Geothermal Energy Market Outlook:

Geothermal Energy Market size was valued at USD 9.4 billion in 2025 and is set to exceed USD 16.06 billion by 2035, registering over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of geothermal energy is evaluated at USD 9.87 billion.

As it harnesses the Earth’s natural heat, which is virtually inexhaustible, geothermal energy use is a sustainable practice with minimal greenhouse gas emissions and a low environmental footprint. Additionally, each country is trying to build or find a method that is more advanced and eco-friendly and allows low-temperature geothermal resource utilization. As per the IEA World Energy Outlook 2024, the United States targets net zero emissions with a 50-52% reduction in greenhouse gas (GHG) by 2030 in comparison to 2005 levels. IEA further states that heat production is among the largest global energy-related CO2 emission contributors, accounting for up to 40% of the overall emissions, making geothermal energy use even more vital.

The launch of geothermal projects is a major driver of the global market as increasing investments are being channeled into exploration and development. The projects are focused on expanding geothermal energy’s role in the global energy mix, driven by its potential for providing reliable, low-emission, and baseload power. In September 2023, Fervo Energy launched a next-generation geothermal project to deliver 400 MW of 24/7 carbon-free electricity at Cape Station, aiming to commence distributing around-the-clock, clean power to the grid in 2026 and reach full-scale production in 2028.

The Climate Investment Funds (CIF) 2024, has allocated USD 810 million for geothermal investments in 15 countries, to break down the barriers of the power expansion. In Africa, the organizations invested USD 125.5 million for 710 MW, Asia USD 414.6 million for 2,200 MW, Europe & Central Asia USD 73.8 million for 79 MW, and Latin America and Caribbean USD 194.8 for 516 MW.

Key Geothermal Energy Market Insights Summary:

Regional Highlights:

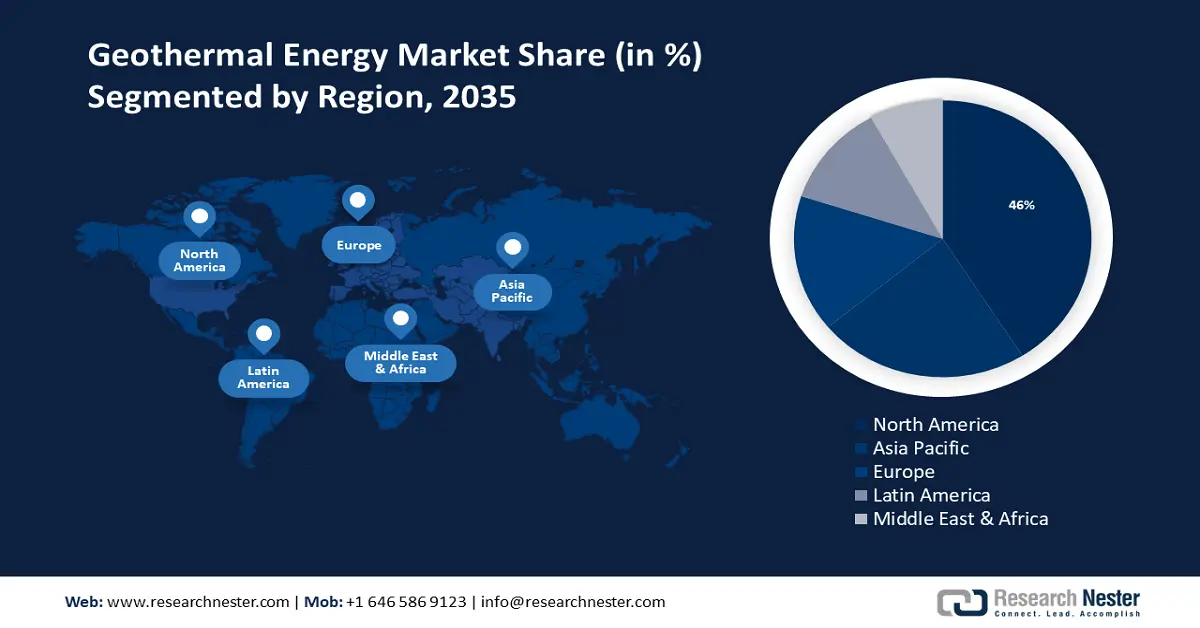

- North America geothermal energy market will hold around 46% share by 2035, driven by favorable legislation and federal initiatives supporting geothermal energy.

