CO2 Heat Pump Water Heater Market Outlook:

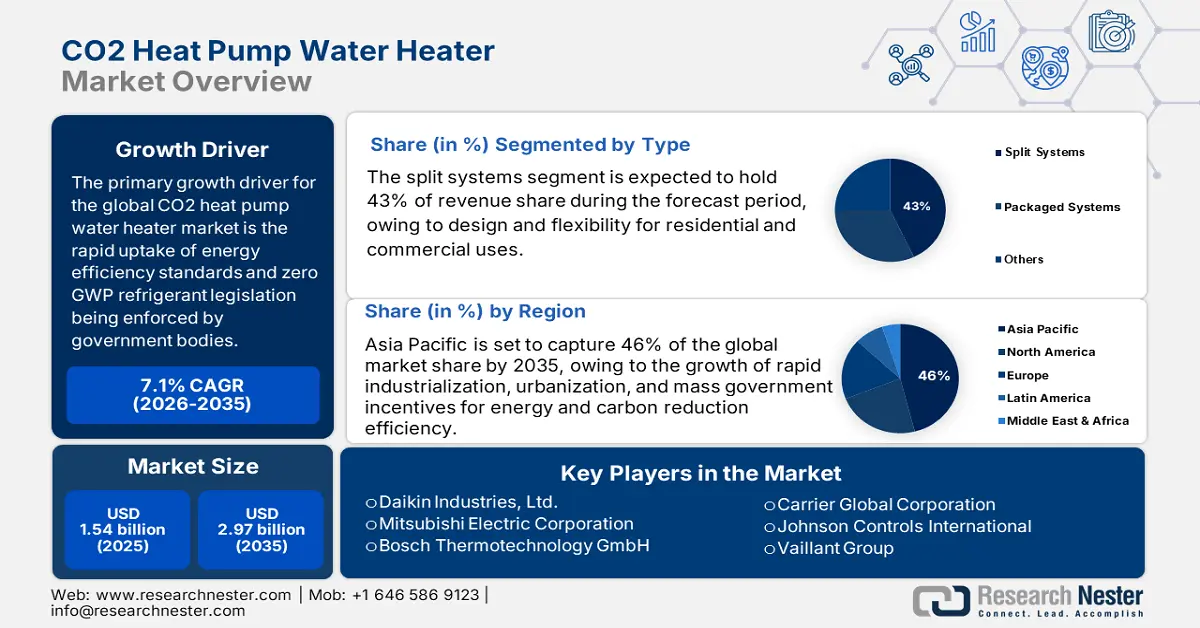

CO2 Heat Pump Water Heater Market size was valued at USD 1.54 billion in 2025 and is projected to reach USD 2.97 billion by the end of 2035, rising at a CAGR of approximately 7.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of CO2 heat pump water heater is evaluated at USD 1.64 billion.

The primary growth driver for the global CO2 heat pump water heater market is the rapid uptake of energy efficiency standards and zero GWP refrigerant legislation being enforced by government bodies. For instance, in April 2024, the U.S. Department of Energy (DOE) completed new efficiency standards that mandate more than 50% of new electric storage water heaters to use heat pump technology by 2029. This will save American families $7.6 billion per year and lower carbon emissions by 332 million metric tons over 30 years. When governments step up standards on appliances, as the EU and North America have, industrial uptake is faster, driving economies of scale and market penetration.

The supply chains for CO2 heat pump water heater market are currently in a state of rapid evolution, for they are being pushed by the demand for raw materials, world manufacturing capacity development, and steadily increasing global trade. The Biden-Harris Administration’s DOE energy efficiency standards are projected to save consumers nearly $1 trillion over 30 years, reducing the average household utility bill by at least $100 annually. Once finalized, these standards are expected to reduce greenhouse gas emissions by about 2.5 billion metric tons, equivalent to the emissions from 18 million gasoline cars, 22 coal-fired power plants, or 10.5 million homes over the same period. The DOE’s Office of Technology Transitions, with the Offices of Fossil Energy and Carbon Management and Clean Energy Demonstrations, announced four National Lab projects receiving $15 million to speed commercialization of carbon dioxide removal technologies, including direct air capture, advancing U.S. efforts to reduce emissions and scale clean energy solutions. Trade, as evidenced by DOE data, is shifting towards near-shoring and locally self-sustaining supply chains, minimizing trade exposures.

