Clinical Immunoanalyzer Market Outlook:

Clinical Immunoanalyzer Market size was over USD 6.06 billion in 2025 and is projected to reach USD 10.73 billion by 2035, witnessing a CAGR of 5.81% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of clinical immunoanalyzer is estimated at USD 6.42 billion.

Significant research and development are playing a pivotal role in augmenting the growth of the market by carefully enhancing the efficacy and clinical applicability. Exhaustive research and development efforts are resulting in the development of high-sensitivity assays and novel biomarkers. This is expanding the extent of detection of the diseases and observance across a wide area, such as oncology and other infectious diseases. Significant investment in research and development has been made by Abbott and Siemens Healthcare, which is further fostering product differentiation and increasing market competition.

The market growth is also closely associated with the resilience of the supply chain. Many high-quality reagents and precision components are sensitive to temperature and need adequate cold chain logistics. Any kind of disruption in the transportation or manufacturing can deter the overall operations of the laboratory. Governments all across the world are acknowledging these challenges and implementing measures to make a robust supply chain. The U.S., EU, and Japan are endeavoring to lower the dependency on imports to ensure continuity in diagnostics.

Key Clinical Immunoanalyzer Market Insights Summary:

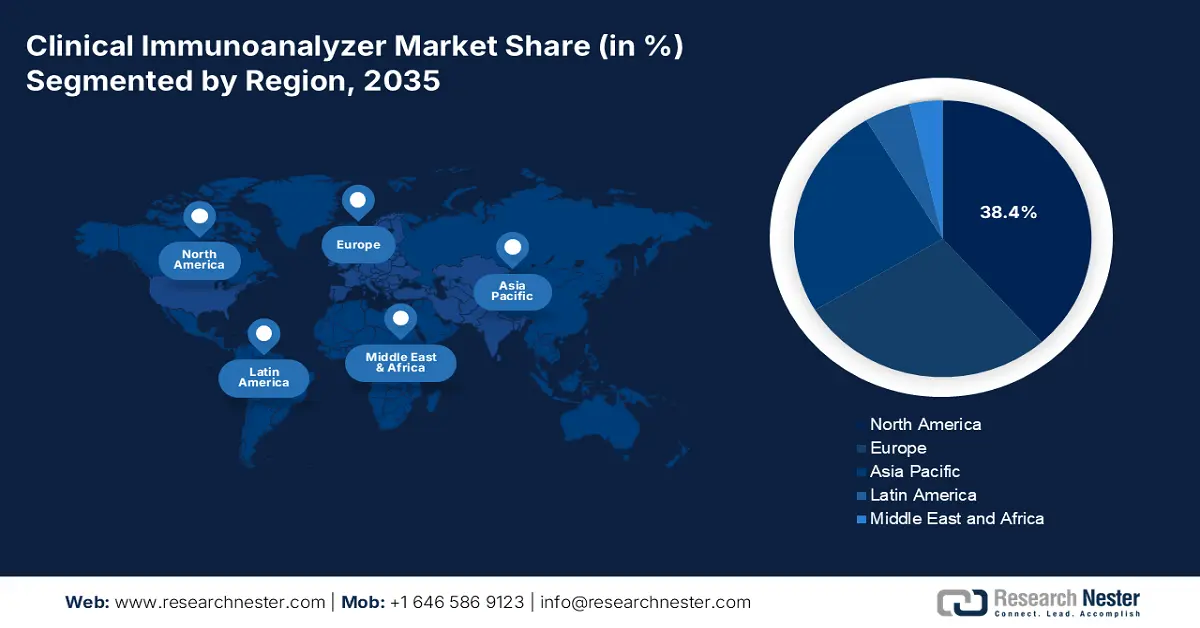

Regional Insights:

- By 2035, North America is expected to capture a 38.4% share of the clinical immunoanalyzer market, upheld by advancements in healthcare infrastructure.

- Asia Pacific is projected to rise as the fastest-growing region by 2035, supported by expanding manufacturing capabilities and policy-led innovation.

Segment Insights:

- By 2035, the chemiluminescence immunoassay (CLIA) segment is anticipated to secure a 38.5% share of the clinical immunoanalyzer market, bolstered by its superior diagnostic performance.

- The hospitals & diagnostic labs segment is forecasted to attain a 45.3% share by 2035, underpinned by escalating volumes of routine patient screenings.

