Electric Vehicle Fluids Market Outlook:

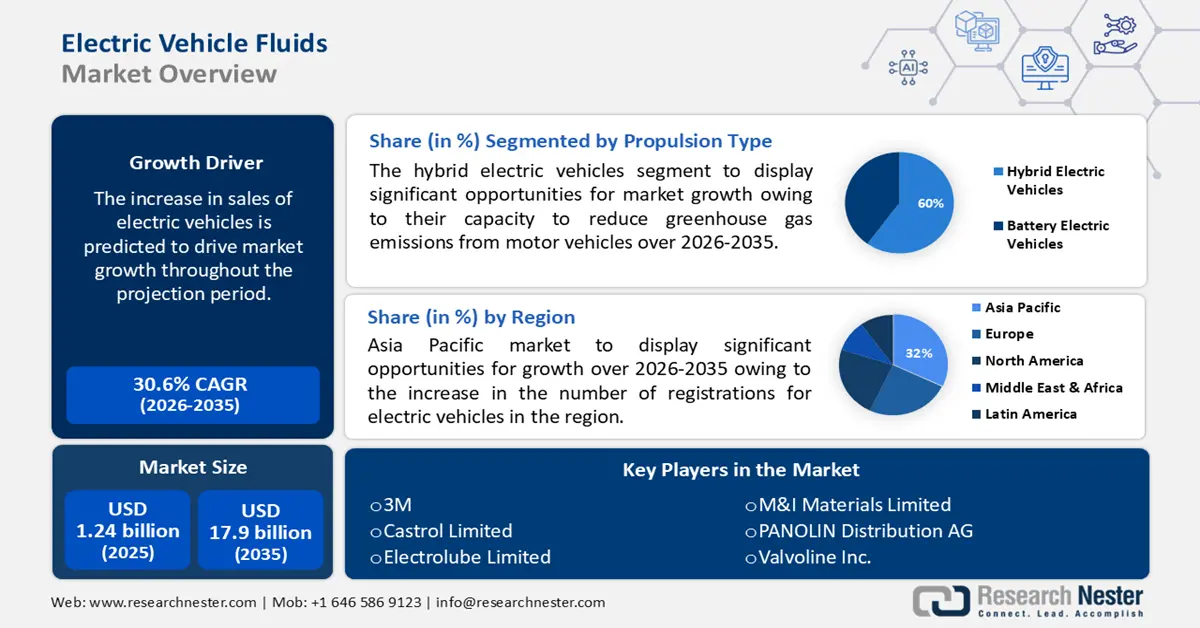

Electric Vehicle Fluids Market size was valued at USD 1.24 billion in 2025 and is likely to cross USD 17.9 billion by 2035, expanding at more than 30.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric vehicle fluids is estimated at USD 1.58 billion.

The ongoing shift from internal combustion engines to electric drivetrains is a major factor fueling market growth. This has prompted automakers to ramp up EV production capacity significantly. This transformation is supported by policy-driven investments, tightening emissions regulations, and OEM-level electrification commitments. As global EV production scales, demand for specialized fluids, especially those formulated for battery thermal management, electric drive unit lubrication, and high voltage component cooling, is increasing.

According to the report published by the International Energy Agency (IEA), global EV sales reached a record 17.1 million units in 2024, marking a 25% increase from 2023. China led this growth, accounting for 11 million units sold—a 40% year-over-year rise. Notably, plug-in hybrid electric vehicles (PHEVs) surged by 81%, driven by range-extended electric vehicles (REEVs) that offer longer driving ranges due to larger batteries. This expansion necessitates specialized EV fluids for thermal and lubrication management. Electric vehicle fluids have become an integral part of OEM specifications, leading to long-term supply agreements and strategic partnerships between automakers and fluid manufacturers.

