Clinical Flame Photometers Market Outlook:

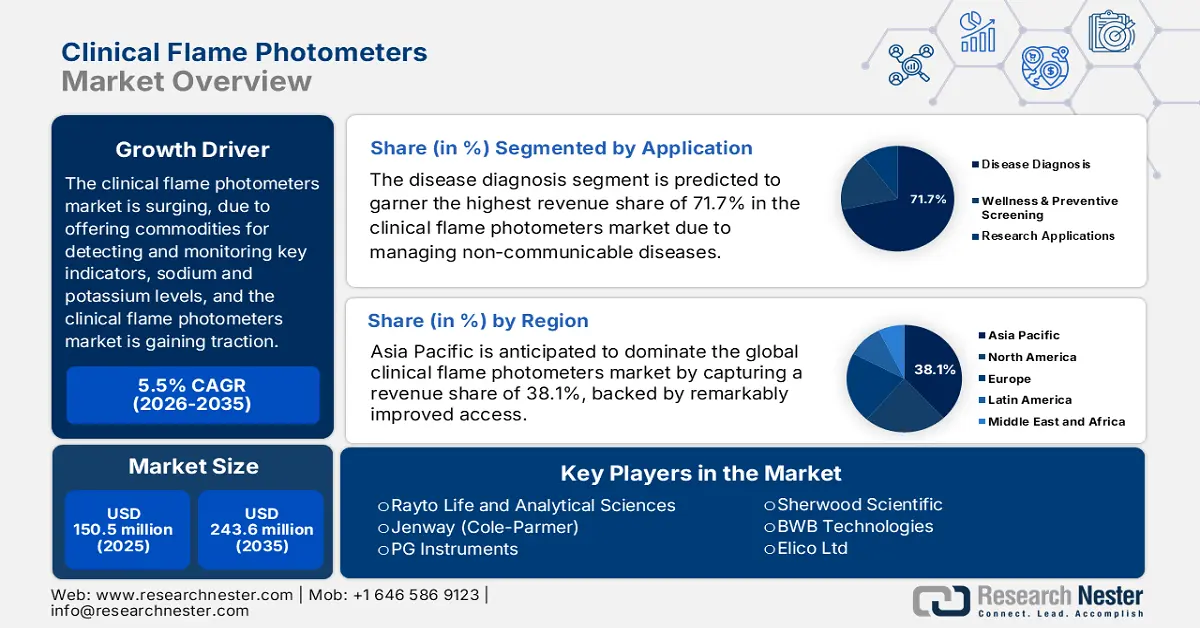

Clinical Flame Photometers Market size was over USD 150.5 million in 2025 and is estimated to reach USD 243.6 million by the end of 2035, expanding at a CAGR of 5.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of clinical flame photometers is estimated at USD 158.7 million.

The international market is considered a niche and stable segment within the global in-vitro diagnostics sector, highly dedicated to ensuring precision in electrolyte levels quantification in urine and human serum. According to an article published by NLM in July 2023, when the serum sodium level is less than 135 mmol/L, hyponatremia is diagnosed, and occurs when the sodium level is more than 145 mmol/L. In addition, symptoms include restlessness, sleeping disorders, and tachypnea, thus denoting a positive impact and increased demand for the market across different nations.

Moreover, factors such as product connectivity and modernization, tactical focus on portable systems, regional penetration, and market consolidation are also uplifting the clinical flame photometers market globally. As per an article published by MDPI in April 2022, the prototype Blynk Internet of Things (IoT) system, as a portable device, effectively provides more than 37.5 degrees Celsius body temperature, constituting a median variance of less than 1%, and is immensely dependable, with a 100% IoT-based data broadcast success rate. Meanwhile, notable manufacturers are focused on boosting current benchtop units, with features, including connectivity, internal data storage, and touchscreen interfaces, thereby denoting an optimistic outlook for the market.