Key Growth Trends:

- Surge in prevalence of chronic and infectious diseases

- Surge in investment in Research and development

Major Challenges:

- High cost associated with the advanced immunoassay systems

- Strict regulatory landscape

Key Players: Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, Danaher (Beckman Coulter), Bio-Rad Laboratories, Ortho Clinical Diagnostics, Mindray, Becton Dickinson (BD), DiaSorin, bioMérieux, PerkinElmer, Randox Laboratories, Snibe, Trivitron Healthcare, SD Biosensor, Biomerica

Global Clinical Immunoanalyzer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.06 billion

- 2026 Market Size: USD 6.42 billion

- Projected Market Size: USD 10.73 billion by 2035

- Growth Forecasts: 5.81% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Singapore

Last updated on : 5 November, 2025

Clinical Immunoanalyzer Market - Growth Drivers and Challenges

Growth Drivers

- Surge in prevalence of chronic and infectious diseases: The rising prevalence of chronic conditions, such as cancers, diabetes, etc., is bolstering the demand for modern solutions, including clinical immunoanalyzers. Hospitals and diagnostic labs are significantly investing in immunoanalyzers to aid in timely clinical decision-making and handle the burgeoning patient burden, thereby directly bolstering the market growth. Other than this, outbreaks of infectious diseases such as Zaire ebolavirus, Measles Resurgence, Entevovirus D68, etc., have highlighted the importance of reliable laboratory diagnostics. Diagnostic laboratories and hospitals are investing in immunoanalyzers to manage the rising patient burden, thereby fostering the market growth.

|

Mental Health Disorder |

Estimated Global Number of Affected Individuals (2021) |

|

Anxiety Disorders |

359 million (including 72 million children and adolescents) |

|

Depressive Disorders |

332 million |

|

Schizophrenia |

24 million |

|

Bipolar Disorder |

60 million |

|

Child and Adolescent Mental Disorders |

293 million aged 5–24 years |

Source: WHO

- Surge in investment in Research and development: The rising investment by prominent market players in conducting exhaustive research and development is fostering rigorous innovation in changing immunoanalyzer technologies. Companies are focusing on expanding menus, enhancing sensitivity, and innovating advanced biomarkers for the detection of early disease. These kinds of innovations increase the utility of the immunoanalyzers and stand out from the products of the competitors. Moreover, prominent manufacturers are joining hands with research and making organizations speed up the discovery of new technology biomarkers, further augmenting the market growth.

- Growing demand for the point of care and decentralized diagnostics: The worldwide healthcare industry is going through a transition and advancing in point-of-care diagnostics. Portable immunoanalyzers are facilitating rapid testing in remote locations and various community health centers. Global manufacturers are emphasizing making compact and cost-efficient analyzers, propelling growth opportunities. According to the World Health Organization, over 40,000 in vitro IVD products are available worldwide. Extensive support for worldwide organizations is further creating a stable demand for immunoanalyzer, thereby augmenting market growth.

Challenges

- High cost associated with the advanced immunoassay systems: These instruments have an exorbitant cost related to the advanced systems. These factors can prohibit small laboratories, mainly in the developing regions. Additionally, the purchase cost and other maintenance costs further increase the total cost of ownership. These factors are limiting the penetration in the low-resource settings. Additionally, supply chain dependency poses another challenge, raising vulnerability in the logistics.

- Strict regulatory landscape: These devices must adhere to the rigorous certification process from the regulatory agencies. The process includes exhaustive documentation and surveillance, which raises cost and time for the manufacturers. Meeting the standard for compliance is also changing rapidly to meet the standard with the technological trends, further slowing down the rollouts and delaying the launch of the novel diagnostic solutions.

Clinical Immunoanalyzer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.81% |

|

Base Year Market Size (2025) |

USD 6.06 billion |

|

Forecast Year Market Size (2035) |

USD 10.73 billion |

|

Regional Scope |

|

Clinical Immunoanalyzer Market Segmentation:

Product Type Segment Analysis

The chemiluminescence immunoassay (CLIA) segment is expected to dominate the clinical immunoanalyzer market with a 38.5% share over the assessed period. Its superior diagnostic capabilities are clinically proven to be the gold standard of analytical assessments, making it the first choice for both service providers and patients. Additionally, the high throughput rendered by the CLIA lowers the human error and upgrades the laboratory efficiency. The current innovations in making the compact CLIA platforms are widening the applications, reinforcing the position as a pioneering product in the market.

End-user Segment Analysis

The hospitals & diagnostic labs segment is poised to hold the largest share of 45.3% in the clinical immunoanalyzer market by the end of 2035. The dominance of the segment is fueled by large number of samples from patients reaching hospitals for routine screening. Various hospitals and large diagnostic laboratories are usually initial adopters of advanced and automated immunoanalyzers. Moreover, a plethora of diagnostic laboratory functions is further increasing demand for the high-capacity analyzers. Subsequently, these labs are continuing to play a prominent role in augmenting the market growth.

Component Segment Analysis

The reagents and consumables segment is anticipated to garner significant growth during the forecasted period. The growth of the market can be attributed to the expanding test menus. Unlike the instruments, which are less frequently bought, reagents and consumables are required to be constantly replaced. Various laboratories and hospitals have long-term supply contracts that ensure regular sales. These reagents are usually upgraded for testing more types of substances or diseases, and more reagents are required, which further raise the sales.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Sub-segment |

|

Product Type |

|

|

Component |

|

|

End user |

|

|

Applications |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clinical Immunoanalyzer Market - Regional Analysis

North America Market Insights

North America is anticipated to garner the highest revenue share of 38.4% in the clinical immunoanalyzer market throughout the analyzed timeline. The region's leadership is primarily fed by its advanced healthcare infrastructure, substantial government investments, and enlarging patient pool. Moreover, the presence of well-established diagnostic laboratories and exhaustive research and development activities further reinforces the market position in the region. Also, the strategic collaboration between prominent market players, along with the favorable reimbursement policies, is projected to sustain the region’s dominance during the forecasted period.

