Global EV Traction Motors Market

- An Outline of the Global Electric Vehicle (EV) Traction Motors Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Market Overview

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulations

- Technological Advancements

- Patent Analysis

- Growth Outlook

- Risk Analysis

- Price Benchmarking

- Regional Demand

- Projected BEV Traction Motors by Voltage Range (2024–2036)

- Global Market Share of Automakers (2024)

- Detailed Overview of EV Traction Motor Technologies

- Electric Vehicle Types: Adoption, Performance, and Market Outlook

- Growth Forecast for Electric Vehicle (EV) Traction Motors products by Vehicle Type

- Root Cause Analysis (RCA) for Discovering Problems in the Industry

- Porter Fiver Forces

- PESTLE

- Comparative Positioning

- Competitor SWOT Analysis

- Strategic Developments by Competitors in the Industry

- Competitive Model

- Company Market Share

- Business Profile of Key Enterprise

- ABB Ltd.

- Hitachi Astemo Americas, Inc.

- MAHLE GmbH

- Medha Traction Equipment Pvt. Ltd.

- NIDEC CORPORATION

- PARKER-HANNIFIN CORPORATION

- Robert Bosch GmbH

- SDT Drive Technology

- WEG

- YASA Limited

- Global Electric Vehicle (EV) Traction Motors Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Electric Vehicle (EV) Traction Motors Market Segmentation Analysis (2024-2036)

- By Motor Type

- Permanent Magnet Synchronous Motors (PMSM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Induction Motors (IM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Brushless DC Motors (BLDC), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Switched Reluctance Motors (SRM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Voltage

- Below 100V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 100-200V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 200-400V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 400-800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Above 800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Vehicle Type

- Battery Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Plug-In Hybrid Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Regional Synopsis, Value (USD Million), 2024-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- By Motor Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2036

- Increment $ Opportunity Assessment, 2024-2036

- Segmentation (USD million), 2024-2036, By

- By Motor Type

- Permanent Magnet Synchronous Motors (PMSM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Induction Motors (IM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Brushless DC Motors (BLDC), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Switched Reluctance Motors (SRM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Voltage

- Below 100V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 100-200V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 200-400V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 400-800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Above 800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Vehicle Type

- Battery Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Plug-In Hybrid Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- By Motor Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2036

- Increment $ Opportunity Assessment, 2024-2036

- Segmentation (USD million), 2024-2036, By

- By Motor Type

- Permanent Magnet Synchronous Motors (PMSM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Induction Motors (IM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Brushless DC Motors (BLDC), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Switched Reluctance Motors (SRM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Voltage

- Below 100V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 100-200V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 200-400V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 400-800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Above 800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Vehicle Type

- Battery Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Plug-In Hybrid Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- By Motor Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2036

- Increment $ Opportunity Assessment, 2024-2036

- Segmentation (USD million), 2024-2036, By

- By Motor Type

- Permanent Magnet Synchronous Motors (PMSM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Induction Motors (IM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Brushless DC Motors (BLDC), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Switched Reluctance Motors (SRM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Voltage

- Below 100V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 100-200V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 200-400V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 400-800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Above 800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Vehicle Type

- Battery Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Plug-In Hybrid Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- By Motor Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2036

- Increment $ Opportunity Assessment, 2024-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2024-2036, By

- By Motor Type

- Permanent Magnet Synchronous Motors (PMSM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Induction Motors (IM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Brushless DC Motors (BLDC), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Switched Reluctance Motors (SRM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Voltage

- Below 100V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 100-200V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 200-400V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 400-800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Above 800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Vehicle Type

- Battery Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Plug-In Hybrid Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- By Motor Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2036

- Increment $ Opportunity Assessment, 2024-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2024-2036, By

- By Motor Type

- Permanent Magnet Synchronous Motors (PMSM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Induction Motors (IM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Brushless DC Motors (BLDC), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Switched Reluctance Motors (SRM), Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Voltage

- Below 100V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 100-200V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 200-400V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- 400-800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Above 800V, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- By Vehicle Type

