Foundry Robots Market Outlook:

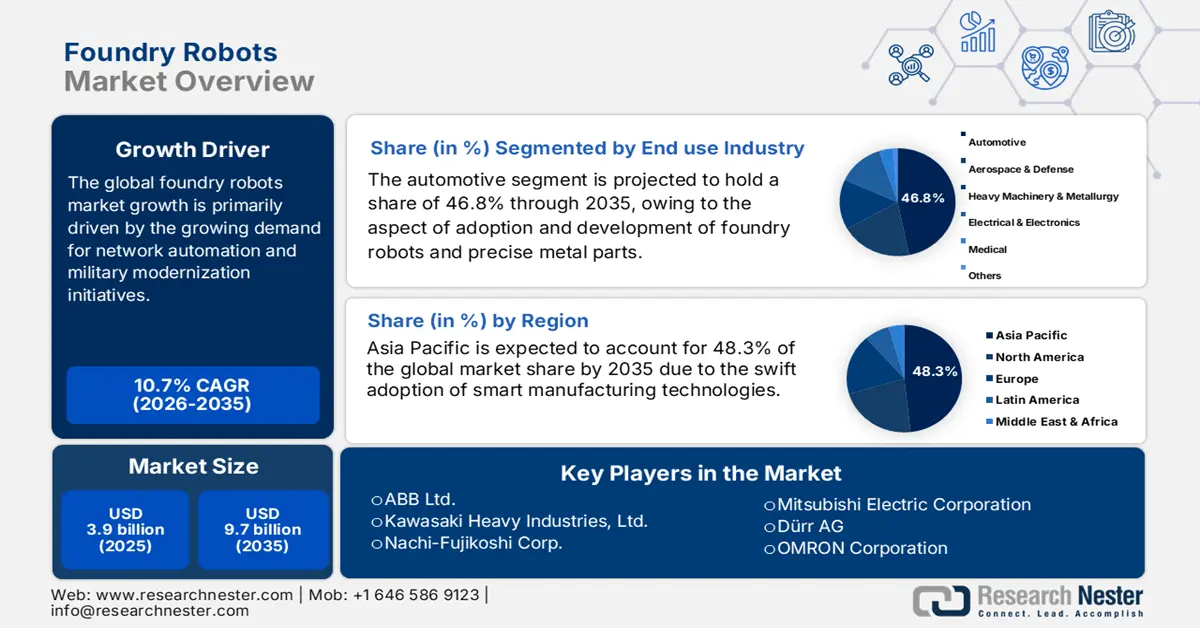

Foundry Robots Market size was over USD 3.9 billion in 2025 and is estimated to reach USD 9.7 billion by the end of 2035, expanding at a CAGR of 10.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of foundry robots is evaluated at USD 4.3 billion.

