Data Center Cooling Market Outlook:

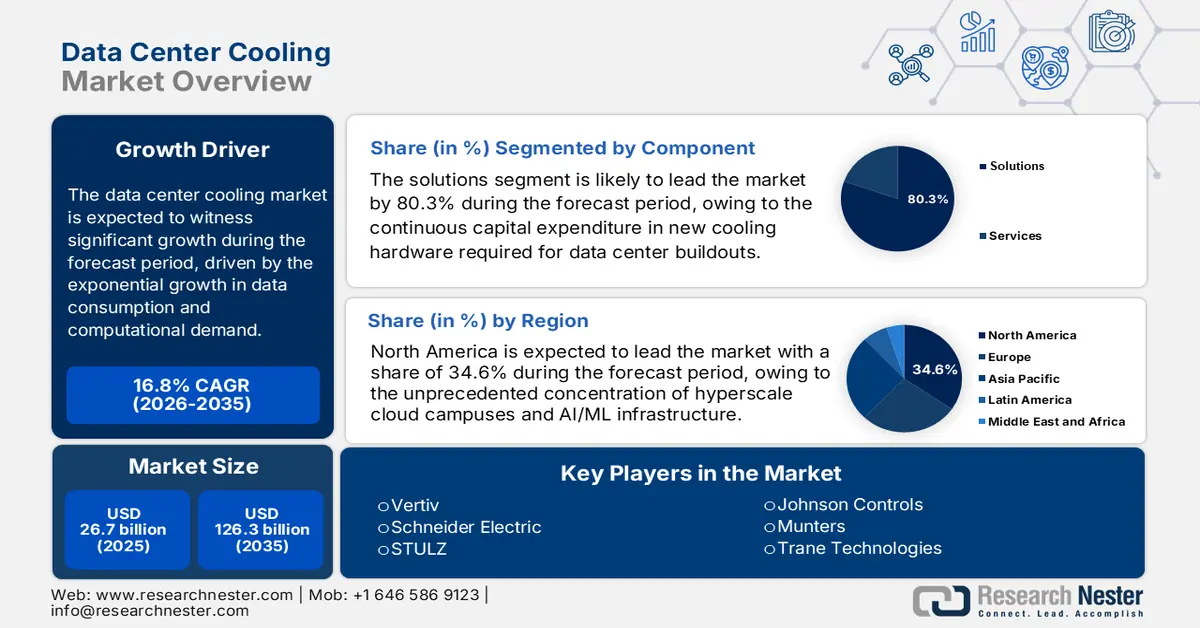

Data Center Cooling Market size was valued at USD 26.7 billion in 2025 and is projected to reach USD 126.3 billion by the end of 2035, rising at a CAGR of 16.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of data center cooling is estimated at USD 31.2 billion.

The data center cooling market is a critical and rapidly evolving segment of the global digital infrastructure sector and is driven mainly by the exponential growth in data consumption and computational demand. The expansion of cloud computing, artificial intelligence, and high-performance computing is significantly increasing the power density and thermal load within data center facilities, necessitating advanced thermal management solutions. The primary indicator of this growth is the substantial energy footprint of the sector. The report from the U.S. Department of Energy in December 2024 indicates that the data centers in the U.S. consumed 176 TWh in 2023, and this number is estimated to increase further. Moreover, over the consumption represents 4.4% of the nation’s total electricity use is consumed by cooling, accounting for a significant portion of this energy expenditure.

Key market drivers are linked to the national and international energy and environmental policy. Robust regulations such as the European Commission’s Energy Efficiency Directive are mandating continuous improvement in power usage effectiveness, pushing the facility operators to adopt more efficient cooling technologies such as liquid-based systems and advanced economization. These technologies can dramatically reduce the auxiliary energy used for cooling. The International Energy Agency data in April 2025 indicates that the global data center energy consumption is set to double by 2030 to 945 TWh. The energy efficiency gains from the technological improvements, including advanced cooling, have helped moderate this growth. The market is consequently shifting toward solutions that not only manage the higher heat loads from the AI servers but also align with the corporate and government sustainability targets.