- Battery Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Plug-In Hybrid Electric Vehicles, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2024-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2024-2036F

- By Motor Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

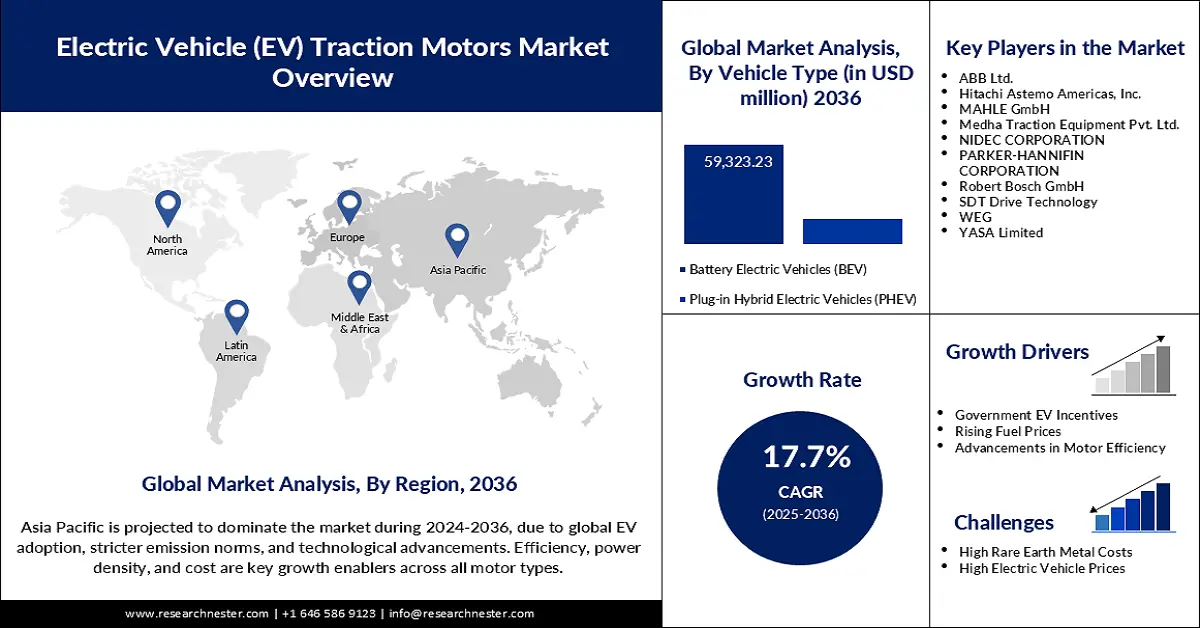

Electric Vehicle Traction Motor Market Outlook:

Electric Vehicle Traction Motor Market size was valued at USD 10.7 billion in 2024 and is projected to reach a valuation of USD 75.9 billion by the end of 2036, rising at a CAGR of 17.7% during the forecast period, i.e., 2025-2036. In 2025, the industry size of electric vehicle traction motor is assessed at USD 12.6 billion.

The electric vehicle traction motor market is accelerating with advances in technology, cross-industry convergence, and heightened international focus on decarbonization. In March 2024, ABB secured a USD 150 million contract with Hyundai Rotem for the supply of advanced traction systems for 65 electric trains operating in Queensland, Australia, thereby enhancing regional sustainable efforts and setting new standards for efficiency. The automotive sector is also rising, with companies introducing electric light commercial vehicles and establishing themselves in a fast-changing mobility market. Producers are competing to meet the demand for increased performance, longevity, and local manufacturing, as governments enforce strict EV take-up mandates and invest in robust supply chains.

Assembly line innovation has centered on vertical integration, as a number of U.S. and foreign automakers moved toward modular and scalable configurations to contain savings and risk of supply. Government-sponsored R&D focused on power density increases, reliability, and cost compression—objectives include cost savings through alternative materials and design breakthroughs, while industry and government laboratories strive to reduce dependence on rare earths and optimize thermal management. These initiatives are critical to scaling to meet ambitious volume targets by major economies and mitigating recognized bottlenecks in extraction and component handling.

