Video Surveillance Market Outlook:

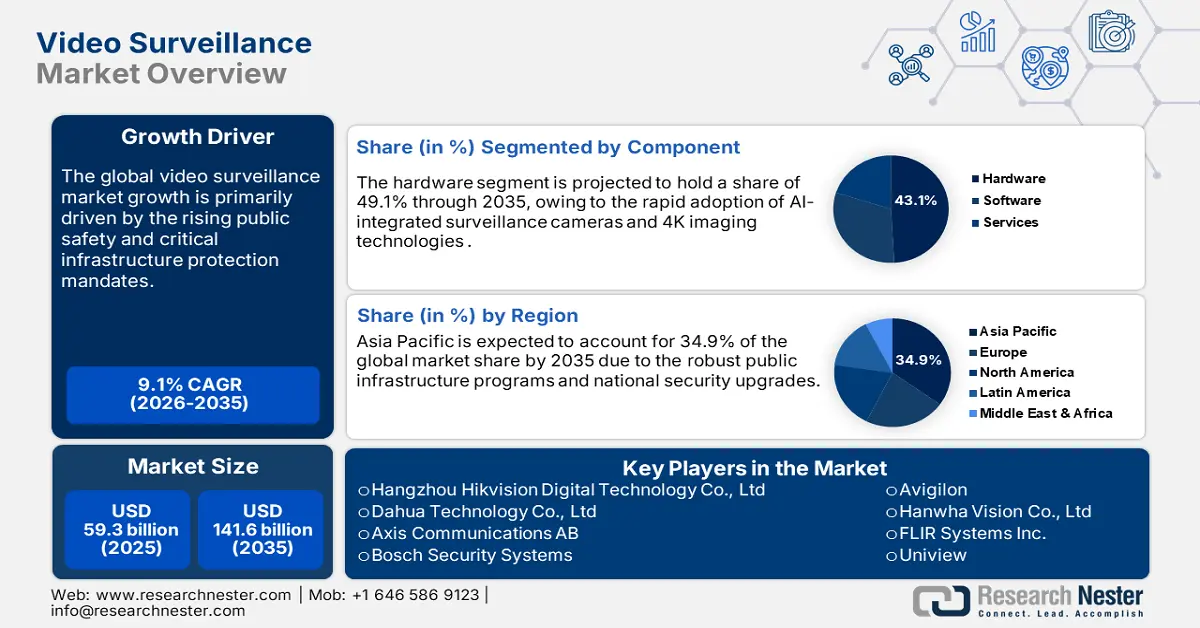

Video Surveillance Market size was USD 59.3 billion in 2025 and is estimated to reach USD 141.6 billion by the end of 2035, expanding at a CAGR of 9.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of video surveillance is evaluated at USD 64.7 billion.

Video cameras are emerging as a key part of smart transportation systems, including monitoring railways, toll booths, and self-driving car networks. The European Commission’s Urban Mobility Framework is focused on the modernization of the EU transportation systems, which is expected to encourage the use of cameras at electric vehicle (EV) charging stations and smart traffic lights to improve city safety. In July 2024, the European Commission chose 134 transport projects to offer more than €7 billion in funding from the Connecting Europe Facility (CEF). This EU program supports important infrastructure projects to improve transportation across Europe.

