Data Center Immersion Cooling Market Outlook:

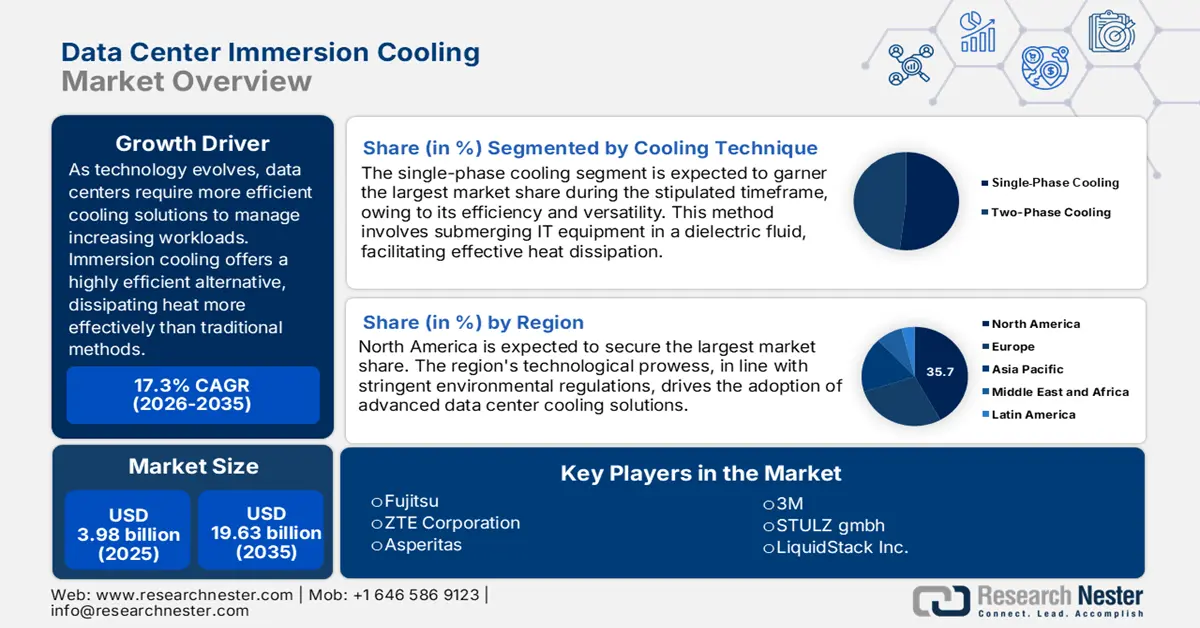

Data Center Immersion Cooling Market size was over USD 3.98 billion in 2025 and is anticipated to cross USD 19.63 billion by 2035, growing at more than 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center immersion cooling is assessed at USD 4.6 billion.

The data center immersion cooling market is projected to exhibit robust growth during the forecast period driven by rising global investment in data center infrastructure. For instance, in October 2024, Equinix Inc. announced a joint venture (JV) agreement worth more than USD 15 billion to expand hyperscale data centers in the U.S. The proliferation of cloud computing, the Internet of Things (IoT), and artificial intelligence (AI) have fueled investments in data centers. The surge in data centers has driven demand for advanced cooling solutions to ensure optimal performance offering lucrative opportunities for businesses offering data center immersion cooling solutions.

A major driver of the data center immersion cooling market is the rising calls for energy-efficient cooling solutions. Data centers are known to be energy-intensive which puts them under scrutiny, leading to rising calls to invest in efficient cooling solutions. Government investments in projects supporting cooling solutions are poised to benefit the key players in the sector by providing lucrative research contracts. For instance, in May 2023, the U.S. Department of Energy announced USD 40 million for 15 projects to develop more efficient data center cooling solutions. Furthermore, the National Renewable Energy Laboratory (NREL) announced that it will join the USD 40 million project that has the potential to commercialize cooling solutions that can reduce energy consumption in immersion cooling.

