Electric Drones Market Outlook:

Electric Drone Market size is valued at USD 46.9 billion in 2025 and is projected to reach a valuation of USD 157.8 billion by the end of 2035, rising at a CAGR of 12.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of electric drone is evaluated at USD 52.9 billion.

The growing use of electric drones in the agricultural sector for several applications, such as crop monitoring, precision farming, and pest management, is expected to surge the demand for advanced electric drones in the coming years. Several key players in the market are focused on developing and launching advanced tools and technologies, including electric drones. In July 2025, DJI launched a range of electric drones, including DJI Agras T100, T70P, and T25P, to drive payload capacity and application efficiency for agricultural work. The farming operations are made easier through the use of unmanned aerial vehicles, with real-time data and lower labour costs.

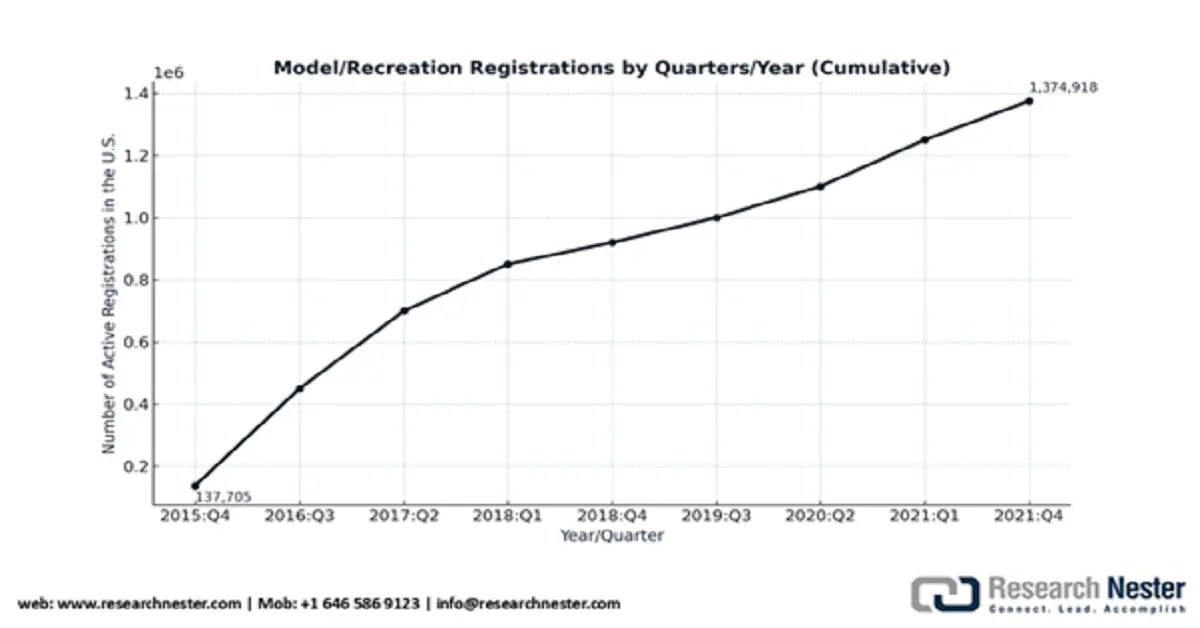

According to the Federal Aviation Administration (FAA), the total drones registered in the U.S. was 822,039 as of July 2025, of which 433,407 were commercial drones and 460,375 were certified remote drones. The FAA 2021 report mentioned that the recreational small drone market grew by 4.6% from 2020 to 2021. The 2021 new registration projections overshot by about 80,000 registrations, and the forecast of recreational small UAVs undershot by 5.06% for 2021 (i.e., 1.5822 million final aircraft data vs 1.5022 million predictions). By the end of December 2021, 1.37 million new recreational UAS owners and registered an average of 10,300 new registrations per month. Considering the total net gain/loss calculations, the effective/active fleet is calculated to be approximately 607,177 in December 2021. This renders the lower bound of the effective/active fleet of NAS recreational small drones.

