Facility Management Market Outlook:

Facility Management Market size was valued at USD 57.5 billion in 2025 and is projected to reach USD 129 billion by the end of 2035, rising at a CAGR of 9.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of facility management is estimated at USD 62.9 billion.

The facility management market is set to witness extensive growth over the forecasted years, owing to the increased demand for integrated services that combine technical, operational, and workplace solutions. As of the July 2025 article from the U.S. General Services Administration, the Facilities Management Institute supports FM professionals by providing online tools and resources to enhance skills and professional development by integrating government, industry, and academia. It also mentioned that this aligns with the Federal Buildings Personnel Training Act, which mandates federal personnel managing buildings demonstrate core competencies to improve operational efficiency and protect taxpayer investment, by saving up to USD 2 billion on a yearly basis. Hence, FMI and the FBPTA framework play a critical role in ensuring that federal facilities are managed efficiently, presenting a positive effect on facility management market growth.

Furthermore, organizations across the world are outsourcing facility operations to improve efficiency, optimize costs, and enhance employee experience, thus contributing to facility management market expansion. In February 2025, Bain Capital announced it had made an investment in Apleona, which is a leading Europe-based integrated facility management company with more than 40,000 employees and a €4 billion (USD 4.68 billion) turnover. Therefore, the acquisition supports Apleona’s continued growth across Europe through both organic expansion and strategic acquisitions, by advancing its digital transformation and ESG-focused solutions. Under Bain Capital’s ownership, Apleona will maintain operational independence, leveraging AI, automation, and sustainability initiatives to optimize building management. Hence, this transaction, previously owned by PAI Partners, underscores the firm’s position as a leading provider of hard and integrated facility management services.

Key Facility Management Market Insights Summary:

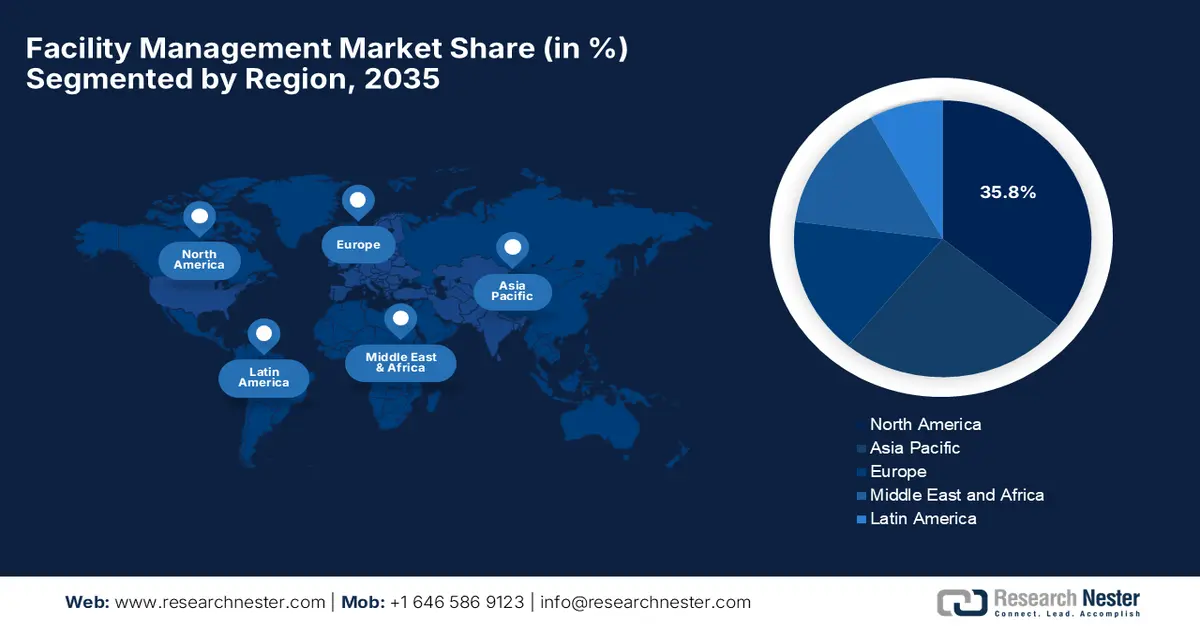

Regional Insights:

- North America is anticipated to command a 35.8% revenue share by 2035 in the facility management market, supported by advanced infrastructure maturity and expanding demand for integrated, sustainability-focused FM solutions.

- Asia Pacific is projected to register the fastest growth over the forecast period, stimulated by rapid urbanization and rising enterprise adoption of digitalized and outsourced facility management models.