Key Electric Vehicle Traction Motors Market Insights Summary:

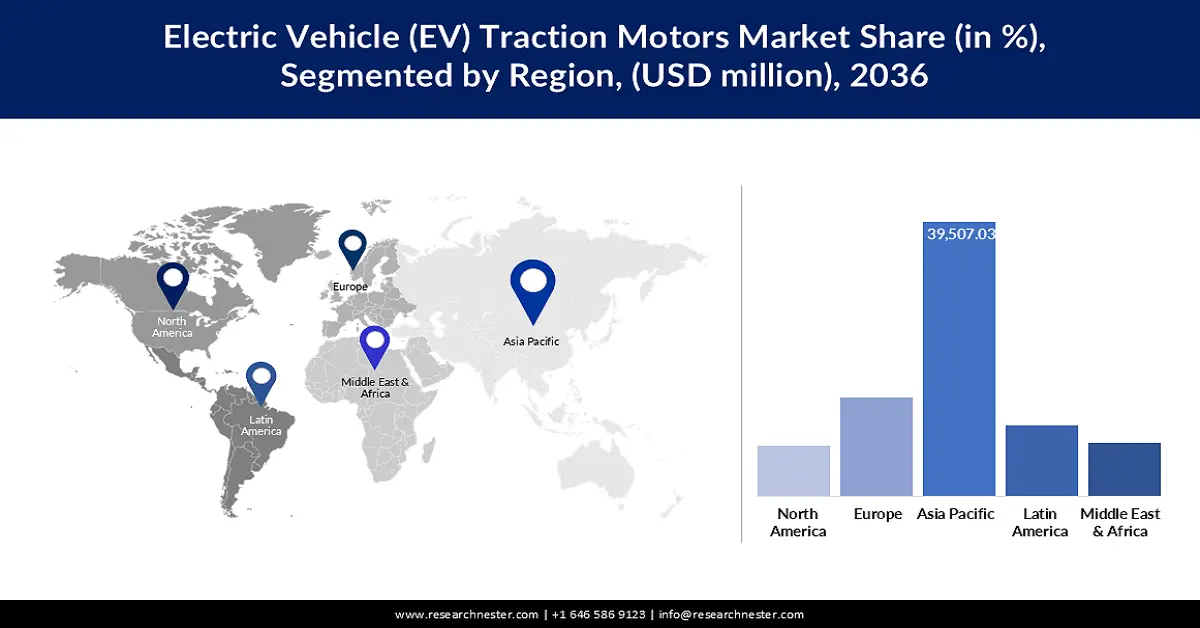

Regional Insights:

- The Asia Pacific Electric Vehicle Traction Motor Market is projected to secure a 52% share during 2026–2035, impelled by mass-scale electrification, expanding EV adoption, and rising regional investment.

- North America is anticipated to grow at a CAGR of 16.9% from 2025 to 2036, owing to robust policy support, OEM investment surges, and technological advancements in eDrive integration.

Segment Insights:

- The permanent magnet synchronous motors (PMSM) segment is anticipated to capture a 73.9% share during 2026–2035 in the Electric Vehicle Traction Motor Market, propelled by rising demand for high-efficiency and high-torque solutions in both passenger and commercial EVs.

- The 200–400V segment is projected to command a 53.3% share by 2036, supported by its widespread adoption in mainstream passenger and light commercial vehicles owing to optimized energy efficiency and cost balance.

Key Growth Trends:

- Aggressive investments in EV platforms by automobile manufacturers

- Expansion of electrified commercial vehicles and buses

Major Challenges:

- Regulatory emphasis on EV localization and traceability of parts

- Evolving safety and performance specifications

- Key Players: Robert Bosch GmbH (Germany), Nidec Corporation (Japan), ZF Friedrichshafen AG (Germany), Valeo (France), BorgWarner Inc. (USA), Parker-Hannifin Corp (USA), Hitachi Astemo, Ltd. (Japan), Jing-Jin Electric Technologies Co., Ltd. (China), Shanghai Edrive Co. Ltd. (China), Electrodrive Powertrain Solutions Pvt. Ltd. (India), YASA Limited (UK), Magna International Inc. (Germany), Dana Limited (USA), AMETEK Inc. (USA), Toshiba International Corporation (USA).

