Clinical Trinocular Microscopes Market Outlook:

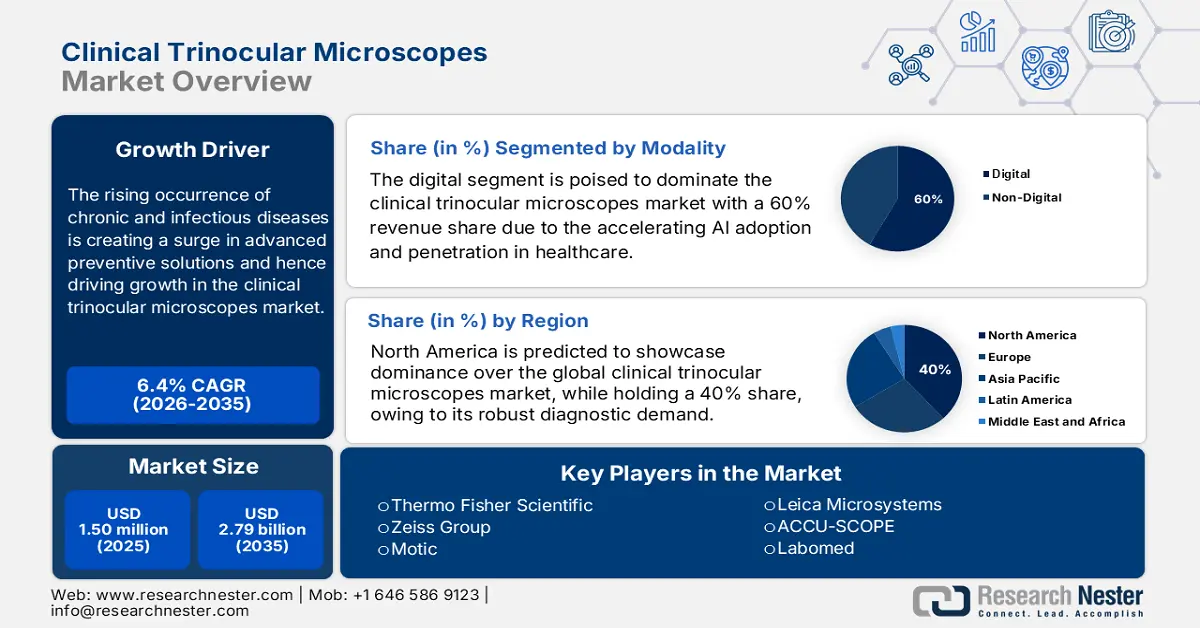

Clinical Trinocular Microscopes Market size was over USD 1.50 billion in 2025 and is projected to reach USD 2.79 billion by 2035, witnessing a CAGR of 6.4% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of clinical trinocular microscopes is estimated at USD 1.60 billion.

The rising occurrence of chronic and infectious diseases, such as cancer and tuberculosis, is creating a surge in advanced preventive solutions and hence driving growth in the clinical trinocular microscopes market. According to data published by the World Health Organization, non-communicable diseases kill 41 million people each year. Thus, due to having an essential role in pathology and diagnosis, the demand for these laboratory instruments is increasing. Furthermore, the burgeoning adoption of digital imaging systems and the amalgamation of advanced imaging cameras in trinocular microscopes are upgrading the digital precision in clinical laboratories and research organizations.

The surge in pressure on costs across the supply chain and distribution networks is putting significant price constraints on the market. The rising expenses associated to the optical components and precision engineering have raised the overall cost of production for the manufacturers. To acknowledge the surge in distribution as well as production costs, a plenty of companies are adopting vertical integration as well as localized manufacturing. Additionally, firms are inclining towards modular microscope designs, which allow for convenient maintenance and cost-efficient upgrades.

Key Clinical Trinocular Microscopes Market Insights Summary:

Regional Insights:

- By 2035, North America is predicted to hold a 40% share of the clinical trinocular microscopes market, underpinned by its robust healthcare infrastructure and extensive research and development investments.

