Clinical Upright Microscopes Market Outlook:

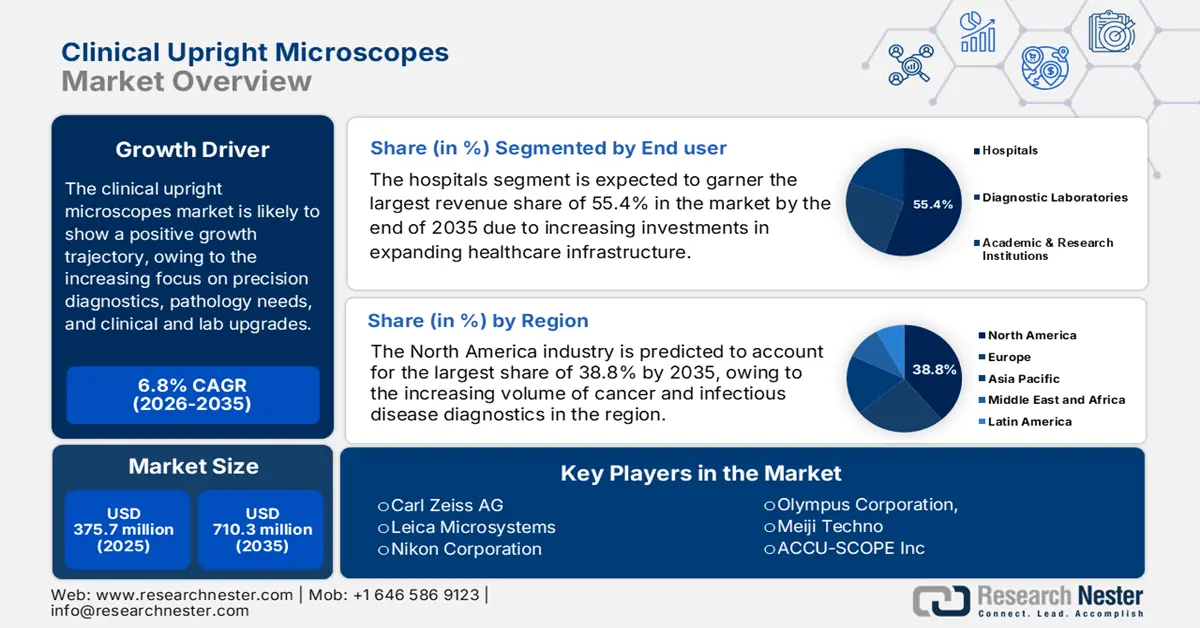

Clinical Upright Microscopes Market size was valued at USD 375.7 million in 2025 and is projected to reach USD 710.3 million by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of clinical upright microscopes is estimated at USD 400.5 million.

The clinical upright microscopes market is likely to show a positive growth trajectory in the upcoming years, owing to the increasing focus on precision diagnostics, pathology needs, and clinical and lab upgrades. For instance, in October 2023, Leica Microsystems reported that it had successfully inaugurated a USD 60 million next-generation facility in Singapore to meet growing global demand for surgical and industrial microscopes. Moreover, the site is expected to double the firm’s production capacity, thereby enhancing innovations by combining R&D and manufacturing under one roof.

Furthermore, the magnificent strategies implemented by the pioneers are strengthening their collaboration with both academic and industry partners. Testifying to this, the Plymouth Electron Microscopy Center in November 2024 revealed that it has relocated to a facility at Plymouth Science Park, followed by a £2.5 million (USD 3.1 million) investment. The organization also underscored that it is equipped with nine advanced instruments, which will allow it to boost its services across different sectors, including pharmaceuticals.