Segment Insights:

- The Hard Services segment is forecast to account for a dominant 55.6% revenue share by 2035 in the facility management market, underpinned by its non-discretionary, regulation-intensive role in maintaining critical building systems across diverse facilities.

- The Real Estate vertical is expected to secure a significant revenue share during the forecast period, accelerated by expanding construction activity and the growing preference for integrated FM solutions across diversified property portfolios.

Key Growth Trends:

- Urbanization and infrastructure expansion

- Adoption of smart buildings & IoT solutions

Major Challenges:

- Shortage of skilled workforce

- Technological integration

Key Players: Sodexo S.A. (France), CBRE Group, Inc. (U.S.), JLL (Jones Lang LaSalle Incorporated) (U.S.), Cushman & Wakefield plc (U.S.), Compass Group plc (UK), ABM Industries Inc. (U.S.), Mitie Group plc (UK), Aramark Corporation (U.S.), G4S Limited (UK), EMCOR Group, Inc. (U.S.), Serco Group plc (UK), OCS Group (UK), Dussmann Group (Germany), Colliers International Group Inc. (Canada).

Global Facility Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 57.5 billion

- 2026 Market Size: USD 62.9 billion

- Projected Market Size: USD 129 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: India, Indonesia, Vietnam, Brazil, Mexico

Last updated on : 16 December, 2025

Facility Management Market - Growth Drivers and Challenges

Growth Drivers

- Urbanization and infrastructure expansion: Increasing urban populations and industrial development are consistently driving demand in the facility management market for well-maintained commercial, residential, and industrial facilities. Both the public and private entities are making investments in large-scale infrastructure projects, creating opportunities for FM providers. In December 2025, Global Infrastructure Partners, a subsidiary of BlackRock, will invest up to INR 3,000 Crores (~USD 335 million) for a minority stake in Aditya Birla Renewables, which marks one of the largest commitments in India’s renewables sector. ABREN, a Grasim subsidiary, stated that it manages a diversified 4.3 GW renewable portfolio across 10 states, delivering solar, hybrid, and floating solar power. Hence, this partnership will accelerate ABREN’s growth toward a 10 GW+ capacity, leveraging GIP’s global infrastructure expertise and ABREN’s operational capabilities to support the facility management market growth.

- Adoption of smart buildings & IoT solutions: The increased adoption of automation systems and integration of smart technologies, IoT, is facilitating strong growth in the facility management market. Facility managers are emphasizing these tools to optimize resources and deliver more quality services to both tenants and organizations. In December 2025, Vingroup announced that it had signed a USD 3 billion MoU with the Government of Telangana to develop a multi-sector ecosystem, which includes smart urban development, electric mobility, healthcare, education, tourism, and renewable energy, across 2,500 hectares. Besides, the projects aim to establish a 500 MW solar farm and enhance social infrastructure. Hence, this partnership reinforces the firm’s global expansion, strengthens India-Vietnam economic ties, hence boosts the market by creating demand for integrated services in smart urban developments and large-scale commercial and social infrastructure.

- Focus on sustainability & energy efficiency: Companies are kept under intensive pressure to meet ESG targets, reduce carbon footprints, and comply with green building standards, which is allowing FM providers to offer energy audits and sustainable maintenance practices, positioning themselves as key partners in sustainability initiatives. Equans announced that, in partnership with SNG, it has scaled up a pilot retrofit project in Hertfordshire into a full programme to decarbonize 372 social housing properties, funded partly by £5 million (USD 6.3 million) from the Social Housing Decarbonization Fund in September 2025. Besides, the initiative includes loft and cavity wall insulation, solar panels, and upgraded internal fans, aiming to bring all homes to a minimum EPC C rating. Hence, this sustainable programme enhances energy efficiency and reduces carbon emissions, improves living conditions, and addresses fuel poverty for residents, thereby positively impacting facility management market growth.

Challenges

- Shortage of skilled workforce: This is one of the primary challenges that has slowed up growth of the facility management market over the years. These roles are currently requiring expertise in technology integration, sustainable practices, along compliance with evolving regulations. Most of the organizations are struggling to attract and retain qualified staff who are capable of handling complex building systems, predictive maintenance, and energy optimization. Therefore, the existence of this shortage is affecting operational efficiency, service quality, and client satisfaction. Hence, training programs and professional certifications help address this concern, but the demand for highly trained personnel continues to outpace the supply, posing a major barrier to facility management market growth.

