Control Valve Market Outlook:

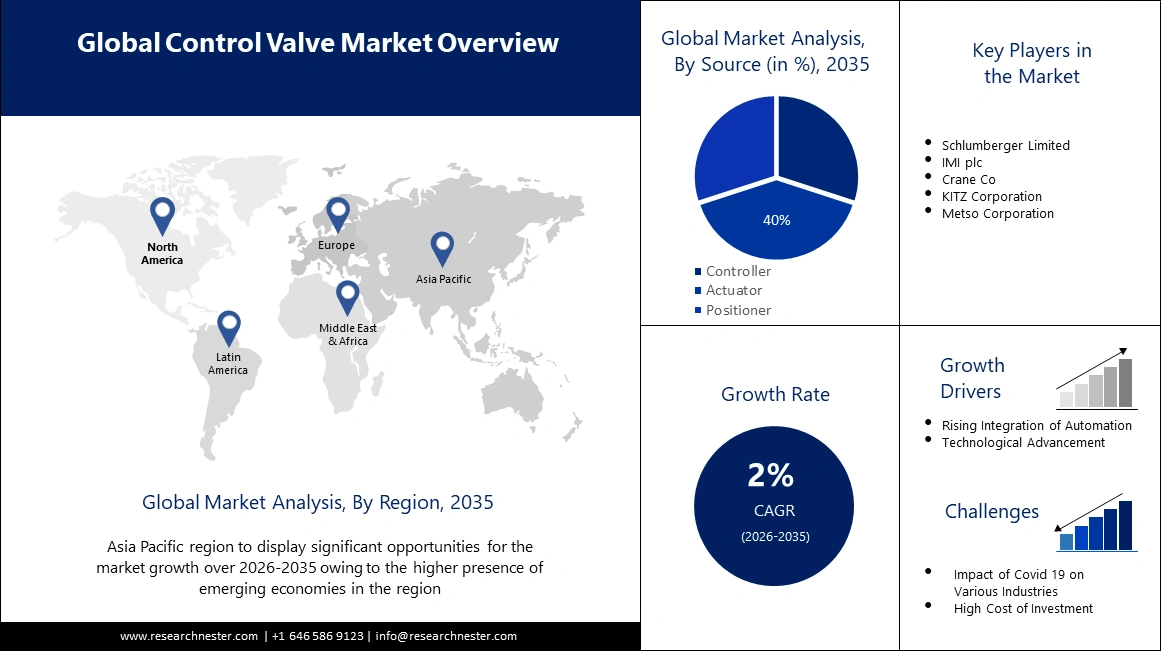

Control Valve Market size was over USD 8.98 billion in 2025 and is projected to reach USD 17.83 billion by 2035, growing at around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of control valve is evaluated at USD 9.55 billion.

The industrial sectors, including chemical, oil and gas, and others, have begun to use IoT technology in recent years. Control valve operational efficiency is increased with the use of IoT. Because IoT systems are linked with smart valves that include embedded processors, wireless vibration sensors, and intelligent control systems, there has been a surge in demand for their adoption in various industries. Only 54% of all the devices installed in the adopter firms are enabled by IIoT technology, despite the high adoption rates.

Furthermore, the production and refinery platforms' high temperatures, high pressure, and unfavorable corrosion conditions have increased the demand for control valves. The primary uses for these platforms are in onshore and offshore oil and gas operations. The majority of crucial systems in the oil and gas sectors use these valves. It regulates the volume, direction, pace, pressure, and flow of fluids in addition to their movement.