Source: FAA

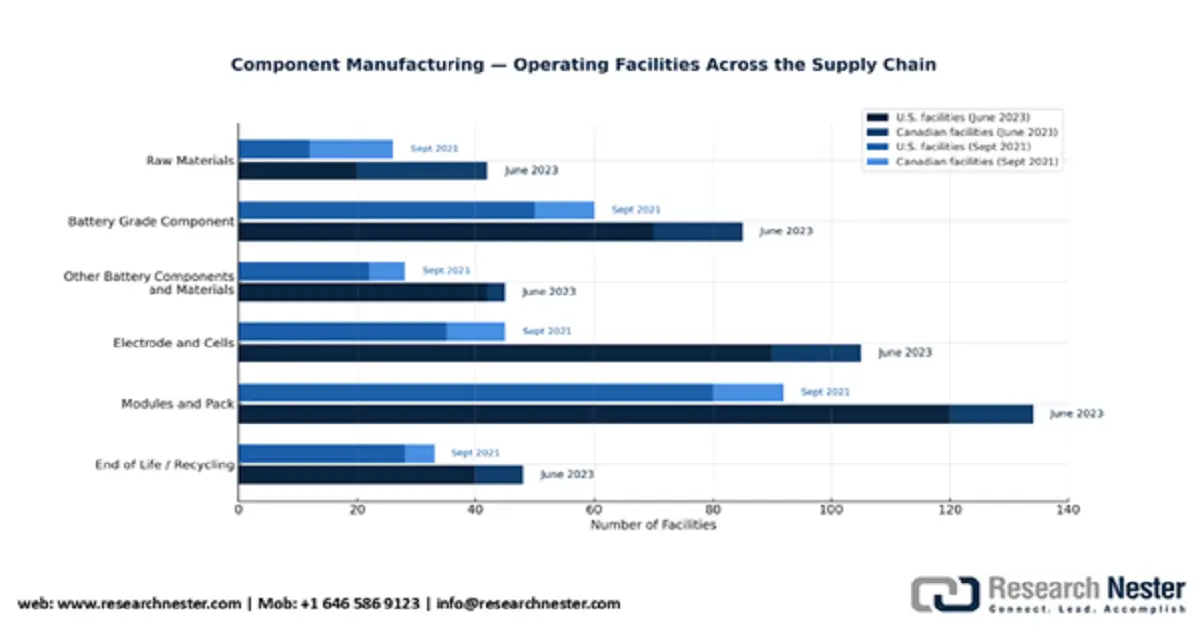

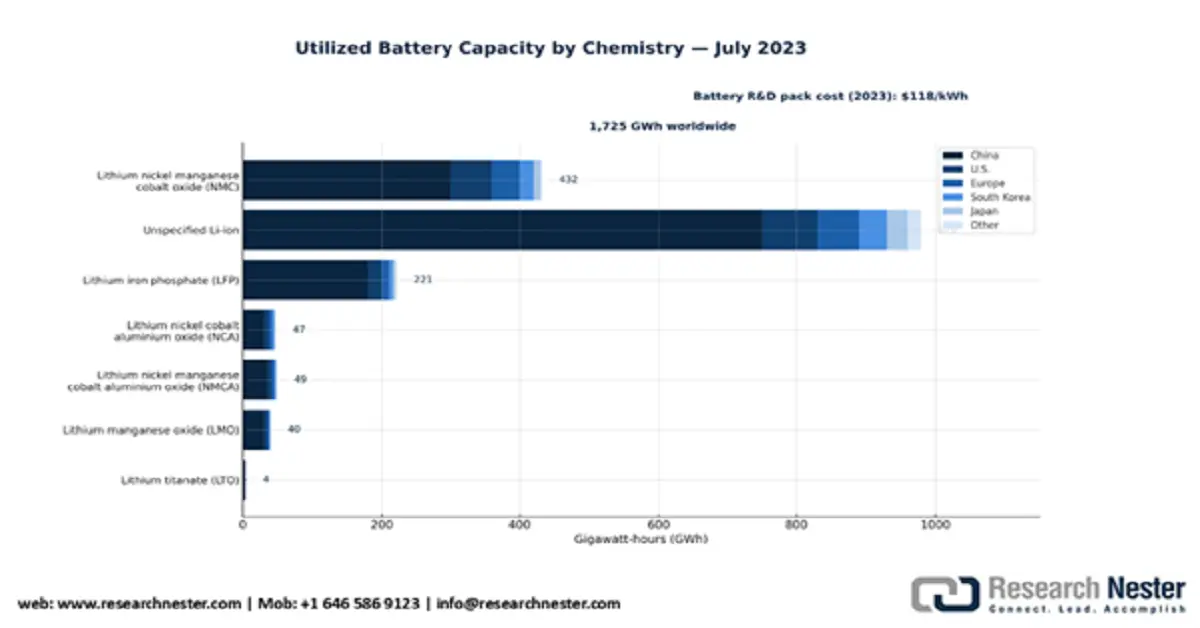

The high production infrastructure has facilitated the use of the readily available lithium-ion batteries in electric drones. Significant advances in battery energy storage technologies have been observed over the past 15 years, thereby decreasing the battery pack costs by 85%, reaching USD 143/kWh in 2020. Over FY2023, the federal funding (in grants or financial assistance) supporting the domestic battery production supply chain was a cumulative of USD 2,283 million and USD 16,488 million in loans. According to the Federal Consortium for Advanced Batteries (FCAB), the U.S. reserves of the primary raw material – lithium- were 1000 metric tons in the U.S., and the total manufacturing capacity with the available reserves was 9,960 GWh. In the global scenario, the reserves were 26,000 metric tons, and the capacity was 247,216 GWh in 2022.

