Tank Level Monitoring System Market Outlook:

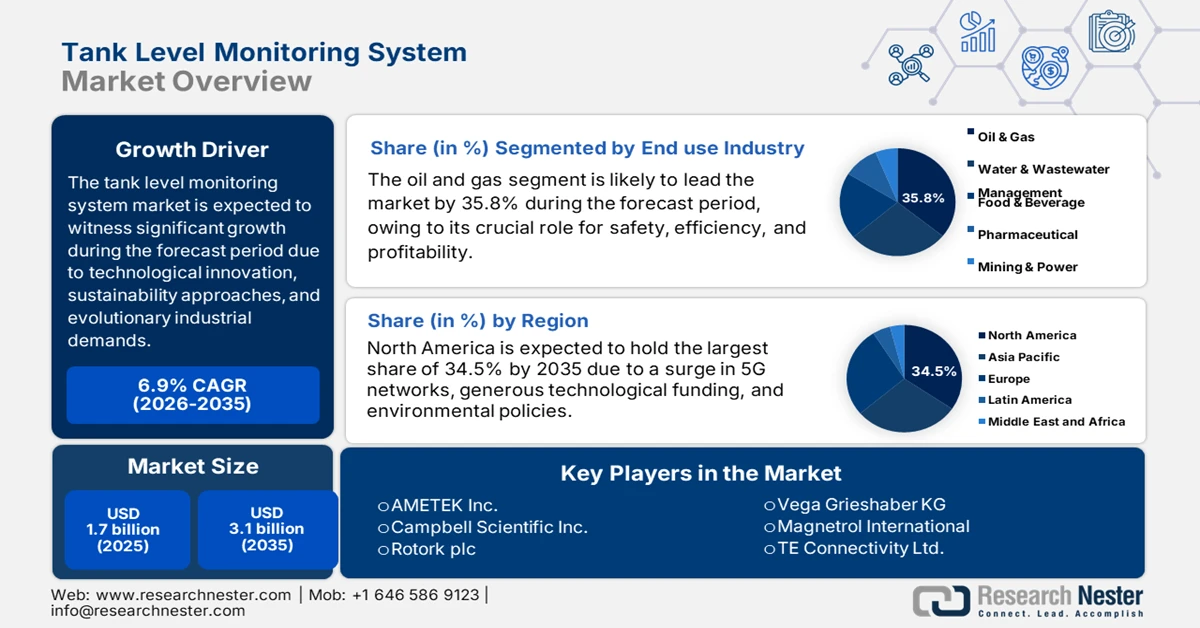

Tank Level Monitoring System Market size was over USD 1.7 billion in 2025 and is estimated to reach USD 3.1 billion by the end of 2035, expanding at a CAGR of 6.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of tank level monitoring system is estimated at USD 1.8 billion.

The global tank level monitoring system market is deliberately entering into a transformative phase, highly fueled by technological advancement, evolving industrial demands, and sustainability imperatives. According to official statistics published by the IMC Organization in May 2024, there have been 16.1 billion active IoT devices as of 2023, which is further projected to increase to 39.9 billion by the end of 2033, along with a 10% growth rate. In addition, the yearly device sales are also predicted to grow from 4.1 billion as of 2023 to 8.7 billion at an 8% growth rate. Besides, cellular connections also grew from 1.9 billion in the same year, and are expected to increase to 7.5 billion within the same timeline. Meanwhile, the overall 5G is projected to account for 5.5 billion, thereby denoting a huge growth opportunity for the market across different countries.

International IoT Connections Growth Forecast Analysis (2023-2033)

|

Year |

Growth % |

|

2023 |

16.1 |

|

2024 |

18.2 |

|

2025 |

20.4 |

|

2026 |

22.7 |

|

2027 |

25.0 |

|

2028 |

27.5 |

|

2029 |

30.0 |

|

2030 |

32.5 |

|

2031 |

35.0 |

|

2032 |

37.5 |

|

2033 |

39.9 |

Source: IMC Organization

Furthermore, the integration of blockchain for data security, the rise of edge computing, the presence of hybrid monitoring models, and circular economy alignment are other factors driving the tank level monitoring system market globally. As an article published by the IEF Organization in June 2024, the yearly upstream oil and gas spending is poised to rise by 22% by the end of 2030. The purpose is to ensure suitable supplies, owing to the cost inflation and growing demand. Besides, organizations are increasingly implementing blockchain-driven platforms to secure tank monitoring data, which is deliberately bolstering the market’s exposure globally. Moreover, a cumulative USD 4.3 trillion in new investments is further anticipated to be provided by the end of 2030. Therefore, with developments and funding opportunities in the sector, the market is poised to experience expansion internationally.