Key Data Center Cooling Market Insights Summary:

Regional Highlights:

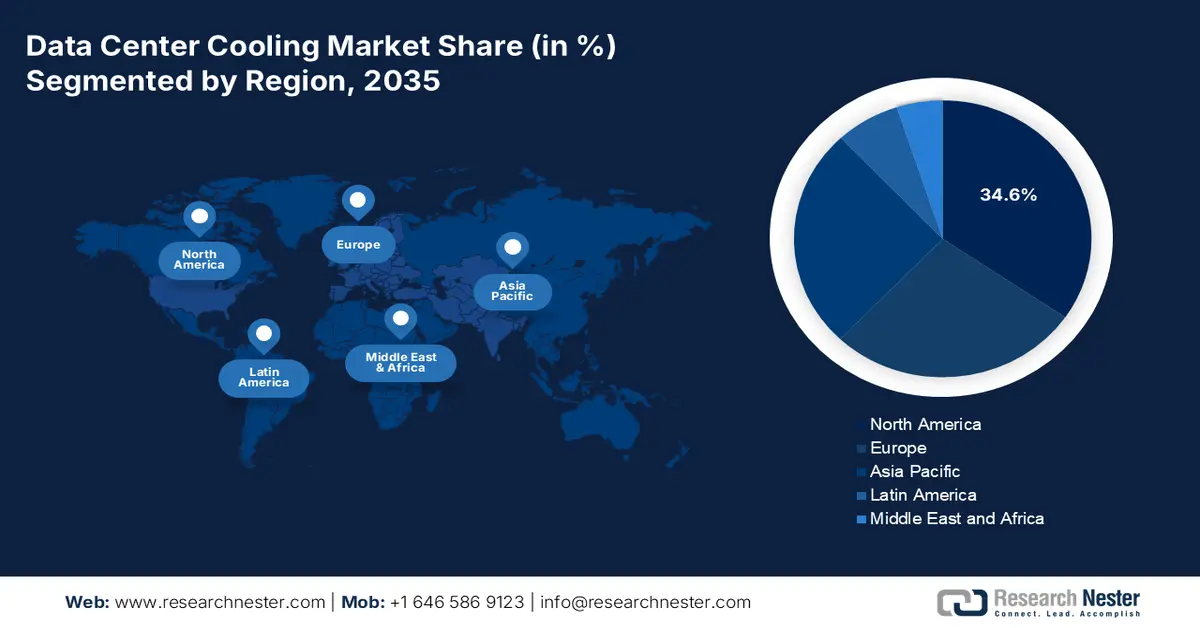

- North America is projected to dominate the data center cooling market with a 34.6% share by 2035, reinforced by dense hyperscale cloud and AI/ML infrastructure concentration in the U.S. and strengthened by large-scale capital inflows and federal incentives encouraging liquid cooling adoption.

- Asia Pacific is expected to be the fastest-growing region, expanding at a CAGR of 14.5% by 2035, underpinned by accelerated digitalization, hyperscale expansion, and government-led digital infrastructure initiatives stimulating advanced cooling demand.

Segment Insights:

- Under the component segment, solutions are anticipated to command an 80.3% share by 2035 in the data center cooling market, supported by sustained capital investment in new cooling hardware and high-density retrofits fueling adoption of advanced liquid cooling systems.

- Within the data center type segment, hyperscale data centers are projected to hold the maximum share by 2035, bolstered by large-scale cloud operators prioritizing extreme energy efficiency and accelerating deployment of advanced, high-capacity cooling technologies.

