Construction Robots Market Outlook:

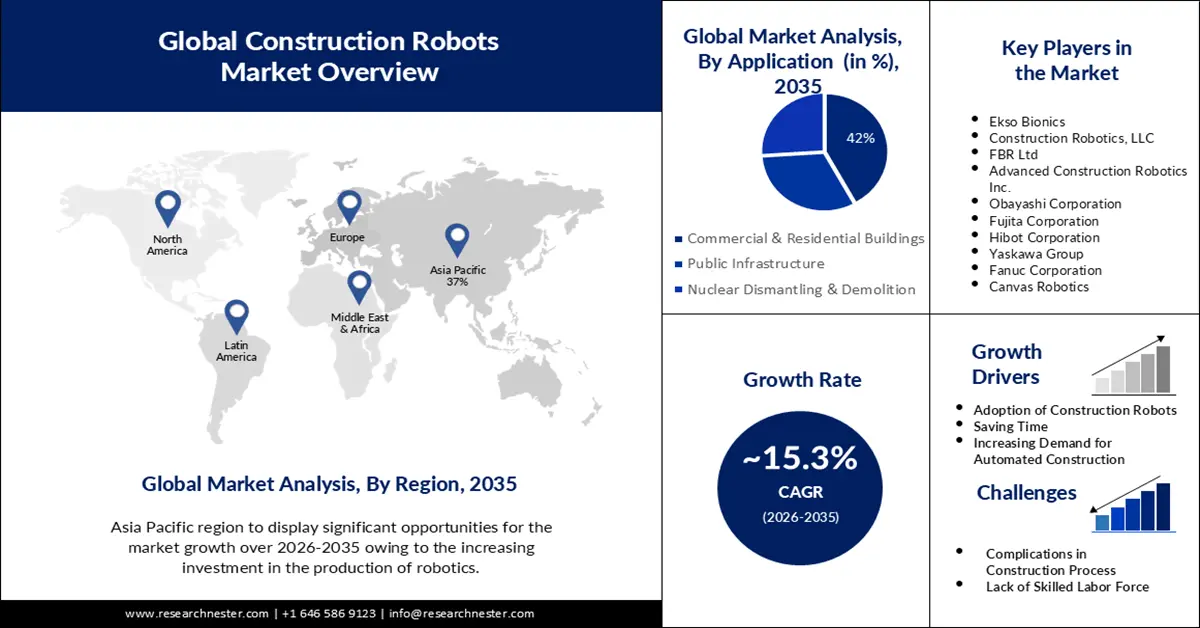

Construction Robots Market size was valued at USD 1.46 billion in 2025 and is set to exceed USD 6.06 billion by 2035, expanding at over 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of construction robots is estimated at USD 1.66 billion.

Automated robots are used to carry out tasks as diverse as bricklaying, steel truss assembly, and concrete laying with varying degrees of success leading to increasing sales. The development and innovations in technology are escalating the market growth. Nearly 584,000 robotic devices were bought in 2022. Sales of robots will make up around 34% of all robot sales by 2025. 88% of businesses worldwide plan to include robotic automation into their infrastructure.

The use of autonomous vehicles and excavators for mining is the most visible deployment of robots in large-scale construction projects. For example, a California startup built robots, which has launched a giant Autonomous Construction Robot to speed up the construction of utility-scale Solar Farms to accelerate the transition towards cleaner energy and protect workers from unsafe conditions in the future. Redshift estimates that from now until 2050, the construction sector will need to construct 13,000 structures every day to accommodate the seven billion people who are anticipated to live in cities.

Key Construction Robots Market Insights Summary:

Regional Highlights:

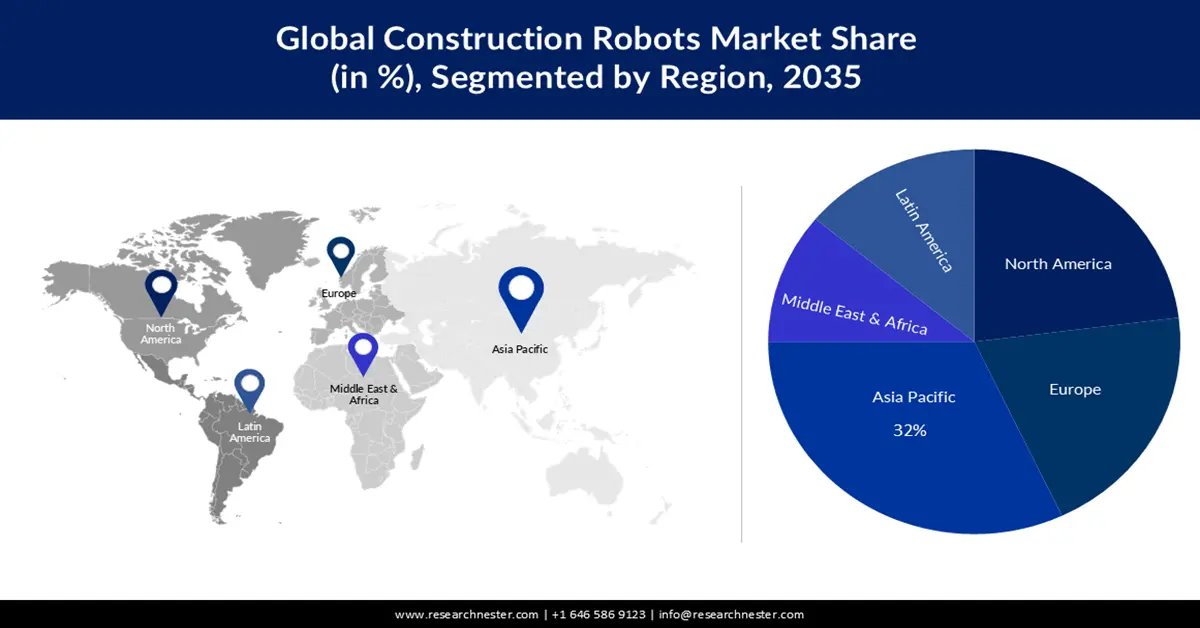

- Asia Pacific construction robots market is projected to capture a 32% share by 2035, driven by increasing adoption of robotic automation and infrastructure demand.