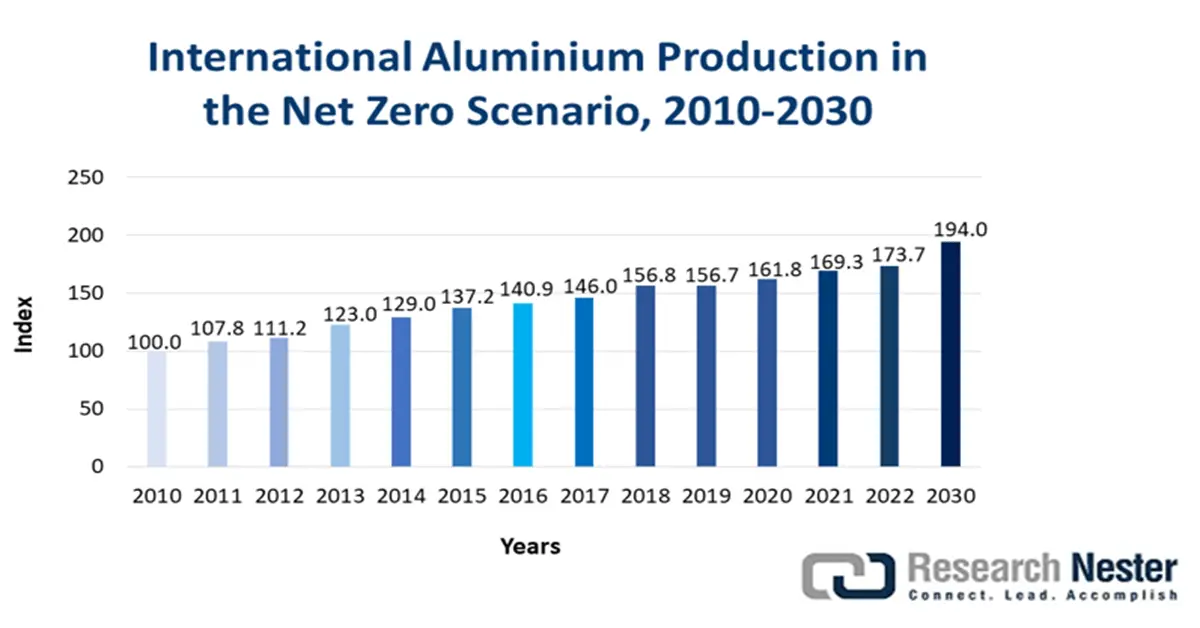

The overall sales of the market depend on the stable and consistent supply of raw materials as well as components. Mostly, the major upstream materials, including steel and aluminum, are traded heavily between Asia, Europe, and North America. According to an article published by the IEA Organization in July 2023, there has been a continuous growth of aluminium between 2020 and 2022 at over 3%. In addition, the worldwide aluminium rates are more than 95% for manufacturing scrap and almost 75% for end-of-life scrap. Meanwhile, foundry robots are essential for material handling and casting, depending on precision parts, including programmable logic controllers (PLCs) and high-temperature-resistant gearings.

Source: IEA Organization

Furthermore, as per an article published by the IFR Organization in April 2024, manufacturing organizations in the U.S. have readily invested in automation, resulting in a rise of industrial robots by 12% and successfully reaching 44,303 units as of 2023. Besides, the expansion has been favorably reinforced by the surging demand domestically and limitations in local manufacturing capacity. The interconnected nature of the global supply chains is highlighted by a convergence of the factors exhibited in the U.S. Meanwhile, assembly lines are readily being clustered near machinery and automotive centers, which is yet another key characteristic driver for the foundry robots market. Additionally, robotics in metal casting facilities and technology upgradation are projected to boost the sales of cutting-edge foundry robots, thus suitable for market growth.

Historical Period of Yearly Industrial Robot Installations in the U.S.

|

Years |

Unit |

|

2013 |

24 |

|

2014 |

26 |

|

2015 |

28 |

|

2016 |

31 |

|

2017 |

33 |

|

2018 |

40 |

|

2019 |

33 |

|

2020 |

31 |

|

2021 |

36 |

|

2022 |

40 |

|

2023 |

44 |

Source: IFR Organization

Key Foundry Robots Market Insights Summary:

Regional Insights:

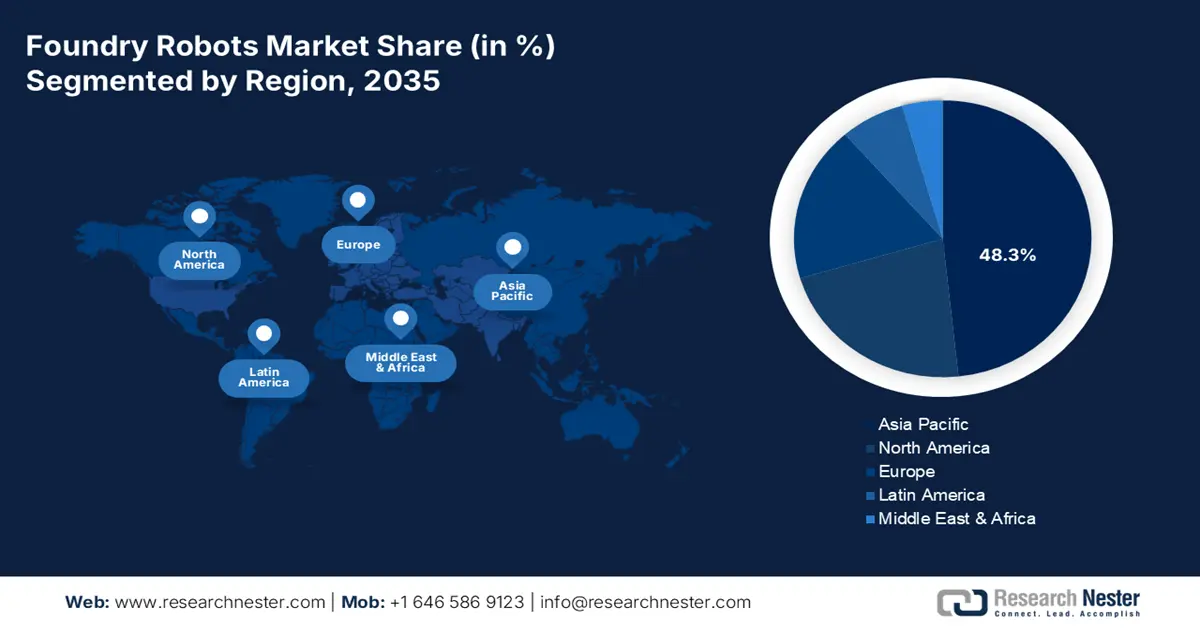

- Asia Pacific: Asia Pacific is expected to secure 48.3% share by 2035, driven by the expansion of automotive and manufacturing industries.

- Europe: Europe is projected to be the fastest-growing region during 2026–2035, impelled by regulatory ESG mandates and automotive electrification.

Segment Insights:

- Automotive Segment: The automotive segment in the foundry robots market is projected to account for 46.8% share by 2035, owing to increasing demand for lightweight, high-quality, and precise metal parts.

- Handling Segment: The handling segment is anticipated to hold a significant share during 2026–2035, propelled by the essential need for enhanced workplace safety and operational efficiency.

Key Growth Trends:

- Advanced manufacturing and Industry 4.0 adoption

- Workforce shortages in heavy industries

Major Challenges:

- Pricing pressure due to high CAPEX

- Lack of reliable infrastructure

Key Players: KUKA AG (Germany), Yaskawa Electric Corporation (Japan), ABB Ltd. (Switzerland), Kawasaki Heavy Industries, Ltd. (Japan), Nachi-Fujikoshi Corp. (Japan), Mitsubishi Electric Corporation (Japan), Dürr AG (Germany), OMRON Corporation (Japan), Hyundail Robotics (South Korea), Stäubli International AG (Switzerland), Comau S.p.A. (Italy), Universal Robots A/S (Denmark), Siasun Robot & Automation Co., Ltd. (China), EFORT Intelligent Equipment Co., Ltd. (China), Estun Automation Co., Ltd. (China), Techman Robot Inc. (Taiwan), Acieta LLC (U.S.), RobotWorx (U.S.), ABB Pte. Ltd. (Singapore).

Global Foundry Robots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 9.7 billion

- Projected Market Size: USD 4.3 billion by 2035

- Growth Forecasts: 10.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, Germany, Japan, USA, South Korea

- Emerging Countries: India, Mexico, Brazil, Thailand, Vietnam

Last updated on : 3 November, 2025

Foundry Robots Market - Growth Drivers and Challenges

Growth Drivers

- Advanced manufacturing and Industry 4.0 adoption: The aspect of Industry 4.0 principles in gaining increased traction, owing to which the demand for the foundry robots market is projected to increase in a similar trend. Besides, the rise in smart factories is likely to bolster the deployment of robots to ensure predictive maintenance and unlock real-time insights. In this regard, according to an article published by the U.S. Department of Energy in July 2024, a USD 33 million funding opportunity has been provided to accelerate the smart manufacturing processes and technologies advancement. The purpose is to deploy and develop advanced materials and technologies required for the clean energy transition.

- Workforce shortages in heavy industries: The limitation of skilled labor in metalworking and foundry plants is creating lucrative growth opportunities for manufacturers in the foundry robots market globally. Besides, there has been a decline in the foundry workers employment due to which job openings are increasingly. However, as per the September 2025 U.S. Bureau of Labor Statistics data report, there has been a surge in job openings, accounting for 7.2 million, with minor modifications in layoffs and job quits, thus denoting an optimistic outlook for the overall market’s development.

- Enhanced occupational safety and environmental compliance: Governments in different nations are adopting stringent regulatory policies to protect workers from inherent dangers of foundry settings, including exposure to toxic fumes, airborne particulates, and extreme heat. For instance, the U.S. Environmental Protection Agency (EPA) has enforced standards for air quality, such as regulations for metal casting, and automated robotic systems can easily optimize process control to reduce fugitive emissions. Meanwhile, the National Institute for Occupational Safety and Health (NIOSH) conducts thorough research and offers guidance on controlling worker exposure, thereby suitable for skyrocketing the market internationally.

