Commercial Printing Outsourcing Market Outlook:

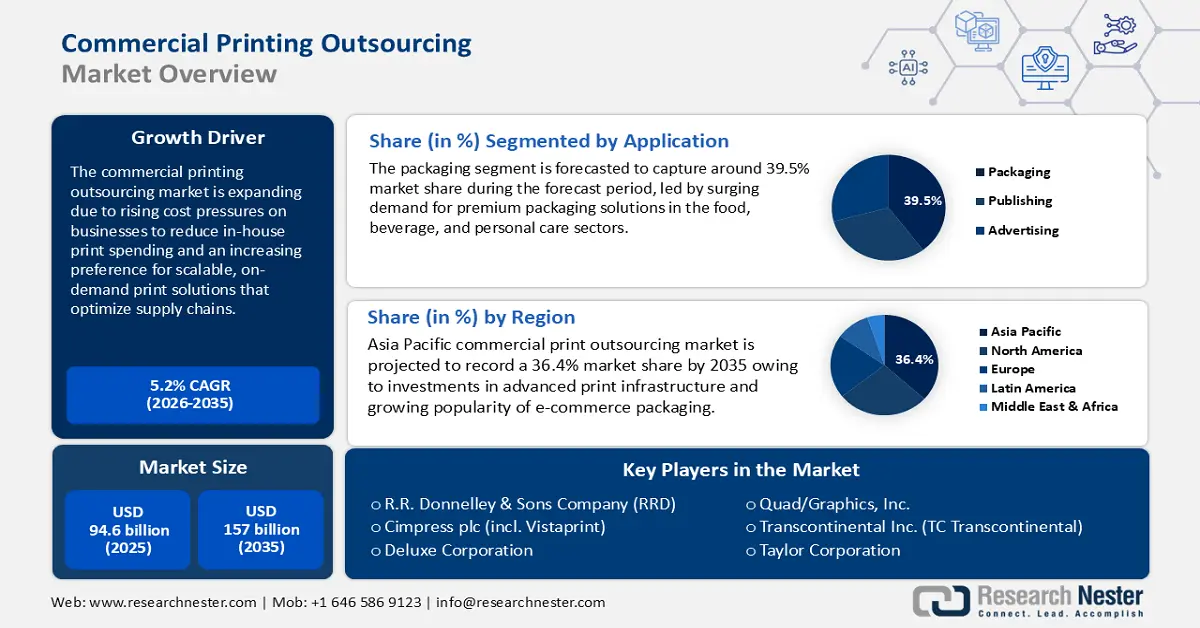

Commercial Printing Outsourcing Market size is valued at USD 94.6 billion in 2025 and is projected to reach a valuation of USD 157 billion by the end of 2035, rising at a CAGR of 5.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of commercial printing outsourcing is estimated at USD 99.5 billion.

The commercial printing outsourcing market is expanding due to the integrated, technology‑enabled platforms that combine creative, print, fulfillment, and logistics under one governance umbrella. Centralized ordering and inventory control streamline operations, reducing cycle times. This approach also helps maintain brand consistency and compliance standards across dispersed teams. In December 2024, RRD introduced ConnectOne Storefront to streamline brand content ordering and management, bringing production and logistics together for at‑scale fulfillment with quantifiable cost and time reductions. This platform solution enables multinationals to streamline processes across markets and scale omnichannel campaigns more effectively.

Market expansion is also being driven by AI‑powered content and data operations that consolidate digital, retail media, and print activation for high‑mix programs. In practical terms, intelligent automation accelerates catalog, POS, and packaging versioning while upholding brand consistency and regulatory standards. In October 2024, Quad launched a partnership with Google Cloud to introduce AI‑driven marketing offerings across data, creativity, and personalization, creating print‑ready and digital assets in volume for intricate catalogs and varied segments. This intersection boosts throughput and targeting accuracy, affirming outsourcing’s position in geographically dispersed, compliance‑heavy campaigns.

