Crypto Asset and Digital Transformation Market Outlook:

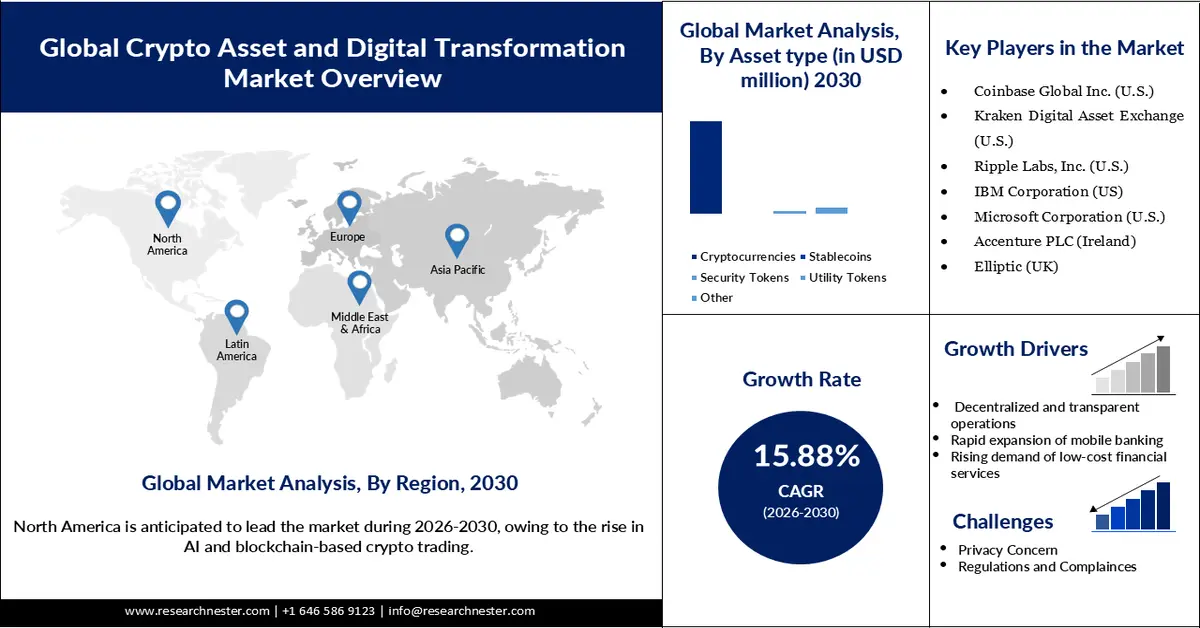

Crypto Asset and Digital Transformation Market size is estimated to be valued at USD 107.86 billion in 2025 and is expected to grow to USD 227.90 billion by 2030, registering a CAGR of 15.88% during the forecast period, i.e., 2026-2030. In 2026, the industry size of crypto asset and digital transformation is estimated at USD 126.37 billion.

The crypto asset and digital transformation market is experiencing significant growth owing to the rise in innovation in blockchain and AI, which has fuelled the market. The blockchain innovation has enabled smooth and transparent exchanges, which have propelled the adoption of crypto assets globally. Fintech companies have entered the crypto market, enabling a centralized system for token exchange and limiting the vulnerability of money-making through these currencies. The adoption of blockchain and crypto assets brought users to a platform where they can track and monitor the performance of their tokens and enhance their decision-making. These platforms further enable the novice to learn and apply trading practices. Moreover, the introduction of AI within the platforms has enabled predictions that further engage the users to invest in crypto assets and digital currencies. These AI-powered platforms also enable fraud detection and help users maintain high security. Crypto platforms like Ethereum and Solana have significantly increased their customer base primarily because of the rise in safe and healthy trading platforms.