Additionally, the data center immersion cooling sector is positioned to benefit from the rising demand for cooling solutions from emerging markets. The expansion of immersion cooling solutions to emerging markets creates new revenue streams for the data center immersion cooling market players. Rapidly growing economies such as Indonesia and Malaysia are attracting significant data center investments owing to strategic locations, and robust power supplies, while expansion to the Middle East offers profitable opportunities within the sector. For instance, in October 2023, Green Revolution Cooling, Dell Technologies, and DCV Industries announced a collaboration to deliver cutting-edge immersion-cooled data centers to the Middle East. The collaboration is set to offer organizations in the region solutions to reduce costs in comparison to traditional air-cooled facilities.

Key Data Center Immersion Cooling Market Insights Summary:

Regional Highlights:

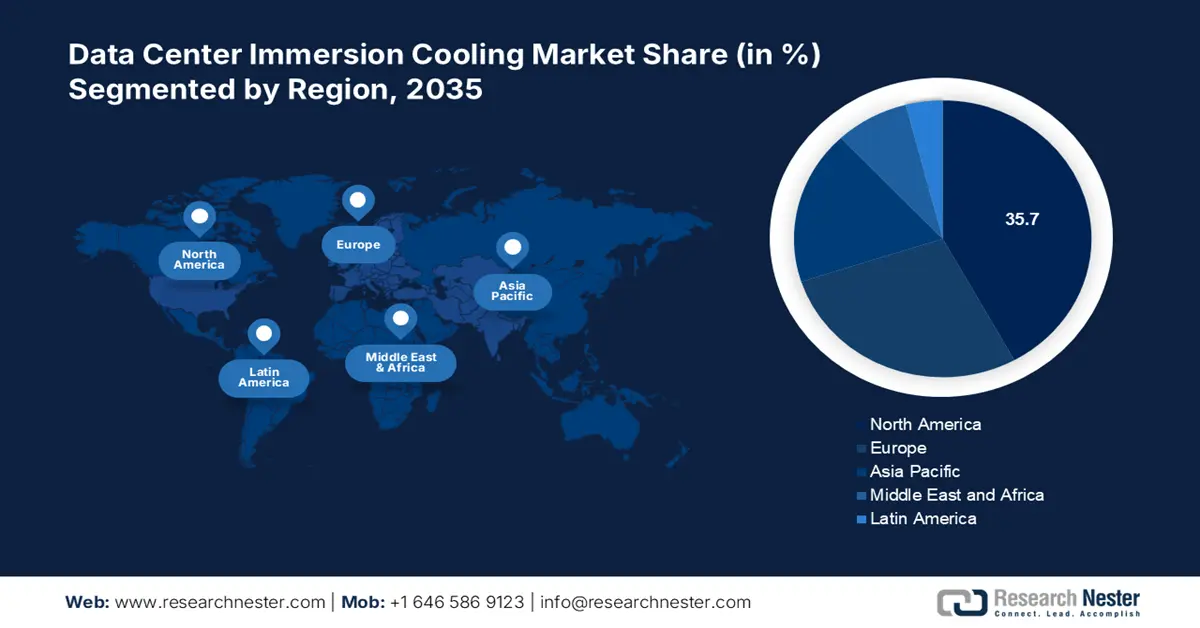

- North America leads the Data Center Immersion Cooling Market with a 35.70% share, driven by increasing high-performance computing workloads in AI, ensuring strong growth prospects through 2035.

- The APAC data center immersion cooling market is poised for rapid growth by 2035, attributed to increasing expansion of data center infrastructure.

Segment Insights:

- The Two-Phase Cooling segment is expected to expand significantly by 2035, driven by its ability to support high-density workloads in data centers requiring intensive thermal management.

- Single-Phase Cooling segment is expected to hold a 63.7% share by 2035, driven by its operational efficiency in blockchain-based applications like cryptocurrency mining.

Key Growth Trends:

- Technological advancements in immersion cooling

- Growing integration with modular data centers

Major Challenges:

- Concerns regarding fluid leakage

- Maintenance challenges driving costs

- Key Players: Green Revolution Cooling Inc., DCX Liquid Cooling Systems, LiquidStack Inc., Asperitas, Fujitsu, Vertiv, Submer, ZTE Corporation, 3M, STULZ GMBH.

