Commercial Heat Pump Market Outlook:

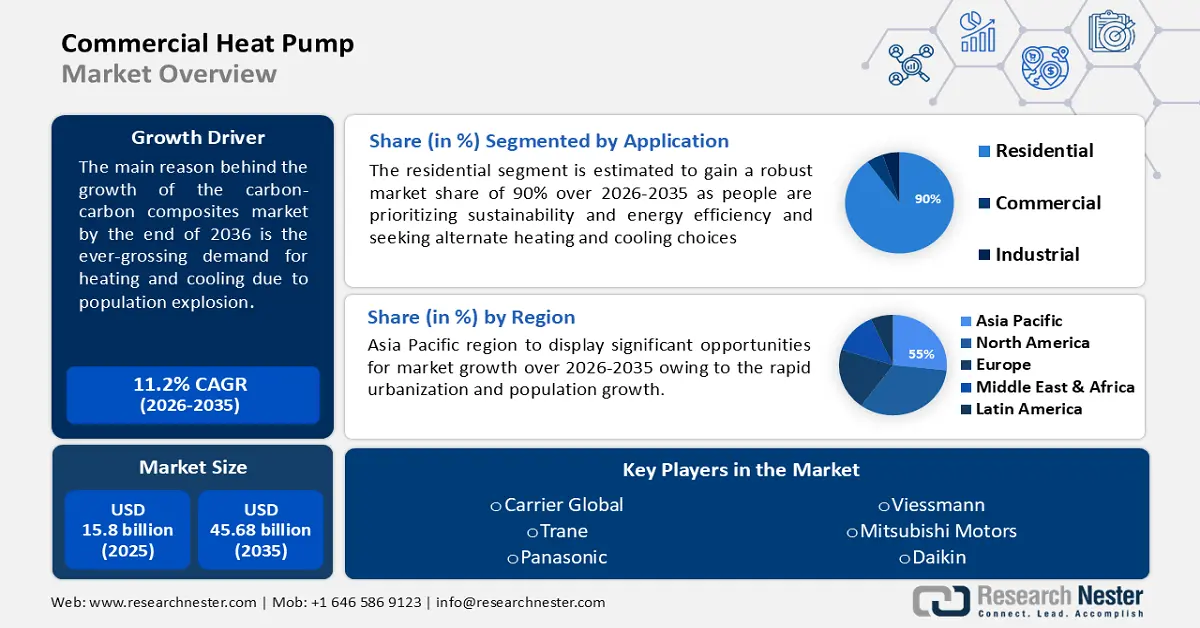

Commercial Heat Pump Market size was valued at USD 15.8 billion in 2025 and is expected to reach USD 45.68 billion by 2035, expanding at around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial heat pump is evaluated at USD 17.39 billion.

Heat pumps are mechanical-compression cycle refrigeration systems that can heat or chill. It is widely utilized as heating and cooling solutions. It has an indoor air handler and an outdoor heat pump that works like a central air conditioner. A compressor in the outdoor unit circulates refrigerant, which absorbs and releases heat between inside and outside units.

The commercial heat pump market is predicted to grow as population growth increases heating and cooling needs. With its largely decarbonized electricity grid, France continues to be the EU’s volume leader, with about 4.25 million heat pumps installed. Finland, pulling ahead of Norway and Sweden, enjoyed the largest growth figures in relative numbers. For every 1000 households, 70 Finnish families purchased a heat pump in 2022.

Key Commercial Heat Pump Market Insights Summary:

Regional Highlights:

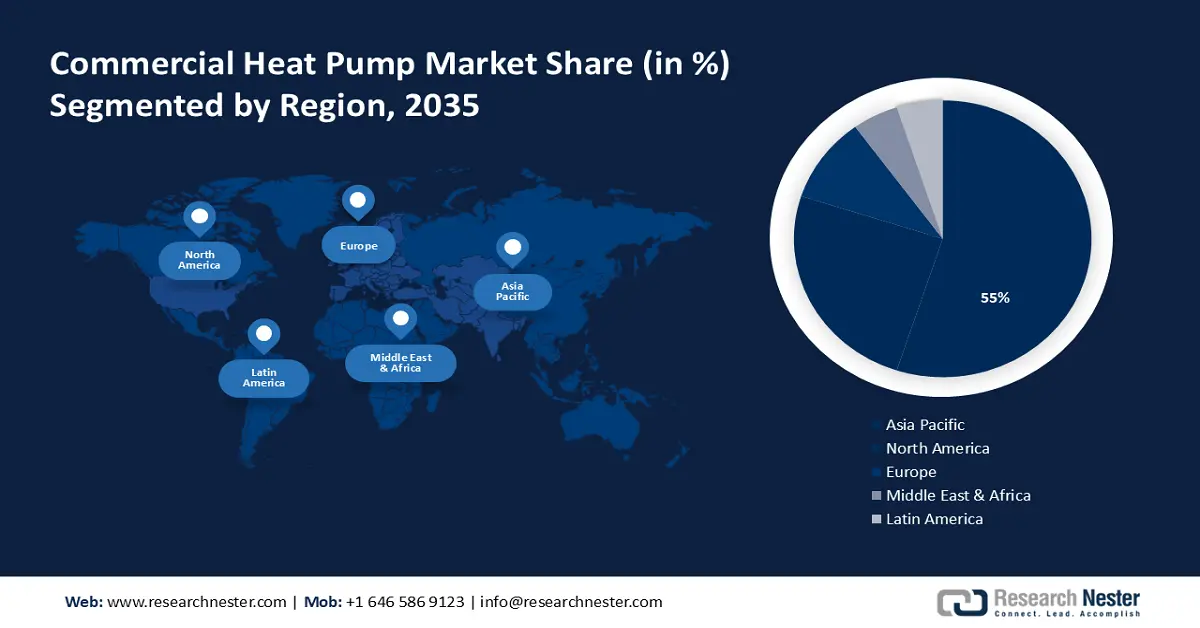

- Asia Pacific commercial heat pump market will dominate around 55% share by 2035, driven by rapid urbanization and population growth increasing demand for heat pumps.

Segment Insights:

- The residential segment in the commercial heat pump market is projected to dominate with a 90% share, driven by the demand for energy-efficient and sustainable heating and cooling alternatives, over the forecast period 2026-2035.

- The air source segment in the commercial heat pump market is anticipated to achieve significant growth till 2035, driven by the demand for sustainable and efficient energy solutions, particularly in heating systems.

Key Growth Trends:

- Rising demand for energy-efficient heating solutions

- Increasing awareness and environmental impact

Major Challenges:

- High Installation Costs

- Changing National Policy Measures

Key Players: Daikin, Carrier Global, Johnson Controls International PLC, Lennox International, Rheem Manufacturing Company, Trane, Robert Bosch, Panasonic, Viessmann, Mitsubishi Motors.

Global Commercial Heat Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.8 billion

- 2026 Market Size: USD 17.39 billion

- Projected Market Size: USD 45.68 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Commercial Heat Pump Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for energy-efficient heating solutions – Heat pumps are more energy efficient than typical heating systems, resulting in cheaper and a lower carbon impact. The use of heat pumps can bring down fossil fuel consumption subsequently lowering the carbon footprint. These are a more cost-effective alternative to traditional heating systems for individuals and governments seeking environmentally friendly heating and cooling options.

For example, researchers at the Swiss Federal Institute of Technology Lausanne (EPFL) are employing aluminum to create a compressor with the goal of reducing electricity use by 25%. The team used machine learning approaches to generate equations for heat pump design charts based on the results of 500,000 simulations. - Increasing awareness and environmental impact – Energy manufacturing and use emit considerable amounts of greenhouse gases and Co2 emissions. Heat pump technology offers a promising alternative for reducing greenhouse gas and carbon emissions. To reduce emissions, major economies are gradually shifting away from nonrenewable energy sources toward renewable energy sources.

The heat pumps that use aerothermal and geothermal technology provide an energy-efficient method for room heating. When utilized in heating, ventilation, and HVAC systems are recognized as environmentally friendly technologies. In May 2019, Vattenfall's UK Energy Solutions business venture successfully provided district heating to 6700 newly built households, making it the largest heat pump installation in the UK. - Government policy support and incentives – Government support for heat pumps considering high natural gas prices and efforts to reduce greenhouse gas emissions were key drivers behind the strong uptake. In Europe, heat pumps enjoyed a record year, with sales growing by nearly 40%.

In Addition, sales of air-to-water devices, which can be used with standard radiators and underfloor heating systems, increased by over 51% in Europe. Heat pump sales in the United States surpassed those of gas furnaces. Nevertheless, in China, which is the largest commercial heat pump market, sales maintained stability despite a widespread economic recession.

Challenges

- High Installation Costs – Heat pump systems are expensive to install, which hinders commercial adoption. Heat pump equipment, infrastructural improvements, and installation are included in these expenditures. Geothermal heat pumps use ground or water heat and can heat water. These pumps cost USD 6,000–USD 20,000 more than air–source heat pumps.

- Changing National Policy Measures– Uncertainty in the commercial heat pump sector may result from changes in national policy initiatives. High borrowing rates, relatively expensive power in comparison to gas, and shifting national policy measures are all contributing factors to the commercial heat pump market slowdown. Investors and consumers are disturbed by these, hence, opting for different heating or cooling solutions

Commercial Heat Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 15.8 billion |

|

Forecast Year Market Size (2035) |

USD 45.68 billion |

|

Regional Scope |

|

Commercial Heat Pump Market Segmentation:

Application Segment Analysis

Residential segment is set to dominate commercial heat pump market share of over 90% by 2035. Heat pumps are popular as people are prioritizing sustainability and energy efficiency and seeking alternate heating and cooling choices. These systems use the ground's temperature or the ambient air to heat and cool, which uses less energy. Technological advances have made home heat pumps more affordable, reliable, and efficient.