Key CO2 Heat Pump Water Heater Market Insights Summary:

Regional Highlights:

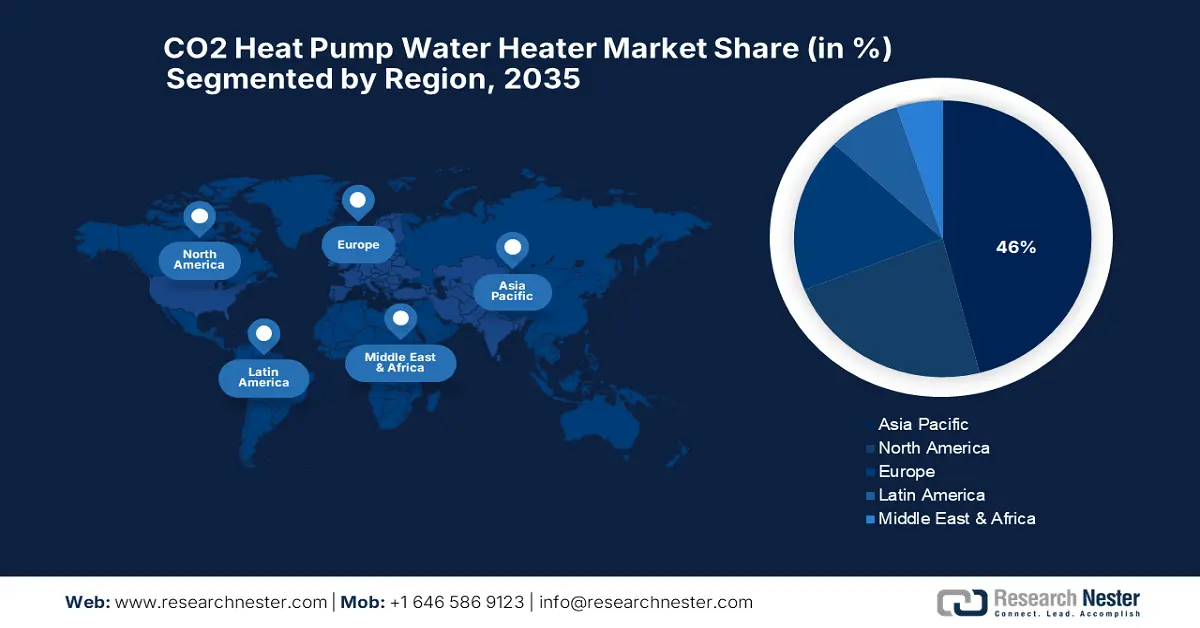

- The Asia Pacific CO2 heat pump water heater market is expected to command around 46% of the global share by 2035, owing to rapid industrialization, urbanization, and extensive government incentives supporting carbon reduction and energy efficiency.

- North America is anticipated to secure nearly 23% share by 2035, attributed to stringent energy efficiency legislation and heightened retrofit and new build activities.

Segment Insights:

- The split systems segment is anticipated to command a 43% share of the CO2 heat pump water heater market by 2035, propelled by its design versatility and suitability for both residential and commercial applications.

- The inverter-driven compressors segment is projected to capture a 41% share by 2035, fueled by superior energy efficiency and precise temperature control capabilities.

Key Growth Trends:

- Regulatory incentives and energy efficiency mandates

- Advanced manufacturing and targeted federal funding drive market growth

Major Challenges:

- High initial capital investment

- Supply chain vulnerabilities

Key Players: Daikin Industries, Ltd., Mitsubishi Electric Corporation, Bosch Thermotechnology GmbH, Carrier Global Corporation, Johnson Controls International, Vaillant Group, Rheem Manufacturing Company, LG Electronics, A.O. Smith Corporation, Blue Star Limited, Toshiba Corporation, Daikin Australia Pty Ltd, Glen Dimplex Group, Fujitsu General Limited, Panasonic Corporation.

