Fraud Management in Banking Market Outlook:

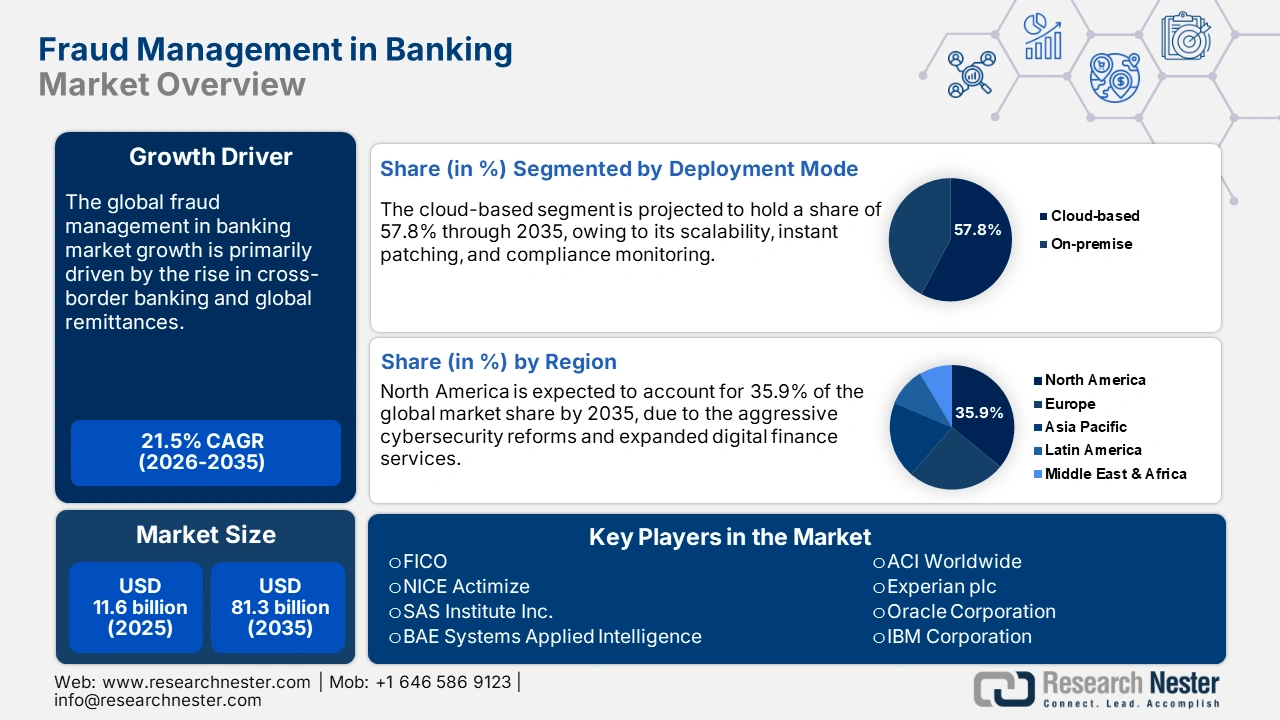

Fraud Management in Banking Market size was USD 11.6 billion in 2025 and is estimated to reach USD 81.3 billion by 2035, expanding at a CAGR of 21.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of fraud management in banking is estimated at USD 14.0 billion.

The global trade for banking fraud management solutions relies on the stable supply chain of specialized hardware and software components. Digital technologies and data analysis tools are essential for the effectiveness of banking fraud management software solutions. The high costs affect the price of business-to-business software licenses and integration, especially for fraud analysis tools used in banking transactions.

The rising number of digital and real-time payments creates a larger attack surface. As customers and merchants turn to massive volumes of instant and embedded payments, banks face far more high-velocity activity to monitor, which increases fraud opportunities and the need for real-time controls. For instance, digital payments volume in India surpassed 18,000 crores transactions in FY 2024–25, including UPI and other digital rails, showing how transaction volume fuels the demand for detection and prevention.

According to the Press Information Bureau (PIB) Report of March 2025, digital payment transactions rose from 8,839 crore in FY 2021-22 to 18,737 crore in FY 2023-24, reflecting a CAGR of 46%. A major contributor to this rise has been the Unified Payments Interface (UPI), which expanded at a CAGR of 69%, growing from 4,597 crore transactions in FY 2021-22 to 13,116 crore transactions in FY 2023-24. The massive rise in digital and instant transactions has expanded the attack surface, creating greater demand for advanced fraud detection.

