Electronic Article Surveillance Market Outlook:

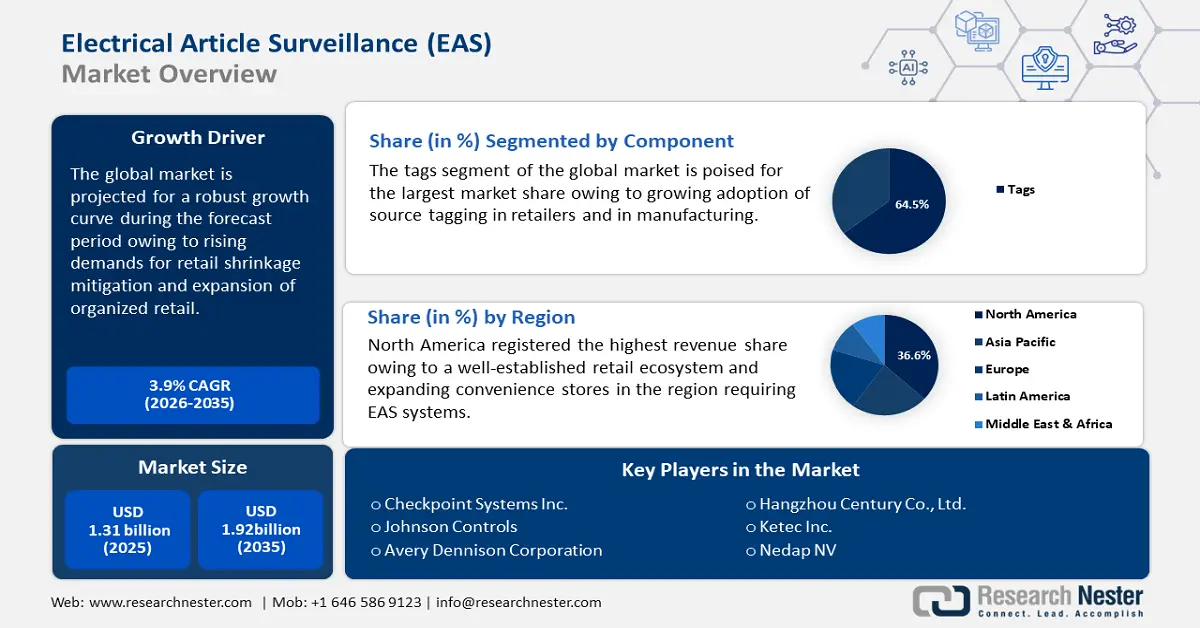

Electronic Article Surveillance Market size was over USD 1.31 billion in 2025 and is poised to exceed USD 1.92 billion by 2035, witnessing over 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electronic article surveillance is estimated at USD 1.36 billion.

The growth of the market is attributed to the increasing number of retail stores around the world and rising cases of retail theft. The demand for surveillance systems in the retail ecosystem is surging and EAS technology is positioned to address the pain point by efficiently detecting unauthorized removal of items across apparel stores, supermarkets, department stores, etc.

A major driver of the global electronic article surveillance sector is the increasing percentage of retail shrinkage affecting inventories of businesses. In September 2023, the National Retail Foundation estimated a whopping USD 112 billion worth of losses associated with theft in the retail industry of the U.S. This drives the demand for robust EAS systems to mitigate undue losses in inventory by providing robust security solutions. Advancements in EAS systems such as video surveillance and RFID locks systems can expand applications of EAS to utility management and analytics, further boosting the electronic article surveillance (EAS) market’s growth. Additionally, the integration of EAS systems with Internet of Things (IoT) sensors is positioned to improve their effectiveness and increase adoption across various retail channels.

The surge in e-commerce and omnichannel retailing is boosting the necessity for security measures in stores and warehouses, leading to greater demand for EAS systems. The growth of organized retail in emerging economies in Asia Pacific and Africa opens up new opportunities for EAS manufacturers. Additionally, the growing adoption of source tagging at the manufacturing stage allows accurate detection of theft benefiting retailers. With a growing threat of inventory losses due to theft, sectors such as healthcare are also poised to integrate EAS solutions increasing opportunities for the key market players. As investments to improve the surveillance systems grow and the efficacy of EAS improves, the global electronic article surveillance (EAS) market is poised to increase its revenue share by the end of the forecast period.