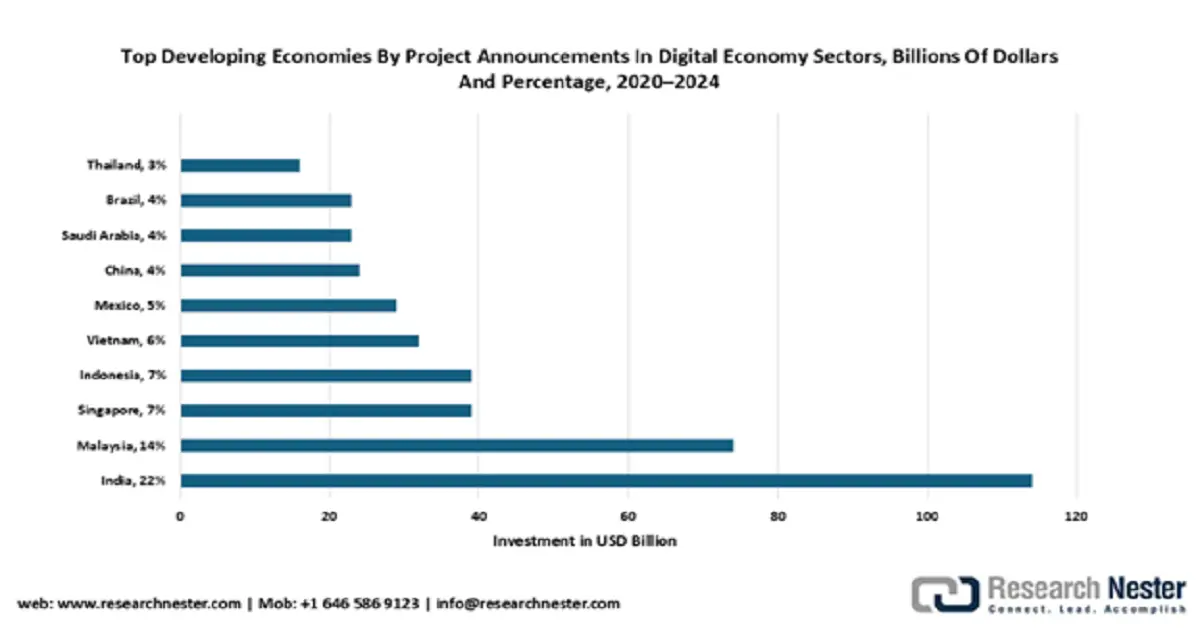

Source: UNCTAD

Also, many countries worldwide are investing in digital technologies to advance their economy. The initiatives, such as France 2030, Made in China, and Digital Bharat, are set to drive investments to foster emerging technologies, including video surveillance systems. Overall, the public-private investment strategies are likely to propel the video surveillance technology trade in the coming years.

Key Video Surveillance Market Insights Summary:

Regional Insights:

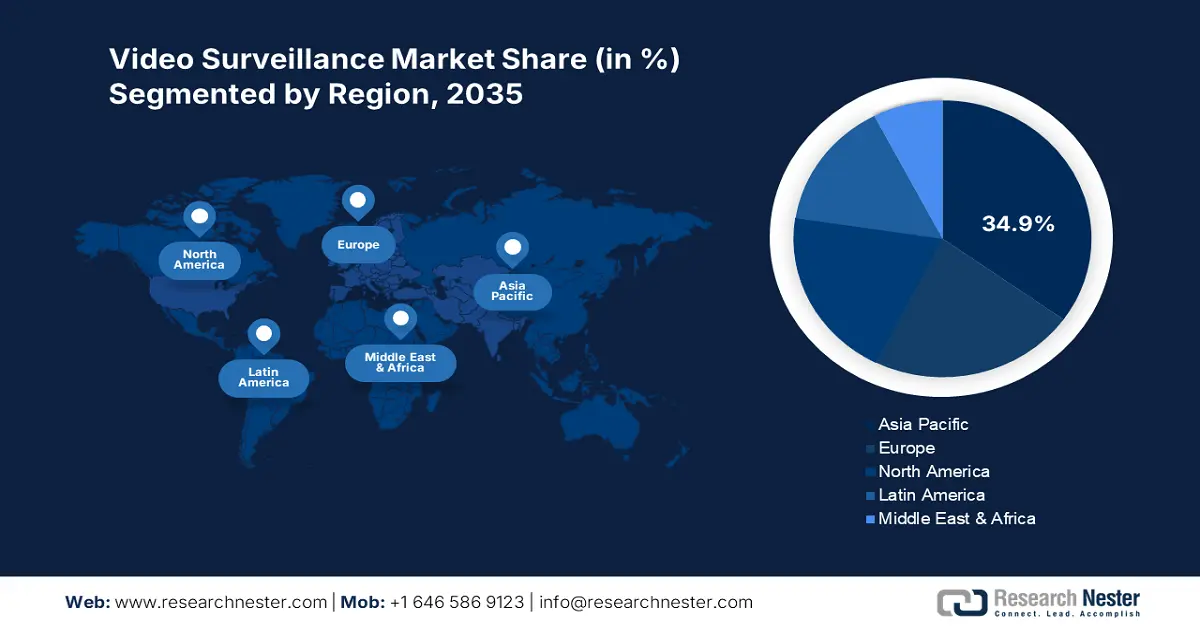

- The Asia Pacific video surveillance market is projected to hold 34.9% of the global revenue share through 2035, owing to robust public infrastructure programs and national security upgrades.

- The North America video surveillance market is expected to increase at a CAGR of 9.9% from 2026 to 2035, fueled by aggressive public safety initiatives and smart city deployments.

Segment Insights:

- The hardware segment is projected to account for 49.1% of the global Video Surveillance Market share by 2035, propelled by the rapid adoption of AI-integrated surveillance cameras and 4K imaging technologies.

