District Heating Pipeline Network Market Outlook:

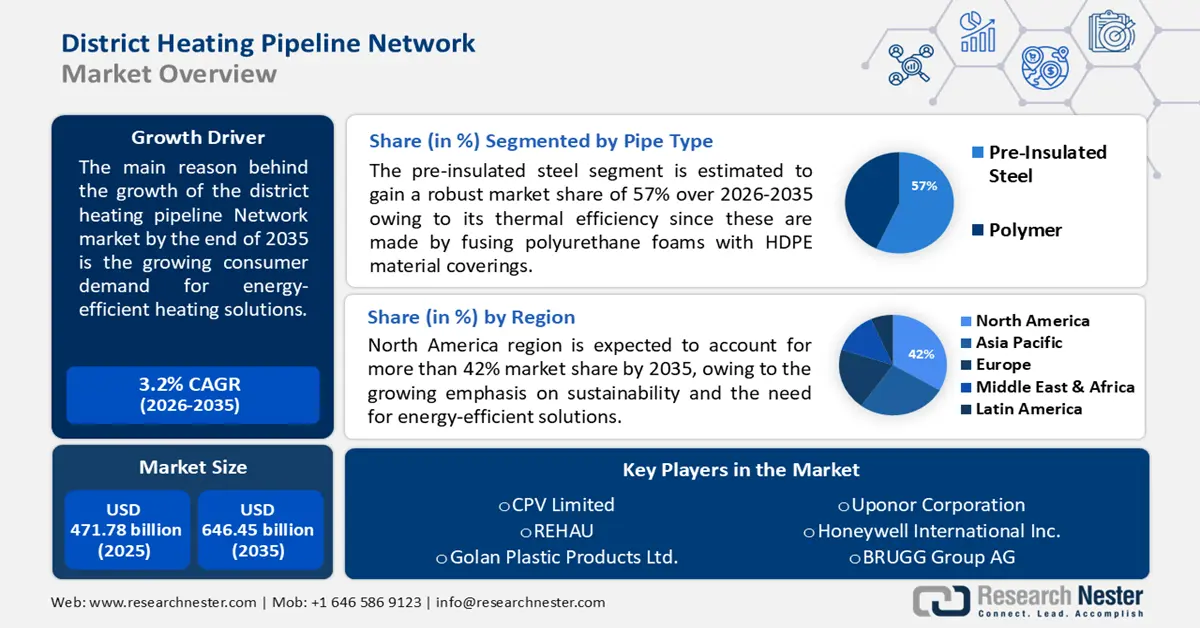

District Heating Pipeline Network Market size was over USD 471.78 billion in 2025 and is projected to reach USD 646.45 billion by 2035, witnessing around 3.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of district heating pipeline network is evaluated at USD 485.37 billion.

In the upcoming years, it is expected to witness a notable expansion in the global market.

The market is expanding as a result of growing consumer demand for energy-efficient heating options, increased attention to lowering greenhouse gas emissions, and government backing for the installation of district heating systems.

According to the most recent IEA analysis, sales of heat pumps worldwide increased by 11% in 2022, reaching a second consecutive year of doubling growth in Central heating technology as part of the world's transition towards sustainable energy. By utilizing waste heat from industrial processes or renewable energy sources, district heating systems contribute to energy efficiency.

Furthermore, the growing need for sustainable heating solutions and the trend toward urbanization are also driving the district heating pipeline network market expansion. Further, individual heating systems can be replaced with more dependable and affordable district heating systems. Carbon emissions are decreased because of the use of renewable energy sources. However, a decrease in reliance on fossil fuels has also been noticed.

Key District Heating Pipeline Network Market Insights Summary:

Regional Highlights:

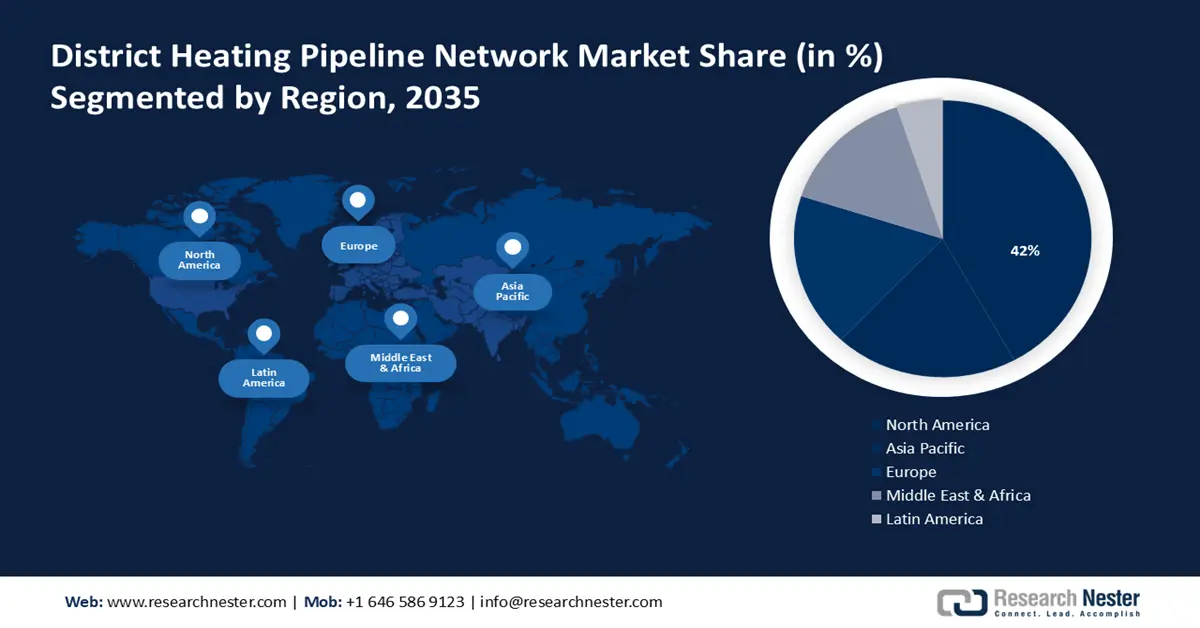

- North America district heating pipeline network market is expected to capture 42% share by 2035, driven by emphasis on sustainability and the need for energy-efficient heating solutions.

- Asia Pacific market will exhibit robust CAGR during 2026-2035, fueled by rapid urbanization, environmental benefits of district heating, and integration of renewable energy sources.

Segment Insights:

- The pre-insulated steel segment in the district heating pipeline network market is expected to capture a 57% share by 2035, attributed to its thermal efficiency due to polyurethane foams with HDPE coverings.

Key Growth Trends:

- Energy efficiency and environmental concerns

- Energy security and resilience

Major Challenges:

- High initial investment

- Inconsistent or unclear regulations can impede the growth of the district heating pipeline network market.

Key Players: Microflex, LLC, CPV Ltd, Perma-Pipe International Holdings Inc., BRUGG Group AG, REHAU, Golan Plastic Products Ltd, LOGSTOR Denmark Holding ApS, Uponor Corporation.

Global District Heating Pipeline Network Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 471.78 billion

- 2026 Market Size: USD 485.37 billion

- Projected Market Size: USD 646.45 billion by 2035

- Growth Forecasts: 3.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Germany, United States, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

District Heating Pipeline Network Market Growth Drivers and Challenges:

Growth Drivers

- Energy efficiency and environmental concerns - District heating systems are known for their energy efficiency compared to individual heating systems. Centralized heat generation plants are often more efficient than decentralized ones, leading to lower overall energy consumption.

Additionally, the use of renewable energy sources in district heating further aligns with environmental sustainability goals, attracting governments and businesses looking to reduce their carbon footprint. - Energy security and resilience - District heating provides a more resilient and secure energy supply, especially in regions susceptible to energy supply disruptions. The centralized nature of district heating systems ensures a consistent and reliable heat supply, reducing vulnerability to individual system failures or external disruptions.

Heat zoning was made possible in the UK in March 2023 by the Energy Security Bill, which implemented a heat networks regulation. According to estimates made by the Climate Change Committee, heat networks might provide about 18% of the UK's total heat consumption by the year 2050. - Integration of renewable energy sources - District heating systems can easily integrate renewable energy sources such as solar thermal, geothermal energy, or biomass. This flexibility allows the use of sustainable and environmentally friendly energy, contributing to the reduction of greenhouse gas emissions. The global emphasis on transitioning to renewable energy sources further boosts the growth of district heating pipeline network market.

Challenges

- High initial investment - The construction of district heating infrastructure involves substantial upfront capital investment. Building a centralized heat generation plant and an extensive network of pipelines can be cost-prohibitive, especially for smaller municipalities or regions with limited financial resources.

- Inconsistent or unclear regulations can impede the growth of the district heating pipeline network market.

- Lack of public awareness and misconceptions about district heating may result in resistance from potential customers.