Source: FCAB

In terms of component manufacturing and overall battery supply chain, China dominated the worldwide cell production and accounted for 83% lithium cell capacity, followed by Europe (9%), the U.S (4%), South Korea (2%), Japan (1%), and the rest of the world (1%). The U.S. held the largest share (53%) in cell fabrication, whereas China’s share increased to 6% in 2022 from <1% in 2020.

Source: FCAB

Key Electric Drone Market Insights Summary:

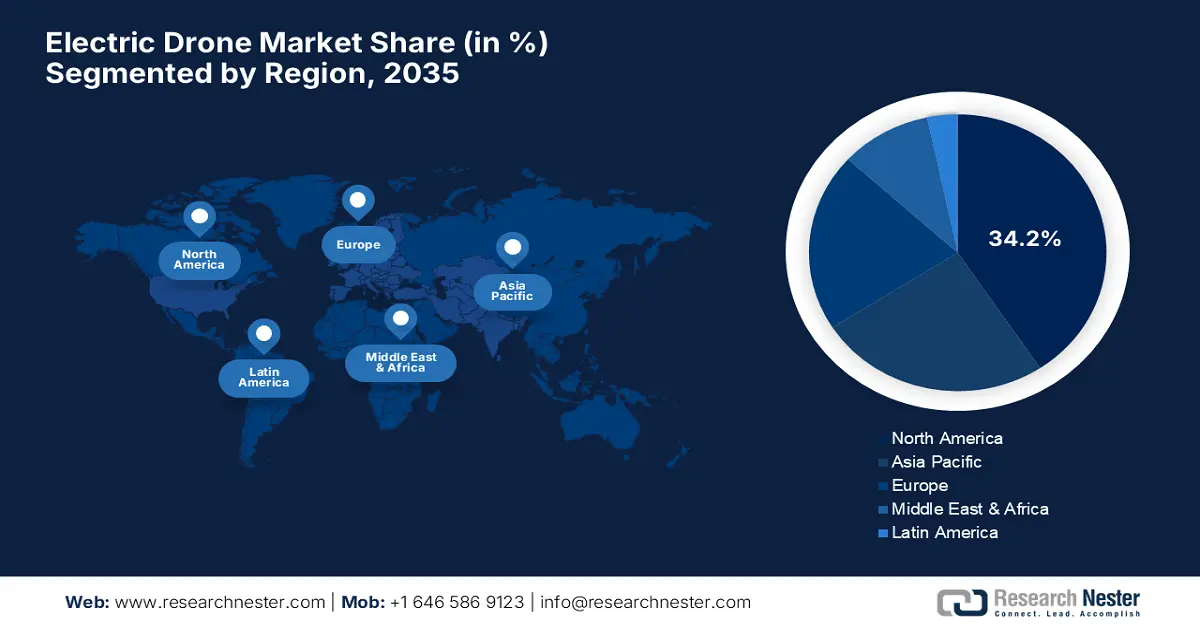

Regional Insights:

- North America is anticipated to command a 34.2% share of the Electric Drone Market by 2035, propelled by advanced technological infrastructure and progressive regulatory initiatives supporting BVLOS and UTM programs.

