ECG Resting System Market Outlook:

ECG Resting System Market size was valued at USD 1.8 billion in 2025 and is projected to reach approximately USD 3.6 billion by the end of 2035, rising at a CAGR of around 7.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of ECG resting system is estimated at USD 2 billion.

The market is all set to witness extensive growth in the years ahead, owing to the increasing prevalence of cardiovascular diseases, expanding aging demographics, and the growing emphasis on early diagnosis. As evidence, the report published by WHO in July 2025 revealed that about 19.8 million people perished due to cardiovascular diseases in a year, out of which 85% were due to heart attack and stroke. It also underscored the importance of early diagnosis to tackle this, hence positively influencing market growth.

Furthermore, the market is receiving extended support from both private and public payers who are implementing pricing strategies increasingly influenced by value-based care models. In June 2025, it is reported that a study (NCT05118035) in Taiwan analyzed the potential of cost reduction and of an AI-enabled ECG system in reducing 90-day mortality among hospitalized patients. In this regard, the AI-ECG group displayed lower all-cause mortality (3.6% vs. 4.3%) with similar overall medical costs. The ICER was $59,500 per death averted, which was found to be a cost-effective tool from the payer’s perspective, supporting its broader use in clinical practice.

Key ECG Resting System Market Insights Summary:

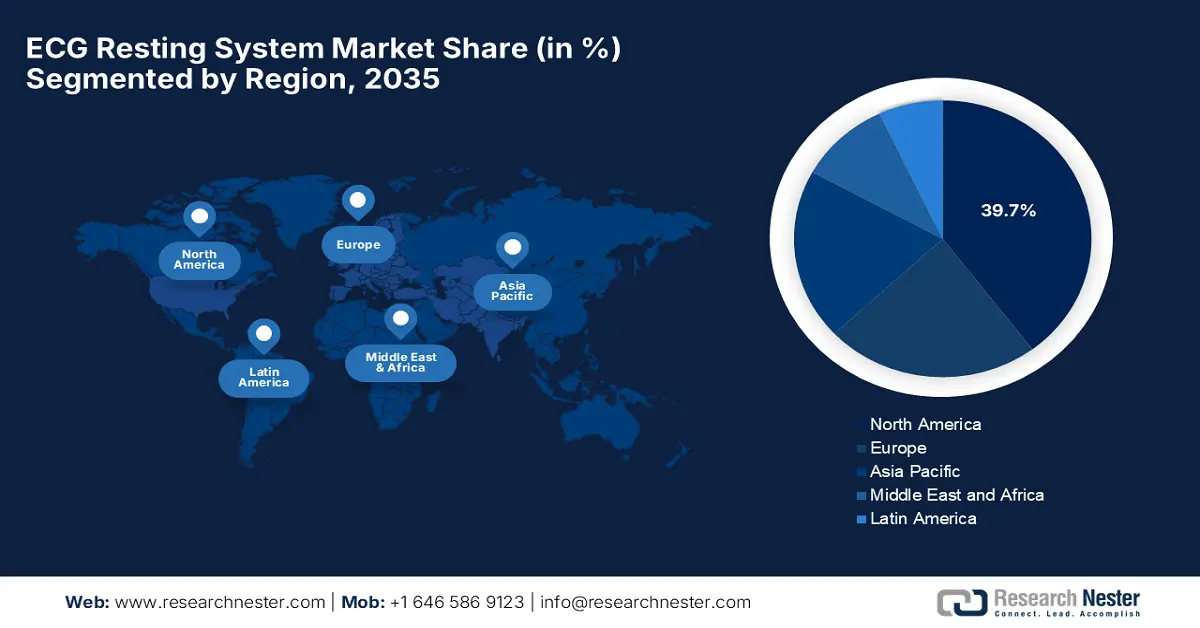

Regional Insights:

- North America is projected to command a 39.7% revenue share by 2035 in the ECG Resting System Market, supported by high healthcare expenditure and the strong presence of major market players.

- Europe is anticipated to hold the second-largest share by 2035, owing to the rising prevalence of cardiovascular diseases and the growing focus on preventive healthcare.

Segment Insights:

- The fixed ECG systems segment is anticipated to secure a 61.9% share by 2035 in the ECG Resting System Market, bolstered by its reliability and integration within healthcare facilities requiring continuous monitoring.