The market in the U.S. is witnessing significant growth owing to a surge in the prevalence of chronic diseases and technological advancements. According to the Centers for Disease Control and Prevention in 2024, among adults aged 65 and older, more than 90% suffer from at least 1 chronic condition. Other than this, the rising healthcare investments are supporting the adoption of advanced diagnostic technologies. A lot of healthcare providers are amalgamating immunoanalyzers to enhance the diagnostic accuracy and the outcomes of the patients.

The market in Canada is witnessing significant growth, bolstered by numerous factors such as an aging population and chronic disease prevalence. According to data published by the Government of Canada, over 861,000 people aged 85 and older were counted in 2021. The development of an advanced immunoassay has significantly enhanced the accuracy of the detection of diseases. Healthcare providers are significantly adopting these technologies to render precise and timely diagnostics. Also, the government initiatives in the healthcare infrastructure are supporting the adoption of modern diagnostic technologies.

APAC Market Insights

Asia Pacific is predicted to emerge as the fastest-growing region in the market by the end of 2035. Being the home to manufacturing powerhouses, such as China and India, the region is gaining traction in this sector. Additionally, the proactive participation and frequent investments from governing bodies in both developed and underdeveloped economies are fueling innovation and maximum deployment in this sector. In China, the market growth is propelled by the surge in the aging population and government initiatives. There has been an increased demand in the country for the demand for decentralization diagnostics with portable analyzers. Additionally, the domestic players are growing in the country and partially meeting local demand and further lowering the dependence on imports.

In India, the market growth is driven by the rising adoption of mobile/last-mile diagnostic laboratories. For instance, in September 2023, the Rajiv Gandhi Centre for Biotechnology developed a mobile virology lab that rendered expert results within 6 hours after testing samples. The launch was to strengthen efforts to contain the Nipah virus infection found in the Kozhikode district. The growth of the market in the country is also driven by the stringent regulations and quality standards set by the government. These factors are propelling the market growth in the country.

Europe Market Insights

The market in Europe is set to garner staggering growth by 2035. The growth of the market can be attributed to the rapidly aging populations and increasing chronic disease prevalence. Also, the governments are spending significantly on healthcare infrastructure and diagnostic capabilities. The adoption of clinical immunoanalyzers is happening on a vast scale in diagnostic laboratories and hospitals to fulfill the requirement of efficient and accurate solutions for diagnostics. There have been significant innovations, such as the introduction of fully automatic dry fluorescence immunoanalyzers are enhancing the diagnostic capabilities.

The Germany clinical immunoanalyser market is going through steady growth driven by technological advancements and government support. Another prominent factor augmenting the market growth is the aging population in the country. According to data published by AARP International, the country’s population of age 65 years and older is anticipated to increase by 41% or nearly 24 million by 2050. Other than this, the country’s adherence to strict regulatory policies is propelling the market growth in the country.

The market in the UK is propelled by the expansion of community diagnostic centers and a faster diagnostic push. According to data published by NHS England in September 2025, the country’s Community Diagnostic Centre (CDC) Programme has permitted 170 sites across England. These centers are capable of conducting a variety of tests and easing the burden on the hospitals, and speeding up the diagnosis. Also, there is a significant investment in the country for expanding the diagnostic innovation and further supporting diagnostic infrastructure and elective recovery.

Key Clinical Immunoanalyzer Market Players:

- Roche Diagnostics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Siemens Healthineers

- Thermo Fisher Scientific

- Danaher (Beckman Coulter)

- Bio-Rad Laboratories

- Ortho Clinical Diagnostics

- Mindray

- Becton Dickinson (BD)

- DiaSorin

- bioMérieux

- PerkinElmer

- Randox Laboratories

- Snibe

- Trivitron Healthcare

- SD Biosensor

- Biomerica

A majority of the commercial dynamics of the market consists of consolidation from Roche, Abbott, and Siemens, who collectively control 55.1% of global revenue. They are following tailored pathways to conquer individual landscapes, such as advancements in AI-driven automation for developed nations and, the introduction of cost-effective solutions for price-sensitive regions. For instance, Thermo Fisher acquired Magellan Diagnostics in a transaction of $1.3 billion to strengthen its market position.

The top contenders of this cohort of key players are:

Recent Developments

- In September 2025, Siemens Healthineers at the IBMS 2025 Congress presented a growing Atellica diagnostic portfolio. These instruments underscore Siemens’ push to combine central-lab standardization with decentralized, rapid testing.

- In April 2025, Beckman Coulter Diagnostics received U.S. FDA 510(k) clearance for its DxC 500i Clinical Analyzer, an integrated system that combines the company's DxC 500 AU Clinical Chemistry Analyzer and Access 2 Immunoassay System.

- Report ID: 7800

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clinical Immunoanalyzer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.