Disposable Respirator Market Outlook:

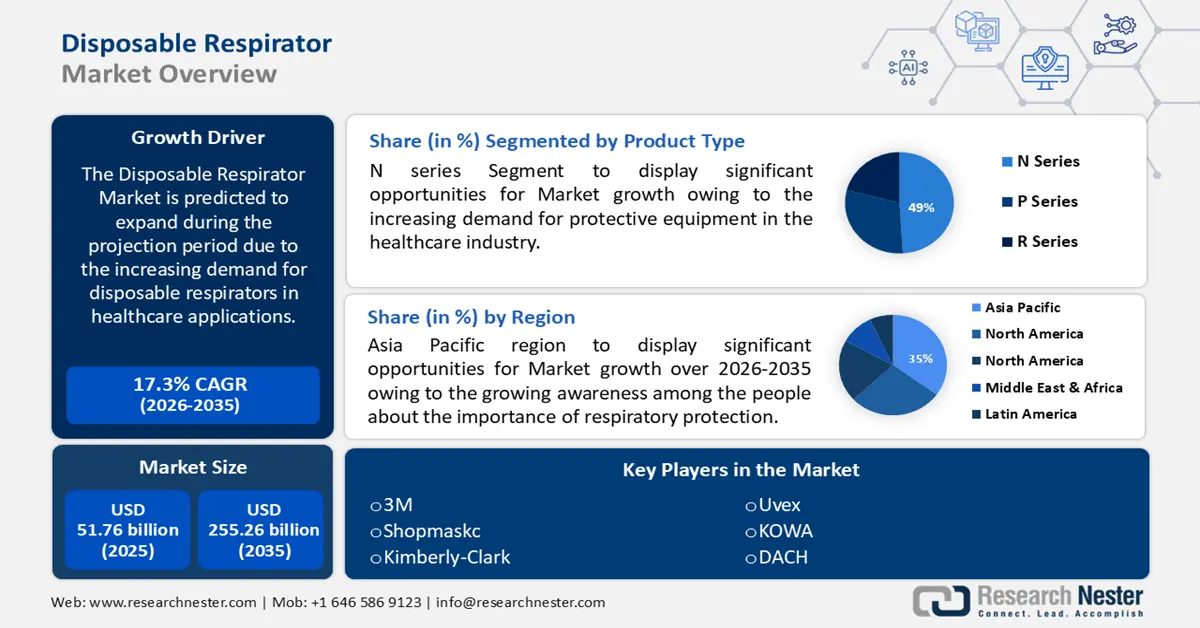

Disposable Respirator Market size was valued at USD 51.76 billion in 2025 and is likely to cross USD 255.26 billion by 2035, registering more than 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of disposable respirator is assessed at USD 59.82 billion.

The growth of the market can be attributed to the rise in the number of COVID-19 cases and the increasing demand for disposable respirators in healthcare applications. WHO reports that a total of 99,244,445 COVID-19 cases and 120,923 deaths have been reported to WHO in China between January 2020 and April 2023. Also, there have been 9,350 new Coronavirus infections in India as of April 2023. With the increase in COVID-19 cases, disposable respirators such as N95 masks, surgical masks, and dust masks are expected to increase in popularity in the near future. Also, the governments of different countries are taking necessary steps to promote the use of these respirators to protect their citizens from the spread of the virus.

In addition to these, factors that are believed to fuel the market growth of disposable respirator include growing awareness about health and safety among workers, the rise in air pollution, and the increasing demand for protective equipment in hazardous industries such as chemical, oil and gas, and construction. For instance, a total of 67 million tons of pollution were released into the atmosphere in the United States in 2021. According to the World Health Organization, air pollution kills approximately 7 million people worldwide every year. In addition, 9 out of 10 people breathe air containing high levels of pollution, including particulates, carbon monoxide, ozone, and nitrogen dioxide. Rising air pollution levels have contributed to an increase in respiratory illnesses, making disposable respirators necessary to protect people from the harmful effects of air pollution.

Key Disposable Respirator Market Insights Summary:

Regional Highlights:

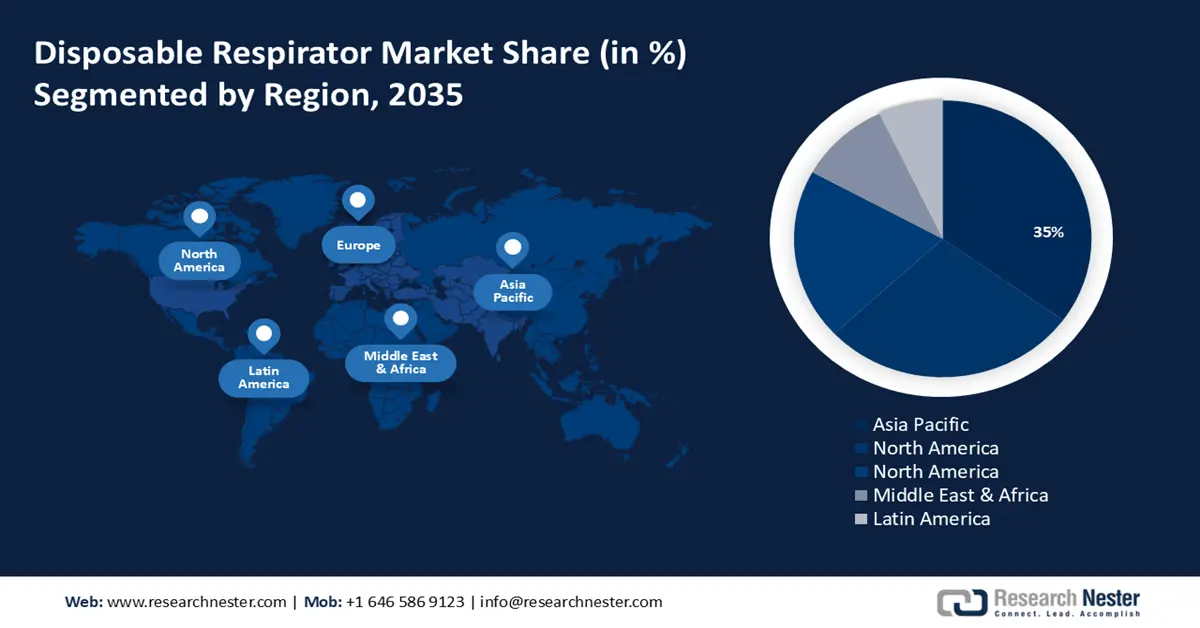

- The Asia Pacific region is poised to command a 35% share by 2035 in the disposable respirator market, supported by rising public awareness of respiratory protection across major economies.

- North America is expected to secure around a 28% share by 2035, sustained by escalating respiratory health concerns and the growing incidence of respiratory diseases and allergies

Segment Insights:

- The manufacturing segment is anticipated to hold about a 38% share by 2035 in the disposable respirator market, spurred by robust industrial output and strengthening consumer-goods demand.

- The N series segment is set to account for nearly a 49% share by 2035, bolstered by rising utilization of protective equipment within the healthcare sector.

Key Growth Trends:

- Increasing Production Lines Of Personal Protective Equipment (PPE)

- Rise in Income Levels of Households

Major Challenges:

- Emergence of substitute products

- Availability of counterfeit products

Key Players: 3M, Shopmaskc, Honeywell International Inc., Moldex-Metric, Inc., Kimberly-Clark, Uvex, KOWA, SAS Safety Corp., The Gerson Company, DACH.

Global Disposable Respirator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 51.76 billion

- 2026 Market Size: USD 59.82 billion

- Projected Market Size: USD 255.26 billion by 2035

- Growth Forecasts: 17.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% share by 2035)

- Fastest Growing Region: North American

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 24 November, 2025

Disposable Respirator Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Production Lines Of Personal Protective Equipment (PPE) - As a result of COVID-19, the Personal Protective Equipment Manufacturing industry has become one of the most important industries in the United States. There is a high demand for PPE such as masks, gloves, hand sanitizer, and rubber boots. Each month, 90 million masks are needed for health responders around the world.

- Rise in Income Levels of Households - The rise in disposable income levels of households has enabled them to buy more non-essential items like disposable respirators, which helps to protect against airborne pollutants, allergens, and other hazards. Based on data from the Bureau of Economic Analysis, the personal income of individuals increased by 131.1 billion (0.6 percent) as of January 2023, and the disposable personal income of households rose to USD 387.3 billion (2.0 percent) as of the same month.

- Increasing Demand for N95 Masks - The demand for N95 masks has been increasing since the COVID-19 outbreak, as they are better at filtering out particles and providing a higher level of protection than regular face masks. For instance, the total production of N95 masks worldwide by 3M, an American multinational conglomerate with interests in healthcare and consumer goods, was approximately 2 billion units in 2020. Estimates put the production rate in 2021 at 2.7 billion units. This increased demand is driving the demand for disposable respirators, as they are the masks most capable of providing the best protection.

- Increasing Number Of Infrastructure Projects And Activities - For instance, a national master plan for multi-modal connectivity was launched by the Indian government in New Delhi under the name Gati Shakti. Several ministries, including Railways and Roadways, will be brought together through Gati Shakti - a digital platform aimed at developing integrated infrastructure connectivity plans and coordinating their implementation. As infrastructure projects increase, there is more demand for workers which increases the need for personal protective equipment. This includes disposable respirators that help protect workers from dust and other harmful particles.

- Rising Prevalence Of Respiratory Diseases Such As Chronic Obstructive Pulmonary Disease (COPD) - COPD is caused by long-term exposure to substances that irritate and damage the lungs. Unfortunately, it has become increasingly common, owing to air pollution, smoking, and other environmental factors. According to the World Health Organization, COPD is the third leading cause of premature death worldwide, causing 3.23 million deaths in the year 2019. Moreover, tobacco smoking is responsible for over 70% of COPD cases in countries with high incomes. As a result, the demand for disposable respirators has increased as people seek to protect themselves from further damage to their lungs.