Global Electric Vehicle Traction Motors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 10.7 billion

- 2026 Market Size: USD 12.6 billion

- Projected Market Size: USD 75.9 billion by 2036

- Growth Forecasts: 17.7% CAGR (2025-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52% Share by 2036)

- Fastest Growing Region: North America

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: India, Mexico, Indonesia, Thailand, United Kingdom

Last updated on : 23 September, 2025

Electric Vehicle Traction Motor Market - Growth Drivers and Challenges

Growth Drivers

- Aggressive investments in EV platforms by automobile manufacturers: One of the major drivers of the market is aggressive investment by automakers to launch affordable, versatile EV platforms. In August 2025, Ford declared a $5 billion investment in equipment for battery plants and $700 million in tax credits to launch a global battery EV platform by 2027 as part of an effort to cut lower inverter, chassis, and traction motor costs. The initiative is planned to compete with Chinese giants and promote affordable EV growth aggressively across global markets. In addition, stricter emissions regulations and government subsidies by manufacturers in response are likely to fuel further demand for high-efficiency traction motors.

- Expansion of electrified commercial vehicles and buses: Another catalyst is the global expansion of electrified commercial vehicles and buses, particularly in regions with stringent clean mobility regulations. For example, ZF's introduction of its AxTrax 2 electric axle drives into a multi-year contract from India's leading automaker in April 2025 marks ZF's entry into the Asian e-bus market, helping India achieve its mass-scale zero-emissions transport ambitions. These advancements are compelling original equipment manufacturers and suppliers in Europe, Asia, and North America to consider energy-efficient, scalable, and integrated traction motor technologies for public fleets and mass-market EVs.

Challenges

- Regulatory emphasis on EV localization and traceability of parts: A significant barrier to electric vehicle traction motor market growth is the increasing regulatory emphasis on the complete localization and traceability of EV parts. India's Ministry of Heavy Industries, in March 2025, mandated that all key EV systems, traction motors, controllers, and batteries be sourced and made locally, even for electric two- and three-wheelers and buses. This policy requires both domestic and international manufacturers to retool supply chains and invest heavily in local production, all the while overcoming new compliance hurdles. As more countries join the trend, the transition could come to a screeching halt or be fragmented market growth unless supply chains are quickly able to keep up.

- Evolving safety and performance specifications: Another challenge lies in the rapid evolution of safety and performance specifications, particularly for high-voltage drive systems in developing countries. These regulation updates require costly R&D for advanced fault protection, onboard diagnostics, and failsafe design. Speed-to-market must be weighed against robust compliance by manufacturers, which raises both technology and operational risks as the EV rollout increases.

Electric Vehicle Traction Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2036 |

|

CAGR |

17.7% |

|

Base Year Market Size (2024) |

USD 10.7 billion |

|

Forecast Year Market Size (2036) |

USD 75.9 billion |

|

Regional Scope |

|

Electric Vehicle Traction Motor Market Segmentation:

Type Segment Analysis

The permanent magnet synchronous motors (PMSM) segment is anticipated to hold a 73.9% share during the forecast period, owing to their dominance in high-efficiency and high-torque applications. In March 2024, BYD launched the 1000V e-Platform 3.0 Evo, with upgraded PMSMs and SiC inverters for super-fast charging and extended EV range. PMSMs are used as they have high power density, precise speed control, and increased efficiency in passenger and commercial EVs. Ongoing investment in SiC power electronics and rare-earth-free alternatives is expected to solidify PMSM's leadership in future-generation designs. As manufacturers focus on energy efficiency and reliability, PMSMs will remain the motor of choice, with technology aimed at maximizing output while minimizing the use of rare earths and reducing cost unpredictability.

