Energy Storage System Market Outlook:

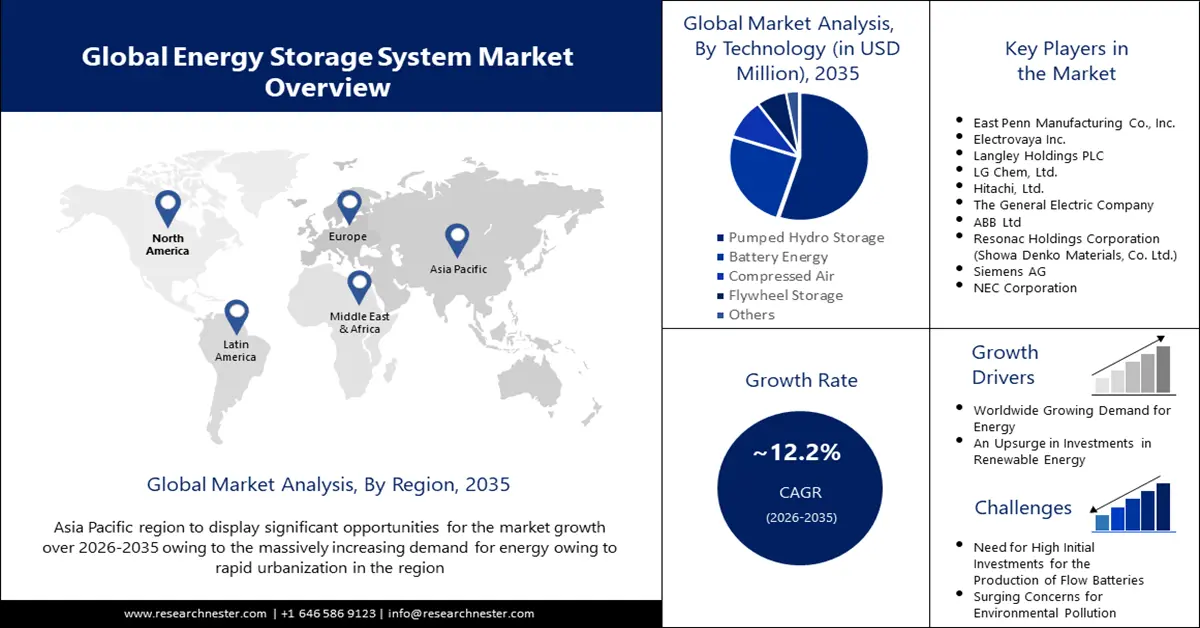

Energy Storage System Market size was valued at USD 241.47 billion in 2025 and is likely to cross USD 763.47 billion by 2035, expanding at more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of energy storage system is assessed at USD 267.98 billion.

The growth of the market can be attributed to the growing demand for energy storage and transportation, backed by the global adoption of renewable energy, and soaring investments in grids are anticipated to drive the market growth in the coming years. As per a report by the International Energy Agency (IEA), electricity grid investments were expected to reach USD 290 billion in 2021. Moreover, the radically increasing demand for energy throughout the world is also predicted to increase the growth of the global energy storage system market further in the years to come.

In addition to these, factors that are believed to fuel the market growth of energy storage system include the worldwide rise in power outages, along with the surging investments in the production of renewable energy. For instance, based on a 2019–2020 assessment of residential energy use in India, more than 55% of rural residents experienced intermittent power outages each day. Additionally, a surge in the demand for efficient grid management, coupled with the favorable governmental framework for sustainable technologies are some major factors that are anticipated to boost the market growth further over the projected time frame.

Key Energy Storage System Market Insights Summary:

Regional Highlights:

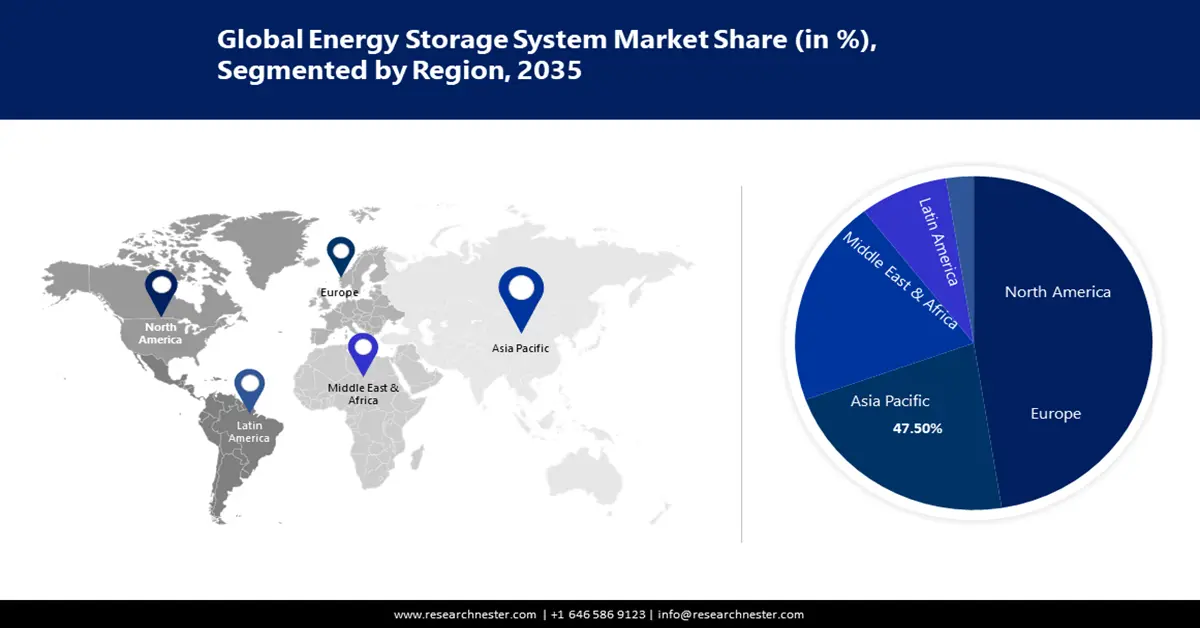

- Asia Pacific energy storage system market will dominate over 47.5% share by 2035, driven by increasing energy demand from rapid urbanization and industrialization.

- North America market will capture significant revenue share by 2035, fueled by initiatives to reduce carbon footprint and high EV adoption.

Segment Insights:

- The grid storage segment in the energy storage system market is expected to secure a significant share by 2035, driven by the extensive use of grid energy storage systems and rising industrial energy demand.

- The pumped hydro storage segment in the energy storage system market is projected to maintain the largest share by 2035, fueled by increasing adoption of pumped hydro storage power generation.

Key Growth Trends:

- An Upsurge in Investments in Renewable Energy

- Worldwide Increase in Carbon Emission

Major Challenges:

- Extreme Expenditure Requirement for Installation of Battery Energy Storage Systems

- Need for High Initial Investments for the Production of Flow Batteries

Key Players: Altairnano, Ecoult, Electrovaya, GENERAL ELECTRIC, Langley Holdings plc, LG Chem, Maxwell Technologies, Inc., Saft, Showa Denko Materials Co., Ltd., The Furukawa Battery Co., Ltd.

Global Energy Storage System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 241.47 billion

- 2026 Market Size: USD 267.98 billion

- Projected Market Size: USD 763.47 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 9 September, 2025

Energy Storage System Market Growth Drivers and Challenges:

Growth Drivers

-

Worldwide Growing Demand for Energy - Global energy demand is rising to meet the expanding needs of the world's population. Energy demand is rising as a result of increased economic activity and technological advancements in both developed and developing nations. Energy consumption is always increasing, generating price volatility in petroleum-based fuels as well as environmental issues linked with fossil fuels, such as greenhouse gas (GHGs) emissions, which contribute to global warming. This scenario motivates researchers to investigate and invent new approaches and sustainable technology for energy storage and biofuel production. Hence, this factor is estimated to significantly boost the growth of the global energy storage system market during the forecast period. According to the statistics of the International Energy Agency (IEA), the worldwide total final consumption of energy increased to 15.1 Etta Joule by 2019.

-

An Upsurge in Investments in Renewable Energy – For instance, Over the past few decades, the United States has witnessed a considerable increase in investment in renewable energy sources. Investments exceeded nearly USD 60 billion in 2019, which increased from around USD 10 billion in 2005.

-

Worldwide Increase in Carbon Emission – As per a report, in 2021, worldwide carbon dioxide emissions from fossil fuels and industries climbed by around 5.6%, setting a new high of nearly 39 billion metric tons (GtCO2). China and the United States were the two major contributors to total emissions that year, with approximately 12.28 and 6.05 GtCO2, respectively.