Key Commercial Printing Outsourcing Market Insights Summary:

Regional Highlights:

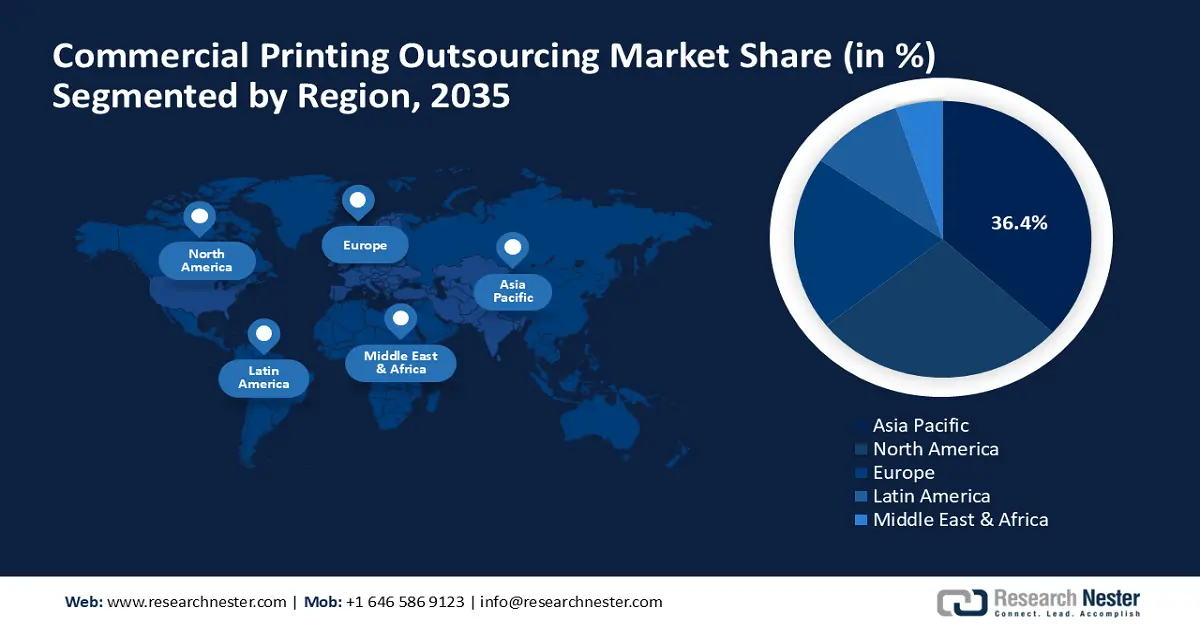

- The Asia Pacific commercial printing outsourcing market is anticipated to capture a 36.4% share throughout the forecast period, supported by the expansion of e-commerce, faster product cycles, and regionally integrated fulfillment networks.

- North America is projected to record an 8% CAGR from 2026 to 2035, sustained by the adoption of standardized secure print frameworks and federal modernization initiatives.

Segment Insights:

- The packaging segment of the commercial printing outsourcing market is projected to secure around 39.5% share during the forecast period, propelled by growing demand for adaptable labeling solutions and synchronized print-pack services aligned with evolving regulatory and retail compliance needs.

- The retail channel segment is expected to account for a 49% share by 2035, driven by the expansion of omnichannel promotional programs and data-driven print activation strategies enhancing in-store marketing efficiency.

Key Growth Trends:

- Resilience, portfolio concentration, and retail media adjacency

- AI‑driven production and personalization

Major Challenges:

- Policy‑driven print management constraints

- Data privacy and cross‑border regulation

Key Players: R.R. Donnelley & Sons Company (RRD), Cimpress plc (incl. Vistaprint), Deluxe Corporation, Quad/Graphics, Inc., Transcontinental Inc. (TC Transcontinental), Taylor Corporation, Cenveo Worldwide Limited, Quebecor (Quebecor World legacy/Graphique), Elanders AB, Shutterfly LLC (enterprise print), WestRock Company (print-pack services), Acme Printing Company, TOPPAN Holdings Inc., Dai Nippon Printing Co., Ltd. (DNP), RAKSUL INC.

Global Commercial Printing Outsourcing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 94.6 billion

- 2026 Market Size: USD 99.5 billion

- Projected Market Size: USD 157 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Indonesia, Vietnam, Mexico, South Korea

Last updated on : 26 September, 2025

Commercial Printing Outsourcing Market - Growth Drivers and Challenges

Growth Drivers

- Platform consolidation and inventory governance: Companies are unifying portals and supplier ecosystems to manage brand assets, stock, and compliance through one operating fabric. The business impact is storefront integration with national production and logistics that shortens time‑to‑shelf and increases program predictability. As a policy backdrop, in July 2025, the U.S. General Services Administration refreshed centralized government IT and print management resources, guiding agencies on outsourced print, secure print, and device consolidation with procurement standards and modernization references, which reinforce consolidated storefront and fleet governance patterns in large programs. Consolidation enhances auditability and minimizes operational drag, deepening outsourcing economics for big programs.