- Europe is projected to witness notable expansion through 2026–2035, owing to sustainability goals, U-Space investments, and extensive industrial adoption across agriculture, surveillance, and energy.

Segment Insights:

- The aerial photography segment in the Electric Drone Market is expected to account for a 32.7% share by 2035, driven by its critical role across marketing, media, and environmental monitoring applications.

- The multirotor electric drones segment is poised to dominate by 2035, owing to their versatility, VTOL capability, and suitability for diverse applications from videography to infrastructure surveying.

Key Growth Trends:

- Favorable trading climate, booming military application of drones

- Increased adoption in differing commercial applications

Major Challenges:

- Exorbitant expenses and unavailability of expert hands

- Regulation and airspace integration issues

Key Players: DJI Technology Co., Ltd., Parrot Drones SAS, 3D Robotics, AeroVironment, Inc., Insitu, Inc., Zipline International Inc., Skydio, Inc., SenseFly SA, Airbus S.A.S., GoPro, Inc., Boeing, Kespry, Inc., DroneDeploy, Inc., ACSL (Autonomous Control Systems Laboratory Ltd.), Yamaha Motor Co., Ltd., Terra Drone Corporation, Mitsubishi Electric Corporation, SkyDrive Inc.

Global Electric Drone Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 46.9 billion

- 2026 Market Size: USD 52.9 billion

- Projected Market Size: USD 157.8 billion by 2035

- Growth Forecasts: 12.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Australia, France, Canada