Voltage Segment Analysis

The 200-400V segment is projected to achieve a 53.3% share in 2036 on the strength of its popularity with mainstream passenger and light commercial EVs that require a trade-off between energy efficiency and cost. All major EV platforms worldwide are dependent on this voltage segment for facilitating best-in-class trade-offs among system complexity, battery size, and fast-charging capability. In May 2024, GM patented a state-of-the-art traction motor-based wheel speed recovery and control system natively integrated with 200-400V architectures that boosts regenerative braking and performance in a wide range of vehicles. Ongoing innovation in inverter design and energy management technology for such systems will continue to drive their dominance, empowering scalable electrification across both developed and emerging EV markets.

Our in-depth analysis of the electric vehicle traction motor market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Voltage |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Traction Motor Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific electric vehicle traction motor market is anticipated to garner a 52% share during the forecast period, driven by mass-scale electrification, active vehicle adoption, and extensive regional investment. Mahindra embarked on the domestic roll-out of Gen5 rare-earth-free traction motors for new electric SUVs in February 2025, propelling localized, low-cost-led innovation that benefits both Indian and export markets. Asia is also seeing an increase in the adoption of magnet-free and modular designs, as domestic legislation encourages the use of indigenous components for delivery fleets and buses. The APAC market, with robust supply chains and manufacturing networks, is set to witness long-term and durable growth.

China electric vehicle traction motor market is expanding fast, backed by mass-manufacturing scale, rising exports, and high-volume e-mobility support from the state. In March 2025, CRRC Electric Vehicle announced it had begun pre-research for its next-generation intelligent driving system serving commercial and mass-market EV demand, further establishing China's supply chain dominance in the region. BYD's September 2024 launch of the 1000V e-Platform 3.0 Evo, with even better PMSM and SiC inverter integration, marks China's long-range, high-performance platform leadership. China's focus on zero-emission vehicle production establishes a global standard of innovation.

India electric vehicle traction motor market is expanding swiftly, with bold policy reforms and rising domestic production. Ashok Leyland partnered with Nidec in October 2024 to co-develop next-gen e-drive motors that are suitably designed for Indian driving conditions, propelling e-mobility in commercial vehicles and buses. The launch of indigenous, magnet-free technology, such as Sona Comstar and the January 2025 pact by Enedym, is in line with India's full-localization mandate for EV components. Current AIS-38 and short-circuit safety revisions, rolled out from late 2024 to early 2025, push local innovation further, positioning India as a regional benchmark for the safe and affordable traction motor manufacturing.

North America Market Insights

North America electric vehicle traction motor market is expected to increase at a CAGR of 16.9% between 2025 and 2036, driven by government policy initiatives, technological advancements, and surges in OEM investment. The region is strengthened by modularity, eDrive platform integration, and higher manufacturing, as demonstrated by Magna's February 2024 production ramp of combined eDrive units for North American OEMs. Incentives and the strict emissions regulations enable North America's rapid transition to domestic, high-efficiency traction motor solutions.

The U.S. electric vehicle traction motor market is advancing quite rapidly, fueled by tighter EPA emissions regulations finalized in August 2024 for model years 2027-2032. These regulations are driving an extensive move towards high-efficiency motor adoption and fleet electrification. For instance, in January 2023, Lucid Motors announced a new motorsports electric drive unit derived from technology in the Lucid Air sedan, illustrating the leadership of the U.S. EV traction motor market in both mainstream and premium traction motor technology. With rising domestic content mandates and technology investment, the U.S. is poised for further volume and technical progress.

Canada electric vehicle traction motor market is growing at a stable rate, owing to the rising investments by technology partners and manufacturers in localized manufacturing and system integration. For instance. ABB announced a CAD $130 million investment in a new R&D and manufacturing facility in Montreal in August 2025, consolidating existing operations and expanding production capacity for sectors including transportation. Canadian car manufacturers are also investing in next-generation motor control software and deploying rare-earth-free motor technologies. Federal and provincial incentives towards fleet electrification and EV component localization are stimulating steady innovation and growth in Canada's EV traction motor sector.