- The IP video surveillance system segment is anticipated to capture 62.5% of the global market share throughout the forecast period, driven by the scalability, remote monitoring capabilities, and integration with cloud and edge AI platforms.

Key Growth Trends:

- Rising public safety and critical infrastructure protection mandates

- Growth in smart retail and industrial surveillance

Major Challenges:

- Tariffs and import restrictions

- Infrastructure readiness and network limitations

Key Players: Hangzhou Hikvision Digital Technology Co., Ltd,Dahua Technology Co., Ltd,Axis Communications AB,Bosch Security Systems,Avigilon (Motorola Solutions),Hanwha Vision Co., Ltd,FLIR Systems Inc. (Teledyne),Uniview (Uniview Technologies),CP PLUS (Aditya Group),Pelco Inc. (Motorola Solutions),IDIS Co., Ltd.,Senstar Technologies Ltd,MOBOTIX AG,Vivotek Inc.,D-Link Corporation

Global Video Surveillance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 59.3 billion

- 2026 Market Size:USD 64.7 billion

- Projected Market Size: USD 141.6 billion by 2035

- Growth Forecasts: 9.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.9% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, U.S., Japan, India, South Korea

- Emerging Countries: Brazil, Mexico, UAE, Saudi Arabia, Australia

Last updated on : 29 September, 2025

Video Surveillance Market - Growth Drivers and Challenges

Growth Drivers

- Rising public safety and critical infrastructure protection mandates: The governments around the world are increasing the use of video cameras in cities and transportation systems to improve safety, handle emergencies, and prevent crime. The National Institute of Standards and Technology (NIST) emphasizes video surveillance in places such as train stations, utility systems, and government buildings. This is likely to accelerate the demand for advanced video surveillance technologies. In February 2024, the U.S. Department of Transportation’s Federal Highway Administration launched a new program under the Bipartisan Infrastructure Law. It offers USD 250 million in grants over five years to support creative solutions that combine different types of transportation to reduce traffic in the most crowded U.S. cities.

- Growth in smart retail and industrial surveillance: Retail stores and factories are using advanced video cameras for more than theft prevention. They now use them to monitor operations, optimize workflows, and analyze consumer behavior. In June 2025, Walmart launched AI-powered tools for its U.S. workforce, like real-time translation and task management solutions that can cut shift planning time from 90 minutes to just 30 minutes to simplify operations and improve customer service. These initiatives are part of the company’s larger investment in frontline employees, which also features wage hikes, expanded training opportunities, and clearer career advancement routes. In Asia, especially China and India, factories are using these systems to become more digital. In North America, they are focused more on preventing losses and reducing risks.

- Increasing adoption of cloud-based video surveillance systems: Cloud-based solutions are gaining traction due to their lower upfront costs, scalability, and centralized management. The swift digital shift in the public and private sectors is set to accelerate the sales of cloud-based video surveillance platforms. End users are building their businesses around cloud technology, which allows remote access, uses AI for data analysis, and rapid scalability. This helps them to boost their operational efficiency and mitigate long-term costs. Some companies are offering different cloud options, such as private, hybrid, or local clouds, to meet regional rules and encourage use in industries with strict regulations.

Leading Companies and Cloud-Based Video Surveillance Products

|

Company |

Products |

Key Features |

|

Eagle Eye Networks |

Cloud VMS (Cloud Video Management System) |

True cloud-native platform, supports thousands of cameras, integrates AI analytics, open API, and works with existing infrastructure |

|

Solink |

Cloud-native security & camera analytics platform; real-time active security monitoring + forensic security |

Deep integration with existing camera infrastructure helps operations beyond just security |

|

Cloudvue |

Video surveillance + access-control Security as a Service offering; cloud cameras, gateways, thermal, cellular solutions. |

Ability to use existing cameras via gateways, cloud storage, centralized management, focus on enterprise scale, and remote monitoring |

|

Synology |

C2 Surveillance - cloud-based monitoring / VSaaS solution |

Serverless/rapid deployment, multi-site monitoring; no additional device license fees; simplifies scaling |

Source:Eagle Eye Network, Cloudvue Surveillance, Solink, Synology

Challenges

- Tariffs and import restrictions: The ongoing tariffs and import restrictions are hampering the raw material as well as the final product supply chain. Between 2022 and 2023, the U.S. banned imports of Chinese surveillance equipment from several companies due to concerns about human rights and national security. In March 2025, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) added several companies and organizations from countries such as China, the United Arab Emirates, South Africa, Iran, and Taiwan to the Entity List. These groups were added due to their actions were seen as harmful to U.S. national security or foreign policy. Such moves by the government entities substantially hamper the pockets of key market players.

