Agricultural Electric Vehicles Market Outlook

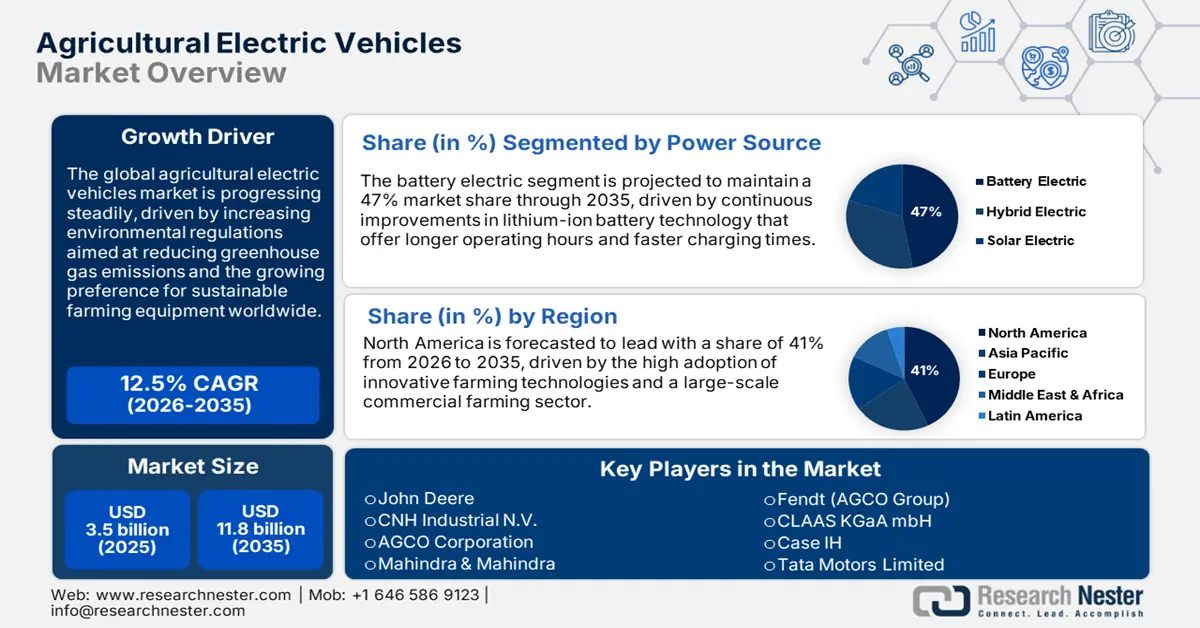

Agricultural Electric Vehicles Market size is valued at USD 3.5 billion in 2025 and is projected to reach a valuation of USD 11.8 billion by the end of 2035, rising at a CAGR of 12.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of agricultural electric vehicles is evaluated at USD 3.9 billion.

The global agricultural electric vehicles market is progressing steadily, driven by environmental issues and the demand for lower emissions. Emerging battery technology and vehicle design allow for cost-effective, efficient operations in today's agriculture. Manufacturers are dedicated to creating adaptable and sustainable EV solutions to suit various farm requirements. In June 2025, John Deere committed $20 billion investment in U.S. production over the next 10 years, directly countering false rumors about shutting down U.S. manufacturing operations. Furthermore, governments from around the world provide subsidies and incentives to promote the adoption of electric vehicles and increase charging infrastructure. Together, these factors drive market growth and enable farmers to meet regulatory requirements. EVs represent a transformative shift towards greener farming globally.

Policy support and incentives globally are critical to driving agriculture EV adoption through comprehensive funding programs and regulatory frameworks. The U.S. encourages the use of EVs through grants and tax incentives, enabling infrastructure development throughout the country. Europe supports the integration of EVs with the Common Agricultural Policy and tight emission measures across the EU member states. Government support for electric agricultural vehicles globally includes 2025 USDA grants and loans to energy-saving farm equipment, such as electric tractors. Additionally, the California Air Resources Board (CARB) has enforced strict emission measures that have pressured farmers to use electric substitutes. Coordinated actions by governments, producers, and providers of services facilitate the diffusion of technology, bridging adoption hurdles. The activities promote the sustainable growth of agricultural electric vehicle markets worldwide.