Total Digital Payment Transactions during The Last Five Financial Years

|

Financial Year |

Total Payments Transactions |

|

|

|

Volume in Crore |

Value (in Lakh) |

|

2020-2021 |

4,370.68 |

1,414.58 |

|

2021-2022 |

7,197.68 |

1,744.01 |

|

2022-2023 |

11,393.82 |

2,086.85 |

|

2023-2024 |

16,443.02 |

2,428.24 |

|

2024-2025 (till January 2025) |

18,120.82 |

2,330.72 |

Source: PIB

Key Fraud Management in Banking Market Insights Summary:

Regional Insights:

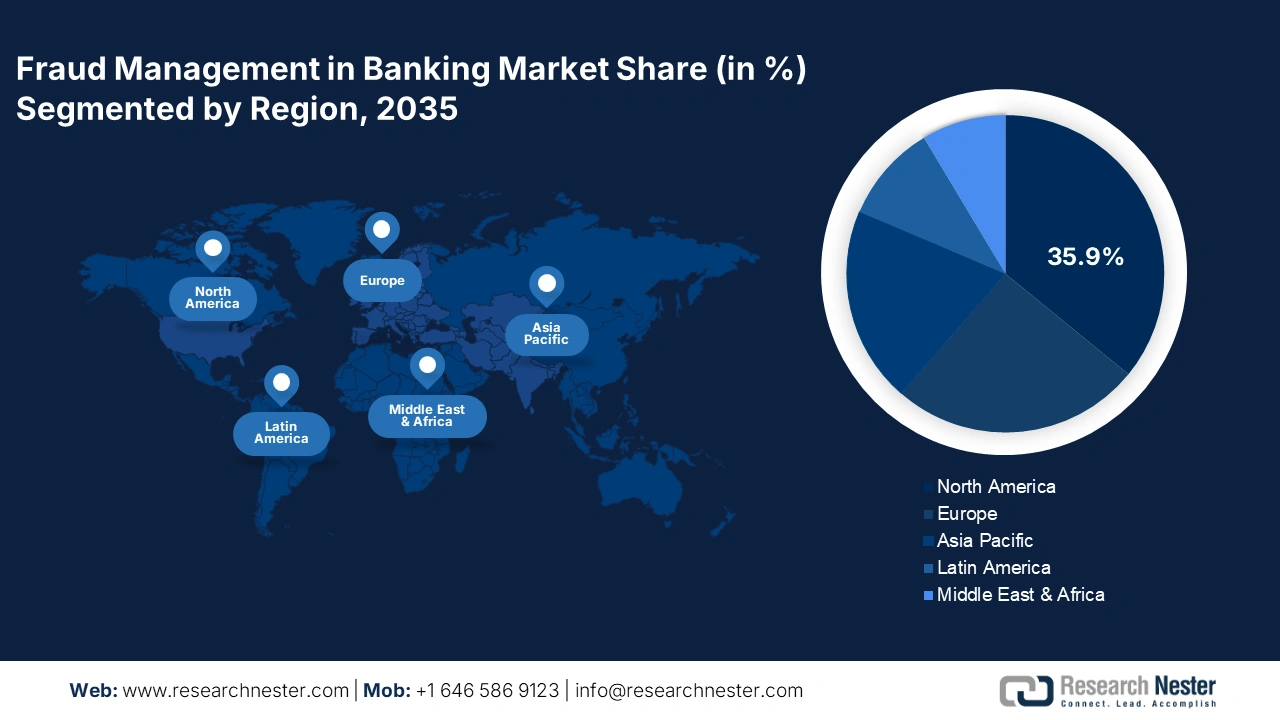

- The North America Fraud Management in Banking Market is anticipated to hold 35.9% of the global share by 2035, spurred by aggressive cybersecurity reforms and expanding digital finance services.

- Europe is projected to capture 25.5% of the global share during the forecast period, sustained by the expansion of digital payment infrastructure and compliance with PSD2 directives.

Segment Insights:.

- The fraud detection & prevention segment is projected to secure 42.9% of the global share by 2035 in the Fraud Management in Banking Market, propelled by rising digital payment volumes, increasing AI-driven fraud threats, and tightening compliance mandates.

- The cloud-based segment is anticipated to account for 57.8% share through the forecast period, impelled by the scalability, real-time patching, and compliance monitoring capabilities of cloud-based fraud management platforms.

