U.S. Quartz Crystal Microbalance Market Outlook:

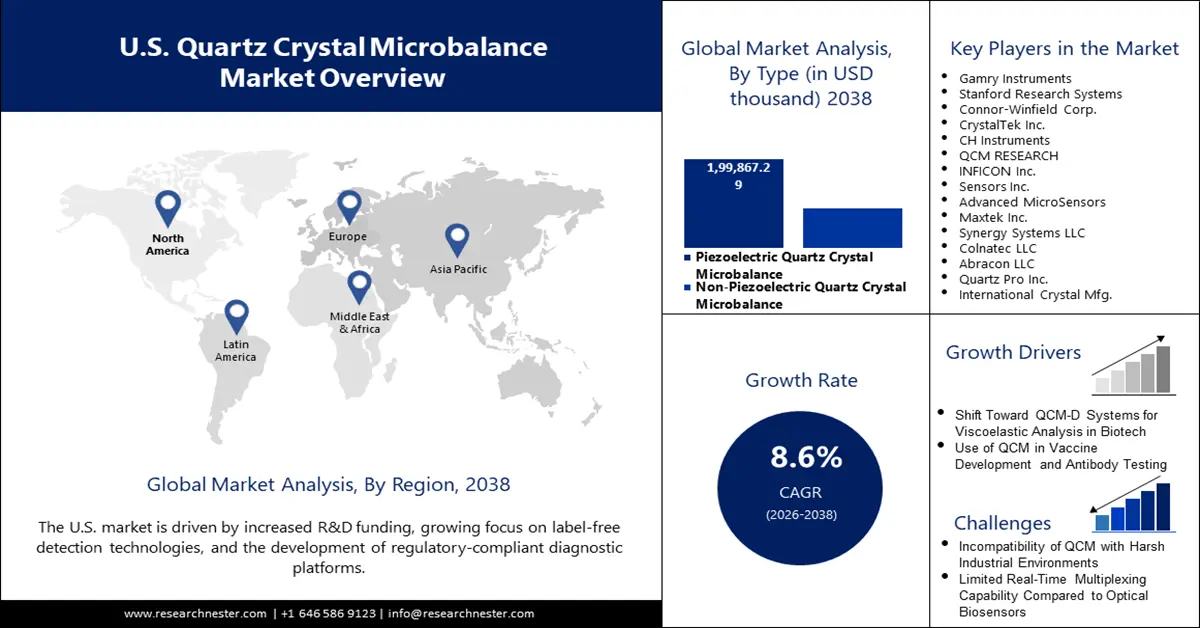

U.S. Quartz Crystal Microbalance Market size was valued at USD 99,932.4 thousand in 2025 and is projected to reach USD 290,631.5 thousand by the end of 2038, rising at a CAGR of 8.6% during the forecast period, i.e., 2026-2038. In 2026, the industry size of U.S.quartz crystal microbalance is assessed at USD 107,534.2 thousand.

The U.S. quartz crystal microbalance market is rising at a rapid rate as regulatory requirements and investment in research drive innovation in industrial and scientific uses. Using QCM technology, Gonzales et al. creatively redesigned the evaporation of the 2-propanol–ethanol–water mixture, significantly cutting the experimental time from 4 hours to 30 minutes. The safety and efficacy of medical devices are governed by the Food and Drug Administration (FDA), a division of the Department of Health and Human Services (HHS). This regulation is compelling for manufacturers to recalibrate and enhance devices, providing high-fidelity air quality information for public health. The QCM market is also gaining from a resurgence in government-sponsored R&D, with government agencies focusing on biosensing, thin-film analysis, and semiconductor process monitoring. As the U.S. remains the world leader in advanced manufacturing and life sciences, the need for high-precision QCM technology is likely to be driven as the country's leadership in analytical instrumentation is further boosted.

One of the leading trends in the U.S. quartz crystal microbalance market is the use of QCM sensors in energy and battery research due to federal investment in next-generation materials. In January 2023, the U.S. Department of Energy announced $125 million for fundamental rechargeable battery research to advance cost-effective, clean energy solutions and provide the scientific knowledge needed to decarbonize and transform the nation’s energy system through innovative battery development and widespread adoption. The program helps public-private laboratories upgrade QCM labs and promote collaboration between academia and industry. As innovation and regulatory compliance merge, the U.S. market for QCM sensors is set for strong, long-term expansion.

