Application Programming Interface (API) Market Outlook:

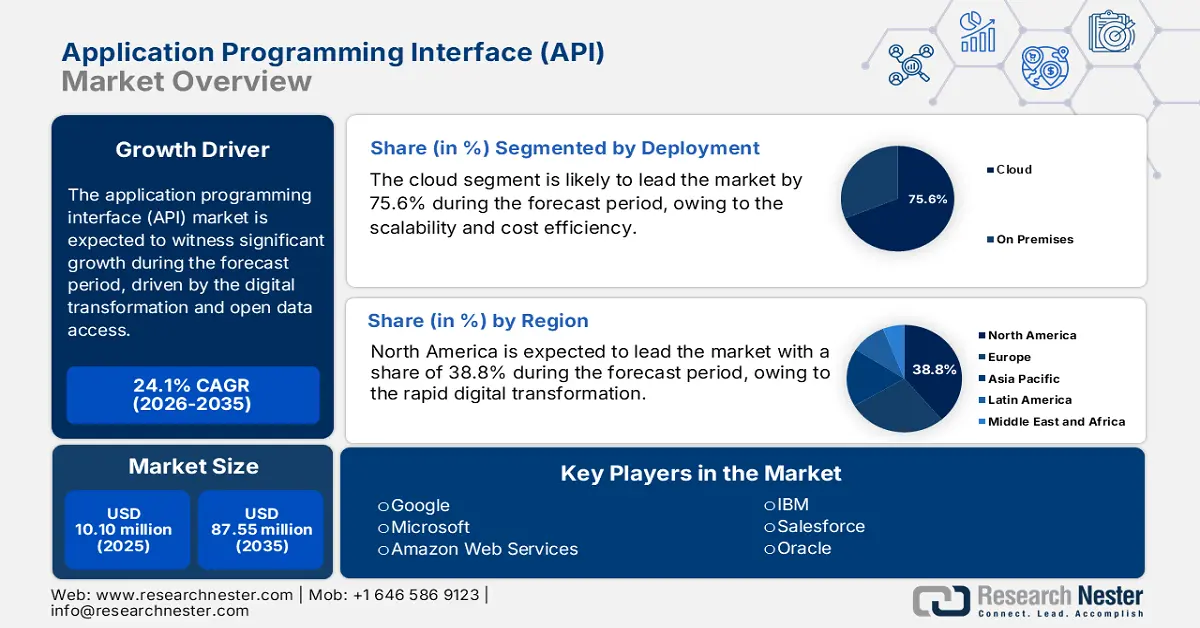

Application Programming Interface (API) Market size was valued at USD 10.10 billion in 2025 and is projected to reach USD 87.55 billion by the end of 2035, rising at a CAGR of 24.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of application programming interface (API) is estimated at USD 12.54 billion.

The application programming interface (API) market is expanding rapidly across public and private sectors, which is driven by government mandates for digital transformation and open data access. In the U.S., the federal agencies have adopted the APIs to improve service delivery and transparency. The Data.gov report in 2025 depicts that there are over 450 public APIs across various domains such as finance, health, and transportation. The Department of Labor’s APIs provide datasets on employment and wages, facilitating integration into the workforce analytics platforms. The Federal Data Strategy 2021 to 2025, APIs are a core mechanism for achieving data accessibility and reuse across agencies. Further, the National Institute of Standards and Technology also emphasizes secure API design in its cybersecurity framework, which is widely adopted by federal contractors and enterprise vendors.

In India, the Ministry of Electronics and Information Technology has prioritized the APIs under the Digital India Program. Digilocker APIs are adopted by most individuals in the country, and as per the DigiLocker 2025 data, the API experiences a rising user base of 60.67 Crore. Further, the PIB data in February 2024 states that merely 56.67 crore Ayushman Bharat Health Accounts were created using APIs to link health records. MeitY’s OpenForge platform also aids collaborative API development for e-governance applications. The Department of Telecommunications also directed the API-based interoperability for telecom service providers under the Unified License framework. These developments are supported by policy frameworks such as the National Data Sharing and Accessibility Policy (NDSAP), which mandates API-based access to government datasets.