- Across 2026–2035, Asia Pacific is anticipated to expand at the fastest pace, supported by exponentially increasing disease burdens and government-led digital transformation initiatives.

Segment Insights:

- By 2035, the digital segment is projected to secure a 60% revenue share in the clinical trinocular microscopes market, propelled by accelerating AI adoption and penetration in pathological diagnostics and the broader healthcare ecosystem.

- Over 2026–2035, the hospitals segment is expected to capture a 50% share, owing to healthcare system modernization and government-backed infrastructural development worldwide.

Key Growth Trends:

- Expansion for clinical and academic research

- Surge in adoption of the remote diagnostic

Major Challenges:

- Limited access and infrastructure in low and middle-class countries

- Shortage of skilled pathologists and laboratory technicians:

Key Players: Leica Microsystems, Zeiss Group, Thermo Fisher Scientific, Motic, ACCU-SCOPE, Labomed, Celestron, Mahr Federal, Vision Engineering

Global Clinical Trinocular Microscopes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.50 billion

- 2026 Market Size: USD 1.60 billion

- Projected Market Size: USD 2.79 billion by 2035

- Growth Forecasts: 6.4 % CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australi

Last updated on : 10 November, 2025

Clinical Trinocular Microscopes Market - Growth Drivers and Challenges

Growth Drivers

- Expansion for clinical and academic research: The surge in research activities in medical and life sciences across the world has remarkably strengthened the need for clinical trinocular microscopes. Various biotechnology companies, universities, and laboratories are investing humongous capital in optical instruments to aid in histopathological and cytological studies. With a surge in funding from governments across the globe and the establishment of private research foundations, the market is witnessing continuous momentum from both the research and academic segments. Also, technological upgradation, such as digital imaging compatibility, is expanding the usability, making these microscopes indispensable.

Number of Registered Clinical Trials by Country in 2024

|

Country / Area |

Number of Trials |

|

United States of America |

186,497 |

|

China |

135,747 |

|

India |

74,031 |

|

Unknown / Not Specified |

69,639 |

|

Japan |

65,167 |

|

Germany |

54,902 |

|

United Kingdom |

49,145 |

|

France |

46,309 |

|

Netherlands |

43,305 |

|

Iran (Islamic Republic of) |

40,245 |

|

Canada |

35,700 |

|

Spain |

33,767 |

|

Italy |

33,386 |

|

Australia |

32,924 |

|

Republic of Korea |

27,283 |

|

Belgium |

20,955 |

|

Brazil |

20,765 |

|

Türkiye |

17,530 |

|

Denmark |

16,517 |

|

Poland |

16,247 |

Source: WHO

- Surge in adoption of the remote diagnostic: The healthcare environment today has embraced telepathology, where digitized images from trinocular microscopes are shared remotely among the specialists for swift diagnosis. This trend is mainly beneficial for rural as well as underdeveloped regions, which have a scarcity of proficient pathologists. Laboratories and hospitals are modernizing the diagnostic infrastructure to enable easy remote consultations. Owing to these factors, the trinocular microscope market is witnessing robust demand from the burgeoning digital health transformation. For instance, in India, the widespread expansion of the remote diagnostic networks under the Ayushman Bharat Digital Mission (ABDM) is making robust demand for digitally integrated laboratory equipment. According to data published by Press Information Bureau in January 2025, more than 750 million accounts have been generated for the e-Sanjeevani telemedicine platform linking hospitals with specialist doctors. As digital healthcare adoption is growing, hospitals are investing in camera-integrated trinocular microscopes to support telepathology, image sharing, and real-time diagnosis.

- Rising focus on personalized and precision medicine: The inclination towards personalized medicine, in which diagnostic and treatments are customized to patient-specific data, has prominently influenced the clinical microscopy market. These microscopes are pivotal in analyzing cellular morphology and tissue structures. The trinocular microscopes can connect cameras and incorporate digital imaging systems to align accurately with data-enabled workflows. Also, the sharp rise in global cancer cases has made an unprecedented requirement for early and efficient tools, prominently boosting the demand for clinical trinocular microscopes during the forecasted period.