Key Clinical Flame Photometers Market Insights Summary:

Regional Insights:

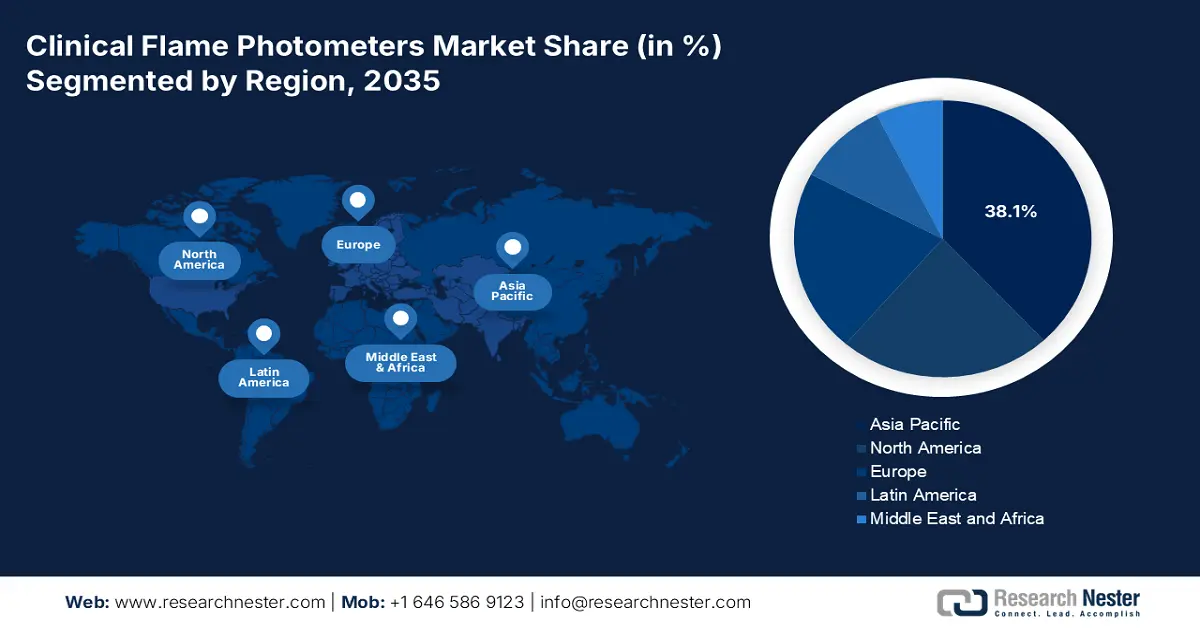

- The Asia Pacific Clinical Flame Photometers Market is anticipated to command a 38.1% share by 2035, bolstered by the rising prevalence of chronic conditions and rapid advancements in healthcare digitalization and infrastructure.

- Europe is expected to register the fastest growth through 2026–2035, stimulated by the surge in rare diseases and supportive regional policies enhancing localized electrolyte monitoring accessibility.

Segment Insights:

- The disease diagnosis segment in the Clinical Flame Photometers Market is projected to hold the largest 71.7% share by 2035, propelled by its critical role in electrolyte evaluation for addressing global non-communicable disease epidemics.

- The sodium and potassium analyzers segment is expected to secure the second-highest share by 2035, owing to its essential use in routine electrolyte panels for managing a wide spectrum of chronic and acute medical conditions.

Key Growth Trends:

- Increase in cardiac disease burden

- Expansion in healthcare and medical facilities

Major Challenges:

- Restrictions in profit margins and price controls

- Protracted delay in administrative clearances

Key Players: BWB Technologies (UK), Jenway (Cole-Parmer) (U.S.), Sherwood Scientific (UK), PG Instruments (UK), Elico Ltd (India), Rayto Life and Analytical Sciences (China), Samsung Lab Automation (South Korea), Labtron Equipment (UK), Spectrolab Systems (Germany), Bibby Scientific (UK), Labnics Equipment (Malaysia), ELICO (India), Labdex (Australia), PCE Instruments (Germany), Labtronics (India), Koehler Instrument (U.S.), Labocon (UK), Labstac (Malaysia), Labtech (Italy), Hitachi High-Tech (Japan), JEOL Ltd. (Japan), Shimadzu Corporation (Japan).

Global Clinical Flame Photometers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 150.5 million

- 2026 Market Size: USD 158.7 million

- Projected Market Size: USD 243.6 million by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Malaysia, Brazil, Mexico, Indonesia

Last updated on : 22 October, 2025

Clinical Flame Photometers Market - Growth Drivers and Challenges

Growth Drivers

- Increase in cardiac disease burden: The international burden of cardiac disorders is severe for the market, since this creates a huge demand for cost-effective, accurate, and rapid electrolyte analysis. According to an article published the CDC in October 2024, 1 person dies every 34 seconds from this disease, while 919,032 people were affected as of 2023, accounting for 1 in every 3 deaths. Besides, heart disease expenses amount to almost USD 417.9 billion, which includes lost productivity, medicines, and healthcare services, thereby suitable for bolstering the market requirement.

