Continuous Thermal Monitoring Market Outlook:

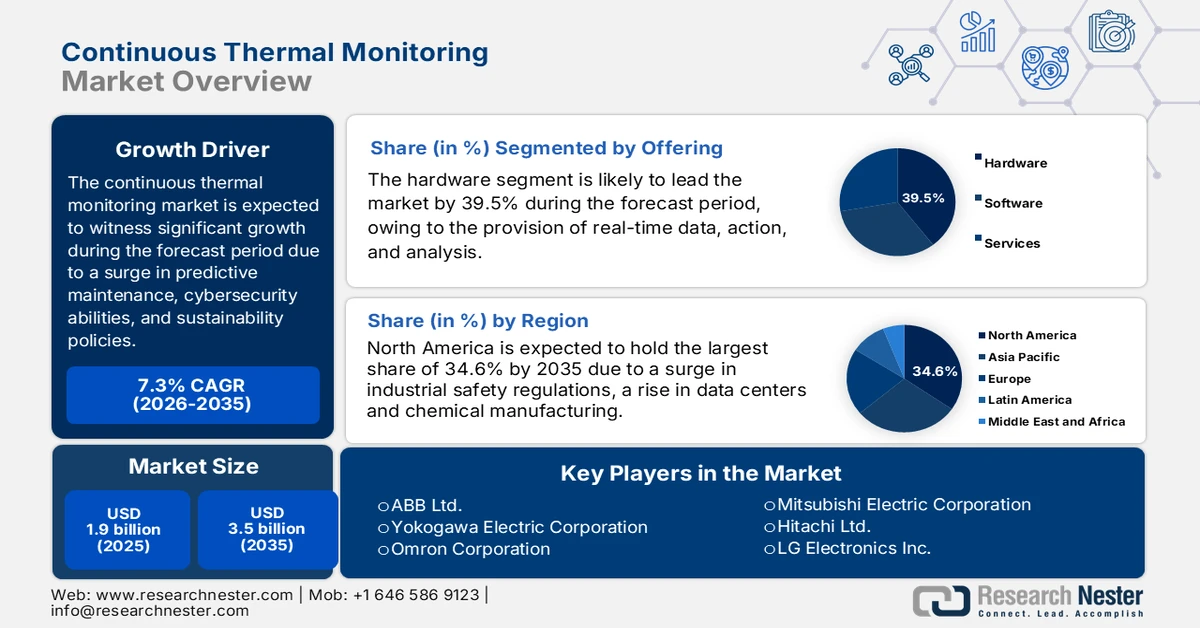

Continuous Thermal Monitoring Market size was over USD 1.9 billion in 2025 and is estimated to reach USD 3.5 billion by the end of 2035, expanding at a CAGR of 7.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of the continuous thermal monitoring estimated at USD 2 billion.

The worldwide market is significantly entering a new phase of growth, based on factors including industrial safety, predictive maintenance, sustainability mandates, cybersecurity concerns, supply chain resilience, and digital twin integration. According to official statistics published by Intelligent Systems with Applications in June 2025, predictive maintenance is applied when the monitoring system is up and running smoothly, resulting in operational expense impact for overall manufacturing, ranging from 15% to 60%. Besides, America-based industries spend over USD 200 billion annually on maintaining industrial organizations and equipment. Besides, as per the 2025 OECD Organization article, almost 30% of international exports are effectively concentrated among a few trading partners. Additionally, there has been a 50% rise in massive import localization internationally, thereby denoting a huge growth opportunity for the market globally.

Country-wise Supply Chain Localization on GDP (2025)

|

Countries |

Modelled GDP |

Volatility |

|

Argentina |

100 |

0.46 |

|

Brazil |

100 |

0.38 |

|

Canada |

100 |

1.02 |

|

China |

100 |

0.28 |

|

France |

100 |

1.10 |

|

Germany |

100 |

1.10 |

|

India |

100 |

0.34 |

|

Indonesia |

100 |

0.26 |

|

Italy |

100 |

0.77 |

|

Japan |

100 |

0.40 |

Source: OECD Organization

Furthermore, the integration of edge computing, cross-industry adoption, sensor miniaturization, and hybrid monitoring models are other trends driving the market across different nations. As stated in an article published by NLM in October 2025, a phosphate detection system, deliberately integrated with a Fabry-Perot resonator, has achieved a detection limit of 0.1 μmol/L, a detection range of 0 to 100 μmol/L, a 6-second response time, and a reagent consumption of only 6 μL. In this particular system, chromogenic agent A comprises an ascorbic acid solution, and meanwhile, chromogenic agent B consists of a mixture of 12% ammonium molybdate as well as 8% of antimony potassium tartrate, and 80% concentrated sulphuric acid. Therefore, with the presence of such a system, the market is gaining suitable exposure globally.