Key Agricultural Electric Vehicles Market Insights Summary:

Regional Insights:

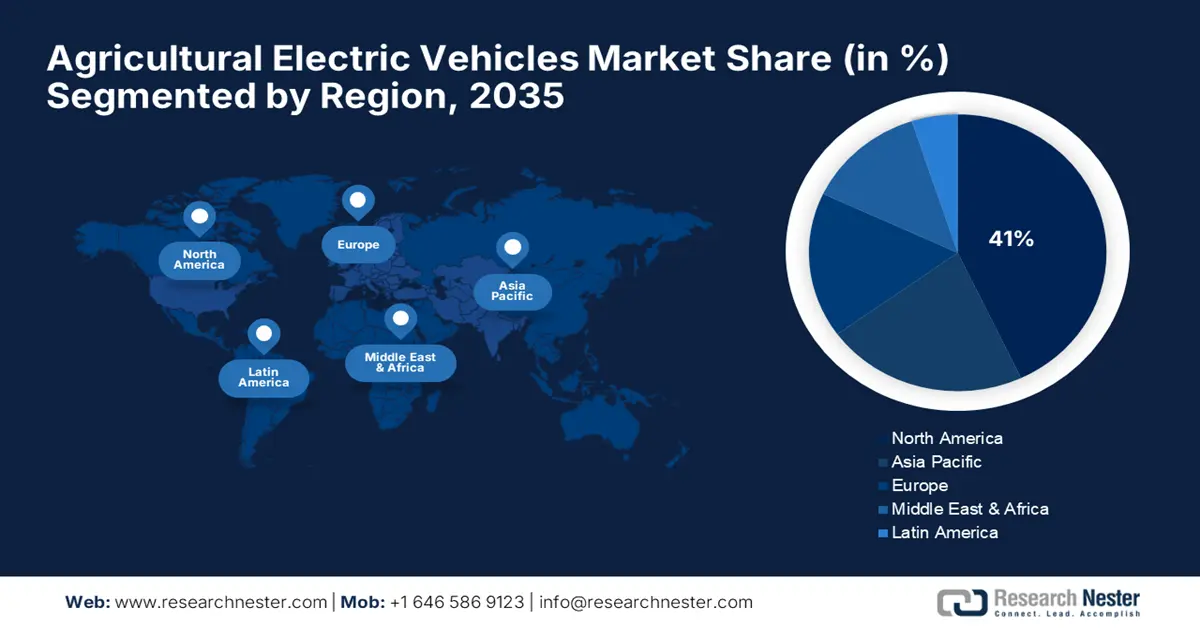

- North America is projected to hold around 41% share of the Agricultural Electric Vehicles Market throughout the forecast period, impelled by strong government support and advanced manufacturing infrastructure.

- Europe is expected to witness steady growth from 2026 to 2035, owing to wide-ranging climate policies and technological innovation programs.

Segment Insights

- The electric tractors segment is projected to account for 37% share of the Agricultural Electric Vehicles Market during the forecast period, propelled by versatility for various farm operations.

- The battery electric segment is expected to hold a 47% share by 2035, driven by the increased adoption of clean energy power systems in agriculture.

Key Growth Trends:

- Advances in battery technology facilitate longer operations

- Government policy incentives boost market adoption

Major Challenges:

- Infrastructure development challenges restrict rural adoption

- Technology complexity needs specialized expertise

Key Players:John Deere, CNH Industrial N.V., AGCO Corporation, Mahindra & Mahindra, Fendt (AGCO Group), CLAAS KGaA mbH, Case IH, Tata Motors Limited, Solis International, Samsung Heavy Industries.

