Size (2035) |

USD 46.1 billion |

|

Regional Scope |

|

API Security Market Segmentation:

Offering Segment Analysis

The platform and solutions sub-segment, which is part of the offering segment, is anticipated to garner the largest share of 68.7% in the API security market by the end of 2035. The sub-segment’s upliftment is highly driven by establishing tools, practices, and protocols that deliberately safeguard interactions between APIs and other systems, by providing solutions to overcome unauthorized accessibility, devastating cyberattacks, and data breaches. Based on government estimates published by the PIB Government in January 2026, the launch of CERT-In managed more than 29.4 lakh cyber incidents, issued 1,530 alerts, 65 advisories, and 390 vulnerabilities, thus reflecting a large-scale national cyber response capability. In addition, 98% of the digitalized population is covered by the Cyber Swachhta Kendra, with 89.5 lakh malware removal tool downloads and 1,427 organizations onboarded, thereby making it suitable for boosting the sub-segment’s exposure.

API Type Segment Analysis

The REST segment in the market is projected to hold the second-largest share during the forecast period. The segment’s growth is highly fueled by its simplicity, scalability, and widespread adoption across industries. REST APIs are lightweight, stateless, and use standard HTTP methods, making them ideal for web and mobile applications. However, their ubiquity also makes them a prime target for cyberattacks, including injection attacks, credential theft, and data exposure. REST APIs often expose sensitive endpoints, requiring robust authentication, encryption, and traffic monitoring. Enterprises increasingly adopt OAuth 2.0, JWT tokens, and zero-trust frameworks to secure REST APIs. The rise of microservices architecture further amplifies REST’s importance, as APIs serve as the backbone for service-to-service communication.

Target Environment Segment Analysis

By the end of the stipulated timeline, the cloud-based sub-segment in the target environment is expected to account for the third-largest share in the market. The sub-segment’s development is highly attributed to a surge in cloud adoption across enterprises, driven by digital transformation and hybrid IT strategies, which has made cloud-native API security a critical priority. APIs serve as the connective tissue in cloud ecosystems, enabling integration between SaaS applications, microservices, and third-party platforms. However, cloud APIs face unique challenges, including multi-tenancy risks, misconfigurations, and exposure to external threats. The U.S. NTIA Broadband Equity, Access, and Deployment (BEAD) program and Canada’s ISED digital equity initiatives highlight government-backed investments in cloud infrastructure, indirectly boosting demand for secure APIs.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Offering |

|

|

API Type |

|

|

Target Environment |

|

|

Deployment Model |

|

|

Functionality |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

API Security Market - Regional Analysis

North America Market Insights

North America is anticipated to garner the highest share of 39.2% in the API security market by the end of 2035. The market’s upliftment in the region is primarily attributed to generous allocation to 5G and broadband expansion under the Infrastructure Investment and Jobs Act, along with the Broadband Equity, Access, and Deployment (BEAD) program supporting secure API integration. According to official statistics published by the ITIF Organization in December 2022, more than 99.9% of the population in the region had access to broadband with download speeds surpassing 3 megabits per second through wired broadband, terrestrial wireless, and satellite. Additionally, of this, 96.3% have access to wired broadband, 84.3% to cable modem services, and 82.2% to DSL from conventional telephone organizations. Therefore, with an increase in such services, there is a huge growth opportunity for the application programming interface (API) security market in the region.

The U.S. in the API security market is growing significantly, owing to enterprise adoption, federal ICT-based investments, an increase in security emphasis, and government broadband strategies. Based on government estimates published by the NTIA Government in November 2024, the Infrastructure Investment and Jobs Act, also referred to as the Bipartisan Infrastructure Law (BIL), included a generous USD 65 billion to connect the population to cost-effective and reliable high-speed internet services, while offering digital skills and connected devices training. Besides, the Broadband Infrastructure Program (BIP) is considered a USD 288 million program, readily authorized by the Consolidated Appropriations Act for developing partnerships among internet service providers, local and state jurisdictions, thus bolstering the application programming interface security market’s demand in the overall country.