Key Continuous Thermal Monitoring Market Insights Summary:

Regional Insights:

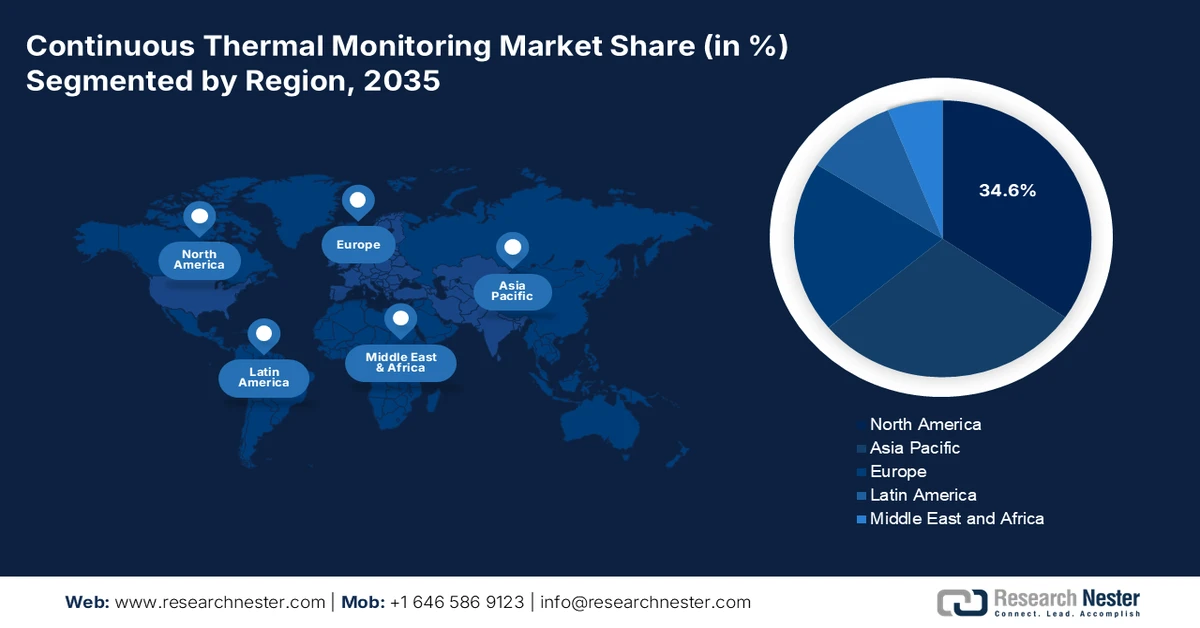

- North America in the continuous thermal monitoring market is forecast to command a leading 34.6% share by 2035, underpinned by stringent industrial safety regulations, expanding chemical manufacturing and data center demand, and strong government backing for advanced manufacturing technologies.

- Europe is projected to emerge as the fastest-growing region during the forecast period, accelerated by sustainability mandates under the Green Deal, rigorous chemical safety regulations, and rising adoption of industrial automation.

Segment Insights:

-

The hardware sub-segment under the offering segment in the continuous thermal monitoring market is projected to account for a dominant 39.5% share by 2035, reinforced by its role as the core infrastructure enabling real-time data capture, analytics, and responsive action across IT, manufacturing, and industrial environments.

-

The data centers segment under application is expected to secure the second-largest share by the end of the forecast period, stimulated by the rapid expansion of cloud computing, AI-driven workloads, and hyperscale infrastructure.