Key Growth Trends:

- Cloud migration and digital infrastructure modernization

- Expansion of open banking and fintech ecosystems

Major Challenges:

- Complex cross-border data protection regulations

- Lack of infrastructure readiness in emerging markets

Key Players: FICO, NICE Actimize, SAS Institute Inc., BAE Systems Applied Intelligence, ACI Worldwide, Experian plc, Oracle Corporation, IBM Corporation, LexisNexis Risk Solutions, Featurespace, TCS (Tata Consultancy Services), Wipro Limited, Axxess Identification, PayShield, Silverlake Axis Ltd, Hitachi Ltd., NEC Corporation, NTT Data Corporation, Fujitsu Limited, SoftBank Technology Corp.

Global Fraud Management in Banking Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.6 billion

- 2026 Market Size: USD 14 billion

- Projected Market Size: USD 81.3 billion by 2035

- Growth Forecasts: 21.5% CAGR (2026-2035)

Key Regional Dynamics:

• Largest Region: North America (35.9% Share by 2035)

• Fastest Growing Region: Asia Pacific

• Dominating Countries: United States, United Kingdom, Germany, China, Japan

• Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 9 October, 2025

Fraud Management in Banking Market - Growth Drivers and Challenges

Growth Drivers

- Cloud migration and digital infrastructure modernization: The robust shift towards digitization is driving banks to invest in cloud-based platforms, owing to favorable opportunities for key players. The automated platforms offer faster rule updates, federated learning models, and secure data interoperability, which are essential for managing fraud. The U.S. Government Accountability Office (GAO) estimated that annual direct financial losses to the government from fraud ranged between USD 233 billion and USD 521 billion, using data from fiscal years 2018 to 2022. This range accounts for several risk conditions during those years, with about 90% of the total estimated losses falling within it. These numbers underscore an urgent need for more advanced tools and systems to prevent, detect, and manage fraud.

- Expansion of open banking and fintech ecosystems: Open banking allows financial institutions to share customer data with third-party apps through special tools called APIs, which creates new fraud risks due to the increased number of access points. However, this creates new risks for fraud as there are more ways for hackers to get in. To overcome these issues, many end users are investing heavily in next-gen fraud management solutions. Also, in 2024, the European Union Agency for Cybersecurity (ENISA) recommended focusing fraud checks on APIs, especially for verifying digital IDs, starting payments, and checking user identities.

- Growth in cross-border banking and global remittances: Sending money across countries is complex, as each country has its own rules, privacy laws, and currency exchange challenges, which make it easier for fraudsters to cause problems. To deter from this situation, many financial institutions are investing in advanced fraud management solutions are expected to gain traction. According to a World Bank report released in December 2024, global remittance flows rose by 5.8%, reaching USD 685 billion during the year. India emerged as the top recipient with a record USD 129 billion, representing 14.3% of the worldwide total. This growth was largely supported by the recovery of job markets in high-income OECD nations, which boosted transfers to low- and middle-income countries. Thus, the digital payment trends in both the developing and developed regions are likely to accelerate the cross-border payment management solutions in the years ahead.

Challenges

- Complex cross-border data protection regulations: The inconsistent and varied data protection laws are hampering the trade of advanced banking fraud detection solutions. The strict regulations restrict cross-border data transfers, which are critical for global fraud analytics platforms. Many companies witness delays in their product launches by 6 to 9 months due to these complex regulations. Thus, to overcome this issue, companies are expected to enter into strategic partnerships with local companies or invest more in legal teams.

- Lack of infrastructure readiness in emerging markets: In emerging markets, the lack of infrastructure readiness poses a major challenge to effective fraud management in banking. Many institutions still work on legacy systems that cannot support advanced fraud detection or real-time analytics. Limited data integration and weak interoperability across banks, fintech, and payment platforms further hinder coordinated defense mechanisms. Poor connectivity and low cloud adoption restrict the use of AI-based monitoring solutions, while shortages of skilled cybersecurity professionals cause gaps in resilience.

Fraud Management in Banking Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

21.5% |

|

Base Year Market Size (2025) |

USD 11.6 billion |

|

Forecast Year Market Size (2035) |

USD 81.3 billion |

|

Regional Scope |

|

Fraud Management in Banking Market Segmentation:

Solution Type Segment Analysis

The fraud detection & prevention segment is estimated to capture 42.9% of the global market share through 2035. The surging digital payment volumes, growing threats from AI-generated fraud, and compliance needs are primarily boosting the demand for fraud detection & prevention solutions. For example, the Federal Trade Commission (FTC) states that U.S. consumers lost over USD 12.5 billion to fraud in 2024, marking a 25% rise compared to the previous year, which boosted an urgent institutional demand for prevention tools. In 2024, consumers stated the highest losses to investment scams, totaling USD 5.7 billion, a 24% increase from 2023. Imposter scams made for the second-largest losses at USD 2.95 billion. That year, consumers also lost more money through scams involving bank transfers and cryptocurrency payments than through all other payment methods combined. Furthermore, in 2024, the National Institute of Standards and Technology (NIST) unveiled an updated Cybersecurity Framework 2.0, encouraging financial institutions to use advanced tools to predict cyber threats and detect risks in real time.