Key Electrical Article Surveillance (EAS) Market Insights Summary:

Regional Highlights:

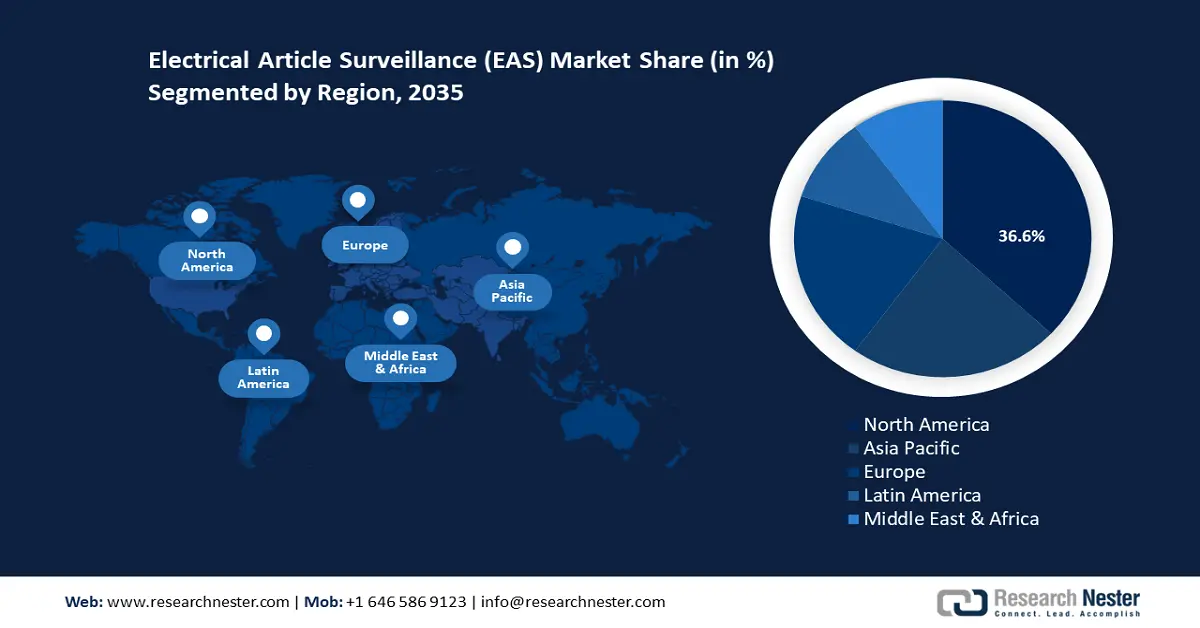

- North America electronic article surveillance (EAS) market will account for 36.60% share by 2035, driven by a strong retail ecosystem with global leaders and growth of e-commerce post-COVID-19.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, fueled by rapid urbanization, retail expansion, and government pushes for unmanned stores and smart tech.

Segment Insights:

- The tags segment in the electronic article surveillance market is expected to experience substantial growth till 2035, driven by the adoption of source tagging and rising use across product types.

- The retailers segment in the electronic article surveillance market is anticipated to achieve the largest share by 2035, driven by high adoption of EAS systems to prevent shrinkage and adapt to unmanned store models.

Key Growth Trends:

- Rising demands for retail shrinkage mitigation

- Expansion of organized retail

Major Challenges:

- Costs of integration with e-commerce and omnichannel retail

Key Players: Checkpoint Systems Inc., Johnson Controls, Avery Dennison Corporation, Nedap NV, Ketec Inc., Hangzhou Century Co., Ltd., Solink.

Global Electrical Article Surveillance (EAS) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.31 billion

- 2026 Market Size: USD 1.36 billion

- Projected Market Size: USD 1.92 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Electronic Article Surveillance Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demands for retail shrinkage mitigation: The increasing percentage of retail shrinkage is a major growth driver of the global electronic article surveillance sector. Retailers globally are prone to losing billions of dollars owing to shrinkage attributed to theft, shoplifting, administrative errors, etc., which can affect profit margins. For instance, the National Retail Security Survey 2023 estimated profit losses of around USD 100 billion from retail shrinkage.

Additionally, a comparison between the National Retail Survey of 2019 and the National Retail Survey of 2023 highlights a grim picture of losses doubling in 5 years. This creates a pain point for retailers that EAS systems can effectively solve. When fitted in a public building or a store, EAS systems can be triggered when a person leaves with a product with an active tag or label attached to it. Providing real-time alerts can significantly reduce thefts and shoplifting, leading to EAS systems becoming mainstays in numerous retail stores. -

Expansion of organized retail: The rise of organized retail globally benefits the growth of the electronic article surveillance (EAS) market. Organized retail is witnessing a surge fueled by growth in emerging economies such as India and Indonesia. The rapid urbanization trends globally benefit the growth of organized retail as a middle class with disposable income emerges for retail stores. With an increased construction of supermarkets, malls, and chain stores and a growing penetration in tier 2 and tier 3 cities, the need for efficient security measures is booming.