-

Key Growth Trends:

- Rise in semiconductor demand

- Increase of government funding for Green Chemistry

Major Challenges:

- Increase in implementation expenses and ROI concerns

- Data security and cyber vulnerabilities

Key Players: Honeywell International Inc., General Electric Company, Emerson Electric Co., Fluke Corporation, Rockwell Automation Inc., Siemens AG, Schneider Electric SE, ABB Ltd., Yokogawa Electric Corporation, Omron Corporation, Mitsubishi Electric Corporation, Hitachi Ltd., LG Electronics Inc., Samsung Electronics Co., Ltd., Larsen & Toubro Limited, Bharat Heavy Electricals Limited, NHP Electrical Engineering Products Pty Ltd., Rotork plc, Endress+Hauser Group, Petronas Chemicals Group Berhad.

Global Continuous Thermal Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2 billion

- Projected Market Size: USD 3.5 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Mexico

Last updated on : 4 February, 2026

Continuous Thermal Monitoring Market - Growth Drivers and Challenges

Growth Drivers

- Rise in semiconductor demand: The continuous thermal monitoring market is significantly critical for monitoring GaAs wafers as well as innovative chip manufacturing, wherein thermal stability directly impacts the yield. According to official statistics published by the Semi Organization in January 2024, there has been a surge in the international semiconductor capacity by 6.4% as of 2024. This readily topped the 30 million wafers per month (wpm) after rising from 5.5% to 29.6 wpm as of 2023. Based on this growth, there has also been an increase in the resurgent market demand, along with surged government incentives internationally, deliberately overpowering generous investment in chipmaking, which further rose by 6.4% as of 2024, thereby denoting a positive impact on the market.

- Increase of government funding for Green Chemistry: The presence of national programs in Europe, India, and China is focused on allocating generous funding provisions to sustainable chemical processes, which is responsible for boosting the continuous thermal monitoring market adoption. As stated in an article published by the Government of Canada in September 2025, the country evidently diminished Scope 1 and Scope 2 greenhouse gas emissions by 40% in 2025, and is further focused on reducing nearly 90% by the end of 2050. In this particular emission reduction pathway, the country’s government aspires to diminish emissions by an additional 10% every 5 years. Therefore, with such government contributions, there is a huge growth opportunity for the market globally.

- Reduction in risks of accidents and overheating: Governments across different nations are readily mandating the continuous thermal monitoring market adoption in energy facilities and chemical infrastructures for reducing the challenges of accidents and overheating. As per an article published by NLM in May 2023, a high level of insulation combined with the proper utilization of night-time natural ventilation can increase thermal comfort hours, usually lasting 2 to 5 times longer than across poorly-insulated houses, along with nearly 2 degrees Celsius temperature difference. Besides, in South Europe, climate modification is poised to comprise heat incidents with a 5 to 10 times increased probability of critical heatwaves within a 40-year period, thus enhancing the market’s demand internationally.

Challenges

- Increase in implementation expenses and ROI concerns: The upfront cost of systems in the continuous thermal monitoring market, including advanced sensors, IoT infrastructure, and AI-driven analytics platforms, remains a significant barrier for many industries. Small and medium enterprises (SMEs), particularly in emerging markets, struggle to justify the investment when immediate returns are not visible. Installation requires specialized expertise, calibration, and integration with existing systems, which adds to expenses. Moreover, the cost of maintaining and upgrading CTM systems can be substantial, especially when paired with cybersecurity and cloud service requirements. While large corporations in energy, chemicals, and data centers can absorb these costs, smaller firms often delay adoption, slowing overall market penetration.

- Data security and cyber vulnerabilities: The market relies heavily on IoT sensors, cloud platforms, and real-time data transmission. This interconnectedness exposes them to cyber threats, including data breaches, ransomware, and industrial espionage. Sensitive thermal data from chemical plants, energy grids, or semiconductor fabs can be exploited if not properly secured, leading to operational risks and compliance violations. Governments are increasingly mandating cybersecurity standards for industrial IoT, but compliance adds complexity and cost. For instance, utilities and defense sectors face heightened risks due to the critical nature of their infrastructure. The challenge also lies in balancing the need for continuous monitoring with robust cybersecurity measures, which can slow adoption and increase operational overhead.

Continuous Thermal Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 3.5 billion |

|

Regional Scope |

|

Continuous Thermal Monitoring Market Segmentation:

Offering Segment Analysis

The hardware sub-segment, which is part of the offering segment, is anticipated to garner the highest share of 39.5% in the market by the end of 2035. The sub-segment’s upliftment is highly driven by the aspect of serving as the backbone that ensures real-time data capture, analysis, and action, particularly across IT environments, manufacturing, and industries. According to official statistics published by the Journal of Environmental Management in April 2024, air pollution causes more than 6.5 million deaths every year internationally, deliberately leading to chronic diseases, climate change, acid rain, reduced visibility, and impaired brain functionality. Therefore, to safeguard the environment and enable compliance with suitable regulations, the sub-segment is gaining more exposure.