- Expansion in healthcare and medical facilities: The aspect of administrative strategies in Latin America and the Asia Pacific is increasingly upgrading and developing clinical laboratories. This expansion is readily fueling the installation of the newest affordable analytical equipment, with flame photometers fundamentally being purchased for usual diagnostic capabilities. For instance, as per the June 2024 ITA data report, the Government of India (GOI) has significantly provided a 12.5% increase in the 2024 budget by readily prioritizing health and medical spending, along with a focus on facility development, thus positively impacting the clinical flame photometers market.

- Presence of cost-efficiency per test: The cost-per-analysis in the market in high-volume environments, particularly for routine sodium and potassium testing, remains lower than that of complicated and integrated analyzers. Besides, this factor effectively ensures its ongoing placement in reference laboratories and hospitals for specific test panels. Besides, it also comprises results or services production by utilizing the least amount of resources, which is significantly possible without the need for compromising quality, thereby positively catering to the market’s upliftment.

Serum Sodium and Serum Potassium Laboratory Values Boosting the Clinical Flame Photometers Market (2023)

|

Components |

Serum Sodium (mmol/L) |

Serum Potassium (mmol/L) |

|

Normal range |

135 to 145 |

3.6 to 5.5 |

|

Mild to moderate hyponatremia |

125 to 135 |

Less than 3.6 and 2.5 |

|

Severe hypokalemia |

Less than 125 |

Less than and greater than 2.5 |

|

Mild to moderate hypernatremia |

145 to 160 |

5 to 5.5 and 5.5 to 6.5 |

|

Severe hypernatremia |

Greater than 160 |

6.5 to 7.0 |

Source: NLM

Challenges

- Restrictions in profit margins and price controls: Despite the enhanced rate of implementation, the government’s limitations on premium pricing might impose financial losses on the global clinical flame photometers market, especially for branded products. In this regard, the Europe Commission highlighted significant reductions in profit margins, owing to the Medical Device Regulation (MDR) commencement that has mandated stringent pricing caps across Europe. However, to combat this challenge, organizations are deliberately partnering with authorized insurers and readily supplying government-specific screening programs to achieve standard profitability.

- Protracted delay in administrative clearances: The existence of strict regulatory processes in notable and emerging landscapes is continuing to display huge hurdles in the clinical flame photometers market internationally. For instance, the reformation of the regulations from the Pharmaceuticals and Medical Devices Agency (PMDA) extended approval timelines by more than half a month, particularly in Japan. Therefore, such delays significantly impact market entries, pertaining to innovative technologies by reducing the advanced diagnostic solution integration, thus causing a hindrance in the market’s upliftment.

Clinical Flame Photometers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 150.5 million |

|

Forecast Year Market Size (2035) |

USD 243.6 million |

|

Regional Scope |

|

Clinical Flame Photometers Market Segmentation:

Application Segment Analysis

The disease diagnosis segment in the market is anticipated to account for the largest share of 71.7% by the end of 2035. The segment’s upliftment is effectively driven by its pivotal role in electrolyte evaluation in administering international non-communicable disease epidemics. According to an article published by NLM in March 2025, this particular disease category accounts for 74% of deaths, along with 86% premature deaths, particularly across low- and middle-income nations as of 2023. Therefore, this application readily caters to rare kidney disease, cardiovascular disorder, and hypertension, thereby bolstering the segment’s exposure.

Type Segment Analysis

The sodium and potassium analyzers segment in the clinical flame photometers market is expected to account for the second-highest share during the predicted duration. The segment’s growth is primarily attributed to its status as a vital tool for the most frequently ordered clinical chemistry evaluation, which is the electrolyte panel. Besides, the aspect of potassium and sodium is effective for managing and diagnosing a massive array of chronic and acute conditions, especially from kidney failure and dehydration to hypertension and cardiac arrhythmias, which creates an optimistic outlook for the overall segment.

Technology Segment Analysis

The conventional flame photometers segment in the market is expected to garner the third-highest share by the end of the projected period. The segment’s development is highly driven by its importance for its affordability, simplicity, and speed, especially for the analysis of alkaline and alkali earth metals. In addition, it is considered an essential application, pertaining to the accurate and rapid determination of potassium and sodium levels, especially in cerebrospinal fluid, urine, and serum, thus making it suitable for the segment’s growth.