Key Tank Level Monitoring System Market Insights Summary:

Regional Highlights:

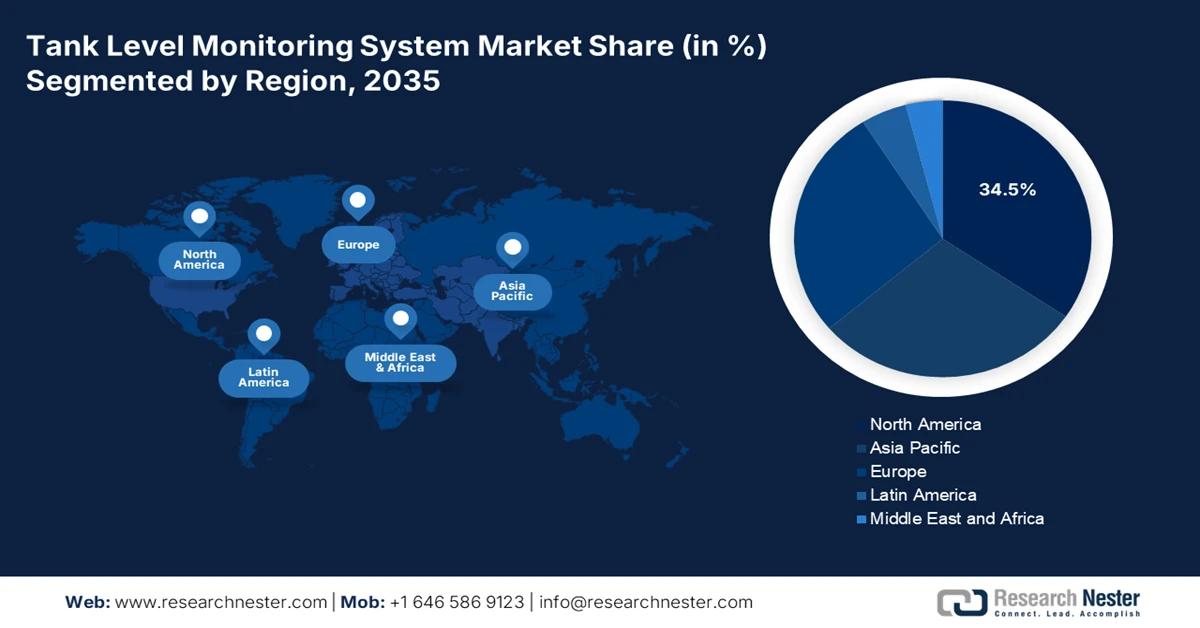

- North America tank level monitoring system market is projected to command the leading 34.5% share by 2035, strengthened by stringent environmental monitoring mandates, widespread 5G deployment, and generous technological investments

- Europe tank level monitoring system market is set to register the fastest growth during the forecast period, supported by regional funding initiatives, environmental compliance requirements, and robust investment opportunities

Segment Insights:

- The oil and gas segment in the end use industry is projected to account for a dominant 35.8% share by 2035 in the tank level monitoring system market, underpinned by its critical role in enhancing profitability, operational efficiency, and safety to prevent overfill-related spills and costly emergency orders

- The radar-based systems sub-segment under the technology category is expected to secure the second-largest share during the forecast period, supported by its high precision, reliability, and adaptability across diverse and hazardous industrial environments

Key Growth Trends:

- Increase of hydrogen and energy transition

- Focus on smart manufacturing

Major Challenges:

- Increased installation and maintenance expenses

- Cybersecurity risks in IoT-enabled systems

Key Players: Emerson Electric Co. (U.S.), Honeywell International Inc. (U.S.), Schneider Electric SE (France), Siemens AG (Germany), ABB Ltd. (Switzerland), Endress+Hauser Group (Switzerland), Yokogawa Electric Corporation (Japan), Omron Corporation (Japan), Krohne Messtechnik GmbH (Germany), Vega Grieshaber KG (Germany), Magnetrol International (U.S.), TE Connectivity Ltd. (Switzerland), AMETEK Inc. (U.S.), Campbell Scientific Inc. (U.S.), Rotork plc (UK), WIKA Alexander Wiegand SE & Co. KG (Germany), Fuji Electric Co., Ltd. (Japan), Hycontrol Ltd. (UK), Icon Process Controls (Canada), Sapura Energy Berhad (Malaysia)

Global Tank Level Monitoring System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 3.1 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, France, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Vietnam, Indonesia

Last updated on : 27 January, 2026

Tank Level Monitoring System Market - Growth Drivers and Challenges

Growth Drivers

- Increase of hydrogen and energy transition: The international push towards hydrogen as a clean fuel is fueling the demand for the tank level monitoring system market to effectively manage hydrogen storage tanks. According to official statistics published by the IEA Organization in 2025, there has been an increase in the hydrogen demand to nearly 100 million tons as of 2024, denoting a rise by 2% in 2023 and significantly in line with total energy demand growth. Besides, its demand from the latest applications accounted for less than 1% of the overall demand and has almost entirely concentrated in biofuels production. Moreover, the supply continued to be readily dominated by fossil fuels, utilizing 290 billion cubic meters of natural gas, along with 90 million tons of coal in 2024, thereby uplifting the tank level monitoring system market’s growth.

- Focus on smart manufacturing: The presence of national and international programs in North America, Asia, and Europe is significantly funding smart factory initiatives, wherein the tank level monitoring system market plays a vital role in efficient automation. As stated in an article published by the ITA in September 2025, the National Investment Promotion and Facilitation Agency of India has effectively predicted that the country’s industrial robotics sector is predicted to reach almost USD 264 million, with a 2.9% growth rate by the end of 2028. Besides, the government introduced the Production Linked Incentive (PLI) scheme, which is worth a USD 24 billion budget to readily enhance the country’s manufacturing capabilities and uplift technological advancements, thus denoting an optimistic outlook for the tank level monitoring system market globally.

- Surge in cross-industry convergence: The tank level monitoring system market is gradually expanding beyond oil and gas into pharmaceuticals, food, and beverages. This is highly attributed to the demand for compliance and precision in diversified industries. As stated in an article published by Invest India in January 2026, the export of processed food and agricultural products was worth USD 49.4 billion between 2024 and 2025. Additionally, processed food readily accounts for USD 10.0 billion, significantly contributing to about 20% of the overall agri-food exports. Besides, 6.5% is the average yearly growth rate o food processing industry during 2023 and 2024. Moreover, 12.4% of employment in the overall registered sector is allocated to the food processing sector, which is surging the market’s demand in the country.

Challenges

- Increased installation and maintenance expenses: The deployment of the tank level monitoring system market, particularly radar and ultrasonic technologies, requires significant upfront capital investment. Many industries, especially small and medium enterprises (SMEs), struggle to justify these costs against short-term returns. Installation involves specialized equipment, calibration, and integration with existing infrastructure, which can be complex and resource-intensive. Additionally, ongoing maintenance costs—such as sensor recalibration, software updates, and replacement of worn components—add to the financial burden. In industries like oil and gas and chemicals, where tanks are often located in hazardous environments, maintenance requires skilled labor and strict safety compliance, further increasing expenses.

- Cybersecurity risks in IoT-enabled systems: As the tank level monitoring system market is increasingly relying on IoT and cloud-based platforms, cybersecurity risks have become a major concern. These systems collect sensitive operational data, including fuel levels, chemical storage conditions, and water utility metrics, which are vulnerable to cyberattacks. Hackers targeting industrial IoT networks can manipulate sensor readings, disrupt operations, or even cause environmental hazards by triggering false alarms or disabling monitoring functions. The integration of monitoring systems with enterprise resource planning (ERP) and supply chain platforms further expands the attack surface. Many industries lack robust cybersecurity frameworks, leaving them exposed to ransomware and data breaches.