- The wireless ECG devices segment is expected to account for 55.2% share by 2035, propelled by advancements in Bluetooth, Wi-Fi, and cloud connectivity.

Key Growth Trends:

- AI integration

- Focus on preventive care

Major Challenges:

- High cost and reimbursement issues

- Data privacy concerns

Key Players: GE Healthcare, Koninklijke Philips N.V., Schiller AG, Mindray Medical International, Mortara Instrument, Inc., Spacelabs Healthcare, Inc., Hill-Rom Holdings, Inc., EDAN Instruments, Inc., BPL Medical Technologies, Welch Allyn, CompuMed, Inc., SHL Telemedicine, Bionet Co., Ltd., Cardionet, Innomed Medical, Mediana Co., Ltd., RMS India, Nihon Kohden Corporation, Fukuda Denshi Co., Ltd., Omron Corporation.

Global ECG Resting System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 2 billion

- Projected Market Size: USD 3.6 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 1 October, 2025

ECG Resting System Market - Growth Drivers and Challenges

Growth Drivers

- AI integration: The integration of AI has been transforming the growth trajectory of the ECG resting system market since it enhances the accuracy and efficiency, driving wider adoption across healthcare facilities. In this regard, Philips in July 2025 reported that it launched Philips ECG AI Marketplace, which is a platform that gives cardiac care teams access to multiple offerings all in one location to help clinicians manage and implement AI-powered diagnostic tools more easily. It also stated that Anumana is the first company to join, offering its FDA-cleared ECG-AI LEF algorithm to help detect low ejection fraction and improve cardiac care.

- Focus on preventive care: The aspect of rising aging demographics is significantly increasing the demand for routine cardiac screenings, making them essential for preventive health programs. In this regard, NIH in April 2024 revealed that the aging population significantly impacts the occurrence of cardiovascular diseases and mortality, as the same is projected to nearly double by 2050. The report also stated that biological aging processes, combined with other risk factors, play a crucial role in aging-related CVD.

- Supportive government initiatives: The increased government and private investments in modernizing healthcare infrastructure, especially in developing nations, and public health campaigns are constantly driving business in the market. For instance, in May 2024, the American Heart Association reported that it launched the Doctor, It’s Been Too Long campaign to encourage proper doctor visits and routine check-ups. Besides, it is backed by the Journey Health Foundation, which highlights the importance of tracking blood pressure, cholesterol, and managing medications in response to rising chronic conditions such as obesity and heart disease.

Population Aged 65 and Older: Numbers and Proportions by Region for 2020 and Projected 2050

|

Region |

Population Aged ≥65 (Millions) |

Proportion of Population Aged ≥65 (%) |

|

|

2020 |

2050 |

|

Global |

727.1 |

1548.9 |

|

Asia |

411.6 |

954.7 |

|

Europe |

142.9 |

199.9 |

|

Latin America and the Caribbean |

58.7 |

144.6 |

|

North America |

61.9 |

96.3 |

|

Africa |

20.4 |

143.1 |

|

Oceania |

5.4 |

10.2 |

Source: NIH

Key Revenue Opportunities in the Market

|

Year |

Company |

Event |

Revenue Opportunity |

|

2025 |

Tempus AI |

FDA 510(k) clearance for ECG-Low EF software |

AI-powered resting ECG analysis systems |

|

2024 |

DHC Group |

Acquisition of ECG On-Demand |

Expansion of ECG interpretation services in the UK market |

|

2021 |

AliveCor |

Acquisition of CardioLabs |

Integrated ambulatory + resting ECG solutions |

Source: Company Official Press Releases

Challenges

- High cost and reimbursement issues: One of the most significant challenges in the ECG resting system market is the high cost associated with the advanced devices, especially those that are integrated with exclusive features. Therefore, these costs can limit adoption, particularly in developing marketplaces or small-scale healthcare facilities. Moreover, the reimbursements also vary across countries and insurance providers, ultimately slowing down market expansion.

- Data privacy concerns: This is yet another factor making it challenging for ECG resting system manufacturers to gain the desired consumer base. The devices consist of cloud-based storage and AI analytics, but protecting sensitive patient information from cyber threats becomes extremely critical in healthcare systems. In addition, integrating these systems with a wide range of healthcare IT infrastructures can be complex, leading to potential interoperability issues.