Application Segment Analysis

By the end of the forecast period, the data centers segment under application is projected to grab the second-largest share in the continuous thermal monitoring market. The segment’s growth is highly fueled by the exponential rise in cloud computing, AI workloads, and hyperscale infrastructure. Thermal management is critical because servers generate significant heat, and even minor fluctuations can lead to downtime, reduced efficiency, or hardware damage. CTM systems provide real-time monitoring of racks, cooling systems, and power distribution units, ensuring optimal temperature control and energy efficiency. The demand is reinforced by sustainability mandates, as data centers consume the majority of global electricity. Besides, operators are under pressure to reduce carbon footprints, thereby negatively impacting the market’s growth.

End user Segment Analysis

The utilities segment in the market is expected to hold the third-largest share by the end of the stipulated period. The segment’s development is highly propelled by ensuring grid reliability by continuously monitoring transformers, switchgear, and bus ducts, preventing overheating and catastrophic failures. With rising energy demand and integration of renewables, utilities face increasing complexity, making CTM indispensable for operational safety and efficiency. Moreover, the driver here is regulatory compliance, based on which agencies such as the U.S. Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) mandate strict monitoring to reduce risks of equipment failure and hazardous incidents. In Europe, the regional Chemicals Agency and Green Deal policies push utilities toward sustainable and efficient operations, further boosting CTM adoption.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Offering |

|

|

Application |

|

|

End user |

|

|

Services |

|

|

Technology |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Continuous Thermal Monitoring Market - Regional Analysis

North America Market Insights

North America is anticipated to garner the highest market share of 34.6% by the end of 2035. The market’s upliftment in the region is highly attributed to the presence of strict industrial safety regulations, a rise in the demand for chemical manufacturing and data centers, and government-funded innovative manufacturing technologies. Based on government estimates published by the Census Government in January 2025, employment in U.S.-based data centers facilitated an increase of over 60% as of 2023, readily driving the market’s demand in the whole region. Additionally, there has been an increase in the number of people working in data centers from 306,000 to 501,000 within the same year. Besides, more than 40% of data center employment in the U.S. is located across Georgia, New York, Florida, Texas, and California, thus making it suitable for bolstering the market in the region.

The continuous thermal monitoring market in the U.S. is growing significantly, owing to chemical industry safety and compliance, energy efficiency and advanced manufacturing, along with semiconductor and GaAs wafer research. According to official statistics published by the Department of Energy in July 2024, the administrative department notified USD 41 million for 14 projects to create technologies and renewables-to-liquids for effectively harnessing renewable energy sources, such as solar and wind. This is suitable for producing liquids for sustainable fuels or chemicals that can be significantly transported as well as stored as easily as carbon-based liquids, including oil or gasoline. At present, low-carbon fuels are expensive at almost USD 10 per gallon, with the objective to create systems that can significantly store nearly 50% of incoming intermittent electrical energy in carbon-containing liquids, thus boosting the market’s growth.

Projects Selected to Pursue Renewables-to-Liquids (RtL) Systems in the U.S. (2024)

|

Project Name |

Location |

Details |

Funding Amount |

|

Georgia Institute of Technology |

Atlanta |

Work on an electrochemical reactor that responds quickly to dynamic changes in renewable energy to work with direct air capture systems that produce syngas for hydrocarbon production. |

USD 1,970,200 |

|

HeatPath Solutions |

Lewis Centre |

Develop a new way to synthesize methanol that works dynamically with intermittent electricity from renewables to create a new path for on-site production and collection of methanol from modular reactors operating at modest temperatures and pressures. |

USD 4,000,000 |

|

Susteon |

Cary |

Create a process to produce kerosene-range hydrocarbons using carbon dioxide, hydrogen, and renewable electricity. Susteon’s approach seeks to supply a new technology platform for the production of aviation fuels and other valuable fuels and chemicals. |

USD 4,999,500 |

The clean energy chemical production, expansion in data centers, cooling efficiency, industrial policy, and environmental sustainability are significantly uplifting the continuous thermal monitoring market in Canada. According to official statistics published by the Government of Canada in August 2025, the country’s clean energy gross domestic product is expected to reach USD 107 billion, highly driven by some USD 58 billion in yearly investments by the end of 2030, and over 600,000 employment opportunities. Besides, an energy cost-effectiveness study has been conducted on behalf of the Canada Electricity Advisory Council. In this regard, the population tends to diminish the overall energy-based expenses by almost USD 15 billion through the transition to a net-zero future. Therefore, with such initiatives, there is a huge demand for the market’s expansion in the overall country.