Our in-depth analysis of the clinical flame photometers market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Type |

|

|

Technology |

|

|

Sales Channel |

|

|

Modality |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clinical Flame Photometers Market - Regional Analysis

APAC Market Insights

Asia Pacific market is anticipated to garner the largest share of 38.1% by the end of 2035. The market’s upliftment in the region is highly attributed to an increase in chronic conditions, which effectively affects the majority of the population in India and China. In addition, an upsurge in robust healthcare digitalization as well as infrastructural development is also fostering huge cash inflow and progression in the region’s market. For instance, the aspect of technological advancements, especially in AI device penetration in South Korea, has readily contributed to cost-effectiveness, while the MedTech foreign direct investment (FDI) surge in Malaysia is also bolstering the market in the region.

Chronic Diseases in Asia Boosting the Clinical Frame Photometers Market (2023)

|

Components |

Prevalence |

|

Regional prevalence |

81.1% |

|

Old adults |

179.9 million |

|

80 to 84 years |

87.2% |

|

Women affected |

84.2% |

|

Men affected |

77.7% |

|

Rural residents |

82.6% |

|

Ethnic minorities |

82.2% |

|

Urban residents |

79.7% |

|

Han ethnicity |

81.0% |

Source: Journal of the American Medical Directors Association

China market is growing significantly, owing to its dominating role, both as a consumer base and major producer, catering to the majority of international exports. According to an article published by NLM in September 2022, the fiscal subsidy, particularly for public health in the country increased from RMB 15 per capita as of 2009 to RMB 84 per capita as of 2022. Additionally, 234 were successfully procured by NHSA between 2018 and 2022, which accounted for almost 30% of overall drug utilization among public hospitals. Therefore, all these factors are extremely essential for boosting the market’s exposure in the country.

The market in India is also growing due to the aspect of strong propagation through government-aided approaches, along with modernization in localized healthcare facilities. Besides, as per the 2023-2024 ICMR data report, the administrative body readily utilized 99.7% of their Rs. 2,350.1 crores budget allocation to successfully fund both extramural and intramural research initiatives. Of this overall allocation, Rs. 698.9 crore has been provided to make advancements across medical institutes, and Rs. 896.1 crore for driving biomedical research, thereby positively impacting the market’s growth.

Europe Market Insights

Europe market is expected to emerge as the fastest-growing region during the predicted duration. The market’s development in the overall region is highly fueled by an upsurge in rare diseases, which has created a massive need for electrolyte monitoring for patients. Besides, according to an article published by AHAIASA Journals in May 2022, the 140/90 mm Hg proportion of hypertension in Europe was 46.7, ranging between 46.5% to 46.8%. Likewise, the 130/80 mm Hg proportion accounted for 67.1, ranging between 67.0% to 67.3%. This has readily pushed governing bodies in the region to enact favorable and subsidiary policies to enhance the localized accessibility and production of the market.

The clinical flame photometers market in the UK is also gaining a robust commitment to accelerate commercial and economic success, with a generous allocation of budget from the National Health Service (NHS). For instance, as per the July 2025 NLM article, the aspect of healthcare expenditure in the country is projected to increase to 2.8% between 2025 and 2026, as well as by 3.7% between 2028 and 2029. Besides, the country has also readily focused on prioritizing artificial intelligence-based devices for effectively managing chronic conditions. Therefore, this indicates that standard funding proactively accelerates diagnostic progression, which is suitable for the market’s upliftment.

The market in Germany is also gaining increased traction, owing to its leadership, which is supported by laboratory-specific investments and the upgradation of administrative policies. As per the April 2025 NLM article, the Federal Statistical Office stated that the spending for laboratory services amounted to € 12.9 billion as of 2022, catering to 2.6% of overall healthcare costs. In addition, the per capita expenditure on laboratory-based diagnostics accounted for € 150 every year, denoting a continuous increase by € 4.5 billion between 2012 and 2022, constituting a 55% growth rate, which denotes an optimistic outlook for the overall market in the country.

North America Market Insights

North America market is projected to grow steadily by the end of the predicted timeline. The market’s exposure in the overall region is fueled by an enlargement in the patient pool, remarkable optimization in accessibility for innovative health and medical facilities. According to an article published by NLM in March 2022, chronic kidney disease in the region is considered a progressive disorder, affecting more than 10% of the population, amounting to over 800 million patients. Subsequently, this demographic is expected to increase every year, which results in a rising demand for clinical services both from diagnostic laboratories and domestic hospitals. Meanwhile, the region’s well-established clinical facility is also another factor for driving the overall market in the region.