Key Electric Vehicle Fluids Market Insights Summary:

Regional Highlights:

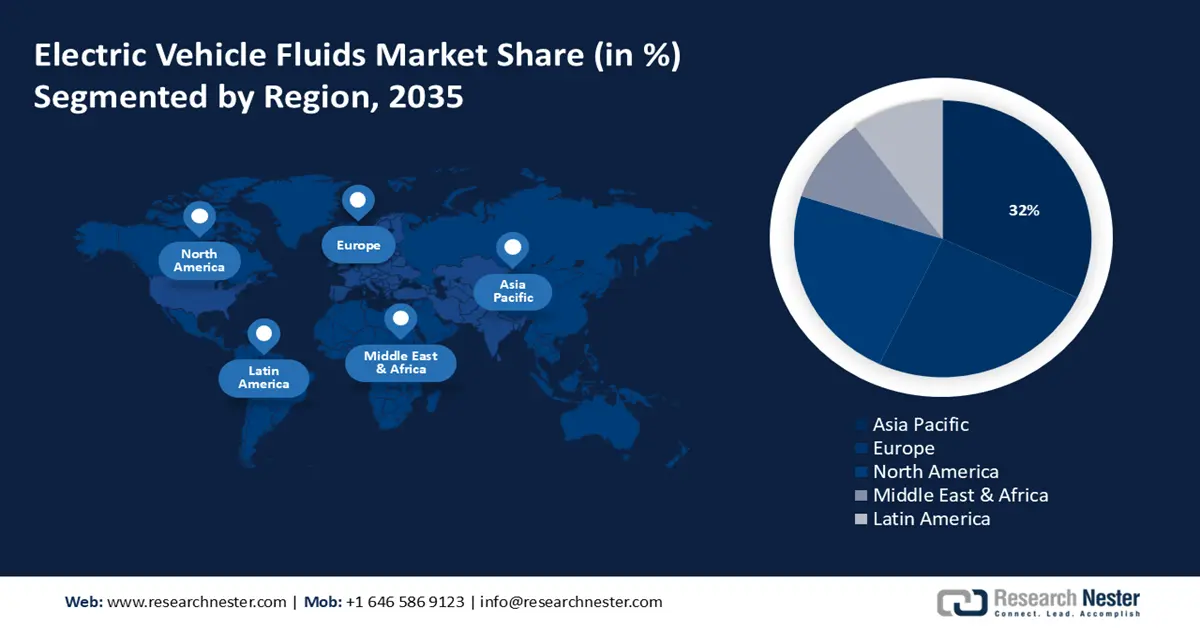

- Asia Pacific electric vehicle fluids market will hold around 48% share by 2035, driven by electrification policies, expanding EV manufacturing base, and demand for thermal management solutions in hot climates, especially in Southeast Asia.

Segment Insights:

- The passenger segment (vehicle type) in the electric vehicle fluids market is anticipated to hold a 68% share by 2035, driven by increasing EV sales, battery tech advancements, and supportive government policies.

- The engine oil segment in the electric vehicle fluids market is projected to achieve a 58% share by 2035, influenced by increasing EV adoption and the demand for specialized lubricants with new properties.

Key Growth Trends:

- Electrification of commercial fleets and public transport systems

- Technological advancements in EV fluid formulations

Major Challenges:

- Complex and evolving OEM specifications

- Limited aftermarket penetration and end-user awareness

Key Players: Exxon Mobil Corporation, BP Plc, Shell Plc, FUCHS, TotalEnergies, Petroliam Nasional Berhad (PETRONAS), Saudi Arabian Oil Co.

Global Electric Vehicle Fluids Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.24 billion

- 2026 Market Size: USD 1.58 billion

- Projected Market Size: USD 17.9 billion by 2035

- Growth Forecasts: 30.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 8 September, 2025

Electric Vehicle Fluids Market Growth Drivers and Challenges:

Growth Drivers:

- Electrification of commercial fleets and public transport systems: The electrification trend is not just limited to passenger vehicles but also includes light-duty trucks, buses, and commercial fleets. The commercial fleets are undergoing rapid electrification, driven by fleet decarbonization mandates, cost savings on fuel, and urban clean air regulations. For instance, in January 2025, Amazon placed the UK’s largest-ever order for electric trucks, acquiring over 140 Mercedes-Benz eActros 600 and eight Volvo FM Battery Electric vehicles. These 40-tonne trucks, each with a range of 310 miles per charge, are expected to transport more than 300 million packages annually, replacing traditional diesel vehicles and contributing to Amazon's goal of achieving net-zero carbon emissions by 2040.