Key Growth Trends:

- Public spending on AI and high-performance computing infrastructure

- Expansion of government cloud and digital public services

Major Challenges:

- Capital intensity and R&D costs

- Supply chain volatility for critical components

Key Players: Vertiv, Schneider Electric, STULZ, Johnson Controls, Munters, Trane Technologies, Carrier Global Corporation, Rittal, Mitsubishi Electric, Fujitsu, Hitachi, Nortek Air Solutions, Airedale International Air Conditioning, CoolIT Systems, Green Revolution Cooling, LiquidStack, Alfa Laval, Samsung Electronics, Submer, Delta Electronics

Global Data Center Cooling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.7 billion

- 2026 Market Size: USD 31.2 billion

- Projected Market Size:USD 126.3 billion by 2035

- Growth Forecasts: 16.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, Indonesia

Last updated on : 6 January, 2026

Data Center Cooling Market - Growth Drivers and Challenges

Growth Drivers

- Public spending on AI and high-performance computing infrastructure: Government investments in AI defense computing and scientific research are increasing the rack densities and intensifying cooling requirements. The White House data in March 2023 indicates that USD 2 million is allocated towards the AI, quantum information sciences, and microelectronics. The national laboratories and federally funded research facilities are deploying high-performance computing clusters that operate at significantly higher thermal thresholds than conventional enterprise IT. The European Commission similarly supports AI compute capacity via Digital Europe and Horizon Europe programs, which explicitly fund data infrastructure expansion. These deployments generate sustained demand for high-capacity cooling systems capable of handling continuous high-load operations.

- Expansion of government cloud and digital public services: Government migration to cloud-based platforms is stimulating the demand for data center capacity and associated cooling infrastructure. The U.S. Federal Cloud Computing Strategy continues to drive the agency migration to shared and commercial data centers, increasing utilization rates and thermal loads. The U.S. Government Accountability Office in August 2025 indicates that the federal IT spending exceeded USD 100 billion, with a growing share allocated to cloud-hosted environments. Similar trends are witnessed in Asia and Europe, where the governments are digitizing healthcare taxation and identity systems. Higher server utilization intensifies cooling needs, mainly in colocation facilities serving public sector clients.