-

Massive Surge in the Demand for Batteries – For instance, the demand for batteries is anticipated to be increased from 188 GWh in 2020 to more than 2,000 GWh by 2030. This significant growth is mostly attributable to the rise in electric transportation, which, in terms of overall energy storage capacity is anticipated to account for the great majority of the demand for batteries by 2030.

-

Worldwide Expanding Count of Data Centers – For instance, there are more than 8,000 data centers worldwide. As of January 2022, there were nearly 2,802 data centers in the United States, with 488 more in Germany. Whereas, with around 460, the United Kingdom placed third among countries in terms of the number of data centers, while China had approximately 446 data centers.

Challenges

- Extreme Expenditure Requirement for Installation of Battery Energy Storage Systems - Battery energy storage techniques, such as lithium-ion batteries, and so on, need high installation costs owing to their high energy density and enhanced efficiency. Furthermore, lithium-ion batteries are expensive owing to their high energy capacity. Hence, this factor is anticipated to hamper the growth of the market over the projected time frame.

- Need for High Initial Investments for the Production of Flow Batteries

- Surging Concerns for Environmental Pollution

Energy Storage System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 241.47 billion |

|

Forecast Year Market Size (2035) |

USD 763.47 billion |

|

Regional Scope |

|

Energy Storage System Market Segmentation:

Technology Segment Analysis

The pumped hydro storagesegment is estimated to gain the largest market share over the projected time frame, attributed to the worldwide increasing demand and adoption of pumped hydro storage power generation, coupled with the growing energy consumption worldwide. For instance, as per a report, as of 2021, pumped hydro energy storage accounted for approximately 94% of total global storage power capacity and nearly 97% of total global storage energy volume. Besides this, rising government initiatives for renewable energy generation to attain zero carbon footprint is also projected to propel the growth of the segment in the coming years.

Application Segment Analysis

The grid storage segment is expected to garner a significant share. ascribed to the extensive use of grid energy storage systems across the globe, along with the radically rising demand for energy in the industrial sector is another major factor that is estimated to boost the growth of the segment in the coming years. As per the International Energy Agency (IEA) report, by the end of 2021, the total installed grid-scale battery storage capacity was up to 16 GW, the majority of which was installed over the last five years. Installations climbed significantly in 2021, jumping by 60% over 2020 as more than 6 GW of storage capacity was installed. That was the second year in a row in which the installations increased significantly. Besides this, large-scale energy storage allows for a continuous and efficient power supply.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Component |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Energy Storage System Market Regional Analysis:

APAC Market Insights

Asia Pacific region is poised to dominate around 47.5% market share by 2035, attributed majorly to the massively increasing demand for energy in the region owing to rapid urbanization. For instance, in 2021, the Asia Pacific region utilized nearly 275.50 exajoules of primary energy, an increase of more than 6% compared to the previous year. Further, the rapid growth in industrialization in the countries such as India, China, Korea, and so on is also accelerating energy consumption on a huge level that is also projected to contribute to the market growth in the region. In addition, mounting investment in rural electrification, excessive government investments in the acceptance of green energy sources, and augmented government programs to stimulate the corporate sector to implement renewable energy sources are the major factors that are estimated to further drive the growth.

North American Market Insights

In energy storage system market, North American region is estimated to capture significant share by 2035. attributed to the expanding initiatives to lessen carbon footprint, coupled with the amplified awareness about the advantages of renewable energy sources in the region. Moreover, demand for efficient and regular power supply on utility and end-use scales is radically surging on the back of the huge adoption of electric vehicles which is thoroughly boosting the proportion of electric vehicle charging stations is also anticipated to fuel the market growth further in the region throughout the forecast period. As per the report of the U.S. Energy Information Administration (EIA), transporting people and commodities utilized around 28% of total U.S. energy usage in 2021.

Energy Storage System Market Players:

- East Penn Manufacturing Co., Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Altairnano, Ecoult

- Electrovaya

- GENERAL ELECTRIC

- Langley Holdings plc

- LG Chem

- Maxwell Technologies, Inc.

- Saft

- Showa Denko Materials Co., Ltd.

- The Furukawa Battery Co., Ltd.

Recent Developments

-

LG Chem, Ltd. to make a substantial equity investment in North America’s largest battery recycling company, ‘Li-Cycle’. LG Chem and LG Energy Solution is estimated to also supply 20,000 tons of nickel for recycling, over ten years’ period starting in 2025.

-

Electrovaya Inc. entered into a strategic supply agreement with the Raymond Corporation for the supply of battery systems for Raymond’s energy essentials battery line.

- Report ID: 3963

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Energy Storage System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.