Global CO2 Heat Pump Water Heater Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.54 billion

- 2026 Market Size: USD 1.64 billion

- Projected Market Size: USD 2.97 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: Japan, China, India, United States, Germany

- Emerging Countries: South Korea, Australia, Canada, France, United Kingdom

Last updated on : 24 September, 2025

CO2 Heat Pump Water Heater Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory incentives and energy efficiency mandates: Coerced by the Government to mandate and incentivize this technology, CO2 heat pump water heaters are driving adoption. In one such case, the DOE anticipates that over 50% of new electric water heaters must use heat pump technology by 2029, and in doing so, they will reduce emissions by a total of 332 million metric tons within 30 years. In B2B procurement, the lack of a globalized system brings uncertainty to long-term planning, especially for OEMs, yet the utilities are looking for value through economies of scale over multiple markets with diverse timelines on compliance.

- Advanced manufacturing and targeted federal funding drive market growth: The CO2 heat pump water heater market is expanding as a result of expenditures meant to offset the high initial manufacturing costs and complex supply chain. The second round of award negotiations was announced by the U.S. Department of Energy (DOE), which selected four projects totaling $84.7 million. This portfolio of round 2 selections will increase production of components, electric heat pumps, and heat pump water heaters at five facilities. By increasing volume production at reduced costs, these projects are expected to help manufacturers and HVAC integrators stabilize supply and shorten lead times. Despite the worldwide supply situation, this type of focused support should boost installers' and builders' acceptability, expand the project pipeline, and speed up market penetration.

- Decarbonization of commercial and industrial hot water: Major facilities like hotels, hospitals, dairies, and food-processing operations require substantial amounts of hot water and are obligated to reduce their carbon emissions. CO2 heat pump water heaters are a highly efficient method of providing high-temperature water without using fossil fuels, and these solutions also align with organizational ESG goals and carbon-neutral commitments. The capacity to use renewable electricity lowers Scope 1 and 2 emissions, making CO2 heat pumps an attractive alternative to gas-fired boilers.

Emerging Trade Dynamics

Heat Pump Sales by Country or Region from 2020-2023

|

Region/Country |

2020 |

2021 |

2022 |

2023 |

|

U.S. |

24 GW |

28 GW |

30 GW |

26 GW |

|

European Union |

14 GW |

19 GW |

28 GW |

27 GW |

|

China |

28 GW |

32 GW |

31 GW |

35 GW |

|

Japan |

7 GW |

7 GW |

8 GW |

7 GW |

|

Rest of the World |

11 GW |

13 GW |

14 GW |

14 GW |

Source: IEA

Challenges

- High initial capital investment: Barriers are posed to the CO2 heat pump water heater segment by the extraordinarily high upfront costs of manufactured materials and manufacturing processes. Large capital requirements indeed deter mass purchase, especially on the part of cost-sensitive commercial customers and manufacturers with low production volumes. Market development thus slows down as procurement cycles increase and project budgets decrease. Unavailability of affordable credit and increased payback duration dissuade large-scale roll-out, with economies of scale and technology spillover to developing economies ruled out.

- Supply chain vulnerabilities: The reliance of the industry on foreign-sourced specialty components, such as variable-speed compressors and CO2-compatible heat exchangers, exposes it to supply chain risk of disruption. Geopolitical tensions, transport congestion, and tariffs impair lead times and manufacturing costs. These risks complicate OEMs' planning and manufacturing, and project execution by end-users is further delayed. Supply unreliability that occurs undermines market trust, limits capacity utilization, and the burden of meeting augmented global demand effectively lies with them.

CO2 Heat Pump Water Heater Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 1.54 billion |

|

Forecast Year Market Size (2035) |

USD 2.97 billion |

|

Regional Scope |

|

CO2 Heat Pump Water Heater Market Segmentation:

Type Segment Analysis

The split systems subsegment is projected to lead the CO2 heat pump water heater market by 2035, accounting for 43% of revenues, due to the design and flexibility for residential and commercial uses. When compared to a typical electric water heater, an ENERGY STAR-certified heat pump water heater typically uses 70% less energy and can save a family of four more than $550 annually. Growing urbanization and retrofitting projects, especially across the Asia-Pacific and Europe, which together are set to generate good revenues in the global market by 2035, increase the demand for compact split systems.