Key US Quartz Crystal Microbalance Market Insights Summary:

Regional Insights:

- California is anticipated to remain a lucrative location in the U.S. quartz crystal microbalance market by 2035, attributable to its leadership in semiconductor processing, environmental sensing, and biotech research.

- Massachusetts is poised to strengthen its position by 2035, hinged on the state’s life-science cluster and growing translational research ecosystem.

Segment Insights:

- The piezoelectric quartz crystal microbalance segment is projected to command a 70.5% share of the U.S. quartz crystal microbalance market by 2035, propelled by advancements in sensor stability and miniaturization.

- The classical QCM segment is expected to secure a 48.2% share by 2038, supported by the launch of modular and easy-to-use QCM platforms.

Key Growth Trends:

- Federal grants drive QCM biosensor commercialization

- QCM sensors break into semiconductor process control

Major Challenges:

- Regulatory pressure places infrastructure needs on labs

- New calibration procedures bring compliance complexity

Key Players: Gamry Instruments, Stanford Research Systems, Connor-Winfield Corp., CrystalTek Inc., CH Instruments, QCM RESEARCH, INFICON Inc., Sensors Inc., Advanced MicroSensors, Maxtek Inc., Synergy Systems LLC, Colnatec LLC,Abracon LLC, Quartz Pro Inc., International Crystal Mfg.

Global US Quartz Crystal Microbalance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 99,932.4 thousand

- 2026 Market Size: USD 107,534.2 thousand

- Projected Market Size: USD 290,631.5 thousand by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: California

- Fastest Growing Region: Massachusetts

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Singapore, Taiwan, Canada, Netherlands

Last updated on : 29 September, 2025

U.S. Quartz Crystal Microbalance Market - Growth Drivers and Challenges

Growth Drivers

- Federal grants drive QCM biosensor commercialization: The major factor of growth is the rise in government and institutional investment in the R&D of biosensors. For instance, Biolin Scientific launched the QSense Omni, a next-generation QCM-D instrument enabling high-sensitivity, label-free analysis of molecular and biomolecular surface interactions. Designed for pathogen and biomarker biosensing, it enhances signal clarity and workflow with advanced hardware and QSense software for real-time mass and viscoelastic monitoring. The developments are accelerating the commercialization of U.S.-made QCM technology and supporting enhanced public health readiness. With national standards bodies focusing on the necessity of quick diagnosis and pandemic readiness, biosensing uses of QCM are increasing in clinical and environmental applications.

- QCM sensors break into semiconductor process control: Another driver is the increasing use of QCM in advanced manufacturing and semiconductor process control. In May 2023, Inficon USA introduced mini-QCM sensor modules for semiconductor fabs to allow in-situ film monitoring on deposition equipment. Early shipments to California MEMS fabs prove the increasing demand for in-situ, high-precision mass sensing in nanofabrication. Interfacing QCM with automated process lines is boosting productivity and quality control, and the technology is becoming an imperative for next-generation U.S. manufacturing innovation.

- Growth of environmental monitoring and pollution control: Environmental agencies and industry stakeholders utilize QCM sensors to monitor airborne particulates, chemical vapors, and pollutants at very low concentrations. Rising regulatory pressure to monitor air quality and the early detection of hazardous substances are driving U.S. quartz crystal microbalance market opportunities. QCM sensors provide continuous, real-time measurements without labels, making them ideal for environmental monitoring. Furthermore, the global push for governments to strengthen environmental protection laws and industrial emissions regulations has prompted an increase in the adoption of QCM-based monitoring across numerous industries, including petrochemical, wastewater treatment, and others. The primary goal of wastewater treatment is to eliminate as many suspended solids as possible before the remaining water, or effluent, is returned to the environment. Primary treatment removes about 60% of suspended solids from the wastewater. Primary treatment also includes aeration (mixing in) the wastewater to add oxygen. Secondary treatment removes over 90% of suspended solids.