Tank Level Monitoring System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 1.7 billion |

|

Forecast Year Market Size (2035) |

USD 3.1 billion |

|

Regional Scope |

|

Tank Level Monitoring System Market Segmentation:

End use Industry Segment Analysis

The oil and gas segment in the end use industry is anticipated to garner the largest share of 35.8% in the tank level monitoring system market by the end of 2035. The segment’s upliftment is highly driven by its importance for profitability, efficiency, and safety to combat dangerous spills from overfills, and to avoid expensive emergency orders. According to official statistics published by the EPA Government in August 2025, the oil and gas industry is considered the largest energy producer in the U.S., which is largely responsible for almost 74% of primary energy production. Besides, as per the August 2025 IBEF Organization article, India exported 64.7 million metric tons of petroleum products, reflecting its robust refining capabilities, and also positioning the nation as a notable player in international energy markets, thereby denoting a huge demand for the overall market’s growth and expansion.

Technology Segment Analysis

Based on the technology segment, the radar-based systems sub-segment in the tank level monitoring system market is projected to account for the second-largest share during the forecast period. The sub-segment’s growth is highly fueled by the provision of high precision, reliability, and adaptability across diverse industrial environments. Unlike ultrasonic or float-based systems, radar technology is unaffected by temperature, pressure, or vapor conditions, making it ideal for hazardous applications such as oil, gas, and chemical storage. Radar sensors use microwave signals to measure tank levels with millimeter accuracy, ensuring consistent performance even in extreme conditions. Their non-contact nature reduces maintenance requirements, as there is no direct exposure to corrosive or volatile fluids, which denotes a positive impact on the sub-segment’s development.

Component Segment Analysis

By the end of the stipulated timeline, the sensors sub-segment, part of the component segment, is expected to account for the third-largest share in the tank level monitoring system market. The sub-segment’s development is highly propelled by the aspect of enabling accurate measurement, data collection, and transmission across industrial applications. They are the primary interface between physical tank conditions and digital monitoring platforms, making them indispensable for system functionality. Modern sensors include radar, ultrasonic, capacitance, and magnetostrictive types, each tailored to specific fluid properties and industrial requirements. The global demand for sensors is rising due to their role in enhancing precision, reducing manual intervention, and supporting predictive maintenance.

Our in-depth analysis of the tank level monitoring system market includes the following segments:

|

Segment |

Subsegments |

|

End use Industry |

|

|

Technology |

|

|

Component |

|

|

Product |

|

|

Application |

|

|

Fluid Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tank Level Monitoring System Market - Regional Analysis

North America Market Insights

The North America tank level monitoring system market is anticipated to garner the highest share of 34.5% by the end of 2035. The market’s upliftment in the region is highly fueled by environmental monitoring mandates, 5G infrastructure, and generous technological investments. According to official statistics published by the America Edge Project Organization in 2025, technology-based employment opportunities are growing 2.5 times rapidly than the rest of the economy, with 33 states witnessing tech employment growth of 10% as of 2025. Besides, the AI boom in the overall region readily attracted USD 144.9 billion in venture capital investment across almost 3,400 deals. From California to Florida, and Minnesota to Texas, the latest AI facilities are emerging as magnets for regional organizations, trade jobs, skilled workers, and data centers, thereby proliferating the market’s upliftment.

Yearly Venture Capital Deal Investment Analysis for AI and ML in North America (2020-2025)

|

Year |

Investment Amount (USD Billion) |

Deal Count |

|

2020 |

41.5 |

2,958 |

|

2021 |

99.6 |

4,320 |

|

2022 |

64.8 |

4,281 |

|

2023 |

62.5 |

4,100 |

|

2024 |

105.6 |

4,857 |

|

2025 |

114.9 |

3,382 |

Source: America Edge Project Organization

The tank level monitoring system market in the U.S. is growing significantly due to connectivity expansion, IoT-based monitoring across water, chemical, and oil sectors, as well as stringent monitoring policies. As per an article published by the Congress Government in November 2023, the Federal Communications Commission (FCC) developed the 5G Fund for Rural America and readily directed USD 9 billion for the upcoming 10 years from the Universal Service Fund (USF). This particular fund comprises USD 8 billion to enable high-speed mobile and voice broadband services to rural locations in the country, along with USD 1 billion to enable networks for supporting precision agriculture. Moreover, the FCC has deliberately modified USF programs, along with reforming the High-Cost program for allocating USD 4.5 billion every year to suitable providers for deploying high-speed internet across rural locations, thus suitable for enhancing the market in the country.