Technology Segment Analysis

The inverter-driven compressors stand at the forefront with a 41% CO2 heat pump water heater market share predicted in 2035, due to the energy efficiency and temperature control they offer. The technology allows the compressor to speed up and slow down, rather than a fixed-speed compressor. Except for Japan and China, the inverter ratio is comparatively low in places like the Middle East and Asia, at 20% and 40%, respectively. The adoption of inverter technology is thus fastened, given the carbon emission regulations imposed in North America and Europe. Further R&D expenditure and government incentives support its lead in the market, particularly in commercial and industrial spheres.

Application Segment Analysis

Residential water heating is expected to hold the highest application revenue CO2 heat pump water heater market share at nearly 39% in the year 2035, indicating applications in keeping pace with consumer appetite for energy-efficient and low-carbon solutions. Nearly every home uses electricity, and in 2020, retail electricity purchases made up roughly 44% of all residential sector end-use energy consumption. In the EU, households' primary energy use in 2023 was for home heating, accounting for 62.5% of total energy consumption in the residential sector. Water heating accounted for a slightly higher percentage, 15.1%. This sub-segment is forecast to witness dominating growth mainly because of retrofit and new-build projects in the residential sector.

Our in-depth analysis of the global CO2 heat pump water heater market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

Technology |

|

|

Source |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

CO2 Heat Pump Water Heater Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific CO2 heat pump water heater market is expected to have the largest regional contribution of around 46% by 2035, due to the growth of rapid industrialization, urbanization, and mass government incentives for energy and carbon reduction efficiency. The region is expected to be led by increasing demand in commercial, residential, and industrial use, with the top contributors being Japan, China, and India. positive environmental regulations and increasing consumer consciousness are promoting the shift from conventional water heating technology to clean CO2-based technology.

As a dominant player in the CO2 heat pump water heater market, China is expected to hold over 51% of revenues in the Asia Pacific by 2035. China is severely pushing to be carbon neutral by 2060, and green appliances such as CO2 heat pump water heaters have been subsidized and given tax credits. China is the world's largest investor in renewable energy, with $625 billion USD in 2024, or 31% of the $2,033 billion global total. In the three years leading up to 2024, installed battery storage tripled in size. From 486 billion RMB ($68 billion) in 2019, grid investment increased by 25% to reach an all-time high of 608 billion RMB ($85 billion USD) in 2024. Demand is mainly fueled by urban residential development and the process of industrialization.

With a CAGR of 6.7%, India is expected to hold a 14% energy-efficient CO2 heat pump water heater market under the PAT scheme. Penetrations into the residential market come through urbanization of the middle class and increasing levels of electrification; infrastructure development of commercial buildings offers increased opportunity for growth. No boiler room or cooling tower is needed, ensuring zero emissions and pollution. The system saves 30–80% energy versus central air conditioning, with 70–5000 kW cooling and 80–6000 kW heating capacity, efficiently conditioning 70–100 m² per kilowatt. India has reduced its energy usage by around 3.5 percent and its annual carbon emissions by 306 million tons, according to the Bureau of Energy Efficiency.

North America Market Insights

North America is expected to capture around 23% of the worldwide CO2 heat pump water heater market in 2035, driven by aggressive energy efficiency legislation and robust industrial demand. The region boasts massive government incentives and research spending to minimize carbon footprints for residential, commercial, and industrial applications. Growth in the regional market is underpinned by rising retrofit activity and new build activity involving CO2 heat pump technology that will likely record a CAGR of 5.4% over the forecast period.

The U.S. is going to lead the North American CO2 heat pump water heater market with more than 80% regional market share and is strengthened by national legislation such as the Bipartisan Infrastructure Law and the Inflation Reduction Act, which provide billions of dollars for investments in clean energy technology. According to the U.S. Energy Information Administration, the average yearly quantity of power sold to (bought by) a home electric utility customer in the United States in 2022 was 10,791 kWh, or roughly 899 kWh per month. Hawaii had the lowest annual electricity purchases per residential user at 6,178 kWh, while Louisiana had the highest at 14,774 kWh. The DOE estimates that CO2 heat pump water heaters with inverters can save residential water heating energy by as much as 50%, a vital contribution to carbon reduction goals. Industrial uses, such as pharmaceutical and food processing, also create demand for CO2 heat pumps because they provide high thermal performance and are environmentally friendly.

