Family Office Market Outlook:

Family Office Market size was valued at USD 20.6 billion in 2025 and is projected to reach USD 38.1 billion by the end of 2035, rising at a CAGR of 7.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of family office is estimated at USD 22 billion.

The family office market is representing continued growth since the ultra-high-net-worth families are looking for tailored wealth management, legacy planning, and investment solutions, due to which firms are constantly upgrading their technologies. For instance, in February 2025, SEI’s Family Office Services business, which is supporting USD 723 billion in assets on its Archway Platform as of 2024, was acquired by Aquiline to enhance technology-driven solutions for family offices. The report also mentioned that this platform integrates accounting, investment management, and reporting functions, enabling more efficient operations for ultra-high-net-worth families. In addition, the acquisition aims to accelerate adoption, extend platform capabilities, and further invest in technology that streamlines complex family office workflows and improves client service, thereby positively impacting family office market growth in the years ahead.

Furthermore, the family office market is witnessing a major shift toward integrated platforms that offer personalized advisory services, enhanced reporting, and access to alternative and private market opportunities. As of September 2025, data from the government of Hong Kong more than 200 family offices have established or expanded operations in Hong Kong, surpassing the government’s target set in the 2022 Policy Address. Besides, this milestone reflects the city’s growing stature as Asia’s leading hub for private wealth management and global family offices, supported by Invest Hong Kong’s dedicated family office HK team. In addition, the aspect of policy measures, including tax concessions, the New Capital Investment Entrant Scheme, and the Hong Kong Academy for Wealth Legacy, has created a competitive environment for family offices. Hence, with continued enhancements to preferential tax regimes and facilitation services aim to sustain the sector’s growth momentum.

Key Family Office Market Insights Summary:

Regional Highlights:

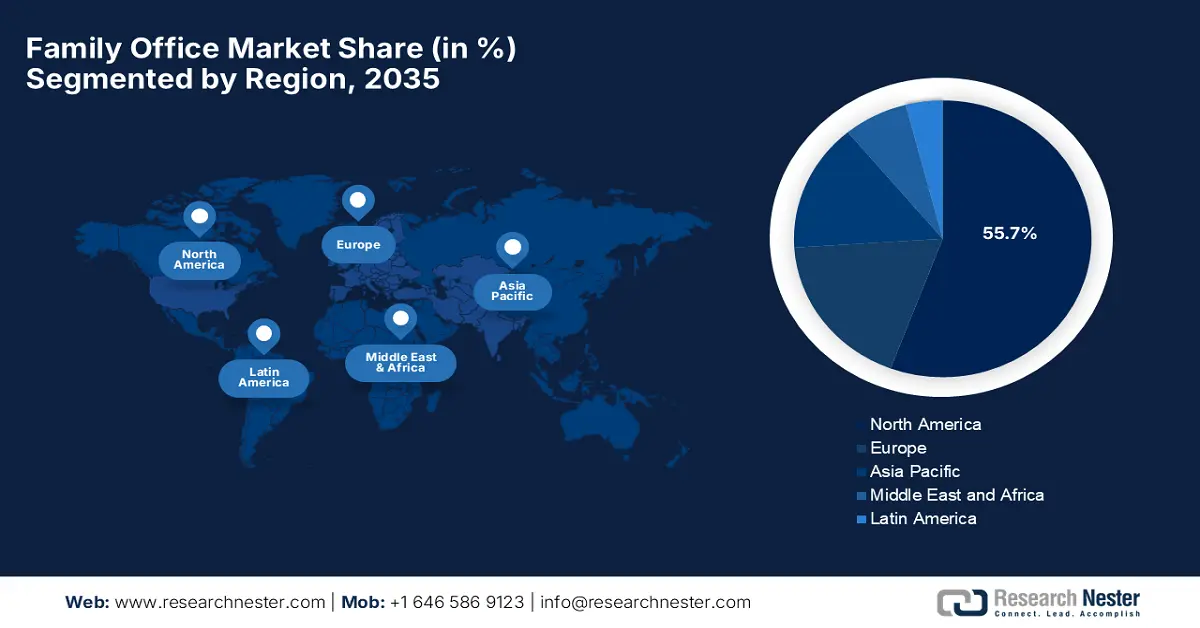

- North America is anticipated to command the family office market with a dominant 55.7% revenue share by 2035, reinforced by mature financial infrastructure, deep advisory talent, and robust trust and estate frameworks supporting sophisticated multigenerational wealth solutions.