- Technological integration: The facility management market is facing severe challenges with the constant improvements in technology in legacy systems. IoT, AI, predictive maintenance tools, and energy management software are necessary for efficient operations, whereas implementing these technologies across diverse building portfolios is both complex and costly. Simultaneously, concerns such as compatibility, security concerns, and staff training are complicating adoption in this field. In addition, Smaller firms across price-sensitive regions are lacking the capital or technical expertise to completely leverage smart building solutions, creating disparities in service quality. Hence, the rapid pace of digital innovation requires continuous adaptation, making technological integration a persistent challenge.

Facility Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 57.5 billion |

|

Forecast Year Market Size (2035) |

USD 129 billion |

|

Regional Scope |

|

Facility Management Market Segmentation:

Service Type Segment Analysis

In the facility management market, the hard services segment is expected to attain the largest revenue share of 55.6% over the forecasted years. The services such as MEP systems, HVAC, plumbing, electrical maintenance, fire safety, and technical building upkeep are highly essential for facility operations. These are non-discretionary, highly regulated, and necessitate skilled maintenance across various facilities. In November 2025, CBRE announced that it had acquired Pearce Services for a total of USD 1.2 billion, enhancing its capabilities in digital and power infrastructure, which includes critical power systems, renewable energy, wireless networks, and EV charging. Besides Pearce’s expertise in design, maintenance, and repair for CBRE positions, to generated more than USD 350 million in Core EBITDA. Furthermore, the acquisition strengthens the firm’s building operations & experience segment, expanding its hard FM offerings and opening new growth opportunities in the market.

Vertical Segment Analysis

In terms of the vertical segment, the real estate segment is expected to capture a significant revenue share in the facility management market during the discussed timeframe. The growth of the segment is subject to the continued rise in the construction and development industry across the developing nations. Besides, IFM offers them unified contracting, streamlined management, and building automation, making it very attractive for diversified real estate. In May 2025, Krystal Integrated Services Limited announced that it had secured a three-year facility management contract from the Airports Authority of India for the new terminal at JPNI Airport, which was valued at approximately ₹20.26 crore (~USD 2.5 million). The firm also mentioned that the project involves operations and infrastructure management, thereby ensuring optimal performance of airport facilities. Hence, such projects strengthen the position of FM firms as key partners in real estate and public infrastructure management.

Deployment Mode Segment Analysis

By the conclusion of 2035, in the deployment mode, the outsourced deployment over in-house models is anticipated to grow at a considerable rate in the facility management market. Its capacity to reduce the overhead for clients, enabling access to professional FM firms, allows the subtype to scale across sites and transfers compliance, liability, and operations burden. Simultaneously, over the recent years, the real estate has become more global and fragmented, wherein multiple locations are outsourced, and FM becomes cost-efficient and flexible. In addition, the increasing complexity of building systems, which includes HVAC, energy management, and smart technologies, encourages organizations to rely on specialized outsourced providers. Therefore, the presence of emphasis on sustainability and ESG compliance is also allowing companies to partner with experienced FM firms capable of implementing energy efficient and green initiatives, hence enhancing the scalability of outsourced FM solutions, reinforcing their preference over in-house models.

Our in-depth analysis of the facility management market includes the following segments:

|

Segment |

Subsegments |

|

Service Type |

|

|

Vertical |

|

|

Deployment Mode |

|

|

Offering |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Facility Management Market - Regional Analysis

North America Market Insights

North America is expected to capture the largest revenue share of 35.8% in the global facility management market over the forecasted years. The region’s prominence in this field is highly driven by the presence of advanced countries in terms of both technology and economy. The region also benefits from well-established infrastructure and heightened demand for facility management solutions. In this regard, Newmark in April 2025 announced that it has unified its property management and facilities management service lines by creating a consolidated structure that is efficiently designed to deliver stronger end-to-end solutions for owners and occupiers. Besides, the move supports Newmark’s strategy to expand its global management services footprint and accelerate its goal of generating over USD 2 billion in recurring revenue within five years. Furthermore, the enhanced structure also enables clients to access a broader suite of sustainability-focused FM solutions, hence creating a positive impact on market growth.

In the U.S., the facility management market has grown significantly over the years, efficiently propelled by the presence of mature corporate and real estate portfolios. The country’s market is also supported by the higher adoption of outsourcing and the rapid integration of smart building technologies. In November 2025, ABM’s update highlighted that organizations are rapidly shifting from fragmented vendor models to integrated, performance-driven facility management to meet rising demands for efficiency, sustainability, and resilience. It also reported the unified services which span HVAC, electrical, janitorial, energy management, and smart-building technologies. The firm is delivering measurable outcomes using self-performance, real-time KPIs, and predictive analytics. Hence, this integrated approach simplifies operations for clients, enhances accountability, and provides a single-partner model that adds long-term facility resilience.