Europe Market Insights

Europe EV traction motor market is expected to witness significant growth between 2026 and 2038, driven by ambitious carbon neutrality goals, increasing localization, and government incentives for EV infrastructure. In March 2024, Hyundai and IVECO introduced the 'eMoovy' electric commercial vehicle platform in Europe, blending electric motor technology with local assembly. Further investment and fleet transformation are promoted by the European Union's distribution of $422 million in October 2023 through the AFIF program for H2 refueling and EV charging. As new partnerships and supply agreements proliferate, Europe remains a hub of advanced motor technology innovation and green mobility.

Germany electric vehicle traction motor market is backed by ground-breaking high-voltage and rare-earth-free traction motor tech innovation. In January 2024, Bosch and Cariad launched a joint project for an automated valet charging technology. The technology is currently being tested in employee parking garages in Germany. This initiative directly addresses common EV charging frustrations, such as long queues for chargers and the need to manually connect charging cables. The region's automotive supply chain is supported by local manufacturing, R&D growth, and partnerships aimed at modular, scalable e-drive systems for the premium and mass market. Government-backed emission and localization standards ensure sustained growth.

The UK EV traction motor market is emerging as a hub for ultra-light, axial flux, and in-wheel motor technology. In June 2025, YASA Limited began developing high-torque, rare-earth-free axial flux motors with £23 million support from the Advanced Propulsion Centre, targeting take-up in UK and foreign EVs. Government net-zero commitment, combined with investment in electrified mobility R&D, is influencing new vehicle architectures and next-generation traction motor supply chains. The UK's blend of start-up ingenuity and OEM collaboration places it at the global vanguard of fast-paced EV drivetrain innovation.

Key EV Traction Motor Market Players:

- Robert Bosch GmbH (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nidec Corporation (Japan)

- ZF Friedrichshafen AG (Germany)

- Valeo (France)

- BorgWarner Inc. (USA)

- Parker-Hannifin Corp (USA)

- Hitachi Astemo, Ltd. (Japan)

- Jing-Jin Electric Technologies Co., Ltd. (China)

- Shanghai Edrive Co. Ltd. (China)

- Electrodrive Powertrain Solutions Pvt. Ltd. (India)

- YASA Limited (UK)

- Magna International Inc. (Germany)

- Dana Limited (USA)

- AMETEK Inc. (USA)

- Toshiba International Corporation (USA)

The electric vehicle traction motor market is extremely competitive, featuring an international portfolio of seasoned players and new entrants driving innovation, scale, and diversity in applications. Key companies in the market are advancing product portfolios with integrated drives, rare-earth-free innovations, and high-voltage e-axle offerings and competing in the auto, rail, and commercial vehicle industries. Among the significant developments in the industry was when Bosch began delivering new high-voltage e-axles to Daimler in March 2025, thereby optimizing Europe's premium electric truck platforms. Meanwhile, players such as ABB, BYD, and Magna are building up capacity for next-generation, high-torque applications. While OEMs are driving decarbonization, mobility innovation, and localization, competition will continue to be driven by technology, policy, and the globalization of the EV value chain.

Here are some leading companies in the electric vehicle traction motor market:

Recent Developments

- In June 2025, YASA Limited inaugurated the UK’s first axial flux motor super-factory, specializing in high-density, lightweight EV motors. Backed by Mercedes-Benz, the facility aims to bolster the supply of next-generation traction motors to global premium and performance EV manufacturers.

- In April 2025, ZF Commercial Vehicle Solutions commenced its first large-scale deployment of AxTrax 2 electric axles in India, supporting a significant fleet renewal toward zero-emission intercity buses. This rollout contributes to India’s clean bus targets and strengthens ZF’s local footprint.

- In October 2024, Mahle and Valeo announced a joint development to expand their magnet-free motor technology to higher-segment EVs. This collaboration highlights the motor's potential beyond entry-level vehicles.

- Report ID: 7981

- Published Date: Sep 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.