Raw and Scrap Aluminium 2023 Export and Import Boosting the Foundry Robots Market

|

Countries/Component |

Raw Aluminium |

Scrap Aluminium |

|

Global Trade |

USD 73.8 billion |

USD 20.9 billion |

|

Global Trade Share |

0.3% |

0.09% |

|

Product Complexity |

-1.4 |

-0.6 |

|

Export Growth |

-20.2% |

-12.1% |

|

Top Exporter |

Canada (USD 8.0 billion) |

U.S. (USD 3.4 billion) |

|

Top Importer |

U.S. (USD 11.9 billion) |

India (USD 3.5 billion) |

Source: OEC

Challenges

- Pricing pressure due to high CAPEX: The upfront investment strategy for installation is one of the major challenges that negatively impact the sales growth of the foundry robots market. The cost frequently increases, depending on high-temperature applications. Besides, small and medium-sized enterprises (SMEs) in the manufacturing industry have cited prohibitive capital demands as a notable gap to automation integration. This readily highlights that foundry robot sales are predicted to register low adoption due to increased CAPEX. However, to combat this pricing barrier, a few organizations are set to provide subscription-based and leasing models to enhance their sales.

- Lack of reliable infrastructure: The deprived network facility is one of the major hurdles for the deployment of the innovative foundry robots market, integrated with remote control, predictive maintenance, and real-time robot monitoring. This particular scenario is usually common in the majority of developing economies, owing to low budgets for advancements. For instance, the maximum of manufacturing locations in Southeast Asia and Sub-Sahara Africa comprised accessibility to industrial-grade 4G and 5G connectivity. This, in turn, has directly hampered the smart robotic systems in foundries, which depend on high-speed data transmission.

Foundry Robots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.7% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 9.7 billion |

|

Regional Scope |

|

Foundry Robots Market Segmentation:

End use Industry Segment Analysis

Based on the end use industry, the automotive segment in the foundry robots market is anticipated to account for the highest share of 46.8% by the end of 2035. The segment’s growth is highly attributed to the aspect of a crucial driver for developing and adopting foundry robots. In addition, automotive manufacturing requires an increased volume of lightweight, high-quality, and precise metal parts. According to an article published by the IFR Organization in March 2023, the automotive sector has the largest number of robots, with an operational stock of almost 1 million units. This represents about nearly 1/3rd of the overall number of installed robots across global industries, thus making it suitable for the segment’s growth.

Function Segment Analysis

Based on function, the handling segment in the foundry robots market is predicted to garner the second-highest share during the stipulated period. The segment’s exposure is highly driven by its pivotal role in automating the most physically, hazardous, and pervasive demanding tasks in a foundry. This comprises the raw materials loading into furnaces, the movement of hot and heavy castings, and the transfer of molten metal between processing stations, including finishing, deburring, and cooling. Besides, the primary drivers for the segment are essential demand for enhanced workplace safety by abolishing personnel from dangerous environments and the pursuit of superior operational efficacy.

Type Segment Analysis

Based on type, the articulated robots segment in the foundry robots market is projected to cater to the third-highest share by the end of the forecast timeline. The segment’s development is effectively fueled by its safety, precision, and flexibility, enabling it to perform a comprehensive range of complicated activities with repeatability and high accuracy. For instance, as per an article published by Energy Reports in November 2022, natural gas consumption in China has reached 277 billion cubic meters every year, and the natural gas pipeline length has also exceeded 80,000 km, due to which robotic devices are developed to ensure suitable water pipe inspection, thus bolstering the overall segment in the market.

Our in-depth analysis of the foundry robots market includes the following segments:

|

Segment |

Subsegments |

|

End use Industry |

|

|

Function |

|

|

Type |

|

|

Component |

|

|

Payload Capacity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Foundry Robots Market - Regional Analysis

APAC Market Insights

Asia Pacific in the foundry robots market is anticipated to account for the largest share of 48.3% by the end of 2035. The market’s upliftment in the region is effectively attributed to the strong extension of robust automotive and manufacturing industries is one of the notable drivers driving the foundry robots sales. Additionally, an increase in the die casting volume demand, along with substantial government ICT investments, is also catering to the foundry robots trade. According to an article published by the ABD Organization in 2025, the international expenditure on digitalized transformation is predicted to reach USD 3.9 trillion by the end of 2027, with the region accounting for over 33% of the share, which is driving the market’s growth.

The foundry robots market in China is projected to increase at a high pace, owing to the massive manufacturing base and aggressive smart factory policies. The digital shift has led to the swift integration of AI and IoT in robotics. As per the March 2025 IFR Organization article, the country’s National Development and Reform Commission has notified a long-lasting fund on next-generation innovation, AI, and robotics, amounting to 1 trillion yuan (USD 138 billion) for more than 20 years. The objective is to continue the country’s technology-based success in manufacturing, thereby boosting the market’s development.