Canada's CO2 heat pump water heater market is expected to hold approximately 21% of the North American market, and is increasing steadily with programs like the Clean Growth Program and the Pan-Canadian Framework on Clean Growth and Climate Change. The Canadian government's resolution to cut greenhouse gas emissions by 40–45% below 2005 levels by 2030 and reach net-zero emissions by 2050 is codified in the Canadian Net-Zero Emissions Accountability Act. Canada's cold climate also increases demand for modern heat pump systems capable of working effectively in cold climates. Canada market growth CAGR is expected to be 4.9% by virtue of increasing usage in residential and commercial construction markets.

Canada Data on Residential Energy Use

|

Sector |

Energy Use % |

|

Space Heating |

63% |

|

Lights and Appliances |

19% |

|

Water Heating |

15% |

|

Cooling |

3% |

Source: IISD

Europe Market Insights

Europe is projected to hold approximately 18% of the global CO2 heat pump water heater market by 2035, due to the comprehensive climate policies and the European Green Deal, and energy efficiency frameworks in individual EU member states. The necessity to reduce carbon emissions to net-zero by 2050 creates a huge demand for modern heat pump technology in residential and commercial buildings. Buildings account for over 30% of the EU’s environmental footprint, consuming approximately one-third of its materials. Their operation accounts for 42% of total energy use and 35% of greenhouse gas emissions, making construction the Union’s most impactful sector. Growth of approximately 4.9% CAGR is projected during 2026-2035 for the European market, supported by subsidies and regulatory frameworks favoring the exchange of fossil fuel-based water heaters.

Energy Consumption in EU Households in 2023

|

Sector |

% of Energy Use |

|

Space Heating |

62.5% |

|

Water Heating |

15.1% |

|

Lights and Electrical Appliances |

14.5% |

|

Cooking |

6.5% |

|

Other End Use |

0.8% |

|

Space Cooling |

0.6% |

Source: Eurostat

Key CO2 Heat Pump Water Heater Market Players:

- Daikin Industries, Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mitsubishi Electric Corporation

- Bosch Thermotechnology GmbH

- Carrier Global Corporation

- Johnson Controls International

- Vaillant Group

- Rheem Manufacturing Company

- LG Electronics

- A.O. Smith Corporation

- Blue Star Limited

- Toshiba Corporation

- Daikin Australia Pty Ltd

- Glen Dimplex Group

- Fujitsu General Limited

- Panasonic Corporation

The CO2 heat pump water heater market is characterized by intense competition with leading players focusing on technological innovation, energy efficiency, and geographic expansion to capture market share. Companies like Daikin and Mitsubishi Electric lead by investing heavily in R&D to enhance inverter-driven compressors and refrigerant management. European players such as Bosch and Vaillant emphasize integration with smart building systems and compliance with strict EU energy regulations. U.S. manufacturers capitalize on federal incentives, broadening product portfolios to address commercial and residential needs. Japanese firms dominate through consistent innovation, expanding manufacturing capacity, and forging strategic partnerships across the Asia-Pacific. Overall, innovation, sustainability, and market penetration remain core competitive strategies.

Top Global Manufacturers in the CO2 Heat Pump Water Heater Market:

Recent Developments

- In November 2022, the International Energy Agency (IEA) released a report emphasizing accelerated adoption of CO₂ heat pump water heaters in commercial and residential sectors worldwide. The report forecasts that global deployment could reduce water heating-related carbon emissions by up to 40.2% by 2030. The IEA called for expanded international collaboration on technology standardization and financial incentives to scale adoption in emerging economies, highlighting their role in meeting the Paris Agreement targets.

- In November 2023, Daikin announced two new VRV 5 heat pump systems launching in early 2024. The Mini-VRV model now offers capacities up to 33.5 kW, while the new Top-Blow series reaches 56 kW, broadening Daikin’s lineup and supporting the decarbonization of commercial buildings with higher efficiency and expanded application flexibility.

- Report ID: 8115

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

CO2 Heat Pump Water Heater Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.