Top Cancer Types: New Cases Worldwide (2022)

|

Cancer Type |

Estimated New Cases (2022) |

Share of Total Global Cases (%) |

|

Lung Cancer |

2.5 million |

12.4 % |

|

Breast Cancer (Female) |

2.3 million |

11.6 % |

|

Colorectal Cancer |

1.9 million |

9.6 % |

|

Prostate Cancer |

1.5 million |

7.3 % |

|

Stomach (Gastric) Cancer |

970,000 |

4.9 % |

Source: WHO

Challenges

- Limited access and infrastructure in low and middle-class countries: The incidences of cancer and prevalence of infectious diseases are rising sharply in LMICs; these regions usually lack basic laboratory infrastructure and stable electricity supply utilized in microscopy operations. In various cases, pathology labs are not adequately equipped and have obsolete monocular systems.

- Shortage of skilled pathologists and laboratory technicians: These microscopes require trained professionals to analyze the microscopic images precisely. There is a worldwide shortage of proficient pathologists and lab technologists. The lack of human resources restricts the utilization of modern microscopes, affecting diagnostic accuracy.

Clinical Trinocular Microscopes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 1.50 billion |

|

Forecast Year Market Size (2035) |

USD 2.79 billion |

|

Regional Scope |

|

Clinical Trinocular Microscopes Market Segmentation:

Modality Segment Analysis

In terms of modality, the digital segment is poised to dominate the clinical trinocular microscopes market with a 60% revenue share by the end of 2035. This is primarily fed by the accelerating AI adoption and penetration in pathological diagnostics and the entire healthcare industry. Considering the enhanced workflow efficiency gained from automation, several governmental institutions are heavily investing in this category. Moreover, the surge in utilization of electronic medical record systems and IoT in healthcare platforms has made digital microscopy a crucial tool in making laboratories modern.

End-user Segment Analysis

Based on end users, the hospitals segment is expected to represent the largest share of 50% in the clinical trinocular microscopes market throughout the assessed timeframe. This is driven by the heavy influence of healthcare system modernization and government-backed infrastructural development across the globe. Other than this, hospitals are incorporating AI-powered trinocular microscopes to refine diagnostic precision and lower the turnaround time for test results. Furthermore, public-private partnerships and national health initiatives are encouraging modern laboratory infrastructure and quality control in diagnostics and further augmenting procurement rates of these devices.

Application Segment Analysis

The pathology and histopathology segment is expected to garner the largest segment owing to the crucial role of histopathological analysis in the diagnosis of diseases, cancer, etc. These microscopes are crucial in pathology laboratories, fostering precise examination of cellular structures. Moreover, governments are putting efforts into digitalization coupled with the integration of high-resolution imaging technologies. Also, governments are making initiatives to support early disease detection and expanding the network of diagnostic laboratories.

Our in-depth analysis of the clinical trinocular microscopes market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Magnification & Optical Technology |

|

|

Application |

|

|

Distribution Channel |

|

|

Price Range |

|

|

End user |

|

|

Modality |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clinical Trinocular Microscopes Market - Regional Analysis

North America Market Insights

North America is predicted to showcase dominance over the global clinical trinocular microscopes market over the discussed period, while holding a 40% share. The region’s robust healthcare infrastructure and extensive research and development investments are continuing to support extensive utilisation of the AI-powered microscope. Additionally, the surge in emphasis on personalised medicine is compelling hospitals to incorporate microscopes integrated with data analytics tools for enhanced diagnostic accuracy. The market in the U.S. is also witnessing sustained growth on the back of a surge in emphasis on modern diagnostics and rising demand for oncology care. Also, the presence of major microscope manufacturers in the country is improving the diagnostic accuracy and workflow efficiency.