Emerging Trade Dynamics in the Market

Top Export Destinations for Quartz from the United States in 2023

|

Partner Country |

Trade Value (USD 1,000) |

Quantity (kg) |

|

Germany |

30,774.85 |

21,134,000 |

|

China |

23,154.62 |

37,343,000 |

|

Mexico |

15,402.49 |

15,768,000 |

|

Norway |

14,011.36 |

18,064,000 |

|

Japan |

4,313.44 |

1,439,000 |

|

France |

3,283.50 |

5,566,000 |

|

Australia |

851.79 |

492,000 |

|

Canada |

700.84 |

1,650,000 |

|

Colombia |

675.00 |

900,000 |

|

Belgium |

625.28 |

340,000 |

Source: WITS

Challenges

- Regulatory pressure places infrastructure needs on labs: A significant impediment is the growing stringency of environmental and occupational health regulations around QCM installations. According to the Centers for Disease Control (CDC), 22 million employees are exposed to potentially harmful noise levels at work every year. NIH infrastructure grants make compliance easier, but specialty enclosures and retrofits contribute to the research lab's operating complexity. Increasing regulatory control means manufacturers and users have to invest capital to upgrade infrastructure to maintain measurement accuracy.

- New calibration procedures bring compliance complexity: Another challenge is the evolving environment for QCM calibration and validation standards. In December 2024, Stanford Research Systems and NIST started a QCM reliability study to standardize standard deviation measures among models for traceable measurement calibration. The findings, released in early 2025, have set new industry standards but will require device manufacturers and laboratories to adjust procedures. This push for standardization, while improving the reliability of data, adds more compliance procedures and training requirements for U.S. QCM users.

U.S. Quartz Crystal Microbalance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2038 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 99,932.4 thousand |

|

Forecast Year Market Size (2038) |

USD 290,631.5 thousand |

|

Regional Scope |

|

U.S. Quartz Crystal Microbalance Market Segmentation:

Type Segment Analysis

The piezoelectric quartz crystal microbalance segment is anticipated to hold a 70.5% U.S. quartz crystal microbalance market share through the forecast period, owing to its unmatched sensitivity and flexibility in detecting mass. Quartz is perfect for ultrasensitive measurement devices like QCMs because of its other qualities in addition to its piezoelectric capabilities. It is easily grown and processed, plentiful in nature, and thermodynamically stable up to 573 °C in its α-quartz phase. The devices are applied in biosensing, pharmaceuticals, and material science for real-time measurement of molecular interactions and thin-film deposition. From 2020 to 2024, U.S. imports of piezoelectric cultured quartz rose overall from about 114 tons in 2020, down to 69 in 2021, then climbing to 76 in 2022, 87 in 2023, and 120 in 2024. The U.S. exports also increased about 37 tons in 2020, 39 tons in 2021, and grew to 76 tons in 2022, 133 tons in 2023, then dropped to 100 tons in 2024. Early adoption in MIT and Caltech labs depicts the segment's importance in high-end research and innovation. Growth in the segment is also driven by advancements in sensor stability and miniaturization, broadening application bases from academic research to industrial process control.

Technology Segment Analysis

The classical QCM segment is likely to maintain a 48.2% U.S. quartz crystal microbalance market share through 2038, owing to its widespread use in research, quality control, and industrial monitoring. Conventional QCMs are valued for their rugged construction, simplicity of integration, and proven track record in offering reliable mass measurement. The basic structure of this type of sensor provides a fair degree of precision for mass and thickness measures with little maintenance or operating cost in the field. Academic labs, chemical sensing applications, and thin film characterization still use classical QCM and will continue to provide a reliable demand base for classical QCM. The segment growth is also driven by the launch of modular and easy-to-use QCM platforms, which make them compatible with routine laboratory protocols as well as sophisticated experimentation.

Application Segment Analysis

The medical diagnostics segment is anticipated to hold a significant U.S. quartz crystal microbalance market share through the forecast period, because QCM applications are uniquely sensitive and permit real-time (non-label) measurements of biomolecular interactions, which are suitable for applications such as pathogen detection/identification, biomarker discovery, and drug development applications. Every year, infectious diseases cause 15 million deaths, with low-to middle-income countries accounting for the majority of these cases. Increased demand for rapid and accurate point-of-care testing, along with increasing funding in health care-related research and personalized medicine, is leading to vast adoption of QCM instruments and sensors in hospitals, clinical laboratories, and pharmaceutical R&D sectors, far surpassing other application sectors.