- Asia Pacific is projected to expand strongly over 2026-2035, underpinned by wealth preservation priorities and accelerated adoption of digital platforms for managing diversified global investments.

Segment Insights:

- Single-family offices are expected to account for a dominant 71.6% share by 2035 in the family office market, strengthened by demand for highly customized, confidential wealth, governance, and legacy management solutions.

- Alternative assets are set to witness notable growth over 2026-2035, bolstered by the pursuit of higher risk-adjusted returns and diversification away from traditional public markets.

Key Growth Trends:

- Rising global wealth & UHNWI growth

- Intergenerational wealth transfer

Major Challenges:

- Talent acquisition and retention

- Regulatory compliance

Key Players: UBS Global Family Office (Switzerland), J.P. Morgan Private Bank (U.S.), Goldman Sachs Private Wealth Management (U.S.), BNP Paribas Wealth Management (France), Citibank Private Bank (U.S.), Northern Trust Global Family Office (U.S.), Bessemer Trust (U.S.), Stonehage Fleming (Jersey/UK), BNY Mellon Wealth Management (U.S.), Rockefeller Capital Management (U.S.), Glenmede Trust Company (U.S.), HSBC Private Banking (U.K.), Banco Pictet (Switzerland), Brown Brothers Harriman Family Office Services (U.S.), Evercore Family Office Services (U.S.).

Global Family Office Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.6 billion

- 2026 Market Size: USD 22 billion

- Projected Market Size: USD 38.1 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (55.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Switzerland

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 19 December, 2025

Family Office Market - Growth Drivers and Challenges

Growth Drivers

- Rising global wealth & UHNWI growth: The most fundamental driver for the family office market is the ongoing increase in global wealth, especially among high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs). This is because more affluent families create greater demand for bespoke wealth management and legacy planning services. According to an Oxfam International report published in June 2025, the world’s richest 1% have added over USD 33.9 trillion in real wealth over the last decade, which highlights the unprecedented concentration of private capital globally. The report also mentioned that over the last two decades, global private wealth grew eight times faster than public wealth, underscoring the expanding financial power of ultra-wealthy individuals and families. Hence, this accelerating accumulation of private wealth reinforces the structural demand for specialized wealth management, governance, and long-term capital preservation frameworks.

Global Distribution of Ultra High Net Worth Individuals (UHNWIs) by Country, as of 2023

|

Country |

Number of UHNWIs |

|

U.S. |

225,077 |

|

Canada |

27,928 |

|

U.K. |

23,072 |

|

Germany |

29,021 |

|

France |

24,941 |

|

Italy |

15,952 |

|

Switzerland |

14,734 |

|

Australia |

15,347 |

|

China |

98,551 |

|

India |

13,263 |

|

Japan |

21,710 |

|

South Korea |

7,640 |

|

Taiwan |

7,310 |

|

Hong Kong SAR |

5,957 |

|

Singapore |

4,783 |

|

Spain |

10,149 |

Source: Center for Data Innovation

- Intergenerational wealth transfer: Huge amounts of wealth are being passed from one generation to the next, which increases the need for structured governance, succession planning, and long-term preservation strategies, prompting a profitable business environment for the family office market. The Silicon Valley Community Foundation in April 2024 disclosed that a large-scale intergenerational transfer of wealth is underway, wherein the majority is expected to move within the wealthiest households, especially among the top 1% who hold control of a disproportionate share of assets. Besides, since the wealth is passing between generations, advisors face complexities in terms of inheritance dynamics and the long-term sustainability of wealth structures. Hence, navigating this necessitates proper family-centric approaches that integrate governance and cultural cohesion along with technical estate planning, thus benefiting the overall family office market.