Europe Market Insights

Europe market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by the presence of sustainability mandates under the regional Green Deal, chemical safety regulations, and industrial automation. According to official statistics published by the EBF in December 2025, the chemical industry is central to the region’s sector-based competitiveness as one of the second-largest chemical producers internationally, with a 12.6% of the international share as of 2023. Additionally, the industry in the region is poised to diminish greenhouse gas emissions by an estimated 164 million tons and successfully reach the 2050 net-zero objectives. Moreover, the April 2025 ECPR article, as of May 2023, importers and manufacturers have registered more than 26,000 individual substances under the regional chemical regulation, thus bolstering the market’s growth.

International Chemical Industrial Growth Analysis in Europe (2013-2023)

|

Year |

Chemical Sales (EUR Billion) |

|

2013 |

510 |

|

2014 |

498 |

|

2015 |

494 |

|

2016 |

478 |

|

2017 |

521 |

|

2018 |

541 |

|

2019 |

542 |

|

2020 |

503 |

|

2021 |

630 |

|

2022 |

748 |

|

2023 |

655 |

Source: ECPR

The continuous thermal monitoring market in Germany is gaining increased traction, owing to the provision of robust government support for sustainability, an increase in prioritizing monitoring technologies, and predictive maintenance for reducing industrial emissions. As stated in an article published by the Clean Energy Wire Organization in March 2024, the existence of 12 largest chemical production facilities in the country has resulted in almost 23 million tons of carbon dioxide emissions as of 2022, denoting an estimated 3% of the domestic yearly greenhouse gas output. In addition, combined power and heat installations, which are usually gas-driven, are significantly responsible for the largest share of emissions, with almost 40%. This is further followed by steamcreacker facilities for chemicals production with 24%, and ammonia production plants with 14%, thus fueling the market’s exposure in the country.

An increase in clean energy investments, semiconductor demand, and data center growth are effectively responsible for boosting the continuous thermal monitoring market in the UK. As stated in an article published by the CEFIC Organization in 2024, the country is regarded as the second-largest chemical sector, amounting to £62 billion in turnover, with 137,000 employees, and 4,090 organizations. In addition, the domestic sector’s capital expenditure amounts to £7.2 billion and £9.8 billion in research and development investment. In this regard, the industry effectively accounted for 18.6% of the private sector’s manufacturing expenditure. Besides, with more than £60.0 billion in exports, along with £ 30.4 billion of value addition to the country’s economy, the chemical sector emerged as the second-largest manufacturing industry in 2023, thus making it suitable for uplifting the market’s growth.

APAC Market Insights

The Asia Pacific continuous thermal monitoring market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is extremely fueled by government-funded sustainability programs, an expansion in the chemical industry, and rapid industrialization. According to official statistics published by the World Bank Group Organization in October 2025, the growth in the region is completely on track and successfully reached 6.6% as of 2025. Besides, as stated in an article published by the TNI Organization in August 2025, Singapore’s Green Plan 2030 is considered a wide-ranging initiative to gain net-zero emissions by the end of 2050, with a target of sourcing 60% of electricity from low-carbon sources by 2035, particularly through solar energy, emerging technologies, and regional power imports, thus uplifting the market in the region.

The continuous thermal monitoring market in China is gaining increased exposure, owing to the CTM integration, as well as predictive maintenance in chemical infrastructure to diminish emissions and optimize safety. As stated in an article published by the ITIF Organization in April 2024, the country readily accounted for 44% of international chemical production, as well as 46% of capital investment as of 2022. This denotes that the country comprises the largest chemicals sector in the world, providing domestic producers with a notable benefit in the regional market. In addition, organizations are effectively investing in China, with 46% of the international chemical industrial capital investment located in the country. Therefore, with such exposure to the overall industry, there is a huge growth opportunity, along with its expansion in the market, in the nation.