Key Crypto Asset and Digital Transformation Market Insights Summary:

Regional Insights:

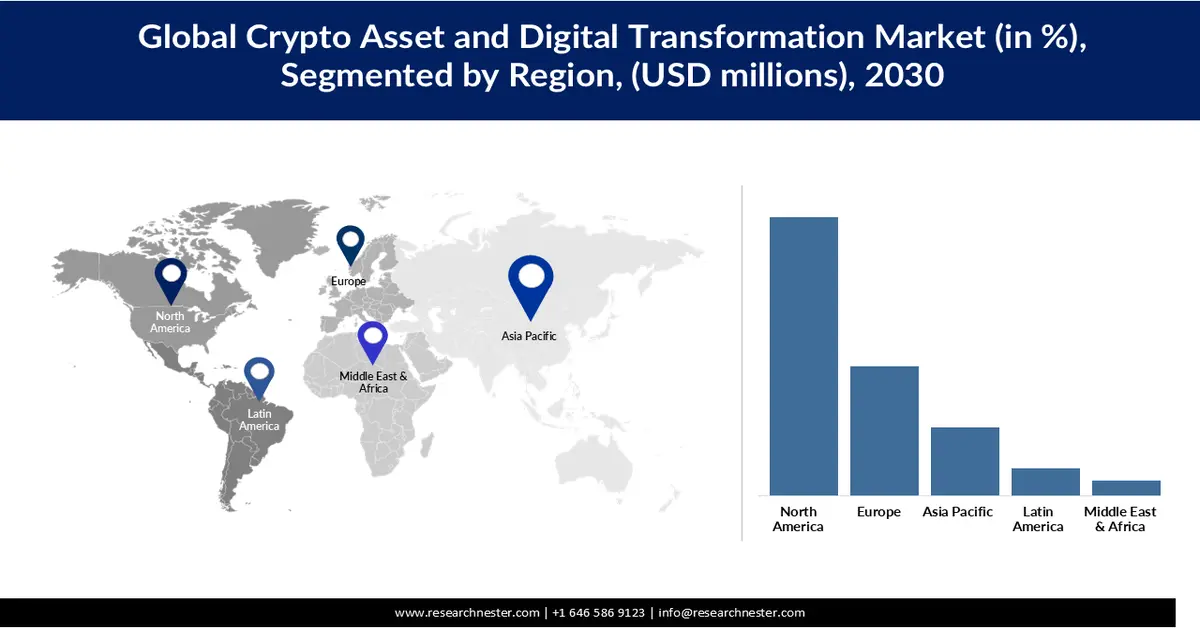

- North America in the crypto asset and digital transformation market is anticipated to command a 53.7% share by 2030, supported by accelerating crypto trading adoption, regulatory clarity, expanding retail acceptance, and heightened investor participation following Spot Bitcoin ETF approval.

- Europe is expected to retain a 25% share by 2030, reinforced by strong institutional participation, mature regulatory frameworks, and broader access to diversified digital investment instruments.

Segment Insights:

- The cryptocurrency segment in the crypto asset and digital transformation market is forecast to secure nearly 85% share by 2030 while advancing at a CAGR of 13.1%, fueled by large-scale global adoption and extensive exchange listings.

- The stablecoin segment is witnessing rising traction over the forecast period, aided by simplified investment access and cost-efficient cross-border transactions.

Key Growth Trends:

- Decentralized and transparent operations

- Rapid expansion in mobile banking and investment

Major Challenges:

- Data privacy and security risk

- Regulations and compliance

Key Players: Coinbase Global Inc., Kraken Digital Asset Exchange, Ripple Labs, Inc., IBM Corporation, Microsoft Corporation, Accenture PLC, Elliptic.

Global Crypto Asset and Digital Transformation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 107.86 billion

- 2026 Market Size: USD 126.37 billion

- Projected Market Size: USD 227.90 billion by 2030

- Growth Forecasts: 15.88% CAGR (2026-2030)

Key Regional Dynamics:

- Largest Region: North America (53.7% Share by 2030)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: Singapore, Switzerland, United Arab Emirates, India, South Korea

Last updated on : 7 January, 2026

Crypto Asset and Digital Transformation Market - Growth Drivers and Challenges

Growth Drivers

- Decentralized and transparent operations: Crypto assets provide users with transparent operations, free from hidden charges or opaque processes, ensuring smooth and reliable transactions. The decentralized nature of crypto platforms enhances security and transparency, fostering greater customer trust and driving adoption in both the crypto and broader digital transformation markets. By eliminating intermediaries such as banks and traditional financial institutions, users can save on fees and retain higher profits. Additionally, unlike conventional financial services, crypto exchanges operate 24/7, offering continuous accessibility and convenience for users worldwide.