- Demand for management solutions: Affluent families prefer customized services such as investment strategy, tax planning, and estate management, when compared to standardized financial products offered by banks or asset managers, contributing to the family office market growth. In this regard, Citi Wealth in September 2025 published a global family office report that highlights a resilient and optimistic family office sector, in which most of the portfolios held steady despite the presence of geopolitical tensions, trade disputes, and market volatility. Besides, the same report highlights that family offices remain strongly focused on direct investments, portfolio resilience, and active management, by reassessing jurisdictions and asset locations regardless of the global policy uncertainty. Furthermore, the growing professionalization needs, particularly in risk management, cybersecurity, leadership succession, and the selective outsourcing of non-core functions, are positively impacting market growth.

Challenges

- Talent acquisition and retention: The family office market is facing severe challenges in terms of attracting and retaining top-tier talent, which includes investment managers, legal advisors, and wealth strategists. Also, the ultra-high net worth families require professionals who are capable of navigating through complex portfolios, multi-jurisdictional regulations, and bespoke investment strategies, adding a barrier for family office market expansion. In addition, this aspect of limited talent is exacerbated by competition from private banks, hedge funds, and fintech firms, which are offering lucrative packages. Furthermore, retention is also a complex process wherein turnover can disrupt goals and negatively impact continuity in family governance.

- Regulatory compliance: The family office market mostly operates under the complex regulatory environments across multiple jurisdictions. In this context, keeping up with tax laws, anti-money laundering rules, and securities regulations can be straining, especially for firms operating in price-sensitive regions. At the same time, falling short on compliance can cause hefty fines, loss of reputation, or even result in legal consequences. In addition, the challenge is amplified for multi-family offices or offices that are managing cross-border investments, requiring constant monitoring of regulations in various regions. Furthermore, navigating these rules without any overburden of operational efficiency requires proper compliance frameworks and investment in technology.

Family Office Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 20.6 billion |

|

Forecast Year Market Size (2035) |

USD 38.1 billion |

|

Regional Scope |

|

Family Office Market Segmentation:

Type Segment Analysis

In the type segment, single-family offices will lead, capturing the largest revenue stake of 71.6% in the family office market over the discussed timeframe. The segment’s prominence in this field is attributable to the deep demand for highly bespoke, confidential wealth management, governance, and legacy planning services for ultra-wealthy families. This is, in turn, fueled by the continued rise in global UHNW populations and the increasing complexity of intergenerational wealth transfer procedures. According to the report published by IBEF in September 2024, Family offices in India have expanded at a rapid pace, reaching around 300 in 2024, and now collectively manage approximately USD30 billion in assets. Besides, this is influenced by rising ultra-high-net-worth wealth, greater professionalization of investment management, and an increased focus on succession planning and philanthropy, hence denoting a wider segment scope.

Asset Class Segment Analysis

By the end of the forecast duration, alternative assets will grow at a considerable rate in the family office market. The growth of the segment is highly subject to the pursuit of higher risk-adjusted returns and long-term capital preservation. Besides, the family offices are allocating capital to private equity, venture capital, hedge funds, real assets, and private credit to reduce dependence on public markets and enhance portfolio resilience. This growth is also supported by greater access to direct investments, co-investment opportunities, and fund structures that are suitable for ultra-high-net-worth investors. In addition, the rising family office market volatility, geopolitical uncertainty, and inflationary pressures are encouraging diversification into alternatives with lower correlation to traditional asset classes. Furthermore, the aspect of enhanced internal investment capabilities enables family offices to manage the complexity and longer investment horizons associated with alternative assets.