District Heating Pipeline Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.2% |

|

Base Year Market Size (2025) |

USD 471.78 billion |

|

Forecast Year Market Size (2035) |

USD 646.45 billion |

|

Regional Scope |

|

District Heating Pipeline Network Market Segmentation:

Pipe Type Segment Analysis

In district heating pipeline network market, pre-insulated steel segment is poised to account for around 57% share by 2035.The segment’s growth is attributed to its thermal efficiency since these are made by fusing polyurethane foams with HDPE material coverings which prevents heat loss during transportation.

Moreover, these pipes can withstand temperatures of over 120’c and are cost-effective thereby the market outlook in the countries with high heating demand. These pipes are available in a varied range of diameters from 20 mm to 1200mm. Additionally, the ongoing investments toward sustainable space heating infrastructure across commercial and residential establishments are expected to boost business growth.

Diameter Segment Analysis

The 20mm to 100 mm segment in district heating pipeline network market is estimated to hold a significant revenue share over the forecast period. It is predicted that rising single-family and multi-story apartment building investments would accelerate the uptake of these pipelines.

The regulatory landscape's favourable subsidies and rebates, drive up demand for environmentally friendly HVAC systems, which will further expand the market. Furthermore, it is projected that rising multi-story residential building penetration in emerging economies will fuel market demand for this particular category.

Our in-depth analysis of the global district heating pipeline network market includes the following segments:

|

Pipe Type |

|

|

Diameter |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

District Heating Pipeline Network Market Regional Analysis:

North American Market Insights

North America industry is estimated to hold largest revenue share of 42% by 2035. The region’s growth is fuelled by a growing emphasis on sustainability and the need for energy-efficient solutions.

In the United States and Canada, Urban development and the revitalization of city centers are driving the demand for centralized heating systems. The integration of renewable energy sources, such as biomass and waste heat recovery, aligns with regional commitment to reduce carbon emissions.

As per U.S Energy Information Administration EIA, the total U.S. energy-related carbon dioxide emissions are set to decline by 1.6% in 2025. While the market is gaining traction, challenges persist, including regulatory complexities, varying regional climates, and the dominance of existing heating infrastructure.

However, government incentives and environmental policies are encouraging investments in district heating projects. The North American district heating pipeline network market is poised for further expansion as stakeholders collaborate to address challenges, ensuring a reliable and sustainable energy supply for urban areas while contributing to the broader goals of mitigating climate change.

Asia Pacific Market Insights

Asia Pacific district heating pipeline network market is estimated to experience robust revenue growth, driven by a confluence of factors. Rapid urbanization, particularly in countries like China and India, has intensified the demand for efficient heating solutions in densely populated areas.

For instance, according to China’s national statistics department, a small 1% increase in the country’s population increases the energy consumption by 60 million tons of coal. Governments across the region are increasingly recognizing the environmental benefits of district heating, aligning with sustainability goals and air quality improvement initiatives.

The integration of renewable energy sources, such as solar and geothermal, within district heating systems underscores the region’s commitment to clean resilient energy solutions. However, challenges persist, including high costs and the need for extensive infrastructure development.

As countries navigate these obstacles, the Asia Pacific district heating pipeline network market is poised for expansion, contributing to energy efficiency, reduced emissions, and enhanced urban living standards across the region.

District Heating Pipeline Network Market Players:

- Thermaflex

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microflex, LLC

- CPV Ltd

- Perma-Pipe International Holdings Inc.

- BRUGG Group AG

- REHAU

- Golan Plastic Products Ltd

- LOGSTOR Denmark Holding ApS

- Uponor Corporation

- Honeywell International Inc.

- Mannesmann Line Pipe GmbH

Recent Developments

- Honeywell stated that its energy-efficient, ultra-low global warming potential (GWP) hydrofluoroolefin (HFO) Solstice® ze (R-1234ze) heat pump is being used in Ireland's first low-carbon district heating network, situated in Tallaght, Dublin. The project is currently operational and will help Ireland meet its targets for renewable energy between 2030 and 2050. It will also benefit the European Union's decarbonization efforts, such as REPowerEU.

- Competitive Power Ventures announced the launch of its retail energy platform, CPV Retail Energy, which will initially serve commercial and industrial customers in PJM states as a retail electricity provider with plans to eventually enter into New York and New England. By helping businesses achieve their sustainability objectives through renewable and dispatchable low-carbon energy solutions, CPV Retail Energy builds on CPV's decarbonization efforts and commitment to environmental sustainability.

- Report ID: 5594

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.