- Resilience, portfolio concentration, and retail media adjacency: Companies are investing in modernization and retail media adjacency to stabilize peaks and lengthen in‑store reach for brands. In execution, portfolio concentration redirects capital to high‑ROI technology alliances and MX capabilities that complement print at scale. In February 2025, Quad reported FY2024 results and reaffirmed 2025 guidance, emphasizing disciplined cash generation to support technology and partnerships while growing in‑store retail media and MX offerings to transform print‑linked solutions. This alignment puts outsourcing partners in a position to bring operational stability and new growth drivers connected to in‑store networks.

- AI‑driven production and personalization: Brands are shortening creative‑to‑output cycles by combining AI tooling with managed print to update localized assets at a greater frequency. Commercially, streamlined layout, translation, and workflow automation reduce rework rates for complex catalog and POS production. In September 2024, Quad, in collaboration with Google Cloud, launched AI‑facilitated creative and layout generation for print and digital, including translation and workflow optimization for sophisticated catalogs and targeted audiences, with rollout ongoing in Q4 2024. This significantly enhances iteration speed and consistency, putting outsourcing as growth driver for omnichannel flexibility at scale.

Estimated Market Value of the Sectors of the Printing Industry

The printing industry is undergoing a significant transformation, with traditional sectors like newspapers experiencing decline while specialized, value-added segments show robust growth. By 2025, packaging printing is projected to lead the market at $433.4 billion, driven by a 4.2% annual growth rate fueled by e-commerce and consumer goods demand.

Source: IARIGAI

Challenges

- Policy‑driven print management constraints: Public‑sector print management regulations are constraining defaults (duplex, centralized fleets, secure release), remapping vendor configurations, and SLAs. In operational terms, stricter device governance and eco defaults translate into more prescriptive outsourced print specifications for regulated customers. In August 2024, the U.S. Department of State revised its Printing Policy (5 FAM 310) mandating duplex‑by‑default, central network printing, and secure PIN/PKI release both on domestic and foreign posts, specifically calling for consolidation and eco defaults. These requirements change bid requirements and compliance requirements for federal outsourcing and affect bordering regulated industries.

- Data privacy and cross‑border regulation: Developing privacy regimes influences list sourcing, personalization, and print‑plus‑digital analytics, requiring proven consent and transfer controls. From a governance perspective, documentation of purpose, retention, and opt‑out processes is becoming a standard audit artifact for campaigns. In December 2025, the U.S. Department of Justice adopted a rule effective for implementing Executive Order 14117 to limit bulk transfers of sensitive personal information to nations of concern, affecting cloud intermediaries and data brokers. This forces outsourcing ecosystems to strengthen data provenance and cross‑border mechanisms in planning and measurement.

Commercial Printing Outsourcing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 94.6 billion |

|

Forecast Year Market Size (2035) |

USD 157 billion |

|

Regional Scope |

|

Commercial Printing Outsourcing Market Segmentation:

Application Segment Analysis

The packaging segment is forecasted to capture around 39.5% market share during the forecast period, led by SKU refreshes, sustainability labeling, and shelf contest. Commercially, responsive print‑pack services that synchronize packaging, inserts, and compliant labels under one governance layer are now a critical capability. In May 2024, the UK released updated “Using the UKCA marking” guidance, which reaffirmed indefinite recognition of CE marking and permitted digital and sticky labels, which directly affect packaging label specifications and importer information for goods documentation. This means outsourcing partners with adaptable label and packaging functions will gain as regulatory and retail requirements change.

End user Vertical Segment Analysis

The retail channel is estimated to hold a 49% market share by 2035, driven by omnichannel promotions, store resets, and retail media programs that demand synchronized print and digital assets. In operational terms, centralized promo orchestration reduces approvals and improves planogram adherence and in‑store execution quality. In March 2024, Albertsons revealed a program with RRD to revolutionize promotional marketing, aligning intricate promo workflows and print activation into a data‑driven construct to accelerate market responsiveness. As retailers expand audience‑driven promotions, outsourcing collaborations that connect data to store‑level activation is poised to hold significant share.