- Asia Pacific market will secure considerable share by 2035, driven by government initiatives and increasing demand for renewable energy.

Segment Insights:

- The binary type segment in the geothermal energy market is expected to achieve a 42% share by 2035, propelled by comparatively less water usage and fewer by-products, enhancing sustainability.

- The commercial segment in the geothermal energy market is anticipated to hold a noteworthy share by 2035, attributed to the ability to generate renewable energy and reduce reliance on fossil fuels.

Key Growth Trends:

- Launch of advanced research projects

- Enhanced funding

Major Challenges:

- High upfront capital costs

- Limited availability

Key Players: Ormat Technologies Inc., Calpine, Enel Green Power North America Inc., EthosEnergy, GEG Power, ElectraTherm, First Gen Corporation, Berkshire Hathaway Energy, Turboden S.p.A., Fuji Electric, Kyushu Electric Power Company, Toshiba International Corporation, Mitsubishi Heavy Industries, Sumitomo Corp..

Global Geothermal Energy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.4 billion

- 2026 Market Size: USD 9.87 billion

- Projected Market Size: USD 16.06 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Italy

- Emerging Countries: China, India, Indonesia, Japan, Mexico

Last updated on : 8 September, 2025

Geothermal Energy Market Growth Drivers and Challenges:

Growth Drivers

- Launch of advanced research projects: By focusing on cutting-edge technologies such as deep drilling techniques, and geothermal heat storage, these projects aim to overcome existing resource limitations and reduce environmental impacts. For instance, according to the EGEC Geothermal in September 2024, funded by the European Union’s Horizon 2020 research and innovation program, the GeoSmart project was concluded, marking a significant achievement in the transition towards sustainable energy systems in Europe. This focus on innovation in enhancing the long-term sustainability and scalability of geothermal energy.

- Enhanced funding: Research and development in the geothermal energy sector is increasing along with more funding and incentives being allocated to develop and test new technologies and solutions. Simultaneously, increased financial support through grants and low-interest loans is mitigating the high costs traditionally associated with the market. For instance, in December 2024, the Caribbean Development Bank approved a loan of USD 34.8 million for the Geothermal Power Company of Dominica (GPC) to fund the construction of a 10-megawatt (MW) geothermal power plant.

Challenges

- High upfront capital costs: Geothermal projects require substantial investments before any power is generated, with exploration success often uncertain due to the difficulty of accurately mapping underground reservoirs. These financial and logistical barriers hinder the scalability of the geothermal energy market despite its long-term benefits.

- Limited availability: Geothermal sites are not available everywhere, which directly limits the placements of the geothermal projects. This creates a highly limited supply of geothermal energy projects and acts as a restraining factor for market growth. High exploration and drilling costs, along with technical uncertainties about resource viability further complicate the market expansion, limiting its accessibility compared to more widely deployable renewables.

Geothermal Energy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 9.4 billion |

|

Forecast Year Market Size (2035) |

USD 16.06 billion |

|

Regional Scope |

|

Geothermal Energy Market Segmentation:

Type Segment Analysis

Binary type segment is predicted to account for a 42% share of the global geothermal energy market during the forecast period. This is majorly due to the comparatively less water usage and also the less production of the by-products as compared to the conventional geothermal energy technologies. This helps in the reduction of the environmental impact and also makes it more sustainable. Furthermore, the binary type also operates at a lower temperature while having a single-phase water-steam cycle, where only one phase of water is used. This reduces the risk of complications and hazards related to multiple phases of fluids and the need for special equipment.

End users Segment Analysis

The commercial segment is estimated to hold a noteworthy share as it can be used to generate electricity using either direct-use heat engines or geothermal power plants. This directly contributes to the supply of renewable energy along with the reduction of the reliance on fossil fuels and this can be used to provide heating and cooling for commercial buildings through geothermal heat pumps which can also reduce the emissions that are associated with the traditional heating and cooling systems.