- Infrastructure readiness and network limitations: The unavailability of advanced bandwidth, edge infrastructure, and stable power, especially in developing regions, hampers the sales of video surveillance solutions. The report by the World Bank discloses that in 2022, only 36 percent of Africa's population had broadband internet access. This reflects the infrastructure gaps in some emerging parts of the world. Such inconsistency in connectivity networks is set to significantly lower the earning opportunities for video surveillance solution manufacturers in the years ahead.

Video Surveillance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 59.3 billion |

|

Forecast Year Market Size (2035) |

USD 141.6 billion |

|

Regional Scope |

|

Video Surveillance Market Segmentation:

Component Segment Analysis

The hardware segment is projected to account for 49.1% of the global video surveillance market share by 2035. The rapid adoption of AI-integrated surveillance cameras and 4K imaging technologies is directly accelerating the demand for specialized hardware products. The swift growth in public infrastructure projects is also contributing to the segmental growth. For instance, in March 2024, the U.S. Department of Transportation allocated USD 54 million to around 34 projects across 22 states, including the District of Columbia and Puerto Rico. The favorable support from the government is poised to double the revenues of video surveillance hardware producers in the years ahead.

System Type Segment Analysis

The IP video surveillance system segment is anticipated to capture 62.5% of the global market share throughout the forecast period. IP-based systems are more preferred than analog due to their scalability, remote monitoring capabilities, and integration with cloud and edge AI platforms. The National Institute of Standards and Technology (NIST) states that IP systems are the key foundation of smart infrastructure and IoT deployments. NIST’s Smart Grid and Smart Cities initiatives explicitly highlight IP-based, real-time surveillance systems as key enablers of urban resilience and operational visibility. Such observations are opening high-earning opportunities for IP video surveillance system producers. Also, the declining costs of broadband and 5G rollout in markets such as Japan and South Korea are contributing to the IP system penetration.

End user Segment Analysis

The commercial segment is expected to expand at a rapid pace during the forecast period owing to increasing security, operational, and regulatory pressures in commercial spaces. Retail stores, malls, offices, banks, hotels, and warehouses are increasingly implementing video surveillance to deter theft and fraud, monitor employee or customer behavior, and ensure the safety of both staff and visitors. Technological advances, especially IP-cameras, cloud storage/VSaaS, AI video analytics, higher resolution, and outdoor/low-light capabilities, are making deployment more effective and affordable. Also, smart-city and regulatory mandates are pushing commercial verticals to adopt surveillance systems to comply with safety norms and crime prevention.

Our in-depth analysis of the video surveillance market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

System Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Video Surveillance Market - Regional Analysis

APAC Market Insights

The Asia Pacific video surveillance market is projected to hold 34.9% of the global revenue share through 2035, owing to robust public infrastructure programs and national security upgrades. The increasing investments in the smart city projects are also estimated to propel the sales of video surveillance systems. China, India, Japan, and South Korea are the most promising marketplaces for video surveillance companies. The swift rise in digitalization and growing demand from both the public and private sectors is accelerating the production and commercialization of advanced video surveillance systems. In addition, the government-backed ICT frameworks and crime prevention mandates are further promoting the demand for advanced surveillance solutions.

China leads the sales of video surveillance technologies, due to its massive investment in urban surveillance infrastructure and AI integration. The smart city initiatives are driving high demand for traffic management solutions, which is directly increasing the deployment of video surveillance solutions. The expansion of 5G-powered surveillance and edge AI analytics is further expected to drive the sales of next-gen camera systems. In February 2025, the government introduced rules to manage public security video systems. These rules aim to keep people safe while protecting their privacy and personal information rights. The evolving regulations are likely to promote the sales of advanced video surveillance systems.

India video surveillance market is expected to grow at a robust pace during the forecast period, attributed to the rising need for secure CCTVs across commercial, residential, and industrial settings and increasing government initiatives, including the Smart Cities Mission and Safe City Projects. Moreover, the rising incidence of thefts, terrorism concerns, and public safety demands is likely to increase the sales of different types of video surveillance systems in the coming years.

North America Market Insights

The North America video surveillance market is expected to increase at a CAGR of 9.9% from 2026 to 2035, owing to the aggressive public safety initiatives and smart city deployments. The expanding industrial automation is also contributing to the growing sales of video surveillance technologies. Government bodies in the U.S. and Canada are increasing ICT-related investments, especially in surveillance infrastructure, cybersecurity, and 5G rollouts.