Service Segment Analysis

In the family office market, the investment management services segment is expected to capture a lucrative revenue share by the end of 2035. The family offices increasingly focus on portfolio diversification, alternative investments risk management strategies to preserve and grow wealth across generations, which is prompting a profitable business environment for the service segment. In November 2024, Goldman Sachs announced the launch of an enhanced family office platform integrating its Ayco and private wealth management offerings to provide ultra-high-net-worth clients with both holistic advisor-led solutions and customizable à la carte services. The firm also stated that this platform combines investment management, alternative asset administration, cybersecurity, and consolidated reporting, thereby enabling families to manage very complex finances without any operational burden of running a full family office, hence denoting a positive family office market outlook.

Our in-depth analysis of the family office market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Asset Class |

|

|

Service |

|

|

Client Base |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Family Office Market - Regional Analysis

North America Market Insights

North America is expected to register its dominance in the family office market, capturing the largest revenue share of 55.7% by the end of 2035. The leadership of the region is effectively attributable to the well-established financial infrastructure, talent pool, and trust & estate regimes. In November 2025, Matter Family Office and IWP Family Office together announced that they have merged to create a comprehensive multi-family office platform serving more than 140 ultra-high-net-worth families with more than USD 10 billion in assets under advisement. Besides, the combined firm integrates deep public and private investment expertise, family office administration, and proprietary family learning programs, thereby emphasizing generational wealth management and client-centered continuity. Furthermore, the merger is supported by BW Forsyth Partners, and it strengthens service breadth and scalability, positioning the firm to deliver multigenerational wealth solutions across its St. Louis, Denver, and Dallas-Fort Worth offices.

The U.S. is the key contributor to progress in the regional family office market, positively influenced by a large base of ultra-high-net-worth individuals who are looking for wealth management, estate planning, and succession strategies. Besides, the growing interest in impact investing and philanthropy is reshaping the services offered, creating encouraging opportunities for pioneers in this field. The Federal Reserve Bank of ST. Louis in June 2025 disclosed that its analysis of U.S. household wealth highlights stark concentration, in which the top 10% hold USD 8.1 million on average and 67.2% of total wealth, whereas the bottom 50% averaged USD 60,000, owning just 2.5%. It also mentioned that wealth disparities also appear across generations, education, and race, whereas the younger Americans and college-educated households hold disproportionately more wealth. Despite volatility from inflation and pandemic-related pressures, average wealth remains elevated relative to pre-pandemic levels, providing insight into the distributional context, increasing the potential for family offices.

Canada is continuously growing in the regional family office market, efficiently driven by an emphasis on professionalization and partnerships with fintech solutions to streamline operations and enhance reporting. The country’s market also benefits from sustainability, and ESG considerations are which are influencing family office investment decisions. Our Family Office Inc., a purpose-built shared family office which is serving Canada’s ultra-high-net-worth segment, was named a finalist in five categories at the 12th Annual Family Wealth Report Awards 2025, which include multi-family office, outstanding CEO, and outstanding CIO. The report also highlighted that the recognition reflects its dedication to delivering top-tier advice and service, while its integrated, family-owned governance model and holistic wealth approach hence attracted more players to establish their footprint in this field.

APAC Market Insights

Asia Pacific is rapidly expanding in the family office market, efficiently propelled by the preference for wealth preservation and diversification into global investments. Simultaneously, the adoption of technology and digital platforms is readily accelerating, thereby enabling family offices in this region to manage complex portfolios and track international investments. In September 2025, Apex Group announced that it had been appointed to provide fund and operational services for Nezu Asia Capital’s new Japan-focused Engagement Fund, targeting undervalued companies in Japan to unlock shareholder value. The mandate also includes fund administration, custody, and banking services across multiple jurisdictions, leveraging Apex’s Paxus technology platform for proper cross-border operations. Furthermore, this partnership highlights Apex Group’s role in supporting Japan-focused strategies and delivering integrated solutions for asset managers and family offices who are looking for efficient, end-to-end fund services.