Key Application Programming Interface (API) Market Insights Summary:

Regional Insights:

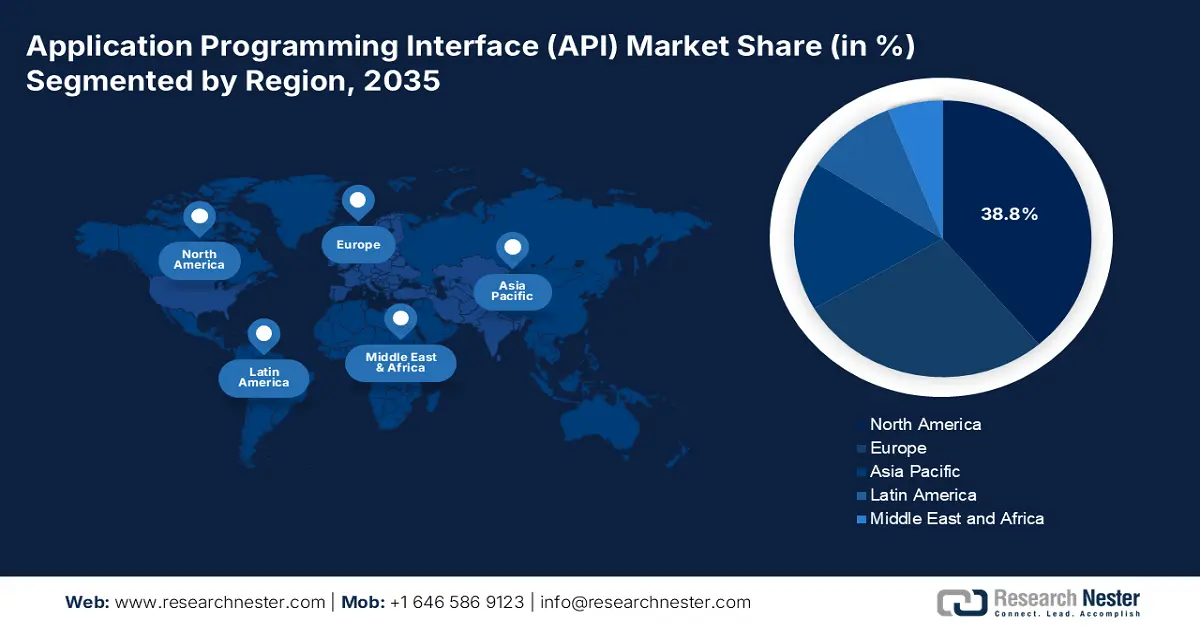

- By 2035, North America is projected to command a 38.8% share of the application programming interface (api) market, fueled by rapid digital transformation across key industries.

- Asia Pacific is expected to grow at a CAGR of 13.0% through 2035, supported by digital transformation mandates and expansive national digital infrastructure programs.

Segment Insights:

- The cloud deployment segment in the application programming interface (api) market is anticipated to secure a 75.6% share by 2035, propelled by scalability, cost efficiency, and ease of management.

- The REST APIs type segment is projected to maintain its lead by 2035, impelled by their simplicity, scalability, and seamless alignment with cloud native and microservices architectures.

Key Growth Trends:

- The rise of IoT and edge computing

- 5G network rollout and API-enabled network exposure

Major Challenges:

- Complex and unharmonized regulatory compliance

- Skilled workforce shortages and certification requirements

Key Players: Microsoft (U.S.), Amazon Web Services (U.S.), IBM (U.S.), Salesforce (MuleSoft) (U.S.), Oracle (U.S.), Broadcom (U.S.), Postman (U.S.), Kong Inc. (U.S.), Software AG (Germany), SAP (Germany), Tyk Technologies (UK), F5, Inc. (U.S.), Noname Security (U.S.), NAVER Cloud (South Korea), WSO2 (USA/Sri Lanka), Zoho Corporation (India), Akamai (U.S.), Axway (U.S./France), Tibco Software (U.S.).