The U.S. Federal Communications Commission’s (FCC) Broadband Equity, Access, and Deployment (BEAD) Program and Canada's Universal Broadband Fund are some of the key boosters for the production and commercialization of video surveillance systems. The Innovation, Science and Economic Development (ISED) agency’s commitment of CAD 3.225 billion under the Universal Broadband Fund (UBF) to connect remote regions by 2027 is expected to boost the sales of expected to scale cloud-based and edge surveillance systems. Furthermore, the Smart Surveillance Directive, aimed at stricter encryption and access standards for public-facing video systems, is likely to accelerate their deployment in municipal and healthcare sectors.

The U.S. is likely to hold a dominant share of the North America market throughout the projected period, due to the hefty federal ICT investments, AI integration, and infrastructure modernization initiatives. The Broadband Equity Access and Deployment Program of the National Telecommunications and Information Administration grants nearly USD 42.5 billion to connect every American to high-speed internet by investing in infrastructure partnerships. This highlights that the expansion of high-connectivity networks is likely to increase the deployment of advanced video surveillance systems in the years ahead.

Europe Market Insights

The Europe video surveillance is anticipated to account for 22.5% of the global revenue share throughout the study period. The digitization initiatives, data security reforms, and investments in smart infrastructure are prime growth drivers fueling the sales of advanced video surveillance systems. In February 2022, the European Commission announced a €3.2 billion investment plan to fund 21 projects in the Western Balkans. These projects are focused on enhancing transportation, digital technology, climate efforts, and energy connections. Such moves are emerging as lucrative opportunities for advanced video surveillance manufacturers.

The sales of video surveillance systems in Germany are poised to be driven by its manufacturing-focused economy and the increasing expansion of smart infrastructure projects. The high public spending on national security advancements is also expected to fuel the demand for advanced video surveillance solutions. The Federal Ministry for Digital and Transport (BMDV) is focused on smart transportation systems, which include the expansion of city-wide networks of AI-powered cameras, especially in Berlin and Munich, to improve traffic management and safety. Such initiatives are likely to boost the revenues of key players. The strong presence of high-tech companies is further contributing to the increasing adoption of video surveillance systems.

In France, the market is expected to register rapid growth during the forecast period owing to rising concerns about thefts, vandalism, and increasing safety pressures from public authorities and private organizations. For instance, in 2024, the average number of residential burglaries was about 5.87 per 1,000 homes in France. This has resulted in increasing demand for advanced video surveillance systems in the residential sector. Moreover, local governments in the country are increasingly embracing smart city initiatives that require well-equipped surveillance systems to manage traffic, crowd and enhance public safety.

Key Video Surveillance Market Players:

- Hangzhou Hikvision Digital Technology Co., Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dahua Technology Co., Ltd

- Axis Communications AB

- Bosch Security Systems

- Avigilon (Motorola Solutions)

- Hanwha Vision Co., Ltd

- FLIR Systems Inc. (Teledyne)

- Uniview (Uniview Technologies)

- CP PLUS (Aditya Group)

- Pelco Inc. (Motorola Solutions)

- IDIS Co., Ltd.

- Senstar Technologies Ltd

- MOBOTIX AG

- Vivotek Inc.

- D-Link Corporation

The global video surveillance market is characterized by the presence of mature companies and the increasing emergence of start-ups. The leading companies are increasing investments in R&D activities to introduce next-gen solutions and attract tech-savvy consumers. The industry giants are also entering emerging markets to earn high profit shares from untapped opportunities and government-backed subsidies. Some of the big players are collaborating with other companies to increase their market reach and enhance their product offerings.

Here is a list of key players operating in the global market:

Recent Developments

- In September 2025, Marshall Electronics introduced the CV625, its first dual-sensor, dual-lens camera that combines PTZ (pan-tilt-zoom) and POV (point-of-view) in one unit. It delivers 4K video at 60 fps, 25× zoom, AI auto-tracking, and picture-in-picture outputs. This is aimed at professional or commercial applications where both close-ups and wide-angle monitoring in a single device are beneficial.

- In June 2025, Honeywell developed its first CCTV camera portfolio manufactured in India with the development of the 50 Series range. This marks the company’s first locally designed and produced range of surveillance products. Developed in line with the Government of India’s Atmanirbhar Bharat initiative, the cameras are fully conceptualized, engineered, and built in the country, and hold Class 1 certification, the highest standard under the Make in India policy.

- Report ID: 100

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Video Surveillance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.