Key Clinical Upright Microscopes Market Insights Summary:

Regional Highlights:

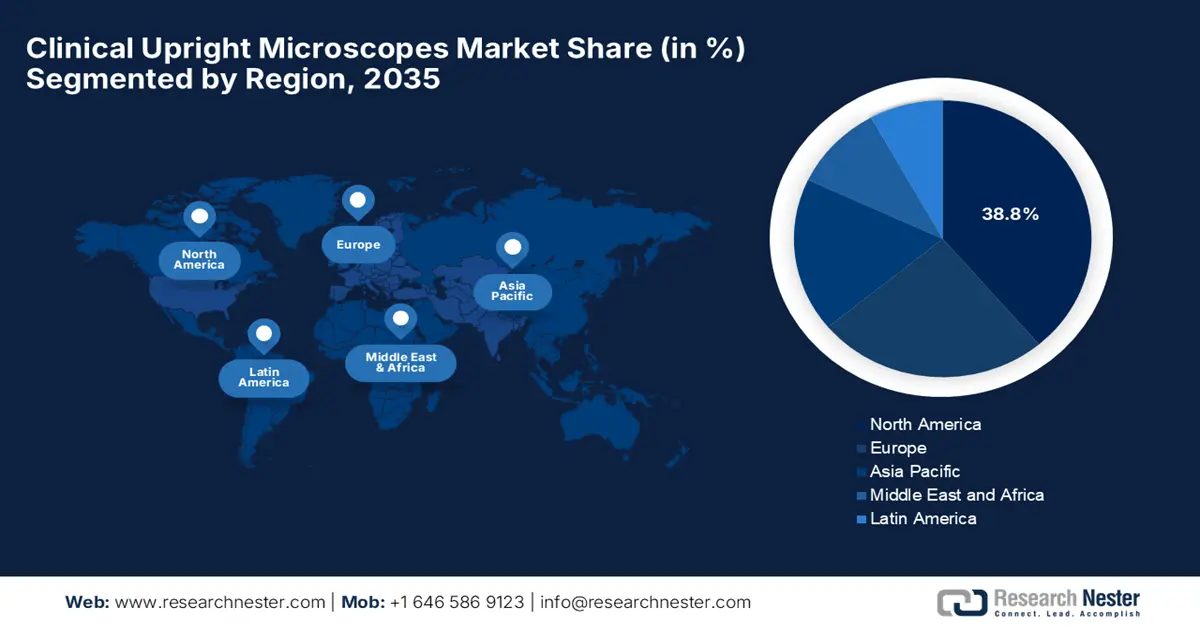

- North America is anticipated to hold a 38.8% share in the clinical upright microscopes market by 2035, supported by the rising incidence of cancer and infectious disease diagnostics along with strong federal health funding initiatives.

- Asia Pacific is set to record the fastest growth during 2026-2035, owing to escalating chronic disease prevalence and extensive government-driven healthcare digitization programs.

Segment Insights:

- The hospitals segment is projected to command a 55.4% revenue share in the clinical upright microscopes market by 2035, propelled by rising investments in healthcare infrastructure and advanced imaging solutions across emerging economies.

- The clinical diagnostics segment is anticipated to capture a 50.8% share by 2035, driven by the increasing prevalence of chronic diseases requiring detailed cellular analysis.

Key Growth Trends:

- Increased frequency of innovations

- Diagnostic demand

Major Challenges:

- Lack of standardization for products and services

- Limited payer coverage for AI upgrades

Key Players: Carl Zeiss AG (Germany), Leica Microsystems (Germany), Nikon Corporation (Japan), Olympus Corporation (Japan), Meiji Techno (Japan), ACCU-SCOPE Inc. (U.S.), Labomed, Inc. (U.S.), Cole-Parmer (U.S.), Thermo Fisher Scientific Inc. (U.S.), Danaher Corporation (U.S.), UNITRON (U.S.), Amscope (U.S.), Motic (China), Bio-Rad Laboratories, Inc. (U.S.), Swift Optical Instruments, Inc. (U.S.), KRÜSS GmbH (Germany), GT Vision Ltd (UK), MEDITE Medical GmbH (Germany), Scientico (India), Magnus Analytics (India).

Global Clinical Upright Microscopes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 375.7 million

- 2026 Market Size: USD 400.5 million

- Projected Market Size: USD 710.3 million by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Singapore

Last updated on : 24 October, 2025

Clinical Upright Microscopes Market - Growth Drivers and Challenges

Growth Drivers

- Increased frequency of innovations: Significant public and private allocations to R&D are accelerating pipeline extension in the clinical upright microscopes market. For instance, in May 2023, Nikon announced the launch of its new ECLIPSE Ni-L upright microscope, which comprises a balanced LED light source that closely mimics natural light, improving color accuracy in specimen observation. The firm also stated that the product significantly enhances image quality for pathology and reduces the need for color correction in digital imaging and AI analysis, thereby reducing environmental impact and maintenance needs.