The scalability of EAS systems makes them ideal for small and large retail operations, positively affecting their adoption rates and boosting the EAS sector’s growth. Hence, the expansion of organized retail correlates with the growth of the global electronic article surveillance (EAS) market. For instance, in February 2024, Miniso launched its revamped store in the DLF mall in India. The brand entered the market in India in 2017 and has expanded to more than 200 stores in 120 cities in the country, highlighting the expansion of organized retail in emerging markets. -

Growth of omnichannel retailing: The rapid growth of omnichannel retailing where customers can shop across multiple channels from physical stores to online, benefits the growth of the global electronic article surveillance sector. The rise in omnichannel retailing leads to increased inventories and store networks of retailers, boosting applications of EAS systems as retailers look to secure warehouse and distribution centers. The ability to mitigate shrinkage at various stages of the retail process is poised to increase demand boosting the electronic article surveillance (EAS) market’s growth. For instance, in September 2024, Decathlon announced a partnership with quick commerce firm Zepto signaling omnichannel expansion. These trends benefit the market’s growth curve as businesses are positioned to seek robust EAS systems to heighten security across various stages of the retail process during omnichannel expansions.

Additionally, EAS systems enable retail analytics that can improve inventory management. This provides greater incentives to various operators to integrate EAS systems in their operations.

Challenges

-

False alarms and malfunctions: The electronic article surveillance sector faces challenges of system malfunctions and false alarms. Electromagnetic interference from nearby equipment or radio frequency noise can trigger false alarms. If the rate of inaccuracies is high then it can cause damage to a manufacturer's reputation and distrust in the electronic article surveillance (EAS) market.

-

Costs of integration with e-commerce and omnichannel retail: Traditional EAS systems face a challenge in integration with omnichannel retail. It can be a challenge for manufacturers to design robust systems able to handle inventory security across various platforms. This creates demands for advanced EAS technology which can increase installation costs, discouraging small-scale retailers.

Electronic Article Surveillance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 1.31 billion |

|

Forecast Year Market Size (2035) |

USD 1.92 billion |

|

Regional Scope |

|

Electronic Article Surveillance Market Segmentation:

Components Segment Analysis

By components, the tags segment is projected to capture electronic article surveillance (EAS) market share of over 64.5% by 2035. The segment’s growth is owed to the increasing adoption of source tagging in products during manufacturing which benefits retailers in efficient inventory management. Printable tags are gaining popularity owing to their versatility and adopted into various products, from clothes to electronics, contributing to the segment’s growth curve.

Additionally, there has been a surge in demand for tamper-resistant discreet tags in the pharmaceuticals and electronics sector. In February 2024, researchers at MIT launched a tamper-proof tag that can authenticate almost anything with high accuracy and is poised to be cheaper than RFIDs. Advancements in technology to manufacture anti-tampering tags that are cost-effective are poised to benefit the robust growth of the segment.

Antenna & detachers segment of the electronic article surveillance (EAS) market is poised for a profitable growth curve by the end of the forecast period. The growth is owed to the increasing adoption of antennas in stores and checkpoints to detect unauthorized arrivals. Detachers are being adopted on a large scale due to their use in deactivating or removing tags to ensure smooth customer experiences and minimize the stigma of false alarms. Additionally, technological advancements in antennas & detachers are projected to boost the growth rate. For instance, in March 2024, RFIDKNOW released the industrial RFID portal designed to be scalable for warehouses and distribution centers, with the new RFID portal designed to be easy to install and ship.

End user Segment Analysis

By end user, the retailer segment of the global electronic article surveillance (EAS) market is poised to register the largest share during the forecast period. The growth of the segment is due to the large-scale adoption of EAS systems in the retail sector to mitigate retail shrinkage. Retails can suffer major losses from shoplifting and employee thefts, which requires robust solutions to curtail. Additionally, the rise of self-checkouts and unmanned stores has increased the need for robust EAS solutions without affecting consumer experience. For instance, Japan is partnering with Avery Denison to push for 100% unmanned stores by 2025. The segment is poised to continue to be the largest end user for advanced EAS systems and maintain a profitable growth curve by the end of the forecast period.