Service Type Segment Analysis

The inkjet printing segment is anticipated to account for a 45% share through 2035, driven by high‑speed, variable data for catalogs, direct mail, and packaging pieces. From an ROI standpoint, inkjet’s compatibility with data‑driven versioning enables shorter runs with lower waste and quicker turns. This makes it a highly attractive option for businesses looking to optimize their printing processes and reduce operational costs. The ability to customize each print piece based on individual customer data significantly enhances marketing effectiveness and customer engagement. As a result, inkjet‑focused outsourcing will grow where personalization density and velocity are key to revenue.

Our in-depth analysis of the commercial printing outsourcing market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user Vertical |

|

|

Service Type |

|

|

Material Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Printing Outsourcing Market - Regional Analysis

APAC Market Insights

Asia Pacific commercial print outsourcing market is predicted to hold a 36.4% market share throughout the forecast period on the back of e‑commerce scale, rapid product cycles, and regional fulfillment networks. Commercially, integrated stacks that reduce deployment overhead and accelerate localization are differentiating outcomes for learner teams. As a result, packaging, POS, and logistics providers are well‑placed to seize growth with quantifiable efficiency gains.

China is expected to capture a significant market share of APAC through localization, platform ecosystems, and managed access patterns for ruled manufacturing. From a policy lens, national strategies are tightening governance over AI use, data flows, and content provenance in commercial operations. In August 2025, China’s State Council advanced the “AI Plus” Action Plan to embed AI across manufacturing, media, and public services alongside strengthened guardrails for trustworthy AI deployment and data security coordination. Consequently, vendors that align print‑plus‑digital workflows with state‑backed transparency, filing, and provenance expectations are best positioned to scale under China’s evolving compliance regime.

India is anticipated to be a significant driver of APAC growth as businesses regulate data governance and digitize print buying for compliant reach. In practice, codified consent, erasure, and grievance processes are becoming baseline selection criteria in enterprise RFPs. In July 2025, India published Draft Digital Personal Data Protection Rules to roll out the DPDP Act, 2023, which sets the stage for defining consent, erasure, and Data Protection Board procedures impacting marketing communications, print mailers, and data enrichment. As a result, suppliers with proof of consent provenance and trackable data use will become more popular among Indian enterprises and public‑sector tenders.

North America Market Insights

North America is forecast to record a CAGR of 8% from 2026 to 2035, aided by scale providers, integrated tech stacks, and public‑sector frameworks that standardize secure print. Strategically, centralized print management influences device consolidation, bid structures, and sourcing standards for agencies and enterprises. In July 2025, the U.S. General Services Administration updated government IT and print management assets, consolidating policies that direct outsourced print, secure print, and device consolidation with references to acquisition support and modernization initiatives. Providers aligned to federal standards and sustainability defaults are therefore poised to maintain share in regulated verticals.

The U.S. is positioned to lead with policy definitions on print governance, privacy, and data transfer standards. In procurement, national specifications and privacy guidance calibrate requirements for secure, efficient fleets and compliant, multi‑channel campaigns. In May 2024, the U.S. State Department released its global digital policy strategy focusing on trusted data flows and platform responsibility, a standard frequently followed in business governance and cross‑border commerce. As a result, suppliers showing compliance with federal specs and privacy‑sensitive data flows will continue to be top picks for sophisticated, multi‑channel programs.

Canada industry is predicted to rise as privacy-protective data environments and cyber protection readiness guide enterprise print procurement. This growth is driven by the increasing demand for secure and compliant data handling. Practically, trusted data and platform accountability expectations shape vendor qualification and cross-border transfer architectures. Accordingly, compliant, consolidated platforms demonstrating cross-border protections should grow in Canadian retail, financial services, and public-sector accounts.

Europe Market Insights

Europe commercial printing outsourcing market is predicted to experience continued growth from 2026 to 2035, with characteristic robust consumer protection and advertising equity regimes. In practice, clearer subscription, disclosure, and packaging obligations are elevating documentation standards for print‑plus‑digital deliverables. In April 2025, consequential regulations to the Digital Markets, Competition and Consumers Act 2024 were passed in the UK, facilitating CMA enforcement on digital markets and consumer protection with effects on advertising transparency and unfairness. Thus, providers incorporating auditability and brand‑safety controls across print‑plus‑digital deliverables are expected to increase share in Europe.