The foundry robots market in India is also gaining increased traction, owing to the provision of generous support from governmental strategies, such as the Make in India campaign, along with PLI schemes for advanced chemistry cell and automotive batteries. These administrative policies are readily encouraging regional manufacturing, which has resulted in an upsurge in investments in automated foundries. For instance, the Department of Heavy Industry has provided support for adopting innovative manufacturing technologies to optimize the competitiveness of the capital goods sector. Additionally, the supply chain aspect of industrial robots is also fueling the market’s demand in the country, as well as in the overall region.

Industrial Robots 2023 Export and Import in the Asia Pacific

|

Countries |

Export |

Import |

|

Japan |

USD 279 million |

USD 30.2 million |

|

China |

USD 183 million |

USD 57.8 million |

|

South Korea |

USD 51.2 million |

USD 28.4 million |

|

India |

USD 1.5 million |

USD 9.3 million |

|

Malaysia |

USD 2.8 million |

USD 8.7 million |

|

Singapore |

USD 3.0 million |

USD 20.4 million |

|

Thailand |

USD 1.8 million |

USD 20.3 million |

Source: OEC

Europe Market Insights

Europe in the foundry robots market is expected to emerge as the fastest-growing region during the projected period. The market’s exposure in the region is driven by the presence of regulatory ESG as well as automotive electrification mandates to uplift the sales of foundry robots. In addition, the automation of high-precision casting in automotive and aerospace foundries is further fueling the application of foundry robots. As per an article published by NLM in March 2023, 25% of large-scale enterprises in the region utilize robots, along with 12% medium-scale enterprises, and 5% of small-scale enterprises. Therefore, this increased adoption of robots in regional workplaces is rapidly bolstering the market’s growth.

Germany is leading the sales of the foundry robots market, and the country’s dominance in the automotive and industrial machinery sectors is propelling the demand for foundry robots. The early adoption of Industry 4.0. and strong presence of tech-savvy consumers is also increasing the adoption of advanced foundry robots. As per the June 2024 OECD data report, the need for artificial intelligence (AI) skills in the country has been growing, with online vacancies constituting 0.4% in 2022, leading to an increase in 2023 by 1.5%. Furthermore, initiatives such as Made in Germany Digital and the Federal Ministry for Digital and Transport’s (BMDV) AI action plans are also responsible for uplifting the overall market.

The foundry robots market in the UK is gaining increased exposure, owing to the existence of the defence and aerospace industries, which demand high-integrity castings that robots can rapidly produce with consistent quality. The country’s policy for supply chain dependency, as well as reshoring the government’s Made Smarter approach, are also uplifting the market’s development. According to an article published by the UK Business Government in June 2025, the country’s advanced Industrial Strategy is rapidly unlocking almost £4.3 billion in funding, which comprises nearly £2.8 billion for R&D for the upcoming five years, thus denoting a positive impact on the market.

North America Market Insights

North America in the foundry robots market is predicted to grow steadily by the end of the forecast duration. The market’s development in the region is fueled by progressive manufacturing strategies, along with a pressing requirement for securing supply chains and reshoring production. According to an article published by NLM in July 2022, 50% of employees require reskilling, owing to the Industry 4.0 technology adoption. In addition, 1/3rd of crucial skills will comprise technology competencies as of 2025, thereby making it suitable for the market’s development in the overall region.

The foundry robots market in the U.S. is growing significantly, owing to supportive government policies and funding initiatives. In addition, the strong presence of the automotive, aerospace, and defense sectors is opening lucrative doors for foundry robot manufacturers. As per a data report published by the U.S. Department of State in September 2024, the organization made the provision of USD 10 million to overcome the artificial intelligence accessibility barrier and instead promote computer credits access. Meanwhile, the foundry automation is being fast-tracked through initiatives such as the Manufacturing USA network and NIST’s Smart Manufacturing Innovation Centers.

The foundry robots market in Canada is also growing due to the tactical adoption of automation to boost the international competitiveness of heavy machinery and resource-based industries. The ultimate focus is effectively leveraging robotics to offer value to raw metal production, while uplifting the value chain into precision component manufacturing, especially for export purposes. Besides, as stated in the August 2024 Government of Canada article, the Minister of Public Services and Procurement declared a new project under the NGen’s approach to support 15 advanced manufacturing projects. This resulted in a generous fund provision of USD 59 million to readily support 31 organizations across the country, thereby creating an optimistic outlook for the market.