- Technological advancements in EV fluid formulations: Continuous innovation in fluid chemistry and engineering promotes market growth. Unlike conventional lubricants and coolants, EV fluids must meet unique technical requirements such as electrical insulation, lower viscosity, compatibility with lightweight materials, and enhanced thermal conductivity. Key players are focused on developing new formulations that address these challenges, including dielectric fluids for direct battery cooling, multi-functional transmission fluids for e-axles, and longer-life lubricants that align with extended EV service intervals.

For instance, in May 2023, Castrol and Jaguar TCS Racing introduced a circular EV transmission fluid in the Jaguar I-Type 6 race cars. The fluid was re-refined from used oil, blended with new additives, and successfully tested in a high-performance race, proving it could match the performance of virgin oil. This innovation supports both sustainability goals and the trend toward customized, high-efficiency EV fluids.

Challenges:

- Complex and evolving OEM specifications: As EV architectures vary significantly across manufacturers, fluid suppliers face a complex and evolving set of technical specifications. Unlike traditional automotive fluids, EV fluids must address unique requirements such as electrical insulation, non-corrosiveness, thermal conductivity, and long service life. The absence of universal standards increases formulation complexity, limits scalability, and creates barriers to widespread product adoption. Thus, suppliers must engage in expensive, ongoing R&D and validation testing to meet the custom needs of OEMs, slowing time to market and increasing development costs.

- Limited aftermarket penetration and end-user awareness: Despite the rising EV population, the aftermarket demand for EV fluids is relatively nascent. Unlike ICE vehicles that require frequent ICE oil changes, many EV fluids are designed for long life, reducing aftermarket turnover. Additionally, EV owners and independent service centers often lack awareness of the specific maintenance needs or replacement intervals for thermal fluids and e-axle lubricants. This limits the growth potential for fluid manufacturers outside of OEM supply contracts, particularly in regions where EV servicing infrastructure is underdeveloped.

Electric Vehicle Fluids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

30.6% |

|

Base Year Market Size (2025) |

USD 1.24 billion |

|

Forecast Year Market Size (2035) |

USD 17.9 billion |

|

Regional Scope |

|

Electric Vehicle Fluids Market Segmentation:

Product Segment Analysis

The engine oil segment in electric vehicle fluids market is expected to hold the highest share of 58% by 2035 due to the increasing adoption of electric drivetrains. In India, Castrol India reported a 6.7% increase in third-quarter profit in 2024, driven by sustained demand for automobile lubrication products, including engine oils. Castrol India launched three new variants under its EDGE brand in June 2024, specifically formulated for hybrid engines, European cars, and SUVs. These products are designed to deliver improved performance and meet the latest OEM specifications, addressing the evolving needs of automotive consumers.

This growth is driven by the need for specialized lubricants that cater to the unique requirements of electric vehicles, such as enhanced thermal stability and electrical insulation properties. As EV adoption accelerates, the demand for high-performance engine oils for electric vehicles continues to rise, positioning this segment as a key player in the evolving automotive fluid landscape.

Vehicle Type Segment Analysis

The passenger segment in electric vehicle fluids market is poised to hold the largest market share of around 68% through 2035 due to increasing consumer demand for sustainable and cost-effective transportation options, advancements in battery technology, and supportive government policies promoting EV adoption. For instance, in India, passenger EV sales tripled in 2021, reaching 14,800 units, and continue to show signs of growth. As the passenger EV market expands, the need for specialized fluids such as advanced coolants and lubricants becomes more critical. These fluids are essential for maintaining optimal performance, enhancing battery life, and ensuring the safety of EV components. The growing adoption of passenger EVs is thus driving the demand for high-performance fluids, presenting significant opportunities for manufacturers in the EV fluids market.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Vehicle Type |

|

|

Propulsion Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Fluids Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific electric vehicle fluids market is expected to dominate with a 48% share through 2035 due to the region’s electrification policies and expanding EV manufacturing base. The increasing demand for thermal management solutions in hotter climates, particularly in Southeast Asia, is driving innovation in specialized EV fluids. Local players are investing in R&D to develop fluids made for next-gen EV components like e-axles and fast-charging systems. Moreover, urban air quality concerns are accelerating EV adoption, which in turn boosts the need for efficient and sustainable fluid technologies.