Global Application Programming Interface (API) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.10 billion

- 2026 Market Size: USD 12.54 billion

- Projected Market Size: USD 87.55 billion by 2035

- Growth Forecasts: 24.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Indonesia

Last updated on : 26 November, 2025

Application Programming Interface (API) Market - Growth Drivers and Challenges

Growth Drivers

- The rise of IoT and edge computing: This is a primary driver for the API market as technologies generate huge data streams that require robust connectivity for collection, processing, and automated action. API serves as the essential component enabling communication between the cloud platforms, gateway, and edge devices. this demands a new class of lightweight, secure and highly reliable APIs designed for constrained network class of lightweight, and highly reliable APIs designed for constrained network environments and low-latency decision-making. The scale of this driver is evidenced by significant public sector investment. For instance, the U.S. Department of Energy has actively funded modern grid technologies, noting in a 2023 report that the integration of IoT and APIs for smart grid applications is projected to increase grid efficiency. This government-backed report highlights the critical role of APIs in managing the expanding universe of connected devices and the data they generate.

- 5G network rollout and API-enabled network exposure: The global rollout of 5G is fundamentally redefining the API ecosystem by introducing a service based architecture that exposes core network functions as programmable interfaces. A variety of Network Exposure Functions have been specified by the 3GPP, enabling carriers to offer APIs for bandwidth slicing and quality of service device location. This enables enterprises and developers to build applications with guaranteed performance, such as ultra-reliable low-latency communications for industrial automation and augmented reality. The National Telecommunications and Information Administration (NTIA) report in 2023 has stated that by the end of 2022, there were approximately 137 million 5G connections in North America. This infrastructure expansion creates a new frontier for telecom APIs, turning network capabilities into billable, on-demand services.

- Expansion of open marketing and open finance: Regulations such as Europe’s PSD2 push financial institutions to expose data and functions through APIs, hence creating a fertile ground for fintech innovation. This movement is evolving into Open Finance, extending the API mandate to insurance, pensions, and investments. In the U.S., 100 million consumers have authorized third parties to access their financial data, which directly reflects the adoption of open banking and API-based data exchange frameworks, as per the Congress data in September 2025. The financial services industry is actively changing due to the legislative drive, which guarantees a steady, long-term demand for compliant and safe financial APIs.

Challenges

- Complex and unharmonized regulatory compliance: API providers mainly in healthcare and finance must transform a labyrinth of sector-specific regulations, such as Europe’s PSD2 for open banking and the U.S. HIPAA for healthcare. The lack of global standardization means a compliant API in one market may be illegal in another market, which is stifling scalability. for example, an API platform in the healthcare sector must undergo a separate and lengthy certification process, which is different in European bodies.

- Skilled workforce shortages and certification requirements: Many government IT contracts require staff with specific qualifications, often locally recognized, security certifications. The global shortages of cybersecurity and API architecture talent, combined with these localized requirements, make it difficult for suppliers to assemble qualified teams to deploy and support their solutions in new markets, as noted in reports from national agencies such as the Australian Cyber Security Center.

Application Programming Interface (API) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

24.1% |

|

Base Year Market Size (2025) |

USD 10.10 billion |

|

Forecast Year Market Size (2035) |

USD 87.55 billion |

|

Regional Scope |

|

Application Programming Interface (API) Market Segmentation:

Deployment Segment Analysis

The cloud is dominating the deployment segment and is expected to hold the share value of 75.6% by 2035. The segment is driven by scalability, cost efficiency, and ease of management. The Cloud APIs are fundamental to integrating diverse services from data analytics and AI to store without any burden of the physical infrastructure. The National Institute of Standards and Technology defines cloud computing characteristics, such as broad network access and rapid elasticity, that are inherently delivered via APIs. The use of cloud-based APIs for international operations and citizen services will further increase as federal and state governments implement cloud-first policies, solidifying this subsegment's leading position.