The market in Canada is set to register significant growth on the back of rising cases of cancer, which has raised the demand for hematology in hospitals. According to data published by the Government of Canada in February 2025, 44% of women and 45% of men in Canada are projected to develop cancer during their lifetime. Other than this, the country’s strong public health infrastructure and government-funded diagnostic initiatives are propelling the adoption of high-performance microscopes in both hospitals and research institutions.

Asia Pacific Market Insights

Asia Pacific is estimated to grow at the highest pace in the clinical trinocular microscopes market over the analyzed timeline. The exponentially increasing disease burdens and government-led digital transformation initiatives are the primary drivers behind the region's accelerated progress in this category. In China, Health China 2030 programs have prioritized the detection of diseases at early stages, prompting both the private and public hospitals to invest significantly in imaging technologies. Also, the swift development of smart hospitals has strengthened the incorporation of connected trinocular microscopes, further augmenting the market growth.

The market in India is experiencing growth with rising investment in diagnostic laboratories and a growing emphasis on medical research and early disease detection. There is a surge in the number of medical colleges in the country is acting as a growth catalyst for the market in the country. According to data published by the Ministry of Health and Family Welfare, there has been an 82% surge in medical colleges from 387 in 2014 to 704 in 2023. Additionally, the widespread availability of cost-efficient domestic manufacturing is enhancing the affordability and accessibility.

Europe Market Insights

The Europe clinical trinocular microscopes market is projected to maintain a steady growth between 2026 and 2035. The aging population, widespread adoption of digital pathology, and region-wide healthcare modernization efforts are fueling this augmentation. Germany is considered to be a pivotal hub for biomedical research, where high-quality microscopy plays a significant role. Moreover, the country’s Health Digitalization Strategy and Horizon Europe framework are promoting the inclusion of connected diagnostic and telepathy systems. Also, the public-private partnership for research and development is strengthening the country’s position as the most lucrative for clinical trinocular microscopes.

The market in the UK is also at the forefront with the integration of high-resolution imaging in hospitals. Renowned institutions such as the Cambridge Biomedical Campus and the Francis Crick Institute are driving continuous demand for state-of-the-art microscopes in conducting various molecular studies. Overall, the commitment of the UK to the digital transformation in healthcare, amalgamated with robust R&D infrastructure and burgeoning cancer diagnostics demand, places the country as a mature and dynamically evolving market in Europe.

Key Clinical Trinocular Microscopes Market Players:

- Leica Microsystems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zeiss Group

- Thermo Fisher Scientific

- Motic

- ACCU-SCOPE

- Labomed

- Celestron

- Mahr Federal

- Vision Engineering

The clinical trinocular microscopes market is highly consolidated, with Olympus, Leica, and Nikon collectively controlling a large global revenue share. These global leaders are pursuing distinct strategies to maintain their dominance, such as Olympus and Zeiss concentrated their focus on advancing AI-powered diagnostics. On the other hand, Leica is solidifying its expansion in emerging landscapes through cost-efficient manufacturing. Whereas Nikon is prioritizing regulatory approvals via strategic partnerships for globalization.

The top contenders of this cohort of key players are:

Recent Developments

- In September 2025, Thermo Fisher Scientific completed the acquisition of Solventum’s Purification & Filtration business for approximately US$4 billion, strengthening its bioprocessing and analytical instrumentation portfolio. The acquisition aims to expand Thermo Fisher’s footprint in laboratory consumables and purification technologies, aligning with the company’s long-term strategy to enhance end-to-end workflow solutions across clinical and research applications.

- In May 2025, ZEISS launched the Smartzoom 100, a cutting-edge digital microscope designed for fast and efficient quality assurance, particularly in industrial settings. The Smartzoom 100 delivers 4K resolution at 60 frames per second, enabling real-time, high-clarity visualisation that eliminates lag and improves inspection productivity.

- Report ID: 7804

- Published Date: Nov 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.