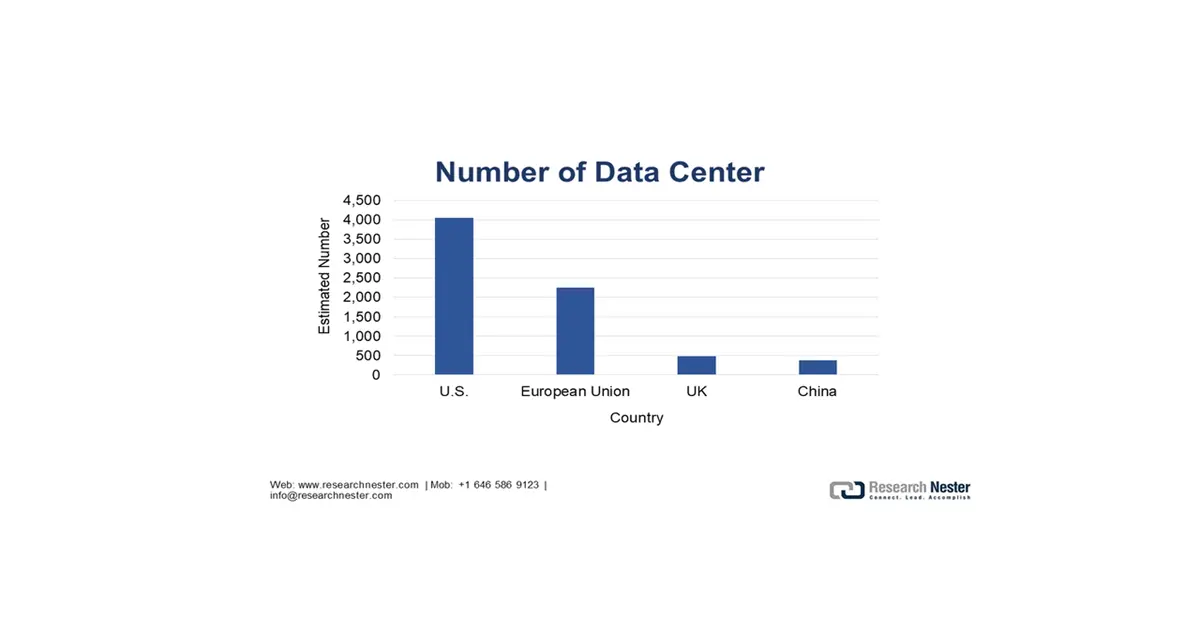

- Rapid expansion of data center capacity: The U.S. has the largest data center cooling market and is driven by the volume and intensity of data center development, as well as capacity expansions. The Federal Reserve System in October 2025 depicts that the U.S. hosted an estimated 4,049 data centers in 2024, significantly exceeding the installed base in the EU, UK, and China. In terms of capacity, the US installed roughly 5.8 GW of new data center power capacity in 2024, compared to 1.6 GW in WU and 0.2 GW in the UK, demonstrating the disproportionate expansion of the competitive infrastructure in the US market. On a per capita basis, the U.S. server base reached 99.9 servers per 1,000 people, far surpassing other advanced economies and China, indicating higher average server and rack densities.

Source: Federal Reserve System, October 2025

Challenges

- Capital intensity and R&D costs: Entering into the data center cooling market needs an immense capital for the R&D and production of complex systems like immersion cooling. Smaller firms struggle to match the investment of giants such as Vertiv, which spent a huge amount on R&D to advance its liquid cooling portfolio. High initial costs create a significant barrier to scaling competitive solutions. This financial disparity ensures that the innovation remains largely concentrated within the well-funded incumbents, constricting the pace of breakthrough technology from new market entrants.

- Supply chain volatility for critical components: The market relies on specialized components, such as controllers and compressors, with the supply chains prone to disruptions. The top players use their scale and vertical integration to ensure supply, a key advantage highlighted during the chip crisis, resulting in more dependable product delivery than smaller competitors.

Data Center Cooling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 26.7 billion |

|

Forecast Year Market Size (2035) |

USD 126.3 billion |

|

Regional Scope |

|

Data Center Cooling Market Segmentation:

Component Segment Analysis

Under the component segment, the solutions are leading the segment and are poised to hold the share value of 80.3% by 2035. The segment is driven by the continuous capital expenditure in new cooling hardware required for data center buildouts and high-density retrofits. The core growth is in the advanced liquid cooling systems, including direct-to-chip and immersion units, which are essential for modern AI clusters. The key statistical indicator from the OEC 2023 shows the scale of this hardware base. The U.S. imports of air conditioning machinery, a category that includes data center cooling units, were valued at over USD 14.3 billion, highlighting the huge global supply chain for cooling solutions. This import value indicates the sector's critical reliance on the global manufacturing and specialized components to meet the escalating demand.

Data Center Type Segment Analysis

The data center type segmentation analyzes cooling demand by facility scale and function, with hyperscale data centers being the leader and projected to hold the maximum share by 2035. The facilities operated by the cloud giants, such as Amazon, Microsoft, and Google, drive innovation and volume demand due to their unprecedented scale and power density. Their centralized procurement and operational focus on extreme energy efficiency make them the primary adopters of advanced sustainable cooling technologies. The data from the Invest UP in November 2022 indicates that the Uttar Pradesh Chief Minister Yogi Adityanath has inaugurated the hyperscale data center Yotta D1 in Noida. This development indicates the global expansion of hyperscale facilities, which are the primary engines of growth for the advanced, high-capacity cooling solutions worldwide.

Type of Cooling Segment Analysis

The type of cooling segment categorizing the core technological approach is undergoing a vital transformation, with liquid-based cooling rapidly ascending to become the leading sub-segment with the greatest revenue share by 2035. The segment is driven by the physical limitations of air in cooling AI servers and the high-performance computing racks. Liquid cooling via immersion or direct to chip methods offers an order of magnitude improvement in heat transfer efficiency, enabling higher compute densities while reducing the energy and water use. The U.S. Environmental Protection Agency’s Energy Star program highlights this technological pivot, indicating the servers capable of liquid cooling saw a dramatic increase in model availability, signaling a massive industry shift toward liquid-ready IT hardware.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Type of Cooling |

|

|

Product |

|

|

Data Center Type |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Cooling Market - Regional Analysis