The tank level monitoring system market in Canada is also growing, owing to the existence of smart infrastructure programs, environmental reforms, and governmental investments. Based on government estimates published by the Government of Canada in October 2025, activities related to the Strategic Innovation Fund (SIF) comprise more than 108 direct-to-business agreements, deliberately representing USD 8.2 billion in contributions. In addition, these projects are projected to generate USD 72 billion as investments for the private sector in the country. Besides, the SIF funding spurred USD 700 million of research and development spending, which further amounted to USD 1.2 billion, denoting 5% of the national total. Meanwhile, SIF-backed activities also accounted for more than 4,600 full-time equivalent employment opportunities, which denotes a huge growth opportunity for the tank level monitoring system market in the nation.

Europe Market Insights

Europe tank level monitoring system market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by regional funding programs, environmental compliance, and robust investment opportunities. According to official statistics published by the Europe Commission in 2025, 13% of regional businesses utilized artificial intelligence-based technologies as of 2024. Besides, based on the regional target, 80% of the population is poised to have basic digital skills by the end of 2030. Meanwhile, as of 2024, over 10 million people in the region worked as ICT specialists, displaying 5% of the overall employment. Additionally, the share of these specialists in the region has been surging in the past decade by 1.6%, while 20 million specialists are to be employed by the end of 2030, thereby denoting an optimistic outlook for the market.

The tank level monitoring system market in Germany is gaining increased traction due to the presence of regulatory compliance, an increase in industrial demand, large-scale investments, and robust manufacturing facilities. As stated in an article published by the ITA in August 2025, the country is considered to be one of the top 5 adopters, with almost 28,400 installations of industrial robots in the world. This readily accounts for nearly 5% of international installations as of 2023. In addition, the country effectively holds a 31% of market share in this particular segment, which is extremely suitable for the overall market’s development. Besides, the VDMA’s Robotics + Automation trade association constitutes three segments, including integrated assembly solutions, machine vision, and robotics, thereby denoting an optimistic outlook for the market’s growth.

The tank level monitoring system market in the UK is also developing, owing to digital infrastructure investment, an increase in industrial demand for water utilities, oil, and chemicals, as well as industry collaborations and associations. As stated in an article published by the UK Government in July 2024, the oil production in the country accounted for 41.3 million tons in 2022, followed by 36.6 million tons in 2023. In addition, oil accounted for 2.2 million tons for the domestic industry, 48.9 million tons for transport, 2.1 million tons for domestic purposes, and 3.5 million tons for services. Besides, as per the 2026 Royal Society of Chemistry Organization article, the turnover of the chemical industry in the country amounts to £50 billion, along with an additional £18 billion of value to the economy every year, which in turn, is suitable for bolstering the market.

APAC Market Insights

The Asia Pacific tank level monitoring system market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by an increase in industrial facilities, organizations adopting monitoring systems, and the provision of governmental funding. Based on government estimates published by the State Council in March 2025, the region’s weighted real gross domestic product (GDP) rate accounted for 4.5% as of 2025, denoting a surge by 4.4% from 2024. Besides, the region’s GDP among the international total rose to 48.6% in the same year, marking an increase by 48.1% from 2024. Moreover, the region has emerged as a crucial player in worldwide cross-border direct investment, with the outward and inward foreign direct investment (FDI) reaching 49.1% as of 2023, thus bolstering the market’s demand.

The tank level monitoring system market in China is gaining increased exposure due to an upsurge in government expenditure, smart manufacturing, industrial expansion, regulatory compliance, digitalized infrastructure, and 5G integration. According to official statistics published by the State Council in October 2025, there have been nearly 4.7 million 5G base stations in the country, despite the effort to strengthen its cyber facility. Besides, the Ministry of Industry and Information Technology noted an increase in stations by 455,000, which is also boosting the market’s exposure in the country. Meanwhile, the number of 5G-based mobile phone consumers among the nation’s 3 major telecommunication enterprises and China Broadnet has successfully reached 1.2 billion per data, thereby making it suitable for uplifting the market in the overall country.