Improved designs, variable-speed compressors, and smart controls improve efficiency and energy savings, appealing to customers seeking cost-effective and sustainable solutions. LG announced an air-to-water propane heat pump for households in November 2023. The new product employs propane refrigerant, which has a lower global warming potential, and has a seasonal coefficient of efficiency (SCOP) of over five. The manufacturer claims it can reach 75 C flow temperatures and 100% heating output at -15 C.

Product Type Segment Analysis

In commercial heat pump market, air source segment is estimated to account for revenue share of around 85% by 2035. This segment has grown due to its sustainability and efficiency. Heat pumps that use water rely on the steady temperature of lakes, rivers, and aquifers. This method utilizes water's higher thermal conductivity property to improve heat exchange. Hence, the desire for renewable energy and eco-friendly alternatives are considered to drive the commercial heat pump market growth.

Navien UK, a Guildford boiler manufacturer, released a monobloc heat pump in July 2023. Navien's first monobloc air source heat pump and latest H2 100% hydrogen boiler are available. It is the latest in a series of innovative heating options for locals ahead of the government's 2050 net zero emissions goal.

Rated Capacity Segment Analysis

By 2035, 10 – 20 kW segment is expected to dominate commercial heat pump market share of over 25%. This segment aligns with the increased demand for small-scale commercial and residential applications that balance efficiency and capacity. As energy efficiency gains popularity, people pick heat pumps in this power range because they save energy while heating and cooling. Technological advancement, improved compressors, heat exchange systems, and componentry boost 10–20kW efficiency.

Intelligent, networked products allow customers to optimize energy use remotely. Awareness, technology advances, and government support boost the 10–20kW heat pump category in this positive feedback cycle. The UK energy provider Octopus introduced the high-temperature heat pump in September 2023 as one of several heating transition goods and services.

Our in-depth analysis of the global commercial heat pump market includes the following segments:

|

Product Type |

|

|

Rated Capacity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Heat Pump Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to dominate majority revenue share of 55% by 2035, Due to rapid urbanization and population growth in this region, the market is developing as more buildings use heat pumps for water, cooling, and space heating.

China, one of Asia-Pacific's largest marketplaces, demands heat pumps in commercial, residential, and industrial sectors. Heat pumps are popular in China because they use renewable energy to heat. This country is estimated to be worth 21,011.7 Mn by 2030.

Sustainable technology awareness, stricter rules, environmental concerns, and Construction of residential and commercial buildings are driving the commercial heat pump market growth. South Korea and other countries are promoting energy-efficient heat pumps because of their energy savings and environmental benefits.

North America Market Insights

By 2035, North America commercial heat pump market is set to dominate over 25% share, Eco-friendly and energy-efficient heating choices are in demand as people become more environmentally conscious.

With USD 169 million in the 2023 climate bill, the US supported nine projects to expedite heat pumps and other energy-efficient cooling and heating systems.

The government in Canada is making heat pumps more accessible for Canadians. Low-to-median-income Nova Scotia households that heat their homes with oil receive up to USD 30,000 in funding to buy a heat pump, including up to USD 15,000 from the Government of Canada's OHPA program and USD 15,000 from the Province of Nova Scotia, with Efficiency One as the co-delivery partner.

Commercial Heat Pump Market Players:

- Daikin

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carrier Global

- Johnson Controls International PLC

- Lennox International

- Rheem Manufacturing Company

- Trane

- Robert Bosch

- Panasonic

- Viessmann

- Mitsubishi Motors

The Commercial Heat Pump Market is mostly controlled by prominent market participants who are gaining influence in the market through the implementation of various methods, such as mergers and acquisitions.

Recent Developments

- Mitsubishi Heavy Industries Thermal Systems, Ltd. (December 25, 2023 ) - a subsidiary of the Mitsubishi Heavy Industries (MHI) Group in Tokyo, has expanded its line of air-to-water (ATW) heat pumps for the European market with the introduction of the "Hydrolution EZY" series. This new series contains two models with capacities of 10kW and 14kW.

- Viessmann – has launched the Vitocal 250-A heat pump for modernization projects (Type: AWO-E-AC 251.A10, rated output 2.6 to 9.7 kW at A-7/W35 based on EN 14511) was the winning product in a comparison conducted by Stiftung Warentest in October 2023. This year, additional output sizes (16 and 18.5 kW) expand the range of applications for Vitocal 250-A and 252-A heat pumps to buildings with larger heating loads.

- Report ID: 6196

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Heat Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.