Global Agricultural Electric Vehicles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 7 billion

- Projected Market Size: USD 11.8 billion by 2035

- Growth Forecasts: 12.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, Japan, Canada

- Emerging Countries: China, India, Brazil, Australia, South Korea

Last updated on : 3 September, 2025

Agricultural Electric Vehicles Market - Growth Drivers and Challenges

Growth Drivers

- Advances in battery technology facilitate longer operations: More advanced battery technology provides extended operating times and rapid charging for electric farm vehicles in various farming uses. Advances in battery chemistry and energy density significantly improve vehicle efficiency and reduce downtime during peak farming seasons. Battery manufacturers work closely with vehicle manufacturers to maximize performance, designing batteries precisely to suit the patterns of agricultural applications and operational requirements. Energy management systems also enhance the usage of electrical power in agriculture and provide real-time monitoring functions. In November 2023, CNH Industrial (New Holland) debuted the T4 Electric Power utility tractor at Agritechnica 2023, its European public premiere as the industry's first all-electric utility tractor. The Battery Electric Vehicle (BEV) boasts cutting-edge autonomous features embodying New Holland and CNH Industrial's most advanced stage of strategic electrification plan.

- Government policy incentives boost market adoption: Government subsidy schemes and integrated regulation provide a head start on the early adoption of sustainable agricultural vehicles in global markets. Incentives include rebates at the time of purchase, tax credits, and substantial investments in rural charging infrastructure development. Policies align with the aims of climate action by encouraging low-emission technologies in agriculture while subsidizing the transition expenses of farmers. In 2025, the China government promoted electric vehicles by waiving value-added tax (VAT) and import tariffs for electric tractor manufacturers on major components, while electric vehicles were exempt from registration and driving bans. China launched purchase incentives for long-range pure electric vehicles over 400 km, and offered major incentives for electric range 250-400 km vehicles. Accelerating programs in the US, Europe, and Asia improve marketplace accessibility and affordability.

- Technological integration advances precision farming ability: Combining AI, telematics, and IoT in electric agriculture implements creates high-end precision farming ability and data-driven decision making. Real-time data capture and connectivity enable remote monitoring, predictive repair, and better vehicle deployment to optimize farming operations. Intelligent tractors and implements give farmers actionable suggestions for enhanced productivity and resource efficiency management. For instance, Kubota Corporation introduced a new IsoMatch FarmCentre telematics solution in November 2023 at Agritechnica 2023, with cutting-edge technology revolutionizing the management of a farm with real-time data and insights. A significant amount is spent by manufacturers in developing in-depth ecosystems between cars, sensors, and management platforms for increased operational effectiveness.

Declining Battery Costs and Improved TCO Fuel Agricultural EV Adoption

Falling battery pack prices, down over 25% globally in 2024, are significantly lowering the upfront cost of agricultural electric vehicles (Ag EVs). While Ag EVs already offer a lower total cost of ownership (TCO) due to reduced fuel and maintenance expenses, narrowing the purchase price gap with conventional diesel-powered equipment remains critical for broader adoption.

|

Factor |

Impact on Agricultural EV Affordability |

|

Battery Price Decline |

Global battery pack prices fell >25% in 2024, reducing upfront costs for electric tractors and harvesters. |

|

Total Cost of Ownership (TCO) |

Lower operating costs (electricity vs. diesel) and reduced maintenance make Ag EVs financially viable over their lifespan. |

|

Regional Disparities |

China leads in cost reduction due to competition; the U.S. and EU lag due to higher manufacturing and import costs. |

|

Economies of Scale |

Increased production volumes and specialized Ag EV models are driving down costs, particularly for mid-sized equipment. |

Source: IEA

Challenges

- Infrastructure development challenges restrict rural adoption: Meager availability of charging points and electricity grid capacity in sparsely populated rural regions massively slows universal take-up of agricultural electric vehicles. Rural farm areas are confronted with huge connectivity issues for telematics and data transmission necessary for the operations of modern smart farming. Creating a secure charging infrastructure specially designed for farm usage involves huge coordinated public-private investment and planning initiatives. In August 2024, the USDA National Institute of Food and Agriculture expanded the Data Science for Food and Agricultural Systems (DSFAS) program under the Agriculture and Food Research Initiative (AFRI), with a specific focus on the intersections of data science and artificial intelligence with agriculture. A1541 DSFAS aims to empower systems and communities to effectively leverage data, enhance resource management, and incorporate new technology, automation, mechanization, and strategies. Defeating these infrastructural obstacles is crucial to achieving widespread electric vehicle adoption in the agricultural sector.

