Electric Vehicle Sensor Market Outlook:

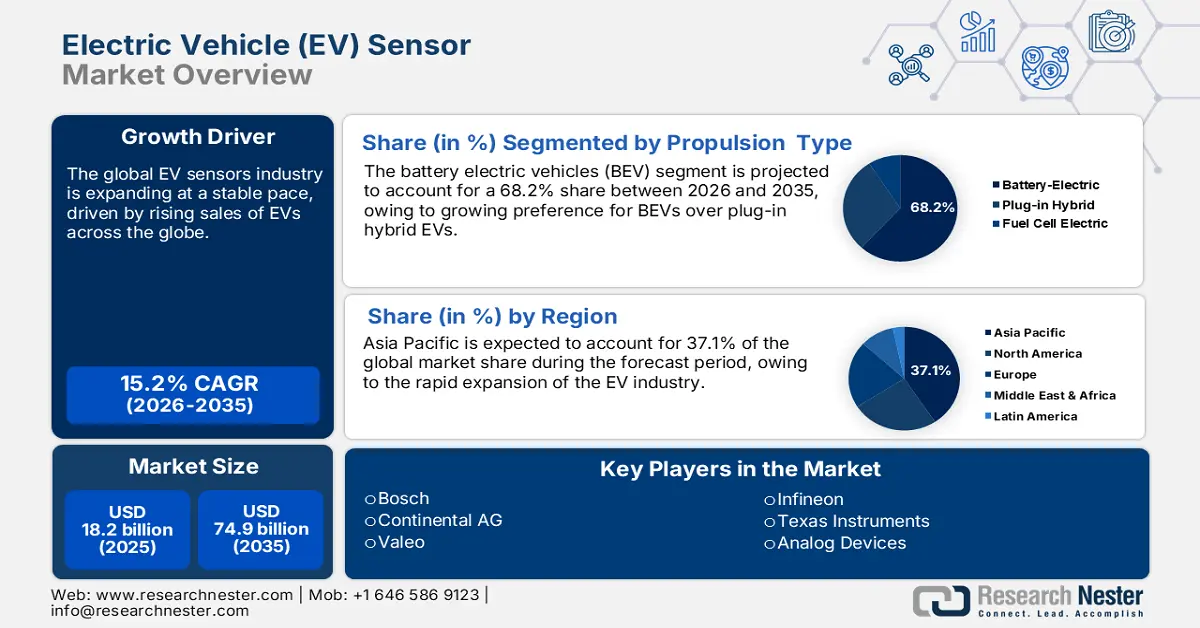

Electric Vehicle (EV) Sensor Market size is valued at USD 18.2 billion in 2025 and is anticipated to surpass USD 74.9 billion by 2035, expanding at a CAGR of 15.2% during the forecast period i.e., between 2026-2035. In 2026, the industry size of electric vehicle (EV) sensor is assessed at USD 20.9 billion.

