Commercial Telematics Market Outlook:

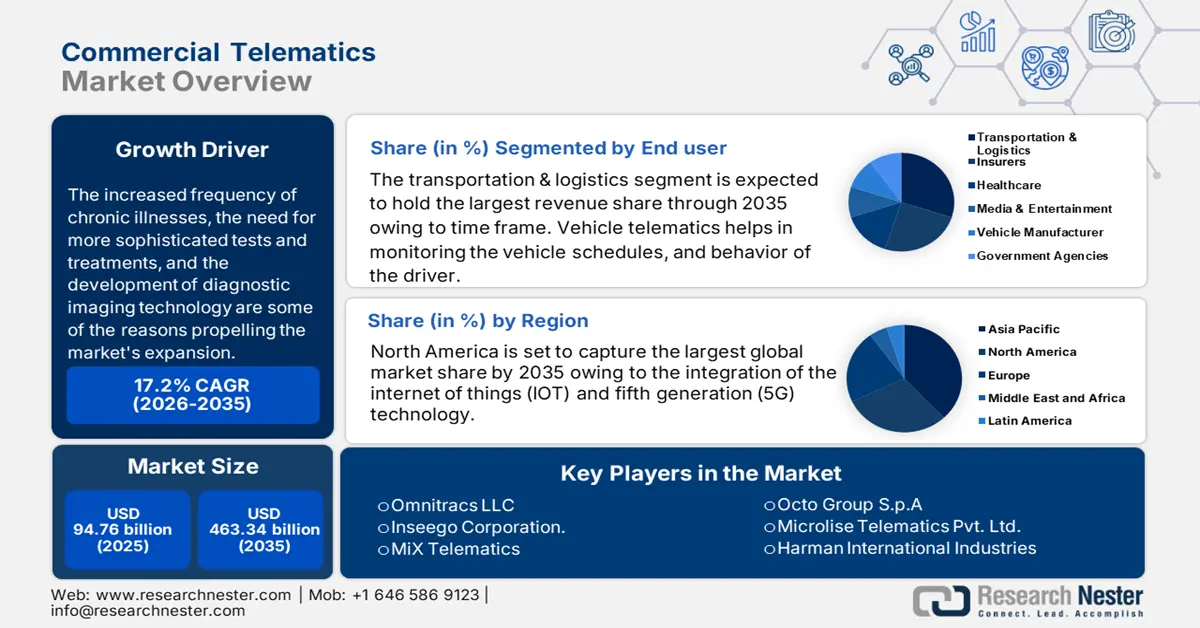

Commercial Telematics Market size was over USD 94.76 Billion in 2025 and is anticipated to cross USD 463.34 Billion by 2035, growing at more than 17.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial telematics is assessed at USD 109.43 Billion.

The growth of the market can be attributed to the growing demand for technological solutions in commercial automobiles. Telematics is the approach of keeping track of the location and movement of a vehicle by the amalgamation of the Global Positioning System (GPS) and the on-board diagnostics system. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2020, globally, 21,787,126 units of commercial vehicles were manufactured, which increased to 23,091,693 units in 2021.

Telematics is of consolidated field enclosed in, telecommunications and vehicular technologies. Technology of sending, receiving, and storing information and informatics for applications in vehicles and to control vehicles on the move. The science of telecommunications and informatics applied in wireless technologies and computational systems. 802.11p, the IEEE standard in the 802.11 and also referred to wireless access for the vehicular environment (WAVE), is the primary standard that addresses and enhances intelligent transport system (ITS). The growth of commercial telematics market is credited rising adoption of the internet all over the world. There are few countries such as Japan and South Korea, where 5G is available. As of March 2022, the 4G network is widely available in most countries, and is the most widely used network.

