Central Lab Market Outlook:

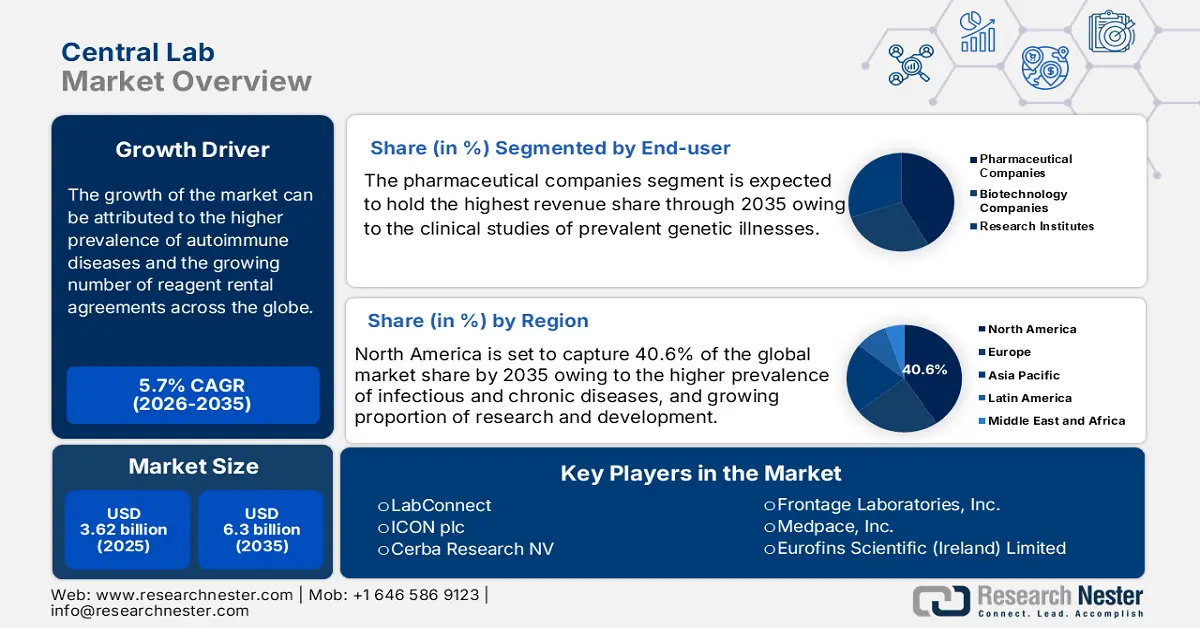

Central Lab Market size was valued at USD 3.62 billion in 2025 and is expected to reach USD 6.3 billion by 2035, expanding at around 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of central lab is evaluated at USD 3.81 billion.

The growth of the market is primarily attributed to the worldwide growing prevalence of numerous genetic abnormalities and the development of novel drugs and devices to treat such types of abnormalities. For instance, in 2021, around 85 novel active substances (NASs) were officially launched globally, which was more than twice the number launched five years ago.

As the occurrence of various diseases rises, so does the demand for new drug discovery and development. Pharmaceutical companies have prioritized efficient service and high-quality data without having to compromise. Therefore, these companies employ central labs for the detection, testing, development, and production of novel drugs and devices. Central labs are intended to facilitate clinical trials for novel drugs as well as genetic testing for a number of genetic diseases. Therefore, ongoing clinical trials for the production of new drugs are estimated to lead to the growth of the market. For instance, till 2022, there have been approximately 134,359 (32%) clinical trials registered in the US region alone, whereas around 221,438 (52%) clinical trials are registered in non-US regions.

Key Central Lab Market Insights Summary:

Regional Highlights:

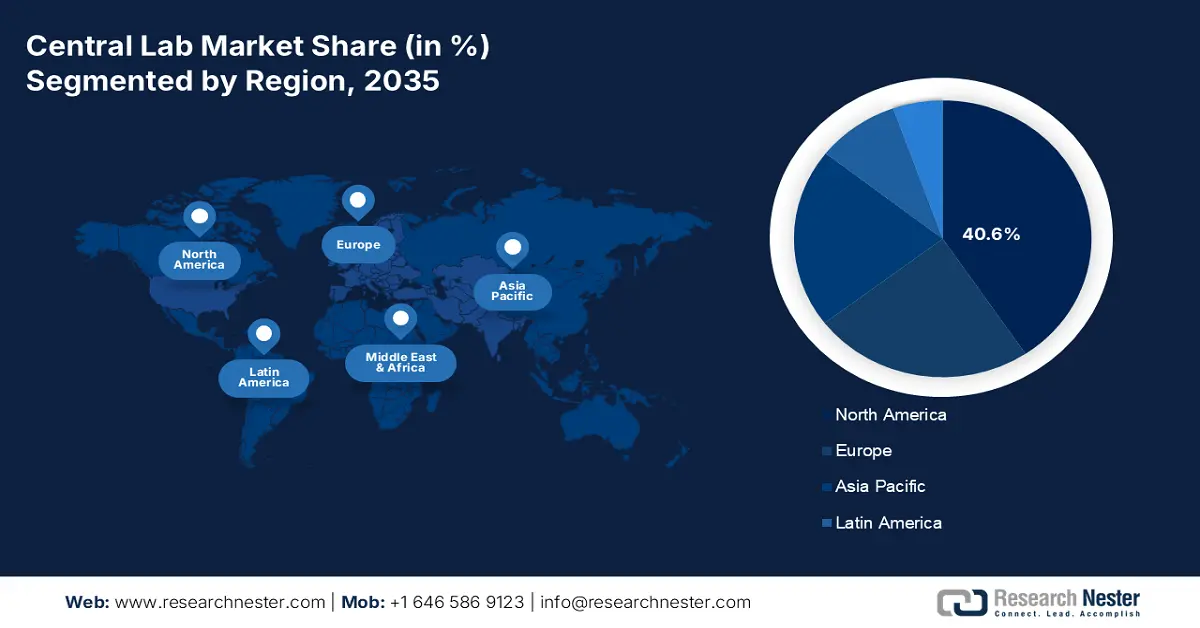

- North America’s central lab market will dominate over 40.6% share by 2035, driven by increased R&D spending and rising prevalence of chronic diseases.