North America Market Insights

The North America is dominating the data center cooling market and is expected to hold a share of the 34.6% by 2035. The market is driven by the unprecedented concentration of hyperscale cloud campuses and AI/ML infrastructure in the U.S. The region’s dominance is fueled by the massive capital investment from the technology giants and supportive federal policies such as the Science Act and CHIPS, which incentivize the domestic semiconductor and high-performance computing facilities that demand liquid cooling solutions. The key trends include a rapid industry-wide pivot from the traditional air conditioning to direct-to-chip and immersion cooling to manage heat loads, and growing regulatory and operational focus on water conservation in the drought-prone areas, pushing the adoption of closed-loop and adiabatic systems.

The U.S. data center cooling market is shaped by the federal energy efficiency funding and decarbonization priorities. The U.S. Department of Energy in May 2023, announced USD 40 million in targeted funding under the ARPA-E COOLERCHIPS program to support projects that are focused on high-performance cooling systems for data centers. The report explicitly notes that the data centers account for 2% of total U.S. electricity consumption, while the cooling alone can represent up to 40% of the total data center energy use, making cooling infrastructure a critical intervention points for the national energy policy. The selected projects span national laboratories, universities, and commercial entities, signaling a clear federal intent to move advanced cooling technologies closer to commercialization and operational deployment. This funding improves the infrastructure resilience reduce operational carbon emissions, and support high density computing environments.

Some DOE ARPA-E COOLERCHIPS Program - Funded Projects (2023)

|

Organization |

Location |

Cooling Focus / Project Scope |

Award Amount (USD) |

|

Flexnode |

Bethesda, MD |

Prefabricated, modular data center design leveraging system-level cooling efficiency improvements |

3,500,000 |

|

HP |

Corvallis, OR |

Advanced liquid cooling reducing thermal interface material and package thermal resistance; heat rejection to high ambient conditions |

3,250,000 |

|

HRL Laboratories |

Malibu, CA |

Novel low-thermal-resistance data center thermal management system for next-generation servers |

2,000,000 |

|

Intel Federal |

Austin, TX |

Adaptation of two-phase immersion cooling to improve heat spreading efficiency |

1,711,416 |

Source: DOE May 2023

Canada’s data center cooling market is shaped by stimulating the data center expansion, rising AI-driven electricity demand, and the strong alignment with the clean energy and efficiency policies. The report from the Canada Energy Regulator in October 2024 indicates that nearly 239 operational data centers are across Canada, with continued capacity additions driven by low electricity prices, abundant hydroelectric power, and a naturally cool climate that lowers baseline data centers consumed 460 TWh of electricity in 2022, with the demand projected to double by 2026, a trend reflected in Canada's utility planning. Hydro Quebec forecasts a 4.1 TWh increase in data center electricity demand between 2023 and 2032, while Ontario’s IESO and Alberta’s AESO explicitly identify data centers as a key source of the commercial load growth. These factors indicate sustained, policy-supported demand for the high-efficiency data center cooling solutions in Canada.

APAC Market Insights

The Asia Pacific is the fastest-growing market and is expected to grow at a CAGR of 14.5% by 2035. The market is driven by the potent mix of digitalization, government investment, and hyperscale expansion. The key drivers include national digital sovereignty initiatives such as China’s East Data West Computing project, which mandates the construction of massive data center clusters in western provinces, and India’s Digital India mission, fueling the demand for new facilities. A primary trend is the rapid adoption of innovative cooling technologies suited to the region’s diverse climates, from the water-scarce Australia to tropical Singapore, with a strong push toward liquid cooling for AI workloads. Governments are actively shaping the market via policies demonstrating leading-edge power and cooling efficiency, directly influencing technology adoption.