Type Segment Analysis

Under the type segment, REST APIs are fueling the segment due to their simplicity, scalability, and seamless alignment with the cloud native and microservices architectures. Their lightweight, HTTP-based design makes them a standard for web and mobile applications, enabling rapid digital innovation. RESTful principles play a major role in government open data programs, such as those supported by the U.S. General Services Administration, which make large datasets available to developers and the general public. This widespread adoption in both private and public sectors, driven by the need for interoperability in modern software development, ensures their leading application programming interface market share.

User Type Segment Analysis

The internal KPIs are leading the user type segment and are poised to have a high revenue share by 2035. These privately used interfaces that connect applications and data within a single organization form the backbone of modern digital architecture. The dominance is based on the widespread enterprise adoption of microservices and cloud native development, where internal APIs are important for breaking down the monolithic systems into agile, interoperable services. This trend is boosted by government and industry focus on cybersecurity, as internal APIs are not directly exposed to the public internet. It requires robust management frameworks to protect sensitive data. Initiatives from bodies like the National Institute of Standards and Technology (NIST), which provide guidelines for securing software supply chains and microservices architectures, underscore the strategic importance and continued investment in secure, high-performance Internal API infrastructure.

Our in-depth analysis of the application programming interface (API) market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Deployment |

|

|

User Type |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Application Programming Interface (API) Market - Regional Analysis

North America Market Insights

By 2035, North America is expected to be the dominant application programming interface (API) market and is projected to hold the share of 38.8%. Rapid digital transformation across healthcare, BFSI, and retail is the key driver for the application programming interface market demand. The widespread use of microservices and cloud-native architectures is driving up demand for security and API management solutions. Government investment in digital infrastructure is the major catalyst. For example, the broadband USA data in June 2023 states that USD 42.45 billion was funded by the Broadband Equity Access and Deployment Program (BEAD), which focuses on connecting every individual in the U.S. to high-speed internet by funding partnerships to build infrastructure. This investment directly enables the API dependent services. Regulatory focus on open banking, supported by the Department of the Treasury and Innovation, Science and Economic Development Canada (ISED), further mandates API use for secure data sharing.

The application programming interface (API) market in the U.S. is fueled by the federal digital modernization, cloud-first policies, and open data mandates. Agencies use APIs for procurement, grants, and budget tracking. According to the USA Spending data 2025, USD 9.4 trillion is the total federal obligated spending across all U.S., a part of which is allocated to the technology sector. The Department of Health and Human Services and the Treasury lead API adoption for public services. Enterprise demand for secure, scalable APIs is rising in fintech, healthtech, and govtech. The U.S. also witnesses a growth in API security, which is driven by NIST cybersecurity frameworks. AI-powered APIs and low-code platforms are expanding in federal and private sectors. The U.S. maintains leadership in API innovation due to its rising developer base, active funding, and regulatory support.

In Canada, the application programming interface market is fueled by the national strategies aimed on digital sovereignty and economic competitiveness. Government commitment to universal broadband is the primary trend focusing to expand the reach of API based digital services. The Government of Canada data in August 2025 depicts that nearly USD 3.225 billion is funded to support high speed projects. Further, USD 50 million invested for mobile internet projects. These investments are aimed on telecommunication and broadband deployment, as they enable the foundational infrastructure upon which API-based services and platforms operate. APIs depend on reliable, high-speed data networks for secure, real-time communication between distributed systems, especially in cloud-based and edge computing environments. Further, the supportive policies, such as the Pan-Canadian Artificial Intelligence Strategy, also drive demand for specialized data-access APIs, positioning Canada as a leader in responsible and interoperable digital innovation.