Source: IEA

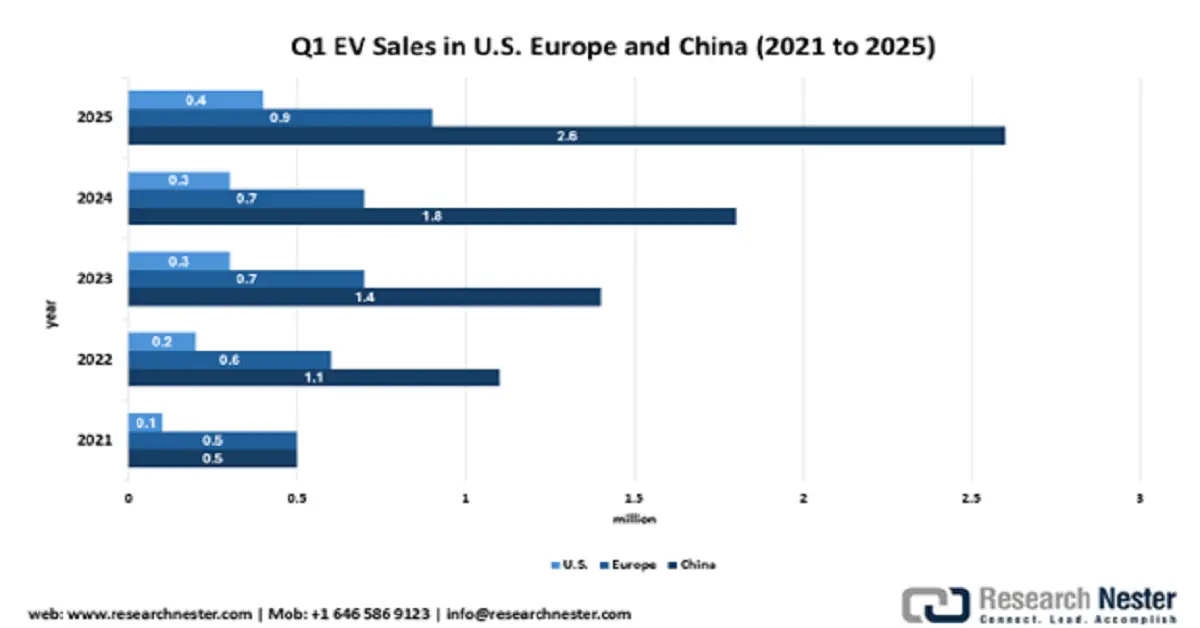

The electric vehicle sensor market is rapidly gaining popularity owing to the rising EV sales across the globe. EV Sensors ensure safety, efficiency, and performance across multiple systems, and assist in managing battery health, powertrain, energy efficiency, thermal management, and safety and driver assistance. According to the IEA analysis, the global sales of electric vehicles reached 17 million in 2024, and an additional 3.5 million cars were sold in the same year, compared to 2023. China maintained its leading position with a total number of EV sales exceeding 11 million due to its trade-in scheme launched in April 2024. As per the scheme, customers are given CNY 20,000 to replace an old vehicle with a new EV. Europe and the U.S. lead the global EV market after China. Thus, the rising adoption of different types of EVs is expected to fuel the demand for advanced sensors. The graph below provides a comparative analysis of the sales of electric vehicles in Q1 between 2021 and 2025.

Key Electric Vehicle Sensor Market Insights Summary:

Regional Highlights:

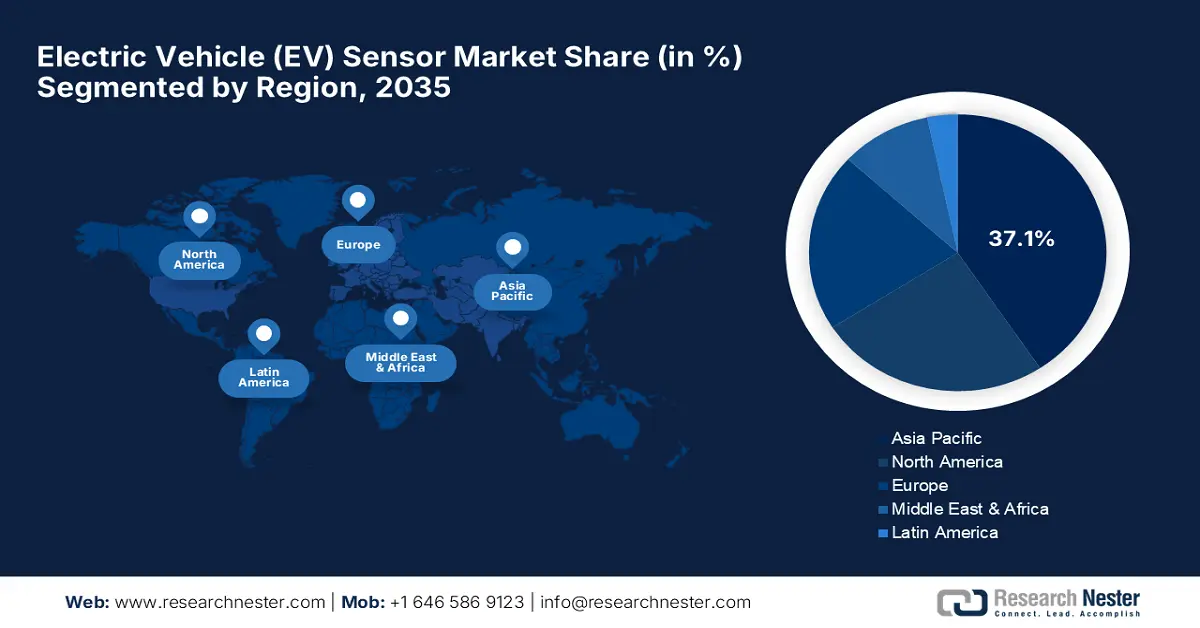

- The Asia Pacific electric vehicle (EV) sensor market is projected to capture 37.1% of the global share by 2035, bolstered by rapid EV industry expansion, favorable government initiatives, and increasing investments in charging infrastructure and battery technologies.