The aspects of regulatory frameworks, government-based ICT programs, digital equity expansion, enforcing cybersecurity standards for telecom operators, and the adoption of secure frameworks are factors that are driving the market in Canada. As stated in an article published by the Channel Life in September 2025, the Sustainable Jobs Training Fund, administered under the Government of Canada, allocated more than CAD 9 million to the AI Pathways: Energizing Canada’s Low-Carbon Workforce project. This particular program has aimed to assist almost 5,000 energy industry workers in acquiring artificial intelligence and machine learning skills that apply to careers in the energy sector. Besides, according to the October 2024 ITA article, the country’s digitalized economy grew at almost 9% through 2025, thereby enhancing the market’s exposure in the overall nation.

APAC Market Insights

The Asia Pacific API security market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by government-funded ICT approach, healthcare modernization, fintech expansion, and rapid digitalization. According to official statistics published by the World Economic Forum in December 2023, the digital economy growth in Southeast Asia is on track to hit USD 600 billion in gross merchandise value (GMV) by the end of 2030. In addition, the country comprises a substantial headroom for long-lasting growth driven by factors, including urbanization potential, room for income growth, and an increase in the working population. Besides, such advancements tend to drive the overall region’s digital economy to reach almost USD 1 trillion GMV by the end of 2030, thus making it suitable for bolstering the market’s exposure.

The API security market in China is gaining increased traction, owing to government ICT investment, regulatory and healthcare compliance, cloud integration, digital transformation, as well as automation and artificial intelligence in security. As stated in an article published by NLM in July 2024, the digital economy industry in the country grew by USD 4.1 trillion as of 2022, accounting for a 14.2% growth rate, which is far greater than that of major economies. By the end of 2023, the industry accounted for almost 1.3 billion 5G users globally. Besides, a suitable action plan for the Broadband China approach has been developed, effectively positioning the country as a tactical public infrastructure for the present digital era and providing a standard foundational push for innovation of the domestic economy. Therefore, based on all these advancements, the application programming interface (API) security market is continuously developing in the country.

Modernization in healthcare, rapid fintech implementation, government-funded ICT strategies under the Digital India, and the presence of a robust developer ecosystem are significantly fueling the market in India. Based on government estimates published by the PIB Government in February 2026, a fund of ₹1,000 crore has been provided for supporting the development of notable electronics manufacturing capabilities underpinning digital facilities, such as advanced computing systems and data centers. Besides, the allocation for the Electronics Components Manufacturing Scheme has been increased from nearly ₹22,000 crore to ₹40,000 crore in the Budget 2026 to 2027. Moreover, IT service in the country is considered one of the largest export sectors, with exports surpassing USD 220 billion, while continuous growth in data centers is gradually enhancing the application programming interface (API) security market’s exposure.

India’s Data Center Growth Analysis (2026)

|

Components |

Growth Capacity/Amount |

|

Overall data center capacity |

1,280 MW |

|

2030 growth projection |

4 to 5 times |

|

Investments underway |

USD 70 billion |

|

Additional fund announcement |

USD 90 billion |

Source: PIB Government

Europe Market Insights

Europe in the API security market is projected to witness considerable growth by the end of the stipulated duration. The market’s growth in the region is highly driven by region-specific funding for ICT advancements, digitalized banking modernization, and GDPR compliance. According to a data report published by the Europe Investment Bank in 2023, 53% of regional firms have reported taking suitable action to digitally emerge by offering online services. In addition, the share of regional firms adopting advanced digital technologies surged from 2022 and successfully reached 69%, in comparison to 71% in the U.S. Moreover, 80% of firms with over 250 employees utilize digital technologies, in comparison to 45% of firms with less than 10 employees. Therefore, the increased utilization of digital technologies has resulted in an upsurge in the application programming interface security market’s demand in the overall region.

The API security market in the UK is gaining increased exposure, owing to the presence of government strategic priorities, research and development budget allocation, along with industrial associations and digital economy adoption. Based on government estimates published by the ITA in February 2026, the country is considered the third-largest artificial intelligence industry globally, with a valuation worth USD 89 billion and a 10% yearly growth. In addition, the industry is generously funded by major private and public investments, such as USD 27 billion at present, as well as a strong national strategy. Besides, Anthropic, OpenAI, and Google DeepMind jointly account for approximately 70% of the overall digital economic capacity. Therefore, with all these progressions in the industry, there is a huge growth opportunity for the application programming interface security market in the overall country.