An increase in semiconductor demand, sustainability initiatives, and modernization in the chemical sector are certain factors that are significantly boosting the continuous thermal monitoring market in India. Based on government estimates published by the PIB Government in August 2025, the chip industry in the country is continuously booming and is further set to hit USD 100 billion to USD 110 billion by the end of 2030. Besides, the domestic semiconductor mission, amounting to ₹76,000 Cr outlay, bolsters localized manufacturing, talent, and design. Moreover, in August 2025, 4 semiconductor units have been readily approved, with an outlay of Rs.4600 crore. Meanwhile, overall accepted projects under ISM have reached 10 cumulative investments of nearly Rs. 1.60 lakh crore across 6 states, thereby making it suitable for bolstering the market’s demand in the country.

Key Continuous Thermal Monitoring Market Players:

- Honeywell International Inc. (U.S.)

- General Electric Company (U.S.)

- Emerson Electric Co. (U.S.)

- Fluke Corporation (U.S.)

- Rockwell Automation Inc. (U.S.)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Yokogawa Electric Corporation (Japan)

- Omron Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Hitachi Ltd. (Japan)

- LG Electronics Inc. (South Korea)

- Samsung Electronics Co., Ltd. (South Korea)

- Larsen & Toubro Limited (India)

- Bharat Heavy Electricals Limited (India)

- NHP Electrical Engineering Products Pty Ltd. (Australia)

- Rotork plc (UK)

- Endress+Hauser Group (Germany)

- Petronas Chemicals Group Berhad (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Honeywell International Inc. is a leading player in CTM solutions, leveraging its expertise in industrial automation and building technologies. The company integrates IoT-enabled sensors and advanced analytics to enhance predictive maintenance and energy efficiency across chemical, utility, and data center applications.

- General Electric Company focuses on CTM adoption within power generation and heavy industries, embedding thermal monitoring into turbines, transformers, and grid systems. Its emphasis on digital industrial solutions and smart grid technologies positions GE as a key driver of reliability and safety in energy infrastructure.

- Emerson Electric Co. delivers CTM systems through its automation solutions, particularly in chemical processing and oil and gas. By combining thermal monitoring with process control, Emerson helps industries reduce downtime and comply with stringent safety regulations.

- Fluke Corporation specializes in portable thermal monitoring devices and diagnostic tools widely used in industrial maintenance. Its handheld infrared cameras and sensors are critical for technicians conducting real-time monitoring and troubleshooting in manufacturing and utilities.

- Rockwell Automation Inc. integrates CTM into its industrial automation platforms, enabling smart factories and predictive maintenance. Its solutions focus on combining thermal monitoring with digital twins and AI-driven analytics to optimize performance in manufacturing and chemical industries.

Here is a list of key players operating in the global market:

The worldwide market is highly competitive, with global players leveraging strategic partnerships, research and development investments, and digital transformation initiatives to strengthen their positions. U.S. companies dominate through advanced sensor technologies, while Europe-based firms emphasize sustainability and compliance with strict regulations. Japan and South Korea-specific manufacturers focus on innovation in semiconductor and electronics applications, whereas India and Malaysia are emerging with government-backed industrial modernization programs. Besides, in June 2023, OroraTech significantly deployed the upcoming thermal sensor of a commercial orbit-based network. Therefore, by continuously monitoring the Earth’s temperature, consumers, such as utility organizations, forestry, and fire-fighting agencies, are offered with real-time detection capability, thus bolstering the continuous thermal monitoring industry internationally.

Corporate Landscape of the Continuous Thermal Monitoring Market:

Recent Developments

- In February 2026, Systems With Intelligence declared the introduction of INTELLINSPECT, which is a cloud-specific inspection automation platform that ensures utilities to effectively streamline the analysis of thermal and visual sensor data.

- In August 2025, Emerson notified the introduction of the Rosemount 3144S Temperature Transmitter, which is the latest industrial measurement solution with the flexibility to effectively meet the most demanding temperature measurement risks, permitting for increased profitability, safety, and efficiency.

- In January 2025, Constellr successfully unveiled the first-ever satellite, known as the Thermal Earth Observation, thereby deliberately ushering in the latest era of international thermal monitoring.

- Report ID: 8380

- Published Date: Feb 04, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.