- Europe is anticipated to hold a substantial share by 2035, attributed to accelerating EV adoption supported by government funding for EV battery projects and fiscal incentives stimulating electric car demand.

Segment Insights:

- The temperature sensor segment in the electric vehicle (EV) sensor market is anticipated to capture a notable share by 2035, propelled by increasing demand for advanced thermal management to prevent battery thermal runaway and enhance charging efficiency.

- The battery electric vehicles (BEV) segment is projected to account for a 68.2% share between 2026 and 2035, driven by the surging preference for BEVs over plug-in hybrids and the rising deployment of advanced sensor technologies.

Key Growth Trends:

- Rising integration of ADAS in modern EVs

- Favorable government initiatives

Major Challenges:

- High initial costs and integration complexity

- Disruptions in the supply chain

Key Players: Bosch, Continental AG, Valeo, Infineon, Texas Instruments, Analog Devices, TDK Corporation, Sensata Technologies, Amphenol, Denso Corporation, Renesas Electronics Corporation, Panasonic Corporation, Daihatsu Motor Co. Ltd., Asahi Kasei Microdevices.

Global Electric Vehicle Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.2 billion

- 2026 Market Size: USD 20.9 billion

- Projected Market Size: USD 74.9 billion by 2035

- Growth Forecasts: 15.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, Japan, Germany, United States, South Korea

- Emerging Countries: India, Indonesia, Mexico, Brazil, Vietnam

Last updated on : 1 October, 2025

Electric Vehicle Sensor Market - Growth Drivers and Challenges

Growth Drivers

- Rising integration of ADAS in modern EVs: The rising number of accidents and traffic crashes has resulted in increasing deployment of advanced driver assistant systems (ADAS) in modern electric vehicles. According to the National Highway Traffic Safety Administration (NHTSA), in 2023, more than 40,900 individuals died in motor vehicle crashes. The ADAS not only helps to keep the driver and passenger safe, but also pedestrians and other drivers. These systems rely on different sensors such as cameras, LiDAR, and ultrasonic for features such as adaptive cruise control, parking assistance, and collision assistance.

Driver Assistance Technologies

|

Technology |

Description / Function |

Sensors Used |

|

Forward Collision Warning (FCW) |

Uses sensors to detect slower or stationary vehicles ahead; alerts the driver when a potential crash is imminent via audible, visual, or other signals, so they can brake or steer to avoid it |

Radar, Camera, LiDAR |

|

Lane Departure Warning (LDW) |

Monitors lane markings and alerts the driver if the vehicle drifts out of its lane. It’s only a warning system and does not take corrective action |

Camera |

|

Rear Cross Traffic Warning |

Alerts the driver, while reversing, to potential collisions from approaching traffic that may be outside the view of a backup camera |

Radar, Ultrasonic, Camera

|

|

Blind Spot Warning |

Warns the driver via audio or visual signals-when another vehicle is in the blind spot during a lane change maneuver |

Radar, Camera |

Source: NHTSA

- Favorable government initiatives: Governments across the globe, including India, the U.S., and Europe, are launching initiatives to support the EV sensor market by promoting EV manufacturing, enhancing battery and charging technologies, and localizing production of components. The government of India, for instance, announced the PLI-Auto scheme of USD 3.1 billion that helps in boosting local manufacturing of Advanced Automotive Technology (AAT) products, including various types of sensors. This scheme is focused on zero-emission vehicles and applies from FY 2022-23 to FY 2026-27. In the U.S., the push towards electrification and the Biden administration’s target for 50% zero-emission vehicle sales by 2030 is also expected to fuel the EV sensor market during the forecast period.