Our in-depth analysis of the U.S. quartz crystal microbalance market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

Application |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

U.S. Quartz Crystal Microbalance Market - Regional Analysis

California is one of the lucrative U.S. quartz crystal microbalance market due to its leadership in semiconductor processing, environmental sensing, and biotech research. In March 2024, Inficon USA delivered the initial semi-QCM sensor modules to a California MEMS fab to facilitate in-situ film monitoring for silicon scaling. The robust research infrastructure in Silicon Valley and leading state universities is driving quick adoption of advanced QCM technologies. With more environmental regulations and nanotechnology advances, California will be a lucrative location for QCM deployment and development.

Massachusetts is also emerging as a significant U.S. quartz crystal microbalance market, fueled by its life-science cluster of biotech, pharmaceutical, and academic research institutions. For instance, Dr. Niya Sa’s team at the University of Massachusetts Boston explores rechargeable battery chemistry to advance energy storage, utilization, and environmental sustainability. Through K-12 and underrepresented STEM outreach, they communicate electrochemistry and green chemistry concepts. Their project implements a hybrid Dynamic Impedance Spectroscopy/Multiharmonic Electrochemical Quartz Crystal Microbalance Dissipation (DEIS EQCM-D) platform to investigate complex interfacial systems for improved battery performance. Public-private partnerships and the state's focus on translational research make Boston an excellent location for QCM developers and manufacturers.

Key U.S. Quartz Crystal Microbalance Market Players:

- Gamry Instruments

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stanford Research Systems

- Connor-Winfield Corp.

- CrystalTek Inc.

- CH Instruments

- QCM RESEARCH

- INFICON Inc.

- Sensors Inc.

- Advanced MicroSensors

- Maxtek Inc.

- Synergy Systems LLC

- Colnatec LLC

- Abracon LLC

- Quartz Pro Inc.

- International Crystal Mfg.

The U.S. quartz crystal microbalance market is competitive, with the major players competing with each other in terms of market share and technological leadership. They include Gamry Instruments, Stanford Research Systems, Connor-Winfield Corp., CrystalTek Inc., CH Instruments, QCM RESEARCH, INFICON Inc., Sensors Inc., Advanced MicroSensors, Maxtek Inc., Synergy Systems LLC, Colnatec LLC, Abracon LLC, Quartz Pro Inc., and International Crystal Mfg. The companies are diversifying their portfolios with advancements in QCM-D, high-frequency sensors, and software integration to develop solutions for the evolving needs of research, manufacturing, and diagnostics.

One of the key advancements was in July 2024, when Biolin Scientific introduced the QSense Analyzer X for protein adsorption in drug discovery. The PhaseDamping technology of the product improves noise reduction by 30%, aimed at U.S. biopharma labs that need label-free assay platforms. Commercialization is set to increase competition, with companies competing to provide more sensitive, reliable, and easy-to-use QCM solutions for the growing life sciences and materials research markets.

Here are some leading companies in the U.S. quartz crystal microbalance market:

Recent Developments

- In March 2025, Nanoscience Instruments expanded U.S. delivery and support for QCM-D systems. This initiative helps academic clients set up research-grade systems, and their certified training improves user outcomes, leading to increased QCM adoption in cross-disciplinary studies.

- In August 2025, Semilab acquired MicroVacuum’s QCM and optical waveguide technologies to boost biosensing and surface characterization capabilities. This integration supports modular QCM platforms for real-time analysis and strengthens Semilab’s presence across the U.S. biotech sector.

- In June 2021, MicroVacuum launched QCM-I Net, a multi-channel measurement platform that allows impedance and dissipation tracking for biosensing applications. It connects with third-party tools and supports scalable U.S. lab use, benefiting researchers with flexible, high-precision QCM setups.

- In December 2024, Micro Photonics partnered with U.S. labs for QCM method development. The company’s training and system tuning services improve measurement accuracy, helping in biosensor calibration and thin-film validation. U.S. universities gain expert support for QCM projects.

- Report ID: 7826

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.