The clinical flame photometers market in the U.S. is gaining increased exposure, owing to the country’s leadership, catering to boosted accessibility, along with technology-based progressions. As per an article published by the CDC in May 2024, over 1 in 7 adults in the country are severely affected with a rare kidney condition, while 9 in 10 are unaware of the disease, and almost 360 people commence treatment for kidney failure. Besides, the cost pertaining to treatment for Medicare beneficiaries amounts to USD 87.2 billion. Therefore, with the increased prevalence and the availability of reimbursement services, there is a huge growth opportunity for the market.

Canada market is also developing due to the existence of coordinated public and private allocations, as well as provincial healthcare strategies. As stated in an article published by Ontario Canada in 2025, the city’s investments for more than 10 years resulted in USD 48 billion to effectively support the rising demands of health and medical care systems. The provision of such funding is poised to bolster capacities in hospitals, develop the latest health infrastructure, and successfully renew current community health centers and hospitals, thereby making it suitable for the market’s growth in the country.

Key Clinical Flame Photometers Market Players:

- BWB Technologies (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jenway (Cole-Parmer) (U.S.)

- Sherwood Scientific (UK)

- PG Instruments (UK)

- Elico Ltd (India)

- Rayto Life and Analytical Sciences (China)

- Samsung Lab Automation (South Korea)

- Labtron Equipment (UK)

- Spectrolab Systems (Germany)

- Bibby Scientific (UK)

- Labnics Equipment (Malaysia)

- ELICO (India)

- Labdex (Australia)

- PCE Instruments (Germany)

- Labtronics (India)

- Koehler Instrument (U.S.)

- Labocon (UK)

- Labstac (Malaysia)

- Labtech (Italy)

- Hitachi High-Tech (Japan)

- JEOL Ltd. (Japan)

- Shimadzu Corporation (Japan)

- BWB Technologies is one of the most prominent specialists, well-known for its strong and high-precision flame photometers, especially for its Optimum range, which sets industrial benchmarks for reliability and accuracy in clinical diagnostics. Besides, the company has consistently made investments in research and development to optimize analytical performance and maintain user safety.

- Jenway (Cole-Parmer) has been leveraging its position within a worldwide laboratory supply conglomerate to provide a versatile portfolio of analytical instruments, which includes flame photometers. Their effective contribution depends on the extended distribution, along with the support network, thereby ensuring comprehensive access for clinical labs across North America and other notable economies.

- Sherwood Scientific has significantly established itself with a long-lasting reputation for manufacturing cost-effective and durable flame photometers. Such as the traditional Model 420. Additionally, the organization is focused on delivering crucial functionality at a competitive cost, which has made it a suitable supplier for cost-effective laboratories.

- PG Instruments effectively specializes in manufacturing and designing a range of analytical instruments. This includes flame photometers that readily emphasize reliable and operational results for routine electrolyte analysis. Besides, as per its 2024 annual report, the company’s net sales is valued at USD 84 billion, with USD 18.5 billion as operating income, and USD 19.8 billion as operational cash flow.

- Elico Ltd is one of the most critical players in making flame photometry easily accessible by providing a wide range of competitively priced instruments that are perfectly suited for the intensified growth, particularly in the Asia Pacific and other developing nations. Additionally, the organization’s strength exists in its strong regional manufacturing, thus permitting affordable production processes and robust regional distribution.

Here is a list of key players operating in the global market:

The worldwide market significantly features distinctive and competitive tiers, based on which manufacturers from the UK and the U.S. are successfully leading through innovations in automation and artificial intelligence. Besides, notable players in the Asia Pacific region, such as Samsung, Rayto, and Hitachi, are competing on cost efficiency as well as IoT integration to effectively dominate price-sensitive economies. In addition, this standard leadership has been conducted through cost-optimized and domestic production processes. Besides, in December 2024, Konica Minolta, Inc. declared the launch of the CM-3700A, which is one of the flagship spectrophotometer model, suitable for quality control and color management, thus driving the market’s upliftment.

Corporate Landscape of the Clinical Flame Photometers Market:

Recent Developments

- In October 2025, CalciMedica Inc., along with Telperian, declared a strategic collaboration for integrating Telperian’s artificial intelligence engine into clinical trial dataset analysis from accomplished clinical trials of Auxora.

- In October 2025, OpenAI and Broadcom notified a partnership for 10 gigawatts of customized AI accelerators and ensure Ethernet solutions for scale-up and scale-out, along with cater to connectivity solutions.

- Report ID: 7793

- Published Date: Oct 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clinical Flame Photometers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.