Key Commercial Telematics Market Insights Summary:

Regional Highlights:

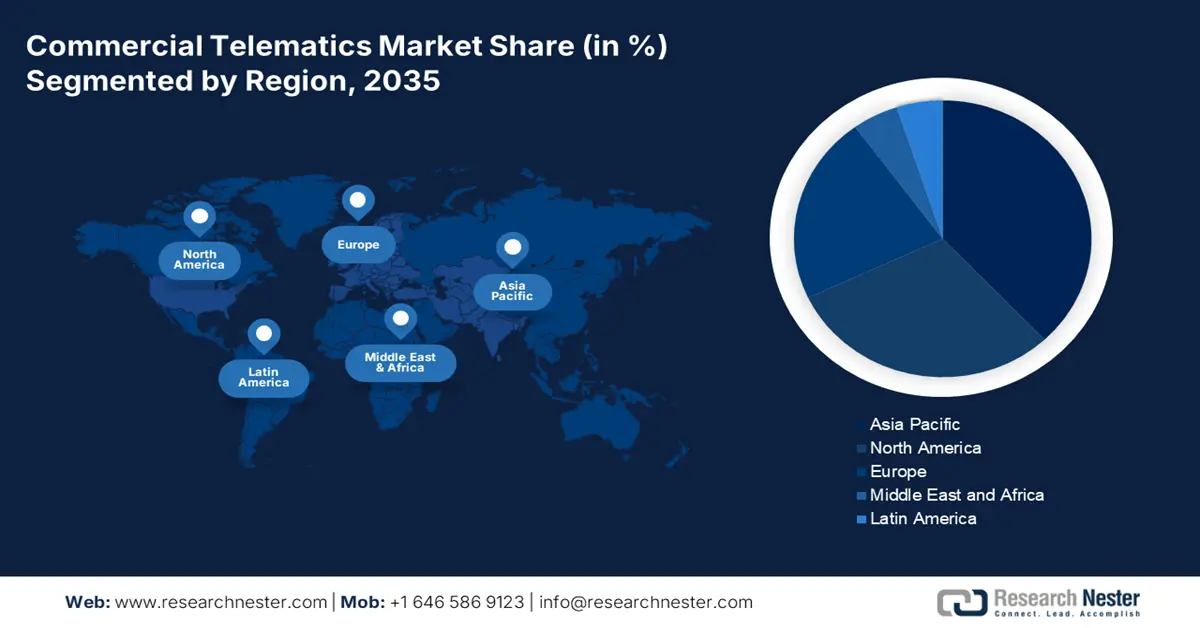

- Asia Pacific commercial telematics market, the largest share by 2035, is driven by the integration of the Internet of Things (IoT) and 5G technology.

Segment Insights:

- The transportation & logistics segment in the commercial telematics market is projected to capture the largest share by 2035, driven by the increasing use of online services for food and grocery delivery.

- The oem segment in the commercial telematics market is projected to capture the largest share by 2035, fueled by increasing strategic partnerships between automobile manufacturers and telematics service providers.

Key Growth Trends:

- Rising Instances of Road Accident

- Higher Usage of MAAS (Mobility-as-a-Service)

Major Challenges:

- Network Safety Concerns to Limit Market Growth of Commercial Telematics

- Inaccessibility of constant and continuous connectivity

Key Players: Zonar Systems, Inc., Trimble Inc., Verizon Telematics, Inc., Omnitracs LLC, Inseego Corporation., MiX Telematics, Octo Group S.p.A, Microlise Telematics Pvt. Ltd., Harman International Industries, Webfleet Solutions B.V.

Global Commercial Telematics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 94.76 Billion

- 2026 Market Size: USD 109.43 Billion

- Projected Market Size: USD 463.34 Billion by 2035

- Growth Forecasts: 17.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, United Arab Emirates

Last updated on : 10 September, 2025

Commercial Telematics Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Instances of Road Accident – Telematics can help in reducing the risk of accidents by analyzing the data and predicting the accident occurrence. For children and young adults aged 5 to 29 years, fatal road accidents are the main cause of death. Moreover, an estimated 1.3 million individuals each year pass away in automobile accidents.

-

Increasing Adoption of GPS Connectivity in Automobiles- Telematics monitors the presence of other vehicles around and presents the data regarding the traffic status on the roads. It uses on-board diagnostics technology and GPS technology to manage the function. For instance, over 60% of American drivers use GPS service in their vehicles.

- Higher Usage of MAAS (Mobility-as-a-Service) – telematics has revolutionized mobility as a service. It enables both drivers and passengers to directly access information, such as traffic, time of arrival, navigation, driver’s behavior, and others. As of June 2021, around 68% of Americans used Uber, on the other hand around 32% of people chose the second-best cab service Lyft.