Global Data Center Immersion Cooling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.98 billion

- 2026 Market Size: USD 4.6 billion

- Projected Market Size: USD 19.63 billion by 2035

- Growth Forecasts: 17.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, UAE

Last updated on : 13 August, 2025

Data Center Immersion Cooling Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements in immersion cooling: Investments in R&D have advanced innovations in the efficiency of immersion cooling systems driving their demand. Developments in dielectric fluids have led to effective thermal management of heat generated by high-performance computing equipment. For instance, in September 2024, Hanhwa Aerospace and SK Enmove launched the world’s first immersion cooling energy storage system that uses advanced thermal fluid technology.

Companies operating in the sector seek to expand their revenue shares by leveraging the rising demand for immersion cooling fluids to assist data centers in mitigating energy consumption. In October 2023, Shell Lubricants announced the introduction of single-phase immersion cooling fluids for efficient cooling of computer components to reduce energy consumption while curbing carbon dioxide emissions. Such advancements bode well for the market as they are poised to drive further adoption. - Growing integration with modular data centers: The rise of modular data centers is a key driver of the data center immersion cooling market. Modular data centers are popular in remote locations where traditional cooling systems face logistical challenges. This provides opportunities for the adoption of immersion cooling systems owing to seamless integration with compact designs. In July 2024, Vertiv launched high-density prefabricated modular data solutions to boost global AI computing, and a rise in AI computing is positioned to drive demand for efficient immersion cooling solutions.

- Expansion of high-performance computing and AI applications: The AI boom globally has driven demand for immersion cooling solutions. Businesses are launching data center components to support advanced cooling solutions and boost AI workloads. For instance, in December 2024, Amazon Web Services (AWS) announced new data center components to support AI innovation and support the creation of energy-efficient data centers. Furthermore, immersion cooling enables higher server densities with a smaller carbon footprint which makes it lucrative for adoption by data centers.

The International Energy Agency released a report that due to the doubling of internet users worldwide, global internet traffic has experienced a 25% increase driving pressure on data centers to improve thermal management systems. Additionally, the data center immersion cooling market is experiencing favorable trends evident by businesses securing funding to advance cooling solutions. For instance, in November 2024, Accelsius announced the securing of USD 24 million in Series A funding to provide solutions to cool AI data centers. The entry of new players in the data center immersion cooling sector augurs well to create a competitive data center immersion cooling market and offer cost-effective pricing solutions for data centers to adopt immersion cooling systems.

Challenges

- Concerns regarding fluid leakage: Despite the advanced manufacturing of immersion cooling systems offering leak-proof solutions, water can still corrode equipment leading to equipment failure. Furthermore, damage due to equipment fluid leakage can cause challenges for operators to file insurance claims, and frequent replacement of liquids can add to costs. The leak concerns open new revenue segments in the data center immersion cooling market. For instance, WEVO-CHEMIE GmbH offers materials to seal the immersion cooling systems efficiently.

- Maintenance challenges driving costs: Data centers are often placed in remote locations, and even underwater. The market faces challenges in immersion cooling system maintenance in data centers in aquatic settings. The growth of preventive maintenance solutions has mitigated the costs associated but the sector can continue to face constraints in the adoption of immersion cooling in data centers located in hard-to-access areas.

Data Center Immersion Cooling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 3.98 billion |

|

Forecast Year Market Size (2035) |

USD 19.63 billion |

|

Regional Scope |

|

Data Center Immersion Cooling Market Segmentation:

Cooling Technique (Single Phase Cooling, Two-Phase Cooling)

Single-phase cooling segment is projected to capture data center immersion cooling market share of over 63.7% by 2035. The operational efficiency coupled with the cost-effectiveness offered by single-phase immersion cooling solutions is a key driver of the market.