Challenges

- Emergence of substitute products -With the increasing technological advancements, manufacturers of disposable respirators are facing the challenge of substitute products such as reusable respirators that are made with superior quality materials, and are eco-friendly options. This is making disposable respirators less appealing to consumers, hence hampering the growth of the market.

- Availability of counterfeit products

- Stringent environmental regulations

Disposable Respirator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 51.76 billion |

|

Forecast Year Market Size (2035) |

USD 255.26 billion |

|

Regional Scope |

|

Disposable Respirator Market Segmentation:

End-user Segment Analysis

The global disposable respirator market is segmented and analyzed for demand and supply by end use into transportation, energy, manufacturing, construction, healthcare, food & beverage, and others. Out of these, the manufacturing segment is estimated to gain the largest market share of about 38% in the year 2035. The growth of the segment can be attributed to the robust industrial production and increasing demand for consumer goods. For instance, India's fast-moving consumer goods (FMCG) sales increased by 16% in 2021, fueling economic expansion. Also, global manufacturing output increased by 7% from 2017 to USD 14,170 Billion in 2018. The demand for manufactured goods has been increasing over the past few years owing to the growth in the global population and the increasing disposable income of people. This has contributed to an increase in the demand for disposable respirators from the manufacturing sector. Additionally, the introduction of stringent safety regulations in the manufacturing sector has increased the demand for disposable respirators.

Product Type Segment Analysis

The global market for disposable respirator is segmented and analyzed for demand and supply by product type into N series, P series, and R series. Out of these, the N series segment is estimated to gain a significant market share of about 49% in the year 2035. The N Series respirators have the highest level of protection and are often used in health care and other industries where there is a risk of exposure to hazardous particles or pathogens. The increasing demand for protective equipment in the healthcare industry owing to the COVID-19 pandemic has further boosted the demand for N Series respirators. The N series respirators are designed for comfort and feature special designs that make them easier to wear for long periods of time, making them a popular choice for medical professionals and essential workers. In addition, the N series respirators are designed to filter out particles as small as 0.3 microns, providing superior protection against airborne viruses and other contaminants.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By End Use |

|

|

By Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Respirator Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 35% by 2035. The growth of the market can be attributed majorly to the growing awareness among the people about the importance of respiratory protection, especially in countries like India, China, and Japan. Moreover, the increasing number of industrial activities, the presence of a large number of manufacturers of disposable respirators, and the increasing demand for respiratory protective devices are projected to drive regional market growth. A majority of these masks are made in China, and the country imported over 55 million respirators and masks in the first week after the January 2020 lockdown in Wuhan, where the Coronavirus was discovered. The daily production of medical masks in China reached 13 million in February 2020, adding to the growth in medical mask production. Additionally, the governments in various countries in the region are taking initiatives to promote the use of disposable respirators in their respective countries, which is further driving the market.

North American Market Insights

The North American disposable respirator market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The growth of the market can be attributed majorly to the growing awareness about respiratory health and the increasing prevalence of respiratory diseases and allergies in the region. Moreover, rapid industrialization and increasing construction activities in the region are projected to accelerate the demand for disposable respirators. Industrialization and construction activities often result in air pollution, which necessitates the use of respirators to protect workers from inhaling hazardous particles. Additionally, these activities often require the use of potentially hazardous chemicals, which require the use of respirators for safety. Further, the increasing awareness of workplace safety regulations has contributed to the implementation of stringent regulations in the region regarding the usage of protective equipment in workplaces, which has further propelled the demand for respirators.

Europe Market Insights

Further, the market in Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing awareness of the need to protect oneself from the inhaling of hazardous particles in the environment, along with the emergence of stringent safety regulations regarding the use of personal protective equipment in industries such as construction, manufacturing, and others, are expected to drive the growth of the disposable respirator market in Europe. For instance, a general product safety regulation proposal was agreed upon by the European Parliament and Council on 28 November 2022. Moreover, The European region has a growing tourist traffic owing to the many attractions it has to offer, including historic monuments and natural beauty. With increased tourist traffic, there is an increased risk of diseases spreading as people travel from different countries. Using disposable respirators is one of the best ways to prevent airborne diseases, and this increased demand is expected to drive the regional market.

Disposable Respirator Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shopmaskc

- Honeywell International Inc.

- Moldex-Metric, Inc.

- Kimberly-Clark

- Uvex

- KOWA

- SAS Safety Corp.

- The Gerson Company

- DACH

Recent Developments

- The Shopmaskc brand has launched KF94 Face Mask. This mask is made up of four layers, the non-woven surface, the two nonwoven and melt-blown inner layers, as well as the soft inner layer that feels gentle against the skin.

- Honeywell International Inc. announced the manufacturing capabilities of its facility in Phoenix so that it can produce N95 face masks as part of the response to a novel Coronavirus (COVID-19) being received by the U.S. government.

- Report ID: 4919

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Respirator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.