China’s data center cooling market is reshaped by the rapid growth in AI workloads, government-backed digital economy initiatives, and the rising deployment of high-density computing infrastructure. The launch of Chayora’s Ingenuity high-density data center solution in November 2023 reflects a broader market shift toward the liquid and hybrid cooling architectures, as traditional air cooling alone is insufficient for AI model training and inference workloads. This transition is reinforced by the national policy support China’s State Council’s New Generation Artificial Intelligence Development Plan, which elevated AI as a strategic industry, while the data from the Ministry of Industry and Information Technology indicates that China’s AI core industry reached RMB 500 billion in 2023, with over 4,300 operating enterprises driving the demand for compute-intensive infrastructure. China’s market is increasingly characterized by liquid cooling adoption, high rack power densities, and efficiency-focused design, positioning cooling systems as a critical enabler of the country’s digital economy expansion.

Recent Data Centers Developments in China

|

Company |

Announcement Date |

Key Development |

Details |

|

Envicool |

September 26 (implied) |

Intel Partnership (DCAI China Liquid Cooling Program) |

First local partner; full-chain solutions (BHS-AP cold plates, UQD quick disconnects, Manifold, CDUs) passed Intel tests for Xeon 6 Granite Rapids; manages 1GW+ cooling; whitepaper co-released |

|

GLP |

August 2025 |

RMB 2.5B Investment |

Landmark funding to scale China data center operations |

|

Vertiv |

July 2024 |

High-Density Prefab Modular Solution Launch |

Accelerates global AI compute deployment via modular data centers |

Source: Envicool, GLP, Vertiv

The data center cooling market in India is experiencing explosive growth and is driven by the government’s Digital India initiative, a surge in domestic data consumption, and massive investments by the global hyperscalers and local operators such as Adani and Reliance, establishing new facilities. The rapid expansion of cloud regions and AI workloads is pushing demand beyond traditional air cooling towards more efficient solutions such as liquid and evaporative cooling, particularly in tropical climates. A key statistical indicator from the PIB March 2024 shows the scale of this digital infrastructure push under the India AI Mission. The government has approved an outlay of ₹10,300 crore (approx. USD 1.24 billion) for 2024-2025 to build AI computing capacity, which will directly fund data centers requiring advanced thermal management.

Europe Market Insights

The data center cooling market in Europe is a mature but rapidly evolving sector primarily driven by the region’s strong sustainability directives and the explosive growth of cloud computing and AI workloads. The European Union’s Energy Efficiency Directives and the European Green Deal are the powerful regulatory drivers pushing the operators to achieve very low power usage effectiveness and adopt water efficiency technologies. Key trends include a strong shift towards liquid cooling solutions to handle high-density AI servers and the widespread use of free cooling systems that leverage the continent’s temperature climate. For example, countries such as Finland and Sweden are becoming major hubs by using outside air and seawater for cooling. These factors make Europe a leader in adopting innovative and environmentally sustainable cooling technologies.

Germany’s market leads in Europe and is driven by the robust national climate legislation and Frankfurt’s position as a global connectivity hub. The country’s Energy Efficiency Act and Federal Climate Change Act legally mandate continuous reductions in energy consumption for the digital infrastructure, making advanced cooling systems a critical compliance investment. This regulatory pressure stimulates the adoption of highly efficient solutions such as liquid cooling and waste heat recovery. A pivotal example of public funding for this transaction is the German government’s AI Action Plan. The Federal Ministry for Economic Affairs and Climate Action announced a funding package specifically for the construction and expansion of AI computing centers, which inherently require next-generation thermal management.

The UK data center cooling market is defined by the rapid growth in AI workloads, hyperscale and colocation expansion, and tightening energy efficiency and sustainability expectations. London remains one of Europe’s largest data center hubs, and rising rack densities associated with AI cloud and edge computing are increasing the thermal loads beyond the limits of conventional air-only cooling. Against this backdrop, in September 2025, Daikin’s focus on high-capacity CRAHs, modular fan arrays, glycol-free chillers, and AI-driven control systems reflects broader market demand in the UK for scalable, resilient, and low-carbon cooling infrastructure. UK operators are under pressure to improve the power usage effectiveness and water usage effectiveness while maintaining the Tier III and Tier IV availability, mainly as energy costs and grid constraints remain structural concerns.