The tank level monitoring system market in India is also growing, owing to the existence of digital infrastructure programs, industrial expansion, and an increase in government spending. Besides, as per an article published by the ITA in January 2024, the overall ICT industry and the digital economy readily contribute more than 13% to the country’s GDP. In addition, the country uplifted the industry to USD 1 trillion as of 2025, denoting a 20% of the predicted GDP. Besides, the country’s technological sector reached USD 245 billion as of 2023, which is based on an 8.4% yearly growth rate. Meanwhile, the nation imported almost USD 3 billion in electronic equipment and computers from the U.S., while the IT expenditure gradually surged by 2.6% to more than USD 112 billion in 2023, thereby denoting a huge growth opportunity for the market.

Key Tank Level Monitoring System Market Players:

- Emerson Electric Co. (U.S.)

- Honeywell International Inc. (U.S.)

- Schneider Electric SE (France)

- Siemens AG (Germany)

- ABB Ltd. (Switzerland)

- Endress+Hauser Group (Switzerland)

- Yokogawa Electric Corporation (Japan)

- Omron Corporation (Japan)

- Krohne Messtechnik GmbH (Germany)

- Vega Grieshaber KG (Germany)

- Magnetrol International (U.S.)

- TE Connectivity Ltd. (Switzerland)

- AMETEK Inc. (U.S.)

- Campbell Scientific Inc. (U.S.)

- Rotork plc (UK)

- WIKA Alexander Wiegand SE & Co. KG (Germany)

- Fuji Electric Co., Ltd. (Japan)

- Hycontrol Ltd. (UK)

- Icon Process Controls (Canada)

- Sapura Energy Berhad (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Emerson Electric Co. is a leading provider of advanced tank monitoring solutions, leveraging its Rosemount product line for precision measurement. The company emphasizes IoT integration and predictive analytics, strengthening its position in the oil and gas and chemical industries.

- Honeywell International Inc. provides robust monitoring systems with strong adoption in industrial safety and compliance applications. Its focus on automation and smart sensing technologies has expanded its footprint in water utilities and hazardous chemical storage.

- Schneider Electric SE integrates tank monitoring into its broader energy management and automation portfolio. The company’s emphasis on sustainability and smart infrastructure aligns with regional regulatory requirements, driving adoption across Europe.

- Siemens AG provides digitalized tank monitoring solutions, combining sensor technology with industrial IoT platforms. Its strong presence in manufacturing and utilities supports large-scale deployments, particularly in Europe’s industrial hubs.

- ABB Ltd. delivers tank monitoring systems with a focus on automation and energy efficiency. Its global reach and expertise in industrial electrification make it a key player in integrating monitoring systems into smart factories and utilities.

Here is a list of key players operating in the global tank level monitoring system market:

The international tank level monitoring system market is highly competitive, with global players pursuing innovation, regional expansion, and strategic partnerships. U.S. and Europe-based companies dominate through advanced sensor technologies and digital integration, while Japan and South Korea-specific firms leverage precision engineering. India and Malaysia-driven manufacturers are expanding their presence with cost-effective solutions and government-backed ICT initiatives. Key strategies include mergers, acquisitions, and investments in IoT-enabled monitoring platforms. Besides, in October 2025, Raytheon successfully introduced the initial production of its latest SharpSight multi-domain surveillance radar. This is the next-generation system for providing high-resolution, high-altitude, and real-time imaging with comprehensive tracking and search for maritime and land surveillance, thus suitable for bolstering the tank level monitoring system industry globally.

Corporate Landscape of the Tank Level Monitoring System Market:

Recent Developments

- In September 2025, BASF SE and Porsche AG by collaborating with the technology partner, Bioenergy and Sustainable Technologies GmbH, successfully accomplished a pilot project on recycling mixed wastage of high-performance plastics from automotive shredder residues with renewable raw materials.

- In September 2025, Northrop Grumman Corporation significantly developed a team of in-country partners to effectively deliver innovative radar capabilities to Taiwan. Additionally, Ramatek Company, Champion Auto, and Vivian and Vincent International Trading Company Ltd. signed a memorandum of understanding with the organization to provide AN/TPS/78 advanced capabilities in the country.

- In May 2024, Iveda notified the launch of LevelNOW, which is a cutting-edge monitoring and tracking solution for efficient liquid storage management. It is a first-of-its-kind solution for targeting oil and gas organizations, government agencies, along with commercial and industrial organizations.

- Report ID: 8364

- Published Date: Jan 27, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tank Level Monitoring System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.