- Technology complexity needs specialized expertise: State-of-the-art electric vehicles have sophisticated systems demanding specialized maintenance skills and expert technical knowledge not typically found in rural settings. Rural agricultural areas often lack experienced technicians with the skills to work on advanced electric powertrains and electronic control systems. Farmers will have to invest heavily in training and continuous technical support to allow for consistent vehicle operation and maintenance. In November 2024, John Deere released its market contraction expectations for 2025, indicating difficult conditions in the agricultural equipment industry. The company reported a 16% decline in sales and revenue compared to the previous year, while maintaining its focus on operational excellence and customer productivity improvement. The complexity of integrating new electric technologies can hinder adoption rates in spite of obvious operating and environmental advantages.

Agricultural Electric Vehicles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 11.8 billion |

|

Regional Scope |

|

Agricultural Electric Vehicles Market Segmentation:

Vehicle Type Segment Analysis

The electric tractors segment is expected to retain 37% of the agricultural electric vehicles market share during the forecast period, owing to versatility for various farm operations such as plowing, planting, and material transportation. These vehicles offer comprehensive functionality that covers most agricultural activities, providing emissions-free alternatives to conventional diesel tractors. Advancements in battery and motor technology enable competitive performance on par with conventional tractors while reducing operational expenses. In August 2025, Case IH introduced new equipment and farmer-centric innovations at Farm Progress Show, showcasing the most powerful tractor in the Steiger family, the Steiger 785 Quadtrac with 785-rated/853-peak horsepower. The new model delivers maximum power to the ground while offering superior traction and reduced compaction, enabling farmers to manage bigger implements. Accelerating demand for zero-emission options fuels ongoing growth and innovation within this leading segment.

Power Source Segment Analysis

The battery electric segment is projected to maintain a 47% agricultural electric vehicles market share through 2035, as the increased preference for clean energy power systems in agriculture gains traction. Advances in batteries and the fast-growing expansion of charging infrastructure development underpin this market choice over other power sources. Governments worldwide are promoting adoption by offering specific policy incentives to reduce agricultural emissions and increase the popularity of sustainable agriculture. For example, VST Tillers Tractors Ltd introduced the indigenously created electric tractor, VST FIELDTRAC 929 EV, during Agritechnica 2023 in Hanover, Germany, in September 2024. This first electric tractor has a 25kWh battery providing maximum torque of 110 Nm and a lift capacity of 1250 kgs with dual-acting power steering. Battery electric solutions offer substantial operational cost savings and a good fit with environmental sustainability objectives while enabling precision agriculture applications.

Application Segment Analysis

The crop farming segment is expected to hold a 39% agricultural electric vehicles market share by 2035, driven by the need for precision crop management that requires vehicles capable of operating efficiently in diverse climatic and soil conditions. Electromobility in tractors and purpose-built implements enables sustainable agricultural practices and compliance with environmental regulations while maintaining operational efficiency. AutoNxt Automation unveiled revolutionary electric tractor technologies in January 2025 at Krishithon 2023, showcasing a prototype 20HP Electric Tractor and introducing a new Loader application for a 45HP tractor. The company highlighted dedication to transforming the agrarian landscape through these technologies, utilizing state-of-the-art battery technology and automated solutions. Rising global food production demand, with accelerating technology adoption, drives ongoing segment growth and innovation.

Our in-depth analysis of the agricultural electric vehicles market includes the following segments:

|

Segment |

Subsegments |

|

Vehicle Type |

|

|

Power Source |

|

|

Application |

|

|

Capacity |

|

|

Charging Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Agricultural Electric Vehicles Market - Regional Analysis

North America Market Insights

North America is expected to account for around 41% of the agricultural electric vehicles market share throughout the forecast period, making the region the global leader in the adoption and innovation of agricultural electric vehicles. The region enjoys strong government support, advanced manufacturing infrastructure, and large technology ecosystems that facilitate innovation in electric tractors and implements. Regulations and holistic incentive schemes encourage lower emissions and energy-efficient vehicle uptake across a range of farm operations. Manufacturing innovation accelerates the integration of intelligent technologies that enhance operational efficiency while reducing the environmental footprint.