Key Foundry Robots Market Players:

- FANUC Corporation (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KUKA AG (Germany)

- Yaskawa Electric Corporation (Japan)

- ABB Ltd. (Switzerland)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Nachi-Fujikoshi Corp. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Dürr AG (Germany)

- OMRON Corporation (Japan)

- Hyundail Robotics (South Korea)

- Stäubli International AG (Switzerland)

- Comau S.p.A. (Italy)

- Universal Robots A/S (Denmark)

- Siasun Robot & Automation Co., Ltd. (China)

- EFORT Intelligent Equipment Co., Ltd. (China)

- Estun Automation Co., Ltd. (China)

- Techman Robot Inc. (Taiwan)

- Acieta LLC (U.S.)

- RobotWorx (U.S.)

- ABB Pte. Ltd. (Singapore)

- FANUC Corporation is one of the global leaders in industrial automation, well-known for its strong and dependable robots, developed to withstand extreme conditions of foundry environments, including repetitive heavy lifting, dust, and heat. The organization’s extended product range, such as high-payload articulated robots, is instrumental in automating tasks, making it a dominating force. Therefore, based on all these developments, the organization’s net sales accounted for Yen 7,953 billion as of the financial year 2024.

- KUKA AG readily specializes in innovative automation solutions, providing a robust portfolio of robots, particularly engineered for required foundry applications, such as metal casting and forging. The firm’s focus is on Industry 4.0 and connectivity integration, thus permitting foundries to develop flexible and smart production cells, thus solidifying its position as a notable technology provider in Europe and other nations.

- Yaskawa Electric Corporation is one of the most pioneering in robotics under the Motoman brand, offering high-performance robots that are essential for undertaking precision tasks in foundries, which include machine tending, deburring, and grinding. Besides, its dual emphasis on advanced motion control and durability ensures efficient and high-quality operation, making it a suitable choice for manufacturing sectors. Meanwhile, as per its 2024 annual report, the company’s capital investment accounted for 37.8 billion yen, along with 21.2 billion yen in R&D expenditure.

- ABB Ltd. is considered one of the powerhouses in robotics, providing a wide-ranging suite of foundry-based robots, preferably the 7000 and IRB 6000 series, which are regarded as industrial standards for efficacy in rapid material transfer and die casting. Besides, the company also drives market development with its OmniCore controller as well as digitalized solutions, thus enabling predictive maintenance and energy improvement for smart foundry operations.

- Kawasaki Heavy Industries, Ltd. is a notable key player with a long-lasting history of manufacturing durable and strong robots, which are capable of handling the most strength-based foundry activities, such as the handling of heavy and very large castings. The firm’s robots are well-known for payload capacity and outstanding reach, which are vital for applications in large-scale forging and automotive casting production lines.

Here is a list of key players operating in the global market:

The international foundry robots market is readily characterized by the existence of large-scale organizations, along with an increase in the emergence of start-ups. Large-scale companies cater to the majority of the global share, and are effectively focused on making investments in digitalized technologies to bolster the efficacy of their products, and rapidly attract a comprehensive consumer base. Besides, organizations in Japan are accounting for a dominant positive in the worldwide landscape due to their know-how approaches. Besides, in October 2025, SoftBank Group Corp. notified its definitive agreement with ABB Ltd, with the intention of acquiring ABB’s robotics business for an overall purchase price of USD 5.3 billion, thus suitable for boosting the foundry robots market.

Corporate Landscape of the Foundry Robots Market:

Recent Developments

- In October 2025, Zimmer Biomet Holdings, Inc. declared that it has readily highlighted bold advancements across its wide-ranging robotics and musculoskeletal portfolio at the American Association of Hip and Knee Surgeons (AAHKS).

- In December 2024, Samsung Electronics notified its development in emerging as one of the largest shareholders in Rainbow Robotics to escalate future robot development, by acquiring a 14.7% stake in the Korea-based firm, along with a KRW 86.8 billion investment.

- In October 2024, Hyundai Motor Company, along with Waymo announced their entry into a multi-year and tactical partnership. Both organizations integrated Waymo’s sixth-generation fully autonomous technology into its all-electric IQNIQ 5 SUV.

- Report ID: 3878

- Published Date: Nov 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Foundry Robots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.