Our in-depth analysis of the global geothermal energy market includes the following segments:

|

Type |

|

|

Application |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Geothermal Energy Market Regional Analysis:

North America Market Insights

The geothermal energy market in North America is set to hold the largest revenue share of 46% by 2035, driven by the new bill- the Geothermal Energy Optimization Act, 2024. Passed in the U.S., the bill permits geothermal projects on public lands drawing the investors’ interest towards it. The federal and state levels are coming hand in hand with implementing the policies that are favorable for the geothermal industry. Furthermore, the latest report by the U.S. Department of Energy claims that the western US region can generate electricity up to 90 gigawatts as soon as 2050. These factors are expected to fuel the demand for Geothermal Energy in this region.

The geothermal energy market in the U.S. is witnessing steady expansion and maintaining its position as the country with the highest installed geothermal capacity globally. Federal initiatives such as the Inflation Reduction Act launched in 2022 and state-level Renewable Portfolio Standards (RPS) are driving investments in geothermal technologies in the country. In November 2023, Google announced a partnership with Fervo which is a clean-energy startup, aiming to launch a geothermal power project in Nevada that will contribute to carbon-free energy to the electric grid.

APAC Market Statistics Insights

The Asia Pacific geothermal energy market is estimated to a considerable share, during the forecasted timeframe led by the increasing demand for clean and renewable energy to move towards sustainability. For instance, initiatives such as the Taiwan International Geothermal Conference (TIGC 2024) are intended to bring further developments in the geothermal sector. The government is also backing people up by implementing affordable and simply permitting initiatives, subsidies, and much more. For instance, the Japan Organization for Metals and Energy Security (JOGMEC) announced six new geothermal power projects shortlisted for the 2024 Geothermal Resource Survey Subsidy Program, boosting the market’s development in the region.

India geothermal energy industry is poised for significant growth with the Geological Survey of India identifying approximately 381 high-potential sites capable of generating about 10,600 megawatts of power, in July 2022. The Ministry of New and Renewable Energy (MNRE) established a task force in August 2024 to harness this potential, aiming to diversify the country’s energy mix and reduce reliance on fossil fuels. Despite the high initial investment required for geothermal projects, India is projected to become a huge market for next-generation geothermal power.

Geothermal Energy Market Players:

- Reykjavik Geothermal

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ormat Technologies Inc.

- Calpine

- Enel Green Power North America Inc.

- EthosEnergy

- GEG Power

- ElectraTherm

- First Gen Corporation

- Berkshire Hathaway Energy

- Turboden S.p.A.

Leading companies in the geothermal energy market are capitalizing on the growing demand for geothermal heat pumps and the increasing use of geothermal energy for power generation. Their strategies encompass forming strategic partnerships, expanding operations, and investing in innovative technologies. For instance, in June 2024, SLB announced a collaboration with Ormat Technologies, Inc. to develop and deliver integrated geothermal projects and reduce the risk associated with it. Such developments reflect a concerted effort by the key players to leverage geothermal energy’s potential.

Recent Developments

- In November 2024, Vulcan and BASF announced a partnership intending to explore the use of geothermal energy at the chemical company’s Ludwigshafen site for jointly evaluating opportunities to harness natural heat to supply renewable energy to BASF’s largest site and make it proficient in meeting base load power requirements.

- In December 2023, Calpine Corporation announced that its Decarbonization project has been selected by the Department of Energy (DOE), which focuses on capturing the CO2 at the post-combustion stage, to capture up to 1.75 million metric tons of carbon dioxide for permanent sequestration each year, further helping in chemical manufacturing and power generation.

- In June 2023, Ormat Technologies, Inc. and Dominica Electricity Services Ltd. signed a revolutionary 25-year Power Purchase Agreement (PPA) at the UN Climate Change Conference (COP28) aiming to develop a state-of-the-art 10 MW binary geothermal power plant in the Caribbean country of Dominica.

- Report ID: 3285

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Geothermal Energy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.