U.S. agricultural electric vehicles market commitments involve substantial federal investment in clean vehicle technology development under large-scale Department of Energy and Environmental Protection Agency programs. The increased use of electric tractors receives assistance through federal grants and tax credits that directly encourage sustainable farming options and infrastructure investments. During the third quarter of 2025, John Deere reported net income of $1.289 billion, or $4.75 per share, as of August 2025, maintaining strong financials amid a challenging market environment. The company remains strategically invested in technology innovation and customer value creation through enhanced agricultural solutions and precision farming capabilities. Original Equipment Manufacturers spend heavily in technology innovations in diesel alternative powertrains and driverless vehicle capabilities. Sector challenges are accelerated by market growth, government aid, and strategic innovations.

Canada government's actions prioritize rural electrification and uptake of agri-technology in financing arrangements involving detailed provincial and federal financing programs. Policy frameworks facilitate electric vehicle utilization to mitigate emissions levels as well as optimize farm operational efficiencies in various agri-regions. In July 2024, the Manitoba and Canadian Governments contributed $2.025 million in financial assistance to the Enterprise Machine Intelligence and Learning Initiative (EMILI) for Enhancing Digital Agriculture Opportunities through the Sustainable Canadian Agricultural Partnership. The funding is in response to EMILI's Innovation Farms Project launch, a 5,500-acre full-sized farming project showcasing and marketing new processes and technologies. Joint ventures facilitate market creation and knowledge exchange among Canadian farm regions, easing infrastructure challenges in isolated areas.

Europe Market Insights

Europe agricultural electric vehicles market is projected to experience steady growth from 2026 to 2035, fostered by the enactment of wide-ranging climate policies and technological innovation programs among European Union member countries. The European Green Deal and Common Agricultural Policy grant vast assistance for the transition to zero-emission farming vehicles and sustainable agriculture schemes. Financing schemes speed up the development of electric tractors and apply technologies while fostering cross-border collaboration and technological exchange. Manufacturers react to strict environmental policy by facilitating clean energy uptake in agriculture by means of innovative electric vehicle technologies. Heavy focus on sustainability and technological autonomy leads to relentless market development. Regional coordination advances technology development and standardization of the market.

The UK agricultural electric vehicles market is driven by specific government policies promoting the use of electric vehicles and green farming technology innovation. Government incentives and holistic innovation schemes enable farmers to access electric machinery while making adoption easier. In April 2025, the UK government made an investment of over £45 million in innovative technologies to improve Britain's food security through new inventions and technologies that maximize profits, enhance food production, and support nature conservation. From robots performing precision fruit picking to cow and sheep health monitors using variable irrigation systems to optimize water use on crops, these grants fund broad-scope project development.

Germany agricultural electric vehicles market innovates European agricultural electric vehicle manufacturing with high-end manufacturing capacity and high federal support for agricultural clean technologies. Investments in industries center on optimizing battery technology and integration systems, improving efficiency and sustainability performance. In July 2024, the German Federal Ministry of Food and Agriculture (BMEL) launched climate action measures focusing on digital technologies and precision farming to contribute to reducing emissions while ensuring agricultural competitiveness. The ministry invested EUR 480 million out of an additional EUR 8 billion into specific climate action measures in the agricultural sector. Germany's regulatory environment facilitates innovation and competitiveness in clean agricultural machinery and supports international technology transfer and cooperation.