- Diagnostic demand: As there is an increasing occurrence of chronic diseases such as cancer, cardiovascular diseases, diabetes, and infectious diseases, the demand for efficient diagnostic tools also increases, driving business in the clinical upright microscopes market. As per an article published by NIH in January 2024, chronic diseases such as heart disease, cancer, and diabetes are leading causes of death across all nations, with a significant economic impact. Diabetes led to more than 103,000 U.S. deaths in 2021 wherein the global health spending on diabetes reaching USD 966 billion in 2021, underscoring the urgent need for prevention and innovation.

- Expansion of healthcare infrastructure: The emerging markets are increasing their spending on healthcare settings by setting up advanced diagnostic laboratories, hospitals, and pathology services, hence expanding procurement of microscopy devices. In this regard, Sarvodaya Hospital in Faridabad in July 2023 reported that it has launched its pathology and lab services department, which features advanced diagnostic technology to support precise, patient-specific treatment. Therefore, such a step represents a major step forward in healthcare innovation and service quality.

Challenges

- Lack of standardization for products and services: The absence of adequate and appropriate protocols for digital models is a significant hurdle in the clinical upright microscopes market. Therefore, it makes it difficult to validate performance across different healthcare settings, thereby affecting diagnostic reliability and limiting widespread adoption. Hence, this underscores the huge necessity for technician training programs, which will successfully reduce diagnostic errors.

- Limited payer coverage for AI upgrades: Economic limitations in the integration of AI-enhanced diagnostics are also a persistent issue for global expansion in the clinical upright microscopes market. A Gap in financial backing slows the adoption of next-generation commodities, discouraging manufacturers from investing in innovations. Furthermore, this lack of insurance reimbursement and insufficient public funding causes a major delay to the clinical adoption, especially in cost-sensitive markets.

Clinical Upright Microscopes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 375.7 million |

|

Forecast Year Market Size (2035) |

USD 710.3 million |

|

Regional Scope |

|

Clinical Upright Microscopes Market Segmentation:

End-user Segment Analysis

Based on end user, the hospitals segment is expected to garner the largest revenue share of 55.4% in the clinical upright microscopes market by the end of 2035. The segment receives huge support from continued investments in healthcare infrastructure, particularly in terms of emerging economies. Besides the growth in the hospital-based diagnostic labs, increased spending on advanced imaging solutions is also a major driving factor for this segment. Furthermore, these investments are increasing to meet the growing healthcare demands, which also include diagnostic equipment.

Application Segment Analysis

In terms of application clinical diagnostics segment is expected to attain a share of 50.8% in the clinical upright microscopes market by the end of 2035. The increasing burden of chronic diseases, such as cancer, infectious diseases, and autoimmune disorders that require detailed cellular analysis, is the key factor behind this leadership. In March 2025, Nikon reported that it efficiently released Version 1.4 of its ECLIPSE Ui digital microscope software, thereby enhancing pathology workflows with new features like Tile View and Layer View for comparing up to 10 specimens simultaneously.

Product Type Segment Analysis

Based on product type optical upright microscopes segment is anticipated to capture a share of 45.5% in the clinical upright microscopes market during the analyzed time frame. The established presence, reliability, and relatively lower cost when compared to digital and hybrid systems are driving growth in this segment. In this regard, Fairfield Memorial Hospital in June 2025 announced that it has acquired an Olympus BX43 upright clinical microscope, funded by the FMH auxiliary, which enhances diagnostic accuracy and supports in-house testing with advanced optics.

Our in-depth analysis of the clinical upright microscopes market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Application |

|

|

Product Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clinical Upright Microscopes Market - Regional Analysis

North America Market Insights

North America is predicted to hold the highest share of 38.8% in the global clinical upright microscopes market throughout the discussed tenure. The leadership is primarily driven by the increasing volume of cancer and infectious disease diagnostics, which account for a major portion of hospital-based microscopy use. Besides the prevention and public health fund, established by the Affordable Care Act, which supports investments in prevention and public health to improve overall health outcomes in the U.S.. Moreover, it also enables funding grants for evidence-based programs such as community prevention, immunizations, screenings, and workforce training to enhance healthcare quality and strengthen public health infrastructure across the country.