The aspects of industrial digitalization, regulatory compliance, rise in enterprise adoption, especially across automotive and manufacturing industries, and an increase in cloud and IoT adoption are factors responsible for boosting the market in Germany. According to official statistics published by the ITA in May 2025, with more than 500 operational data centers, the country is considered Europe’s ultimate leader in the data center sector. Additionally, the sector’s revenue is predicted to extend to USD 25.3 billion by the end of 2029, demonstrating a yearly growth rate of 6.2%, and meanwhile, the expansion of cloud data centers is deliberately playing a suitable role in this particular expansion and currently represents 45% of the industry in the country. Moreover, Frankfurt is the country’s largest data center landscape, comprising an IT load of 745 MW, along with the 542 MW under construction and 383 MW in the planning phase, thereby bolstering the application programming interface security market’s exposure in the overall nation.

Key API Security Market Players:

- Google LLC (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Akamai Technologies Inc. (U.S.)

- Salt Security Inc. (U.S.)

- Noname Security Inc. (U.S.)

- Amazon Web Services (U.S.)

- Broadcom Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

- SAP SE (Germany)

- Software AG (Germany)

- WSO2 Inc. (UK)

- Axway Software (France)

- TIBCO Software Inc. (U.S.)

- Fujitsu Limited (Japan)

- NEC Corporation (Japan)

- Samsung SDS (South Korea)

- Infosys Limited (India)

- Telstra Corporation Limited (Australia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Google LLC strengthens API security through its Apigee platform, offering advanced monitoring, authentication, and AI-driven threat detection. Its integration with Google Cloud enhances scalability and compliance for enterprises.

- Microsoft Corporation’s API Management provides robust API security with identity protection, traffic monitoring, and encryption. The company leverages its enterprise cloud ecosystem to deliver end-to-end secure API solutions.

- IBM Corporation focuses on API security via its API Connect platform, integrating AI-powered threat analytics and compliance frameworks. Its solutions are widely adopted in regulated industries like healthcare and BFSI.

- Oracle Corporation API Gateway ensures secure API traffic management, authentication, and data protection. The company emphasizes cloud-native security integration across enterprise applications and SaaS platforms.

- Akamai Technologies Inc. delivers API security through its edge security solutions, protecting APIs from DDoS, bot attacks, and data breaches. Its global CDN infrastructure strengthens resilience and performance for enterprises.

Here is a list of key players operating in the global application programming interface security market:

The worldwide API security market is highly competitive, dominated by U.S. players such as Google, Microsoft, IBM, and Cisco, alongside strong European firms such as SAP and Axway. Asia-based companies, including Fujitsu, NEC, Samsung SDS, and Infosys, are expanding aggressively, leveraging regional digitalization programs. Strategic initiatives include AI-driven threat detection, cloud-native security platforms, and compliance-focused solutions. Partnerships with hyperscalers (AWS, Azure, GCP) and vertical-specific offerings in BFSI, healthcare, and telecom are key differentiators. Besides, mergers, acquisitions, and R&D investments are also accelerating innovation. For instance, in February 2026, Anthropic successfully raised USD 30 billion in Series G funding at USD 380 billion during post-money valuation. This investment was jointly co-led by MGX, ICONIQ, Founders Fund, Drangoneer, and D.E. Ventures for driving the frontier research, infrastructure extensions, and product development, thus enhancing the API security industry globally.

Corporate Landscape of the API Security Market:

Recent Developments

- In December 2025, Salt Security unveiled its 12-months of innovation in terms of organizational research momentum, partnership, and product for adopting artificial intelligence agents, cloud-native architectures, and MCP services, thus assisting security teams to keep pace with an extended API attack surface.

- In May 2025, Netcraft has significantly set the latest standard for reporting threats in real-time through the newest JSON-based API powered by its notable Cybercrime Disruption and Takedown platform, offering infrastructure providers with a real-time and free threat feed of abuse incidents evolving in their facilities.

- In May 2025, Akamai Technologies introduced the latest 2025 API Security Impact Study, which is an in-depth Asia Pacific evaluation for exploring the hidden vulnerabilities, operational risks, and financial impacts caused by API security incidents across largest economies.

- Report ID: 8400

- Published Date: Feb 18, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

API Security Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.