The electric vehicle fluids market in China is expanding rapidly, fueled by the country's dominant position in the global EV supply chain. Government incentives, such as subsidies and tax breaks, have spurred consumer adoption, leading to a significant increase in EV sales. In April 2025, Chinese automakers reported strong sales, particularly in the EV segment, with companies like BYD and XPeng achieving substantial growth. For instance, in April 2025, BYD sold 380,089 new energy vehicles, marking a 21% increase from last year, of which 195,740 were battery electric vehicles. This surge in EV production and sales drives the need for high-performance fluids tailored to the unique requirements of electric vehicles.

The South Korea electric vehicle fluids market is experiencing growth, driven by the nation's commitment to energy efficiency and technological innovation. The South Korean government offers substantial subsidies and tax incentives for EV purchases, making electric vehicles more accessible to consumers. Major automakers like Hyundai are investing heavily in EV development, aiming to produce over 3.6 million electric cars by 2030. This investment not only boosts EV production but also increases the demand for specialized fluids that enhance vehicle performance and longevity. Additionally, South Korea's emphasis on sustainability and environmental awareness aligns with the growing preference for eco-friendly EV fluids, further propelling market growth.

North America Market Insights

The electric vehicle fluids market in North America is anticipated to garner a robust share from 2026 to 2035 due to technological innovation and government incentives. Companies are developing advanced fluid formulations that offer better thermal stability, enhanced conductivity, and reduced friction, which are critical for improving the efficiency and range of electric vehicles. These innovations not only enhance vehicle performance but also contribute to the overall sustainability of EVs. As the market continues to evolve, the demand for specialized EV fluids is expected to rise, driven by ongoing advancements in vehicle technology and consumer preference for environmentally friendly transportation options.

The U.S. market is growing due to a combination of government incentives, technological advancements, and increased consumer demand. The growth is driven by federal and state governments actively promoting EV adoption through various rebates and subsidies. For example, Delaware offers up to USD 2,500 for new battery electric vehicles (BEVs) and USD 1,000 for plug-in hybrid electric vehicles (PHEVs) under its Clean Vehicle Rebate Program. This financial support encourages consumers to transition to EVs, increasing the demand for specialized fluids essential for EV performance and longevity.

In Canada, the EV market is thriving, bolstered by strong government support and strategic investments in EV infrastructure. The ambitious targets set by Canada to achieve carbon neutrality by 2050 and put up 1.5 million EVs on the road by 2030 are driving market growth. The commitment to expanding EV charging networks and developing a domestic battery supply chain further accelerates EV adoption. As the number of EVs on the road increases, so does the need for high-performance fluids tailored to the unique requirements of electric vehicles.

Electric Vehicle Fluids Market Players:

- Castrol

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Exxon Mobil Corporation

- BP Plc

- Shell Plc

- FUCHS

- TotalEnergies

- Petroliam Nasional Berhad (PETRONAS)

- Saudi Arabian Oil Co.

- Repsol ENEOS Corp.

- Gulf Oil International Ltd.

The electric vehicle fluids market is dominated by key players like Castrol, Valvoline, Shell, and TotalEnergies, all investing heavily in specialized formulations for EV thermal management. These companies are leveraging strategic partnerships with automakers and launching EV-specific product lines to strengthen their market presence.

Here are some leading players in the electric vehicle fluids market:

Recent Developments

- In March 2023, Lubrizol Corporation introduced a novel formulation of sulfur-free driveline lubricant technology for EV transmissions and e-axles. This innovation is expected to enhance the efficiency and reduce th overall environmental impact.

- In December 2022, Gulf Oil Lubricants India Ltd., part of the Hinduja Group, teamed up with Altigreen to supply EV fluids like brake and gear oils. Gulf will now make custom EV fluids for Altigreen’s electric vehicles. This partnership allows Altigreen to use Gulf’s research and development expertise to create a full range of fluids designed for EVs.

- Report ID: 2915

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Vehicle Fluids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.