The U.S. clinical upright microscopes market is undergoing a rapid AI-driven transformation, with labs expected to adopt AI-integrated systems. In this regard, PathAI in July 2025 reported that it has launched the precision pathology network, which is a digital pathology lab network powered by its AISight platform, aimed at advancing AI-driven pathology solutions and precision medicine. The company also stated that the network enables offering early access to new AI algorithms, enabling labs to monetize de-identified real-world pathology. Hence, both traditional microscopy and digital pathology solutions are shaping the future of clinical diagnostics and precision medicine in the country.

Canada in the clinical upright microscopes market is gaining momentum owing to the increased focus on bringing advanced options, with remarkable investments in microscopy upgrades. The University of Alberta, in October 2025, unveiled a USD 8 million Thermo Fisher Titan Krios G4 cryo-electron microscope, which is marked as one of only five in the country and the only one in Alberta. Meanwhile, this advanced tool allows researchers to study biological processes at the molecular level, accelerating discoveries in infectious diseases, cancer, hence positively impacting market expansion.

APAC Market Insights

Asia Pacific is estimated to emerge as the fastest-growing region in the global clinical upright microscopes market during the analyzed timeline. The rising chronic disease burdens and government-led healthcare digitization initiatives are the key engines of the region's progress. For instance, in October 2025, Evident announced that its DSX2000 digital microscope series and IXplore IX85 motorized inverted microscope platform received the Good Design Award 2025 from the Japan Institute of Design Promotion. Hence, such instances improve research efficiency and accuracy, encouraging both buyers and investors, thereby accelerating expansion in this category.

China dominates the overall Asia Pacific clinical upright microscopes market, effectively propelled by the increasing healthcare investments and expanding research facilities. Besides, the country also benefits from the strong focus on improving diagnostic capabilities and the adoption of medical technologies that fuel the demand for high-quality microscopes. Furthermore, there has been an increasing awareness of early disease detection coupled with government initiatives, which are significantly enhancing healthcare infrastructure, hence supporting market expansion.

India represents a potential opportunity for global leaders in the clinical upright microscopes market, owing to the unmet diagnostic needs and a growing number of diagnostic centers and research institutions. In September 2025 MoHFW reported that the country’s Union Minister of State for Health inaugurated the national virus research & diagnostic laboratory, highlighting India’s progress in health research, diagnostics, and indigenous innovations. Thus, such initiatives strengthen the country’s disease surveillance, diagnostic capabilities, and position it as a predominant leader in health research innovation.

Recent Advanced Microscope Installations in India’s Healthcare Institutions (2025)

|

Institution |

Technology Introduced |

Purpose / Use |

Key Benefit |

|

THDC India Ltd. & Vivekanand Netralya |

ZEISS EXTARO 300 Surgical Microscope |

Eye surgeries (esp. in remote/hilly areas) |

Improved precision, better outcomes for underserved patients |

|

Army Hospital R&R |

3D Microscope |

Minimally invasive glaucoma and other eye surgeries |

Faster surgeries, fewer complications, 3D visualization |

|

Amrita Hospital, Faridabad |

Deca-Head Microscope |

Pathology & Microbiology diagnostics, education |

Real-time collaboration, improved diagnostics, and training aid |

Source: Official Press Releases

Europe Market Insights

Europe in the clinical upright microscopes market is likely to grow at a notable pace between 2026 and 2035, while retaining its position as the 2nd largest shareholder in this field. The rising demand for advanced diagnostics makes Germany and France the regional leaders in adoption, which is supported by increased healthcare spending and government-funded R&D. In August 2025 Avasa stated that it secured NZD 4.75 million (USD 3 million) in a pre-series-A funding round to advance its Avasa Coupler, which is a device designed to simplify and speed up microsurgery by enabling safe reconnection of tiny arteries under a microscope, reducing the time and complexity of delicate procedures.

The U.K. represents an epicenter of innovation for the clinical upright microscopes market in Europe, backed by its progressive MedTech culture, pathology lab modernization, and increased diagnostic demand. For instance, in January 2025 University of Strathclyde announced that its scientists had created the world’s first fully 3D-printed microscope in under three hours for less than £50 (USD 60), making advanced microscopy accessible and affordable. Hence, this innovation has the complete potential to democratize access to microscopes, especially in low-income countries and educational settings.