Key Data Center Cooling Market Players:

- Vertiv (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric (France)

- STULZ (Germany)

- Johnson Controls (U.S.)

- Munters (Sweden)

- Trane Technologies (U.S.)

- Carrier Global Corporation (U.S.)

- Rittal (Germany)

- Mitsubishi Electric (Japan)

- Fujitsu (Japan)

- Hitachi (Japan)

- Nortek Air Solutions (U.S.)

- Airedale International Air Conditioning (UK)

- CoolIT Systems (Canada)

- Green Revolution Cooling (GRC) (U.S.)

- LiquidStack (U.S.)

- Alfa Laval (Sweden)

- Samsung Electronics (South Korea)

- Submer (Spain)

- Delta Electronics (Taiwan)

- Vertiv is a global leader in the market, significantly advancing the industry by integrating modular, scalable, and liquid cooling solutions into critical infrastructure. This advancement ensures ultra-high-density computing for AI and cloud services can operate with maximum reliability and energy efficiency, optimizing thermal management in the world’s most demanding data centers. The annual report for 2024 has indicated that the annual revenue of the company reached USD 8.0 billion.

- Schneider Electric is a pioneer in providing integrated data center management solutions and has made significant advancements in the data center cooling market by adopting IoT ad AI driven analytics into its EcoStruxure platform. This advancement ensures a dynamic cooling optimization and predictive maintenance, enabling the data centers to achieve unprecedented levels of energy efficiency and operational sustainability.

- STULZ is a specialist and technology leader in the market, significantly advancing precision air conditioning via innovative CyberAir and chilled water systems. This advancement ensures exact environment control for the IT equipment, providing exceptional reliability and efficiency to support 24/7 operations in the facilities ranging from enterprise server rooms to large-scale colocation hubs. The company has made a total sale of 850 million euros in 2024.

- Johnson Controls is a pioneer in smart building technologies and has made significant advancements in the data center cooling market by integrating its OpenBlue digital platform with the advanced chiller and thermal storage solutions. This advancement ensures the data centers can intelligently balance the cooling loads with grid demand and renewable energy use, optimizing both performance and sustainability.

- Munters is a global expert in energy efficiency air treatment and has made significant advancements in the market via its patented indirect evaporative cooling and liquid cooling technologies. This advancement ensures data centers mainly in hot and dry climates can dramatically reduce the water and energy consumption while maintaining optimal operating conditions, optimizing the total cost of ownership.

Here is a list of key players operating in the global market:

The global data center cooling market is very competitive and fragmented, with key players from North America, Europe, and the Asia Pacific vying for dominance. The competitive landscape is defined by the intense R&D investment, strategic mergers and acquisition and a push towards innovative energy efficiency and sustainable cooling solutions. For instance, Daikin acquired DDC Solutions in August 2025 to enhance AI data center cooling technologies. The leading companies are strategically expanding their global footprints via partnerships, enhancing their product portfolios with advanced technologies such as liquid cooling, AI-driven monitoring, and modular systems to address the rising heat densities from AI and HPC workloads. Sustainability initiatives focusing on water conservation and reduced PUE are now central to corporate strategies to meet both the environmental regulations and client demands.

Corporate Landscape of the Data Center Cooling Market:

Recent Developments

- In October 2025, Johnson Controls announced a multi-million-dollar strategic investment in Accelsius, a leader in two-phase, direct-to-chip liquid cooling technology for data centres. Two-phase solutions use phase change from liquid to vapor to remove heat, enabling more efficient heat extraction with reduced energy consumption.

- In August 2025, Modine has officially opened its new 100,000 ft.2 facility in Chennai, India. The event marked the beginning of full-scale, in-region production of Airedale by Modine data center cooling equipment and a strategic positioning to meet demand from data center customers across the Asia-Pacific region.

- In May 2025, Ecolab Inc. announced the launch of a new technology within an advanced portfolio of solutions to drive high-performance data center cooling. The new cooling management technology aims to revolutionize performance and efficiency for data centers.

- Report ID: 4756

- Published Date: Jan 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Cooling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.