Our in-depth analysis of the electronic article surveillance (EAS) market includes the following segments:

|

Component |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electronic Article Surveillance Market Regional Analysis:

North America Market Insights

North America electronic article surveillance (EAS) market is set to capture revenue share of over 36.6% by 2035. The growth is owed to the region’s established retail landscape with the presence of global market leaders such as Walmart, Costco, Amazon, etc. The advanced retail ecosystem is boosting demands for EAS systems to cut down on retail shrinkage and offer customers a seamless shopping experience to increase footfall. The U.S. and Canada lead the revenue share in North America. Additionally, the growth of e-commerce post-COVID-19 and omnichannel retailing necessitates a need for product protection from warehouse to last-mile delivery.

The U.S. holds the largest share in the electronic article surveillance sector in North America owing to the large-scale adoption of EAS systems across department stores and supermarkets for safety purposes and inventory management. Rising trends of automated stores in urban areas create a steady demand for EAS systems that key electronic article surveillance (EAS) market players can leverage. For instance, in June 2024, Walmart announced the launch of automated distribution centers to get their groceries to stores faster. These trends are set to boost the demands of RFID systems owing to their efficiency in processing large volumes of items. The favorable trends boost the electronic article surveillance (EAS) market in the U.S. to continue its growth curve.

Canada is poised to increase its share in the electronic article surveillance sector in North America. The market’s growth is attributed to rising demands for integrated security solutions for an expanding retail sector. By the end of the forecast period, the market in Canada is poised to register a spike in demand for reusable printable tags. Additionally, manufacturers within the Canada electronic article surveillance (EAS) market are offering advanced integrated solutions to cater to demands. For instance, in December 2021, Prosegur Security introduced a landmark EAS system with an integrated ad platform that can provide retailers with valuable data as well as generate revenue for itself through advertising.

APAC Market Insights

The Asia Pacific market is projected to register the fastest growth owing to a rapidly expanding retail sector. The electronic article surveillance (EAS) market of APAC is led by China, India, Japan, and South Korea. The large-scale urbanization in APAC is leading to an expansion of the retail sector. This creates a growing need for EAS systems in retail stores. Additionally, libraries and the healthcare sector contribute to the growing demand for robust EAS solutions in the region. As more businesses seek scalable solutions to protect goods, the EAS sector is projected to maintain its growth curve.

China holds the largest share in the electronic article surveillance sector. The electronic article surveillance (EAS) market’s growth in China is attributed to the growth of smart retail and large-scale footfalls in supermarkets and malls, necessitating demands for integrated EAS systems. Additionally, the growth of automated convenience stores is poised to rise after COVID-19 stalled the growth, boosting the EAS sector. In July 2024, Xiaomi unveiled an AI-powered unmanned smart factory that runs 24 hours. The trend of automated factories, warehouses, and malls necessitates EAS systems for robust security measures and inventory management. Additionally, Research Nester estimated China to be the second largest exporter of EAS systems in 2023 with almost 2000 shipments. The trends are favorable for domestic manufacturers to leverage and increase their profit share.

Japan has a leading share in the electronic article surveillance sector in APAC. The electronic article surveillance (EAS) market’s growth is attributed to a surging push by the government for unmanned convenience stores across the country by 2025 owing to a declining workforce. Additionally, smart EAS technologies are on the rise in Japan, which already has a robust innovation-focused ecosystem, helping businesses with efficient inventory management and security. Additionally, Tokyo has the largest urban population in the world and the country has a large network of convenience stores called Konbini stores, that experience large footfall. The growing number of retail stores boosts demands for integrated EAS solutions.

Electronic Article Surveillance Market Players:

- Checkpoint Systems Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson Controls

- Avery Dennison Corporation

- Nedap NV

- Ketec Inc.

- Hangzhou Century Co., Ltd.

- Solink

The global electronic article surveillance market is poised to register a profitable growth curve by the end of the forecast period. Key players in the market are investing in acquisitions and improving the efficacy of the systems to reduce false alarms and integrate analytics to improve EAS solutions.

Here are some key players in the market:

Recent Developments

- In June 2024, Sensormatic Solutions announced that it can now provide RFID source tagging services globally. The new RFID service bureau in Matamoros, Mexico makes the service accessible in North and Central American retailers and for manufacturers to apply on merchandise.

- In April 2023, Checkpoint Systems acquired Alert Systems. The acquisition is positioned to improve the portfolio of Checkpoint Systems in providing solutions to organized retail crime.

- Report ID: 6656

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrical Article Surveillance (EAS) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.