Disposable Articulators Market Outlook:

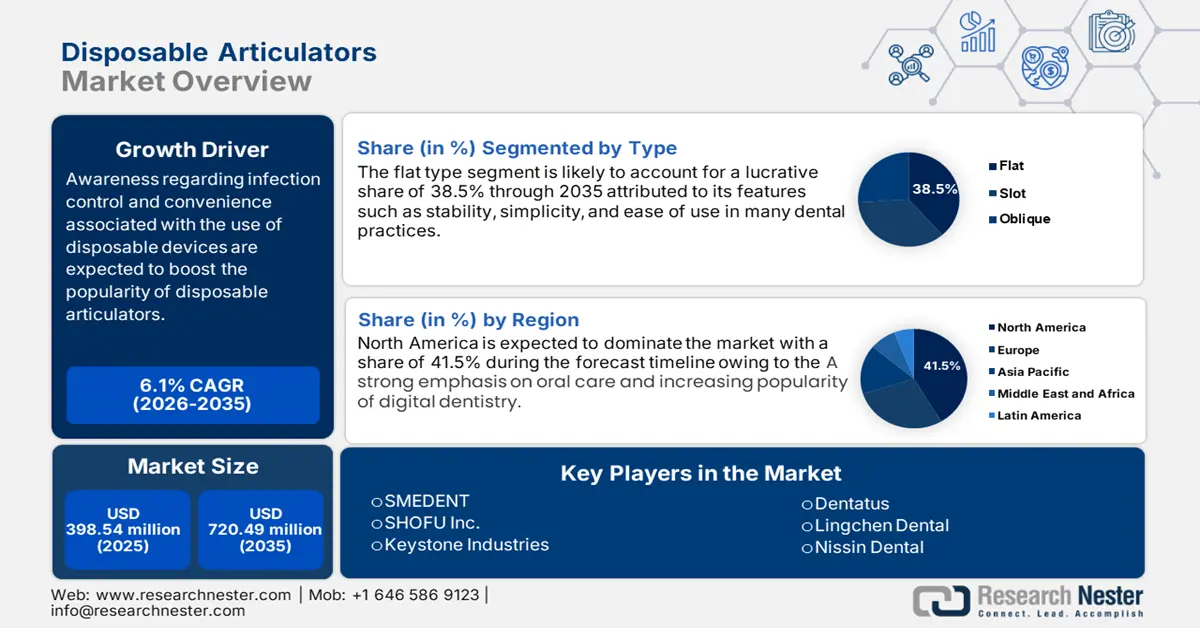

Disposable Articulators Market size was valued at USD 398.54 million in 2025 and is likely to cross USD 720.49 million by 2035, expanding at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of disposable articulators is assessed at USD 420.42 million.

The growth of the market is being spurred rapidly by the mounting emphasis on strict infection control protocols at dental clinics globally. Moreover, complemented by the increasing implementation of digital dentistry procedures, wherein compatibility with disposable articulators and ease of interfaciality with digital scanning machines and CAD/CAM machines contribute to restorative and prosthetic accuracy and convenience. For instance, in March 2025, Planmeca announced that it would showcase its entire range of CAD/CAM products at IDS 2025, with three new additions. At the forefront is a completely new Planmeca Onyx intraoral scanner that offers unprecedented flexibility for dental practices of any size.

Moreover, the increasing population of geriatrics with its growing prevalence of treatable dental conditions necessitates proper articulation to enable effective therapy, thus to the requirement of consistent and precise disposable devices. For instance, as per the data revealed by the UNFPA in December 2023, the elderly population of 153 million (60 years and older) is projected to swell to a whopping 347 million by the year 2050. Furthermore, the circumvention of the cost of sterilization, time saving in chair usage through streamlined workflow, and consistency of performance without loss are also pushing disposable articulators to become increasingly popular in dental activities.

Key Disposable Articulators Market Insights Summary:

Regional Highlights:

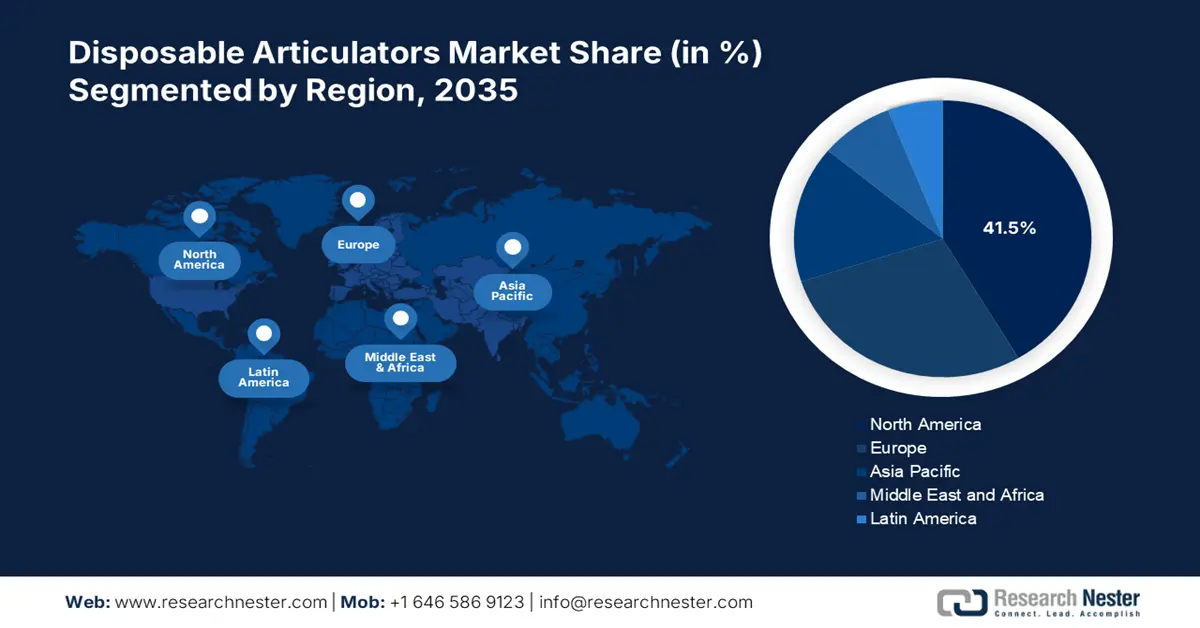

- North America disposable articulators market will account for 41.50% share by 2035, fueled by strict dental hygiene regulations and healthcare infrastructure.

- Asia Pacific market will register lucrative growth during the forecast period 2026-2035, attributed to better healthcare infrastructure and increasing dental hygiene awareness.

Segment Insights:

- The flat type segment is anticipated to secure a 38.50% share by 2035, propelled by its uncomplicated but predictable configuration, user-friendliness, and cost-effectiveness in dental clinics.

Key Growth Trends:

- Expansion of dental tourism

- Demand for advanced dental procedures

Major Challenges:

- Material Limitations

- Competition from sterilizable alternatives

Key Players: KaVo Kerr (Envista), Whip Mix Corporation, Shofu Dental Corporation, Amann Girrbach AG, DenMat Holdings, LLC, Jensen Dental, NOW Foods, Dentatus AB, SAM Präzisionstechnik GmbH, A-dec Inc.

Global Disposable Articulators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 398.54 million

- 2026 Market Size: USD 420.42 million

- Projected Market Size: USD 720.49 million by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Disposable Articulators Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of dental tourism: The expanding dental tourism is a key growth engine for the disposable articulators market. As patients are increasingly seeking cost-effective dental care treatment from around the world, demand for disposable articulators in overseas hospitals and clinics will see a surge. For instance, in the statistics by UK Smiles, witnessed 60% increase (150,000-200,000 people) in the volume of UK patients traveling to Turkey for dental treatments was witnessed between 2019 and 2022. Moreover, Turkey ranked as the world's 3rd most favored destination for dental tourism, followed by Hungary and Poland. Thus, making disposable articulators an essential element in enabling safe and effective dental treatments.

- Demand for advanced dental procedures: The increased need for advanced dental procedures, such as implantology, advanced restorative treatment, and full-mouth rehabilitations, is a major growth stimulus for the market. For instance, in February 2024, Carbon unveiled its Automatic Operation (AO) suite of solutions tailored to address the needs of dental labs, establishing a new benchmark in lab automation and efficiency. These procedures demand precise interocclusal records and proper cast mounting, thereby driving the need for single-use articulators that offer more precision, eliminate cross-contamination risk, and enhance workflow ease in modern dental clinics.

Challenges

- Material Limitations: The most significant barriers in the disposable articultors market is material constraints. The inherent cost-saving necessity would restrict the selection of polymers and composites and consequently may reduce accuracy and durability required for exacting diagnostic and treatment planning procedures. Moreover, biocompatibility and long-term material degradation potential raise new issues concerning patient safety and performance reliability of such devices within a clinical setting. Overcoming these limitations through the development of maetrials with improved mechanical properties and biocompatibility is an urgent challenge.

- Competition from sterilizable alternatives: Disposable articulator market faces stiff competition from sterilizable products, which make a strong case of value against cost-conscious as well as green dentists. Even though the use of disposable articulators poses low cross-contamination risk and is convenient, long-term value, as well as lower carbon footprint, accompanying sterilizable high-performance polymer articulators or metal articulators pose to be difficult to counteract. These reusable models, for reuse following rough sterilization techniques, can provide lower long-term expenses for dental businesses while being more costly in the beginning.