Challenges

- High initial costs and integration complexity: One of the key challenges affecting the electric vehicle sensor market growth is the high costs of EV sensors. Advanced sensors, including LiDAR, thermal, current, or battery monitoring, require cutting-edge technology and materials that are complex and expensive to develop and produce. In addition, the need for miniaturization, real-time data processing, and durability contributes to overall development and manufacturing costs. Thus, even though there is a high demand for these sensors, the production is not yet at a mass scale, compared to traditional automotive sensors.

- Disruptions in the supply chain: EV sensors heavily rely on semiconductors and crucial raw materials for processing real-time data. The shortage of these is expected to delay the production processes. However, to overcome such instances, the government of India announced its plans to invest more than USD 577 million in June 2025, to boost the production of rare earth minerals following China's export curbs. In addition, delays in global shipping and rising freight costs are expected to affect the timely availability of EV sensors.

Electric Vehicle Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.2% |

|

Base Year Market Size (2025) |

USD 18.2 billion |

|

Forecast Year Market Size (2035) |

USD 74.9 billion |

|

Regional Scope |

|

Electric Vehicle Sensor Market Segmentation:

Sensor Type Segment Analysis

The temperature sensor segment in the electric vehicle sensor market is expected to account for a significant market share during the forecast period due to its crucial role in preventing battery thermal runaway and improving charging efficiency by regulating and monitoring the thermal levels across the battery, motors, and other electronic components. The rising adoption of EVs and electrification, and stringent regulations and safety requirements for precise thermal monitoring have resulted in growing investments in novel products and technology. In June 2025, Continental AG launched the first e-Motor Rotor Temperature Sensor (eRTS) technology to measure heat in EV motors. This technology delivers precise measurement as compared to current software-based temperature simulation.

Propulsion Type Segment Analysis

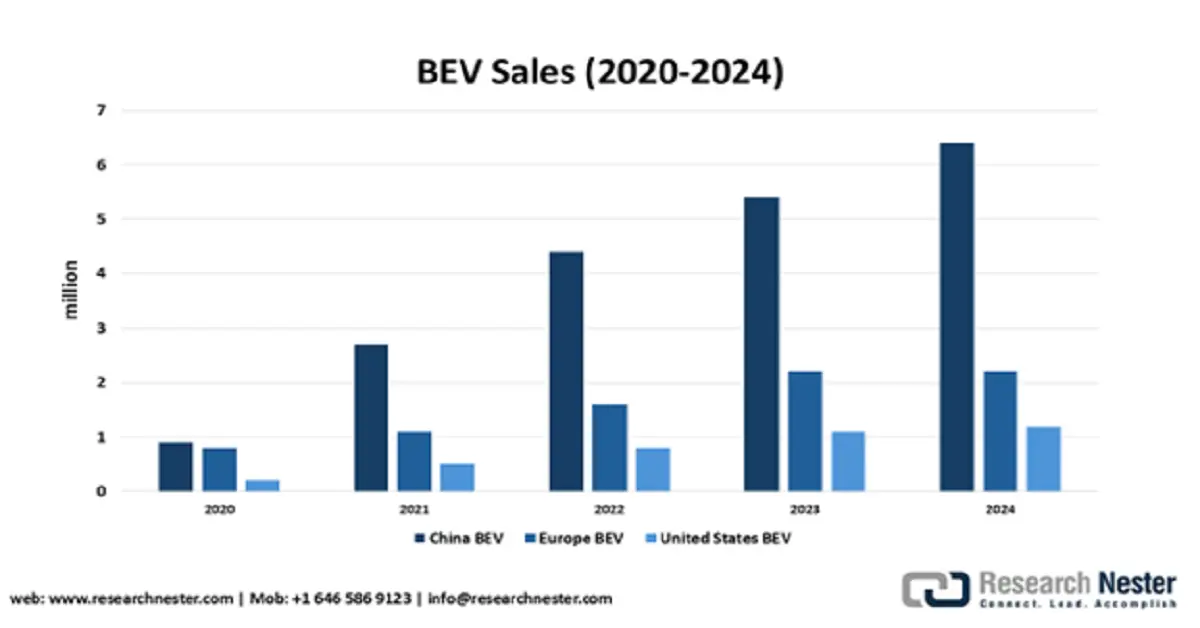

The battery electric vehicles (BEV) segment in the electric vehicle sensor market is projected to account for a 68.2% share between 2026 and 2035, owing to growing preference for BEVs over plug-in hybrid EVs. As per the report published by IEA, in April 2025, the sales of BEVs in China reached 6.4 million in 2024, while it reached 2.2 million in Europe, followed by 1.2 million in the U.S. in the same year. This has resulted in rising investments in developing advanced sensors for BEVs.