Last updated on : 1 October, 2025

Electric Drone Market - Growth Drivers and Challenges

Growth Drivers

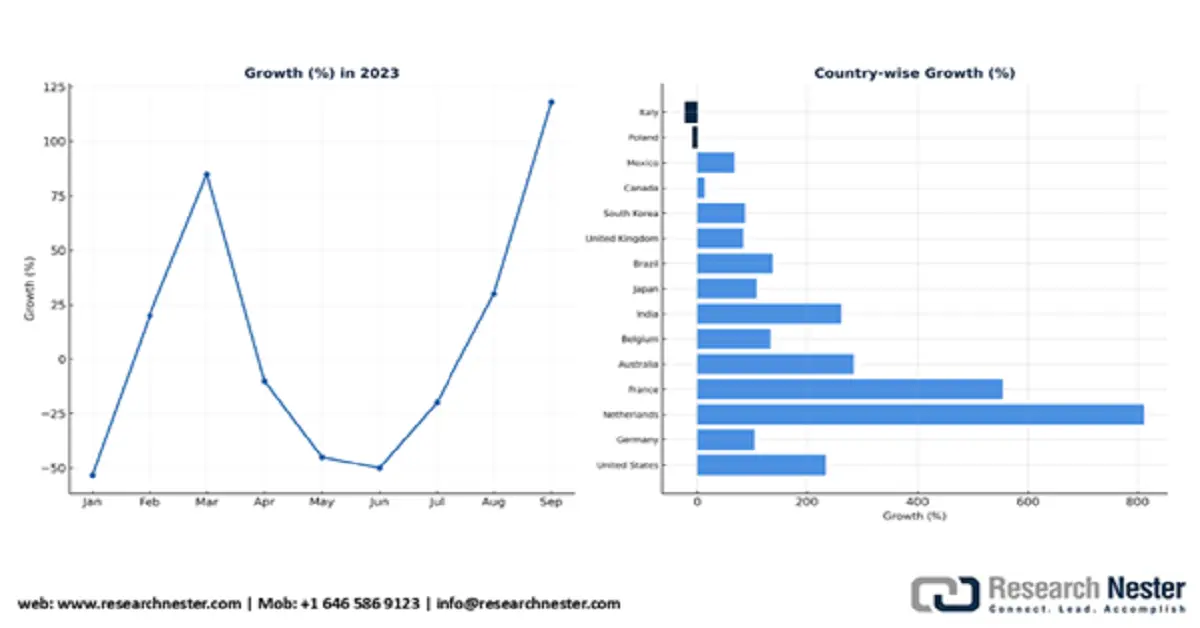

- Favorable trading climate, booming military application of drones: The military drone industry is estimated to triple by 2030. Countries are strategically fueling domestic civilian and military drone development and building widespread global trade networks for advanced systems. As of September 2023, China’s drone exports increased by 74.1% and reached USD 237 million, particularly in the remote-controlled drones segment (under 250g take-off weight), which showcased higher traction. In 2023, the worldwide drone trade was valued at USD 3.93 billion, underscoring a 60.9% surge from 2022, when the trade reached USD 2.44 billion. Drones were the 608th most traded product out of 1,228 items. In 2023, the top exporters of drones were China (USD 1.83 billion), Hong Kong (USD 408 million), and Turkey (USD 231 million), whereas the leading importers included Ukraine (USD 464 million), the U.S. (USD 423 million), and the Netherlands (USD 223 million).

Source:OEC

- Increased adoption in differing commercial applications: The electric drone market is being propelled by the rapid and global uptake of drone technology from traditional consumer platforms to a broad diversity of commercial applications. This stems from the proven ability of drones to enhance efficiency, reduce operational costs, and improve the level of security across different industries. Drones with multispectral sensors and AI-enabled software, for instance, are giving farmers accurate information on the health of their crops. By using this information to customize spraying and watering, yield can be significantly increased while utilizing less pesticide and water. Additionally, the logistics and distribution industries are growing rapidly. For example, Zipline International is expanding its drone delivery for consumer goods and medical equipment. Zipline's updated Platform 2 (P2) autonomous home delivery platform, faster and quieter than car delivery, was unveiled in March 2023.

- Rechargeable power source & electronic advancements: The electric drone market is largely reliant on improvements in rechargeable power sources and electronic efficiency. Drone applications in most industrial and commercial markets have been challenged by limited flight times. Breakthroughs over the past several years in solid-state and lithium-polymer (LiPo) battery technology have yielded higher energy density, increasing payload capacity, and endurance. At the same time, advances in motor and Impeller technologies are reducing the amount of effort required for efficiency so that drones can develop more forward thrust and lift from batteries. For example, in June 2025, DJI released the Matrice 400, its newest commercial drone. It offers a 59-minute flight and payload time of 6 kg, highly suitable for business applications such as emergency response and mapping. Such specialized performance enhancement meets the very needs of business customers and widens the overall addressable base of the market.

Challenges

- Exorbitant expenses and unavailability of expert hands: The two significant inhibitions to market expansion, particularly in the emerging economies, are the exorbitant expense of sophisticated drone technology and the unavailability of expert operators. While recreational drones have come down in cost, commercially relevant electric drones, especially those with advanced sensors, payloads, and autonomous capabilities, continue to be a significant capital expenditure for small and medium-sized businesses. This high cost of entry can prove to be a considerable barrier, especially for sectors such as agriculture, where the investment required for a drone can range from USD 6,000-12,000resulting in limited rural usage in nations such as India. The maintenance, repair, and training costs also contribute to the overall expenditure of ownership.

- Regulation and airspace integration issues: The most challenging barrier for the electric drone industry is likely to be the multifaceted and often non-conformant regulatory environment. While several countries are moving along the path towards making the environment more accommodating, significant challenges remain in terms of operations, such as flying beyond the line of sight (BVLOS), over people, or at night. Lack of a discernible universal standard for these sophisticated operations leaves it unclear for businesses and holds back the commercialization of new uses.