- Rapid expansion in mobile banking and investment: Smartphones have significantly deepened market penetration, facilitating wider adoption of digital assets and cryptocurrencies. Most trading platforms now offer both mobile and desktop applications, enabling fast, seamless investments and real-time asset monitoring. Users no longer need to visit banks for transactions, as investments and withdrawals can be completed online with a single click. Globally, fintech firms have developed applications that support not only crypto trading but also investments in commodities such as bonds and mutual funds, expanding platform usage and driving growth in the global crypto asset and digital transformation market.

- Rising demand for low-cost financial services: Traditional banks and financial institutions often charge high fees on net profits, making investments costly for users. The emergence of app-based fintech firms has streamlined lengthy processes such as documentation and fund transfers, offering services at significantly lower costs. This affordability has boosted demand for low-cost financial solutions, driving the expansion of the crypto asset and broader financial transformation markets. Reduced service costs have also enabled greater penetration into rural areas, bringing users from all socio-economic levels into the digital financial ecosystem. Additionally, these low-cost platforms often provide loans for trading in crypto assets and other investments at lower interest rates, further supporting wider adoption.

Challenges

- Data privacy and security risk: Crypto fraud has become common, where fraudsters pose as a leading crypto asset company and make users purchase them to later scam them out of the funds. Deepfake videos are circulated with celebrities' facial impersonation to gain trust from investors. Data privacy is yet another aspect that highly hampers the growth of the market. The applications developed by the companies are often replicated with the real one, which may gain the data and other banking details and then drain the wallets or linked bank account, leading to total loss of investment.

- Regulations and compliance: Countries are promoting safer and healthier investment and crypto trading, resulting in enhanced regulations and compliance. In India, crypto trading is limited and highly taxed in order to limit the trading. People can buy, sell, and exchange cryptocurrency and assets; however, the net profits are taxed at 30% with 1% TDS, which is mandatory. Moreover, users need to comply with other laws and regulations, which significantly reduce the adoption of crypto asset and digital transformation market.

Crypto Asset and Digital Transformation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2030 |

|

CAGR |

15.88% |

|

Base Year Market Size (2025) |

USD 107.86 billion |

|

Forecast Year Market Size (2030) |

USD 227.90 billion |

|

Regional Scope |

|

Crypto Asset and Digital Transformation Market Segmentation:

Asset Type Segment Analysis

The cryptocurrency segment is estimated to hold the largest crypto asset and digital transformation market share of 85% by 2030, owing to the large-scale global adoption and widespread exchange listings. Cryptocurrencies are not affected by inflation and other economic factors because of their network-based funding. Countries like Dubai, Singapore, and Switzerland actively promote crypto trading as they are highly regulated and safe, which allows the majority of investors to invest overseas. Countries like China are adversely impacting the segment as they have banned crypto trading, citing financial instability and regulatory concerns. The stablecoin segment is growing in terms of popularity because of easy access to investments. Stablecoins enable international transactions with minimal legal oversight and fees. However, the crypto segment will lead the market and is rising at a CAGR of 13.1%.

Our in-depth analysis of the global crypto asset and digital transformation market includes the following segments:

| Segment | Subsegment |

|

Asset Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crypto Asset and Digital Transformation Market - Regional Analysis

North America Market Insights

North America is projected to hold the largest market share of 53.7% by 2030, driven by the growing adoption of crypto trading across the region. A well-regulated market has encouraged the entry of financial organizations and banks that were previously hesitant, further boosting adoption. The increasing acceptance of crypto in retail stores has also expanded transactions through trading platforms, supporting market growth. Additionally, the approval of the Spot Bitcoin ETF has attracted investors who were previously cautious due to Bitcoin’s price volatility.

The U.S. crypto asset and digital transformation market is valued at 12.7% over the forecast period of 2026–2030, fueled by the popularity of meme coins and other high-return crypto assets. Around 28% of American adults have reportedly invested in cryptocurrency, supported by a strong crypto adoption ecosystem and robust infrastructure. The country has also seen a surge in mobile-based financial service applications that allow multipurpose investments through a single, integrated platform.

Canada represents a mature crypto asset and digital transformation market, driven by rising demand for secure and reliable trading platforms. Easy access to funds and the ability to invest anytime have further increased crypto adoption. Favorable tax policies, which require minimal payments to the government, have also contributed to significant market expansion in the country.