Furthermore, the proliferation of blockchain-based applications such as cryptocurrency mining owing to the surging popularity of decentralized finance platforms has encouraged businesses to forward single-phase immersion cooling solutions. For instance, in June 2023, Green Revolution Cooling launched the HashRaq which is a productivity-driven, immersion cooling solution that tackles the extreme heat loads generated by crypto mining. Additionally, single-phase immersion cooling solutions support higher data density that is poised to ensure sustained demand by the end of the forecast period.

The two-phase cooling segment of the data center immersion cooling market is poised to expand during the forecast period. A key driver of the segment’s growth is its ability to support high-density workloads boosting adoption in data centers. Furthermore, the rising demand for data centers to handle high-performance computing applications requires intensive thermal management solutions, and two-phase immersion cooling solutions can handle higher thermal loads in comparison to single-phase immersion cooling.

Additionally, the demand for specialty fluid has created profitable revenue streams in the segment that businesses can leverage. For instance, in July 2023, the Chemours Company announced the development of Opteon 2P50, i.e., a new heat-transfer specialty fluid for two-phase immersion cooling. The new fluid is at the final testing stages for manufacturing capability, and commercial production is poised to assist the segment’s growth.

End use (Hyperscale, Supercomputing, Enterprise HPC, Cryptocurrency, Edge/5G Computing, Others)

By end use, the hyperscale data center segment in data center immersion cooling market is projected to drive the largest demand for immersion cooling systems by the end of the forecast period. Hyperscale data center supports cloud service providers and major enterprises, requiring the handling of vast amounts of data with operations generating significant heat. The efficient thermal management requirements drive the demand for immersion cooling solutions in hyperscale data centers. Opportunities to leverage the large-scale demand from this end user arise with businesses offering solutions targeted for hyperscale data centers.

Furthermore, investments to build new hyperscale data centers are poised to create opportunities to supply immersion cooling solutions. For instance, in October 2024, Microsoft announced a USD 4.47 initiative to expand its hyperscale cloud and AI data center infrastructure in Italy.

Our in-depth analysis of the global market includes the following segments:

|

Cooling Technique |

|

|

End use |

|

|

Cooling Fluid |

|

|

Organization Size |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Immersion Cooling Market Regional Analysis:

North America Market Forecast

North America in data center immersion cooling market is anticipated to account for around 35.7% revenue share by 2035. The growth of the regional market is attributed to increasing high-performance computing workloads in the fields of AI, driving demand for cost-effective data center cooling solutions. Furthermore, the growing investments in new energy-efficient cooling solutions and data center infrastructure in the region are positioned to benefit the businesses operating in the sector.

For instance, in December 2024, the Governor of Ohio announced a USD 10 billion investment plan from Amazon Web Services to expand its data center infrastructure across greater Ohio, U.S. Large-scale investments as such are poised to create profitable opportunities for the data center immersion cooling sector by driving demand for advanced immersion cooling systems.

The U.S. holds a dominant revenue share in the North America data center immersion cooling market. The country’s market benefits from investments to advance immersion cooling solutions through investments in R&D projects. The U.S. government has been proactive in supporting R&D activities to ensure energy-efficient solutions that can mitigate emissions and reduce energy consumption in the data centers.

Additionally, the country has a well-established digital ecosystem driven by the presence of data center immersion cooling market leaders such as OpenAI, Google, Microsoft, Amazon, etc., which drives investments in data centers. The higher digital load in the country is expected to create a steady stream of opportunities for immersion cooling systems. For instance, in September 2022, Dow launched the Dowsil Immersion Cooling Technology, i.e., a next-generation solution for cooling hyperscale cloud and enterprise data centers with optimized efficiency and sustainability. The trends indicate opportunities for businesses to expand their immersion cooling portfolios in the U.S. to leverage the surging demands.

Canada is poised to expand its revenue share in the North America data center immersion cooling market. The market in Canada is characterized by stringent regulations to curb emissions and energy use by data centers that drive demand for immersion cooling systems. A key feature of the Canada market is the cool climate that boosts the energy efficiency of data centers by mitigating cooling costs. In February 2022, the Canada Energy Regulator estimated a total of 239 data centers operating across the country, and the data center immersion cooling market to be expanding rapidly. The trends bode well for businesses providing immersion cooling systems for data centers in Canada, as the increasing demand is poised to expand revenue streams.