Germany is likely to maintain a dominant position throughout Europe due to its industrial B2B base and high bar for reliability and auditability on enterprise procurements. From a policy standpoint, the federal push on digital infrastructure and sovereign cloud is setting modernization guardrails for enterprise selection. In 2025, Germany's formal guidance also emphasized the country’s drive for digitization and a sovereign administrative cloud with infrastructure acceleration, as tagged as first‑order public interest through to 2030, simplifying approvals and planning for national connectivity and secure services. As a result, suites with lifecycle assurance and context‑secure data access move more easily through German RFPs where governance is a stringent requirement.

The UK is forecasted to significantly contribute to Europe’s continued growth up to 2035 by merging innovation with more effective governance and identity verification across channels. In market terms, government‑led advertising and consumer‑protection initiatives are raising compliance bars for omnichannel promotions. In December 2024, the UK government’s Online Advertising Taskforce progress report reported a trial of Intermediary and Platform Principles to enhance ad compliance, such as removal of non‑compliant adverts and better age targeting, with future steps to integrate into ASA processes. As a result, suppliers that provide fast iteration with maintained auditability and brand protection will be poised to garner share in the UK.

Key Commercial Printing Outsourcing Market Players:

- R.R. Donnelley & Sons Company (RRD)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cimpress plc (incl. Vistaprint)

- Deluxe Corporation

- Quad/Graphics, Inc.

- Transcontinental Inc. (TC Transcontinental)

- Taylor Corporation

- Cenveo Worldwide Limited

- Quebecor (Quebecor World legacy/Graphique)

- Elanders AB

- Shutterfly LLC (enterprise print)

- WestRock Company (print-pack services)

- Acme Printing Company

- TOPPAN Holdings Inc.

- Dai Nippon Printing Co., Ltd. (DNP)

- RAKSUL INC.

Competition in the commercial printing outsourcing market encompasses global platforms and specialty providers of web‑to‑print, packaging, DM, and retail media‑aligned print services. The strategic angle for buyers is the ability to connect data, creative, and fulfillment with governance and sustainability defaults across regions. Key players leading the market are R.R. Donnelley & Sons Company (RRD), Cimpress plc (including Vistaprint), Deluxe Corporation, Quad/Graphics, Inc., Transcontinental Inc. (TC Transcontinental), Taylor Corporation, Cenveo Worldwide Limited, Quebecor, Elanders AB, and Shutterfly LLC (enterprise print). A key operational differentiator lies in the ability to integrate data, creative, and fulfillment processes, while adhering to default governance and sustainability standards across different regions.

Strategic realignment is gaining momentum, with portfolios shifting towards technology and channel proximity. This optimization extends to the scope of core integrated marketing solutions. Operators are linking this reallocation to AI-enabled operations, retail media expansion, and disciplined capital deployment in core geographies. In October 2024, Quad agreed to sell the majority of its European operations to Capmont while progressing the Google Cloud partnership, with a focus on AI‑enabled U.S. operations and revising guidance along with operational concentration. As a result, vendors that integrate AI partnerships, robust operations, and regulated fulfillment stand to capture share gains in commercial printing outsourcing.

Here are some leading companies in the commercial printing outsourcing market:

Recent Developments

- In July 2025, Cimpress communicated portfolio and strategy updates across Vista, National Pen, and other brands, emphasizing mass customization and technology investment. Public materials underscored on-demand manufacturing scale and software enablement for SMB acquisition. Investor updates outlined cost discipline and category expansion. The program supports resilient print commerce and localized production.

- In February 2025, RRD announced a digital transition of its Georgia facility to modernize production for faster, more personalized output. The update targets improved reliability, time-to-market, and cost efficiency in large outsourced programs. It supports omnichannel marketing requirements with advanced press and workflow investments. The transition anchors regional service consistency for clients.

- In November 2024, Deluxe announced pricing of senior secured notes and highlighted platform momentum in payments and data solutions supporting business customers. Capital actions backed product investment for growth and profitability. Communications referenced roadmap execution and scale advantages.

- Report ID: 3075

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.