Closed System Transfer Devices Market Outlook:

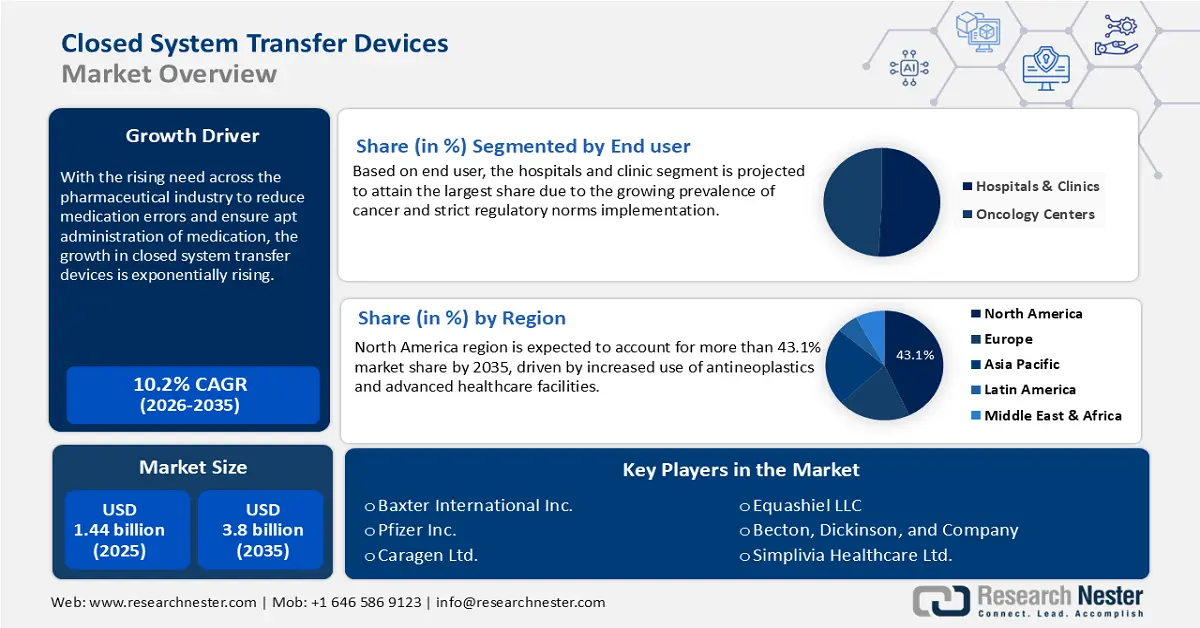

Closed System Transfer Devices Market size was valued at USD 1.44 billion in 2025 and is expected to reach USD 3.8 billion by 2035, expanding at around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of closed system transfer devices is evaluated at USD 1.57 billion.

The growth of this market can be attributed to the growing number of cancer cases globally. It has led to a positive rise in the implementation of chemotherapy treatment all over the world. According to WHO, more than 10 million people worldwide died from cancer in 2020. Additionally, according to projections from the IARC and WHO, there would be 19.3 million new instances of cancer worldwide by 2025. In addition, a sharp rise in the number of oncology drug approvals is another important aspect that significantly boosts this market's expansion effectively.

Moreover, the growing demand for monitoring compliance for safe pharmaceutical handling is expected to drive the growth of the closed system transfer device market. It is possible to determine differences in safety compliance between several groups using ANOVA (Analysis of Variance). Antineoplastic drugs can save or improve a patient's survival but on the other side can be detrimental to the health of medical workers. This might occur in cases when medicine escapes during administration, compounding, or patient delivery or in case there is service contamination. Therefore, pharmacy professionals at cancer centers prepare all types of chemotherapy drugs under the supervision of a professional pharmacist.

Key Closed System Transfer Devices Market Insights Summary:

Regional Highlights:

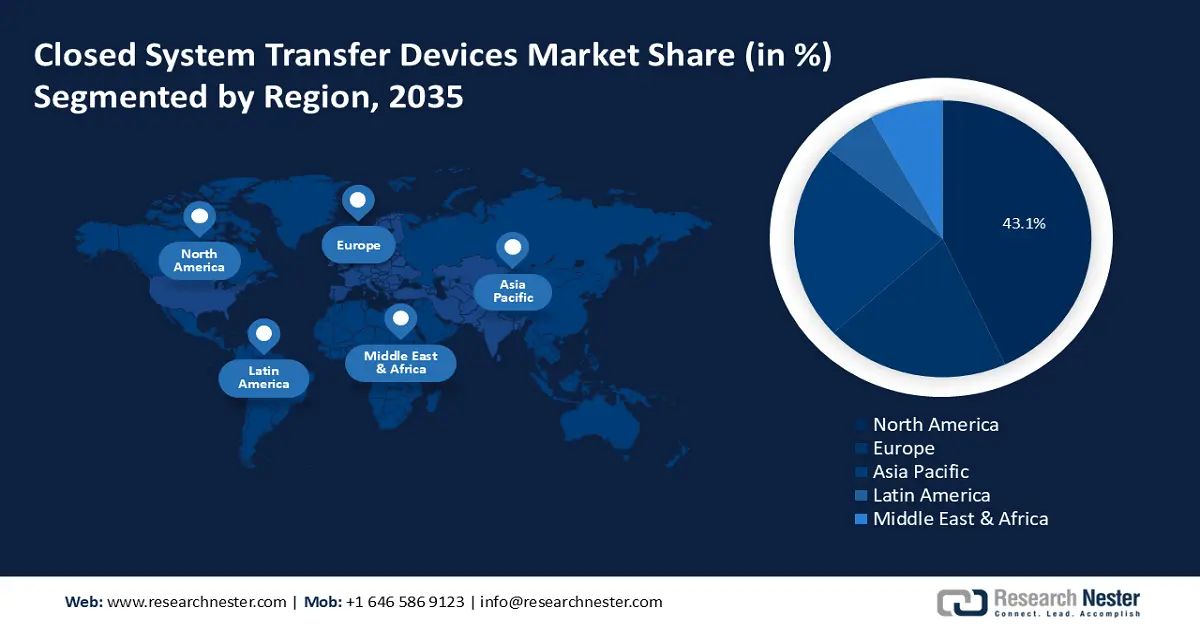

- North America closed system transfer devices (CSTD) market will dominate over 43.1% share by 2035, driven by increased use of antineoplastics and advanced healthcare facilities.

- Asia Pacific market will register noteworthy growth from 2026 to 2035, fueled by high cancer prevalence and improved healthcare infrastructure.

Segment Insights:

- The hospitals & clinics segment in the closed system transfer devices market is expected to secure the largest share by 2035, influenced by hospitals’ financial capacity to adopt advanced closed system transfer devices and regulatory compliance requirements.

- The hospitals & clinics segment in the closed system transfer devices market is expected to secure the largest share by 2035, influenced by hospitals’ financial capacity to adopt advanced closed system transfer devices and regulatory compliance requirements.

Key Growth Trends:

- Increasing Prevalence of Cancer

- Growing Use of Antineoplastic Drugs and Other Toxic Drugs

Major Challenges:

- Increasing Prevalence of Cancer

- Growing Use of Antineoplastic Drugs and Other Toxic Drugs

Key Players: Becton, Dickinson, and Company, B. Braun Melsungen AG, ICU Medical, Inc., Equashield, LLC, CODAN Medizinische Geräte GmbH & Co KG, Simplivia Healthcare Ltd., Corvida Medical, Inc., Caragen Ltd., Baxter International Inc., Pfizer Inc.

Global Closed System Transfer Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.44 billion

- 2026 Market Size: USD 1.57 billion

- Projected Market Size: USD 3.8 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Closed System Transfer Devices Market Growth Drivers and Challenges:

Growth Driver

- Increasing Prevalence of Cancer – The growing presence of cancer globally and also growth in several oncology products approval are the primary factors expected to drive the growth of this market in the forecast period. According to a report in 2020, there were approximately 19,292,789 new cases of cancer globally in that year. By 2040, there would be 28,887,940 cases, according to estimates. The large population of cancer patients, which is driving demand for cutting-edge drug delivery methods, is anticipated to contribute to the market's expansion for closed-system transfer devices.

- Growing Use of Antineoplastic Drugs and Other Toxic Drugs – Antineoplastic drugs are hugely used in the treatment of cancer and are considered to be harmful. Healthcare professionals associated with the delivery, transport, preparation, distribution, administration, and disposal of these drugs are at high risk. As per statistics, around 8 million healthcare workers in the United States are exposed to hazardous drugs.

- Stringent Government Drug Safety Standards - Globally, governments are establishing strict laws to guarantee the security of healthcare professionals when handling dangerous pharmaceuticals. Guidelines for the safe handling of hazardous medications have been released by the US Occupational Safety and Health Administration (OSHA) and the National Institute for Occupational Safety and Health (NIOSH). Similarly to this, the European Medicines Agency (EMA) has published recommendations for the administration of risky medications in healthcare facilities. It is anticipated that this will accelerate the use of closed-system transfer devices.