Canada’s facility management market is gaining momentum owing to the strong public-sector infrastructure programs, stringent building codes, and increasing focus on green-certified facilities. Organizations in the country are prioritizing lifecycle asset management and preventive maintenance, especially in institutional buildings such as schools and hospitals. In this context, Dexterra Group in July 2025 announced that it acquired a 40% stake in Pleasant Valley Corporation, which is a facility management provider generating approximately USD 175 million on a yearly basis, and the deal was valued at USD 58.3 million. Hence, the investment expands Dexterra’s facilities management footprint by adding PVC’s integrated FM capabilities, proprietary technology platform, and long-standing client relationships. Furthermore, the company also secured an option to acquire the remaining 60% stake in the future, thereby positioning Dexterra for strengthened scale and long-term growth.

APAC Market Insights

Asia Pacific has registered the fastest growth in the international facility management market, influenced by urbanization, coupled with rising outsourcing trends among enterprises. Simultaneously, the region is witnessing stronger adoption of digital tools for IoT monitoring and predictive maintenance, which is accelerating market growth across emerging and developed nations. Supreme Facility Management announced in January 2025 that it will acquire a 76% stake in Cleanway Management Systems and Ashok Business Service India to expand its integrated facility management presence across Karnataka, Tamil Nadu, and Telangana. These two companies are generating a combined ₹53.56 crore (≈ USD 6.5 million) in FY24 revenues; the acquisition is expected to add ₹45–₹50 crore (≈ USD 5.5–6.1 million) to Supreme’s ongoing revenue post-completion. Hence, the move strengthens the company’s southern regional leadership by creating operational synergies and an integration pathway due to the overlapping service portfolios.

China is solidifying its dominance in the regional landscape of the facility management market, backed by the massive commercial real estate development, smart city initiatives, and modernization of public infrastructure. Also, the country’s shift toward professionalized FM services is due to the need for efficiency, compliance, and standardized operations. The country’s government in July 2024 revealed that China has launched a green development action plan for data centers, setting targets to accelerate the sector’s low-carbon transition. It stated that by the conclusion of 2025, the average power usage effectiveness of data centers is to be reduced to below 1.5, while the utilization of renewable energy is targeted to grow 10% annually. The plan shows the country’s push toward sustainable and large-scale digital infrastructure, which directly expands demand for facility management of data centers: technical maintenance, energy management.

India is witnessing strong progress in the facility management market growth due to rapid construction activities and increasing adoption of managed services by the corporate sector. The country also benefits from government sustainability programs and smart city projects, which are proactively increasing the demand for energy management FM solutions. In May 2025, Supreme Facility Management Limited reported financial performance for the year in which the standalone net profit surged to 95% to ₹6.79 Cr (≈ USD 0.83 million), fueled by growth in integrated facility management services. It also mentioned that the consolidated total income reached ₹403.49 Cr (≈ USD 49.2 million) with EBITDA of ₹36.29 Cr (≈ USD 4.4 million), which reflects the robust operational efficiency across IFM, employee transportation, and production support services. Furthermore, integrated facility management remained the core revenue driver for the firm, contributing over 74.4% to consolidated income.

Europe Market Insights

Europe has established itself as the prominent player in the international facility management market owing to aspects as mature outsourcing practices, strict environmental regulations, and widespread adoption of integrated FM models. The region’s market also benefits from digitalization, including automation and building analytics, which is reshaping service delivery across commercial, government, and industrial sectors. In February 2025, ISS Germany announced that it had secured a major contract with Aroundtown to provide integrated facility management services across 47 locations in Germany, covering around 715,000 m². The company also notes the scope, which includes cleaning, building technology, security, landscaping, and winter services, with mobilization. Hence, this partnership highlights the growing demand for large-scale, multi-site FM solutions in Europe.

Germany in the facility management market is supported by its advanced industrial infrastructure, strong engineering standards, and rapid modernization of commercial buildings. The country deliberately emphasizes building efficiency, predictive maintenance, and compliance-driven services. In May 2025, SPIE reported that it had been awarded a renewed six-year contract to provide technical facility management for Commerzbank’s service centre in Frankfurt, covering 105,000 m² and approximately 2,500 workstations. In this context, the scope includes maintaining and modernizing building systems, upgrading refrigeration units, and replacing the building management system with over 30,000 data points by implementing energy efficiency measures to reduce CO₂ emissions. Further, this long partnership of 23 years highlights the firm’s commitment to energy-efficient FM solutions in Europe.