In December 2024, Cohere and CoreWeave announced plans for a multi-billion-dollar data center in Canada supported by the government with up to USD 170 million in funding as a part of the Canadian Sovereign AI Compute Strategy. Large-scale data center investments as such augur well for the continued growth of the Canada data center immersion cooling sector by ensuring a steady stream of opportunities to provide robust cooling solutions.

APAC Market Forecast

The APAC data center immersion cooling market is poised to exhibit rapid growth during the forecast period owing to the increasing expansion of data center infrastructure to support digital transformation across the region. APAC’s position as a technology hub in the global market has heightened demand for immersion cooling systems for data centers to ensure continued seamless operations.

Furthermore, the proliferation of green data centers has increased complexity in power generation driving sustained demand for immersion cooling systems. In June 2024, ZTE Corporation of China launched its latest immersion cooling server, i.e., Ice Tank, designed for AI and high-performance computing data center scenarios requiring efficient heat dissipation.

China is poised to register the largest revenue share in the APAC data center immersion cooling market. The high digital load in China drives an increasing load on data centers in the country, which drives demand for immersion cooling systems. Additionally, China accounts for the highest number of data centers in APAC, which makes the market lucrative. Businesses in the country are actively advancing partnerships to drive advancements in immersion liquid cooling technology. For instance, in January 2024, Fuchs Lubricants China Ltd. signed an agreement with Anhui Zhongding Intelligent Thermal Management Systems Co. to provide long-term thermal immersion cooling solutions for data centers.

A feature of the data center immersion cooling market in China is the collaboration between academic institutions, businesses, and the government to improve immersion liquid cooling solutions. For instance, in October 2024, the Hong Kong University of Science and Technology launched the largest liquid immersion cooling system in its research computing facility. The new technology reduced energy consumption in data center cooling by over 80% which is poised to assist the growth of the China data center immersion cooling sector.

India is poised to account for a significant share of the APAC data center immersion cooling market. The market’s growth in the country is due to the boom in internet users fueled by 5G proliferation in the country. Another key factor of the sector’s expansion in India is the country’s position as a tech hub and the tropical climate in the country that impacts data centers in the region. The factors drive demand for immersion cooling solutions creating profitable opportunities in the India data center immersion cooling market. For instance, in January 2024, Neev Cloud announced a partnership with ZutaCore to leverage the latter’s two-phase liquid cooling solution.

Key Data Center Immersion Cooling Market Players:

- Green Revolution Cooling Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DCX Liquid Cooling Systems

- LiquidStack Inc.

- Asperitas

- Fujitsu

- Vertiv

- Submer

- ZTE Corporation

- 3M

- STULZ GMBH

The data center immersion cooling market is poised to expand during the forecast period. The market trends and analysis indicate that key players in the sector are investing in R&D to improve energy-efficient immersion cooling solutions to assist data centers in mitigating energy usage. Additionally, advancements in fluid for immersion cooling are positioned to benefit the market players.

Businesses in the sector can invest in providing leakage-proof immersion cooling systems to drive adoption and expand their data center immersion cooling market share, in a highly-competitive sector. Furthermore, opportunities are rife with the emergence of green data centers to collaborate on immersion cooling services to hasten their advent. For instance, in November 2023, Infosys and Shell announced collaboration on immersion cooling services to enable sustainability-first data centers by leveraging Shell’s immersion cooling fluid.

Here are some key players in the data center immersion cooling market:

Recent Developments

- In March 2024, Marathon Digital Holdings launched a two-phase immersion cooling system to optimize data center operations. Mara’s solution is poised to assist bitcoin mining specifically with the system able to enable data centers to be built and operated in remote or harsh climates that were previously inaccessible.

- In January 2024, Modine announced investment in liquid immersion cooling technology to support high-density data center applications. Modine’s announcement stated that it had purchased the intellectual property and other specific assets of TMG Core, a specialist in single- and two-phase liquid immersion cooling technology for data centers with high-density computing requirements.

- Report ID: 6893

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.