ECG Resting System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 3.6 billion |

|

Regional Scope |

|

ECG Resting System Market Segmentation:

Device Type Segment Analysis

Based on device type, the fixed ECG systems segment is projected to garner the largest revenue share of 61.9% in the market during the discussed timeframe. The dominance of this subtype is effectively attributable to its reliability and integration in healthcare settings where continuous monitoring is essential. Also, these systems enable higher data accuracy and multi-lead configurations that provide detailed cardiac information, which is pivotal in terms of complex diagnoses.

Connectivity Segment Analysis

In terms of connectivity, the wireless ECG devices segment is predicted to attain a significant share of 55.2% in the ECG resting system market by the end of 2035. The advancements in Bluetooth, Wi-Fi, and cloud connectivity are key factors propelling growth in this subtype. In June 2024, Clario reported that its SpiroSphere platform, integrated with the wireless COR‑12 ECG device, has received FDA 510(k) clearance, which streamlines workflows and improves the experience for both patients and trial sites.

End user Segment Analysis

Based on the end user hospitals segment, it is anticipated to grow at a considerable rate with a share of 48.7% in the ECG resting system market during the analyzed tenure. The growth in the segment originates from the existence of a high volume of cardiovascular patients who necessitate advanced ECG diagnostics. Also, the availability of skilled professionals, infrastructure for advanced devices, and integration with other diagnostic tools are valuable assets for the subtype, thereby allowing a steady cash influx in the sector.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Device Type |

|

|

Connectivity |

|

|

End user |

|

|

Application |

|

|

Technology |

|

|

Lead Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

ECG Resting System Market - Regional Analysis

North America Market Insights

North America is predicted to capture the largest revenue share of 39.7% in the ECG resting system market by the end of 2035. The high healthcare expenditure and the presence of major market players are the key factors behind the region’s leadership. In December 2024, HeartBeam reported that it had received FDA 510(k) clearance for its at-home, cable-free ECG device, which is designed for arrhythmia assessment that records high-fidelity heart signals from three angles and syncs with a mobile app to send data to physicians in real time.

The U.S. is augmenting its leadership in the regional ECG resting system market on account of increased focus on preventive healthcare and substantial investments in healthcare innovation. In July 2024, Octagos Health secured over USD 43 million in a Series B funding round, which was led by Morgan Stanley Expansion Capital, with continued support from Mucker Capital and other investors. Further, the investment will accelerate the company's mission to enhance cardiac care through advanced artificial intelligence and comprehensive patient monitoring services.

There is a huge exposure for Canada in the regional market owing to the ever-increasing healthcare expenditure, rising awareness about cardiovascular diseases, and a growing geriatric population. In this regard, Health Canada stated that the Government of Canada, through CIHR, has invested USD 5 million to establish the Canadian Heart Function Alliance, a national research network that is focused on improving heart failure prevention, diagnosis, treatment, and care, hence suitable for standard market growth.

APAC Market Insights

The Asia Pacific region is identified as the fastest-growing region in the ECG resting system market over the discussed timeframe. The region’s upliftment in this field is effectively attributed to the widespread adoption when compared to Holter and stress ECG monitors. On the other hand, healthcare investments in this region are readily increasing, which is supporting strong momentum in the region. Furthermore, technological innovations, especially in terms of portable and wireless ECG models, are also boosting the market growth, positioning the region as the predominant leader in this field.

China represents the largest and influential landscape in the regional market, which is propelled by the rapid modernization of healthcare infrastructure and digital health adoption. In April 2025, Beneware Medical reported that it successfully showcased its latest innovations at the 91st Shanghai CMEF, showcasing its products such as the Digital Electrocardiograph, Exercise Stress Test System, and Remote ECG Network. The company also displayed a range of cardiac and pulmonary diagnostic devices, drawing attention from medical institutions and suppliers.

India is experiencing rapid growth in the ECG resting system market on account of strong government support and heightened demand in both urban and semi-urban medical settings. For instance, in February 2024, SCHILLER announced that it has launched the CARDIOVIT FT-2, which is a portable touchscreen ECG device designed for advanced hospital use, featuring a seamless, easy-to-clean interface and an optional thermal printer. The device is built on a security-hardened Linux kernel, and it offers strong cybersecurity, extensive connectivity with hospital IT systems, and supports both paper-based and paperless workflows.