Source: IEA

Vehicle Type Segment Analysis

Among the vehicle types, the passenger cars segment in the electric vehicle sensor market is likely to register rapid growth during the stipulated timeframe owing to rising EV adoption curves, especially in Norway, India, China, Japan, and Germany, among others. In 2024, China led the global EV passenger car sales with around 11 million, according to a study by the World Resources Institute. As sales of passenger EV rises, manufacturers are focusing on adding more advanced sensors such as battery temperature, motor position, and ADAS per car, resulting in high demand for sensors. For instance, in October 2024, Honeywell announced the launch of a new sensor, Battery Safety Electrolyte Sensor (BES), in EV passenger cars to detect first vent events.

Our in-depth analysis of the electric vehicle sensor market includes the following segments:

|

Segments |

Subsegments |

|

Sensor Type |

|

|

Vehicle Type |

|

|

Propulsion Type |

|

|

Application |

|

|

Sensor Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Sensor Market - Regional Analysis

Asia Pacific Market Insights

The EV sensor market in Asia Pacific is expected to account for 37.1% of the global market share during the forecast period, owing to the rapid expansion of the EV industry and rising sales of EVs. As per the latest EIA report, the EV sales in emerging and developing economies in Asia reached 400000 in 2024, upto 40% from the previous year. In addition to this, favorable government support to enhance the EV sales and promote zero emission goals by 2050, and rising investments in charging infrastructure and battery technology are expected to fuel the APAC market growth during the forecast period.

In China, the electric vehicle sensor market is expected to expand at a rapid pace during the stipulated timeframe owing to various government initiatives such as direct purchase subsidies, R&D investments, and tax exemptions to support EV adoption. According to IEA, the electric vehicle sales in China increased by more than 40% in 2024, making it the 4th consecutive year in which the sales increased by around 10%. Several Chinese giants are focused on developing advanced sensors for these modern EVs. In April 2024, BYD announced the launch of the Seal EV with LiDAR sensors. Other factors, such as the rapid expansion of ultra-fast DC charging networks and high voltage architectures, China’s robust EV battery supply chain, and rising investments in R&D activities, are expected to fuel market growth in the coming years.

The India electric vehicle sensor market is likely to witness the fastest growth between 2026 and 2035 due to rising sales of electric vehicles in the country and increasing EV launches. According to a statistic by IBEF, the EV sales increased by 49.2% in 2023, reaching 1.52 million units, and as of February 2024, India has around 12416 operational public EV charging stations, with the highest in Maharashtra, followed by Delhi, and so on. Moreover, the rising demand for advanced features such as temperature control, ADAS in modern EVs, and increasing investments in improving battery technology are other factors expected to support market growth going ahead.

Europe Market Insights

Europe is expected to hold a significant share in the global EV sensor market during the forecast period due to the rapid expansion of EV sector and government investments in EV development and infrastructure projects. In July 2025, the European Commission announced its plan to invest €852 million in 6 EV battery projects. This is expected to fuel the demand for different types of sensors. In addition, many European countries provide fiscal support to stimulate market uptake of electric cars by providing tax benefits and incentives, supporting market growth in the coming years.

Germany is a leading electric vehicle sensor market in Europe in terms of automotive sales and production and a key player in the development and production of EV sensors for leak detection, battery current, along temperature control. In May 2022, Continental AG announced the launch of new sensors, the Current Sensor Module (CSM) and Battery Impact Detection (BID) system to protect the EV battery. Moreover, rising sales of EVs and government norms to enhance EV adoption are expected to fuel market growth. The government has set a goal to deploy 15 million EVs by 2030.