- Growing Adoption in Healthcare Sector – As the presence of chronic diseases such as cancer and diabetes seems to be growing globally, the adoption rate of closed system transfer devices also grew as closed system transfer device is widely related to the treatment of these diseases. A 2019 study conducted by the American Society of Health-System Pharmacists (ASHP) found that the use of closed-system transfer devices in healthcare settings has increased significantly in recent years. The survey found that 83% of hospitals and healthcare systems use CSTD for at least some dangerous drugs.

Challenges

- High Cost of Implementation of Closed System Transfer Device – One of the significant challenges faced by the closed system transfer device market is the high cost associated with these devices. The high price of closed-system transfer devices makes it difficult for healthcare facilities to afford them, which limits their adoption. This factor is expected to pose a challenge to the growth of the market in the forecast period.

- Regulatory Challenges

- Limited Awareness

Closed System Transfer Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 1.44 billion |

|

Forecast Year Market Size (2035) |

USD 3.8 billion |

|

Regional Scope |

|

Closed System Transfer Devices Market Segmentation:

End-user Segment Analysis

The hospitals & clinics segment is anticipated to hold the largest market share by the end of 2035, attributed owing to the great financial power of hospitals to afford high-ranged CSTSs, the growing prevalence of cancer, and the requirement imposes some regulatory guidelines. According to the American Cancer Society, an estimated 1.9 million new cancer cases were diagnosed in the United States in 2021, with approximately 608,570 deaths from cancer. The acceptance of closed system transfer devices (CSTDs) in healthcare has increased significantly in recent years. Several factors have contributed to this trend, including increased awareness of the risks associated with exposure to hazardous drugs, regulatory requirements, and technological improvements oncology medical devices, and many more. The use of closed-system transfer devices in hospitals is also driven by regulatory requirements. Several regulatory agencies, such as the Occupational Safety and Health Administration (OSHA) and the National Institute for Occupational Safety and Health (NIOSH), have issued guidelines recommending the use of closed system transfer devices for hazardous drug handling in healthcare facilities.

Type Segment Analysis

The membrane-to-membrane segment is anticipated to account for the largest market share by the end of 2035. The huge share and the growth of this segment can be attributed owing to the simplicity of operation and low risk of contamination associated with the double membrane containment system.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Technology |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Closed System Transfer Devices Market Regional Analysis:

North American Market Insights

North America region is expected to account for more than 43.1% market share by 2035, attributed to the higher use of antineoplastics for cancer treatment, backed by the availability of advanced healthcare facilities. According to the data from the American Cancer Society, about 1.9 million new cancer cases and 693,000 cancer deaths were recorded in Northern America in 2018. North America is one of the most technologically advanced regions globally, with a high adoption rate of advanced medical technologies, including closed-system transfer devices. Such factors are estimated to boost the demand for the closed system transfer devices market in the region.

APAC Market Insights

The closed system transfer devices market in the Asia Pacific region is estimated to witness noteworthy growth over the forecast period, attributed to the back of increasing prevalence of cancer in low- and middle-income nations. As per a report by WHO, cancer is the second leading cause of death after CVD in the Asia Pacific region. Additionally, growing investment in healthcare infrastructure, an increase in total, population, and a rise in facilities offering closed system transfer device services are further expected to drive the growth of this market in the forecast period. The demand for personalized medicine is increasing in the Asia Pacific region, which requires the use of hazardous drugs.

Europe Market Forecast

The closed system transfer device market in Europe region is anticipated to see a significant market share in the forecast period, attributed owing to increasing awareness of the risks associated with hazardous drugs and a growing demand for advanced medical technologies. Healthcare professionals in Europe are becoming more aware of the risks associated with occupational exposure to hazardous drugs and are increasingly adopting CSTDs to reduce their risks. The European Union (EU) has regulations in place to protect healthcare workers from exposure to hazardous drugs, which has led to high adoption rates of CSTDs in the region. These factors are further expected to drive the growth of this market in the Europe region.

Closed System Transfer Devices Market Players:

- Becton, Dickinson, and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B. Braun Melsungen AG

- ICU Medical, Inc.

- Equashield, LLC

- CODAN Medizinische Geräte GmbH & Co KG

- Simplivia Healthcare Ltd.

- Corvida Medical, Inc.

- Caragen Ltd.

- Baxter International Inc.

- Pfizer Inc.

Recent Developments

- Merck Group, a leading science and technology company, to complete the acquisition of the MAST (Modular Automated Sampling Technology) platform from Lonza.

- Fresenius Kabi to enter an exclusive U.S. distribution agreement with Corvida Medical for the HALO Closed System Drug-Transfer Device.

- Report ID: 4090

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.