Electric Drone Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.9% |

|

Base Year Market Size (2025) |

USD 46.9 billion |

|

Forecast Year Market Size (2035) |

USD 157.8 billion |

|

Regional Scope |

|

Electric Drone Market Segmentation:

Application Segment Analysis

The aerial photography segment in the electric drone market is expected to hold a share of 32.7% throughout the forecast period, owing to its fundamental role in different industries. The primary function of aerial photography in marketing and media is driven by the demand for high-quality, dynamic images. Drones offer videographers and advertisers a cheaper option than traditional methods, such as using helicopters, enabling stunning cinematic shots and novel angles for property commercials, business videos, and functions. Additionally, along with advertisement application, aerial photography is also required for environmental observation, which yields high-resolution images for conservation, habitat mapping, and an overall sense of expansive landscapes.

Drone Type Segment Analysis

The multirotor electric drones’ segment is expected to dominate the electric drone market throughout the forecast period due to its versatility, easy handling, and vertical take-off and landing (VTOL) capabilities. They are typically made up of four, six, or eight rotors and are mainly used in a variety of applications such a aerial photography and videography, monitoring, and load-carrying delivery. Their stability and precise direction through small areas make them applicable for surveying complex infrastructure and motion picture, as well as film photography. This dominance is facilitated by the fact that multirotor drones are readily accessible and utilized by amateur and professional users. They also possess greater payload capacity compared to other forms, and therefore, they are perfectly appropriate for a broad array of end applications.

End use Segment Analysis

The commercial sector in the electric drone market is witnessing a significant switch with the prominent adoption of electric drones, driven by their ability to enhance efficiency and reduce operational costs. In delivery services, drones are transforming logistics by offering a reliable, economical, and environmentally friendly means for last-mile delivery, particularly in inaccessible or remote areas. This helps the commercial segment bypass city traffic congestion and respond to the growing need for speed in delivery. In agriculture, drones are instrumental in precision agriculture, using advanced sensors to monitor the well-being of crops, soil, and watering needs more accurately than ever. This results in improved asset management, higher yield, and reduced ecological impact. Such a massive rollout is an indication of the flexibility of drones and their actual business advantages.

Our in-depth analysis of the electric drone market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Payload |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Drone Market - Regional Analysis

North America Market Insights

North America is expected to lead the electric drone market with a share of 34.2%, driven by sophisticated technological infrastructure, dense manufacturer and startup concentration, and early regulation innovation supporting BVLOS and UTM pilots. For instance, the FAA's BVLOS programs and proposed rulemaking, and ongoing industry pilots such as Amazon, Zipline, many utility and energy inspections, etc., are building a substantial domestic market.

The U.S. electric drone market has benefited from public safety and defence procurement and high enterprise expenditure on inspection & surveying services. In the U.S., FAA initiatives like BEYOND and BVLOS approvals have substantially increased commercial drone operational capacity. In June 2025, the DOT/OIG reported substantial increases in BVLOS approvals over recent years, further supporting the market growth. This regulatory growth and expansion of pilot programs such as healthcare, logistics, and energy position the U.S. as the dominant commercial market for electric drones.

Canada electric drone market is gaining traction with growing investments and regulatory developments in the electric drone industry for both commercial and research applications. The market is driven by a strong ecosystem of large tech firms, startups, and defence contractors who are investing heavily in R&D to improve drone features, such as extended battery life, analytics powered by AI, and sophisticated sensors.

Europe Market Insights

Europe electric drone market is projected to have a strong upward trajectory fuelled by sustainability objectives, investment in U-Space (EASA) and state innovation funding, and a broad industrial base embracing drones for agriculture, surveillance, and energy. EASA's U-Space concept and associated AMCs provide scaled operations across member states, supporting interoperable traffic management as well as commercial deployments. As per the report by the European Union Aviation Safety Agency, as of July 2024, there were more than 1.6 million drone operators registered in Europe. In addition, rising adoption of electric drones for industrial cases and increasing investments in developing advanced drones are expected to fuel market growth during the forecast period.

In Germany electric drone market strong industrial uptake for infrastructure and industrial inspection is expanding the industry for electric drones in Germany. For example, a specialized gyrocopter-type drone, DB UAS, caters to applications such as surveying, vegetation management, and general infrastructure monitoring.