China is augmenting its leadership over the regional family office market due to a focus on succession planning, offshore diversification, and alternative investments such as private equity and real estate. In this regard HKSAR government in 2022 reported that Hong Kong has established itself as a prominent hub for family offices, which is hosting a significant concentration of ultra-high-net-worth individuals and providing a credible ecosystem for wealth management. Besides, HKSAR supports this sector through policies such as the capital investment entrant scheme, the Hong Kong Academy for wealth legacy, art storage facilities, philanthropic support, and full profits tax concessions for family-owned investment holding vehicles managed by single-family offices. Hence, these measures, coupled with guidance on structures, compliance, taxation, and governance, make Hong Kong a preferred base for family offices in the country that are looking to operate both nationally and internationally.

India is also efficiently growing in the Asia Pacific’s family office market, owing to the increasing engagement in philanthropy, startup investments, and direct equity participation, reflecting evolving wealth management needs. The sector is also opting for technology solutions to improve operational efficiency by ensuring long-term wealth preservation across generations. In April 2025, UBS announced that it had entered into an exclusive strategic collaboration with the country’s 360 ONE WAM, combining UBS’s global expertise with 360 ONE’s local reach to enhance wealth management for ultra- and high-net-worth clients. Besides, the partnership will offer onshore and offshore investment solutions, potential asset management and investment banking synergies, and involve UBS acquiring a 4.95% stake in 360 ONE. Furthermore, this move strengthens both firms’ positions in India and globally by expanding growth opportunities in the market.

Europe Market Insights

Europe is growing exponentially in the family office market due to a focus on tax optimization and cross-border investment strategies. Strong governance, risk management, and family cohesion remain central in the region, whereas philanthropic advisory and legacy planning are becoming highly essential to service offerings. In February 2025, the SEB Nordic Family Office Summit 2025 in Stockholm showcased strong growth, thereby attracting 200 principals and senior executives from Northern Europe, which marks up 65% from the previous year. The summit also emphasized governance, succession planning, and next-generation engagement, in which the speakers from leading family offices such as the IMAS Foundation, the Messer Family, and Kiilto shared insights on long-term strategy and family-business balance, hence, highlighting the importance of sustainability, innovation, and intergenerational wealth stewardship.

Germany is extensively growing in the family office market, facilitated by the emphasis on long-term wealth preservation, estate planning, and structured investment strategies. ESG-focused investing is growing in the country in which offices are increasingly incorporating sustainability into portfolio allocation, reflecting both regulatory trends and generational priorities. In August 2025, FORUM Family Office announced that it has acquired 100% of ab-data GmbH & Co. KG which is, a Germany-based financial software provider for municipalities, through its holding company FORUM Software Mittelstandsholding SE. Besides, the acquisition secures the continued development of the VOIS|Finanzwesen platform, and this move aligns with the firm’s long-term, family-equity investment approach, supporting succession solutions and sustainable growth for medium-sized companies.

U.K. market is highly developed, which is offering services in investment management, tax planning, philanthropy, as well as estate succession. Besides, London serves as a prime hub for global UHNW families who are seeking access to worldwide markets, alternative investments. Simultaneously, the country’s firms are focused on cross-generational planning and socially responsible investing, thereby reflecting evolving wealth management expectations and global market potential. In this regard, FNZ in December 2025 announced that it has launched an AI study, which is an AI-powered investment firm, analyzing more than 500 financial institutions with USD 74.2 trillion in assets across 16 markets, highlighting the role of AI in transforming wealth and asset management. Also, the research shows that early AI adoption drives growth, efficiency, and risk reduction, whereas integrated platforms and governance frameworks are key differentiators, hence enabling industrial-scale AI adoption across the wealth management value chain.

Key Family Office Market Players:

- UBS Global Family Office (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- J.P. Morgan Private Bank (U.S.)

- Goldman Sachs Private Wealth Management (U.S.)

- BNP Paribas Wealth Management (France)

- Citibank Private Bank (U.S.)

- Northern Trust Global Family Office (U.S.)

- Bessemer Trust (U.S.)