- 5G Connectivity to Create Opportunities for Market of Commercial Telematics - The growing development of 5G technology for enhanced internet connectivity solution is anticipated to generate lucrative growth opportunities for the market over the forecast period. For instance, 5G subscriptions grew by 70 million in 2021 to around 620 million in 2022.

- Growing Adoption of IoT Connected Devices- In the connected vehicles, the in-car infotainment is installed that majorly runs on telematics. In 2021, there were nearly 240 million IoT-connected automobiles in the world. Furthermore, it is expected to reach to around 400 million by 2025.

Challenges.

-

Network Safety Concerns to Limit Market Growth of Commercial Telematics- there is huge threat to cyber security due to network breaching, that can cause release of sensitive data. While accessing the telematics server it grants unauthorized access to multiple vehicles, after receiving the control of remote of the vehicle illegally, the hacker can easily maneuver or even steal the vehicle. It can also impose serious threat to the lives of drivers, passengers, and pedestrians. Therefore, network breaching is expected to hamper the market growth.

-

Inaccessibility of constant and continuous connectivity

- Unawareness of commercial telematics

Commercial Telematics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.2% |

|

Base Year Market Size (2025) |

USD 94.76 Billion |

|

Forecast Year Market Size (2035) |

USD 463.34 Billion |

|

Regional Scope |

|

Commercial Telematics Market Segmentation:

End-user

The global commercial telematics market is segmented and analyzed for demand and supply by end-users into transportation & logistics, insurers, healthcare, media & entertainment, vehicle manufacturers, and government agencies. Out of the six types of end users, the transportation & logistics segment is estimated to gain the largest market share over the projected time frame. Vehicle telematics helps in monitoring the vehicle schedules, and behavior of the driver. It also helps in tracking the vehicle and the estimated time of arrival. The growth of the segment can be attributed to the increasing use of online services for food and grocery delivery. Around 38% of American consumers had used a food delivery app as of March 2020 to order food. 47% of Americans utilized a food delivery app by March 2021. Moreover, in America, almost everyone orders food online, and nearly 86% of people order online food at least once a month. Furthermore, segment growth is also expected on the account of rising trends in online shopping. In 2021, there were around 2 billion people who did online shopping, worldwide.

Solution Type

The global commercial telematics market is also segmented and analyzed for demand and supply by solution type into OEM and aftermarket. Amongst these segments, the OEM segment is anticipated to garner the largest revenue by the end of 2035, backed by the increasing strategic partnerships of automobile manufacturers with telematics service providers. For instance, in March 2017, General Motors announced a strategic partnership with Spareon to facilitate telematics solutions to General Motor’s fleet customers.

Our in-depth analysis of the global commercial telematics market digestive health market includes the following segments:

|

By Solution Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Telematics Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific commercial telematics market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the integration of the internet of things (IOT) and fifth generation (5G) technology. 5G is commercially available in 14 markets, with others including India and Vietnam. 5G adoption is set to grow across Asia-Pacific, with more than 400 million 5G connections by 2025. Moreover, the rising cases of car accidents in the region is also expected to augment the market growth. According to the statistics of Accidental Deaths & Suicides in India 2021, traffic accidents in India have jumped from 368,828 in 2020 to 422,659 in 2021.

Commercial Telematics Market Players:

- Zonar Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Trimble Inc.

- Verizon Telematics, Inc.

- Omnitracs LLC

- Inseego Corporation.

- MiX Telematics

- Octo Group S.p.A

- Microlise Telematics Pvt. Ltd.

- Harman International Industries

- Webfleet Solutions B.V.

Recent Developments

-

Zonar Systems expands ecosystems of Smart Mobility Solutions for Pupil Transportation with record growth. Zonar’s smart fleet mobility solutions provide school districts with real-time, actionable data to increase school bus safety, efficiency, and accountability.

-

Webfleet Solutions B.V. and Bridgestone teaming up to launch its eagerly anticipated integrated solution called Fleetcare, which delivers enhanced efficiency and reduced operating costs to fleet.

- Report ID: 4558

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Telematics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.