The U.K. is considered to be the frontrunner in the regional facility management market, primarily fueled by high outsourcing penetration, a strong public-sector service base, and a well-established integrated FM ecosystem. There has been a heightened demand for sustainable building operations, workplace experience solutions, and energy management services in the country. Bellrock, in December 2025, announced that it has launched Symphony, which is a data-driven facilities management solution that enables predictive maintenance and real-time monitoring, transforming traditional reactive FM approaches. Also, this platform efficiently analyzes building data to identify any inefficiencies and alert engineers before failures occur, thereby reducing costs and improving compliance. In addition, Symphony adapts to each building’s usage patterns and energy targets, hence providing bespoke maintenance regimes.

Key Facility Management Market Players:

- ISS A/S (Denmark)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sodexo S.A. (France)

- CBRE Group, Inc. (U.S.)

- JLL (Jones Lang LaSalle Incorporated) (U.S.)

- Cushman & Wakefield plc (U.S.)

- Compass Group plc (UK)

- ABM Industries Inc. (U.S.)

- Mitie Group plc (UK)

- Aramark Corporation (U.S.)

- G4S Limited (UK)

- EMCOR Group, Inc. (U.S.)

- Serco Group plc (UK)

- OCS Group (UK)

- Dussmann Group (Germany)

- Colliers International Group Inc. (Canada)

- ISS A/S is one of the leading global FM providers which is offering cleaning, technical maintenance, catering, security, and workplace solutions in more than 50 countries. The company is readily making investments in digital building management and IoT-based predictive maintenance with a prime focus on improving efficiency. In addition, ISS also focuses on long-term contracts with multinational clients, leveraging its global scale and operational expertise.

- Sodexo S.A. is identified as the frontrunner in this field, which is operating in more than 70 countries, combining soft services such as catering and cleaning with integrated FM solutions. The company is emphasizing sustainability, wellness, and smart workplace analytics. Besides, Sodexo is efficiently expanding through acquisitions and multi-service bundling, which strengthens its position as a partner for organizations that are seeking operational efficiency and enhanced employee experience.

- CBRE Group, Inc. is based in the U.S., and it delivers technical, operational, and workplace management solutions across the globe by leveraging technology for predictive maintenance and energy optimization. Simultaneously, the firm’s strong focus on sustainability and AI-based facility optimization is helping it to secure long-term contracts and strengthen client relationships across corporate portfolios.

- JLL (Jones Lang LaSalle Incorporated) integrates property, project, and facility management with workplace strategy solutions. The company is developing FM talent while using digital and IoT tools for smart building operations and sustainability through IFMA partnerships and certifications such as FMP and SFP. JLL also focuses on workplace efficiency and employee experience improvements, thereby gaining the interest of a widespread audience group.

- Cushman & Wakefield plc is considered to be one of the most prominent players in this field, which offers technical operations, cleaning, and security by emphasizing analytics and building automation to optimize client assets. Strategic initiatives undertaken by the firm include digital transformation and expanding integrated facility management services by combining local expertise with global resources for consistent service delivery.

Below is the list of some prominent players operating in the global facility management market:

The global facility management market is dominated by large multinational firms that are combining both hard and soft services. Key pioneers such as ISS, Sodexo, and CBRE are leveraging integrated service portfolios, extensive global reach and scale, and strong operational capabilities. Expanding through acquisitions, investing in digital or IoT-driven building management, and bundling services under integrated FM contracts are a few strategies implemented by these players to uplift the market growth. In September 2024, Weinberg Capital Partners announced that it had acquired a stake in ProNet Services, which is one of the leading facility management companies in Switzerland. The investment is a part of WCP#4, supports ProNet’s continued growth through both organic expansion and strategic acquisitions, including technical maintenance and concierge services. Furthermore, DECALIA Capital will remain a shareholder, and the partnership aims to strengthen ProNet’s high-value-added FM offerings by leveraging Weinberg’s expertise in buy-and-build strategies.

Corporate Landscape of the Facility Management Market:

Recent Developments

- In December 2025, OCI Global and Orascom Construction announced an agreement to combine, creating a global Abu Dhabi-anchored infrastructure and investment platform with capabilities across construction, infrastructure, and capital investment. OCI shareholders will hold approximately 47% of the combined entity, with an exchange ratio of 0.4634 Orascom shares per OCI share, pending shar55eholder approval.

- In November 2025, JLL announced that over 1,700 of its professionals worldwide completed IFMA’s facility management professional program, along with sustainability facility professional and essentials of FM courses, resulting in a 2% increase in promotions and a 14% improvement in retention.

- Report ID: 8319

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Facility Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.