Segment Insights:

- The pharmaceutical companies segment in the central lab market is projected to secure a notable revenue share by 2035, driven by clinical studies of prevalent genetic illnesses such as Parkinson’s disease.

Key Growth Trends:

- Growing Prevalence of Genetic Disorders Owing to Rising Mutations

- Rise in Genetic Testing as the Number of Genetic Cases Increasing

Major Challenges:

- Problems Associated with Contamination of Samples

- Stringent Government Regulations

Key Players: Laboratory Corporation of America Holdings (Labcorp), ICON Plc, Medpace, Inc., Eurofins Scientific (Ireland) Limited, LabConnect, Cerba Research NV, Frontage Laboratories, Inc., Lambda Therapeutic Research Limited, InVitro International (IVRO), Clinical Reference Laboratory, Inc.

Global Central Lab Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.62 billion

- 2026 Market Size: USD 3.81 billion

- Projected Market Size: USD 6.3 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Central Lab Market - Growth Drivers and Challenges

Growth Drivers

- Growing Prevalence of Genetic Disorders Owing to Rising Mutations -A genetic disorder is a medical disease caused by one or more malformations in the genome. These disorders consist of several types of chronic diseases and birth defects that are received from one or both parents. Such disorders require in-depth research and study to discover an optimum treatment. For instance, there are over 6,010 clinically defined rare diseases, out of these 72% are genetic disorders.

- Rise in Genetic Testing as the Number of Genetic Cases Increasing - Changes in genes, chromosomes, or proteins are detected through genetic testing. Genetic test results confirm or rule out a suspected genetic condition. The increasing number of genetic abnormalities is leading to the growth of genetic testing. For instance, by 2021, over 78,000 genetic tests were in use.

- Increasing Prevalence of Cancer in All Age Groups of Population - Cancer is one of the leading causes of death globally and numerous clinical trials have been performed to find out the best-suited treatment for it. As per the data provided by the World Health Organization (WHO), nearly 10 million people died from cancer worldwide in 2020.

- Upsurge in Cardiovascular Diseases (CVDs) Across the World - Conditions affecting the heart or blood vessels are collectively referred to as cardiovascular disease (CVD). It is commonly related to a buildup of fatty deposits inside the arteries. The number of CVDs patients is growing faster which leads to the rising number of testing and trials for new and effective drugs. As per the World Health Organization, in 2019, approximately 17.9 million people died from CVDs, representing 32% of all deaths worldwide.

- Growing Investment in R&D with Government and Private Support – According to the data released by the Unesco Institute for Statistics, worldwide R&D investment has continued to rise, with an average annual increase of 4.7% over the last decade (2010-2020). In global terms, the proportion of global GDP invested in R&D has grown substantially from 1.61% in 2010 to 1.93% in 2020.

Challenges

- Requirement of High Capital Investments to Operate Central Lab

- The need for high capital investment to develop and operate a central lab is estimated to hamper the market growth. The central lab requires costly equipment, skilled medical professionals to handle the equipment, and a large space to set up a sophisticated lab facility.

- Problems Associated with Contamination of Samples

- Stringent Government Regulations

Central Lab Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 3.62 billion |

|

Forecast Year Market Size (2035) |

USD 6.3 billion |

|

Regional Scope |

|

Central Lab Market Segmentation:

End-user Segment Analysis

The pharmaceutical companies segment is anticipated to hold the notable share in the global central lab market during the forecast period on account of the clinical studies of prevalent genetic illnesses such as sickle cell anemia, Parkinson's disease, and Alzheimer's disease. As per the data from World Health Organization, in the last 25 years, the prevalence of Parkinson’s disease (PD) has doubled, and more than 8.5 million people worldwide are anticipated to have PD in 2019.

Our in-depth analysis of the global central lab market includes the following segments:

|

By Service Type |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Central Lab Market Regional Analysis:

North America Market Insights

North America region is set to dominate around 40.6% market share by 2035. The high prevalence of infectious and chronic diseases, an increase in patient awareness about the significance of laboratory tests, increasing adoption of technological developments with proper quality, efficient and effective serve, and a significantly growing proportion of research and development in the region. For instance, medical and health research and development (R&D) investment in the United States reached approximately USD 244 billion in 2020, an 11% expansion from 2019.

Central Lab Market Players:

- Laboratory Corporation of America Holdings (Labcorp)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ICON Plc

- Medpace, Inc.

- Eurofins Scientific (Ireland) Limited

- LabConnect

- Cerba Research NV

- Frontage Laboratories, Inc.

- Lambda Therapeutic Research Limited

- InVitro International (IVRO)

- Clinical Reference Laboratory,inc

Recent Developments

-

Laboratory Corporation of America Holdings (Labcorp), declared the launch of the first broadlyavailable test, Neurofilament Light Chain (NfL), that delivers direct indicationof neurodegeneration and neuronal injury.

-

Eurofins Scientific (Ireland) Limited, announced the launch of RT-PCR kits thatoffersthe toolset for rapid detection of fast spreading SARS-CoV-2 variant B.1.1.529.

- Report ID: 4233

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Central Lab Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.