- Stonehage Fleming (Jersey/UK)

- BNY Mellon Wealth Management (U.S.)

- Rockefeller Capital Management (U.S.)

- Glenmede Trust Company (U.S.)

- HSBC Private Banking (U.K.)

- Banco Pictet (Switzerland)

- Brown Brothers Harriman Family Office Services (U.S.)

- Evercore Family Office Services (U.S.)

- UBS Global Family Office operates one of the most established global family office platforms, which offers wealth planning, investment management, estate, and governance solutions across multiple regions. The company has a deep expertise and a strong international network, and it delivers integrated reporting and consolidated investment management for family office clients. Hence, UBS’s digital emphasis reflects its strategy to blend high-touch advisory with innovative technology, hence attracting a wider audience group.

- J.P. Morgan Private Bank is yet another dominant force in this field, which provides suitable family office services built on its global investment platform, concierge wealth planning, and estate advisory. Besides, the organization has pursued strategic expansions to bolster its family office offerings, which include acquiring family office advisory units to enhance research and investment capabilities. Thus, this underscores its priority on scaling advisory depth by reinforcing bespoke solutions.

- Goldman Sachs Private Wealth Management is well known for its investment management expertise, and it integrates traditional family office services with private markets access, governance tools, and advisory partnerships. The firm also co-develops enhanced advisory services and platforms directed at family offices, thereby emphasizing innovation in governance and investment research. Therefore, this aligns with a broader strategy of client relationships and broadening service breadth.

- Rockefeller Capital Management deliberately combines legacy family office heritage with modern strategic advisory and wealth management services. The company is highly focused on personalized service, governance support, and multi-generational planning. In addition, Rockefeller’s brand strength and client focus position it in a competitive landscape where bespoke, trust-centered advisory is increasingly valued by UHNW families.

- Bessemer Trust is a frontrunner in this field and is a leader in terms of independent multi-family office managing wealth, fiduciary, and investment solutions for affluent families and institutions. The company has over a century of history, and it emphasizes customized investment strategies and deep client relationships. Furthermore, Beesemer’s regional presence and focus on wealth preservation and governance services anchor its competitive positioning in the market.

Below is the list of some prominent players operating in the global family office market:

The global family office market is extremely competitive, which is leveraging a mix of large global banks, private wealth managers, and specialized multi-family office firms that are constantly striving to offer services across various jurisdictions. Pioneering companies such as UBS Global Family Office and J.P. Morgan Private Bank are deeply emphasizing international networks and digital platforms to attract ultra-high-net-worth families. UBS Group AG in May 2024 announced that it had completed the merger of UBS AG and Credit Suisse AG by consolidating all rights, obligations, and clients of Credit Suisse under UBS. Besides this strategic integration aims to migrate clients onto unified UBS platforms, thereby unlocking cost, capital, funding, and tax efficiencies. Hence, the merger strengthens UBS’s global wealth management and family office services, further enhancing operational scale, client reach, and investment capabilities in the ultra-high-net-worth segment.

Corporate Landscape of the Family Office Market:

Recent Developments

- In December 2025, Nomura announced that it had completed the USD 1.8 billion acquisition of Macquarie’s U.S. and Europe-based public asset management business, adding around USD 166 billion in client assets across equities, fixed income, and multi-asset strategies.

- In November 2025, Mondevo Group introduced ITTIKAR, which is the world’s first-ever AI-native merchant bank for family offices from Abu Dhabi, with a dedicated AI-Agent for each family office to manage investment sourcing, due diligence, and the entire lifecycle. It was built on relationships with over 120 family offices representing USD 6 trillion in assets.

- In July 2025, TIGER 21 announced the launch of a second Kansas City Group, bringing together UHNW entrepreneurs from the Midwest to meet the growing demand for peer guidance on wealth, family, and legacy, using TIGER 21’s confidential portfolio defense process with USD 200 B in collective assets and 50+ cities globally.

- Report ID: 2782

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Family Office Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.