Europe Market Insights

In 2024, Europe’s crypto asset and digital transformation market generated revenue of USD 1.3 billion, reflecting the growing popularity of digital assets. The region’s mature market is supported by well-established policies and regulatory compliance, creating a safer and more reliable trading environment. Europe holds a dominant market share of 25%, highlighting rising adoption among both individual and institutional investors. Institutional adoption, coupled with ongoing encouragement for these entities to invest in crypto, has further expanded the market. Additionally, the availability of diversified investment options, including mutual funds, ETFs, and cryptocurrencies, allows investors to manage portfolio risk effectively.

The UK represents a key market for crypto assets and digital transformation, driven by strong government intervention to standardize and regulate the sector, which has enhanced investor trust. Capital gains tax in the UK ranges between 10% and 20%, depending on the investment type and amount.

Germany holds the largest cryptocurrency market in Europe, supported by clear policies and regulatory frameworks. Leveraging EU guidelines, Germany has established rules that increase investor confidence in cryptocurrencies and related assets. High institutional adoption in the country has created significant market opportunities, further strengthening its position in the European crypto landscape.

Asia Pacific Market Insights

The Asia Pacific region is expected to hold 13.22% of the global crypto asset and digital transformation market, driven by rapid developments in crypto wallet and exchange platforms. In 2024, the region generated revenue of USD 1,750.90 million, supported by a young population that is highly engaged in trading and exchanging digital assets. Rapid growth in digital investments across the region has fostered investor trust and confidence. However, some countries have completely banned cryptocurrency due to regulatory concerns, introducing government-operated central bank digital currencies (CBDCs) to ensure proper oversight and taxation.

In India, crypto adoption is particularly strong, driven by a growing base of young investors and rising disposable incomes. While cryptocurrency is not considered legal tender, it remains widely available for trading. Initiatives such as Make in India have further supported domestic trading platforms, offering financial services at lower costs and reduced complexity, fueling market growth.

In contrast, China’s ban on cryptocurrency exchanges has slowed market expansion. Despite China’s advanced knowledge and infrastructure in fintech products, government restrictions have significantly limited the adoption of crypto assets and digital transformation initiatives within the country.

Key Crypto Asset and digital Transformation Market Players:

- Coinbase Global Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kraken Digital Asset Exchange (U.S.)

- Ripple Labs, Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Accenture PLC (Ireland)

- Elliptic (UK)

- Microsoft Corporation, headquartered in the U.S., the company is one of the oldest hardware and software development companies in the world, which has diversified into BaaS, where enterprises can build blockchain without the need for underlying infrastructure.

- Accenture PLC, based out of Ireland, the organization is a global consulting and technology service firm that is an active member of blockchain consortia and governance that maintain standards and operational transparency across various platforms.

- IBM, headquartered in the U.S., is one of the oldest tech firms that has stepped into enterprise blockchain, which allows businesses to build a safe, transparent, and scalable shared ledger network. The blockchain systems are highly employed in various fronts of the business, including healthcare and supply chain.

- Coinbase Global, a publicly listed cryptocurrency exchange platform with more than 100 million users and a presence in more than 99 countries. Some of the key offerings from the business are crypto asset management, stablecoin services, staking, and trading.

Below is the list of the key players operating in the global crypto asset and digital transformation market:

The global crypto asset and digital transformation market is expected to witness intense competition during the forecast period. The market consists of both established key players and new entrants, making it moderately fragmented. Emerging entrants create significant competitive pressure, limiting the ability of existing players to capture a dominant share of revenue. Specialized providers continue to shape a dynamic competitive landscape, while leading market participants benefit from substantial government support for research, innovation, and technological development, strengthening their market position.

Competitive Landscape of Global Crypto Asset and Digital Transformation Market:

Recent Developments

- In December 2025, Microsoft announced its systematic investment of USD 17.5 million in India towards its data centers that will enhance the skills and cloud-based infrastructure to ensure its position in the global competitive market. This is also believed to be one of the largest ever investments by Microsoft in Asia.

- In December 2025, IBM announced its acquisition of Confluent, a streaming platform, in an all-cash deal of USD 11 billion to strengthen its cloud and AI capabilities. The investment will support the organization in handling high-volume data, which is a pivotal aspect for real-time streaming.

- Report ID: 8331

- Published Date: Jan 07, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crypto Asset and Digital Transformation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.