Key Control Valve Market Insights Summary:

Regional Highlights:

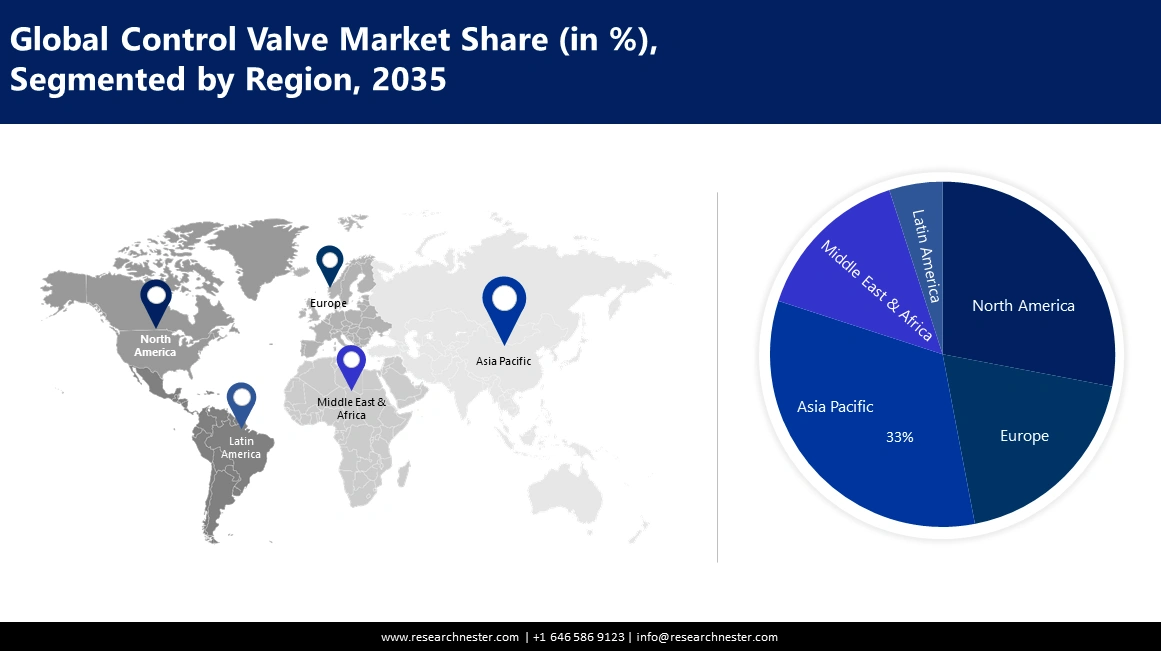

- Asia Pacific control valve market will secure over 33% share, driven by the presence of emerging economies like China and India, forecast period 2026–2035.

Segment Insights:

- The actuator segment in the control valve market is forecasted to achieve a 40% share by 2035, driven by IoT and automation technologies enhancing installation flexibility and optimization.

- Energy & power segment in the control valve market is anticipated to secure the largest share by the forecast year 2035, fueled by advancements in sensor and valve technology reducing costs and maximizing uptime.

Key Growth Trends:

- Rising Demand in Renewable Energy

- Advancement in Technology

Major Challenges:

- Rising Demand in Renewable Energy

- Advancement in Technology

Key Players: Emerson Electric Co., Flowserve Corporation, IMI plc, Samson AG, Crane Co., Spirax-Sarco Engineering plc, Metso Corporation (Neles), Curtiss-Wright Corporation, Velan Inc., Burkert Fluid Control Systems.

Global Control Valve Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.98 billion

- 2026 Market Size: USD 9.55 billion

- Projected Market Size: USD 17.83 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Control Valve Market Growth Drivers and Challenges:

Growth Drivers

- Rising Demand in Renewable Energy - The market has driven the development of control valves with a substantial amount of cycles and strong temperature resistance. The increased focus on funding alternative energy sources, particularly renewable energy, has also opened up new avenues for application and possibilities for control valves. As an example, the IEA projects that 70% of all energy investments made worldwide will go to renewable energy sources.

- Advancement in Technology - Technological developments have produced creative ideas that can assist process plants in streamlining their operations and becoming more and more efficient. Process automation is becoming more and more necessary as sensor technology is used to control valves in sectors where high performance and safe operation are required. In the manufacturing sector, another technology that is becoming increasingly important is the digital field bus protocol. In manufacturing plants, industrial field bus system networks are used to link instruments that demand a significant reduction in wire. The size of the control valves industry is expected to be driven by the manufacturing sectors' adoption of cutting-edge technology for valve control.