Deployment Mode Segment Analysis

The cloud-based segment is projected to account for 57.8% of the global market share throughout the forecast period. Cloud-based fraud platforms are most sought-after, owing to their scalability, instant patching, and compliance monitoring. In 2024, the U.S. Department of the Treasury reported that its recent technology- and data-driven initiatives to combat fraud and improper payments helped prevent and recover over USD 4 billion during FY 2024 (October 2023 – September 2024), a sharp rise from USD 652.7 million in FY 2023. Additionally, using machine learning–based AI to accelerate the detection of Treasury check fraud resulted in USD 1 billion in recoveries. This progress underscores the focused efforts of the Treasury’s Office of Payment Integrity (OPI), under the Bureau of the Fiscal Service, to strengthen fraud prevention measures and broaden its services for both new and existing customers. Also, the European Union Agency for Cybersecurity (ENISA) stated that cloud-based security tools are essential for managing fraud in banks. Such recommendations from reputable organizations are directly opening lucrative doors for cloud-based fraud management platform producers.

End user Segment Analysis

The investment banks segment is rising as the fastest-growing end user in the fraud management market, due to increased cases of market manipulation, insider trading, and sophisticated cyberattacks targeting high-value transactions. With large-scale mergers, acquisitions, and cross-border deals, investment banks face complicated risks that demand advanced fraud detection and compliance solutions. Moreover, growing regulatory pressure around anti-money laundering (AML) and Know Your Customer (KYC) compels banks to adopt AI-driven monitoring platforms. This trend shows how investment banks are prioritizing fraud management to upkeep client trust and meet global compliance standards.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Deployment Mode |

|

|

Solution Type |

|

|

Fraud Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fraud Management in Banking Market - Regional Analysis

North America Market Insights

The North America fraud management in banking market is anticipated to hold 35.9% of the global revenue share by 2035. The aggressive cybersecurity reforms and expanded digital finance services are expected to fuel the sales of fraud management solutions. The expanding ICT budgets and cloud shift in public offices are further increasing the demand for fraud management technologies. The investments in digital security modernization and AI-enhanced financial technologies are also expected to draw the attention of several international and domestic players.

The sales of banking fraud management solutions in the U.S. are expected to be driven by the strict compliance polices. The real-time transaction monitoring mandates under the Banking Secrecy Act (BSA) and the PATRIOT Act are likely to contribute to the high demand for fraud management technologies. Moreover, the supportive government policies and schemes are set to drive the overall market growth in the coming years.

The Canada fraud management in banking market is poised to increase at the fastest pace during the forecast period, due to the regulatory enforcement, AI adoption, and digital transformation among both private and public entities. The Innovation, Science and Economic Development (ISED) states that banks are mandated to adopt digital fraud prevention frameworks, aligning with Canada’s Digital Charter Implementation Act. Thus, support from the public entities is likely to accelerate the adoption of banking fraud management solutions.

Europe Market Insights

The Europe fraud management in banking market is projected to capture 25.5% of the global revenue share throughout the study period, owing to strong demand from both Western and Northern regions. The digital payment infrastructure expansion and compliance with PSD2 directives are expected to propel the sales of fraud management technologies. Governments across Europe are tightening cybersecurity enforcement, forcing banks to use AI-powered fraud detection and behavior analytics platforms, which is expected to fuel market growth in the coming years.

Germany fraud management market is expected to expand rapidly during the forecast period as digital payments adoption is rising and cybercriminals are exploiting growing online banking usage. With a traditionally cash-heavy country moving toward digital transactions, fraud risks have risen, particularly in phishing and account takeover schemes. For instance, in June 2025, a study of 2,000 German users, conducted by the Global Anti-Scam Alliance (GASA) and BioCatch, indicated that scam-related losses in Germany reached USD 11.5 billion in the last year, with the average loss per victim surpassing USD 891. About 50% of respondents were targeted by scams in the last 12 months, and among them, 55% said they lost money to online shopping-related scams.