- North America market is expected to secure a 23% share by 2035, driven by growing automation in industries and urbanization in the US and Canada.

Segment Insights:

- The robotic arm segment in the construction robots market is expected to capture a 45% share by 2035, driven by the demand for compact, precise, and plug-and-play automation solutions.

- The application (commercial & residential buildings) segment in the construction robots market is projected to capture a 42% share by 2035, driven by the growing use of collaborative robots in global construction projects.

Key Growth Trends:

- Adoption of Collaborative Robots

- Installation of Robots to Save Time

Major Challenges:

- Adoption of Collaborative Robots

- Installation of Robots to Save Time

Key Players: Canvas Robotics, Ekso Bionics, Construction Robotics, LLC, FBR Ltd, Brokk AB, Husqvarna AB, Komatsu Ltd., Autonomous Solutions, CONJET ab, Giant Hydraulic Tech Co., Ltd.

Global Construction Robots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.46 billion

- 2026 Market Size: USD 1.66 billion

- Projected Market Size: USD 6.06 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, China, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Construction Robots Market Growth Drivers and Challenges:

Growth Drivers

- Adoption of Collaborative Robots - The adoption of collaborative robots will be driven by an increase in the focus of building companies on reducing material resources and waste during construction. In addition, Autodesk points out that it is difficult to obtain precise data on waste produced at a typical construction site, but several construction organizations believe that almost 30% of the total weight of building materials transported to a construction site is wasted.

- Installation of Robots to Save Time - The growth of robots in the construction sector will be facilitated by shortening project durations. It can be used for a variety of flexible manufacturing processes, e.g. by material transportation, welding, milling, cutting, drilling, painting, and even bricklaying.

- Increasing Demand for Automated Construction - Automated building solutions are expected to become a key driver in the years ahead, as infrastructure needs increase and they will be an important influence on the market. For the sake of an expected 7 billion people living in cities, Redshift estimates that from now on industry will have to construct 13,000 buildings a day by 2050. Moreover, collaborative robots are used for performing multiple tasks that need accuracy.

Challenges

- High Maintenance Cost - One of the challenges in the implementation of collaborative robots is the high costs involved in acquiring and maintaining the technology. It costs a great deal of money to buy and implement these technologies. Consequently, these technologies cannot be used by any company with a good turnover and competition on the market.

- Complications in Construction Process

- Lack of Skilled Labour Force

Construction Robots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 1.46 billion |

|

Forecast Year Market Size (2035) |

USD 6.06 billion |

|

Regional Scope |

|

Construction Robots Market Segmentation:

Type Segment Analysis

The robotic arm segment in the construction robots market is anticipated to hold the highest revenue share of 45%. The adoption of innovative technology was supported by trends within the construction industry, which included better design, faster construction, and standardized designs. As demand increases, market players that operate in the robot arm segment need to keep developing and designing new and innovative products. For instance, the Meca500 robot arm is by far the smallest, most compact of all six-axis industrial robots. And it's the most precise, too. In fact, Meca500 is a plug-and-work automation component unlike most of the industrial robots that are generally complex stand-alone systems.

Application Segment Analysis

The commercial & residential construction robots market is expected to hold 42% of the revenue share. Key companies around the world, such as Fastbrick Technologies Limited, are exponentially working on several commercial and residential projects in multiple countries, and collaborative robots are majorly used during the construction process. Fastbrick Technologies Ltd., an exponentially growing company engaged in numerous commercial and residential projects throughout the world, is using collaborative robots for the work.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Function |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Construction Robots Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 32% by 2035. A major factor driving growth is the increasing adoption of robotic automation and tools in this region. Moreover, Asia Pacific is home to a large population and this has led to an increased demand for housing and industry infrastructures making the Asian region one of the prospective regions. Schindler's announcement in February 2022 that it would be deploying a R.I.S.E robot to Asia Pacific was a case in point. Schindler's R.I.S.E robot is used to install in elevator shafts, and is one of the robots that are independent and cannot be controlled on its own.

North America Market Insights

North America is expected to hold the second-largest share of about 23% in the market. The growth can be accredited to the growing automation across numerous sectors or industries. Moreover, the growing industry of construction in the US and Canada is also escalating the market growth. Canada showcased growth in construction of about 6%, in the residential sector. Also, in North America urbanization is growing swiftly, which has contributed to the growth of the construction robots market.

Construction Robots Market Players:

- Canvas Robotics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ekso Bionics

- Construction Robotics, LLC

- FBR Ltd

- Brokk AB

- Husqvarna AB

- Komatsu Ltd.,

- Autonomous Solutions

- CONJET ab

- Giant Hydraulic Tech Co., Ltd.,

Recent Developments

- A construction robotics firm called Canvas has created a robotic drywalling solution with the goal of enabling people to build in daring new ways. Hilti has announced a strategic relationship with Canvas.

- The Human Motion and Control ("HMC") Business Unit from Parker Hannifin Corporation ("Parker"), a leading provider of motion and control technologies, has been acquired by Ekso Bionics, a leader in exoskeleton technology for medical and industrial applications.

- Report ID: 5225

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Construction Robots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.