Challenges

- High Cost of Investment - The main obstacle facing control valves is the hefty investment costs. Control valve process automation requires a substantial upfront expenditure to be put into place. But this should be weighed against the advantages in terms of output and adherence. Making the transition from a machine-operated manufacturing process to a human-manned one requires a substantial upfront cost. The market expansion for control valves is also being hampered by the high expenses of educating staff on how to operate this new, complex machinery.

- Lack of Standardization is Anticipated to Hinder the Control Valve Market Growth During the Projected Period

- Impact of COVID-19 in Industries Such as Oil and Gas Sector is Set to Pose Limitation on the Market Expansion in the Upcoming Period

Control Valve Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 8.98 billion |

|

Forecast Year Market Size (2035) |

USD 17.83 billion |

|

Regional Scope |

|

Control Valve Market Segmentation:

Source Segment Analysis

Based on source, the actuator segment in the control valve market is anticipated to hold the largest revenue share of 40% during the forecast period. The demand for control valves is expected to grow as a result of the introduction of Internet of Things and automation technologies in different sectors. The actuators are capable of fully rotating their heads by 360 in control valves, allowing flexibility of installation and optimization. This helps to reduce the total cost of installation and make it more efficient for actuators to be integrated into production processes, thus stimulating market growth. The most common type of valve is the linear style valve.

End-user Industry (Segment Analysis

In terms of end user, the energy & power segment is set to dominate the control valve market by the end of 2035. Headways in sensor and valve innovation have empowered producers within the vitality sources industry to up their fabricating capabilities by diminishing the in general taken a toll of gear possession, maximizing uptime, and bringing down support costs. Moreover, energy companies are trying to find oil and gas generation openings within the locale, owing to the developing territorial request. For occurrence, in November 2021, the Bureau of Sea Vitality Administration (BOEM) held an oil and gas rent deal for the Gulf of Mexico. This rent deal pulled in over USD 191 million in offers for 308 squares. Within the rent deal, a add up to of 33 companies submitted 317 recommendations.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Source |

|

|

End-user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Control Valve Market Regional Analysis:

APAC Market Insights

The control valve market in the Asia Pacific region is set to hold the largest revenue share of 33% during the forecast period. The growth is driven by the presence of emerging economies like China and India. In addition to technologies that need to be involved in converting them into smart valves, companies in the region invest heavily in valve and actuator manufacturing. In industries such as water, wastewater, food and beverage, energy, and pharmaceutical there is also an increasing demand for automation of valve operations.

North American Market Insights

The control valve market in the North America region is poised to grow significantly during 2026-2035. In both the United States and Canada, there are colossal requests from different businesses, including oil and gas, power, nourishment and bundling, and chemicals. Major sectors within the nation, such as oil and gas, renewable vitality, and water and industrial wastewater treatment, are moving toward valve innovation with implanted processors and organizing capability to work nearby advanced checking innovation facilitated through a central control station. Oil generation within the Joined together States proceeds to expand rapidly. For occurrence, ExxonMobil, one of the driving oil makers within the nation, declared its plans to extend the generation movement within the Permian Basin of West Texas by creating more than 1 million barrels per day (bpd) of oil identical as early as 2024. This can be identical to an increment of about 80% compared to the show generation capacity. Additionally, Chevron is anticipated to extend its net oil-equivalent generation to reach 600,000 bpd by 2020 and 900,000 bpd by 2023.

Control Valve Market Players:

- Emerson Electric Co

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Flowserve Corporation

- Weir Group

- Curtiss-Wright Corporation

- Honeywell International Inc

- Schlumberger Limited

- IMI plc

- Crane Co

- KITZ Corporation

- Spirax-Sarco Engineering plc

- GEMU Group

- Metso Corporation

Recent Developments

Spirax Sarco released the Steam-Tight control valve Spira-trol. The flip-over seat doubles the life of the secure steam control with class VI isolation, resulting in a lower total cost of ownership for the client.

A new control valve with a motorized actuator, the GEMÜ R563 eSyStep, was introduced by GEMÜ in April of 2021. The GEMÜ eSyStep actuator has been added to the GEMÜ 566 control valve by the valve specialist.

- Report ID: 5740

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Control Valve Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.