Key Statistics on the Burden and Economic Impact of Cardiovascular Diseases (CVDs) in India as of June 2024

|

Statistic |

Value/Description |

|

Percentage of deaths due to CVDs |

31.8% of all deaths |

|

Number of persons affected by CVDs |

Increased from 271 million (1990) to 523 million (2019) |

|

Economic loss due to CVDs |

Estimated USD 2.17 trillion between 2012 and 2030 |

|

Age-standardized death rate for CVDs in |

282 deaths per 100,000 |

|

Per capita health expenditure |

USD 253 (4.5% of GDP) |

|

Government contribution to total health expenditure |

31.3% of total expenditure (1.1% of GDP) |

Source: NIH

Europe Market Insights

Europe has a huge potential in the market, which is considered to be the second largest landscape in this field. The increasing prevalence of cardiovascular diseases and the growing emphasis on preventive healthcare are the key reasons behind the leadership. For instance, in 2025, Norav Medical announced that its entire ECG product portfolio had received CE marking under the European Medical Device Regulation (MDR) EU 2017/745, reinforcing its suitability for clinical, hospital, and research settings.

Germany stands at the forefront of growth in the regional ECG resting system sector due to its advanced healthcare infrastructure and strong emphasis on early cardiovascular diagnostics, which contributes to a high adoption rate of resting ECG systems. Besides, these systems are extensively utilized in both public and private hospitals, which is also supported by the country’s leadership in medical technology manufacturing and investment in telecardiology services, hence positively influencing market growth.

The U.K. is gaining momentum in the ECG resting system industry owing to the notable rise in the adoption of resting ECG systems, particularly within the National Health Service (NHS). In June 2025, the country’s parliament noted that the country’s government aims to reduce premature deaths from heart disease and strokes by 25% in 10 years. Following a critical NHS review, a new 10-year plan focuses on shifting care from hospitals to communities, increasing digital health tools, and expanding local diagnostics.

Under-75 Cardiovascular Disease Mortality Rate per 100,000 Population - U.K.

|

Year |

Number of people per 100,000 who died under age 75 from CVD |

|

2021 |

Approximately 75.5 |

|

2022 |

Approximately 77.8 |

|

2023 |

Approximately 77.4 |

Source: Lords Library

Key ECG Resting System Market Players:

- GE Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Koninklijke Philips N.V.

- Schiller AG

- Mindray Medical International

- Mortara Instrument, Inc.

- Spacelabs Healthcare, Inc.

- Hill-Rom Holdings, Inc.

- EDAN Instruments, Inc.

- BPL Medical Technologies

- Welch Allyn

- CompuMed, Inc.

- SHL Telemedicine

- Bionet Co., Ltd.

- Cardionet

- Innomed Medical

- Mediana Co., Ltd.

- RMS India

- Nihon Kohden Corporation

- Fukuda Denshi Co., Ltd.

- Omron Corporation

The market for ECG resting system is a combination of both established and emerging entities, wherein the players such as GE Healthcare and Philips are leveraging advanced digital and AI-integrated platforms to maintain leadership. The market is also witnessing ample initiatives, such as significant investment in AI and predictive analytics to enhance diagnostic precision, which is also strengthening their market positions. Further, there is a strong industry shift towards developing portable and wearable ECG devices to meet the growing demand for home-based care and telehealth, a segment where Omron is particularly active.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, AliveCor reported that it had launched a wAI-powered, handheld Kardia 12L ECG system in India with approval received from CDSCO, which offers a portable, single-cable 12-lead device that detects 35 cardiac conditions, including heart attacks.

- In June 2024, Fukuda Denshi announced the launch of its FX-9800 resting ECG and EFS-1000 data management system, which possesses 18-lead synthesis for enhanced detection of Acute Coronary Syndrome and is especially designed for ERs and ICUs.

- In September 2024, iRhythm Technologies notified that its AI-powered Zio 14-day ECG monitoring system has been approved in Japan, marking the first such device approved without clinical trials since it enhances arrhythmia diagnosis.

- In June 2024, Toyota Tsusho Corporation reported that it had launched LOTUS HEART, Japan’s first-ever compact electrocardiograph with telecommunication capabilities for long-term monitoring and remote data analysis via a cloud system.

- Report ID: 8159

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ECG Resting System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.