Disposable Articulators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 398.54 million |

|

Forecast Year Market Size (2035) |

USD 720.49 million |

|

Regional Scope |

|

Disposable Articulators Market Segmentation:

Type Segment Analysis

The flat type segment in the disposable articulators market is anticipated to dominate with 38.5% by the end of 2035, based primarily on its uncomplicated but predictable configuration. Within this setup, there is a predictable and stable platform required to precise dental model articulation for a broad variety of standard prosthetic and diagnostic procedures. For instance, in April 2025, Align Technology announced invisalign system with mandibular advancement featuring occlusal blocks for class II skeletal and dental correction. Flat-type articulators' inherent simplicity is a direct result in terms of user-friendliness and cost, both highly desirable in hectic dental clinics and laboratories and thus achieving wide popularity and market leadership.

Application Segment Analysis

Based on the application, the dentistry segment is expected to garner the major share in the disposable articulators market by the end of 2035 attributable to its unique features such as accuracy in treatment planning and appliance design. For instance, in September 2023, the PAL 2.0 Articulator System was a reusable, 2-in-1, versatile plastic articulator. Panadent articulator was intended for use as a stand-alone system for general dentistry and can accommodate traditional models mounted with plaster and 3D-printed models. The recurring demand for disposable articulators from dental clinics and laboratories due to strict hygiene protocols and requirement of seamless workflow supports dentistry segment.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Articulators Market Regional Analysis:

North America Market Insights

The disposable articulators market in North America is expecting its dominance during the forecast timeline with a notable share of 41.5% driven largely due to the highly advanced and strict healthcare infrastructure of the region, most notably in the dental industry. This regulation demands rigid practice towards infection control and hygiene norms within dental clinics and labs. Therefore, the uniform and firm demand imposed by this prioritization of hygiene within North American dental clinics bolsters the dominance of the market within the region.

The U.S. market is growing exponentially owing to the optimal use of disposable devices such as disposable articulators and advancing technologies utilization by companies. For instance, in January 2025, VideaHealth, announced to have raised USD 40 million in an oversubscribed Series B funding round to solidify its position as the clear leader for dental service organizations (DSOs). Through its cutting-edge AI-driven software and established, influential industry partnerships, it extends effective dental solutions to dentist to be practiced to deliver efficacy in patient’s treatment.

Canada disposable articulators market is likely to witness substantial growth during the forecast period driven by exponentially diversifying dental health facilities within the nation with rising adoption of disposable articulators. For instance, in February 2025, Argen acquired Dental Axess Canada's denture clinic and lab business. This acquisition is part of Argen's strategic bid to increase its presence in Canada's dental sector by enhancing its market leading digital dental manufacturing base support. Furthermore, the emphasis on ensuring unblemished levels of hygiene within the Canada dental community is an added driver behind the evolving market.

Asia Pacific Market Insights

The disposable articulators market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline due to the fast developing healthcare infrastructure coupled with increasing focus on high-quality dental care across its fast-evolving economies. As disposable incomes have been increasing and awareness towards oral health improved, there has been mounting demand for better quality dental treatments. This, subsequently, generates need for low-cost, hygienic dental consumables such as disposable articulators.

India is experiencing rapid growth in the disposable articulators market because of increased awareness about hygiene and cross-contamination prevention in oral health care. Initiatives are implemented all across the country through strategic moves and decisions made by companies and governments in this support. For instance, in November 2024, Colgate-Palmolive (India) launched its revolutionary Oral Health Movement to drive India's oral health mission forward. The technology-enabled, AI-driven effort aimed to encourage Indians to make oral hygiene a priority and leverage technology to fill the gap between awareness and access in oral care.

China disposable articulators market is witnessing lucrative growth opportunities propelled by companies offering more precise treatment options and an enhanced patient experience to the market and the increasing number of medical centers in China. For instance, in March 2025, LargeV Instrument was one of the greatest highlights at newly opened Dental South China 2025. It featured advanced technology and a wide product range, which gained the focus of numerous dental industry professionals. This exhibition was not only an opportunity to promote its latest innovation but also presented a great chance to guide the future development of the dental field.

Disposable Articulators Market Players:

- SMEDENT

- Company Overviews

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SHOFU Inc.

- Keystone Industries

- Amann Girrbach

- Dentatus

- Lingchen Dental

- Nissin Dental

- Whip Mix

- KaVo Dental

The company landscape in the market is predominantly driven by the revolutionizing arena of material science and product innovation to make products more precise and useful. For instance, in April 2023, Henry Schein, Inc. announced that it acquired a majority interest in Biotech Dental S.A.S., to create a digital view of the patient, offering greater diagnostic accuracy and an improved patient experience. This trend point out greater use of ergonomically formed shapes that are providing dentists with better handling and stability in the process.

Here's the list of some key players:

Recent Developments

- In March 2025, Mikrona Group AG effectively took over Dental Axess AG as part of consolidating its share in digital dentistry. The product portfolio in Dental Axess AG is centered on leading edge CAD/CAM products, intraoral scanners, 3D printers, X-ray machines, and software offerings.

- In March 2025, Solventum announced a strategic alliance with SprintRay to address the demands of dentists. This R&D and commercialization partnership is aimed at creating and marketing high-quality, long-lasting and permanent same-day restorations.

- Report ID: 7612

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Articulators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.