The U.K. fraud management in banking market is predicted to increase at a high pace, owing to the strong digital banking maturity. The UK remains one of the most advanced but also most targeted banking markets, with fraud losses among the highest in Europe. In 2023, UK Finance reported USD 1.567 billion in fraud losses, with APP scams accounting for half of the total, posing consumer protection as an urgent national need. The Financial Conduct Authority (FCA) has created new guidelines compelling banks to adopt stronger real-time fraud detection and customer reimbursement policies. To address this, top UK banks are investing heavily in ML, data orchestration, and consortium fraud databases. This regulatory effort, incorporated with high fraud exposure, is increasing the growth of fraud management solutions in the UK banking industry.

APAC Market Insights

The Asia Pacific fraud management in banking market is foreseen to increase at a CAGR of 14.7% from 2026 to 2035. The surging cybercrime, digital transformation in banking, and stricter regulatory frameworks are expected to fuel the sales of fraud management solutions. India and China are leading the demand for advanced fraud management solutions, owing to the strong presence of early adopters and a high online payment trend. While Japan and South Korea are pushing tech innovation in fraud detection, which is also set to drive the overall market growth in APAC.

The fraud management in banking market in China is anticipated to grow, propelled by the country’s dominance in the digital payments and e-commerce sector. China's commitment to overcoming financial fraud has resulted in notable investments in fraud management within the banking sector. In July 2024, the China Securities Regulatory Commission (CSRC), together with other regulatory bodies, launched a detailed framework targeting fraudulent activities in capital markets. This initiative aims at stringent measures against illicit stock and bond issuances, misappropriation of funds, and dissemination of false information, aiming to enhance market discipline and investor confidence. These regulatory advancements are driving the adoption of advanced fraud detection technologies in the banking industry. The government's proactive stance on financial fraud has led to increased demand for sophisticated fraud management systems that can quickly identify and eliminate risks.

The India fraud management in banking market is anticipated to be fueled by record-high digital financial transactions and government-led data protection reforms. India has emerged to be one of the world’s largest digital payment hubs, creating high demand for fraud management in banking. The country processed over 18,700 crore digital transactions in FY 2022-23, but this major juncture also led to cases of cyber fraud, especially UPI-related scams. The Reserve Bank of India has also set up the DIGIDHAN Mission and mandated stronger KYC, transaction monitoring, and real-time reporting frameworks for banks. In 2024, prime Indian banks, namely HDFC and SBI, collaborated with global fintech players to improve AI-led fraud prevention. As digital adoption increases, fraud management is becoming important to secure India’s financial ecosystem.

Key Fraud Management in Banking Market Players:

- FICO

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NICE Actimize

- SAS Institute Inc.

- BAE Systems Applied Intelligence

- ACI Worldwide

- Experian plc

- Oracle Corporation

- IBM Corporation

- LexisNexis Risk Solutions

- Featurespace

- TCS (Tata Consultancy Services)

- Wipro Limited

- Axxess Identification

- PayShield

- Silverlake Axis Ltd

- Hitachi Ltd.

- NEC Corporation

- NTT Data Corporation

- Fujitsu Limited

- SoftBank Technology Corp.

The fraud management in banking market is mainly dominated by Western companies and high-tech giants from some Southeast Asian countries. The leading companies are more focused on the introduction of next-gen solutions. They are also entering into strategic partnerships with other players to boost their product offerings and market reach. Key players are employing mergers and acquisitions strategies to uplift their position in the global landscape. Some of the big companies are exploring emerging markets to earn hefty gains from untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2025, the American Bankers Association (ABA) launched a free online platform that enables member banks to more efficiently verify payee information on government-issued checks using the Treasury Department’s Treasury Check Verification System.

- In May 2025, Velera enhanced fraud management and cardholder experience with the FICO Platform. Velera leverages FICO Platform’s Omni-Channel Engagement capabilities to modernize fraud alerting for clients and cardholders, achieving an 85% reduction in fraud alert response time and a 76% improvement in cardholder self-service efficiency. The company successfully migrated 715 financial institutions in just eight months without incurring additional costs for clients.

- In March 2025, Fujitsu Limited partnered with FICO, a global leader in analytics software, to introduce FICO’s solutions in Japan and expand into additional financial markets. Starting July 2025, Fujitsu will offer Japanese financial institutions access to FICO Platform’s Omni-Channel Engagement capabilities, while also expanding the range of solutions and exploring further regional opportunities to support the digital transformation of the financial sector.

- Report ID: 8183

- Published Date: Oct 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fraud Management in Banking Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.