APAC Market Insights

Asia Pacific is forecasted to be the fastest-growing application programming interface (API) market and is expected to grow at a CAGR of 13.0%. The market is driven by the digital transformation mandates, a booming fintech sector, and massive government investments in national digital infrastructure. The strategic adoption of API first architecture to build open ecosystems in banking and healthcare, which is fueled by initiatives such as India’s Unified Payments Interface and Singapore’s APIX. The push for digital sovereignty and data localization in countries such as India and China is shaping the API governance models. Further, the region’s rapid cloud adoption and 5G deployment are creating a strong ground for real-time and IoT-based APIs. For instance, India's Aadhaar identity system, which processes billions of API calls monthly for authentication, exemplifies the scale of API-driven public infrastructure.

Japan is leading the application programming interface (API) market in APAC due to its increased budget allocation. As per the Government of Canada data in November 2023, 10.2% of Japan’s GDP came from ICT in 2025. Further, the ICT market in Japan is projected to reach USD 1.2 trillion by 2033. This investment is channeled via agencies such as the Ministry of Economy, Trade and Industry, which has actively promoted the API standardization across the critical sector. For instance, METI’s Society 5.0 strategy specifically allocates funds for integrating APIs into smart manufacturing and healthcare systems. The government invested a significant amount in 2024 to support API-driven interoperability projects in these fields. Consequently, Japan's robust financial commitment and structured policy support are cementing its leadership in the regional API landscape, creating a mature ecosystem for enterprise and public-sector digital innovation.

India’s API market is fueled by its rising innovative digital public infrastructure. The government’s IndiaStack initiative, which is a suite of open APIs, has become the digital backbone of the nation. The most key component for the market growth is the Unified Payments Interface (UPI), which is managed by the National Payments Corporation of India has seen transaction volumes of 16.58 billion financial transactions in October 2024, as per the PIB data in December 2024. Further, ₹23.49 Lakh Crores across 16.58 billion financial transactions in October 2024, demonstrating unprecedented adoption. According to the National Association of Software and Service Companies (NASSCOM), fintech and the required Account Aggregator framework for safe financial data sharing drove a surge in India's API management sector year over year in 2023. This API-first approach, supported by strong policy, positions India not just as a high-growth application programming interface market, but as a global blueprint for digital transformation.

UPI Transactions in India from 2021-2024

|

Year |

Transaction Volume (billion) |

|

2021 |

4.21 |

|

2022 |

7.30 |

|

2023 |

11.40 |

|

2024 |

16.58 |

Source: PIB data in December 2024

Europe Market Insights

The Europe market is defined by the robust growth that is fueled by the strong regulatory mandates and a concerted push for digital sovereignty. The region focuses on the interoperability within the public service and healthcare, that is exemplified by the EU’s European Health Data Space regulation which mandates standardized APIs for cross-border health data exchange. The application programming interface market is also heavily influenced by initiatives like GAIA-X, which aims to create a federated, secure data infrastructure relying on API connectivity. Furthermore, the widespread adoption of Open Banking, driven by the Revised Payment Services Directive (PSD2), has created a mature fintech API ecosystem, particularly in the UK and Germany. According to the European Medicines Agency (EMA), the use of APIs for digitizing product lifecycle management and submission processes saw an increase among companies from 2022 to 2024. This regulatory and standards-based approach, combined with significant investment in cloud and cybersecurity, positions Europe as a highly structured and compliance-driven API market.

The UK application programming interface market is propelled by the world’s leading fintech sector and robust regulatory mandates. The key driver is the Competition and Markets Authority's (CMA) Open Banking order, which compelled the nine largest banks to provide open APIs. This initiative has flourished with the Open Banking Limited data in February 2023, reporting over 7 million UK consumers and businesses now using these services. This success is highlighting a path for a broader Smart Data initiative that will expand the API market into telecoms, retail, and energy. This creates massive, sustained public sector demand. The UK's Department for Science, Innovation and Technology reports that the country's digital industry is primarily dependent on APIs, which steadily expand every year, indicating the UK's standing as a dynamic, policy-driven API market.