The UK market is expected to register rapid growth during the forecast period, being the second-largest car market in Europe. Factors such as rising efforts by public and private sectors to enhance the adoption of EVs and reach the Zero Emission Vehicle target, and a high focus on improving passenger safety, are expected to fuel market growth by 2035. In addition, technological advancements in ADAS features, battery thermal runaway control are expected to boost the demand for advanced EV sensors going ahead.

North America Market Insights

North America electric vehicle (EV) sensor market is expected to register rapid growth by the end of 2035, owing to the rising need for advanced sensors in BEVs and PHEVs, supported by strong environmental policies and incentives at the federal and provincial levels. Moreover, continuous advancements in sensor technologies and rising focus on improving features in EVs, such as collision detection, adaptive cruise control, and lane keeping, are likely to drive the North America market during the forecast period.

The U.S. electric vehicle (EV) sensor market is likely to expand at a fast pace during the forecast period, owing to rising favorable incentives and tax credits for EV buyers and increasing adoption of different types of electric vehicles across the country. As reported by IEA, the EV sales in the U.S. surpassed 1.3 million in 2023. Moreover, the U.S. companies are investing in ADAS and autonomous vehicles, which is expected to lead a rising need for different types of sensors like LiDAR, ultrasonic, and camera. Along with this, demand for EV sensors is expected to rise due to the electrification of fleets, delivery vans, and buses for various uses.

High adoption of various types of EVs in several parts of Canada, including Ontario, Quebec, and British Columbia, increasing investments in automotive sensors and camera technologies, and favorable tax rebates are likely to fuel market growth between 2026 and 2035. In August 2025, the government announced its plan to invest more than $25 million in 33 projects aimed at improving electric vehicle (EV) charging and developing innovative technologies for different types of EVs. This is also expected to increase the demand for advanced sensors. In addition, the market is expected to witness rapid growth due to rising focus on passenger safety and increasing investments in improving EV batteries.

Key Electric Vehicle Sensor Market Players:

- Bosch

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- Valeo

- Infineon

- Texas Instruments

- Analog Devices

- TDK Corporation

- Sensata Technologies

- Amphenol

- Denso Corporation

- Renesas Electronics Corporation

- Panasonic Corporation

- Daihatsu Motor Co. Ltd.

- Asahi Kasei Microdevices

The EV sensor market is highly competitive, comprising key players operating at global and regional levels dominated by diversified Tier-1s and semiconductor experts possessing thorough automotive qualifications and safety credentials. Bosch, DENSO, Continental and Valeo utilize system-level integration (powertrain, chassis, ADAS) to specify and package sensors into car platforms. Infineon, NXP, STMicroelectronics, Texas Instruments, Renesas and Analog Devices control mixed-signal, power and magnetic/MEMS portfolios for EV power and control. Allegro MicroSystems, Melexis and TDK lead in magnetic/current and position sensing, and Sensata, TE Connectivity, Amphenol and Honeywell provide current, pressure, temperature, and connectivity components at automotive grade.

Here are some leading companies in the electric vehicle (EV) sensor market:

Recent Developments

- In June 2025, Continental developed a new sensor technology called the e-Motor Rotor Temperature Sensor (eRTS). The eRTS sensor directly measures the temperature inside permanent magnet synchronous EV motor rotors, an enormous improvement compared to the traditional approach of using software calculations.

- In January 2025, Aptiv showcased its next-generation ADAS technologies, including the Gen 6 ADAS platform, designed for software-defined vehicles at CES 2025. This modular platform extends to automobile manufacturers the means to add diverse sensors, such as Aptiv's new Gen 8 radar family. Gen 8 radars, equipped with AI/ML capabilities, offer higher range and resolution for better object detection and classification, hence being integral to both Level 2 and higher autonomous driving levels.

- In March 2025, TDK Corporation announced the launch of new immersion temperature sensors for EV powertrain cooling applications. This highly responsive, fully sealed NTC thermistor is engineered to provide fast and precise temperature control, e.g., for oil-cooled systems.

- In October 2023, Denso Corporation, one of the big Japanese players, and KOITO MANUFACTURING CO., LTD. entered into a tie-up to build a system that supports boosting the object recognition rate of vehicle image sensors by synchronizing them with lamps. The tie-up will contribute to ensuring the safety of nighttime driving.

- Report ID: 8145

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Vehicle Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.