Germany is solidifying its leadership in the Europe clinical upright microscopes market owing to the presence of key industry players and acquisitions, strengthening the product portfolio. In September 2025, B. Braun SE declared that it has fully acquired True Digital Surgery which is, a company specializing in digital robotic-assisted 3D surgical microscopy, to boost advancements and expand its market share in digital microsurgery. Hence, this acquisition strengthens the company’s Aesculap division, enhancing products such as the AEOS system used in neurosurgery, spine, and ENT surgeries.

Key Clinical Upright Microscopes Market Players:

- Carl Zeiss AG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Leica Microsystems (Germany)

- Nikon Corporation (Japan)

- Olympus Corporation (Japan)

- Meiji Techno (Japan)

- ACCU-SCOPE Inc. (U.S.)

- Labomed, Inc. (U.S.)

- Cole-Parmer (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Danaher Corporation (U.S.)

- UNITRON (U.S.)

- Amscope (U.S.)

- Motic (China)

- Bio-Rad Laboratories, Inc. (U.S.)

- Swift Optical Instruments, Inc. (U.S.)

- KRÜSS GmbH (Germany)

- GT Vision Ltd (UK)

- MEDITE Medical GmbH (Germany)

- Scientico (India)

- Magnus Analytics (India)

- Leica Microsystems, the company is based in Germany and is recognized as the global leader in optical precision. It is a part of Danaher Corporation, which has efficiently dominated the clinical upright microscopes market through continuous innovation in imaging technology. The firm also has considerable manufacturing and R&D hubs across different nations is maintains a great presence in terms of pathology, histology, and lab diagnostics.

- ZEISS, which is also called Carl Zeiss Meditec AG, is a major division of the ZEISS Group, which is recognized for its high-performance clinical microscopes used in both surgical and diagnostic applications. The company hosts a robust product portfolio enabling support for both upright and surgical microscopy for ENT, neuro, and pathology applications, with manufacturing footprints in Europe, the U.S., and Asia.

- Olympus, which is rebranded as Evident in 2022, Olympus's life sciences and industrial microscopy division will remain a central player in the upright microscope market. The firm’s strategic acquisition positions itself as a digital pathology leader, combining its legacy in both superior optics with AI-driven workflows.

- Nikon Instruments Inc. is based in Japan and has maintained a very strong presence in this field in recent years. It also has an ECLIPSE series, which is known for modularity, ergonomic design, and optical clarity. The company focuses on integrating digital imaging systems with AI capabilities for diagnostic precision and real-time analysis, benefiting greatly from global distribution and support networks.

- Motic is a subsidiary of the Hong Kong-based Motic Group, which offers cost-effective and technologically advanced upright microscopes for clinical, educational, and research settings. Its Panthera and BA series are especially popular in emerging markets for their digital capabilities and ease of use, thereby strengthening the brand name in the global market.

Below is the list of some prominent players operating in the global market:

The commercial dynamics of the clinical upright microscopes market are controlled by intense competition, where key players, including Zeiss, Leica, Olympus, and Nikon, collectively hold maximum revenue share. These established leaders in this field are extensively focusing on AI integration, modular designs, and diagnostic lab partnerships to secure their dominant positions. For instance, in August 2025, Evident reported that it had finalized the acquisition of Pramana, Inc., which is a pioneer in AI-powered autonomous whole slide imaging systems. Furthermore, this strategic move enables the integration of its advanced clinical microscopy expertise with Pramana’s digital pathology innovations to drive the next phase of Digital Pathology 2.0.

Corporate Landscape of the Clinical Upright Microscopes Market:

Recent Developments

- In July 2025, ZEISS Medical Technology announced the successful launch and NMPA approval of the PENTERO 800 S surgical microscope, which integrates 4K 3D imaging, enhanced depth of field, and ultra-high magnification tailored for neurosurgery, ENT, and reconstructive surgery.

- In May 2025, Leica Microsystems reported that it had launched the Visoria series of upright microscopes, which includes Visoria B (clinical/lab), Visoria M (materials), and Visoria P (polarization) to improve user efficiency and comfort across clinical, life science, and industrial applications.

- Report ID: 7792

- Published Date: Oct 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clinical Upright Microscopes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.