The manufacturing dominance and significant public investment in digital sovereignty is driving the Germany’s market. The key driver is the government’s Platform Industrie 4.0 initiative that promotes the widespread adoption of standardized administrative shells and APIs to create a seamlessly connected manufacturing ecosystem. As per the HIMSS data in 2025, Germany’s Federal and State governments invested 4.3 billion euros in the digital infrastructure of German hospitals, with a significant portion dedicated to interoperable API systems for patient data exchange. A key differentiator is Germany's aim for data sovereignty via projects such as GAIA-X and the Sovereign Cloud Initiative, which mandate specific API standards for secure, federated data sharing.

Key Application Programming Interface (API) Market Players:

- Google (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft (U.S.)

- Amazon Web Services (U.S.)

- IBM (U.S.)

- Salesforce (MuleSoft) (U.S.)

- Oracle (U.S.)

- Broadcom (U.S.)

- Postman (U.S.)

- Kong Inc. (U.S.)

- Software AG (Germany)

- SAP (Germany)

- Tyk Technologies (UK)

- F5, Inc. (U.S.)

- Noname Security (U.S.)

- NAVER Cloud (South Korea)

- WSO2 (USA/Sri Lanka)

- Zoho Corporation (India)

- Akamai (U.S.)

- Axway (U.S./France)

- Tibco Software (U.S.)

- Google has significantly advanced the application programming interface (API) market with its Apigee platform, focusing on API analytics and monetization. With the use of machine learning it provides deep insights into PAI performance and usage patterns, enabling businesses to create a robust digital ecosystem and unlock new revenue streams, making Apigee a leader in API management.

- Microsoft has made a major impact in the application programming interface (API) market via its Azure API Management service. Its key strategic initiative is deep, seamless integration with the broader Azure cloud systems. This cloud-first method provides enterprises with a unified platform for securing, publishing, and analyzing APIs, which is crucial for driving hybrid cloud adoption.

- Amazon Web Services is pioneering in the application programming interface (API) market with its AWS API Gateway, which is a core strategic offering within its cloud dominance. The service is engineered for massive scalability and serverless architecture, enabling developers to create, deploy, and manage APIs at any scale with minimal overhead, lowering the challenges in market entry.

- IBM is leading its role in the enterprise application programming interface (API) market with IBM API Connect. The company mainly focuses in providing robust security, governance, and integration capabilities customized for large, regulated industries. IBM has generated USD 62.8 billion in revenue in 2024, which is up 3% at constant currency, and USD 12.7 billion in free cash flow.

- Salesforce has shaped the application programming interface (API) market via its acquisition of MuleSoft. The core strategic advancement is the core concept of the API, let connectivity layer that goes beyond simple management to orchestrate applications and data connect across an entire organization applications and data connect across an entire organization. The company has made a revenue of USD 34,857 million in 2024, reflecting strong growth driven by increasing enterprise adoption of application programming interface (API) integration and management solutions.

Here is a list of key players operating in the global API market:

The application programming interface (API) market is very competitive and is fueled by the U.S.-based cloud hyperscalers and enterprise giants. Their strategic advantage lies in deep integration with their broader cloud ecosystems, using vast global infrastructure and existing customer relationships. Key strategic initiatives include an intense focus on AI and machine learning to enhance API security, analytics, and developer productivity. Further, companies are actively pursuing mergers and acquisitions of startups to expand their footprint. For example, in October 2022, Munich acquired apinity GmbH, which is a start-up company that supplies application programming interface (API) solutions in the form of Software as a Service (SaaS) for the insurance industry’s entire ecosystem. Key strategic initiatives include an intense focus on AI and machine learning to enhance API security, analytics, and developer productivity.

Corporate Landscape of the Application Programming Interface (API) Market:

Recent Developments

- In June 2024, Akamai has announced that it had acquired API Security Company Noname and had signed an agreement between the two parties for Akamai to acquire the company in exchange for approximately USD 450 million.

- In May 2024, Boomi announced that it had acquired the federated API management business from APIIDA AG. They are bolstering the enterprise-grade scalability and security of the Boomi platform by acquiring API management assets which are the former Mashery product from Cloud Software Group, a new company formed by the combination of TIBCO and Citrix.

- Report ID: 8271

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Application Programming Interface (API) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.