The UK electric drone market is growing at a steady rate and its expansion is fuelled by government programs such as the Future Flight Challenge and the creation of drone corridors for next-generation air mobility. This has fostered a solid, innovative climate for drone startups and public sector engagement. For example, the UK Research and Innovation Future Flight Challenge is a USD 384 million programme, half-funded by government and industry, that is funding the development of the aviation ecosystem required to bring forward the introduction of advanced air mobility (AAM), drones, and electric sub-regional aircraft across the UK.

Asia Pacific Market Insights

Asia Pacific electric drone market is expected to register rapid growth during the forecast period due to an ideal integration of conditions, such as strong public support with regard to administrative aid and beneficial regulatory environments. This is simultaneous with a growing agenda of business applications, which are extending into high-end uses such as construction monitoring, precision agriculture, and urban logistics. The most significant enabler is the ongoing deflation in sensor costs, making high-grade imaging, thermal, and LiDAR technologies more affordable. In addition, improvements in battery efficiency, AI-enabled autonomous systems, and 5G networks is driving the adoption of drones in multiple sectors, from environmental monitoring to disaster response and energy infrastructure inspection.

China electric drone market of the largest centres for drone manufacturing, with several giants dominating both hardware output and services. The market is likely to expand owing to government incentives to adopt commercial UAVs and the high-speed spread of precision agriculture programs. Along with this, China's move towards fleet-scale agricultural spraying and imaging is an important trend.

In India, the electric drone market is expected to register rapid growth owing to favorable government policies, including the SVAMITVA scheme, Production Linked Incentive (PLI) Scheme and Drone Rules 2021, supporting sales of the electric drones and a rising number of drone startups in the country. As per the records by the government, more than 398 drone startups were registered as of August 2024, a remarkable surge from 157 in 2021.

Key Electric Drone Market Players:

- DJI Technology Co., Ltd.

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Parrot Drones SAS

- 3D Robotics

- AeroVironment, Inc.

- Insitu, Inc.

- Zipline International Inc.

- Skydio, Inc.

- SenseFly SA

- Airbus S.A.S.

- GoPro, Inc.

- Boeing

- Kespry, Inc.

- DroneDeploy, Inc.

- ACSL (Autonomous Control Systems Laboratory Ltd.)

- Yamaha Motor Co., Ltd.

- Terra Drone Corporation

- Mitsubishi Electric Corporation

- SkyDrive Inc.

The global electric drone market is dominated by players such as DJI Technology Co., Ltd., Parrot Drones SAS, and Yuneec International Co., Ltd., among several others. They offer a wide range of products, with premium features such as obstacle avoidance and high-end camera systems, and a proven brand status as a company that is safe and user-friendly. DJI Technology Co., Ltd. is indeed a market leader in the professional and consumer photography segments. Manufacturers are investing a lot of money in research and development to increase battery life, range, and capacity in payload to address the ever-evolving and diversified needs of most industries. This presents a competitive environment that is defined by ongoing innovation.

Here is a list of key players operating in the global electric drone market:

Recent Developments

- In June 2025, DJI Technology Co., Ltd., announced the launch of Matrice 400, an enterprise-level flagship drone. The new platform has a 59-minute flight time, 6 kg payload capacity, and improved obstacle sensing with LiDAR and mmWave radar, aimed at professional use cases like emergency response and mapping.

- In June 2025, Parrot Drones SAS introduced the new ANAFI UKR line of quadcopter UAVs at the Paris Air Show. The new drones are a bit bigger than its predecessor ANAFI USA model, and have upgraded sensory, navigation, and communications features for military and defence purposes.

- In June 2025, AeroVironment, Inc. reported its fiscal year 2025 results with a record $1.2 billion in total bookings. The Chairman and CEO of the company emphasized that the strong backlog and strategic victories directly resulted from investments in multi-generational Uncrewed Systems and Loitering Munition Systems.

- In June 2023, Skydio received the Nationwide BVLOS approval. The leading autonomous drone manufacturer was granted a first-of-its-kind, nationwide permission by the Japan Civil Aviation Bureau (JCAB) to operate its drones remotely beyond visual line of sight (BVLOS). This exemption is a significant milestone because it facilitates streamlined BVLOS operations without the usual need for additional crew members, including visual observers.

- Report ID: 8152

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Drone Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.