APAC Market Insights

Asia Pacific agricultural electric vehicles market is expected to achieve a CAGR of 12.5% between 2026 and 2035, spurred by intensified sustainability awareness development and infrastructure growth in various regional economies. Electrification is given top priority in emerging economies across the region in accordance with food security and climate change mitigation objectives. Government initiatives and large-scale private sector investments drive market expansion in various agricultural sectors and applications. Regional emphasis points are the development of advanced battery technology, smart vehicle integration capacity, and the adoption of renewable energy for sustainable agriculture. Technological progress and environmental protection cultural importance facilitate fast market growth and technology adaptation. Developing middle-class societies requires sustainable farming practices, propelling electric vehicle uptake.

China agricultural electric vehicles market is facilitated by across-the-board government incentives encouraging electric vehicle production and extensive use for agricultural purposes. Strategic policy tools lower taxes and offer large subsidies for electric tractor acquisition and usage fees. China published a 2025 action plan for the development of a Digital China in May 2025, including major plans for areas such as AI Plus, infrastructure improvement, the data sector, and digital talent. The strategy dictates promotion of market-oriented reform of data resource allocation, stepped-up building of a unified national data market, and all-around improvement of the overall level of Digital China development. Local manufacturers spearhead research in powertrain and battery technology innovation to improve vehicle performance while facilitating agricultural modernization objectives.

India agricultural electric vehicles market is accelerating the adoption of agricultural electric vehicles through large-scale government programs aimed at transforming digital agriculture and implementing end-to-end sustainability measures. Innovations by industry leaders such as Tata Motors, Mahindra & Mahindra, and Kubota Corporation are driving the market expansion. For example, Mahindra & Mahindra finalized the takeover of a 58.96% controlling stake in commercial vehicle maker SML Isuzu Ltd in August 2025, renaming it SML Mahindra Ltd (SML). Public-private partnerships address infrastructure deficits while supporting farmer training and education to promote the adoption of technologies in various agricultural areas and applications.

Key Agricultural Electric Vehicles Market Players:

- John Deere

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CNH Industrial N.V.

- AGCO Corporation

- Mahindra & Mahindra

- Fendt (AGCO Group)

- CLAAS KGaA mbH

- Case IH

- Tata Motors Limited

- Solis International

- Samsung Heavy Industries

The agricultural electric vehicles market reflects high competition among well-established manufacturers such as John Deere, CNH Industrial N.V., AGCO Corporation, Mahindra & Mahindra, Fendt (AGCO Group), and CLAAS KGaA mbH. These firms spend aggressively on research and development to create sophisticated electric tractors and implements equipped with AI features and autonomous driving technologies. Competitive strategies rely on product innovation, eco-sustainability, and international market growth through strategic alliances and acquisitions. Asian producers such as Kubota Corporation, Yanmar Co. Ltd., and Mitsubishi Heavy Industries bring precision engineering and sophisticated manufacturing capabilities. Firms compete on operational efficiency, technology leadership, and full-service customer support capabilities while responding to changing regulatory demands and agricultural electric vehicles market needs.

Strategic acquisitions and initiatives to integrate technology continue to redefine competitive dynamics as firms compete for greater market reach and greater technological capabilities. Market leaders are seeking collaborative innovation, as emerging players compete on specialized applications and transformative electric vehicle technology. In August 2025, CNH Industrial announced Q2 2025 results with consolidated revenue down 14% year-over-year to $4.71 billion while reaffirming full-year adjusted EPS guidance of $0.50-$0.70. Despite tough market conditions, such companies are committed to fostering operational excellence and advancing cutting-edge electric vehicle solutions through dealer collaboration and technology development initiatives.

Here are some leading companies in the agricultural electric vehicles market:

Recent Developments

- In July 2025, CNH Industrial announced plans for more than 70 new product launches between 2025-2027, including over 15 new tractor launches, 10 combine launches, 19 crop production launches and over 30 precision technology releases. CEO Gerrit Marx emphasized comprehensive product portfolio expansion with Case IH and New Holland dealers experiencing more integration.

- In January 2025, John Deere unveiled next-generation autonomous machines at CES 2025 featuring second-generation autonomy kit with AI, advanced computer vision, and 360-degree camera coverage to address skilled labor shortage across agriculture, construction, and commercial landscaping.

- Report ID: 8045

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.